Introduction

Designing a long-term investment portfolio involves balancing high-growth opportunities with stable income and risk management. In this deep-dive, we outline a 5–10 year strategy for a retail investor with an example $100,000 portfolio. We’ll combine cutting-edge growth themes (like artificial intelligence and defense technology) with income-generating assets (covered-call equity funds and bonds) to create a diversified, future-ready portfolio. The goal is to capture upside from transformative trends while managing volatility and earning steady income. All recommendations are made in plain language for accessibility, but with the rigor of a Goldman Sachs research team. Let’s explore how each component plays a role.

Embracing the AI Revolution for Growth

Artificial Intelligence (AI) has emerged as a defining investment theme of this decade, often compared to a new industrial revolution. The excitement is evident in the rapid growth of AI-focused funds – for instance, the iShares A.I. Innovation and Tech Active ETF (BAI) launched in late 2024 and already amassed around $2.5 billion in assets by 2025. This active ETF holds a concentrated portfolio of global tech companies poised to benefit from AI advancements. Its top holdings include well-known tech leaders like NVIDIA, Broadcom, Meta, and Microsoft, alongside emerging innovators like Snowflake and Cloudflare, all positioned at the forefront of AI and data analytics.

Investing in the AI theme offers high-reward potential but also comes with higher volatility, as the sector’s valuations can swing with market sentiment. For a 5–10 year horizon, a moderate allocation (e.g. ~25% of the portfolio) to an AI-focused fund or a basket of AI-related stocks can provide significant growth horsepower. The key attraction is the secular trend: AI adoption is spreading across industries, potentially boosting revenues for chipmakers, cloud computing firms, and software innovators. An actively managed ETF like BAI brings professional research insight to navigate this fast-evolving field, selecting companies with strong AI credentials. This active approach aims to “maximize total return” by focusing on AI leaders and disruptors. For a retail investor, this means you get exposure to the AI boom without having to pick individual winners – the fund’s experts do that for you.

From a tactical standpoint, patience and disciplined sizing are crucial. AI stocks had a spectacular run in 2023–2024, so some pullbacks are possible. By committing a portion (not all) of your capital to this theme, you participate in the long-term AI growth story while avoiding over-concentration risk. Over 5–10 years, the expectation is that AI will drive productivity and earnings, potentially rewarding investors, but be prepared for bumps along the way. High growth comes with high volatility, so ensure your AI allocation matches your risk tolerance. Regularly reviewing this segment is wise – if the AI fund soars and becomes too large a piece of your portfolio, consider rebalancing to lock in gains and maintain diversification.

Defense Tech: Investing in Security and Innovation

Geopolitical tensions and rising global defense budgets have turned Defense Technology into a compelling investment theme for the next decade. Global defense spending surged 9.4% year-over-year to $2.7 trillion in 2024, the fastest annual increase since the end of the Cold War. Projections see defense expenditures growing about 5% annually to reach $3.6 trillion by 2030. This trend is driven by a need to modernize military capabilities with cutting-edge tech – think advanced sensors, AI chips, drones, cybersecurity, and robotics in defense systems. For investors, this means a broad array of companies (beyond traditional weapons makers) stand to benefit from defense tech spending.

An easy way to tap this theme is via an ETF like the Global X Defense Tech ETF (SHLD), which focuses on companies poised to gain from increased adoption of defense technology. Its holdings span multiple industries: from established aerospace & defense contractors to tech firms specializing in military applications. For example, SHLD’s top holdings include Palantir Technologies (~9%) – known for its AI-driven data platforms used by governments, RTX (Raytheon) (~8%) – a leader in missile and radar systems, Rheinmetall (~8%) and BAE Systems (~7%) – major European defense firms, and Lockheed Martin (~6–7%) – the U.S. aerospace giant. This diversified mix captures both the hardware side (jets, missiles, defense electronics) and the software side (cybersecurity, data analytics) of modern warfare. Importantly, defense tech revenues depend more on strategic government priorities than on consumer economic cycles, providing potential stability if the broader economy slows. In other words, regardless of economic ups and downs, governments tend to keep investing in defense and security, which can make this sector a useful stabilizer in your equity mix.

