August 24, 2025

When the Pentagon declares “attritable airpower” its top priority and Germany signs partnership deals for loyal-wingman drones, most investors would expect to find the sector’s prime beneficiary trading at a reasonable multiple. Instead, they find Kratos Defense & Security (KTOS) sporting a forward P/E above 89x and a stock price that’s gained over 200% in twelve months. The question isn’t whether the defense transformation is real—it’s whether there’s still alpha left after such an explosive run.

At $66.71 per share and flirting with 52-week highs, KTOS sits at the epicenter of a fascinating market paradox: exceptional execution meeting stretched valuations in a sector where patient capital typically wins. The company has transformed from a niche defense contractor into the cornerstone of America’s “affordable mass” drone revolution, but success has bred its own challenges.

The Strategic Reality Behind the Numbers

The investment thesis crystallizes around one undeniable trend: modern warfare demands quantity over perfection. Wall Street analysts maintain a Strong Buy consensus on KTOS based on 14 analyst ratings, but the real validation comes from defense procurement shifts that favor Kratos’ core competency—building “good enough” platforms at scale rather than exquisite systems in small numbers.

Consider the Valkyrie program, Kratos’ flagship loyal-wingman drone. This isn’t just another defense contract; it represents a fundamental reimagining of airpower where unmanned aircraft fly alongside F-35s to scout, jam, or absorb incoming fire. The Airbus partnership to supply these systems to Germany by 2029 signals that allied procurement is aligning with this philosophy, creating multiple revenue streams beyond traditional U.S. DoD channels.

The financial momentum supports this strategic positioning. Q2 2025 revenue hit $351.5 million with approximately 15% year-over-year growth, maintaining the steady cadence that has characterized Kratos’ recent execution. But here’s where the story gets complex—the market has already recognized this transformation, pushing valuations to levels that demand perfection.

Where Strategist Consensus Meets Valuation Reality

According to 21 analysts tracking KTOS, the stock maintains a Buy consensus rating as of August 19, 2025, yet price targets reveal the challenge facing new investors. Current analyst price targets average $57.64, meaningfully below today’s $66.71 price, while more optimistic forecasts from JMP Securities reach $70—barely 5% upside from current levels.

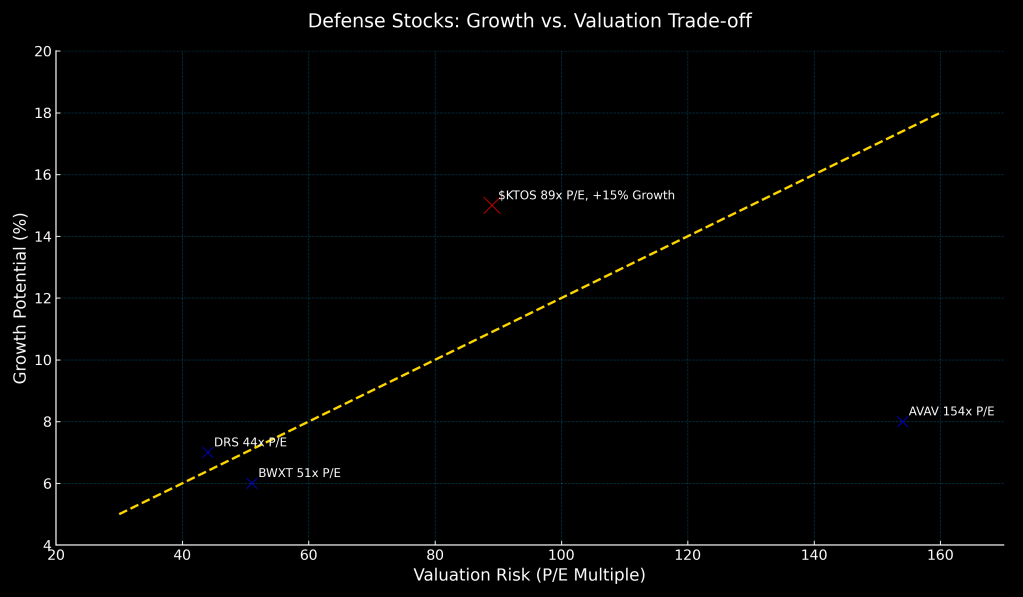

This disconnect between strategic enthusiasm and valuation caution reflects broader market tensions. The defense transformation is undeniably real, but timing and execution risk loom large when paying 89x forward earnings for a manufacturing company, regardless of its strategic positioning.

The Risk-Reward Mathematics

The Stock Rover analysis reveals the stark mathematics of KTOS ownership: a Quality Score of 62 versus peers, but a Value Score of just 39—among the lowest in its defense peer group. Operating margins of 2.0% trail both industry averages (8.0%) and broader market benchmarks (15.2%), though this reflects the company’s current phase of investment in production scaling.

More concerning for risk-aware investors: one-year volatility near 50% with maximum drawdowns over five years reaching -72.7%. These aren’t abstract statistics—they represent real portfolio impact for investors who mistime entries or size positions incorrectly.

