In a Nutshell: We’ve identified ten elite hedge funds that stand out for stellar multi-year returns, transparent stock disclosures, and consistency through bull and bear markets. By distilling their recent 13F filings, we built a “Smart Money” Conviction Portfolio – essentially the top 10 stocks that multiple top funds agree on most strongly. The result? A high-conviction basket dominated by Big Tech and a few strategic outliers, reflecting where Wall Street’s sharpest investors see the best opportunities. Below, we break down each fund’s profile (performance, strategy) and their top holdings, then dive into the consensus stocks and themes shaping this power portfolio.

Meet the Hedge Fund Heavyweights

These hedge funds combine influence and performance. Many are famed for double-digit annual returns over 5–10 years, and all regularly disclose positions via 13F filings (so we can actually see what they own). In a world of thousands of funds, these ten have risen to the top:

- Renaissance Technologies (Medallion) – Legendary Quant Wizards (Average ~30–40% annual returns over the past decade[1]). RenTech’s Medallion fund, led by Jim Simons, is often cited as the most successful hedge fund of all time[2]. It uses sophisticated algorithms to trade almost anything. Consistency: Nearly unparalleled (no down years for Medallion). Transparency: Moderate – they file 13Fs, but with thousands of tiny positions. Top Equity Holdings (latest 13F):

| Top Holding | % of Portfolio | Strategy Insight |

| Palantir (PLTR) | Top position (data analytics)[3] | RenTech often uncovers mid-cap tech gems. |

| NVIDIA (NVDA) | Significant[3] | Riding the AI chip wave alongside others. |

| Robinhood (HOOD) | Significant[3] | A contrarian bet on retail trading platforms. |

| Verisign (VRSN) | Notable[3] | A long-time holding (internet infrastructure). |

| Netflix (NFLX) | Notable[3] | Shows RenTech isn’t shy about FAANG names. |

Renaissance’s Medallion fund famously delivered ~66% gross annual returns from 1988–2021 (about 37% net after fees!)[4]. The catch: it’s closed to outside investors. Still, their 13F reveals positions from their other funds (e.g. Renaissance Institutional). They hold an extensive, diversified portfolio – but the above stocks were among the largest recent holdings. These picks reflect RenTech’s data-driven confidence in tech and quantitative “value” anomalies.

- Citadel Advisors (Ken Griffin) – Multi-Strategy Powerhouse (≈19.5% annualized since inception[5]). Citadel is renowned for consistent double-digit returns across market conditions[6], recently minting a record $16 billion profit for investors in 2022. Griffin’s team runs strategies from equities to bonds to commodities. Consistency: Very high (no major losing years lately[7]). Transparency: Medium – 13F shows thousands of positions (they trade everything). Top Disclosed Equity Holdings:

| Top Holding | Position Context |

| SPY (S&P 500 ETF) | Core market exposure[8] – used for broad index bets/hedges. |

| Invesco QQQ ETF | Nasdaq-100 tech exposure[8]. |

| NVIDIA (NVDA) | Largest single-stock long[9][10] – high-conviction AI play. |

| Meta (META) | Major tech holding[8] – reflecting bullishness on social/media. |

| Tesla (TSLA) | Another top holding[8] – Citadel boosted its stake, though opinions on Tesla differ widely among funds. |

Citadel’s stock portfolio is extremely active – the top five positions make up only ~5% of its $576B equity portfolio value (and include index ETFs and options)[11]. That said, Citadel’s big winners in 2023 included NVIDIA (they quadrupled their stake ahead of its surge) and energy plays like Hess Corp[12][13]. Griffin’s strategy is to deploy a broad net: while they hold many stocks, the fund’s overall net exposure and big sector tilts (e.g. towards tech) drive performance. The presence of SPY and QQQ indicates Citadel often uses ETFs to rapidly adjust market exposure.

- D.E. Shaw & Co. – Quantitative Multi-Strategy (Estimated ~15–18% annual returns over 10 years[14]). DE Shaw, founded by David Shaw, blends quant and fundamental approaches. In 2024 it topped industry rankings with $11B in profits[15]. Consistency: Very high (steady gains, low correlation strategies[16]). Transparency: Medium – they disclose a large equity book. Top Equity Holdings:

