August 25, 2025

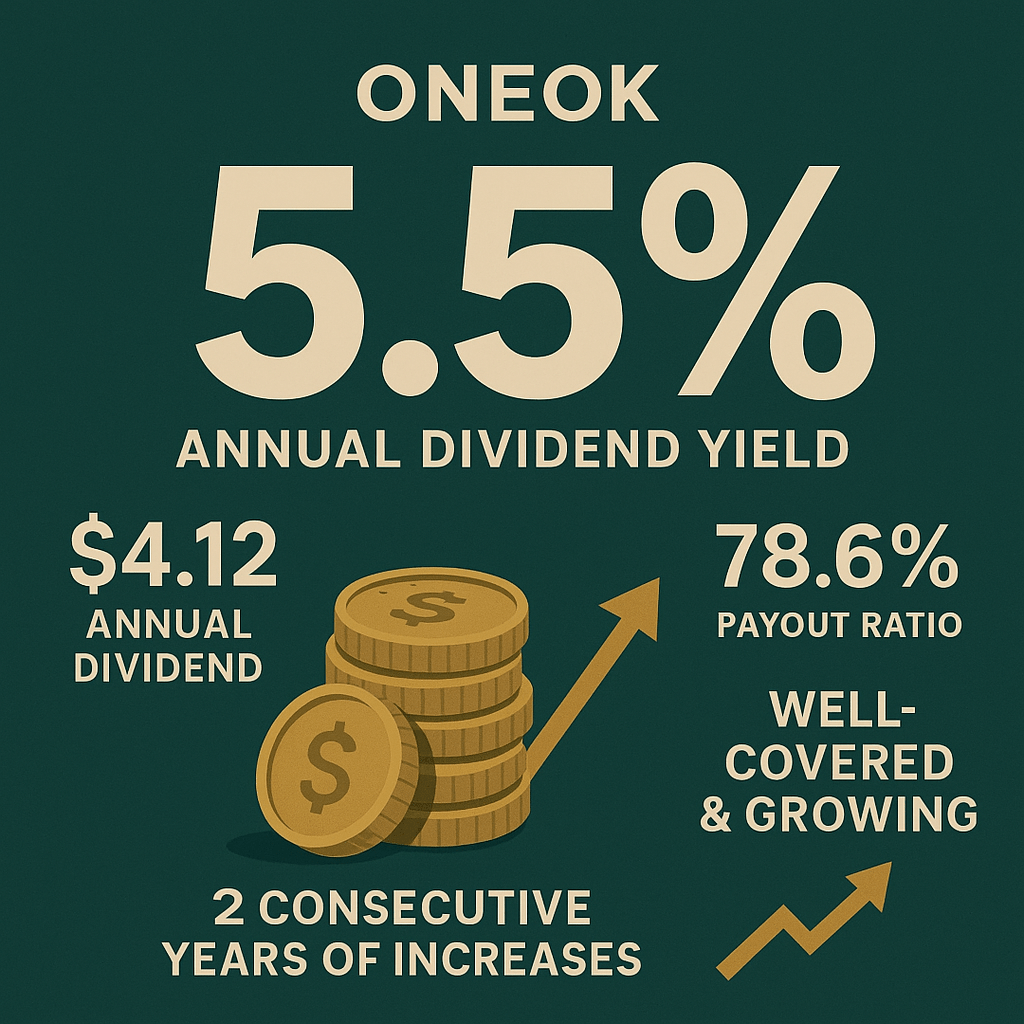

While growth investors chase AI stocks and momentum plays dominate headlines, a different opportunity is quietly developing in America’s energy infrastructure backbone. ONEOK (OKE), trading at $74.84 with a 5.5% dividend yield, presents a compelling paradox: a beaten-down stock in a sector poised for multi-year expansion, offering both immediate income and meaningful appreciation potential.