For a 5–10 year portfolio, one might allocate on the order of 15–20% to defense tech. This offers a counterbalance to the pure tech of the AI segment: defense companies often have steadier cash flows (some even pay dividends) and may behave differently than high-growth Silicon Valley firms. Strategically, the defense segment could shine during times of geopolitical stress or increased government spending, providing a tactical hedge against global instability. It’s also worth noting that many defense tech firms are investing heavily in R&D, so there’s a growth element here too, not just “value stock” stability. Over the next decade, areas like autonomous drones, hypersonic missiles, and AI-driven defense systems could be growth frontiers. By investing in a fund like SHLD, a retail investor gains exposure to all these sub-themes in one sweep, with professional index methodology ensuring the portfolio stays current with the industry’s evolution.

Generating Income with Covered-Call Strategies

While growth themes are exciting, a solid portfolio also needs income and downside cushioning – that’s where covered-call equity strategies come in. Covered-call ETFs own a portfolio of stocks and systematically sell call options on them to generate option premium income. The result is an enhanced yield paid out to investors, albeit at the cost of capping some upside if the stock prices rally too high. These strategies are particularly useful in a 5–10 year horizon for adding steady cash flow and smoothing volatility.

One example is Goldman’s own Nasdaq-100 Core Premium Income ETF (GPIQ) and S&P 500 Core Premium Income ETF (GPIX). These funds provide broad market exposure (to the Nasdaq-100 and S&P 500 respectively) while using a dynamic covered-call strategy. GPIQ and GPIX actively manage how much of the portfolio has calls written (anywhere from 25% to 75% of the notional value at a given time), aiming to balance income generation with participation in rising markets. The appeal for a long-term investor is the high yield: GPIQ currently yields roughly 10% annually, and GPIX yields about 8%, paid via monthly distributions. These yields far exceed typical stock dividends, thanks to the option premiums. In fact, GPIX’s strategy of writing options generates an “8.2% yield while maintaining partial market upside and price stability”, and GPIQ “stands out… delivering a 10% yield and consistent payouts”. For an income-focused investor, that’s very attractive, and even for growth investors, reinvesting such income can significantly boost total returns over time.

In our portfolio, we might allocate around 25–30% to a covered-call equity fund. For diversification, GPIX (S&P 500) could be a preferred choice here since our other allocations (AI and defense) are more tech and industry-specific. GPIX would give us broad market coverage – the S&P 500 includes everything from tech to healthcare to consumer staples – while still yielding ~8%. This way, we get some exposure to sectors we might otherwise miss (like healthcare or consumer sectors not prominent in BAI or SHLD) and we get substantial income. Alternatively, GPIQ (Nasdaq-100) could be used if one wanted to double-down on tech exposure with income; it offers higher yield (~10%) but note it will overlap with the AI fund holdings heavily (big tech names). Either choice implements the same principle: generate cash flow to fund other goals or to reinvest, and provide a buffer if markets trade sideways.

From a strategic perspective, covered-call funds tend to outperform in flat or modestly up markets (due to the earned premiums) but can lag in runaway bull markets (since some upside is given up by the calls). Over a 5–10 year period that is likely to contain both bull and bear phases, having this sleeve can be quite beneficial. It is relatively low maintenance – the fund managers handle the complex option trades – making it friendly for retail investors who want income without trading options themselves. It’s worth noting that many covered-call ETFs, including GPIX/GPIQ, distribute a lot of their gains as return of capital for tax efficiency, which can defer taxes for taxable accounts (a bonus point for some investors). Overall, adding an income-focused equity fund strengthens the portfolio’s resilience: those monthly income streams can be used to buy more shares on dips (an automatic way to “buy low”), or to rebalance into other assets as needed.

The Role of Bonds for Stability and Income

No balanced portfolio is complete without some high-quality bonds to provide stability, especially for a medium-term horizon like 5–10 years. Bonds act as a shock absorber when equity markets get choppy, and they offer predictable interest income. In recent years, bond yields have become quite attractive again, making them a viable contributor to total return rather than just a safety play.