| Top Holding | % Portfolio (approx.) | Note |

| SPY (S&P 500 ETF) | ~3% (largest)[17] | Used for macro exposure/hedging. |

| NVIDIA (NVDA) | ~2%[17] | High-conviction in AI boom, like peers. |

| Apple (AAPL) | ~2%[17] | Big-tech staple in portfolio. |

| Microsoft (MSFT) | ~2%[17] | Another core tech holding. |

| Netflix (NFLX) | ~1–2%[17] | Notably large position for this quant fund. |

DE Shaw runs over 4,300 equity positions[17], but its top concentrations reveal a tech-centric tilt. In fact, the top five (above) comprised just ~9.5% of the equity portfolio[18] – showing how diversified their book is. Still, the fund’s conviction in mega-cap tech and the broader market is evident: SPY, NVDA, AAPL, MSFT consistently rank high. DE Shaw’s strength is risk-adjusted consistency – they manage to capture upside (e.g. Oculus macro fund +36% in 2024[15]) with limited drawdowns. The heavy use of ETFs like SPY suggests a systematic approach to balancing market exposure*. *

- Millennium Management (Izzy Englander) – Multi-Manager Market Neutral (~14% annual since inception[19]). Millennium is a giant with 270+ trading teams, famous for strict risk limits and only one down year in 30+ years[20]. Consistency: Excellent (very low volatility returns). Transparency: Medium – thousands of small positions in 13F. Top Disclosed Holdings:

| Top Holding | % of Portfolio (recent) | Comment |

| iShares Russell 2000 ETF (IWM) | ~1% (largest single position)[21] | Signals small-cap market exposure. |

| NVIDIA (NVDA) | ~1.14%[22] | Top individual stock long. |

| Microsoft (MSFT) | ~1.03%[22] | Core large-cap tech holding. |

| Amazon (AMZN) | ~0.89%[22] | Another significant tech position. |

| AppLovin (APP) | ~0.81%[22] | A surprising top-5: mid-cap mobile tech bet. |

Millennium’s top 10 positions are only ~16% of its $190B equity portfolio[23] – reflecting its highly diversified, market-neutral style. The fund often pairs longs and shorts, so a stock’s presence in top holdings indicates a relative bet rather than a huge directional wager. For instance, being long NVDA might be hedged with shorts in other tech names. Still, it’s telling that NVidia, Microsoft, Amazon make the cut – consensus winners that even a market-neutral fund is betting on. The appearance of an offbeat name like AppLovin shows Millennium hunting for alpha in less-covered corners (perhaps expecting an acquisition or rebound in that mobile-app sector). Overall, Millennium’s approach yields steady, low-risk gains, but it also means their conviction overlaps often align with broad hedge fund consensus (mega-cap tech), rather than idiosyncratic picks.

- TCI Fund Management (Chris Hohn) – Concentrated Activist (~15–20% est. annual return over 10 years[24]). London-based TCI (The Children’s Investment Fund) is known for big, long-term bets and shareholder activism. It soared +33% in 2023 (after a -18% 2022)[24], showing both upside and volatility. Consistency: Generally strong; a few volatile years but blockbuster gains overall. Transparency: High – only ~10 positions, all public equities. Top Holdings (Q2 2025):

| Top Holding | % of Portfolio[25] | Activist Angle |

| GE Aerospace (GE) | 24.1%[25] | Result of TCI’s push to break up GE[25]. High conviction in GE’s aviation unit. |

| Microsoft (MSFT) | 17.2%[25] | Big bet on Big Tech (recently added more)[26]. |

| Visa (V) | 13.3%[25] | Steady compounder; TCI has urged lower costs, higher buybacks. |

| Moody’s (MCO) | 13.1%[27] | Long-term holding in credit ratings (wide moat, pricing power). |

| S&P Global (SPGI) | 11.5%[27] | Another data/ratings firm – thematic pairing with MCO. |

TCI’s entire portfolio is only 10 stocks (100% concentration in top 10)[28], reflecting extreme conviction. Hohn typically holds positions for years (average holding ~5 years for top names). When he invests, he goes big – e.g. TCI is one of the largest shareholders of Alphabet (Google) and recently agitated for cost cuts there[29]. (Google isn’t in the top 5 above, but is a notable holding around ~8%.) This fund’s performance is proof that focus can pay off: TCI zeroes in on dominant franchises (tech, monopolistic data providers, etc.) and sometimes pushes management to unlock value. The flip side is higher short-term volatility – as seen in 2022’s loss – but over the long run, TCI has delivered index-crushing returns by sticking to its convictions[24].

