A handful of tech stocks have exploded more than +30% in 2025 – raising the question of whether to cash in some gains or stay onboard. We examine four high-flyers – Palantir (PLTR), AMD (AMD), Oracle (ORCL), and Coinbase (COIN) – through the Vulcan-mk5 model lens. Each boasts huge year-to-date returns and intense retail buzz (AI! Chips! Crypto!), but also stretched valuations and mounting risk flags. Below we break down their Vulcan Scores, fair value gaps, upside/downside projections, technical trends, and a checklist for deciding when to sell a winning stock versus when to ride the wave.

Top 5 Takeaways

- Tech Rockets Up in 2025: “High-volatility” winners like Palantir (+100% YTD), AMD (+30%+), Oracle (+48%), and Coinbase (+72%) are trouncing the S&P 500’s ~5–7% return. Each is surfing powerful themes (AI boom, chip demand, crypto resurgence) and has become a retail favorite.

- Vulcan Scores & Valuations Flash Caution: Despite strong Quality/Growth credentials, their multi-factor Vulcan Scores are middling-to-low (≈3–6 out of 10) due to extreme overvaluation. For example, Palantir and Oracle trade ~2× their fundamental fair values, with consensus 12-month price targets 40–85% below current prices.

- 12-Month Outlook: Modest Upside at Best: Analysts still see some upside in AMD (~+24% on AI chip momentum), but downside in others – e.g. Oracle’s YTD rally makes it 43% over analyst targets, and Palantir’s price is far above even bullish scenarios (Wedbush calls it “generational” yet acknowledges the stock’s euphoric premium).

- Technical Trends: Strong but Overextended: All four stocks are in bullish uptrends (trading well above their 200-day moving averages, e.g. Palantir is ~70% above its 200-day MA). Momentum is positive but bordering on overbought – recent 14-day RSI readings in the high-60s to 70+ for names like Palantir and Oracle. This signals powerful trend strength and a risk of near-term pullbacks.

- Profit-Taking vs. Holding – A Balanced Gameplan: Given frothy sentiment, emotion-neutral discipline is key. Consider trimming positions that have far overshot fair value (e.g. PLTR’s P/E ~285x) or where risk flags (debt, regulation, competition) loom large. However, if you have high conviction in the long-term story (e.g. AMD’s AI roadmap, Oracle’s cloud backlog) and a tolerable position size, you might ride the wave with safeguards (stop-losses, staggered sells). Below is a checklist to guide your decision.

Why These Stocks Soared (and What Could Keep Them Up)

AI Hype, Chips and Cloud: The 2025 Gold Rush

Palantir (PLTR) – “Second-best performing S&P 500 stock of 2025” riding a perfect storm of AI hype + government deals + retail fervor. Shares have doubled (≈+100% YTD) on surging demand for its AI-enabled data platforms. Palantir has landed big new contracts (DoD, ICE, etc.) and is positioning itself as indispensable infrastructure for AI in defense and enterprise. Wedbush even sees Palantir as a potential “trillion-dollar market cap” candidate in coming years. 12M outlook: Palantir’s growth story is compelling – analysts expect 40%+ EPS growth long-term – but the stock’s current price already bakes in years of success. Its Vulcan Growth and Momentum factors score high, yet the Vulcan Value score is near-zero (extremely pricey). Barring new “AI revolution” contract wins to justify its valuation, the stock could plateau as excitement cools.

Advanced Micro Devices (AMD) – The #2 maker of AI chips has surged ≈+33% YTD. With Nvidia’s AI GPUs in hot demand, investors are betting AMD (up +59.9% vs S&P in 3 months as of July) will capture a big slice of the AI silicon pie. Jim Cramer calls AMD a “strong performer” with shares up 33% YTD and robust momentum. Indeed, AMD just launched its MI300 AI accelerators to challenge Nvidia’s H100, aiming to power large language model training. Its data center division revenues jumped +57% YoY in Q1’25. 12M outlook: Tailwinds include sustained AI chip demand (hyperscalers are eager for Nvidia alternatives), and AMD’s long-term growth forecast ~28% CAGR. Headwinds: Nvidia’s lead and an overall chip cycle that can turn down. Analysts see moderate upside (+24% in 12M) from here. AMD’s Vulcan multi-factor profile is balanced – strong Growth/Momentum, solid Quality (debt is minimal, interest coverage 32×) – but valuation is rich (37× forward earnings). That yields a mid-range Vulcan Score (~6/10). Further upside likely hinges on AMD grabbing AI market share and delivering on big earnings hikes projected into 2025–2026.