The market has punished OKE with a 37.6% maximum drawdown over the past year, yet the fundamentals tell a different story. With acquisitions of Medallion Midstream and EnLink Midstream positioning ONEOK to lead with greater connectivity and scale across the midstream energy value chain, the company is executing a classic infrastructure consolidation playbook just as demand drivers are accelerating.

At current levels, OKE trades at a 17% discount to fair value while offering a secure 5.5% yield backed by improving cash flows and systematic debt reduction. For income-focused investors seeking alternatives to overvalued dividend aristocrats, this setup demands attention.

The Strategic Reality: Infrastructure Consolidation Meets Energy Demand

The investment thesis crystallizes around a simple reality: America’s energy infrastructure needs massive investment, and ONEOK has positioned itself as the consolidator of choice. 29 analysts have given ONEOK (OKE) a consensus rating of Buy while the ONEOK (OKE) price prediction in 2025 is $78.48—notably above current trading levels.

Q2 2025 results demonstrated execution momentum with adjusted EBITDA of $1.98 billion and net income of $841 million, supporting management’s reaffirmed 2025 guidance range of $8.0-$8.45 billion in adjusted EBITDA. More importantly, the company announced a Final Investment Decision (FID) on a new Delaware Basin gas processing plant while achieving record NGL raw feed volumes—tangible evidence that integration efforts are translating into operational leverage.

The broader midstream landscape supports this individual execution story. Companies are expected to continue generating free cash flow and prioritizing returns to shareholders. Dividend growth will remain a top priority, while buybacks are expected to be more opportunistic, according to industry outlook research. This sector-wide focus on capital discipline and shareholder returns creates a favorable backdrop for quality operators like ONEOK.

The Valuation Opportunity: Multiple Approaches Pointing Higher

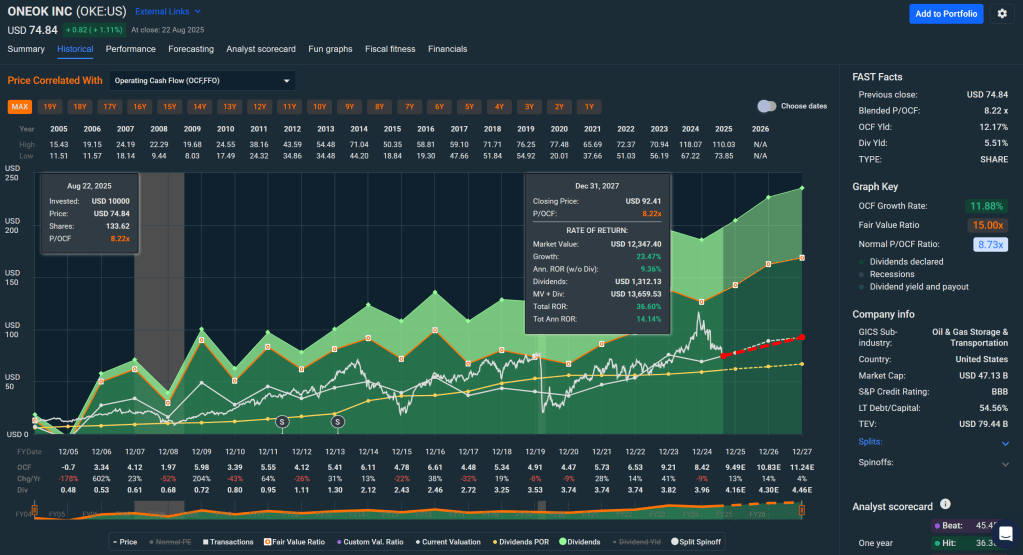

Unlike growth stocks trading on optimistic projections, OKE’s valuation rests on concrete asset values and cash flow generation. Three independent valuation methodologies converge around $87-88 fair value:

- Stock Rover Fair Value: $87.38

- Normalized DCF Analysis: $88.03

- Blended Approach: ~$88 target

At Friday’s close of $74.84, this suggests 15-18% upside before considering the 5.5% annual dividend yield. The company’s EV/EBITDA multiple of 10.9x appears reasonable versus large-cap peers, especially considering OKE’s superior growth profile post-integration.