- Viking Global Investors (Andreas Halvorsen) – Tiger Cub Stock Pickers (~22.6% annual over recent 5-year period[30]). Viking, born from Julian Robertson’s Tiger Management lineage, has a reputation for rigorous fundamental research. Consistency: Strong long-term, though 2022 was challenging (tech pullback hurt). Transparency: High – typically 80–100 equities in 13F, but with notable large positions. Top Holdings (mid-2025):

| Top Holding | % of Portfolio[31] | Theme |

| Bank of America (BAC) | 4.3%[32] | Contrarian financials bet (post-rate-hike recovery). |

| Charles Schwab (SCHW) | 4.2%[32] | Another finance play – capitalizing on 2023’s dip in brokers. |

| Capital One (COF) | 3.5%[32] | Consumer finance (credit card) wager. |

| JPMorgan Chase (JPM) | 3.4%[32] | Banking leader – Viking went overweight on big banks. |

| U.S. Bancorp (USB) | 3.2%[33] | Regional banking stake. |

Surprise: Viking’s top five are all financials as of mid-2025[31]. Halvorsen rotated into banks after 2023’s turmoil (when many regionals fell). This contrarian tilt shows Viking’s willingness to go where others aren’t. But Viking hasn’t abandoned tech – further down the portfolio are big tech names. For instance, Amazon was ~2.5% of Viking’s portfolio (they increased their Amazon stake by 43% in Q2)[34][35], and it remains a high-conviction growth holding. Historically, Viking’s winners have included tech darlings and healthcare plays. The current portfolio suggests a barbell strategy: deep value in financials coupled with select growth stocks (Amazon, UnitedHealth, etc.). It’s a reminder that even the top tech-focused funds will pivot to new sectors when opportunities arise.

- Lone Pine Capital (Steve Mandel) – Tiger Cub Growth Focus (~23.5% annual over 5 years[36]). Lone Pine (named after a ski run) made its name riding internet and software stocks in the 2000s and 2010s. Mandel has stepped back, but the fund continues in his style. Consistency: Very strong long-term (though like many growth funds, had a drawdown in 2022). Transparency: High – 20–30 stocks, with fairly concentrated top holdings. Top Holdings (Q2 2025):

| Top Holding | % of Portfolio[37] | Note |

| Vistra Energy (VST) | 9.1%[38] | Unusual top pick: Texas power utility (value play). |

| Meta Platforms (META) | 8.9%[38] | Core growth holding (bet on Facebook’s rebound). |

| Amazon.com (AMZN) | 7.9%[39] | Long-term e-commerce/cloud conviction. |

| Microsoft (MSFT) | 6.6%[37] | Big-cap tech anchor in portfolio. |

| Taiwan Semi (TSM) | 5.5%[39] | Key bet on global chip manufacturing. |

Lone Pine balances high-growth tech with select value plays. Meta, Amazon, Microsoft show the classic Tiger-cub DNA – investing in dominant tech platforms. But the #1 position, Vistra, is a power producer; Lone Pine clearly saw deep value in it (possibly an inflation hedge with stable cash flows). The fund drastically slimmed its portfolio from 30 to ~22 holdings by 2025, upping concentration in its highest convictions[40]. They exited or reduced weaker ideas and doubled-down on winners. This reflects a broader theme: after 2022’s shakeout, top growth funds refocused on quality over quantity. Lone Pine’s recent performance has rebounded as tech recovered, thanks to sticking with names like Amazon and Meta through the volatility.

- Coatue Management (Philippe Laffont) – Tech-Centric Tiger Cub (~22.9% annual over 5 years[41]). Coatue specializes in technology, media, and telecom investing – across public and private markets. Consistency: Very strong in bull markets, with some drawdowns in tech downturns (2022 was likely tough). Transparency: High – around 70 stock positions, but top 10 make up over half the portfolio[42]. Top Holdings (mid-2025):

| Top Holding | % of Portfolio[43] | Theme |

| Meta Platforms (META) | 9.5%[44] | Social media & VR – high conviction. |

| Amazon.com (AMZN) | 9.0%[44] | E-commerce & cloud – core holding. |

| Taiwan Semi (TSM) | 5.8%[44] | Chips – belief in semiconductor cycle. |

| Constellation Energy (CEG) | 5.5%[44] | Clean energy utility – a non-tech diversifier. |

| Microsoft (MSFT) | 5.4%[44] | Big Tech staple (AI and cloud exposure). |

Coatue’s portfolio reads like a who’s who of tech – but also with some surprising plays (Constellation, a nuclear/renewables utility, being a top 5 holding shows an eye on energy transition themes). Laffont, a former Robertson disciple, famously says “follow the smartest engineers” to the next big thing. Lately that “big thing” is AI – hence Coatue’s heavy positions in NVIDIA (which, while just outside the top five, is a notable holding) and TSMC (which makes the chips). Coatue also invests in private tech startups, but those don’t show up in 13F filings – so their public holdings skew toward mega-cap platforms that can reliably compound. After a rocky 2022, Coatue trimmed positions and concentrated in the highest-conviction winners (Meta, Amazon, Microsoft) which has paid off in 2023’s rebound. The fund’s top holdings suggest optimism in both consumer internet and the picks-and-shovels (semiconductors, cloud) that power the digital economy.

