Picture this: You’re holding a stock that’s been paying dividends for over a decade, just raised its payout again, and is now yielding a mouth-watering 7.5%. Yet analysts are slashing price targets faster than a UPS driver on Christmas Eve. Welcome to the paradox that is United Parcel Service (NYSE: UPS) in August 2025—a company where the market’s pessimism may have created one of the most compelling dividend opportunities of the year.

While the S&P 500 climbed 15.5% over the past twelve months, UPS shareholders watched their stock plummet 28%. But here’s where it gets interesting: beneath the surface carnage lies a deliberate strategic transformation that could reward patient income investors handsomely. The question isn’t whether UPS is broken—it’s whether the market understands what management is actually building.

The Transformation Hidden in Plain Sight

UPS isn’t just another struggling logistics company trying to compete on volume. CEO Carol Tomé and her team are executing something far more sophisticated: a complete reimagining of the company’s revenue mix. They’re deliberately shedding low-margin enterprise volume—the kind that looks impressive on quarterly reports but destroys shareholder value—while pivoting toward high-margin segments like small and medium businesses (SMB), business-to-business (B2B), healthcare logistics, and premium time-definite services.

The near-term cost? Lower package counts, declining revenue growth, and Wall Street analysts throwing tantrums about “missed volume expectations.” The long-term payoff? Structurally superior unit economics and a profit engine built for sustainable growth rather than vanity metrics.

The 18 analysts that cover UPS stock have a consensus rating of “Buy” and an average price target of $112.11, which forecasts a 29.11% increase in the stock price over the next year. Yet the stock trades at just $87.32, suggesting either the market is wrong, or the analysts are missing something fundamental about the transformation timeline.

Why the Market’s Panic Creates Your Opportunity

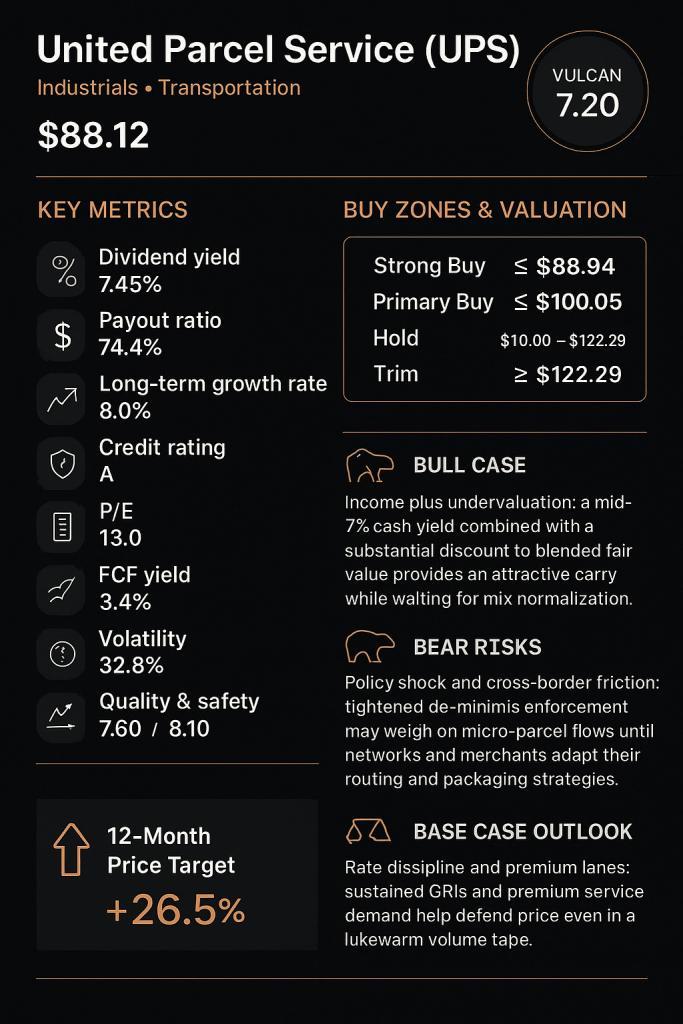

Our Vulcan-mk5 analysis framework reveals UPS as a quality compounder trading at distressed valuations. With a composite score of 7.20 out of 10.00, the stock exhibits strong value characteristics (8.40/10) and solid safety metrics (8.10/10), while growth (4.90/10) and momentum (3.80/10) reflect the near-term headwinds from the strategic shift.