For example, U.S. Treasury bonds are a core holding for many conservative investors. An intermediate-term Treasury ETF like iShares 7–10 Year Treasury Bond ETF (IEF) currently yields around 3.7% (12-month yield) with an average yield-to-maturity near 4.1%. If you prefer very low volatility and short-term safety, an ultra-short Treasury fund like iShares 0–3 Month Treasury (SGOV) yields roughly 4.4%–4.5% in today’s market – essentially a yield similar to a high-yield savings account, backed by government bills.

In a 5–10 year portfolio, allocating roughly 20–25% to bonds can be prudent. This allocation could be split between intermediate Treasurys (like IEF) and short-term T-bills (like SGOV) to balance interest rate risk. The strategic rationale: if the economy weakens or if there’s a flight-to-safety, longer-term Treasurys (IEF) could appreciate in price (and you’ve locked in a higher yield now) – providing capital gains and offsetting equity losses. On the other hand, if rates continue to rise or stay high, the short-duration T-bills (SGOV) let you capture rising yields with minimal price downside. Essentially, this approach creates an “all-weather” bond ladder.

For simplicity, one might also choose a single broad bond fund (like a total bond market index) yielding ~4%, but using Treasurys ensures maximal credit quality (no default risk) which is comforting for the stable portion of the portfolio. The bond income can be paid out or reinvested; either way, it’s nice to have a guaranteed stream that isn’t tied to corporate profits or market cycles. Over a full market cycle, this bond ballast can reduce overall portfolio volatility – an important consideration if you might need to withdraw some money within that 5–10 year window (e.g., for a home purchase or tuition). It also gives you “dry powder” to rebalance: if stocks plunge in a given year, your bonds likely hold value or rise, and you can sell some bonds to buy stocks low, then reap the recovery. That is classic strategic rebalancing in action.