Oracle (ORCL) – The 46-year-old database giant has transformed into an “AI cloud” stock, shocking Wall Street with a +50% YTD rally to all-time highs. Oracle has morphed from steady grower to “artificial intelligence darling” in the past year. Its cloud infrastructure (OCI) unit – which hosts AI workloads for startups like OpenAI and Musk’s xAI – is booming, with revenue up +52% last quarter and management guiding to 70%+ cloud growth this year. Massive new cloud deals (one worth $30B/year starting in 2028) underscore the bullish narrative. 12M outlook: Oracle’s fundamentals are indeed improving (double-digit sales growth, expanding cloud backlog). However, the stock now trades at 37× earnings with a 0.9% dividend yield – a growth stock valuation for what historically was a value name. Its Vulcan Score is low (~4/10) due to this valuation and a high debt load (Debt/Cap 89% vs industry norm 40%). While Oracle likely has further upside long-term from AI cloud adoption (management sees revenue doubling by 2029), in the next year the stock may churn unless it keeps delivering big earnings beats. It’s already outperformed AI darlings like Nvidia YTD, so expectations are elevated.

Crypto Comeback: Retail Speculation Returns

Coinbase (COIN) – The lone crypto exchange here, Coinbase has vaulted ≈+72% YTD amid a broader crypto market revival. Bitcoin’s resurgence and hopes for a U.S. Bitcoin ETF approval have reenergized crypto investors, and Coinbase – as a primary on-ramp – is benefiting. The stock’s high volatility (Beta ≈2.5) cuts both ways: after a brutal 2022–24 bear market, 2025 has seen a sharp recovery. 12M outlook: Crypto cycles are notoriously hard to predict. Coinbase’s fate is tied to crypto prices and volumes, which could soar further (e.g. if Bitcoin hits new highs in anticipation of 2024’s halving) or fade if regulations bite. Notably, by early 2025 the SEC’s major enforcement action against Coinbase was dismissed, removing a huge cloud – but regulatory risk isn’t zero (scrutiny of crypto exchanges continues). The Vulcan model would score COIN around 5/10: Momentum is strong and institutional sentiment improved (BlackRock and others showing interest in crypto ETFs), but fundamentals are weak (earnings have been negative, making valuation metrics like P/E not applicable). Wall Street’s consensus sees Coinbase as overvalued at current levels – average 12M target ~$326, ~22% below the recent price. This suggests limited further upside unless the crypto market enters a full-fledged bull run.

Risk Flags to Watch

Despite their exciting stories, these high-fliers carry elevated risks. Keep these flags in mind:

- Valuation Overshoot: All four trade at frothy valuations. Palantir’s P/E is ~285× (trailing), effectively pricing in decades of growth. Oracle’s forward P/E ~37× is more than double its historical norm. AMD (≈40× forward) isn’t cheap either, and Coinbase has no P/E (loss-making). Reversion risk is high – any slip in growth or shift in sentiment could trigger a sharp correction toward fundamental fair values.