- Pershing Square (Bill Ackman) – High-Concentration Activist (~26% annual over last 5 years[45]). Pershing Square runs a focused portfolio of 10 or fewer names, often with an activist tilt (Ackman takes big stakes and sometimes board seats). Recent years have been stellar – Ackman scored huge wins on plays like Chipotle and interest rate hedges. Consistency: Historically volatile (famously, big losses on Herbalife and Valeant earlier last decade; but huge gains more recently). Transparency: Very high – only ~11 stocks, all disclosed. Top Holdings (Q2 2025):

| Top Holding | % of Portfolio[46] | Rationale |

| Uber Technologies (UBER) | 20.6%[46] | “Platforms of the future” – Ackman sees Uber as a dominant, underpriced tech platform. |

| Brookfield Corp (BN) | 18.5%[47] | Asset management & real estate conglomerate – a play on hard assets and cash yield. |

| Restaurant Brands (QSR) | 11.1%[48] | Owner of Burger King, Tim Hortons – Ackman’s classic consumer/brand investment. |

| Amazon.com (AMZN) | 9.3%[49] | Newer position – a nod that even Ackman couldn’t ignore Amazon’s dominance[50]. |

| Howard Hughes Holdings (HHH) | 9.3%[51] | Real estate development – Ackman’s long-term value play (he’s on the board). |

Pershing Square is the most concentrated fund on this list after TCI, and Ackman’s bold bets generate intense interest. For instance, his near-21% allocation to Uber signals enormous conviction (Pershing was buying Uber throughout 2022-23 as it turned profitable). This aligns with Ackman’s theme of post-pandemic urban revival and the “platform economy.” His Brookfield stake shows a taste for inflation-resistant asset managers. Pershing’s addition of Amazon in 2023 raised eyebrows – Ackman traditionally avoided Big Tech, but he now believes Amazon’s valuation finally justified a buy[50]. Pershing’s portfolio skews to consumer, real estate, and platform tech, with relatively less pure finance or industrial exposure. The risks? With so few positions, any one mistake (or macro shock) can hurt – but Ackman mitigates this by sometimes using hedges (famously turning a $27 million hedge into $2.6 billion during the March 2020 crash). Overall, Pershing offers retail observers a very clear window into one investor’s highest convictions – it’s practically a stock-picking syllabus.

- Bridgewater Associates (Ray Dalio) – Global Macro Giant (~10–12% estimated annual returns over 10 years[52]). Bridgewater is the world’s largest hedge fund, famed for Dalio’s “All Weather” risk-parity strategy and big macro calls. It’s less of an equity stock-picker, more of an asset allocator, but its sheer influence merits inclusion. Consistency: Good in macro regimes (e.g. +35% in 2022’s bear market)[53], but had hiccups (–$12B in 2020)[54]. Transparency: High – Bridgewater’s 13F reveals broad index holdings rather than specific stock bets. Top Disclosed Holdings:

| Top Holding | Portfolio Role |

| SPDR S&P 500 ETF (SPY) | ~9% (largest position)[55] – core U.S. equity exposure. |

| iShares Core S&P 500 (IVV) | ~6%[55] – another S&P 500 index position (similar to SPY). |

| iShares Core EM ETF (IEMG) | ~4%[55] – broad emerging markets equity exposure. |

| Alibaba (BABA) | ~3% (top single stock)[56] – high-conviction China play (Bridgewater has often bet on China’s growth). |

| Alphabet (GOOGL) | ~3%[56] – a large-cap tech holding, notable in a macro portfolio. |

- Unlike others here, Bridgewater’s portfolio is designed to be balanced across economic scenarios. Thus, its top holdings are ETFs representing entire markets – the fund essentially owns the haystack rather than picking a few needles. Dalio’s rationale: diversification and risk-parity (mixing assets to perform in inflation, recession, etc.). That said, Bridgewater does tilt based on macro views – for example, it significantly increased positions in Chinese stocks like Alibaba when bullish on China[56]. The presence of Alphabet (Google) in top holdings[56] shows that even a macro fund finds value in Big Tech’s resiliency (likely as a proxy for U.S. growth trends). For retail investors, Bridgewater’s moves highlight macro themes: in recent filings, it has been long equities broadly (SPY), long emerging markets (IEMG), and still holding big tech and commodities as inflation hedges. While its stock picking insight is limited (you won’t find edgy small-caps here), Bridgewater offers a masterclass in allocation – a reminder that sometimes the broad market bet is the high-conviction bet.

