Current Price: $41.85 | Vulcan Score: 7.10/10 | Rating: Reasonable Buy

When Tom Lee, one of Wall Street’s most accurate strategists, predicts Ethereum will hit $15,000 by 2025, it’s time to pay attention. But here’s the fascinating part: you don’t need to navigate crypto exchanges, manage private keys, or worry about security nightmares to capitalize on this thesis.

The Grayscale Ethereum Mini Trust (ETH) puts institutional-grade Ethereum exposure directly into your brokerage account with the simplicity of buying any stock. With a 0.15% expense ratio and growing institutional adoption, this ETF represents the cleanest way to ride Ethereum’s next wave higher.

The Wall Street Consensus: Ethereum Is Just Getting Started

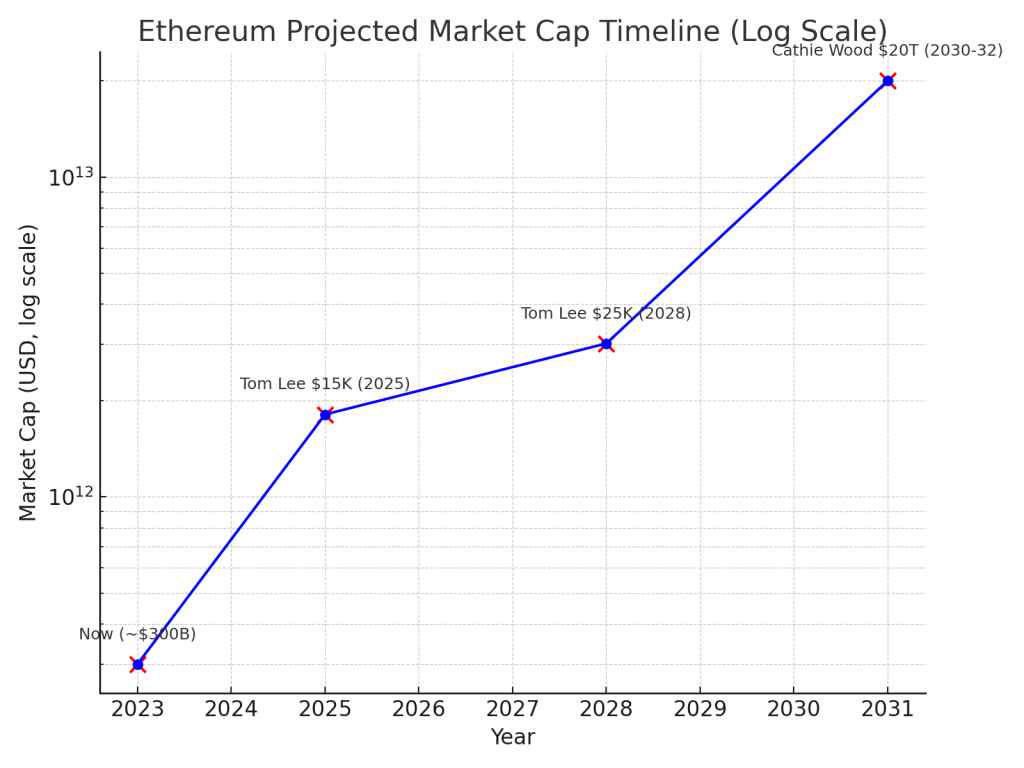

The smart money isn’t just bullish on Ethereum – they’re predicting a generational wealth transfer. Tom Lee from Fundstrat targets $15,000 by 2025 and $25,000 by 2028, but that’s conservative compared to Cathie Wood’s ARK Invest, which predicts Ethereum could reach a $20 trillion market capitalization by 2030-2032. To put that in perspective, that would represent over 7,000% growth from current levels.

Even Bitcoin maximalist Michael Saylor has shifted his stance, now viewing Ethereum ETFs as legitimizing crypto as an institutional asset class. When the most prominent voices in traditional and digital finance converge on bullish scenarios, it’s worth paying attention.

The thesis centers on what Lee calls the “stablecoin revolution” and what Wood sees as the foundation of a new financial system. As digital dollars and other stablecoins become mainstream infrastructure, Ethereum benefits as the primary settlement layer. Every USDC transfer, institutional DeFi interaction, and tokenized asset transaction generates fees while reducing token supply through EIP-1559 burns.

This isn’t just theoretical anymore. We’re seeing massive institutional adoption accelerating through 2025, with traditional finance increasingly embracing Ethereum-based solutions. The ETF structure makes this adoption even easier, allowing pension funds, endowments, and family offices to gain exposure without operational complexity.

Why the ETF Structure Changes Everything

The Grayscale Ethereum Mini Trust solves every pain point that kept institutional investors on the sidelines. No custody headaches, no security concerns, no regulatory ambiguity about holding digital assets directly. You buy ETH shares just like any other ETF, and your exposure tracks Ethereum’s price movements closely thanks to the creation/redemption mechanism.

The 0.15% annual expense ratio is essentially noise compared to Ethereum’s typical volatility. When an asset can move 60-80% annually, paying 15 basis points for professional custody and operational infrastructure is a bargain. More importantly, U.S. institutional investors can now include Ethereum in their portfolios without creating new operational frameworks or compliance headaches.

