Current Price: $8.41 | Vulcan Score: 4.12/10 | Rating: Speculative Hold

When the Pentagon says “every squad needs a drone by 2026,” and you’re the Army’s chosen provider, that should be rocket fuel for your stock price. So why is Red Cat Holdings trading like a wounded bird instead of soaring like its drones?

The answer lies in the brutal mathematics of pre-profitability defense contractors, where policy tailwinds collide head-on with fundamental realities. RCAT represents one of the most fascinating investment dichotomies in today’s market: a company positioned at the epicenter of a genuine defense revolution, yet shackled by execution risks that could ground even the most optimistic bull case.

The Pentagon’s Drone Revolution is Real – And RCAT is At Ground Zero

Let’s start with what’s undeniably bullish: the policy winds have shifted dramatically in Red Cat’s favor. In July 2025, Defense Secretary Pete Hegseth signed a memo titled “Unleashing U.S. Military Drone Dominance” with an audacious goal – every squad equipped with expendable drones by the end of fiscal year 2026. This isn’t Pentagon wishful thinking; it’s doctrine-level change driven by brutal battlefield lessons from Ukraine and strategic competition with China.

The numbers are staggering. We’re talking about potentially thousands of squads across the Army, Marines, and other services. Each squad potentially fielding multiple disposable reconnaissance drones annually. The total addressable market for Small Unmanned Aircraft Systems (sUAS) just expanded exponentially.

Red Cat didn’t just happen to be in the right place at the right time – they earned their seat at the table. In November 2024, the U.S. Army selected Teal Drones (Red Cat’s subsidiary) as the production provider for the Short Range Reconnaissance (SRR) program. This isn’t a prototype contract or a pilot program; it’s a Program of Record, meaning the Army has committed to scaling this system across formations.

But here’s where the story gets complicated: being chosen by the Pentagon and actually executing at Pentagon standards are two very different challenges.

Manufacturing Credentials vs. Manufacturing Reality

Red Cat’s recent achievement of AS9100 aerospace manufacturing certification represents a crucial milestone that many investors are overlooking. This isn’t just paperwork – AS9100 is the gold standard for defense-grade production quality systems. Without it, scaling beyond Low Rate Initial Production (LRIP) would be nearly impossible.

The certification timing is strategic. Red Cat closed a $46.75 million registered direct offering in June 2025, and their Q2 update showed approximately $66.9 million in cash and receivables. They have the capital runway to execute initial production deliveries, and now they have the quality systems to do it at defense-grade standards.

Yet this is precisely where our skepticism intensifies. Having the credentials and capital is table stakes – actually delivering on yield, throughput, and reliability at scale is where defense contractors separate winners from casualties. The graveyard of defense startups is littered with companies that had great technology, solid contracts, and adequate funding, but couldn’t bridge the chasm between prototype and production.

The Valuation Paradox That’s Crushing Current Shareholders

Here’s the uncomfortable truth that bulls don’t want to acknowledge: RCAT’s valuation metrics are in la-la land territory. The stock trades at a trailing twelve-month price-to-sales ratio of approximately 36-40x, compared to established defense contractors like Kratos Defense (KTOS) at 8-9x P/S and L3Harris (LHX) at 2.4x P/S.

Even allowing for growth premiums and the sUAS opportunity, these multiples only make sense if Red Cat executes flawlessly on a massive scale-up. Our fair value estimate of $9.10 per share assumes a base case where the company successfully transitions to profitable production – hardly a certainty given the current gross margin picture.

