Snapshot for busy readers

Apple remains a fortress business with exceptional margins, a sticky ecosystem, and consistent cash returns. At roughly 9% above our $210 fair-value anchor, we see a constructive but not urgent setup: Hold now, add on dips into the low-$200s, and get aggressive sub-$185. Our 12-month base case points to mid-single to low-double-digit total return powered by Services growth and steady buybacks. The bull case needs cleaner on-device AI monetization or a re-stretch in the multiple; the bear case revolves around policy/tariff shocks and a slowdown in Greater China.

What’s already priced in—and what isn’t

The market has re-rated Apple back toward the upper half of its recent valuation band. On trailing numbers, Apple sits in the mid-30s P/E—rich to the S&P 500 yet fair relative to mega-cap quality peers. That premium reflects three durable edges:

- Ecosystem lock-in that suppresses churn and supports pricing power.

- High-visibility Services cash flows that expand margins and smooth hardware cycles.

- Capital-return flywheel that converts cash into per-share growth.

What the tape hasn’t fully priced in, in our view, is the shape of on-device AI monetization. If Apple translates device-level intelligence into higher ARPU, upsell bundles, or a broader revenue share from third-party services, the earnings-quality mix tilts even more toward recurring. For a useful analogue of how large-cap platforms convert AI into dollars (ads, cloud, services), see our Amazon piece on the AI flywheel and medium-term monetization paths: https://vulcan-stock.com/2025/04/28/amzns-12-month-price-target-252-and-beyond/ . (Vulcan Stock Analysis Engine)

Core engine: Services steady, devices cyclical but resilient

Services is the stabilizer: higher gross margin than hardware, recurring in nature, and increasingly diversified beyond App Store economics. Bundling and family subscriptions continue to widen the moat. Hardware cycles, meanwhile, are less about unit blowouts and more about installed-base monetization. The emerging AI layer across iPhone, iPad, and Mac should support both replacement intent and attach rates for storage, iCloud, and content over the next 12–24 months.

On margins, the story is discipline and mix. Apple’s ability to hold gross margin in the mid-40s (with operating margin in the low-30s) amid component and logistics noise speaks to scale and supplier leverage. That cushion matters if tariffs or FX wobble the P&L—there’s room to defend earnings without sacrificing the balance sheet.

The push and pull of policy, tariffs, and regulation

Two exogenous levers matter most near-term:

- Tariffs and supply-chain policy: Outcomes range from exemptions to partial pass-through pricing. Our base case assumes some friction but limited structural damage thanks to supplier diversification and pricing power. For context on how 2025’s tariff regime feeds into earnings and multiples at the index level (and why we demand a margin of safety for hardware), see our H2 market outlook: https://vulcan-stock.com/2025/06/28/second-half-2025-u-s-stock-market-outlook/ . (Vulcan Stock Analysis Engine)

- Regulatory remedies in services/search: Adjustments to default-search deals or platform fees would dent high-margin Services dollars at the margin. The offset is Apple’s latitude to evolve bundles or introduce new paid tiers if needed.

Neither issue is new. What’s changed is that valuation sits at a premium, so the market’s tolerance for adverse headlines is lower. That’s why we want a margin of safety on entry.

Where the upside comes from

- AI-inflected upgrade cycle: A tangible “it just works faster/better privately on-device” story is more compelling for mainstream users than speculative AI sizzle. If Apple sticks the landing—fewer steps, better suggestions, tighter privacy—that drives intent.

- ARPU expansion: Even a modest lift in paid iCloud tiers, Apple TV+/Music bundles, or productivity add-ons compounds quickly across a two-billion-plus installed base.

- Share-count shrink: The buyback engine quietly boosts per-share metrics every quarter. When growth is steady and the multiple is stable, buybacks are alpha.

What could go wrong (and how we’d know)

- China softness + FX drag: A steeper-than-expected demand slowdown or currency hit would show up first in regional segment commentary and ASP mix.

- Policy shocks: Tariff headlines that directly raise landed cost on core devices without offsetting exemptions.

- Execution on AI: If the on-device experience feels marginal vs. cloud-centric competitors, the narrative loses oxygen—and so does the multiple.

- Multiple compression: With the premium back, any stumble can take two turns off the multiple quickly.

We monitor estimate revisions (direction and breadth), margin-guidance cadence, and the slope of Services growth to separate signal from noise.

