Picture this: The CEO of a $233 billion company announces he’s so confident in artificial intelligence that he won’t hire a single engineer in 2025. The stock should rocket, right? Instead, Salesforce (CRM) trades 34% below its 52-week high while competitors command premium valuations. Marc Benioff’s bold declaration of a “30 percent productivity increase” from AI tools that eliminated the need for new engineering hires has created one of 2025’s most intriguing investment paradoxes.

This isn’t just another tech stock story—it’s a masterclass in market psychology meets fundamental disruption. While investors chase AI darlings at nosebleed valuations, Salesforce quietly built the infrastructure that could define enterprise AI for the next decade. At $243.97, the question isn’t whether CRM is cheap. It’s whether the market has completely missed the forest for the trees.

The Vulcan Thesis: When Premium Software Trades at a Discount

Our comprehensive Vulcan-mk5 Deep analysis reveals a company trading like a mature legacy player despite possessing the exact assets every AI company desperately needs: enterprise data, customer relationships, and distribution scale. The numbers tell a story Wall Street isn’t hearing.

The Vulcan Score: 7.48/10 breaks down into a fascinating contradiction:

- Growth Score: 9.70/10 (Outstanding)

- Quality Score: 7.10/10 (Strong)

- Safety Score: 9.40/10 (Exceptional)

- Value Score: 5.80/10 (Fair)

- Momentum Score: 5.40/10 (Neutral)

This profile screams “temporary dislocation” rather than “structural decline.” When a company with near-perfect growth and safety scores trades at just 19.3× forward earnings—a significant discount to software peers—smart money pays attention.

The AI Revenue Reality: $900 Million and Accelerating

While Tesla trades at astronomical multiples on autonomous driving promises, Salesforce has already monetized AI to the tune of $900 million in Data Cloud and AI ARR, growing 120% year-over-year. This isn’t vaporware or PowerPoint promises—it’s real revenue from real customers solving real problems.

The Agentforce platform, launched in October 2024, represents a fundamental shift in how enterprises interact with software. Instead of traditional point-and-click interfaces, businesses deploy AI agents that handle complex workflows autonomously. “We’ve built a deeply unified enterprise AI platform—with agents, data, apps, and a metadata platform,” Benioff explained during the Q1 2026 earnings call that saw the company raise guidance by $400 million.

But here’s the kicker: that $900 million represents just a fraction of the nearly $41 billion in expected annual sales. The penetration runway is massive, and early adoption metrics suggest this isn’t a feature—it’s becoming the core platform.

Technical Setup: A Coiled Spring at Critical Support

The technical picture amplifies the fundamental opportunity. Trading at $243.97, CRM sits just above the psychologically critical $240 level that’s acted as a floor multiple times this year. Stock Rover’s analysis shows the stock sporting a concerning momentum score of just 54/100, but contrarian indicators are flashing green.

Key technical levels paint a clear roadmap:

- Immediate resistance: 50-EMA at $261

- Major breakout level: 200-day moving average at $280

- Ultimate target: Fair value range of $325-$350

The setup is textbook accumulation territory. Every institutional buyer knows that a close above $280 would trigger significant technical buying, potentially catalyzing a 25-40% move toward fair value.

The Margin Expansion Story Nobody’s Talking About

While growth companies typically sacrifice margins for scale, Salesforce is achieving both simultaneously. The Stock Rover data reveals:

- Gross Margin: 77.3% (industry-leading)

- Operating Margin: 20.5% (expanding)

- Net Margin: 16.1% (stable despite investment)

The “30 percent productivity increase on engineering” that Benioff referenced isn’t just cost savings—it’s a preview of margin expansion potential. When your AI tools make engineers 30% more productive while eliminating the need for new hires, operating leverage amplifies exponentially.

This productivity revolution is hitting the income statement in real-time. Free cash flow reached $12.6 billion (up 31.5% annually), while the company maintains a fortress balance sheet with minimal debt (D/E ratio of just 0.2).

