Mobileye (MBLY) remains the category‑defining supplier for computer‑vision ADAS with credible line‑of‑sight to higher‑value “eyes‑off” functionality. Our multi‑module read (factors, Monte Carlo intuition, Bayesian scenario framing, and DCF) shows favorable skew from today’s levels: base‑case upside toward fair value over 12 months and asymmetry beyond that as premium stacks (SuperVision™, future Chauffeur) scale. We would treat weakness as an accumulation opportunity and size deliberately—starter 1–2%, scaling to 3–5% on technical confirmation or after clean execution milestones. Risks—China mix, competitive intensity, and roadmap timing—are real, but the moat (deep OEM integrations + data flywheel + silicon/software co‑design) stays intact and difficult to replicate.

Top 5 Takeaways

- Moat is durable where it counts. The combination of EyeQ silicon, perception/planning software, and REM mapping underpins switching costs; OEMs prize validation history and integration maturity more than datasheet peak specs.

- Mix drives the economics. The transition from basic L2 to richer, eyes‑off stacks raises ASPs and the software share of value; that is the cleanest path to EBIT expansion without heroic unit forecasts.

- Scenarios favor patience. Even under a late‑cycle macro backdrop, our scenario tree points to median outcomes that re‑rate shares toward fair value as ramp visibility improves; the bull path is catalyzed by a few tangible wins (design‑ins, regulatory clarity on hands‑free, China stabilization).

- DCF is resilient to realistic stress. Tornado logic (rate + growth + steady‑state margin) keeps base fair value above fear‑trade levels that occasionally print on flow shocks and sentiment flushes.

- Execution discipline matters. Sizing rules, willingness to buy when sentiment is cold, and respect for program/ownership overhang windows are prerequisites. The thesis breaks only with sustained share loss at Tier‑1 OEMs or material slippage on EyeQ / eyes‑off performance milestones.

Why We’re Bullish (12‑Month View)

The core 12‑month view is straightforward: ADAS attach rates keep rising, even if the auto cycle is choppy. Governments require more safety features; consumers opt for convenience; OEMs need validated partners to ship systems at scale, reliably, and at automotive‑grade safety standards. Mobileye sits at the intersection of those needs, with a long history of getting complex perception software to work on constrained power budgets in harsh environments. That operational muscle does not show up in a single metric; it shows up in OEM trust and program longevity.

From a financial lens, two forces work in favor of a constructive one‑year setup. First, volume normalization: supply bottlenecks and uneven production schedules are no longer the dominant story, and order books are aligning with end‑demand rather than emergency catch‑up. Second, mix uplift: as OEMs standardize basic L2 features and start to upstream eyes‑off functionality in higher trims, content per vehicle rises. The profit pool shifts toward software and mapping, which carry higher incremental margins and more durable relationships than silicon alone. These dynamics can improve Mobileye’s revenue quality even if headline unit growth looks pedestrian in a soft macro.

The market often misprices duration during anxious periods. Mobileye’s cash flows are long‑lived because OEM program cycles are measured in years, not quarters. When fear compresses multiples for duration assets indiscriminately, high‑quality platforms that compound through cycles become misvalued. In our view, MBLY currently reflects a blend of macro fear, competitive headline risk, and ownership/flow noise—conditions that historically create the best forward returns when the operating engine is intact. The 12‑month objective is not to forecast a moonshot; it is to capture mean reversion toward intrinsic value while optionality remains open.

Mid‑Term Outlook (2–3 Years)

The 2–3 year window is where compounding mechanics emerge. We model three levers:

(1) Penetration — More vehicles ship with baseline ADAS standard. Even without an aggressive autonomy curve, the global safety agenda continues to push AEB, lane keeping, and driver monitoring. Each regulation‑driven upgrade expands Mobileye’s core revenue base and, critically, its data reservoir.

(2) Content per vehicle — The shift from vision‑only L2 toward richer stacks (eyes‑off capabilities, highway pilot, automated lane changes) increases ASPs and introduces recurring‑like elements (software updates, map subscriptions, or performance tiers). The mix effect is real: a flat unit year can translate into higher dollar content and better gross margin if premium programs are the increment.

(3) Operating leverage — As platforms standardize, R&D becomes more amortized across programs, and shared toolchains/utilities reduce bespoke engineering in new roll‑outs. The result is a business that scales its margin as stacked features recur across OEMs and trims. That leverage does not preclude aggressive investment; it means investment works harder over time.