At the current price of approximately $88.12, UPS offers a forward dividend yield of 7.45%—nearly double the yield of traditional dividend aristocrats like Johnson & Johnson or Coca-Cola. More importantly, our blended fair value analysis, weighting 60% external intrinsic value and 40% dividend discount modeling, suggests the stock is worth $111.17, representing a 26% upside to fair value.

This isn’t just about yield, though that 7.5% dividend certainly doesn’t hurt. UPS has maintained dividend payments for over a decade and continues growing its payout despite current headwinds. The company’s commitment to returning cash to shareholders remains unwavering, with management viewing the dividend as a core component of total shareholder return rather than an afterthought.

The Macro Tailwinds Wall Street Is Missing

While analysts obsess over quarterly package counts, they’re missing three critical macro trends that play directly into UPS’s strategic repositioning:

Policy Regime Shifts: Changes to de-minimis import thresholds and enforcement are creating friction for low-value cross-border parcels. While this initially appears negative, it actually reinforces UPS’s strategic pivot away from low-margin volume while supporting domestic pricing discipline. When cheap imports face higher barriers, domestic logistics networks with premium service capabilities benefit.

Supply Chain Realignment: Lingering Red Sea-related shipping disruptions and periodic ocean capacity volatility keep premium air lanes tighter than pre-2023 baselines. This benefits high-reliability networks like UPS’s, particularly for time-sensitive healthcare and B2B shipments where service quality trumps price competition.

Growth and Inflation Dynamics: In a slower growth, lower inflation environment, businesses increasingly value reliability and service quality over rock-bottom pricing. UPS’s pivot toward SMB and healthcare—segments where relationships and service matter more than pure cost optimization—positions the company perfectly for this regime.

The Numbers That Matter: Beyond the Surface Metrics

Let’s cut through the noise and focus on what really matters for dividend investors:

Financial Fortress: Despite recent headwinds, UPS maintains a debt-to-equity ratio of 1.8 with an interest coverage ratio of 8.9x, indicating solid financial stability. The company’s free cash flow generation, while cyclically depressed, remains sufficient to cover dividend obligations with a coverage ratio of 1.0x.

Valuation Disconnect: Trading at just 13.0x trailing earnings compared to the S&P 500’s 29.7x, UPS offers compelling value for patient investors. According to recent analyst consensus, UPS stock is currently priced at $87.43, with a 12-month average price forecast of $124.25 among 25 analysts, suggesting a potential upside of 42.11%.

Return Profile: Our Monte Carlo simulation of 20,000 price paths suggests a 12-month expected total return of 13.9% with the median outcome landing around 7.6%. The P95 upside scenario reaches 73.0% total return, while downside risk (P5) sits at -31.0%—asymmetric risk/reward that favors patient capital.

Risk Management: The Honest Assessment

No investment thesis is complete without acknowledging the genuine risks. UPS faces three primary headwinds:

Policy Uncertainty: Tightened de-minimis enforcement may create more friction for certain cross-border flows than our base case assumes. If small business adaptation proves slower than expected, this could weigh on the SMB pivot timeline.

Labor Cost Pressures: The multi-year wage framework provides labor stability but embeds higher unit costs. Success depends on management’s ability to offset these increases through productivity gains and favorable mix shifts—execution risk that can’t be ignored.

Modal Competition: Faster-than-expected normalization in ocean shipping rates could reduce pressure on air cargo yields, potentially narrowing one of UPS’s current competitive advantages in premium lanes.

Position Sizing and Entry Strategy

From a portfolio construction perspective, UPS represents an ideal core holding for dividend-focused strategies, but prudent risk management suggests capping single-name exposure at 6-8% of equity allocation. The combination of yield, strategic transformation potential, and reasonable valuation makes it worthy of meaningful weight, but policy and execution uncertainties counsel against overconcentration.

