The Fed’s about to make REITs interesting again. Here’s how to play it without getting burned.

The Setup: Why REITs Are About to Get Their Moment

Remember 2021-2022? REITs got absolutely hammered as rates shot higher. The math was brutal: higher borrowing costs crushed margins, rising Treasury yields made REIT dividends look less attractive, and property values took a beating as cap rates expanded.

Now we’re potentially heading in reverse. When the Fed starts cutting, several things happen that REITs love:

- Cheaper debt = better margins and easier refinancing

- Lower Treasury yields = REIT dividends suddenly look juicy again

- Falling cap rates = property values start climbing

- Renewed investor appetite = money flows back into real estate

But here’s the thing: why rates fall matters just as much as that they fall. Are we getting cuts because the economy is humming along and inflation is under control? Great—apartments, retail, and net-lease properties should thrive. Or are we getting emergency cuts because something’s breaking? Then you want the defensive plays: storage, manufactured housing, grocery-anchored retail.

That’s why we built a basket that works in multiple scenarios.

How We Picked These 8 (Without the BS)

We ran our internal Vulcan-mk5 model on the entire REIT universe, scoring each stock 0-10 across:

- Value: Are you getting a deal, or paying full price for hype?

- Quality & Safety: Can this company survive if things get messy?

- Momentum: Is the stock moving in your favor or fighting you?

- Income: Obviously crucial for REITs, but we also check payout sustainability

Then we applied some common-sense filters:

- No stocks we’d flag as “Trim” or “Too Expensive”

- Must be trading at a meaningful discount (or fair value if it’s truly exceptional)

- Balance sheet can’t be garbage

- Mix of rate-sensitive plays AND secular growth stories

The result: 8 core picks that should work whether we get a soft landing, mild recession, or sticky inflation that delays cuts.

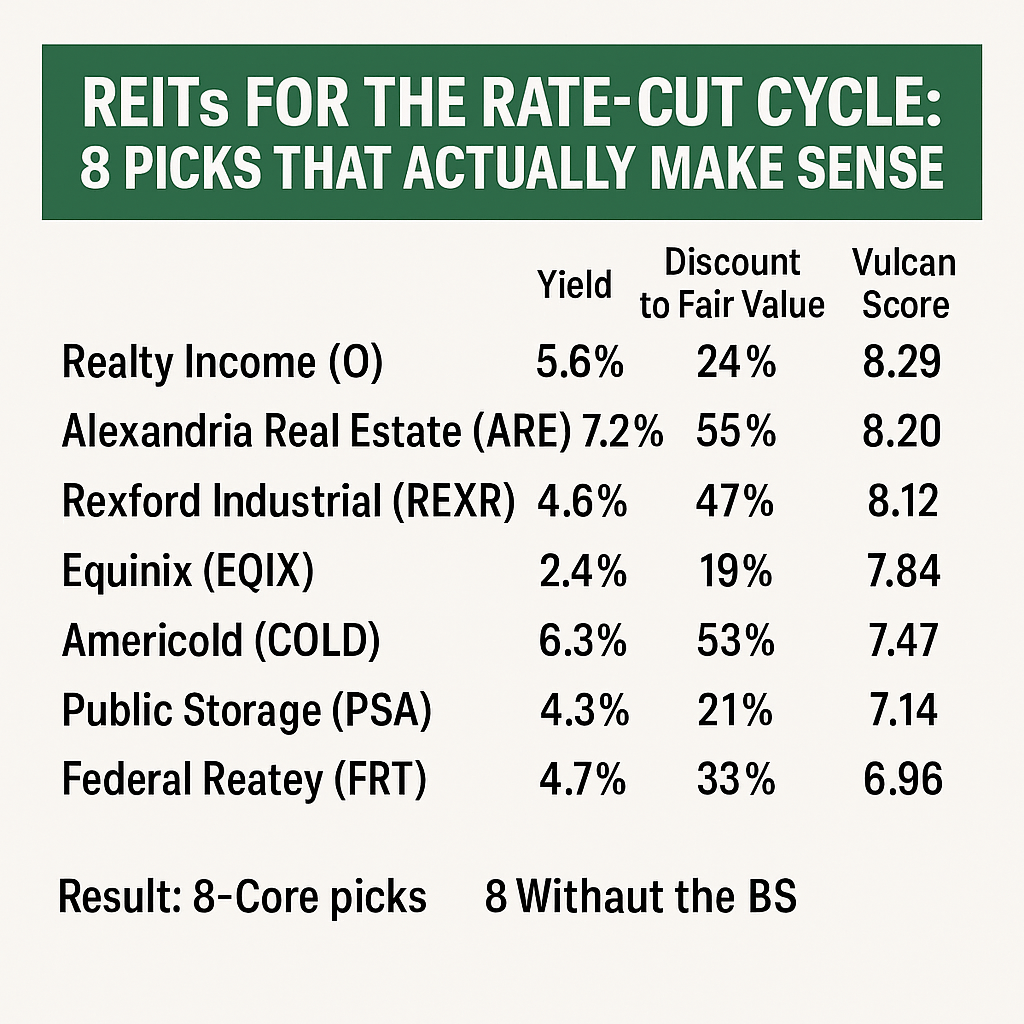

The 8 Core REITs (And Why They Made the Cut)

1. Realty Income (O) — The Dividend Machine

Yield: 5.6% | Discount to Fair Value: 24% | Vulcan Score: 8.29

This is your steady Eddie. Realty Income owns over 15,000 properties leased to companies like Walgreens, Dollar General, and FedEx on long-term contracts. When rates fall, those long-duration cash flows become more valuable, and the stock typically re-rates higher.