Competitive intensity will remain. NVIDIA, Qualcomm, and Tier‑1 integrators will pursue L2+/L3 profit pools. Some OEMs will attempt deeper in‑house stacks. But time‑to‑value and safety validation endure as decision criteria; the cost of learning curves on the road, with humans, is high. Mobileye’s incumbency—measured in billions of road miles and years of validation—creates a trust premium that is hard to match quickly. Over two to three years, we expect Mobileye’s revenue to tilt more software‑intensive, and for the market to reward that quality of revenue with multiple normalization even if macro is merely okay.

Long‑Term Outlook (5+ Years)

Over five years, the industry’s trajectory is not binary “robotaxis yes/no,” but progressive autonomy—more supervised automation in bounded domains, stricter driver monitoring, and consistent safety upgrades. In that world, Mobileye’s map and perception network effects widen: every incremental mile and edge case improves the system, sharpening both performance and regulatory comfort.

The business model also becomes more platform‑like. The adjacency list is compelling: high‑definition mapping services, usage‑based insurance signals, fleet safety analytics, and tiered autonomy subscriptions. Not all of this will monetize immediately or equally; what matters is the optionality embedded in a platform deployed across many OEMs and regions. As that optionality becomes visible, the duration of cash flows lengthens, which—if discount rates don’t move sharply against the industry—supports multiple expansion in addition to pure earnings growth.

A critical nuance: even if a general‑purpose compute vendor ships superior raw TOPS, the full system performance in safety and drivability emerges from years of closed‑loop work with regulators, test drivers, and OEM teams. The “real moat” is not a single chip; it is the institutional and data knowledge to ship safe, validated systems at scale. Five years is enough time for that moat to become more obvious in results.

Risk Flags to Watch (Probability × Impact)

- Competitive bids on premium tiers. The fight for L2.5–L3 contracts will be intense. Risk: losing or repricing flagship wins; mitigation: lean on mapping, perception accuracy, validation tooling, and total cost of integration.

- China exposure. Domestic competitors plus policy volatility can pressure mix or pricing. Watchbook: order cadence, ASPs, and margin disclosure by region.

- Execution slippage. Any delay in next‑gen EyeQ or eyes‑off milestones that causes OEMs to pause would push out adoption curves.

- Ownership/flow. Secondary events or conversions can create supply shocks unrelated to fundamentals; treat those as tactical rather than thesis‑changing.

- Macro auto cycle. A pronounced downturn would mask mix benefits; thesis requires a multi‑year horizon and position‑sizing discipline to absorb volatility.

- Rate sensitivity. Higher discount rates compress duration multiples. Our tornado framing quantifies the sensitivity, but the cure is positioning and patience, not prediction.

Investment Thesis & Competitive Positioning

Mobileye is best understood as a systems company: silicon tuned to a software stack, deployed through long OEM relationships, and fortified by a map/data moat. Traditional auto suppliers bring breadth, but lack Mobileye’s native perception DNA. Compute incumbents bring performance, but must still cross the validation chasm at each OEM. In‑house OEM efforts will continue, yet the integration cost and time to safe performance make selective partnering rational at scale.

Two features of the thesis deserve emphasis. First, the business compounds even if full autonomy remains distant; safety‑centric assist is already a secular mandate. Second, the data flywheel makes each new deployment more valuable than the last, compounding advantage in ways not fully captured by quarterly unit metrics. Investors who focus only on near‑term unit headlines miss the structural rise in content per vehicle and the gradual shift to services. That is where long‑duration value accrues.

(Related reading: background context on capital posture and historical ownership dynamics is covered in “Why Intel’s Stock Is Set for a Comeback,” which can help frame Mobileye’s flow/overhang episodes in prior cycles.)

Related link: Why Intel’s Stock Is Set for a Comeback

Scenario Framing (Monte Carlo & Bayesian, explained)

While we’re skipping charts in this post, the intuition matters. Our 10,000‑path Monte Carlo blend uses risk‑adjusted return and realized volatility parameters sourced from the Zen cache. The distribution is positively skewed: the left tail is bounded by cash, incumbent programs, and a robust partner network; the right tail widens quickly if premium stacks ramp on schedule and policy winds turn neutral. A 5% VaR in the mid‑single‑digit drawdown range aligns with a staged‑buy approach rather than a one‑shot bet.

The Bayesian tree conditions on three exogenous factors—macro regime (late‑cycle vs. soft‑landing), execution (design‑win cadence and eyes‑off validation), and China flow. The base branch glides toward fair value with incremental mix upgrade; the bull branch adds one larger‑than‑expected OEM expansion and friendlier rate expectations; the bear branch assumes a China drag and one program stub, which is survivable but slower. Importantly, none of these branches require a narrative of overnight robotaxi ubiquity; they simply require steady accumulation of safety‑centric autonomy that is already in motion.