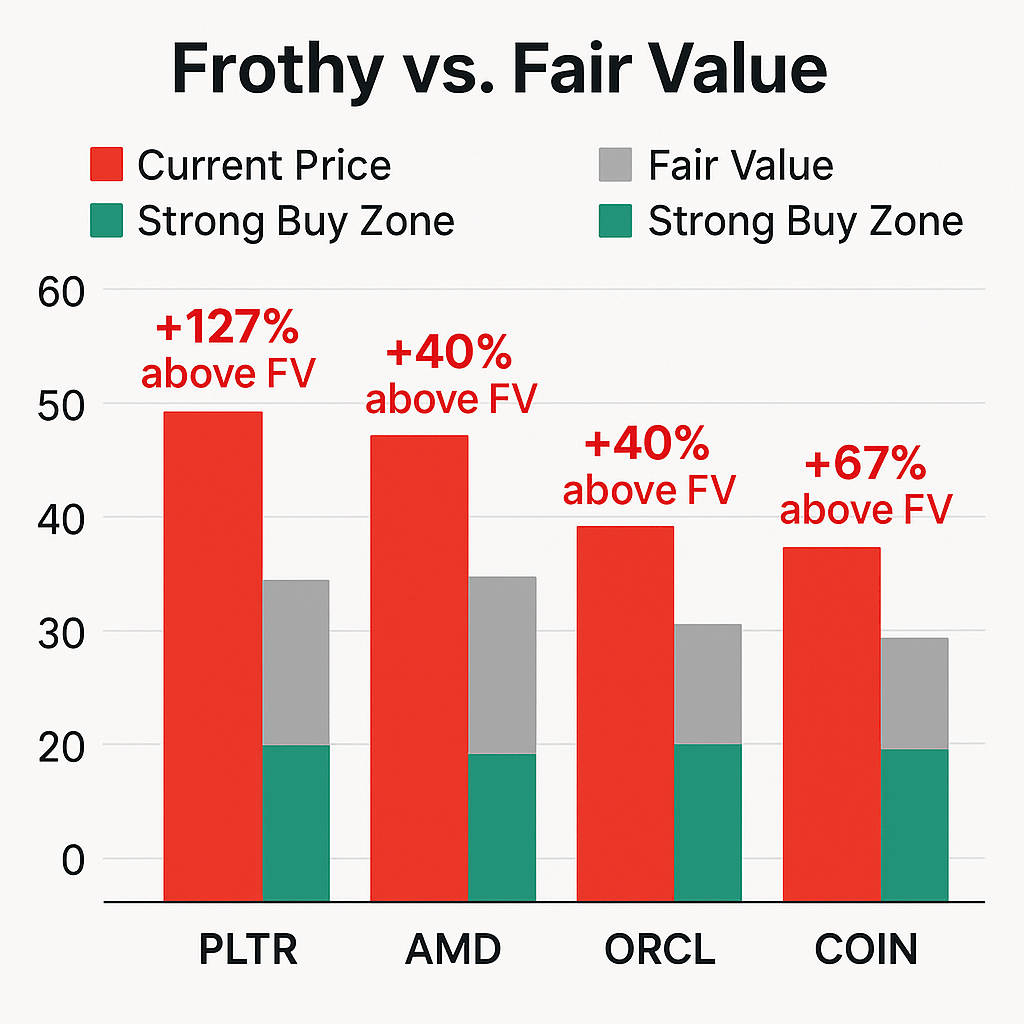

- Vulcan “Margin of Safety” Negative: The Vulcan model finds no margin of safety in these prices – e.g. Palantir is 127% above its fair value (i.e. price is more than double what DCF and fundamentals justify), and Oracle ~115% above fair value. Even AMD and Coinbase trade well above conservative fair value estimates. Such gaps historically lead to subpar forward returns.

- Analyst Expectations vs Reality: These stocks have outrun analyst targets. Consensus 12-month return predictions are negative for PLTR (

–87%) and ORCL (–43%), and only modestly positive for AMD (~+24%). When a stock far exceeds its price targets, it often reflects peak optimism. Any disappointment (earnings miss, slowing growth, etc.) could bring prices back in line. - High Volatility & Momentum Exhaustion: Their price momentum, while a positive, also implies volatility. Palantir’s 1-year beta and volatility are in the top percentile (annual vol ~121%) – it moves fast, in both directions. Technical indicators show some are overbought or near it (14-day RSI for Oracle recently ~70, a typical sell signal). A momentum reversal could snowball as trend-following traders take profits.

- Macro and Liquidity Risk: These rallies occurred in a period of improving sentiment and falling volatility. But rising interest rates or a market risk-off turn could hit high-valuation tech hardest. They have little fundamental “floor” to cushion a selloff. For instance, Oracle’s debt (89% debt-to-capital) could become an anchor if credit conditions tighten. Coinbase is tied to crypto liquidity – if liquidity dries up, so do its trading revenues.