The 5.6% yield is solid, but the real appeal is consistency—they’ve raised the dividend for 30+ years and pay monthly. If you want one “set it and forget it” REIT, this is probably it.

For the full dividend story and entry strategy: Is Realty Income (O) Undervalued? Key Investment Insights

2. Alexandria Real Estate (ARE) — The Deep Value Play

Yield: 7.2% | Discount to Fair Value: 55% | Vulcan Score: 8.20

Here’s your high-risk, high-reward pick. Alexandria owns premier life science real estate in Boston, San Francisco, and other biotech hubs. The problem? Biotech funding dried up, tenants struggled, and the stock got obliterated.

But that 55% discount to fair value is screaming. These are irreplaceable assets in the best locations. As interest rates fall and biotech funding normalizes, ARE could see a massive re-rating. The 7.2% yield cushions you while you wait.

Full bull/bear case breakdown: Alexandria Real Estate: Undervalued REIT with 7% Yield

3. Rexford Industrial (REXR) — The California Scarcity Story

Yield: 4.6% | Discount to Fair Value: 47% | Vulcan Score: 8.12

Want to own something they literally can’t build more of? Rexford owns industrial real estate in infill Southern California—think warehouses near the ports of LA and Long Beach where land is scarce and zoning is brutal.

E-commerce isn’t going away, and someone needs to store all those packages. With a 47% discount and improving port volumes, this could be a multi-year winner as supply stays constrained and demand recovers.

4. Equinix (EQIX) — The AI Hedge

Yield: 2.4% | Discount to Fair Value: 19% | Vulcan Score: 7.84

Okay, the yield sucks. But Equinix owns the internet’s plumbing—data centers where cloud providers, enterprises, and networks interconnect. Think of them as digital toll booths.

If rate cuts get delayed because of sticky inflation, you want secular growth stories that don’t depend on macro cycles. AI demand, cloud migration, and 5G buildouts should keep driving utilization regardless of what the Fed does.

5. UDR (UDR) — The Apartment Play

Yield: 4.5% | Discount to Fair Value: 22% | Vulcan Score: 7.73

Apartments are classic rate-sensitive real estate. Lower rates help with refinancing costs, make new developments pencil, and boost household formation as people can afford to move out.

UDR has a nice mix of coastal and Sunbelt properties. The apartment oversupply story is mostly played out in their markets, so rent growth should normalize into 2025-2026.

6. Americold (COLD) — The Cold Storage Specialist

Yield: 6.3% | Discount to Fair Value: 53% | Vulcan Score: 7.47

This one’s a bit off the beaten path. Americold owns temperature-controlled warehouses for frozen and refrigerated goods. It’s specialized, capacity-constrained, and benefits from long-term trends like online grocery and meal delivery.

The 53% discount reflects some operational hiccups, but lower financing costs should improve margins. Plus, someone always needs to store ice cream.

7. Public Storage (PSA) — The Recession-Proof Cash Cow

Yield: 4.3% | Discount to Fair Value: 21% | Vulcan Score: 7.14

Storage is beautifully simple: people rent small spaces to store their stuff. Demand stays sticky even in recessions (divorce, downsizing, life transitions), and there’s almost no maintenance capex.

PSA is the undisputed king with the strongest balance sheet and best locations. If the economy hits a rough patch, you want to own assets people can’t easily live without.

8. Federal Realty (FRT) — The Premium Retail Play

Yield: 4.7% | Discount to Fair Value: 33% | Vulcan Score: 6.96

Retail REITs have been left for dead, but Federal Realty owns the good stuff: grocery-anchored shopping centers in wealthy suburbs. Think Whole Foods, Target, and other tenants people actually visit.

The 33% discount seems excessive for assets in places like Bethesda and Greenwich. As rates fall and consumer spending stabilizes, this could be a nice recovery play.

How to Actually Use This List

The Core Portfolio (If You Want All 8):

- O: 15% (your dividend anchor)

- EQIX: 15% (your secular growth hedge)

- REXR: 12% (scarcity value)

- UDR: 12% (rate sensitivity)

- PSA: 12% (defensive)

- FRT: 12% (recovery play)

- ARE: 12% (deep value bet)

- COLD: 10% (specialty play)

The Lazy Approach (Pick 3-4):

Start with O for income, ARE for deep value, EQIX for growth, and PSA for defense. That covers your bases.

The Execution:

- Only buy in the designated buy zones (Strong Buy, Ultra Value, etc.)

- Scale in gradually—REITs can be volatile, so build positions over time

- If a stock moves to “Trim” or “Too Expensive”, rotate that money into the best remaining opportunity

Regime Adjustments:

- Soft landing scenario: Add more rate-sensitive names like O and FRT

- Recession fears: Emphasize PSA and other defensive plays

- Sticky inflation: Lean heavier into EQIX and other secular growers

The Bottom Line

REITs are about to become interesting again after years in the penalty box. This isn’t about chasing the highest yields or betting everything on one macro outcome. It’s about building a diversified basket of quality companies trading at discounts, collecting decent income while you wait, and positioning for multiple ways to win.

The key is staying disciplined on entry prices and not getting too cute. Buy good companies when they’re cheap, collect the dividends, and let the rate cycle do the heavy lifting.

Market conditions and valuations change rapidly. All metrics based on our internal Vulcan-mk5 model as of publication date. See individual stock analyses for detailed risk factors and updated buy zones.

Leave a comment