The timing couldn’t be better. ETF adoption is accelerating precisely as Ethereum’s fundamental value proposition is becoming clearer. We’re not just buying speculative digital tokens anymore – we’re buying exposure to what’s increasingly looking like the internet’s financial operating system.

The Technical Setup: All Systems Go

From a technical perspective, Ethereum is exhibiting textbook bullish structure. The asset is trading above a rising 200-day moving average with intermediate momentum turning constructive. More importantly, we’re seeing healthy consolidation patterns that often precede significant breakouts.

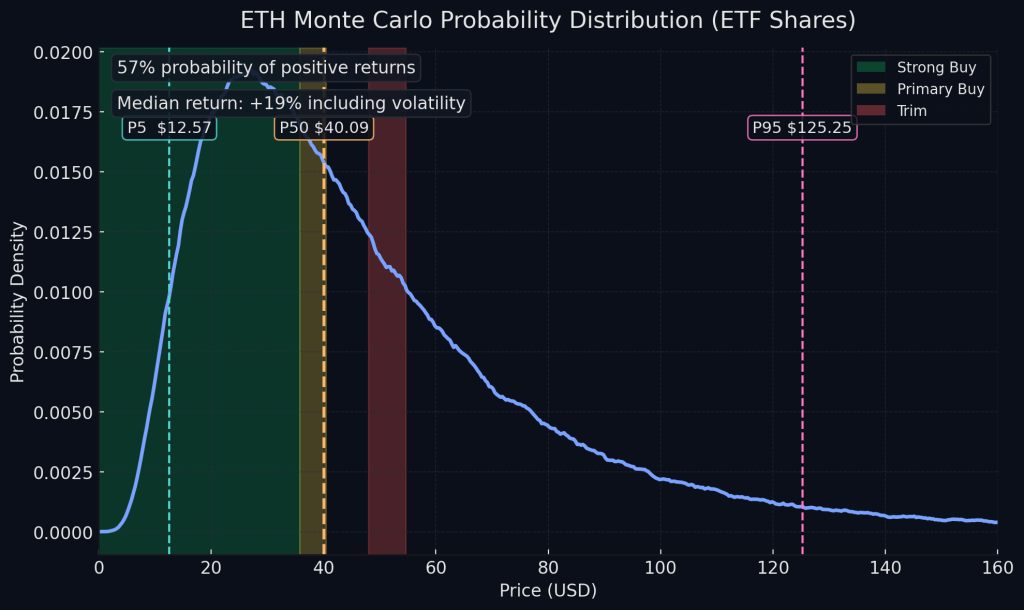

Our Monte Carlo simulation, running 30,000 paths over 12 months, suggests a median price target around $40 per ETF share, with the 95th percentile reaching $125. The 5th percentile sits at roughly $12.57, illustrating both the upside potential and downside risks that define crypto investing.

The key insight from our modeling: Ethereum’s return distribution shows positive skew, meaning the potential upside scenarios significantly outweigh the downside cases on a probability-weighted basis. This asymmetric risk-reward profile is precisely what sophisticated investors seek in portfolio construction.

Portfolio Strategy: The Laddered Approach

Given Ethereum’s volatility profile, position sizing and entry strategy become critical to long-term success. Our recommended approach treats the ETH ETF as a growth allocation requiring careful risk management rather than a core holding.

Starting Position: Begin with 0.5-1.5% of portfolio value this week, using our laddered entry strategy within the Primary Buy zone ($35.78-$40.48 per share).

Build Strategy: Scale into a 2-5% target allocation over time, with more aggressive portfolios potentially reaching 8% maximum. The key is staging entries during periods of weakness rather than chasing momentum.

Risk Management: Plan around 60-80% annualized volatility and size positions so that the 5th percentile outcome (roughly 70% drawdown) doesn’t force panic selling at the worst possible moment.

This systematic approach allows participation in Ethereum’s upside while managing the inevitable volatility that comes with emerging asset classes. The portfolio risk management principles we emphasize become even more critical with crypto allocations.

The Institutional Adoption Catalyst

What makes the current setup compelling isn’t just price momentum – it’s the underlying adoption trajectory that suggests sustainable demand growth. We’re witnessing the early stages of traditional finance embracing blockchain-based solutions, with Ethereum positioned as the primary beneficiary.

Consider the stablecoin ecosystem: over $150 billion in digital dollars now exist, with the majority running on Ethereum. Every transaction generates fees and reduces token supply through EIP-1559’s burn mechanism. As stablecoins continue growing – and they show no signs of slowing – Ethereum benefits from increased utility and deflationary pressure.

Corporate treasury allocation represents another catalyst. While Bitcoin grabbed headlines as a treasury asset, forward-thinking companies are beginning to recognize Ethereum’s superior utility for business operations. Smart contract capabilities, DeFi integration, and tokenization possibilities make Ethereum more than just digital gold – it’s programmable money.

The ETF structure accelerates this adoption by removing operational barriers. Institutional investors can now gain Ethereum exposure through familiar investment vehicles, likely accelerating the timeline for broader acceptance.