- Competitive & Regulatory Risks: Each faces specific external risks. Palantir competes with a swarm of AI software upstarts (and big cloud providers offering AI tools). AMD is in a GPU arms race with Nvidia – if its AI chip rollout falters, the market may not tolerate mistakes. Oracle is up against Amazon and Microsoft in cloud, deep-pocketed rivals that won’t cede ground easily. Coinbase, as noted, faces an uncertain regulatory environment; any new adverse regulations or a cyber breach (as happened in 2025) can rapidly erode trust.

DCF Valuations & Buy Zone Benchmarks

According to Vulcan’s DCF and scenario analysis, these stocks are firmly in “Too Expensive” territory today. Here are approximate buy-zone levels where valuations would begin to make sense (based on discounted cash flow and historical multiples):

- Palantir (PLTR): Fair Value ≈ $68; Primary Buy ≈ $54; Strong Buy ≤ $47; Ultra Value ≤ $40. *(Current ~$152 is ~3× the upper buy zone – a significant premium.)

- AMD (AMD): Fair Value ≈ $117; Primary Buy ≈ $93; Strong Buy ≤ $82; Ultra Value ≤ $70. (Current ~$160, ~1.7× the primary buy level. AMD would need a pullback into the $90s to align with its DCF value zone.)

- Oracle (ORCL): Fair Value ≈ $116; Primary Buy ≈ $98; Strong Buy ≤ $87; Ultra Value ≤ $75. (Current ~$249, a whopping >2× the fair value – reflects the “AI premium” on this legacy name.)

- Coinbase (COIN): Traditional DCF is tough (earnings are volatile/negative). Analysts peg fair value in the ~$300s (avg. PT ~$326) with pessimistic cases around $190. We’d consider sub-$200 as a speculative buy zone for COIN absent clear profits. (Current ~$420 is baking in a full crypto bull market already.)

Valuation takeaway: All four are priced for perfection. Unless you have a very bullish long-term thesis (and stomach for volatility), it may pay to wait for more attractive entry points closer to the above buy zones. Buying or adding at current levels means accepting a low margin of safety. As Vulcan-mk5 notes, only stocks at >30% discount with strong growth qualify as “Ultra Value” buys – none of these qualify now.

Technical Snapshot (Momentum vs. Mean Reversion)

From a technical analysis perspective, all trends remain bullish, but there are hints of froth:

- Moving Averages: Each stock is trading well above its key moving averages. For example, Palantir’s price is ~69% above its 200-day SMA (

$153 vs. $90) – a sign of a powerful uptrend. AMD is similarly above its 200-day (which is in the $120s), and Oracle’s 50-day ($135) is far above its 200-day (~$104) – a golden cross pattern indicative of strong upward momentum. These gaps suggest overextension; prices often eventually gravitate back toward the 200-day mean, either via a correction or time (sideways consolidation). - RSI & Momentum Indicators: Short-term momentum oscillators show potential overbought conditions. Oracle’s 14-day RSI hit ~70 around its recent highs, and Palantir’s RSI likewise flirted with the overbought 70 level in June. (As of mid-July, PLTR’s RSI cooled to ~67 – still elevated.) Coinbase’s RSI spiked during crypto surges. Overbought RSI (>70) historically precedes at least a mild pullback ~70% of the time. Momentum is still positive (MACD for these stocks remains in “buy” territory), but it may be prudent to expect slower gains or volatility ahead rather than a straight-line climb.

- Volume & Participation: Notably, volume spikes accompanied many of these rallies – a sign of heavy trader involvement. Palantir, for instance, traded nearly 100 million shares on some up-days, reflecting high retail participation. Such volume climaxes can mark blow-off tops, but in these cases volume has remained robust, indicating continued interest. Watch volume on any down-days for clues: a big price drop on rising volume could signal the smart money exiting.

- Price Structure: All four have maintained a pattern of higher highs and higher lows in 2025, which is the simplest definition of an uptrend. For instance, AMD’s dips have been shallow and met with buying around its 50-day MA. As long as those higher low levels hold (for reference: ~$120 for AMD, $120-ish for PLTR, $230 for ORCL, $350 for COIN), the uptrend is intact. A breach of those support zones and the 50-day average would be early warning of a trend change.

