When state media in Beijing warns about backdoors while Wall Street whispers about trillion-dollar revenues, smart money asks: What’s the real story behind NVIDIA’s remarkable resilience?

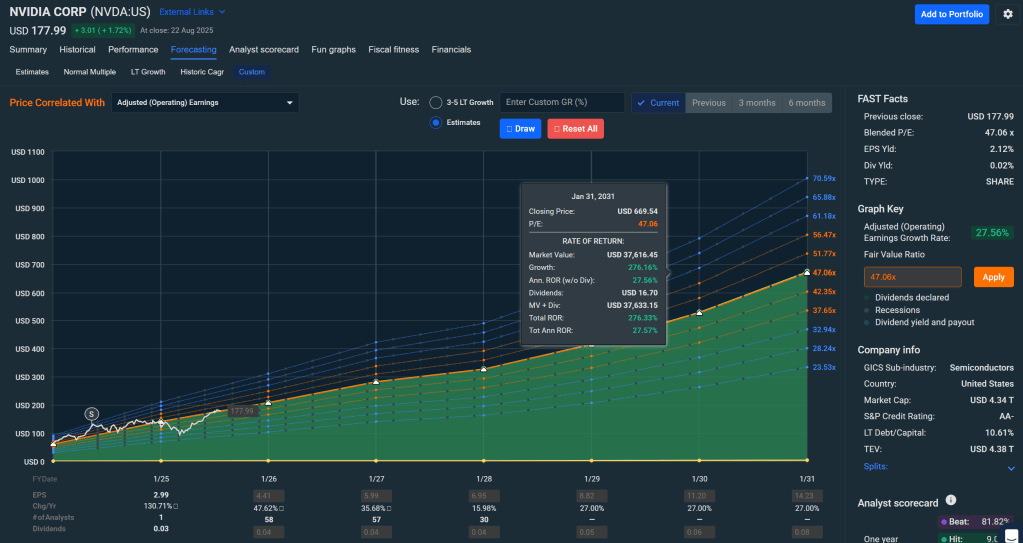

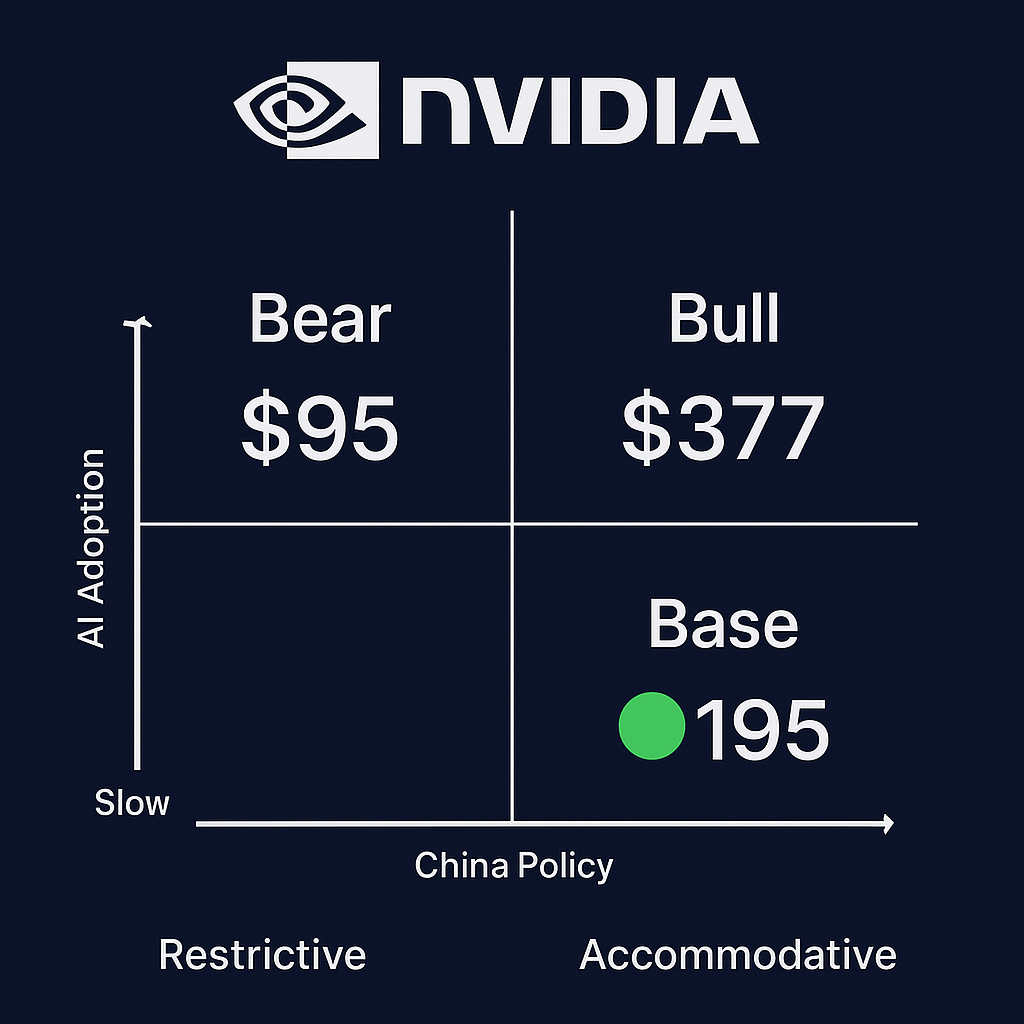

At $174.98, NVIDIA sits in a fascinating paradox. China’s state media questions the safety of its H20 chips, regulators pause production, and geopolitical tensions simmer—yet the stock trades with the confidence of a company that owns tomorrow’s most critical technology. With Fundstrat’s Tom Lee predicting NVIDIA could grow tenfold over the next decade, potentially reaching $1 trillion in revenue, and our comprehensive analysis pointing to a $195 fair value, this isn’t just another tech stock story. This is the battle for AI supremacy playing out in real-time.

The China Conundrum: Risk That’s Priced, But Not Paralyzing

Let’s address the dragon in the room. Beijing’s concerns about NVIDIA’s H20 chips create genuine headline risk, but our analysis suggests the market has already internalized much of this uncertainty. Trading at $175 with a Vulcan Score of 8.50 out of 10, NVIDIA demonstrates remarkable resilience against what could be existential threats to lesser companies.

The key insight? NVIDIA isn’t just weathering the storm—it’s building lifeboats. Reports indicate a “China-ready” Blackwell derivative (B30-class) is in development, offering a compliant pathway back into the world’s second-largest economy. This isn’t capitulation; it’s strategic adaptation from a company that understands the game being played.

Our base case DCF lands at $195 per share, using conservative assumptions that account for geopolitical friction. Even with China exposure haircuts in our bear scenario, we see a floor around $95—a compelling risk-reward profile for investors who understand both the opportunity and the execution risks.

