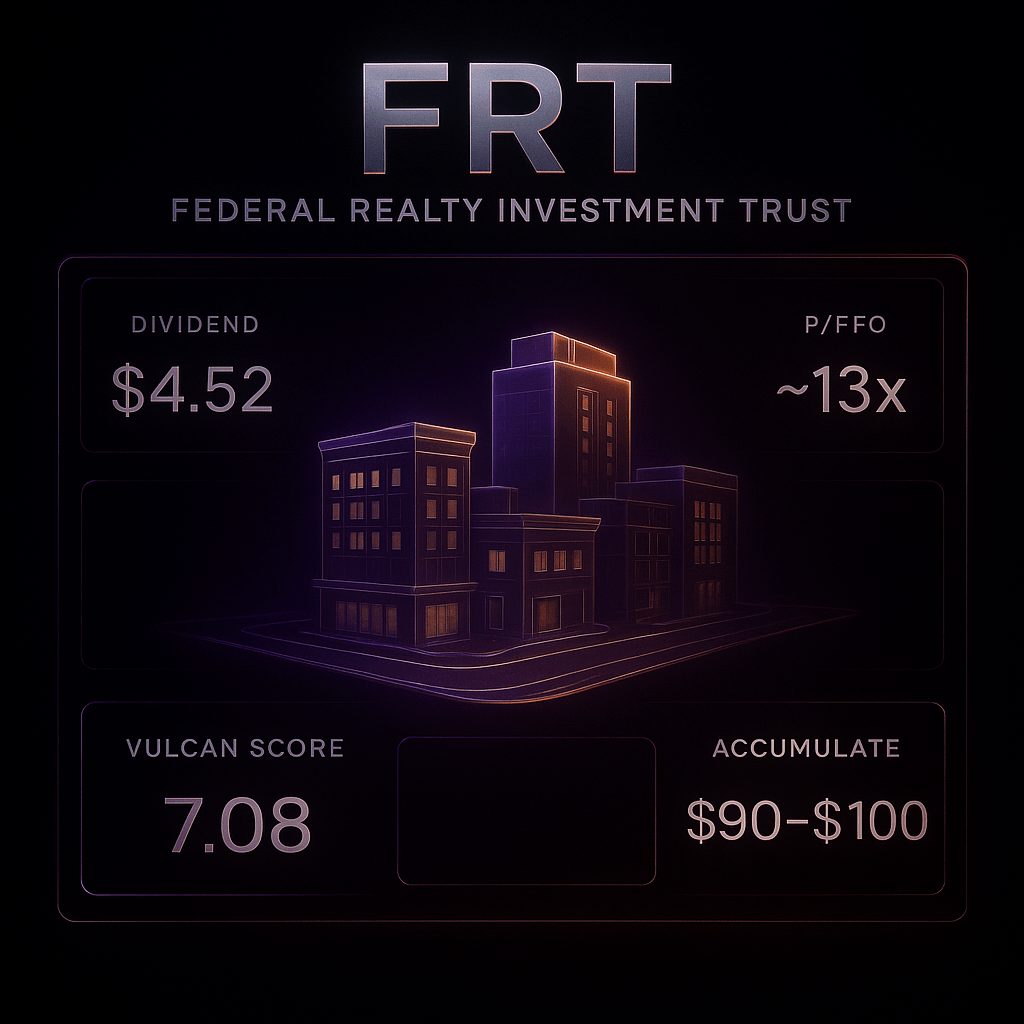

Current Price: $93.85 | Vulcan Score: 7.08/10 | Rating: Buy

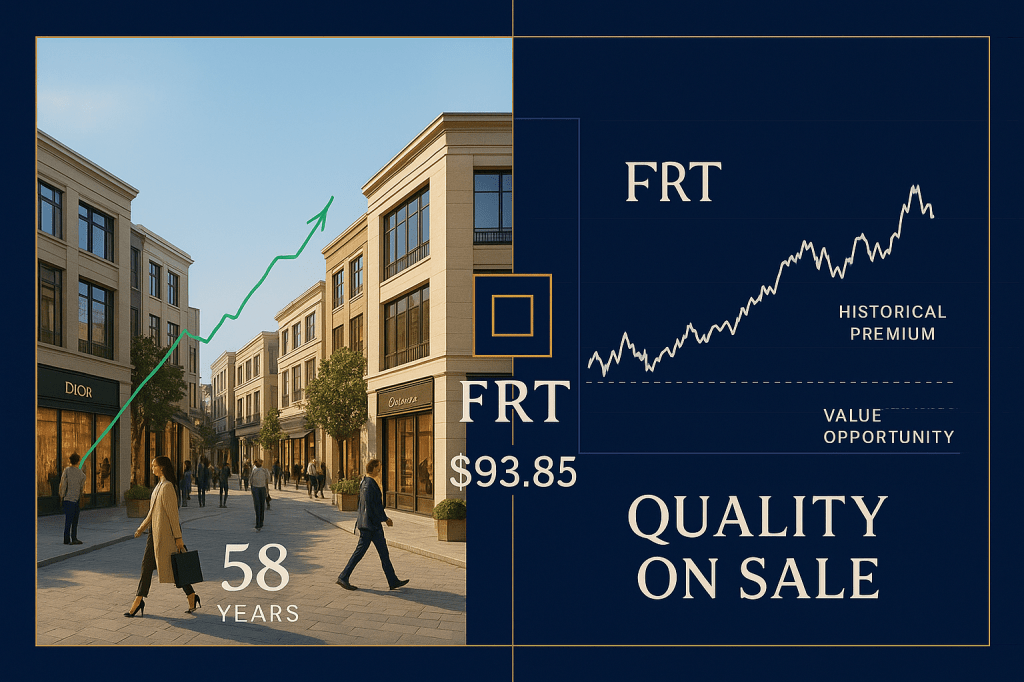

In a world obsessed with the next AI breakthrough or meme stock moonshot, Federal Realty Investment Trust quietly achieved something truly remarkable: its 58th consecutive annual dividend increase. While tech stocks gyrate wildly and crypto burns fortunes, FRT has been methodically compounding wealth for nearly six decades.

But here’s what makes this story compelling right now: this dividend aristocrat is trading at a discount to its own quality premium, creating a rare opportunity to buy excellence on sale.

The Aristocrat That Wall Street Forgot

Federal Realty isn’t just another REIT collecting rent from strip malls. This is a meticulously curated portfolio of high-street, mixed-use properties in some of America’s wealthiest corridors. Think Georgetown in Washington D.C., Santana Row in San Jose, and Assembly Row near Boston. These aren’t your typical suburban shopping centers – they’re experiential destinations where affluent consumers live, work, and shop.

The Q2 2025 results reinforced everything we love about this company’s execution. Management raised full-year FFO guidance, reported cash leasing spreads in the low double digits, and delivered straight-line spreads in the 20% range. Meanwhile, they bumped the quarterly dividend to $1.13 per share, marking that historic 58th consecutive annual increase.

