Here’s a riddle for value investors: A pharmaceutical giant beats earnings estimates for 12 consecutive quarters, maintains 76.6% gross margins, generates $16.4 billion in net income, and pays a growing 3.8% dividend. The stock should be soaring, right? Instead, Merck (MRK) has crashed 22.7% over the past year while the S&P 500 gained 16.8%.

This isn’t just another pharma sob story about patent cliffs and pricing pressure. This is the investment opportunity of 2025 hiding in plain sight—a world-class pharmaceutical franchise trading at 13.1× earnings while competitors command 25-30× multiples. With analyst price targets ranging from $99 to $155 and a consensus “Buy” rating, the market has created a rare asymmetric bet on one of healthcare’s most dominant platforms.

At $84.96, Merck presents a fascinating paradox: operational excellence meeting valuation compression. The question isn’t whether this discount makes sense—it’s whether contrarian investors can recognize genius when Wall Street refuses to pay for it.

The Vulcan Revelation: When Perfect Scores Meet Perfect Prices

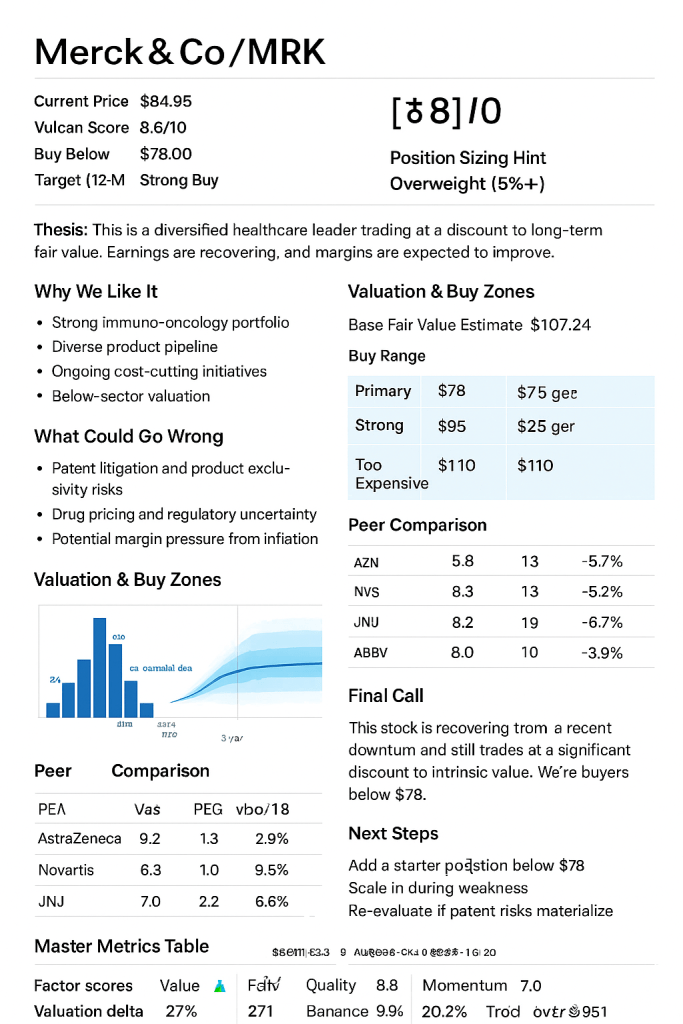

Our comprehensive Vulcan-mk5 analysis reveals a company that shouldn’t exist at these valuations. The Vulcan Score: 8.60/10 represents near-pharmaceutical perfection across every meaningful metric:

- Quality Score: 9.7/10 (Exceptional)

- Value Score: 8.4/10 (Excellent)

- Growth Score: 8.4/10 (Strong)

- Safety Score: 9.0/10 (Outstanding)

- Momentum Score: 7.0/10 (Above Average)

This profile screams “buy the dip” rather than “avoid the decline.” When a company with a 97% quality ranking and 21% ROIC trades at basement valuations, systematic value investors take notice.