Our technical analysis suggests staged entry opportunities. With the stock trading below its 200-day moving average around $111 and RSI near 38, momentum remains soft but oversold conditions are developing. Support appears solid in the low $80s, while initial resistance sits near the 50-day moving average.

The optimal approach: build positions gradually within our Strong Buy zone (below $88.94) and Primary Buy range (below $100.05), using any weakness toward support levels as accumulation opportunities. If the stock reclaims and holds above the 200-day moving average on improving fundamentals, reassess position sizing and consider profit-taking in the Hold/Fair Value band ($100.05-$122.29).

The Healthcare and SMB Catalyst

Here’s what most analysts are missing: UPS’s healthcare logistics and SMB pivot isn’t just about revenue mix—it’s about customer lifetime value and pricing power. Healthcare shipments typically involve high-value, time-sensitive deliveries where reliability matters more than cost. SMB customers, meanwhile, tend to exhibit higher loyalty and less price sensitivity than enterprise accounts that squeeze every penny.

As this mix shift accelerates, UPS should see expanding margins, improved cash conversion, and more predictable revenue streams. The company’s investment in healthcare-specific infrastructure and SMB-focused services positions it to capture disproportionate value from these growth segments.

Social Media Summary

Tweet 1 (Hook-focused): When a dividend aristocrat yields 7.5% while analysts scream “buy,” something doesn’t add up. $UPS is executing the logistics industry’s boldest transformation—shedding low-margin volume for high-value healthcare and SMB clients. The market’s missing the strategy behind the carnage. #DividendStocks #FinTwit

Tweet 2 (Data-driven): $UPS numbers that matter: 7.5% yield, 13x P/E vs S&P’s 29x, analyst consensus $112 vs current $87. Monte Carlo shows 13.9% expected return, 73% upside scenario. Strategic mix shift from volume to value creating asymmetric opportunity for patient capital. cc: @dividendinvesting #StockAnalysis

The Bottom Line: Quality at a Discount

UPS represents that rare combination of quality, yield, and transformation potential trading at distressed valuations. While the market fixates on quarterly package counts and revenue growth rates, management is building a more profitable, sustainable business model optimized for long-term shareholder returns rather than short-term metrics.

The 7.5% dividend yield provides excellent downside protection while investors wait for the strategic transformation to bear fruit. With analyst consensus pointing toward 29-42% upside and our own fair value analysis suggesting similar potential, UPS offers compelling risk-adjusted returns for dividend investors willing to look beyond the surface noise.

Our Rating: Very Strong Buy – A high-quality income compounder trading at deep discount to intrinsic value, with the dividend doing the heavy lifting while strategic transformation unfolds.

For more insights on dividend investing strategies and portfolio risk management, explore our comprehensive guides on building sustainable income portfolios at vulcan-stock.com.

Master Metrics Table

| Category | Metric | Value |

|---|---|---|

| Price & Yield | Price (as‑of analysis) | $88.12 |

| Forward Dividend / Yield | $6.56 / 7.45% | |

| Valuation | External Fair Value Anchor | $118.00 |

| DDM Fair Value (r=9.5%, g=3.0%) | $100.92 | |

| Blended Fair Value | $111.17 | |

| Buy Range Guidance | Strong Buy ≤ | $88.94 |

| Primary Buy ≤ | $100.05 | |

| Hold / Fair Value | $100.05 – $122.29 | |

| Risk & Return | Monte Carlo TR (P5 / P50 / P95) | −31.0% / +7.6% / +73.0% |

| Expected TR (mean) | 13.9% | |

| Modeled Sharpe (12m) | 0.27 | |

| Quality & Safety | Vulcan Score (Composite) | 7.20 / 10.00 |

| Pillars (Value / Growth / Quality / Momentum / Safety) | 8.40 / 4.90 / 7.60 / 3.80 / 8.10 |

Leave a comment