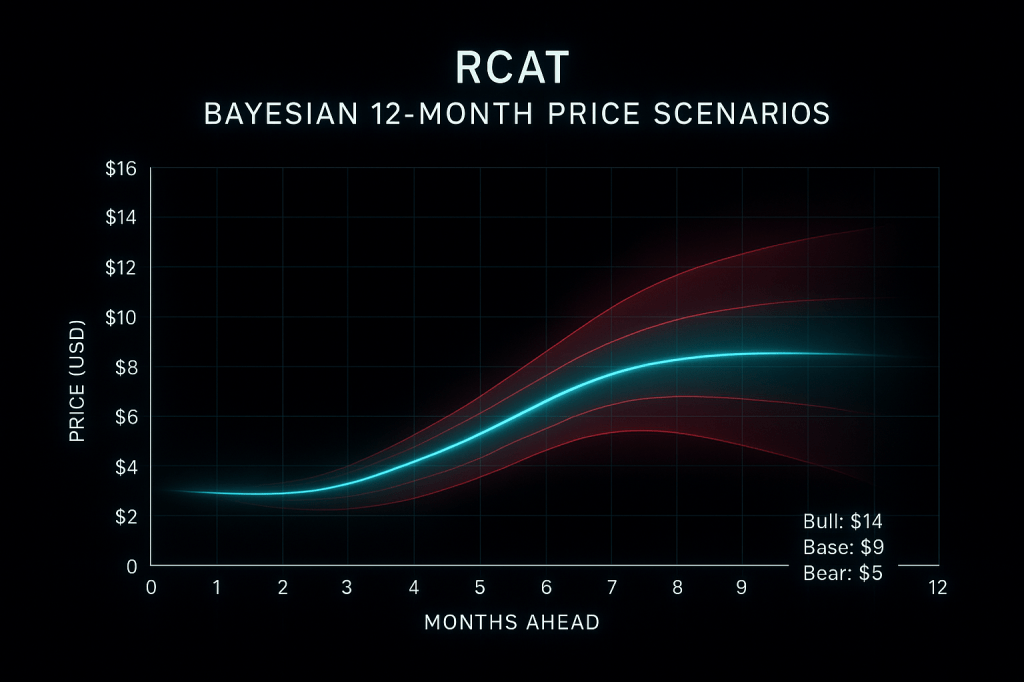

The Monte Carlo simulation we ran paints an even more sobering picture. Using the stock’s extraordinary historical volatility of 126% (yes, you read that correctly), our 12,000-path simulation shows a 57% probability of mark-to-market losses over the next twelve months, even accounting for the Pentagon’s policy support.

This Bayesian fan chart illustrates RCAT’s potential 12-month price path under bull, base, and bear scenarios. The electric teal median line projects a base outcome around $9, while the shaded confidence bands show a wide range of possible outcomes: upside toward $14 in the bull case, and downside near $5 in the bear case. The widening bands highlight the high uncertainty and volatility embedded in RCAT’s trajectory, reinforcing its speculative nature despite strong policy tailwinds.

This isn’t a stock for the faint of heart or the poorly capitalized investor.

Short Sellers Circle While Legal Clouds Gather

Recent months have brought fresh controversy that adds another layer of risk to an already volatile situation. Short sellers have published reports questioning Red Cat’s production capabilities and promotional activities, while class-action attorneys have begun soliciting shareholders for potential litigation.

These developments represent sentiment headwinds that could persist until management provides verifiable proof points on deliveries, acceptance rates, and production yields. In our experience with growth stock analysis, controversy often creates both risk and opportunity – but only for investors who can stomach the volatility and size positions appropriately.

The short interest currently sits at 19.7% of float, suggesting significant skepticism among professional investors. This creates a potential short squeeze setup if Red Cat delivers strong execution metrics, but also indicates substantial downside risk if execution falters.

Technical Picture: Volatility as a Feature, Not a Bug

From a technical perspective, RCAT exhibits all the characteristics of a high-beta, event-driven name. The stock’s beta coefficient of 2.43 means it moves more than twice as much as the broader market, while the maximum drawdown over the past year reached -67%.

