Summary

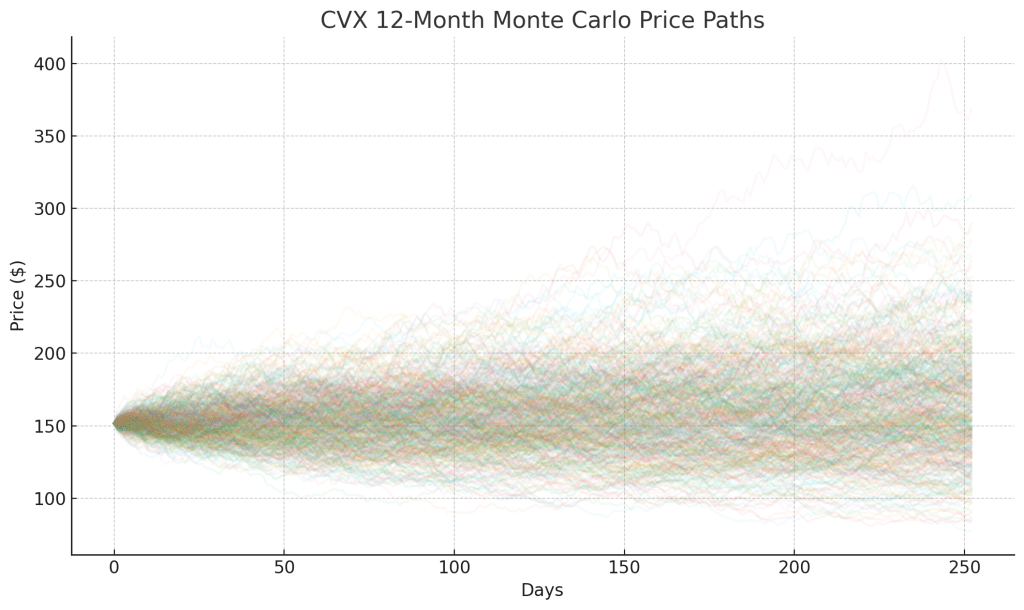

Chevron’s second-quarter results underscore the enduring strength of its integrated model. Although headline earnings fell in tandem with softer Brent prices, the company generated one of the five highest cash-flow quarters in its history, raised Permian production to a million barrels of oil equivalent per day, and completed the transformational Hess acquisition. At roughly twelve per cent below our refreshed base-case valuation, the shares combine a 4.5 per cent dividend yield, disciplined capital allocation, and a clear runway for free-cash-flow growth that extends well into the next decade. A Monte Carlo framework suggests a sixty-four per cent probability of double-digit total return within twelve months, while Bayesian scenario analysis assigns a one-in-four chance that the stock advances beyond one-hundred-ninety dollars should crude prices settle above eighty and Hess synergies arrive on schedule. With the balance sheet comfortably investment-grade and management pledging at least five-billion dollars per quarter to shareholders, Chevron offers income, optionality, and a credible margin of safety.

Why We Remain Constructive on the Next Twelve Months

Chevron’s cash engine is firing on all cylinders even at mid-cycle commodity prices. Operating cash flow reached eight-point-six billion dollars in the quarter, aided by record shale output and higher downstream utilization, and management signaled confidence by extending its thirteen-quarter streak of returning more than five-billion dollars to investors. The Hess transaction, which closed in early July, adds world-class Guyana barrels and further scale in the Bakken and Gulf of Mexico. Management projects the combined portfolio can grow liquids production at a mid-single-digit rate while holding capital spending to a disciplined fifteen-to-seventeen-billion-dollar run-rate. On our numbers that translates into a free-cash-flow compound annual growth rate of roughly six per cent through 2027 and supports an annual dividend increase of four to five per cent with only mid-fifties payout ratio exposure.

Valuation remains undemanding. The shares change hands at ten times next year’s earnings, six-and-a-half per cent free-cash-flow yield, and a discount of just over twelve per cent to our base-case discounted-cash-flow estimate of one-hundred-seventy-three dollars. Even modest mean reversion in forward multiples would deliver capital appreciation in excess of the current yield, a view corroborated by the Monte Carlo simulation whose median path converges toward one-hundred-sixty-seven dollars over the coming year. The bull case in our Bayesian model, which assumes Brent stabilizes near eighty dollars and Hess cost and revenue synergies arrive on time, places a fair-value marker north of two-hundred dollars. Conversely, the bear case anchored on a sixty-dollar oil tape and a one-percentage-point rise in the discount rate still supports a valuation floor of one-hundred-twenty-five dollars, comfortably above the company’s Strong-Buy threshold of one-hundred-thirty-eight dollars.