“Smart Money” Conviction Portfolio – Top 10 Consensus Stocks

Using the above funds’ 13F data, we compiled a Smart Money Conviction Portfolio – the ten stocks that multiple top funds converge on with sizable positions. Think of it as the ultimate hedge fund VIP list. Here are the winners:

Consensus “Smart Money” stock convictions – ranked by how many of our top 10 hedge funds hold each in size. For example, Microsoft is a top holding in 5 of the 10 funds, making it the most agreed-upon pick.

The list reads like a Who’s Who of Big Tech, with a couple of twists:

- Microsoft (MSFT) – Held in 5 of 10 elite funds’ top portfolios[25][32], Microsoft is the consensus bet. Funds love its dominant cloud business and AI upside (OpenAI partnership). TCI, Lone Pine, Coatue, DE Shaw, and Millennium all have Microsoft as a major holding. Even value-activist TCI boosted MSFT to 17% of its portfolio[25], a huge testament to their conviction.

- Amazon.com (AMZN) – A top holding in 4 funds’ portfolios (Pershing, Lone Pine, Coatue, Millennium)[48][43]. After a 2022 slump, Amazon attracted activists and growth investors alike – Ackman bought in[50] and Tiger Cubs doubled down. The consensus: Amazon’s e-commerce + AWS cloud juggernaut is too cheap to ignore.

- Nvidia (NVDA) – 4 funds (RenTech, Citadel, DE Shaw, Millennium) count NVIDIA among top positions[12][17]. It’s 2023’s poster child for AI, and hedge funds rode its surge. Even typically neutral funds had >1% in NVDA[22]. The risk is its high valuation, but no other stock offers pure-play AI hardware exposure at scale – so the smart money is willing to hold on.

- Meta Platforms (META) – 4 funds (Citadel, Lone Pine, Coatue, Millennium) made Meta a top pick[8][38]. After its metaverse-fueled crash in 2022, Meta’s cost cuts and rebound in ad revenue have drawn in hedge funds. It’s now seen as a leaner, high-cash-flow business (with a huge user base to monetize further). The contrarian buy last year is a consensus long now.

- Alphabet/Google (GOOGL) – At least 3 funds hold Alphabet significantly (Bridgewater, TCI, DE Shaw)[29][56]. (DE Shaw’s top-five didn’t list it, but likely it’s in their top ten). Google’s core search and YouTube franchises, plus its AI prowess, make it a staple. Notably, TCI bought more Alphabet in 2023 and has pushed the company to cut expenses and increase buybacks[57]. The hedge fund thesis: at ~20x earnings, Google is a bargain for a near-monopoly on global information.

- Apple (AAPL) – The world’s biggest company is unsurprisingly a hedge fund favorite (in 2–3 of these portfolios)[17]. DE Shaw and Millennium both list Apple among top holdings, and others hold smaller positions. While Tiger Cubs have been less overweight Apple (perhaps seeing more upside elsewhere), quant-centric funds love its stability. Apple’s resilient iPhone economics and burgeoning services segment make it a “safe” growth stock – a must-have anchor in many portfolios.

- Taiwan Semiconductor (TSM) – Featured in 2 top funds (Lone Pine and Coatue)[39][43], TSM is the world’s chip fabrication linchpin. It’s an indirect play on every trend from smartphones to AI (since TSM makes the chips for Apple, NVIDIA, etc.). Hedge funds like that TSM has high barriers to entry and geopolitical importance. Coatue and Lone Pine both put ~5–6% in TSM[39], showing conviction that this “arms dealer” of tech will keep thriving. Risk: U.S.–China tensions, since TSM’s main ops are in Taiwan.

- Netflix (NFLX) – A top holding for quant funds RenTech and DE Shaw[3][17], Netflix appears as a consensus pick mostly on the quant side – interestingly, the traditional stock pickers have gravitated to other FAANGs instead. Still, multiple funds betting on Netflix implies a view that its profitability and subscriber growth have room to run (and perhaps that password-sharing crackdowns and an ad-supported tier are boosting financials). Netflix’s inclusion highlights that even after the streaming wars, the original leader remains in favor with savvy investors.

- Visa (V) – TCI’s 13% position in Visa[25] puts it on the map, and many other hedge funds hold Visa or its cousin Mastercard in smaller sizes for steady growth exposure. Visa gives our consensus portfolio a bit of financial sector ballast (10% weighting by sector). The bullish view: Visa’s global payments network is a tollbooth on commerce with decades of runway, benefiting from digitization of cash. Its inclusion reminds us that not all “smart money” plays are high-flying tech – profitable, oligopoly businesses like Visa also rank high in conviction.