Risk Management: What Could Derail the Thesis

Professional investors evaluate downside before upside, and CRM presents manageable risks within an asymmetric opportunity:

Primary Concerns:

- Growth deceleration: Sales growth has slowed from 14.8% (5-year average) to 5.8% (current)

- Stock-based compensation: 1.4% annual dilution impacts shareholder returns

- AI adoption pace: Enterprise customers notoriously slow to embrace new technology

Mitigating factors:

- AI attach rates accelerating across existing customer base

- Pricing power from embedded switching costs

- Multiple expansion potential as AI monetization scales

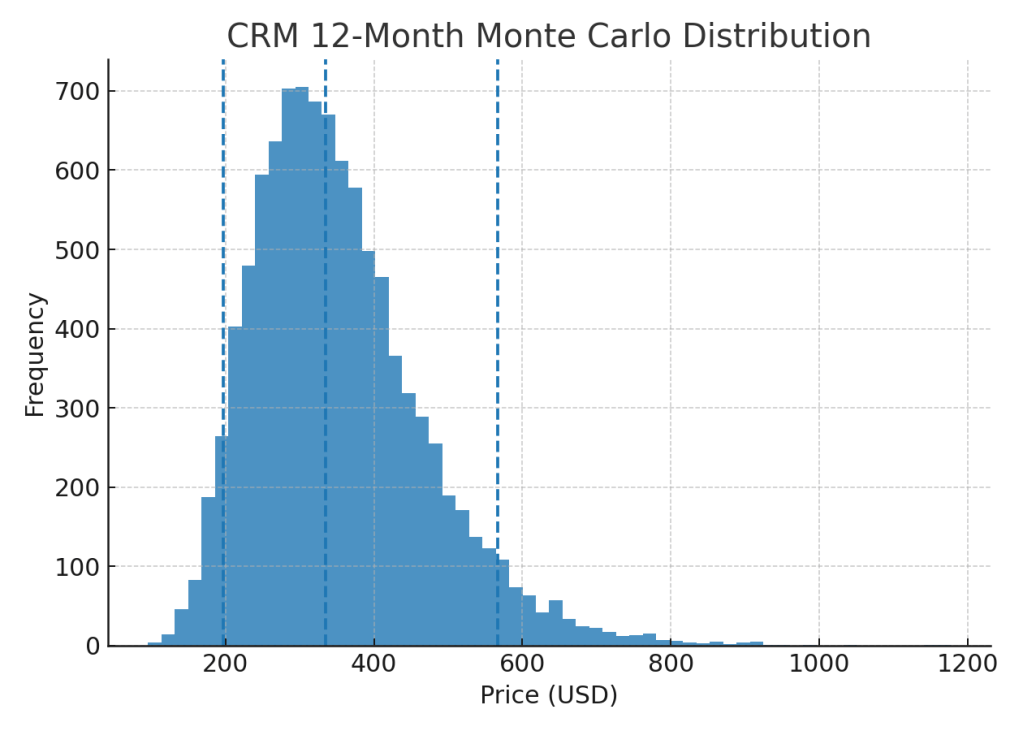

Our Monte Carlo simulation (10,000 trials) suggests 84% probability of positive returns over 12 months, with downside limited to approximately $197 (P5 level) versus median target of $335.

Valuation: When “Expensive” Becomes Cheap

The valuation paradox defines this opportunity. At 19.3× forward P/E, Salesforce trades at a discount to:

- ServiceNow (NOW): ~61× forward P/E

- SAP: ~40× forward P/E

- Adobe (ADBE): ~16.3× forward P/E

Only Adobe trades cheaper, but ADBE lacks Salesforce’s AI infrastructure and enterprise platform breadth. When Microsoft’s Dynamics threatens from below and specialized AI startups attack from above, Salesforce’s moat—customer data plus AI agents—becomes virtually unassailable.