The Tom Lee Vision: $1 Trillion in Revenue by 2034

When one of Wall Street’s most respected voices makes a 10x revenue prediction, it demands serious analysis. Tom Lee’s projection of $1 trillion in revenue over the next decade isn’t just optimism—it’s mathematics based on secular trends that remain intact regardless of Chinese policy shifts.

Consider the fundamentals driving this thesis:

- AI training capacity: Still in early innings with enterprise adoption accelerating

- Accelerated networking: The infrastructure backbone of AI transformation

- Enterprise GPU refresh cycles: A multi-year replacement wave just beginning

Our analysis supports Lee’s bullish framework, though we maintain more conservative base-case assumptions. With current TTM free cash flow of approximately $72.1 billion and shares outstanding of 24.7 billion post-split, NVIDIA generates $2.91 per share in free cash flow—a foundation for sustained multiple expansion.

Vulcan Score Breakdown: Excellence Across All Dimensions

The numbers tell a compelling story:

Composite Score: 8.50/10

- Value: 6.50 (tempered by premium multiples)

- Growth: 9.00 (reflecting ~22% long-term consensus)

- Quality: 9.60 (best-in-class balance sheet metrics)

- Momentum: 7.50 (positive but choppy on policy headlines)

- Safety: 9.90 (exceptional financial strength)

This isn’t a one-trick pony riding AI hype. NVIDIA scores exceptionally across all fundamental dimensions, with margins that would make any CFO envious: 70.1% gross margin, 58.0% operating margin, and 51.7% net margin. These aren’t unsustainable boom metrics—they reflect genuine competitive advantages and pricing power.