Putting It All Together: Sample $100K Allocation

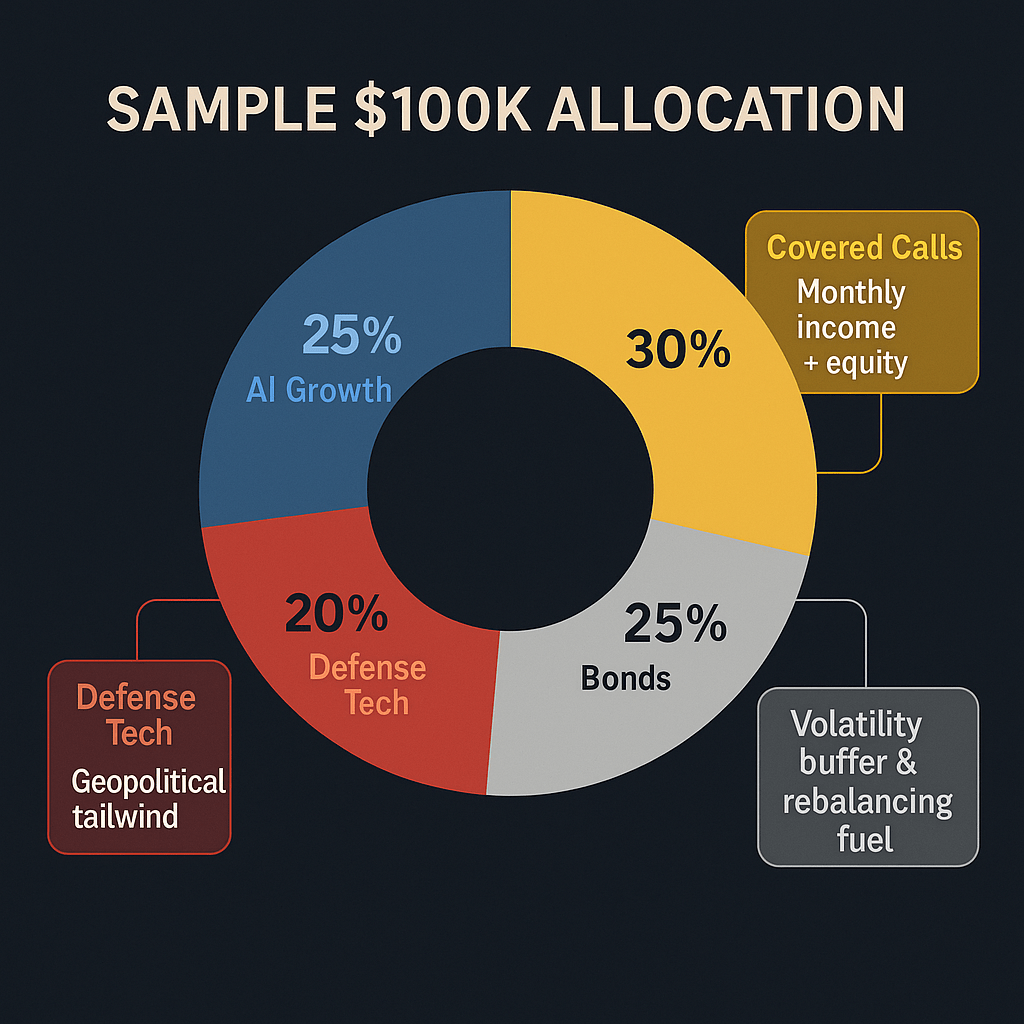

Let’s combine these elements into an example $100,000 portfolio allocation. Keep in mind this is a starting point – individual investors should adjust weights based on their own risk appetite and convictions. But our goal is a balanced approach:

- 25% in AI Growth (BAI or similar) – $25,000

Rationale: Aggressive growth engine of the portfolio. We expect this to drive high capital appreciation by tapping into the AI/tech boom. Actively managed BAI provides exposure to both mega-cap tech (e.g. Microsoft, NVIDIA) and next-generation AI players, with professional selection. This is a long-term bet on technology’s secular growth. - 20% in Defense Tech (SHLD or defense stocks) – $20,000

Rationale: A focused thematic tilt that offers diversification away from consumer-driven sectors. Defense tech benefits from government spending trends that are on the rise. SHLD gives international exposure (U.S. and allies’ defense firms) and balances the portfolio with holdings in industrials and defense IT. This portion should exhibit more stability if market volatility picks up, given defense budgets are often multi-year and less sensitive to recessions. - 30% in Covered-Call Equity Income (GPIX or GPIQ) – $30,000

Rationale: Core equity exposure with a twist. This anchors the portfolio in large-cap stocks (S&P 500 via GPIX), but generates a high ~8% yield for income. The covered-call strategy means we give up some upside in roaring bull markets, but in a long-term portfolio that’s acceptable in exchange for steady cash flow. That cash can be reinvested or used opportunistically (for instance, GPIX pays monthly distributions – you could accumulate these and deploy into the AI or defense funds on dips). If one prefers more tech tilt and yield, they could opt for GPIQ (Nasdaq-100 focus) which yields ~10%, though note the overlap with the AI bucket. Either way, this allocation is about marrying growth and income, a tactical play to boost returns in sideways markets and cushion downturns with regular income. - 25% in Bonds (Treasurys via IEF and/or SGOV) – $25,000

Rationale: Safety net and liquidity reserve. We allocate a quarter of the portfolio to high-quality bonds to reduce overall volatility. For example, one could put $15k in IEF (intermediate Treasurys, ~4% yield) and $10k in SGOV (T-bills, ~4.5% yield) to diversify rate exposure. This bond stake yields roughly $1,000+ per year in interest (which itself almost rivals the S&P’s dividend yield, but with far less risk). More importantly, if an unexpected event causes stocks to drop (say a financial crisis or a pandemic-like shock), this portion should hold its value or rise, allowing the investor to rebalance – selling some bonds to buy beaten-down stocks, thereby enhancing long-term returns. It also provides peace of mind; knowing that a chunk of the money is in the safest assets can prevent panic selling when equities get volatile.