- Tesla (TSLA) – This one’s contentious. Only Citadel had Tesla among its very top holdings[8], but we include it as an “honorable mention” due to its frequent appearance in hedge fund portfolios (sometimes as a large long and in some cases as a short). Tesla is a stock that divides hedge funds – some see it as wildly overvalued, others as an industry disruptor that still has upside. Citadel’s multi-strat approach evidently saw enough trading opportunity to make Tesla a notable long. For our portfolio, Tesla provides exposure to the EV revolution – but keep in mind, this is likely the highest-risk, highest-variance name in the basket. Notably, many fundamental-focused funds have avoided Tesla (or bet against it in the past), so its presence with the quants and multi-strats is a more recent development.

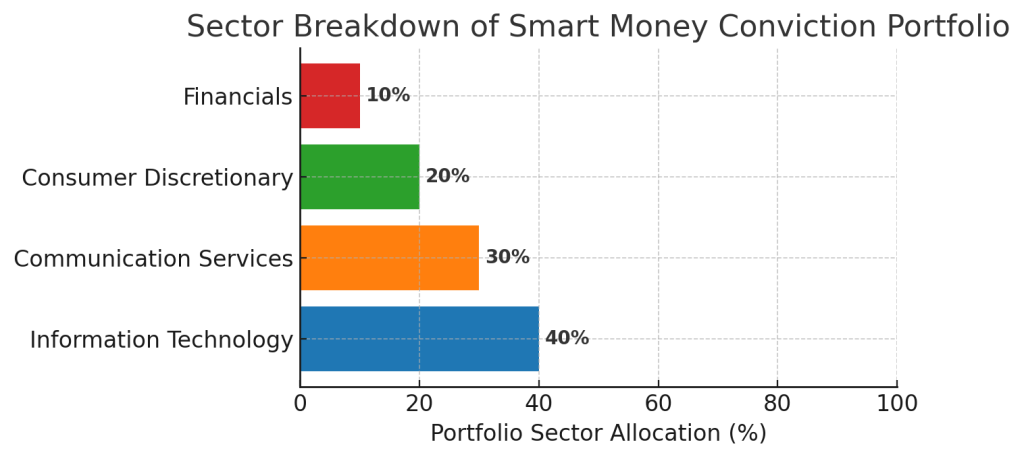

Overall, this “Smart 10” portfolio skews heavily toward technology and growth. Here’s the sector breakdown:

Sector allocation of the hedge fund consensus portfolio (by weight of the top 10 stocks). It’s 70% in Tech/Tech-like sectors (Information Technology 40% + Communication Services 30% which includes internet/social media), 20% in Consumer Discretionary (Amazon, Tesla), and a modest 10% in Financials (Visa). This concentration reflects the institutional view that big tech platforms remain the most compelling long-term bets, albeit with limited diversification.

Emerging Themes & Common Threads: The dominance of tech, media, and telecom in the conviction list underscores a theme: hedge funds are leaning into the digital economy’s leaders. AI is a big driver – Microsoft, NVIDIA, Google, Amazon (through AWS) are all key AI players. Several funds also hold semiconductors (NVDA, TSM), essentially picks-and-shovels for the AI/cloud boom, indicating a belief that the “arms suppliers” will profit regardless of which consumer application wins.

Another theme is platform power: companies like Amazon (e-commerce/cloud), Meta (social media), Alphabet (search/YouTube) have scalable platforms that throw off massive cash flows. Hedge funds see these as relatively safe and high-growth – a rare combo. Even Uber in Pershing’s portfolio fits here: it’s become a platform for urban mobility and food delivery with improving economics.

On the value side, high-moat financial services appear via Visa (and in some funds via Moody’s/S&P Global, not consensus enough to make top 10 but present in TCI and others). These are plays on entrenched networks or data monopolies – again, businesses with huge barriers to entry.

What’s notably absent? Traditional energy, heavy industry, pharma/healthcare (none of the consensus top 10 are in healthcare). It’s not that hedge funds don’t invest there – they do (e.g. Viking owns UnitedHealth, Renaissance holds many biotechs) – but no single healthcare stock achieved multi-fund high-conviction status. This could be a risk if those sectors outperform tech. It also highlights that hedge funds collectively might be overlooking sectors like healthcare or staples in favor of sexier tech names – a form of consensus bias.

How Should Retail Investors Read This?

