How to escape the U.S. echo chamber and build a smarter, more resilient portfolio with international dividend ETFs

Picture this: You’re at a dinner party, and everyone’s talking about the same five U.S. tech stocks. Again. Meanwhile, across the globe, there’s a Danish wind energy company paying a 7% dividend, a Japanese utility trading at 12x earnings, and a Swiss pharmaceutical giant that’s been raising its payout for 23 consecutive years. But here’s the kicker—most American investors will never even know these companies exist.

Welcome to the international dividend opportunity hiding in plain sight.

The Great American Blind Spot

Here’s a uncomfortable truth: if your portfolio looks like the S&P 500, you’re essentially betting that 4% of the world’s population will continue to generate the best investment returns forever. That’s like only shopping at one grocery store when there’s an entire global marketplace of opportunities next door.

The numbers tell the story. While U.S. stocks represent about 60% of global market capitalization, they’ve become increasingly expensive relative to their international peers. Meanwhile, many developed international markets are trading at significant discounts, often with dividend yields that make U.S. income investments look downright stingy.

But here’s where most investors go wrong: they either ignore international markets entirely, or they dive in blindly with a generic “international fund” that dilutes their strategy. What you need is a surgical approach—an international ETF sleeve that complements your existing portfolio while targeting specific outcomes.

The Vulcan-mk5 Discovery: Three Paths to Global Dividend Success

Using our proprietary Vulcan-mk5 modeling system (think GPS for your investments), we’ve identified three distinct international dividend strategies, each designed for different investor personalities and goals. Think of them as three different vehicles for the same journey—a sports car, an SUV, and a luxury sedan. All will get you there, but the ride will feel completely different.

Option 1: The Growth Accelerator (For the Ambitious Dividend Hunter)

The Mix: 40% UIVM, 25% IDMO, 20% JIVE, 15% VYMI

This isn’t your grandfather’s dividend strategy. The Growth Accelerator combines international value and momentum factors with a splash of high-yield diversification. It’s like ordering the surf and turf—you get the best of both worlds.

The star player here is UIVM (VictoryShares International Value + Momentum), which hunts for companies that are both attractively valued and showing improving business momentum. Think of it as finding great companies at good prices just as the market is starting to notice them. We pair this with IDMO for pure international momentum exposure and JIVE for actively managed value expertise.

The Numbers Game: With a beta of 0.82 and volatility running about 6% lower than the S&P 500, this sleeve gives you international exposure without the wild swings you might expect. The upside capture of 112% means when international markets rally, you’ll participate fully—but with downside capture of just 84%, you’ll lose less when things go south.

The Sweet Spot: Historical modeling suggests a 3.1% current yield with dividend growth averaging 7% annually. But here’s the kicker—our Monte Carlo simulations show a 54% chance of beating the S&P 500 over the next year, with median returns around 8.2%.

Who Should Choose This: You’re comfortable with some extra volatility in exchange for higher upside potential. You believe international value and momentum factors will work together as global markets normalize post-pandemic distortions.