The current price of $8.41 sits modestly above the 200-day moving average around $7.40-7.50, but momentum indicators like RSI (53) suggest neutral short-term dynamics. This aligns with our view that the stock is more likely to trade on fundamental catalysts – quarterly earnings, delivery milestones, and contract announcements – rather than technical momentum.

For traders and active investors, this volatility profile creates opportunities. For buy-and-hold investors accustomed to steady dividend payers, RCAT represents a completely different risk-return profile that may not align with portfolio objectives.

The Macro Picture: Interest Rates Still Matter for Pre-Profit Growth Stories

While much attention focuses on Red Cat’s military contracts and production ramp, macroeconomic conditions continue to influence valuation multiples for pre-profitability growth companies. The 10-year Treasury yield around 4.24% represents a meaningful discount rate for future cash flows that may not materialize for several quarters.

Higher rates create a more challenging environment for companies asking investors to pay premium multiples for distant profitability. This dynamic has particularly impacted defense contractors and aerospace companies with longer development cycles and capital-intensive scaling requirements.

The recent inflation data and Federal Reserve positioning suggest rates may remain elevated longer than many growth investors hoped, creating persistent headwinds for richly valued pre-profit names like RCAT.

Position Sizing: The Most Critical Decision You’ll Make

If you’re considering Red Cat as an investment, position sizing becomes absolutely critical to long-term success. This is not a stock where you allocate a standard 3-5% portfolio weighting and forget about it. The volatility profile and execution risks demand a more nuanced approach.

Our recommendation: treat RCAT as a “starter position” not exceeding 1% of portfolio value, with the opportunity to scale up only if the company demonstrates consistent execution on delivery milestones and gross margin improvement. This approach allows you to participate in potential upside while limiting the impact of adverse scenarios.

For those interested in our methodology behind portfolio risk management and position sizing volatile stocks, understanding risk management becomes even more important than stock selection in this space.

The Verdict: Speculative Hold With Disciplined Entry Points

Red Cat Holdings represents a fascinating case study in how policy tailwinds, technological positioning, and financial fundamentals can simultaneously point in different directions. The Pentagon’s commitment to small drone proliferation is real and represents a genuine growth opportunity. Red Cat’s selection as the Army’s SRR provider demonstrates competitive positioning and product-market fit.

However, the gap between opportunity and execution remains vast, while current valuation metrics price in near-perfect execution across multiple variables: production scaling, yield improvement, gross margin expansion, and contract win rates.

Our Vulcan score of 4.12 reflects this tension: strong growth prospects (6.00/10) offset by weak current quality metrics (3.20/10), challenging valuation (4.00/10), mixed momentum (4.50/10), and significant safety concerns (2.00/10) driven by extraordinary volatility.

Investment Zones:

- Strong Buy Zone: ≤ $7.00

- Primary Buy Zone: ≤ $7.90

- Fair Value: ~$9.10

- Trim Zone: ≥ $12.00

The current price of $8.41 sits in the cautious hold range – not cheap enough to initiate positions aggressively, but not expensive enough to warrant immediate exit for existing shareholders.

What We’re Watching

Two factors will determine whether Red Cat transforms from speculative hold to strong buy over the coming quarters:

- Production Metrics: Quarterly delivery numbers, acceptance rates, and gross margin progression will validate or refute the scaling thesis.

- Order Visibility: Evidence of follow-on contracts beyond initial SRR tranches, potentially including international opportunities or other service branches.

Red Cat Holdings embodies both the promise and peril of investing in defense innovation during periods of rapid doctrinal change. The opportunity is real, the risks are substantial, and the outcome will likely be determined by execution quality rather than market conditions.

For investors willing to embrace volatility and size positions appropriately, RCAT offers exposure to a genuine defense transformation story. For those seeking predictable returns and steady dividends, this roller coaster may not align with investment objectives.

The drone revolution is coming to every squad in the U.S. military. Whether Red Cat Holdings will be flying high or crash landing when it arrives remains the multi-billion-dollar question.

Leave a comment