The dividend mathematics are particularly compelling. The current $4.12 annual dividend (paid quarterly at $1.03) is well-covered with a 78.6% payout ratio and supported by steadily improving cash flows. With two consecutive years of dividend growth and management’s stated commitment to returning cash to shareholders, the yield provides attractive carry while awaiting multiple expansion.

Market Sentiment vs. Fundamental Reality

The outlook for the pipeline and midstream sector in 2025 is neutral to modestly positive, according to investment research company Morningstar, yet this conservative assessment may understate the opportunity. Current market sentiment reflects broader energy sector skepticism, creating a disconnect between operational performance and stock price action.

Consider the technical picture: OKE trades below its 50-day ($79.05), 100-day, and 200-day ($89.7) moving averages with neutral RSI around 43. This technical weakness has created an entry opportunity for patient capital, particularly given the fundamental improvements occurring beneath the surface.

The recent 37.6% maximum drawdown represents the deepest selloff in five years, yet this coincides with the company’s strongest operational position in years following successful integration of major acquisitions. Smart money recognizes when technical weakness creates fundamental opportunity.

The Risk-Reward Framework: What Could Go Wrong

Investing in energy infrastructure requires acknowledging sector-specific risks. Management recently trimmed 2026 EBITDA guidance by approximately $200 million due to commodity spread pressures, particularly around frac spreads and ethane rejection economics. This guidance adjustment reflects the reality that midstream operations, while generally stable, remain exposed to producer activity levels and processing margins.

Leverage presents another consideration. With debt-to-equity at 1.5x and net debt around $32.4 billion, ONEOK carries material debt obligations despite the recent $3 billion notes offering that addressed near-term maturities. Interest coverage of 3.6x provides adequate cushion, but rate sensitivity remains a factor for income-focused investors.

The company’s Altman Z-Score of 1.4 indicates some financial stress, though this largely reflects the capital-intensive nature of midstream operations rather than fundamental weakness. More concerning are the mixed earnings surprises over recent quarters, including a 16.8% miss in Q1 2025, suggesting execution risk remains present.

Strategic Positioning: The AI Energy Demand Catalyst

An underappreciated catalyst for midstream infrastructure involves artificial intelligence’s voracious power demands. Artificial Intelligence may be an additional tailwind for midstream companies as data center expansion drives natural gas demand for power generation. This represents a structural growth driver that few market participants are properly pricing into energy infrastructure valuations.

ONEOK’s expanded processing capacity and transportation network position the company to benefit from this incremental demand, particularly as renewable energy intermittency requires reliable natural gas backup power. The Delaware Basin expansion specifically targets regions where AI-driven power demand is accelerating.

Tactical Execution: How to Position

Given the technical headwinds and fundamental opportunity, a staged entry approach makes sense:

Primary Buy Zone: $64-$72 (current levels qualify) Strong Buy Zone: $56-$64 (deeper value opportunity) Fair Value Hold: $80-$92 Trim Zone: Above $100

Position sizing should reflect OKE’s role as an income compounder rather than growth speculation. A 3-5% allocation within a diversified income sleeve allows meaningful participation while managing sector concentration risk.

The dividend reinvestment opportunity merits emphasis. At 5.5% yield, reinvested dividends significantly enhance long-term returns, particularly when acquired below fair value. This compounding effect becomes powerful over multi-year holding periods.

The 12-Month Outlook: Probability-Weighted Returns

Scenario modeling suggests three primary paths for OKE over the next twelve months:

Base Case (55% probability): Integration benefits offset commodity headwinds, driving shares toward $88-90 fair value plus dividend income.