Bottom line (technicals): The trend is your friend – until it bends. Right now, momentum bulls are in control, but keep an eye on those 50-day and 200-day levels. A stock trading 50–70% above its long-term average, with overbought indicators, is ripe for a pause. Even a healthy correction of –20% would not break the longer uptrend in most of these names, but would serve to work off the froth. Prepare for choppiness ahead, even if the long-term trend remains positive.

When to Sell Winning Stocks vs. Ride the Wave

Seeing huge gains on paper is thrilling – but it also raises the hardest question in investing: Should you take profits or let them run? Here’s an emotion-neutral checklist of profit-taking signals and hold-if conditions to guide your decision:

Consider Trimming or Selling if…

- Valuation Far Exceeds Fair Value: The stock is 50%+ above your estimate of fair value or well beyond analysts’ price targets. (E.g. PLTR and ORCL are 2× their DCF fair values; COIN 20% above consensus PT.) This suggests limited further upside — a classic time to lock in gains.

- Overbought & Extended: Technicals show overbought signals (RSI > 70) and the price is dramatically above moving averages (e.g. far above the 200-day MA). An extremely extended stock often reverts or at least stalls – taking some profit before the crowd does can protect your win.

- Thesis Is Playing Out (or Priced In): The catalyst or hype that drove the run-up is now well known and fully priced. Ask: “Is there a new upside catalyst from here?” If not (or if hype has outrun reality), consider harvesting gains. For example, Oracle’s AI-fueled re-rating has already happened – the bar for more surprise is high.

- Position Size is Now Too Big: The position has swelled to become a large % of your portfolio, beyond your comfort. Rebalancing by trimming a winner is prudent risk management (no matter how much you love the stock). Don’t let one high-flyer accidentally turn your portfolio into a one-stock bet.

- Fundamental Red Flags Emergence: Any deterioration in fundamentals (slowing revenue growth, margin erosion, increased debt, insider selling) while the stock is near peak euphoria is a cue to step back. For instance, if AMD’s next earnings show data center growth fading while stock is priced for perfection, that’s a cue. Or if regulatory winds shift negatively for Coinbase (new laws, unfavorable court rulings), take heed.

Consider Holding (Riding the Wave) if…

- You Have High Conviction in the Long-Term Story: You believe the company’s 5+ year prospects justify even the current rich valuation. In other words, the growth runway is so exceptional that today’s price will look reasonable in hindsight. (E.g. you think Palantir truly can become the next $500B–$1T tech titan in AI, or that AMD will eventually rival NVDA’s market cap.) High conviction can warrant riding through volatility – but be sure it’s grounded in research, not just optimism.

- Momentum and Fundamentals Still Align: The stock is beating earnings estimates, raising guidance, and fundamentally earning its uptrend. If quarterly results keep validating the bullish thesis (e.g. Oracle posting 50%+ cloud growth, AMD securing major AI chip wins), then holding makes sense – the market may continue to reward that outperformance.

- Not Yet Overvalued by Your Metrics: Despite big gains, perhaps the stock is still within your valuation bounds. For instance, maybe you think Coinbase’s real value is $600 if crypto adoption expands – so at ~$420 it’s not a sell to you. Or AMD at 40× P/E is acceptable given its growth rate. If your personal analysis says there’s more upside, you might ride further, but keep evaluating objectively.

- You’re Managing Tax or Timing Considerations: For taxable accounts, selling after >1 year for long-term capital gains (vs. short-term) can save a hefty tax cut. If you’re close to that holding period, you might hold a bit longer. Similarly, if markets are still in a strong uptrend and you don’t see immediate negative catalysts, you might trail a stop-loss rather than preemptively sell – letting the market strength work for you.

- Partial Profit-Taking Already Done: If you’ve already trimmed and taken back your original investment (or some profits), holding the rest can be emotionally easier. This “house money” approach can let you participate in further upside with less stress. Just don’t round-trip those remaining gains into a loss – have an exit plan or stop in place.

Key: You don’t have to go all-or-nothing. In many cases, the best move is a balanced approach – trim a portion (say 25–50%) to secure profits and let the remainder run. This way you alleviate FOMO (you’re still in the game if it keeps climbing) and regret (you banked respectable gains if it drops).