Here’s the kicker: you’re getting this quality machine for roughly 13x 2025 estimated FFO of $7.21 per share. Historically, Federal Realty has commanded a 15-16x multiple, and for good reason. The discount represents either a market inefficiency or a fundamental shift in how investors value steady, compound growth. We believe it’s the former.

Why Premium REITs Are Set for a Renaissance

The macroeconomic setup couldn’t be more favorable for quality income investments like Federal Realty. After years of fighting elevated interest rates that compressed REIT valuations, we’re finally seeing signs that the long end of the yield curve may be stabilizing or even declining.

When long-term rates ease, REITs typically benefit through multiple mechanisms: lower discount rates boost present values of future cash flows, cheaper financing costs improve development economics, and yield-hungry investors rotate back into dividend-paying equities. Federal Realty, with its investment-grade balance sheet (BBB+/Baa1 ratings) and over $1 billion in available liquidity, is perfectly positioned to capitalize on this transition.

But the real catalyst isn’t just falling rates – it’s the widening quality gap in retail real estate. While weaker shopping centers struggle with tenant bankruptcies and capital constraints, Federal Realty’s assets in supply-constrained submarkets continue to command premium rents and attract best-in-class tenants.

The company’s redevelopment pipeline exemplifies this advantage. Rather than chasing volume, management focuses on fewer, higher-return projects in markets where demand density creates structural pricing power. This disciplined approach to capital allocation is precisely why Federal Realty has maintained its dividend growth streak through multiple economic cycles.