The CUDA Moat: Why Switching Costs Matter More Than Headlines

While competitors press price-performance angles, NVIDIA’s software ecosystem remains remarkably sticky. Developer tooling, enterprise integrations, and ecosystem inertia create switching costs that extend far beyond hardware specifications. Even as alternatives like AMD’s ROCm improve, the CUDA moat preserves pricing power across new architectural generations.

This software advantage explains why NVIDIA trades at premium multiples and maintains them through volatility cycles. It’s not just selling chips—it’s selling the infrastructure of AI development itself.

Strategic Position Sizing: Managing Volatility While Capturing Upside

With 51% annual volatility, NVIDIA demands disciplined position management. Our recommendation:

- Core position: Up to 10% of portfolio

- Maximum with tactical sleeve: 15%

- Primary buy range: $170.96–$192.31

- Strong buy threshold: Below $170.95

The current price of $174.98 sits comfortably within our Primary Buy range, offering attractive entry for long-term investors. Use trailing stops on tactical additions and consider dollar-cost averaging during headline-driven volatility.

Monte Carlo Reality Check: What the Math Says

Our simulation of 10,000 one-year price paths, anchored to 51% volatility, reveals:

- Median outcome (P50): $183

- Bear case (P5): $79

- Bull case (P95): $421

- Probability of positive returns: ~54%

These aren’t pie-in-the-sky projections—they’re mathematical probabilities based on historical volatility and fundamental drift patterns. The 46% probability of negative returns reminds us why position sizing matters, while the median $183 target suggests current prices offer reasonable value.

Risk Management: The Four Flags to Watch

Smart NVIDIA investors monitor these key risk factors:

- China Policy Evolution: Watch for B30 commercialization progress and regulatory shifts

- Export License Volatility: U.S.-China licensing terms remain fluid

- Supply Chain Concentration: TSMC capacity and packaging constraints

- Software Moat Erosion: Monitor enterprise wins by competitors like Intel’s Gaudi ecosystem

Each risk is manageable with proper position sizing, but they require active monitoring rather than set-and-forget strategies.

The Technical Picture: Discipline in a Volatile Name

Current technical setup supports selective accumulation:

- Trend: Uptrend intact above medium-term EMAs

- Volatility: Elevated but manageable with proper sizing

- Bull trigger: Sustained closes above the high-$180s to low-$190s

- Bear guardrail: Weekly close below mid-$160s increases deeper retrace odds

Use the Primary Buy range as your strategic guide, adding aggressively near $171 if policy headlines create further dislocations.

Cathie Wood’s Contrarian Signal: When ARK Buys the Dip

Cathie Wood’s recent $15.2 million NVIDIA purchase after the stock slid 14% provides an interesting contrarian signal. While Wood’s timing hasn’t always been perfect, her willingness to add during volatility aligns with our strategic accumulation thesis within the Primary Buy range.

The Verdict: AI Infrastructure Play Disguised as a Chip Stock

NVIDIA at $175 isn’t just a semiconductor investment—it’s a position in the infrastructure of artificial intelligence itself. With a $195 fair value, Vulcan Score of 8.50, and secular growth trends intact, the current price offers compelling risk-adjusted opportunity for patient investors.

The China headlines create noise, but the fundamental thesis remains: NVIDIA owns the picks and shovels of the AI gold rush, with software moats that extend far beyond hardware cycles. Smart accumulation within the $171-$192 range, proper position sizing to handle 51% volatility, and patience for the secular trends to unfold.

In a market obsessed with quarterly noise, NVIDIA offers something rarer: a decade-long growth story with the financial strength to execute through any geopolitical storm. The question isn’t whether AI transforms the economy—it’s whether you want to own the company building the infrastructure that makes it possible.

Rating: Buy with conviction. Fair Value: $195. Position accordingly.

For more sophisticated analysis of market-leading growth stocks and AI infrastructure plays, explore our comprehensive research at Vulcan Stock Research. Risk management and position sizing discipline separate winners from casualties in volatile growth names.

Leave a comment