Finally, check your emotional temperature. If holding a high-flyer is causing you sleepless nights or obsessive screen-checking, it might be a sign you’re overextended. Likewise, if you’re so in love with the stock that you’re dismissing any bearish facts, step back. Strive for that Vulcan-esque rationality – weigh the data (valuation, risk, trend strength) above the hype.

Comparative Snapshot: Master Metrics

To summarize the profile of these four tech rockets, here is a side-by-side look at key metrics and Vulcan model outputs:

| Stock | YTD Price Gain | Vulcan Score (0–10) | Valuation vs. Fair Value | 12M Predicted Return (Analyst Cons.) | Major Risk Flags |

|---|---|---|---|---|---|

| Palantir (PLTR) | +103.9% | 3/10 – Low (Hype > Earnings) | Overvalued ~+127% vs DCF fair value (P/E 285×) | –86% (downside) to cons. PT ~$21 | Valuation bubble; unproven profitability |

| AMD (AMD) | +33% | 6/10 – Med (Growth vs Price) | Overvalued ~+38% vs fair value (forward P/E ~40×) | +24% (upside) to cons. PT ~$200 | Competition (Nvidia); cyclical semi demand |

| Oracle (ORCL) | +48% | 4/10 – Low (Debt & Price) | Overvalued ~+115% vs fair value (PEG >>1, high debt 89%) | –43% (downside) to cons. PT ~$140 | Debt load; cloud competition; back to norm? |

| Coinbase (COIN) | +72% | 5/10 – Med (Speculative) | N/A (Neg. earnings; P/B ~4×) – avg. PT $326 is 22% below | –22% (downside) to cons. PT ~$326 | Regulatory uncertainty; crypto volatility |

– Sources: YTD returns from Yahoo Finance/NerdWallet as of Jul 21, 2025; Vulcan-mk5 model data for fair values and risk metrics; Analyst consensus from Refinitiv/TipRanks.

As shown, fundamentals and forecasts do not fully support the astronomical YTD gains – a classic hallmark of a frothy market. Vulcan-mk5’s quantamental verdict: Palantir and Oracle earn “Trim” ratings, AMD a cautious “Hold”, and Coinbase (if covered) likely a Hold/Speculative. None are in “Strong Buy” range at current prices. This doesn’t guarantee they’ll drop – momentum can defy fundamentals longer than we expect – but it does imply asymmetric risk (more downside risk than upside reward) unless business results surprise dramatically on the upside.

Final Verdict

In a year when tech enthusiasm – from AI to crypto – has again reached a fever pitch, it’s wise to remember the old adage: Trees don’t grow to the sky. The stocks profiled here have delivered outstanding gains (many justifiably, due to real growth and innovation), but expectations and valuations are sky-high.

Should you sell into strength or ride the wave? The prudent approach is to take some profits off the table while momentum is strong, especially if your position has grown outsized or the valuation gives you nosebleeds. Scale out gradually – nobody ever went broke taking a profit. At the same time, if you remain a long-term believer, keep a core stake and a clear plan: perhaps use trailing stops to protect against a sharp reversal, or set a mental stop at a key technical level (e.g. a close below the 50-day MA). This way, you respect the trend but also respect the risks.

Remember, market darlings can and do stumble. A year ago, few imagined Oracle would be an AI high-flier – now it is. Conversely, today’s winners could be next year’s laggards. By staying disciplined – trimming when fundamentals diverge from price, and holding only what you’re prepared to weather through a storm – you can enjoy the gains you’ve already won and still participate in any further upside. In frothy times, that balance of greed and fear is your superpower.

In short: Celebrate the win, bank some of it, and let the rest ride with a plan. Selling into strength, not into weakness, is a hallmark of savvy investing. But you don’t have to abandon the party entirely – just know where the exits are. After all, as any surfer knows, you ride the wave as long as you can… but you don’t forget to watch the breaks.

Happy Investing, stay safe out there!

Sources: Financial data from Vulcan-mk5 model and Zen Research Terminal; Performance and analyst insights from Yahoo Finance, Business Insider, and Motley Fool.

Leave a comment