Valuation: Beyond Traditional Metrics

Traditional valuation methods struggle with crypto assets, and the original analysis acknowledges this challenge. However, we can construct useful frameworks by focusing on Ethereum’s economic fundamentals: transaction fees, token burn rates, and network growth metrics.

Our conservative DCF approach treats Ethereum’s fee generation and token burns as “owner earnings,” establishing a valuation floor while acknowledging the limitations of applying equity analysis to crypto networks. The real value driver is adoption growth and the resulting network effects.

Think of Ethereum less like a stock and more like prime real estate in a rapidly developing digital economy. As more applications, users, and capital flow onto the network, the underlying asset becomes increasingly valuable due to fixed supply and growing demand.

Risk Management: What Could Go Wrong

Crypto investing requires honest assessment of potential risks. Regulatory changes remain the primary concern – adverse policy decisions could impact flows overnight. While the ETF structure provides some insulation, crypto regulations continue evolving globally.

Technical risks include MEV (Maximal Extractable Value) concentration and potential centralization concerns as Ethereum scales. These don’t represent immediate threats but warrant monitoring for quality-focused investors.

Tokenomics variability adds another layer of complexity. Lower Layer 2 fees help adoption but can make net token burn less predictable in the short term. Don’t over-anchor to quarterly burn rates when evaluating the long-term thesis.

Most importantly, plan for volatility. Ethereum can experience 50%+ drawdowns even during bull markets. The key is positioning size and entry strategy so these inevitable corrections become buying opportunities rather than forced selling events.

The 12-Month Outlook: Bayesian Scenarios

Our scenario analysis assigns 25% probability to bull cases (strong regulatory clarity, accelerated institutional adoption), 55% to base cases (steady growth, moderate volatility), and 20% to bear cases (regulatory setbacks, market correction).

Even with conservative assumptions, the probability-weighted outcomes skew positive. Bull scenarios could see the ETF reaching $125+ per share, while base cases suggest steady appreciation toward our $48 fair value estimate.

The beauty of the laddered entry approach is that it works across scenarios. Weakness allows for accumulation at better prices, while strength confirms the thesis and justifies holding positions.

Investment Strategy: Playing for Alternative Investment Alpha

Buy Zones:

- Strong Buy: ≤ $35.78

- Primary Buy: $35.78-$40.48

- Hold/Fair Value: $40.48-$48.02

- Trim Zone: $48.02-$54.61

- Too Expensive: > $54.61

The current price around $41.85 sits in our fair value range, suggesting patience for better entry points or small starter positions for those wanting immediate exposure.

Our recommended execution: place limit orders in the Primary Buy range, adding on any weakness into Strong Buy territory. Allow one momentum add on decisive breakouts above resistance, but keep total allocation within risk parameters.

The Ethereum Advantage: More Than Digital Gold

Unlike Bitcoin’s “digital gold” narrative, Ethereum offers utility-driven value creation. Every DeFi transaction, NFT mint, stablecoin transfer, and smart contract execution generates fees while potentially burning tokens. This creates a fundamentally different investment dynamic than pure store-of-value plays.

The programmability aspect enables entirely new financial primitives impossible in traditional systems. Decentralized exchanges, lending protocols, derivatives markets, and tokenized assets all run primarily on Ethereum, generating sustainable demand for the underlying token.

As traditional finance continues digitizing, Ethereum’s first-mover advantage in programmable money becomes increasingly valuable. The network effects and developer ecosystem create significant competitive moats that should support long-term value appreciation.

Final Verdict: Reasonable Buy With Conviction

The Grayscale Ethereum Mini Trust offers institutional-quality exposure to what may be the next decade’s most important financial infrastructure. With top strategists like Tom Lee predicting massive price appreciation and institutional adoption accelerating, the setup appears constructive for risk-appropriate allocations.

Our Vulcan score of 7.10 reflects strong growth prospects (4.40/5) and improving quality metrics (4.10/5), tempered by inherent volatility that keeps safety scores modest (2.10/5). This isn’t a conservative income play – it’s a growth allocation requiring active risk management.

Rating: Reasonable Buy – Start small with 0.5-1.5% allocation, build toward 2-5% target using our laddered approach. The combination of institutional access, growing utility, and positive strategist consensus creates an attractive risk-adjusted opportunity for patient investors.

In a world where traditional assets offer limited upside and significant downside risks, Ethereum via the ETH ETF provides asymmetric opportunity with institutional-grade execution. Sometimes the best trades are hiding in plain sight.

Master Metrics Summary

Vulcan Score: 7.10/10

- Value: 2.90 (premium multiple, but justified by growth)

- Growth: 4.40 (stablecoin adoption, institutional flows)

- Quality: 4.10 (network effects, developer ecosystem)

- Momentum: 3.85 (constructive technical setup)

- Safety: 2.10 (high volatility, regulatory risks)

Monte Carlo (12-month): P5/P50/P95 = $12.57/$40.09/$125.25 Target Allocation: 2-5% of portfolio (up to 8% for aggressive profiles) Entry Strategy: Ladder into Primary Buy zone, build on weakness

Leave a comment