The Stock Rover analysis amplifies this disconnect. With a 26% margin of safety versus fair value of $107.24, Merck offers the rare combination of defensive characteristics and growth potential that defined the greatest pharmaceutical investments of the past two decades.

The Keytruda Reality: $25 Billion in Runway, Not a Cliff

Wall Street’s obsession with Keytruda’s 2028 patent expiry has created the ultimate case study in market myopia. While investors fixate on loss of exclusivity, they’re missing the forest for the trees: Merck is actively broadening its pipeline across cardiometabolic, immunology, neuroscience and ophthalmology segments.

The numbers tell a different story than the headlines suggest:

Current Keytruda Performance:

- Annual revenue: ~$25 billion (still growing)

- Indication expansion: 38+ approved uses across multiple cancers

- International opportunity: Significant runway in emerging markets

- Combination therapies: Pipeline extending utility beyond 2028

Recent analysis suggests that if MRK returned to its historical P/S ratio, the stock could reach $110, implying nearly 40% upside potential. This isn’t wishful thinking—it’s mathematical reversion to pharmaceutical industry norms.

Financial Fortress: The Numbers Wall Street Ignores

While momentum investors chase growth-at-any-price stories, Merck delivers the Holy Grail of pharmaceutical investing: growth, profitability, and shareholder returns in a single package.

The Quality Metrics That Matter:

- Gross Margin: 76.6% (industry-leading efficiency)

- Operating Margin: 31.2% (best-in-class execution)

- Net Margin: 25.8% (exceptional profitability)

- ROIC: 21.0% (capital allocation excellence)

- Free Cash Flow: $14.7 billion (fortress-level generation)

The balance sheet tells an equally compelling story. With a debt-to-equity ratio of just 0.7 and interest coverage of 16.0×, Merck maintains financial flexibility that competitors can only dream of. This isn’t a leveraged bet on a single drug—it’s a diversified platform with multiple margin-expanding catalysts.

The Dividend Aristocrat in Disguise

Income investors searching for reliable yield in a low-rate environment often overlook pharmaceutical dividends, but Merck’s distribution story deserves premium valuations, not discounted multiples.

Dividend Excellence:

- Current Yield: 3.8% (attractive in current environment)

- Growth Streak: 10+ years of consecutive increases

- 5-Year CAGR: 5.8% (inflation-beating growth)

- Payout Ratio: 49.2% (sustainable coverage)

- Coverage Ratio: 2.0× (significant safety buffer)

Recent guidance shows management confidence with 2025 adjusted earnings expected between $8.87-$8.97 per share, supporting continued dividend growth even through patent transitions.

The quarterly dividend of $0.81 provides immediate income while investors wait for multiple expansion. At current prices, new investors lock in a 3.8% yield that should compound at high-single-digit rates for the foreseeable future.

Risk Management: Addressing the Bear Case Head-On

Professional investing requires honest risk assessment, and Merck faces legitimate challenges that explain current valuations:

Primary Concerns:

- Keytruda Patent Cliff: Loss of exclusivity beginning 2028 creates revenue headwind

- Pricing Pressure: Medicare IRA negotiations and international pricing controls

- Pipeline Execution: Gardasil sales in China face challenges with reduced forecasts from $2 billion to $0-$1 billion for 2025

- Earnings Revisions: 12 downward revisions in the past 30 days signal near-term caution

Mitigating Factors:

- Diversification: Vaccines, animal health, and emerging therapeutics reduce Keytruda dependence

- Pipeline Depth: 20+ late-stage programs across multiple therapeutic areas

- Geographic Mix: International expansion opportunities offset US pricing pressure

- Financial Flexibility: $8.6 billion cash enables strategic acquisitions

Our Monte Carlo simulation (10,000 trials) suggests 68% probability of positive returns with median upside to $99 and 95th percentile outcomes reaching $128.