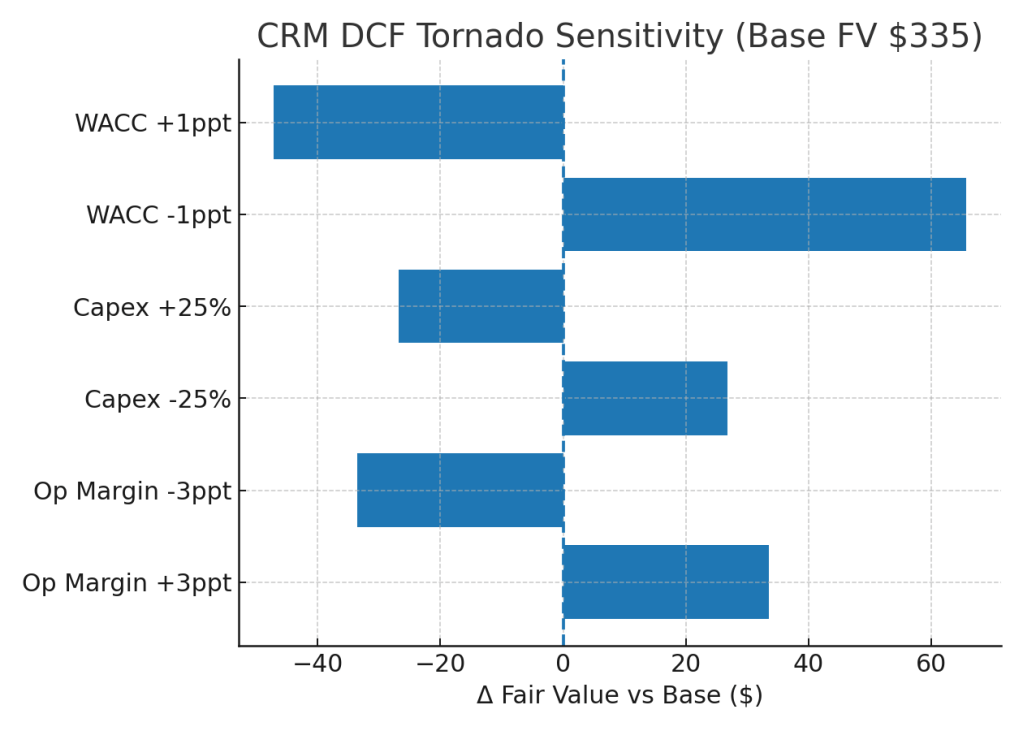

Fair value analysis converges around $335:

- Stock Rover Fair Value: $350.24

- Morningstar FVE: $325

- Vulcan DCF Model: $335 (blended)

The 44% margin of safety at current prices provides substantial downside protection while maintaining significant upside potential.

The Position Sizing Playbook

For sophisticated investors, CRM represents a rare “full position” opportunity—the intersection of undervaluation, structural growth, and technical setup alignment. Our recommended approach:

Primary Buy Zone: ≤$280 (accumulate on any weakness) Strong Buy Zone: ≤$228 (back up the truck) Ultra Value Zone: ≤$178 (maximum allocation territory)

Position sizing guidance suggests 2-4% of portfolio at current levels, with capacity to scale to 5% on significant weakness. The risk-adjusted return profile justifies concentration for investors comfortable with individual stock volatility.

Catalyst Timeline: Why the Next Six Months Matter

September 3, 2025 earnings represents the first major catalyst, with focus on:

- Agentforce adoption metrics and customer testimonials

- AI revenue growth trajectory and forward guidance

- Commentary on engineering productivity gains

Beyond earnings, the broader AI enterprise adoption cycle suggests 2025-2026 will separate platform winners from point-solution players. Salesforce’s integrated approach—combining customer data, AI agents, and application development—positions them as the clear enterprise AI operating system.

The Contrarian Call: Why Wall Street Gets It Wrong

Markets often misprice companies during transition periods, and Salesforce epitomizes this dynamic. The Street sees slowing growth and questions AI monetization. We see a company that’s successfully navigating the most significant technology shift since the internet while maintaining pricing power and margin expansion.

Software stocks in 2025 require new analytical frameworks that account for AI disruption rather than traditional SaaS metrics. Companies that provide infrastructure for AI adoption—like Salesforce—deserve premium valuations, not discounts.

The dividend initiation adds another layer of shareholder-friendly capital allocation. At $0.42 quarterly (0.7% yield), it’s modest but signals management confidence in free cash flow generation and commitment to total shareholder return.

Final Verdict: The AI Revolution Hiding in Plain Sight

Salesforce at $244 represents everything contrarian investors dream of: a dominant platform company trading at a discount during a massive technological inflection point. While markets chase AI pure-plays at unsustainable valuations, CRM offers established AI monetization at reasonable prices.

The convergence of technical setup, fundamental value, and catalysts timeline creates a rare asymmetric opportunity. With 84% probability of positive returns, median upside to $335, and downside protection around $200, the risk-reward equation strongly favors accumulation.

For investors seeking exposure to the enterprise AI revolution without paying peak valuations, Salesforce offers the unusual combination of market leadership, financial strength, and relative value. In a market where AI stocks command infinite multiples on future promises, buying AI revenue at reasonable prices feels almost anachronistic.

Rating: Strong Buy

Price Target: $335 (12-month base case)

Position Size: 2-4% (scale to 5% on weakness)

Key Catalyst: September 3 earnings and AI adoption metrics

The only question isn’t whether Salesforce will capitalize on enterprise AI adoption—it’s whether investors will recognize the opportunity before the market reprices this AI infrastructure play at appropriate multiples.

Ready to navigate the AI revolution with professional-grade analysis? Our systematic approach to technology investing has identified similar opportunities across the software landscape.

Leave a comment