This mix results in roughly a 75% equity / 25% fixed-income portfolio, which is a balanced moderate-aggressive stance suitable for a 5–10 year timeframe. The equity side is tilted toward high-growth themes (AI, tech) and is offset by the defense and income strategies to add some sturdiness. The bond side ensures not all eggs are in the stock basket and offers flexibility. Overall, the portfolio is designed to be forward-looking (AI, defense), income-generating (covered calls, bonds), and resilient (diversified across different asset behaviors).

Tactical Considerations and Risk Management

Even the best portfolio plan needs ongoing attention. Here are a few strategic considerations for managing this 5–10 year portfolio:

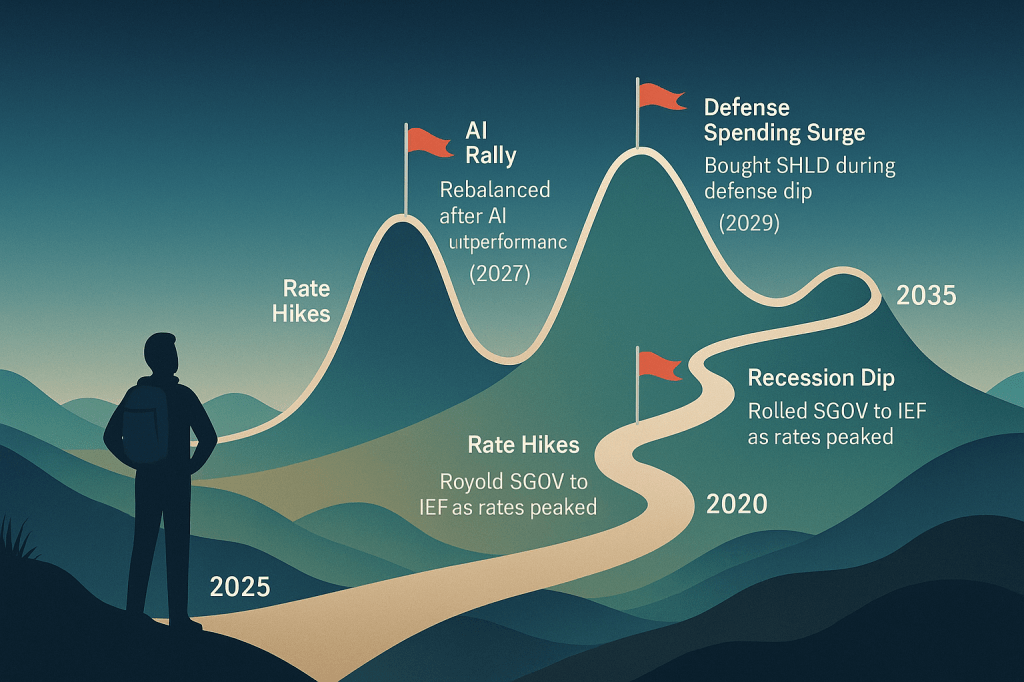

- Rebalance Periodically: With such distinct components, expect performance to diverge. For example, if AI stocks have a blockbuster year and the BAI fund doubles, it could become too large a chunk of the portfolio. Likewise, a major drop in tech could shrink BAI. Set a schedule (e.g. yearly or semi-annual) to review and rebalance back to target weights. This enforces a “buy low, sell high” discipline – trimming winners and adding to laggards – which can improve long-term returns.

- Watch the Macroeconomic Climate: Keep an eye on interest rates and inflation, as they influence our income assets. If the Federal Reserve starts cutting rates during an economic slowdown, our IEF bonds would likely rise in price – that might be a good time to rebalance some gains from bonds into stocks (since lower rates often boost equities). Conversely, if inflation surprises to the upside and rates climb, our short-term SGOV position will benefit by rolling into higher yields, helping offset potential bond price declines. The covered-call equity fund (GPIX/GPIQ) may also adjust its option coverage in different volatility environments, but generally, these do well when markets are choppy or range-bound. Staying aware of these dynamics lets you make tactical tweaks (like adjusting the bond duration or swapping between GPIQ and GPIX if tech conditions change).