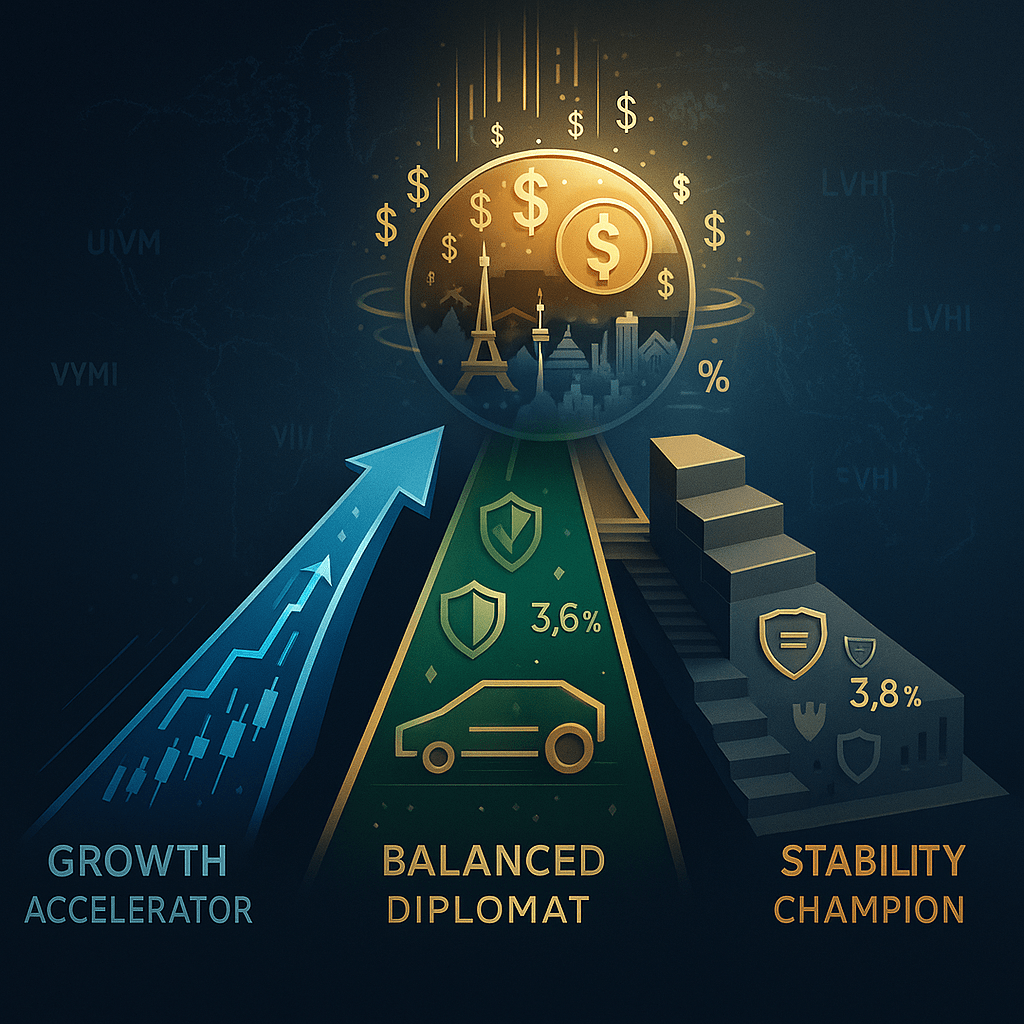

Option 2: The Balanced Diplomat (For the Strategic All-Rounder)

The Mix: 25% UIVM, 25% VYMI, 50% LVHI

If the Growth Accelerator is a sports car, the Balanced Diplomat is a perfectly engineered SUV—comfortable, reliable, and ready for any terrain. This strategy recognizes that you want international exposure, dividend income, AND downside protection.

The secret sauce is LVHI (Franklin International Low-Vol High Dividend), which does exactly what it says on the tin—finds international dividend payers with lower volatility. We balance this defensive core with UIVM for factor tilts and VYMI for broad international dividend exposure.

The Numbers Game: With a beta of 0.71 and volatility 13% lower than the S&P 500, this sleeve prioritizes smoother sailing. The upside capture of 106% and downside capture of 72% creates an asymmetric return profile—you participate in rallies while getting meaningful protection during selloffs.

The Income Story: The yield bumps up to 3.6% with dividend growth averaging 6.3% annually. While the median return expectation drops slightly to 7.5%, the risk-adjusted Sharpe ratio of 1.10 is actually higher than the Growth Accelerator.

The Probability Paradox: Here’s something interesting—while this sleeve has only a 48% chance of beating the S&P 500’s raw returns, it has a 63% chance of delivering better risk-adjusted returns. In other words, you might make slightly less money, but you’ll sleep much better.

Who Should Choose This: You want the best of all worlds—international diversification, steady income, and downside protection. You’re playing the long game and value consistency over home runs.

Option 3: The Stability Champion (For the Sleep-Well-at-Night Investor)

The Mix: 60% LVHI, 30% VYMI, 10% SCHY

Think luxury sedan with advanced safety features—maximum comfort, premium amenities, and built to protect what matters most. The Stability Champion is unapologetically defensive, designed for investors who prioritize capital preservation and steady income above all else.