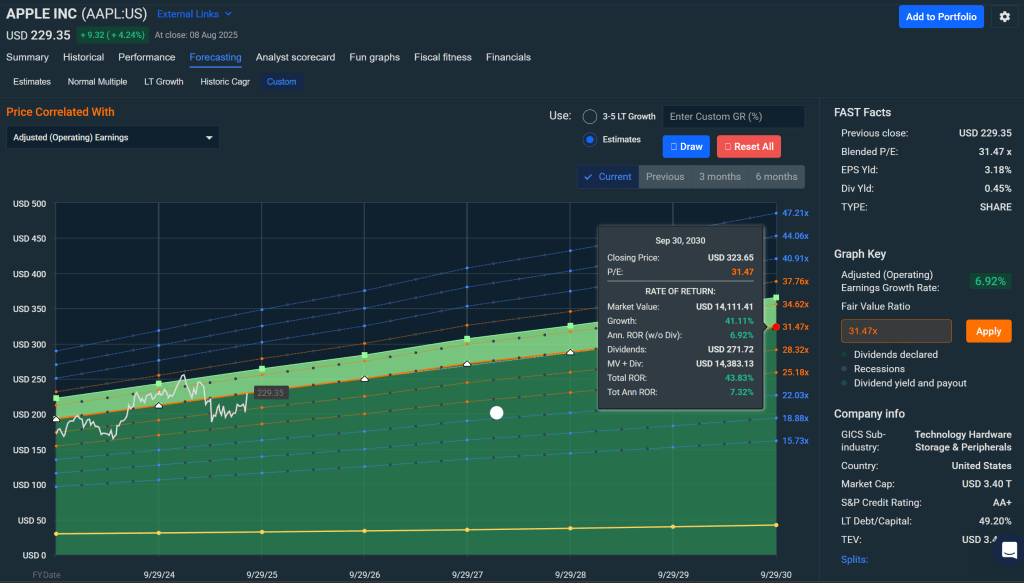

Our fair value and buy zones (how we anchor decisions)

We anchor to a $210 fair value and translate that into Buy Range Guidance so entries are disciplined:

- Strong Buy Zone: ≤ $179

- Primary Buy Range: $180–$200

- Hold / Fair Value Zone: $200–$240

- Trim Zone: $240–$273

- Too Expensive Zone: ≥ $273

At roughly $229 today, Apple sits in the Hold / Fair Value area. We add incrementally closer to $200 and keep dry powder for any single-stock or macro shock that drags it into the $180s.

Scenario thinking: base, bull, and bear in plain English

- Base case (most likely): Services mid-teens growth, stable hardware units with modest ASP help, gross margin around the mid-40s, and a forward multiple in the high-20s. Total return: mid-single to low-double digits over 12 months.

- Bull case: AI-device cycle upgrades come in stronger, Services outgrows expectations, and macro/tariff headlines fade. Multiple re-stretches toward prior cycle highs. Total return: mid-teens+, with upside to the low-20s.

- Bear case: Tariff hit + China softness + regulatory friction on Services. Margins hold up better than peers but the multiple compresses back toward the mid-20s. Drawdown risk: low-teens to high-teens.

Bayesian view: why our probabilities shift over time

We nudge the base probability modestly higher on recent momentum improvement and clean estimate trends, keep bear steady given policy risk, and leave bull as a function of AI-device traction.

Monte Carlo: what the distribution of outcomes implies

We simulate 5,000 price paths using a one-year horizon, anchoring volatility near Apple’s 1-year realized level and a balanced drift that reflects steady—but not explosive—fundamental progress.

- 5th percentile: about $148

- Median: about $240

- 95th percentile: about $402

Interpretation: the median sits just above spot, signaling a constructive but not urgent risk-reward. The left tail exists (policy and macro are real), yet buybacks, balance-sheet strength, and Services mix help cushion extreme downside.

DCF lens and what really moves the needle

We calibrate our internal DCF to the $210 anchor and test sensitivities around the core value drivers. The goal isn’t to win an academic prize—it’s to understand which levers matter most to fair value over the next 3–5 years.

- WACC is king: ±100 bps moves fair value by roughly ±$15.

- Terminal growth matters: ±50 bps shifts fair value by around ±$10.

- Operating margin is the workhorse: ±1 percentage point yields about ±$8.

- Capex intensity and tax rate are meaningful but smaller in impact at Apple’s scale.

Takeaway: the macro rate path (WACC) and the durability of high-40s gross margins are the two fulcrums that most change our fair value. That’s why our buy discipline focuses on pulling the trigger when rates wobble higher or when the market overreacts to a transient margin scare.

Tape talk: how we’d actually trade it

- If underweight mega-cap core: build a 2–4% core on pullbacks into $200–$205; be ready to scale toward $185–$190 if macro volatility gifts the entry.

- If at target weight: hold; consider covered calls in the Trim Zone ($240–$273) to monetize the premium without exiting the position.

- If overweight: trim into strength above $260+ if the growth cadence lags expectations, and recycle into names with a larger margin of safety.

Stops aren’t our default on a compounding core like Apple, but respecting position sizing is non-negotiable.

Bottom line

Apple is still Apple: a wide-moat cash machine with enviable margins, an unmatched installed base, and levers to pull if the macro turns. At today’s price we respect the quality and wait for a better margin of safety. When the market gives you $180–$200, take it. Until then, let compounding do its quiet work.

Leave a comment