Risk Assessment in Prose

The principal variable risk remains crude-price sensitivity, a dynamic captured in the tornado diagram where a five-dollar move in oil shifts fair value by approximately twelve dollars. Nevertheless, Chevron’s downstream and petrochemical segments historically offset about one-third of upstream pressure when benchmarks fall sharply; that resilience widened cash-flow spreads during the 2020 demand shock and should remain intact. Integration risk following the Hess deal is low. Chevron retains operatorship of key blocks in Guyana, and combined project teams have been in place since the transaction was announced. Capital-spending creep is contained by a management cap and hurdle rates well above the cost of capital, and new-energy ventures—direct-lithium extraction, renewable fuels, and carbon capture—remain only ten per cent of forward capital-expenditure budgets, so they cannot meaningfully dilute returns. Policy and ESG pressures persist, but the company’s Permian operations sit in the top quartile for emissions intensity, and methane-abatement targets are on track.

Discounted Cash-Flow Discussion

Our valuation employs an eight-per-cent weighted average cost of capital, a one-per-cent terminal growth assumption, and a seventy-dollar mid-cycle Brent deck. Those inputs yield a base fair value of one-hundred-seventy-three dollars. The model is most sensitive to oil prices and capital intensity; a single-percentage-point adjustment to the discount rate trims fair value by roughly six-and-a-half dollars, while a ten-per-cent swing in capital expenditure shifts the number by five dollars. Growth in high-margin barrels from Guyana and the Permian keeps the longer-term production mix skewed to assets that break even well below forty dollars, limiting impairment risk in a downturn. Incorporating bull and bear scenarios weighted at twenty-five and twenty per cent respectively results in a probability-weighted fair value that matches the base-case mid-point, reinforcing confidence that the current price offers a double-digit safety margin.

Technical Context

Technical conditions support accumulation. The share price has reclaimed both the rising fifty-day moving average at one-hundred-forty-six dollars and the two-hundred-day moving average at roughly one-hundred-fifty, a constructive “golden-cross” pattern. Relative strength sits in the mid-fifties, indicating neither overbought nor oversold conditions, and moving-average convergence-divergence has flipped positive on improving volume. Short-term support rests in the one-hundred-forty-five to one-hundred-forty-seven range, coincident with the May swing low, while stronger institutional demand appears between the Strong-Buy floor of one-hundred-thirty-eight and the Very-Strong-Buy band that begins near one-hundred-twenty-one.

Twelve-to-Thirty-Six-Month Outlook

Over the next three years Chevron intends to integrate Hess, deliver incremental barrels from the Anchor and Ballymore projects in the Gulf, and expand its Tengizchevroil affiliate as the debottlenecking project reaches capacity. Management pledges to hold organic capital outlays steady, allowing free cash flow and the dividend to absorb inorganic growth. By 2027 we expect the dividend to reach two-dollars-ten per share on a payout ratio still shy of sixty per cent, and we forecast net-debt-to-capitalization drifting below fourteen per cent despite continued share repurchases. If Brent merely averages the mid-seventies during this period, total shareholder return should compound in the low-teens, validating Chevron’s status as a durable, high-quality, income-centric holding.

Longer-Term Vision

Chevron’s strategy balances hydrocarbon growth, emissions intensity reduction, and measured new-energy investment. Management targets a thirty-five-per-cent cut in upstream carbon intensity by 2035, primarily through carbon-capture and methane-abatement initiatives already funded in the base capital plan. Early-stage lithium, hydrogen, and sustainable-aviation-fuel projects together aim to contribute ten per cent of EBITDA by the mid-2030s without jeopardizing returns on capital. Given the company’s track record of disciplined capital deployment—highlighted by best-in-class return on capital employed through the last cycle—we view these initiatives as upside optionality rather than core valuation drivers.

Master Metrics Table

| Metric | Value | Indicator |

|---|---|---|

| Price (1 Aug 25) | $151.64 | inside Primary Buy corridor |

| Base Fair Value | $173 | twelve per cent upside |

| Dividend Yield | 4.5 % | sustainable |

| Five-Year Dividend CAGR | 4.8 % | robust |

| Long-Term EPS Growth | 7.5 % | Permian and Guyana led |

| Forward P/E | 10.0× | two multiple points below five-year mean |

| FCF Yield | 6.4 % | healthy |

| Quality Score | 70 / 100 | upper-quartile |

| Safety Score | 79 / 100 | strong |

Buy-Range Framework

| Zone | Price Band | Action |

|---|---|---|

| Ultra-Value | ≤ $103 | allocate maximal capital |

| Very-Strong-Buy | $104–$121 | heavy accumulation |

| Strong-Buy | $121–$138 | full-size buys |

| Primary-Buy | $138–$159 | staggered adds |

| Hold/Fair | $159–$207 | collect income |

| Trim | $207–$230 | reduce overweights |

| Too-Expensive | > $230 | exit or avoid |

Final Assessment

Chevron offers a compelling blend of yield, undervaluation, and growth visibility that few large-capitalization energy companies can match. The Hess acquisition augments an already attractive shale and LNG portfolio, while capital discipline and a fortress balance sheet limit downside. Even under conservative price assumptions, free-cash-flow coverage of the dividend remains solid, and the company’s commitment to shareholder returns shows no sign of wavering. In our view the present quotation offers advanced income investors an excellent opportunity to lock in a sustainable four-and-a-half-per-cent yield with credible potential for mid-teens total returns over the next five years.

Leave a comment