The Execution Framework: How to Navigate the Opportunity

Despite valuation concerns, the fundamental drivers remain compelling enough to warrant strategic exposure. NATO defense spending continues expanding, U.S. procurement increasingly emphasizes affordable mass over premium platforms, and international channels like the Airbus partnership broaden addressable markets beyond domestic programs.

The key lies in tactical execution:

Entry Strategy: Scale into positions between $60-$68, using pullbacks toward the 50-day moving average (currently around $54) as primary accumulation zones. The stock’s established uptrend remains intact, but momentum can pause without breaking the underlying story.

Position Sizing: Limit exposure to 2-3% of diversified portfolios maximum, with starter positions at 0.5-1.0% until price action provides better entry points. This isn’t a core holding suitable for large allocations—it’s a targeted play on defense transformation.

Risk Management: Implement soft stops below $60 unless new material contracts offset technical damage. More importantly, plan trim levels around $95-$105 if shares advance without commensurate estimate upgrades from Wall Street.

The Probability-Weighted Outlook

Using scenario analysis, the risk-adjusted outlook suggests three primary paths over the next twelve months:

Base Case (55% probability, $79 target): Continued contract cadence with modest margin expansion as production learning curves mature. The multiple compresses slightly but execution rewards keep upward momentum alive.

Bull Case (25% probability, $95 target): Accelerated European adoption combined with faster U.S. program ramps. International channels deliver above expectations while margins begin reflecting operational leverage.

Bear Case (20% probability, $55 target): Program timing slips or execution stumbles trigger multiple compression. High expectations meeting inevitable delays in defense procurement create downside volatility.

The expected value calculation suggests potential upside, but wide confidence intervals demand careful position sizing and tactical patience.

Why This Matters for Portfolio Construction

KTOS exemplifies the challenge of investing in thematic winners after institutional recognition. The loyal-wingman concept and attritable airpower revolution are real—but market efficiency means most obvious opportunities get priced quickly.

Even sophisticated investors like Cathie Wood are focusing on defense technology as an emerging theme alongside AI applications, suggesting the sector rotation has institutional validation. However, success in these momentum-driven names requires balancing conviction with valuation discipline.

For retail investors building diversified portfolios, KTOS works best as a satellite position within a broader defense allocation rather than a standalone bet. The volatility profile demands tactical execution, making it unsuitable for buy-and-hold strategies despite the compelling long-term narrative.

The Bottom Line: Opportunity with Discipline

Kratos Defense represents authentic exposure to defense transformation—loyal-wingman technology, attritable airpower, and international market expansion create a durable competitive moat in an expanding market. The company executes consistently, maintains healthy cash positions, and benefits from structural procurement shifts that should persist for years.

The challenge isn’t identifying the opportunity; it’s accessing it at prices that offer adequate risk-adjusted returns. At current levels, KTOS demands tactical precision rather than strategic accumulation. Scale in on weakness, respect the volatility, and remember that even great companies can be poor investments at the wrong price.

For investors comfortable with high-beta defense exposure and disciplined about entry points, KTOS offers legitimate participation in the defense sector’s most important transformation in decades. Just don’t mistake a great story for a great trade—in momentum markets, timing matters as much as thesis.

Investment Summary

- Current Price: $66.71

- Base Target: $79 (12-month)

- Buy Range: $60-$68 on weakness

- Position Size: 2-3% maximum in diversified portfolios

- Risk Level: High (50% volatility, execution-dependent)

- Thesis: Defense transformation winner requiring valuation discipline

Key Catalysts to Watch: European program progression, U.S. contract cadence, margin expansion evidence, and any operational leverage demonstration as production scales.

Master Metrics Table

| Metric | KTOS |

|---|---|

| Price Anchor (Aug 24, 2025) | $66.71 |

| 52-Week Range | $20.83 – $72.70 |

| Market Cap | $11.26B |

| Revenue (TTM) | $1,213M |

| Revenue Growth (1Y) | 7.8% |

| Forward P/E | 89.5 |

| EV/EBITDA (TTM) | 123.8 |

| Operating Margin | 2.0% |

| Net Margin | 1.2% |

| Return on Equity | 0.7% |

| Debt/Equity | 0.1 |

| 1-Year Volatility | 50% |

| 1-Year Beta | 1.09 |

| 1-Year Return | +208.1% |

| Short Interest | 6.0% |

| Analyst Rating | Strong Buy (12 Buy, 1 Hold) |

| Fair Value Estimate | $78.62 |

| Margin of Safety | 18% |

| Vulcan Quality Score | 62/100 |

| Vulcan Growth Score | 91/100 |

| Vulcan Value Score | 39/100 |

| Buy Range Guidance | Strong Buy ≤ $60; Primary Buy ≤ $68; Hold $68-$82; Trim $95+ |

For more insights on defense sector positioning and portfolio risk management strategies, explore our comprehensive analysis framework at vulcan-stock.com.

Leave a comment