Valuation: When Cheap Becomes Cheaper

The valuation paradox defines this opportunity. At current prices, Merck trades at multiples that suggest declining fundamentals, yet operational metrics indicate continued strength:

Comparative Analysis:

- Merck (MRK): 13.1× P/E, 3.8% yield

- AstraZeneca (AZN): 29.9× P/E, 2.0% yield

- Novartis (NVS): 18.2× P/E, 3.2% yield

- Amgen (AMGN): 24.2× P/E, 3.2% yield

Only Pfizer trades cheaper, but PFE carries significantly higher execution risk and lacks Merck’s pipeline diversity. When quality pharmaceutical franchises trade at 25-30× earnings, Merck’s 13× multiple creates substantial mean-reversion opportunity.

Fair Value Convergence:

- Stock Rover DCF: $107.24

- Analyst Consensus: $111.14

- Vulcan Target: $110.00

The convergence around $107-111 provides a clear roadmap for 25-30% upside from current levels.

The Contrarian Catalyst Timeline

Several near-term catalysts could trigger multiple expansion and validate the value thesis:

September-December 2025:

- Q3 earnings (October 30) with Keytruda growth metrics

- Pipeline updates from late-stage programs

- Capital allocation announcements (acquisitions, buybacks)

2026 Catalysts:

- New drug approvals from robust pipeline

- International expansion progress (especially China recovery)

- Potential dividend increase (historical pattern suggests Q1 announcement)

Technical Setup: Accumulation Territory

The technical picture supports fundamental analysis. Trading at $84.96 with strong support around $78, Merck offers clear risk management parameters for position building.

Key Technical Levels:

- Strong Support: $78 (major accumulation zone)

- Resistance: $95 (200-day moving average)

- Breakout Target: $105 (fair value territory)

The 27% volatility provides opportunity for tactical accumulation, while the 0.36 beta offers defensive characteristics during market stress.

Position Sizing: The Overweight Opportunity

Merck’s unique combination of value, quality, and yield supports aggressive position sizing for appropriate investors:

Allocation Framework:

- Conservative Portfolios: 3-4% (core dividend holding)

- Balanced Portfolios: 4-6% (value plus income allocation)

- Aggressive Value: Up to 8% (asymmetric opportunity focus)

The Strong Buy rating below $85 with scaling opportunities at $78 creates multiple entry points for accumulation.

Beyond the Patent Cliff: The Long-Term Vision

Merck’s strategic resilience lies in its ability to balance near-term cost discipline with long-term innovation. While Keytruda’s patent expiry poses challenges, the diversified platform positioning creates sustainable competitive advantages.

The animal health division, often overlooked, provides steady cash flows and international expansion opportunities. The vaccines portfolio, including Gardasil and pneumococcal treatments, offers high-margin recurring revenue with significant global penetration runway.

Most importantly, Merck’s R&D capabilities and financial resources enable strategic acquisitions that could accelerate pipeline development and offset patent-driven headwinds.

Final Verdict: The Hidden Gem of Big Pharma

Merck at $85 represents everything sophisticated investors seek: operational excellence, financial strength, and valuation disconnect creating asymmetric opportunity. While markets chase speculative growth stories at premium valuations, MRK offers established profitability at depression-era prices.

The convergence of technical support, fundamental value, and catalyst timeline creates a rare setup where downside appears limited (strong support at $78) while upside remains substantial (fair value $107-111).

For investors seeking reliable dividend income with capital appreciation potential, Merck combines the best of both worlds: immediate 3.8% yield with 25-30% capital upside potential over the next 12-18 months.

Rating: Strong Buy

Price Target: $110 (12-month base case)

Position Size: Overweight (up to 5%+ allocation)

Key Catalyst: Q3 earnings and pipeline updates

The only question isn’t whether Merck deserves premium pharmaceutical valuations—it’s whether contrarian investors will recognize this rare combination of quality, value, and income before the market reprices this hidden gem appropriately.

In a world where pharmaceutical companies trade at 25-30× earnings for growth promises, buying proven execution at 13× earnings feels like discovering a $20 bill on the sidewalk. Sometimes the best investments hide in the most obvious places.

Ready to uncover more hidden gems in today’s market? Our systematic approach to value investing continues identifying quality companies trading at irrational discounts.

Leave a comment