LVHI dominates this allocation at 60%, providing the defensive backbone. VYMI adds broad international dividend exposure, while SCHY (Schwab International Dividend Equity) brings a quality overlay—essentially screening for companies with strong balance sheets and sustainable dividend policies.

The Numbers Game: Beta drops to 0.63 with volatility 20% lower than the S&P 500. The upside capture stays at 100% (you won’t miss rallies entirely), but downside capture falls to just 62%—meaning you’ll keep more money during market storms.

The Income Focus: This sleeve delivers the highest current yield at 3.8%, though dividend growth moderates to 5.8% annually. The median return expectation is 6.9%, but with much tighter outcome ranges—the 90th percentile scenario is “only” +16%, but the 5th percentile is just -11%.

The Insurance Policy: While this sleeve has only a 42% chance of beating the S&P 500’s returns, it has a 75% probability of experiencing smaller drawdowns. It’s investment insurance that pays dividends.

Who Should Choose This: Capital preservation is your top priority. You’re in or approaching retirement, or you simply value peace of mind over potential gains.

The Scenario Playbook: What Could Happen Next

Our Vulcan-mk5 modeling runs thousands of scenarios to stress-test these strategies. Here’s what the crystal ball suggests for the next 12 months:

The Bull Case (30% probability): Global economies synchronize in a positive direction, the dollar weakens, and international earnings revisions turn positive. In this environment, the Growth Accelerator could deliver 15-25% returns, while even the conservative Stability Champion might generate 9-16%.

The Base Case (50% probability): The muddle-through economy continues—not great, not terrible. Soft landing scenarios where dividends do most of the work. Expect the Growth Accelerator to deliver 4-10%, Balanced Diplomat 3-9%, and Stability Champion 2-8%.

The Bear Case (20% probability): Growth scares, dollar strength, and margin pressure outside the U.S. Even here, the defensive positioning helps—the Stability Champion might only lose 7-11%, compared to potential 12-18% losses for the Growth Accelerator.

The Implementation Playbook: Making It Real

Here’s how to actually put this into practice without overthinking it:

Step 1: Choose Your Fighter Pick the sleeve that matches your personality and risk tolerance. Don’t try to be clever and mix strategies—each is designed as a complete solution.

Step 2: Size It Right These sleeves typically work best as 15-30% of a total portfolio, depending on your overall international allocation target. Start conservatively and scale up as you get comfortable.

Step 3: Stage Your Entry Don’t try to time the market. Split your allocation into 3-4 tranches and invest over 6-10 weeks. This smooths out any unfortunate timing and reduces regret risk.

Step 4: Set It and (Mostly) Forget It Quarterly rebalancing is plenty. Only adjust if individual ETF weights drift more than 3% from targets. The strategies are designed to be low-maintenance.

Step 5: Stay Disciplined If your chosen sleeve’s beta or down-capture starts behaving outside expected ranges for more than a quarter, make small tactical adjustments by shifting 5% toward the most defensive holding.

The Bottom Line: Your Global Dividend Future

International dividend investing isn’t about abandoning U.S. markets—it’s about building a more complete portfolio that can thrive in different environments. Whether you choose the Growth Accelerator’s ambitious pursuit of value and momentum, the Balanced Diplomat’s all-weather approach, or the Stability Champion’s defensive excellence, you’re solving the same fundamental problem: over-concentration in expensive U.S. assets.

The data is clear—all three sleeves improve portfolio diversification and offer compelling risk-adjusted returns. The Growth Accelerator gives you the best shot at outright beating the S&P 500, the Balanced Diplomat offers the highest probability of superior risk-adjusted returns, and the Stability Champion provides the most reliable path to capital preservation with income.

The question isn’t whether you should add international dividend exposure—it’s which strategy matches your investment personality. The global dividend goldmine is real, liquid, and accessible through simple ETFs. The only question left is: which vehicle will you choose for the journey?

Ready to build your international ETF sleeve? The global dividend opportunity won’t wait forever, but with the right strategy, it doesn’t have to.

Leave a comment