For a retail investor, seeing where top hedge funds align can be insightful. A few takeaways:

- Sector Concentration = Double-Edged Sword: The smart money portfolio is very concentrated in tech/consumer discretionary. This was a winning bet in the past decade, but it introduces risk. If interest rates rise or tech earnings falter, this basket could underperform. Retail investors should note that even the “best and brightest” are making a big macro bet here on continued tech dominance. Diversification beyond this list (e.g. some healthcare or energy exposure) could be prudent for balance.

- Conviction in Quality and Scale: All these consensus companies are giants – each a leader in its domain. Hedge funds gravitate to companies with scale advantages, strong cash flows, and secular growth tailwinds. The smallest market cap in the top 10 is likely Netflix (~$180B). This suggests that for all the complex stock-picking these funds do, when it comes to high conviction, they favor known quantities and liquid large-caps. Retail investors can emulate this by focusing on quality companies they understand, rather than speculative micro-caps.

- Emerging Ideas Lurking Below: The consensus list doesn’t show some emerging themes that individual funds are playing. For instance, renewable energy and utilities (Coatue’s Constellation Energy, Lone Pine’s Vistra), financial services rebound (Viking’s banks), or specific consumer brands (Pershing’s Restaurant Brands). These themes haven’t hit multi-fund consensus, but they are noteworthy. It implies that beyond FAANG-type stocks, hedge funds are selectively venturing into post-pandemic recovery stories (travel, food, retail) and transition stories (energy transition, fintech). Keep an eye on those one-off high convictions – they could become the next consensus plays if a couple more funds jump in.

- Risk Management & Time Horizon: Even these top funds sometimes get it wrong (e.g., many were burned in early 2022). What sets them apart is risk management – sizing positions appropriately and hedging. For example, despite being bullish, Millennium and DE Shaw keep any single stock around 1% of capital[22][18]. In contrast, activists like Pershing make fewer, bigger bets but may hedge elsewhere. Retail investors should be cautious about going “all in” on any single idea. The hedge funds’ high-conviction portfolio is meant to be taken as a basket – the idea is that a few losers won’t sink the ship if you hold the group.

- Patience with Conviction: Many of these funds stick with their top ideas through turbulence. When Meta plunged in 2022, some of the smartest investors (Coatue, Lone Pine) held or added – and they were vindicated in 2023 as Meta’s stock doubled. TCI stuck with Moody’s through years of it being range-bound, only to see it break out. The lesson: if your fundamental thesis is strong, patience pays off. However, also note when hedge funds change their minds: Tiger Global (not in our top 10 but an influential fund) famously rode tech up then cut exposure dramatically in 2022 after losses. Our listed funds too made adjustments – e.g., Viking rotating into banks shows adaptability. Retail investors should combine conviction with an open mind to new information.

The Mini Leaderboard: Fund Performance & Profile Recap

To put it all together, here’s a quick “leaderboard” summary of these ten hedge funds, ranked roughly by recent performance and influence:

| Hedge Fund (Manager) | 5-Year Avg Annual Return | Style & Focus | Example Top Holdings |

| Renaissance Tech (Simons) | ~35%[4] (Medallion) | Quantitative – short-term trading | PLTR, NVDA, HOOD[3] |

| Pershing Square (Ackman) | ~26%[45] | Concentrated Activist, Long-term | UBER (21%)[46], BN[47], QSR[48] |

| Lone Pine Capital (Mandel) | ~23.5%[36] | Growth Stock Picking (Tiger Cub) | META (9%)[38], AMZN[39], MSFT[37] |

| Coatue Mgmt (Laffont) | ~22.9%[41] | Tech-Focused Long/Short (Tiger Cub) | META (9%)[44], AMZN[44], TSM[44] |

| Viking Global (Halvorsen) | ~22.6%[30] | Diversified Long/Short (Tiger Cub) | BAC, SCHW, JPM (financals)[31]; plus AMZN[34] |

| Citadel Advisors (Griffin) | ~20% (est. last 5 yrs)[6] | Multi-Strategy, All Asset Classes | NVDA[10], META[8], SPY[8] |

| D.E. Shaw & Co. (Team-run) | ~17% (est.)[14] | Quant & Fundamental Hybrid | SPY[17], NVDA[17], AAPL[17] |

| TCI Fund (Hohn) | ~15–18% (est.)[24] | Activist Value, Concentrated | GE (24%)[25], MSFT[25], V[58] |

| Millennium (Englander) | ~14%[59] | Multi-PM Market Neutral | NVDA[22], MSFT[22], AMZN[22] (each ~1%) |

| Bridgewater (Dalio) | ~10–12%[52] | Global Macro (Risk Parity) | SPY, IVV, IEMG (ETFs)[55]; BABA[56] |

(Sources: Fund return data from various estimates and reports[4][45][59]; Holdings from latest 13F filings as cited throughout.)