The Valuation Setup That Screams Opportunity

Let’s talk numbers, because the math here is compelling. At $93.85, Federal Realty trades at approximately 13.0x forward FFO – a meaningful discount to both its historical average and current peer group. A simple reversion to 15x multiples implies a stock price near $108, delivering roughly 15% upside before considering the dividend.

Add in the $4.52 annual dividend (4.8% current yield), and you’re looking at potential total returns approaching 20% over the next twelve months. Our Monte Carlo simulation, running 10,000 paths with 20.5% historical volatility, suggests a median twelve-month price of $106.90, with the 95th percentile reaching $150.

The risk-reward profile becomes even more attractive when you consider Federal Realty’s defensive characteristics. This isn’t a speculative growth story dependent on flawless execution. The company has demonstrated consistent cash flow generation through multiple real estate cycles, supported by long-term leases with creditworthy tenants in irreplaceable locations.

Peer Comparison: Quality Commands Its Premium

To understand Federal Realty’s value proposition, consider how it stacks up against retail REIT peers:

Regency Centers (REG) focuses on grocery-anchored shopping centers, offering more defensive characteristics but less redevelopment upside. Trading at a slight premium to FRT despite lower growth potential.

Kimco Realty (KIM) operates a similar grocery-anchored strategy with more development variability. Roughly in-line valuation with slightly higher yield but greater execution risk.

Simon Property Group (SPG) dominates Class-A malls and outlets but faces structural headwinds from changing consumer behavior. Trades at a discount with higher yield, reflecting the challenging category mix.

Federal Realty’s premium to some peers reflects its superior asset quality, consistent execution, and track record of value creation. The current compression of that premium creates the opportunity.

The Income Investor’s Dream Scenario

For dividend-focused investors, Federal Realty represents the holy grail: a growing dividend supported by growing cash flows, backed by tangible assets in prime locations. The 58-year dividend growth streak isn’t just a marketing gimmick – it reflects management’s conservative approach to capital allocation and commitment to shareholder returns.

The current 4.8% yield provides meaningful income in today’s environment, while the consistent dividend growth offers protection against inflation over time. Unlike bond investments that lose purchasing power to inflation, Federal Realty’s rent rolls are largely tied to market rates, providing natural inflation hedging.

The company’s balance sheet strength adds another layer of security. With investment-grade ratings and substantial liquidity, Federal Realty can weather economic storms while opportunistically investing in high-return projects. This financial flexibility becomes crucial during periods of market stress, when weaker competitors face funding constraints.

Risk Management in an Uncertain World

No investment is without risks, and Federal Realty faces several worth monitoring. Interest rate volatility remains the primary concern – while we expect rates to moderate, a renewed backup in long-term yields would pressure both valuations and development economics.

Retail bankruptcies and tenant churn present operational risks, though Federal Realty’s focus on essential and experiential tenants provides some insulation. The company’s diversified tenant base and active asset management help mitigate concentration risks.

Execution on capital allocation remains critical. Federal Realty’s returns on invested capital must remain disciplined to protect net asset value per share. The timing and pricing of acquisitions, dispositions, and redevelopment projects directly impact long-term value creation.

Given these risks, our approach to market correction protection emphasizes position sizing and entry discipline. We recommend treating Federal Realty as a 2-4% core holding within an income-focused portfolio allocation, with opportunities to add below $95 and trim above $115.

Technical Picture: Setting Up for the Next Leg Higher

From a technical perspective, Federal Realty sits just below its 200-day moving average around $97-98, with RSI in the low-50s – neutral but showing signs of improvement. Support appears solid near $90, while initial resistance clusters around $100-105.

A decisive break above the 200-day moving average would confirm trend repair and likely attract momentum-based buying. The relatively low volatility compared to growth stocks makes Federal Realty suitable for conservative investors while still offering meaningful upside potential.

The options market reflects this balanced risk-reward profile, with implied volatility generally below realized volatility – suggesting potential opportunity for those comfortable with covered call strategies or protective put purchases.