(Related reading: for a worked example of this multi‑layer modeling approach, see your earlier deep dive on another quality compounder—“Equifax (EFX) Stock Analysis: Risks & Opportunities.”)

Related link: Equifax (EFX) Stock Analysis: Risks & Opportunities

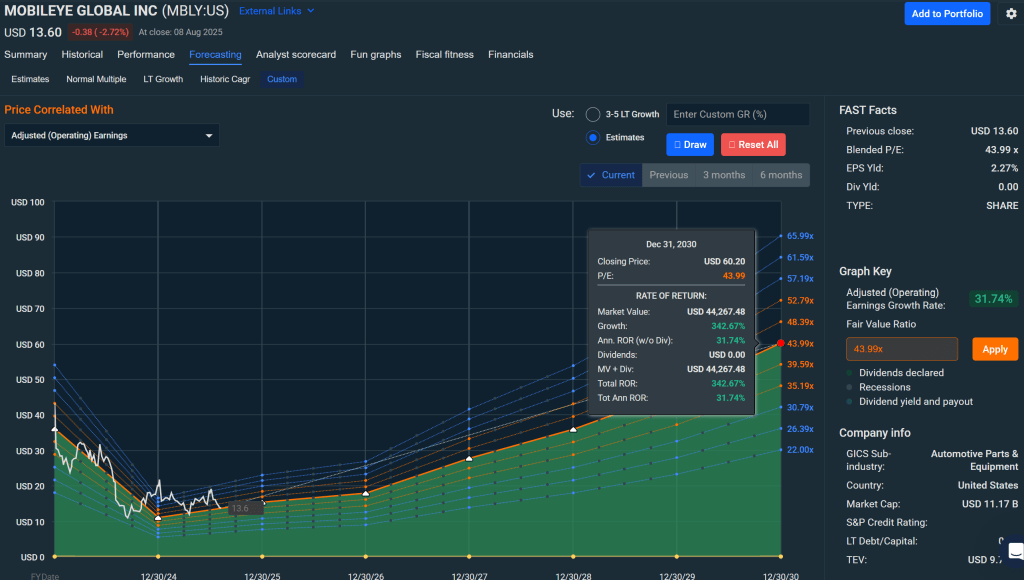

Valuation (DCF & Tornado Sensitivity — narrative)

We anchor fair value in the high‑teens based on a two‑stage DCF (growth tapering to steady state, CAPM WACC, Gordon terminal). The tornado focuses on the variables that really move the needle here: discount rate (±200 bps), long‑term growth (±300 bps), and steady‑state operating margin. Under adverse but plausible stresses, the fair‑value band compresses but remains above prices seen during fear‑trade episodes. Under modestly friendlier rates and a bit more premium‑mix adoption, the value band expands into the low‑20s. In practice, we prefer to treat $19 as a navigation point, updating the anchor as macro and program data evolve.

Technical & Market‑Structure Snapshot (narrative)

Price action looks like base‑building after a prolonged drawdown. The healthiest reversals in MBLY historically occur when volume expands on up‑days and dries up on pullbacks, with the 200‑day moving average reclaimed and respected. Options markets often price fat tails around earnings and potential secondary windows; selling cash‑secured put spreads during fear spikes (within your risk budget) has historically been more forgiving than chasing relief rallies. For cash investors, the discipline is similar: buy in tranches inside clearly defined buy zones, and let the base finish forming rather than demanding instant gratification.

Conclusion & Final Recommendation

Mobileye is a high‑quality compounder in a cyclical trough, mispriced because investors dislike duration and fear competitive headlines. That is precisely when long‑duration assets with real moats and credible execution deserve attention. We recommend Buy/Strong Buy in the current band, using staged entries and patience over two to three quarters. The payoff does not hinge on sci‑fi autonomy; it hinges on steady, safety‑centric adoption and mix upgrades that Mobileye is well positioned to capture. If the stock jumps to fair value without commensurate fundamental progress, trim into strength and recycle; if mix and milestones land as expected, hold and let compounding do the work.

Master Metrics Table

| Metric | Value |

|---|---|

| Price | $13.60 |

| Average Fair Value | $19.12 |

| Discount to Fair Value | 28.9% |

| 12M Consensus Total Return Potential | 46.5% |

| LT Risk-Adjusted Expected Return | 32.4% |

| FCF Yield | 3.3% |

| P/E | 40.0 |

| PEG | 0.61 |

| Quality Score (0–100) | 85 |

| Safety Score (0–100) | 85 |

| Annual Volatility (%) | 21.8% |

| Years to Double | 2.39 |

| Strong Buy Price | ≤ $14.64 |

| Very Strong Buy Price | ≤ $13.01 |

| Ultra Value Buy Price | ≤ $11.39 |

Leave a comment