This table underscores how different these funds are. Renaissance and Citadel excel through quantitative breadth and fast trading; Pershing and TCI through deep concentration; Viking, Lone Pine, Coatue through fundamental stock picking; Bridgewater through macro diversification. Yet, for all their differences, when we aggregate their top ideas, we saw a striking commonality in the stocks they favor.

Parting Thoughts – Institutional Insights for Retail Portfolios

It’s fascinating that the smart money’s favorite stocks are largely the same names many retail investors favor – just think FAANG/MAMAA stocks (Meta, Amazon, Microsoft, Apple, Alphabet) plus NVIDIA. This is reassuring: these companies have been long-term winners for a reason, and the savviest investors still see upside. It also means those stocks are crowded trades – something to watch if the tide turns.

Retail investors can glean a few strategies from the hedge fund titans:

- Do Your Homework & Build Conviction: The reason these funds can hold through volatility is because they’ve done in-depth research to believe in the long-term story. If you’re investing in individual stocks, try to know why you own them (beyond “it’s going up”). Whether it’s understanding Apple’s ecosystem lock-in or NVIDIA’s CUDA software moat, having that conviction will help you weather downturns.

- Concentrate but Diversify: Sounds contradictory, but the top funds demonstrate balance. They concentrate on their best ideas (they’re not buying the 50th best stock, they’re buying the top 5–10). But as a group, they’re still diversified across themes – our consensus portfolio has e-commerce, software, hardware, media, payments. Within a personal portfolio, this might mean: don’t hold 50 stocks (that’s likely too many to follow), but do hold enough different winners that you’re not betting the farm on one trend.

- Stay Flexible with the Macro: Hedge funds shift when the environment shifts. In 2022, many cut exposure; in 2023, they added back. Viking rotated into cyclicals; Bridgewater tweaked its allocations on inflation changes. As a retail investor, you don’t need to trade every twist, but be aware of the big picture. If interest rates spike, maybe trim extremely speculative growth stocks; if a recession looms, know which companies in your portfolio might be resilient (the ones with fortress balance sheets and essential products).

- Watch What They Do, Not Just What They Say: We often hear hedge fund managers on TV talking their book. The real insight is in the filings – actions speak louder. For instance, some managers talked bearish in mid-2023, yet 13F data showed they were buying tech again. Following the data (e.g., via sites that track 13Fs) can help cut through noise. Our analysis used sources like WhaleWisdom, 13F.info, and fund letters[25][46] to get the real scoop. It’s public info available with a short delay each quarter. Just remember, 13Fs show positions, not necessarily hedges or shorts – so interpret them as incomplete snapshots, albeit useful ones.

In conclusion, the top hedge funds’ high-conviction holdings reveal a strong collective bet on a tech-driven future, anchored by companies with dominant market positions. They complement that with select plays in finance, consumer, and other niches where they see idiosyncratic value. For a retail investor, there’s no shame in piggybacking some of these ideas – after all, these funds have armies of analysts crunching numbers to arrive at these picks[60]. Just make sure any stock you buy fits your risk tolerance and time horizon.

The hedge funds we profiled have access to lines of credit, derivatives, and diversification that an individual might not – so if you imitate a Pershing Square and put 20% of your portfolio in one stock, know that you’re taking on a lot of risk (Ackman can call investors or use portfolio hedges if that goes south; you might not have that luxury).

By studying what the best are doing – and understanding why – you can make more informed decisions. Not every hedge fund move will be right (they’re human, and 2022 proved even the greats can misstep), but over time their collective wisdom has produced market-beating returns. Now that collective wisdom points toward a handful of high-quality companies. It’s up to each of us to decide if that makes sense for our own portfolios.

Happy investing, and remember: even the “smart money” isn’t infallible, but they often have a method to their madness.

Sources: Recent 13F filings and performance data were referenced from WhaleWisdom, SEC filings, and financial news analyses (LevelFields.ai report on hedge fund returns[61][62], Institutional Investor, etc.). Key holdings and fund statistics were cited throughout from sources like GuruFocus and WhaleWisdom (e.g., TCI holdings[25], Pershing holdings[63], HedgeFollow/Fintel summaries for Millennium[22], Citadel[8], DE Shaw[17], and others). These give an up-to-date picture as of Q2 2025 of where top hedge funds are placing their bets.

Leave a comment