The 2-3 Year Outlook: Steady as She Goes

Federal Realty’s investment thesis isn’t built on dramatic transformation or disruptive innovation. Instead, it relies on the steady compounding of cash flows from irreplaceable assets in supply-constrained markets. Over the next 2-3 years, we expect mid-single-digit FFO growth annually, supported by rent escalations, occupancy improvements, and selective redevelopment.

The company’s redevelopment pipeline, while smaller than in previous cycles, focuses on higher-return projects that should layer in incremental NOI as they stabilize. Balance sheet management remains conservative, with dividend growth likely tracking in the low-to-mid single digits.

If interest rates settle into a more benign range, the quality premium that compressed during 2022-2023 should gradually reassert itself. Federal Realty’s track record of consistent execution positions it well relative to peers facing capital constraints or operational challenges.

Long-Term Vision: The Power of Compounding Quality

Looking out 5+ years, Federal Realty’s value proposition becomes even more compelling. The company’s focus on urban and suburban mixed-use properties aligns with demographic trends toward walkable, amenity-rich communities. The asset base naturally lends itself to densification opportunities – adding multifamily or office components where appropriate.

The most important long-term drivers will be Federal Realty’s ability to maintain low tenant churn among essential and experiential retailers, capture steady rent growth that keeps pace with inflation, and opportunistically rotate capital as market windows open and close.

This isn’t a get-rich-quick story. It’s a get-rich-slowly story, built on the reliable compounding of high-quality assets managed by experienced professionals with aligned interests.

Monte Carlo Reality Check: What the Numbers Say

Our simulation analysis provides helpful perspective on potential outcomes. Running 10,000 paths over twelve months, using Federal Realty’s historical volatility of 20.5%, produces a median price target of $106.90 with total returns (including dividends) approaching 19%.

The 5th-95th percentile range spans from roughly $76 to $150, illustrating both the potential upside and downside scenarios. The relatively tight distribution compared to growth stocks reflects Federal Realty’s lower volatility and more predictable cash flows.

Importantly, the dividend component provides significant downside protection. Even in adverse scenarios, the 4.8% yield cushions total returns and provides ongoing income during periods of price weakness.

Investment Strategy: Patience Rewarded

Our recommended approach treats Federal Realty as a core income holding with capital appreciation potential. The current price of $93.85 sits in our accumulation zone, with stronger buying opportunities emerging below $95.

Buy Zones:

- Strong Buy: ≤ $90

- Primary Buy: $90-$100

- Hold/Fair Value: $100-$115

- Trim Zone: $115-$125

- Too Expensive: > $125

This tiered approach allows for strategic accumulation during periods of weakness while taking profits when valuations become stretched. The 2-4% target weight provides meaningful portfolio impact without excessive concentration risk.

The Verdict: Quality Never Goes Out of Style

Federal Realty Investment Trust represents everything we value in dividend investing: consistent execution, conservative management, and the patient compounding of high-quality assets. The 58-year dividend growth streak isn’t just a historical curiosity – it’s evidence of a business model that works through multiple economic cycles.

At current prices, investors can access this quality franchise at a discount to its historical premium, with multiple catalysts for re-rating over the next 12 months. The combination of 4.8% current yield, potential multiple expansion, and steady FFO growth creates an attractive risk-adjusted return profile.

In a market obsessed with disruption and exponential growth, Federal Realty offers something perhaps more valuable: the steady, reliable compounding of wealth through time-tested fundamentals. For income-focused investors willing to embrace the boring path to riches, Federal Realty deserves serious consideration.

Rating: Buy – Accumulate below $100, with stronger conviction below $95. This is the kind of quality income investment that belongs in every long-term portfolio.

Master Metrics Summary

Vulcan Score: 7.08/10

- Value: 6.30 (attractive vs. historical premium)

- Growth: 4.35 (steady, not spectacular)

- Quality: 8.60 (excellent track record)

- Momentum: 5.05 (neutral, improving)

- Safety: 8.10 (strong balance sheet, dividend history)

Valuation: 13.0x 2025e FFO vs. 15x historical average Dividend: $4.52 annual (4.8% yield), 58 consecutive increases Target Price: $108-$114 (15x FFO + dividend) Position Size: 2-4% of income-focused portfolio

Leave a comment