- Diversification and Overlap: While we chose distinct themes, note that there is some overlap. Big Tech appears in both the AI fund and the Nasdaq-100 covered-call fund. Defense tech has some tech element as well (e.g., Palantir in SHLD). This is okay – those are key companies – but be mindful not to inadvertently concentrate too much in any single stock. The use of ETFs helps mitigate single-stock risk, and our inclusion of broad S&P exposure and bonds adds further diversification. The portfolio has exposure to hundreds of companies across the ETFs, plus the U.S. government (through Treasurys), which is about as diversified as it gets. Still, review the look-through exposure occasionally. For instance, if NVIDIA (in BAI) and Microsoft (in BAI, GPIX, and maybe GPIQ) become extremely large in market cap, you might find they represent, say, 10%+ of your total portfolio. You could then decide if you’re comfortable with that or if you want to trim a little.

- Stay Educated, but Avoid Noise: Over a 5–10 year span, you will no doubt encounter hype cycles and scary headlines. It’s important to stick to the long-term thesis for each allocation unless something fundamentally changes. AI, defense, and income strategies each have strong secular arguments behind them as discussed. Don’t let short-term volatility derail your plan. That said, do stay informed on developments: e.g., new AI regulations, defense budget changes, tax rule changes for ETFs, etc., since these could inform minor strategy adjustments. Being a retail investor today means you have a wealth of information at your fingertips – just be sure to filter for quality research (not Reddit rumors alone) when evaluating if an adjustment is warranted.

- Use Market Downturns to Your Advantage: One tactical tip – keep some of that bond interest and ETF income aside as cash if you expect a correction, or simply have your bond ETF dividends go to cash. When there’s a notable dip (say the S&P 500 falls 10%+), that cash can be used to buy additional shares of your equity ETFs at a discount. For instance, adding to BAI during an AI stock pullback or to SHLD if defense stocks temporarily wobble can enhance future returns. Essentially, dollar-cost averaging during volatility, funded by your income streams, is a strategy to compound gains.

Conclusion

In summary, a well-rounded $100k portfolio for a 5–10 year horizon could look like the one we’ve outlined: a blend of visionary growth (AI), strategic sector exposure (Defense), high-yield equity income (covered calls), and steady anchors (bonds). This approach marries the excitement of investing in tomorrow’s technologies with the prudence of diversification and income focus. By structuring the portfolio in themes, we make it educational – each slice has a story and a purpose – which helps investors understand why they own what they own.

From a retail investor’s perspective, this thematic yet balanced strategy can be both engaging and confidence-inspiring. You’re not just buying stocks; you’re investing in narratives: the AI revolution transforming business, the imperative of national security driving defense innovation, and the timeless benefit of earning income on your capital. With the hooks of these themes, you’re more likely to stay interested and committed to your plan, learning along the way. And with the risk-managed allocation, you’re also protected from the worst outcomes of putting all your money in one hot stock or sector.

As always, individual circumstances vary – some might lean a bit more into stocks if they have higher risk tolerance or a longer horizon, while others might hold more bonds or cash if they anticipate needing funds sooner. But the framework here is flexible enough to adjust. The key takeaway is to think in terms of buckets: Growth, Thematic Plays, Income, and Stability. By having all four, you ensure that no single market event will throw you completely off course, and you give yourself multiple ways to win over the next decade.

Remember: Investing is a marathon, not a sprint. With a thoughtfully constructed portfolio and a willingness to adapt tactically, you’ll be well positioned to reach your financial goals over the next 5–10 years. Stay diversified, stay informed, and stay patient – let your money work for you across these powerful themes and strategies. Here’s to your investing journey and the knowledge gained along the way!

Sources: The data and examples cited (on fund holdings, yields, and market statistics) are sourced from reputable financial platforms and fund providers for accuracy. Key references include BlackRock’s fund description for BAI, Global X research on defense spending, and analysis of Goldman Sachs’ income ETFs highlighting their yields, among others. These sources reinforce the points made and can be referred to for further reading and validation of the strategy outlined.

Leave a comment