Bull Case (25% probability): Stronger energy demand and operational leverage exceed expectations, targeting $95+ levels.

Bear Case (20% probability): Commodity spread compression and execution delays pressure shares toward $70 levels.

The risk-adjusted expected return of mid-teens total returns (price appreciation plus dividend) appears attractive relative to bond yields and dividend aristocrat valuations in the current environment.

Why This Matters for Income Portfolio Construction

ONEOK exemplifies the opportunity within energy infrastructure: real assets generating predictable cash flows, trading at discounts to intrinsic value due to sector pessimism. For investors seeking alternatives to overvalued utilities and REITs, midstream energy offers both yield and growth potential.

The key insight involves recognizing that energy transition doesn’t eliminate energy infrastructure—it evolves it. Natural gas remains critical for power generation, industrial processes, and petrochemical feedstocks regardless of renewable energy growth. ONEOK’s asset base serves these durable end markets.

Moreover, the consolidation theme within midstream creates winners and losers. ONEOK’s recent acquisitions and operational scale suggest it’s positioned among the winners, benefiting from industry rationalization and improved pricing power.

The Bottom Line: Quality at a Discount

ONEOK represents authentic exposure to American energy infrastructure expansion at a price reflecting temporary pessimism rather than permanent impairment. The company executes consistently on integration goals, maintains a growing dividend backed by improving cash flows, and trades at a meaningful discount to multiple fair value estimates.

This isn’t a momentum play or speculative bet—it’s a quality income investment temporarily mispriced by market sentiment. The 5.5% yield provides attractive carry while operational improvements drive multiple expansion toward fair value.

For investors seeking yield without sacrificing growth potential, ONEOK offers a rare combination: immediate income from a secure dividend, appreciation potential as valuation normalizes, and exposure to structural energy infrastructure trends. The technical weakness creates a tactical entry opportunity for those willing to buy quality at a discount.

The energy infrastructure story is far from over—it’s evolving. ONEOK has positioned itself to benefit from that evolution while paying shareholders to wait. Sometimes the best opportunities hide in the sectors everyone’s forgotten.

Investment Summary

- Current Price: $74.84

- Fair Value Target: $87-88 (15-18% upside)

- Dividend Yield: 5.5% (well-covered, growing)

- Buy Range: $64-72 for primary allocation

- Risk Level: Moderate (infrastructure stability with commodity exposure)

- Total Return Potential: Mid-teens annually (price + dividend)

Key Catalysts to Watch: Integration milestone achievement, dividend growth announcements, commodity spread recovery, and AI-driven energy demand acceleration.

Master Metrics Table

| Metric | OKE |

|---|---|

| Price Anchor (Aug 24, 2025) | $74.84 |

| 52-Week Range | $72.18 – $118.07 |

| Market Cap | $47.0B |

| Revenue (TTM) | $27.95B |

| Revenue Growth (1Y) | 46.4% |

| Forward P/E | 12.1 |

| EV/EBITDA (TTM) | 10.9 |

| Operating Margin | 19.6% |

| Net Margin | 11.1% |

| Return on Equity | 14.2% |

| Debt/Equity | 1.5 |

| 1-Year Volatility | 32% |

| 1-Year Beta | 0.98 |

| 1-Year Return | -10.4% |

| Dividend Yield (Forward) | 5.5% |

| Payout Ratio | 78.6% |

| Analyst Rating | Buy (11 Buy, 1 Hold) |

| Fair Value Estimate | $87.38 |

| Margin of Safety | 17% |

| Vulcan Value Score | 85/100 |

| Vulcan Growth Score | 99/100 |

| Vulcan Quality Score | 70/100 |

| Buy Range Guidance | Strong Buy ≤ $64; Primary Buy $64-72; Hold $80-92; Trim $100+ |

For more insights on energy infrastructure positioning and dividend portfolio construction strategies, explore our comprehensive analysis framework at vulcan-stock.com.

Leave a comment