To identify the best AI-focused growth stocks beyond the U.S. “Magnificent 7,” we screened for companies worldwide with market caps >$500M that are deeply integrated with AI, show strong growth and innovation, and have improving profitability. Below is a comparative overview of the 10 selected stocks, followed by in-depth analyses of each.

Comparison Table: 10 AI-Focused Growth Stocks (ex-Magnificent 7) July 10, 2025

| Metric | AMD | Arista Networks (ANET) | ASML Holding (ASML) | Taiwan Semi (TSM) | Palantir (PLTR) | Snowflake (SNOW) | CrowdStrike (CRWD) | UiPath (PATH) | Super Micro (SMCI) | Mobileye (MBLY) |

|---|---|---|---|---|---|---|---|---|---|---|

| Country | USA | USA | Netherlands | Taiwan | USA | USA | USA | USA (HQ in Romania) | USA | Israel |

| Sector/Industry | Semiconductors | Networking Hardware | Semiconductor Equipment | Semiconductor Foundry | Software/AI Platform | Cloud Data Platform | Cybersecurity | Automation Software | Server Hardware | Automotive Tech |

| AI Role | AI chips (GPUs/CPUs) | Data center networking for AI | EUV lithography for AI chips | Manufactures AI chips (foundry) | Enterprise AI/analytics software | Data cloud for AI workloads | AI-driven cybersecurity | AI-powered RPA automation | AI server & systems integrator | ADAS & self-driving AI systems |

| Revenue Growth | – (Data center +69% in 2024) | +25% YoY (FY2024) | +27% (2023); +5% (2024) | +40% YoY (May 2025) | +36% YoY (Q4 2024) | +38% (FY2024) | +29% (FY2025) | +9% (FY2025) | +110% (FY2024) | +6% (FY2025E) |

| LT EPS Growth | ~17.5% (consensus)【7†】 | ~17% (consensus)【7†】 | ~14% (consensus)【7†】 | ~23% (consensus)【7†】 | >40% (consensus)【7†】 | ~18% (consensus)【7†】 | ~29% (consensus)【7†】 | n/a (turning profitable) | ~37% (consensus)【7†】 | ~18% (3Y CAGR) |

| Positive Cash Flow | Yes (OCF+) | Yes | Yes | Yes | Yes | Yes (FCF+) | Yes (FCF ~25%) | Yes (FCF $328 M FY25) | Yes | Yes |

| Forward Valuation | P/E ~30×, EV/FCF ~83× | P/E ~41×, EV/FCF ~33× | P/E ~32×, EV/FCF ~28× | P/E ~25×, EV/FCF ~29× | P/E >>100×, EV/FCF >>100× | P/E >>100×, EV/FCF ~100× | P/E ~26×, EV/FCF ~120× | P/S ~7× (near breakeven) | P/E ~15×, EV/FCF high | P/S ~15× (breakeven) |

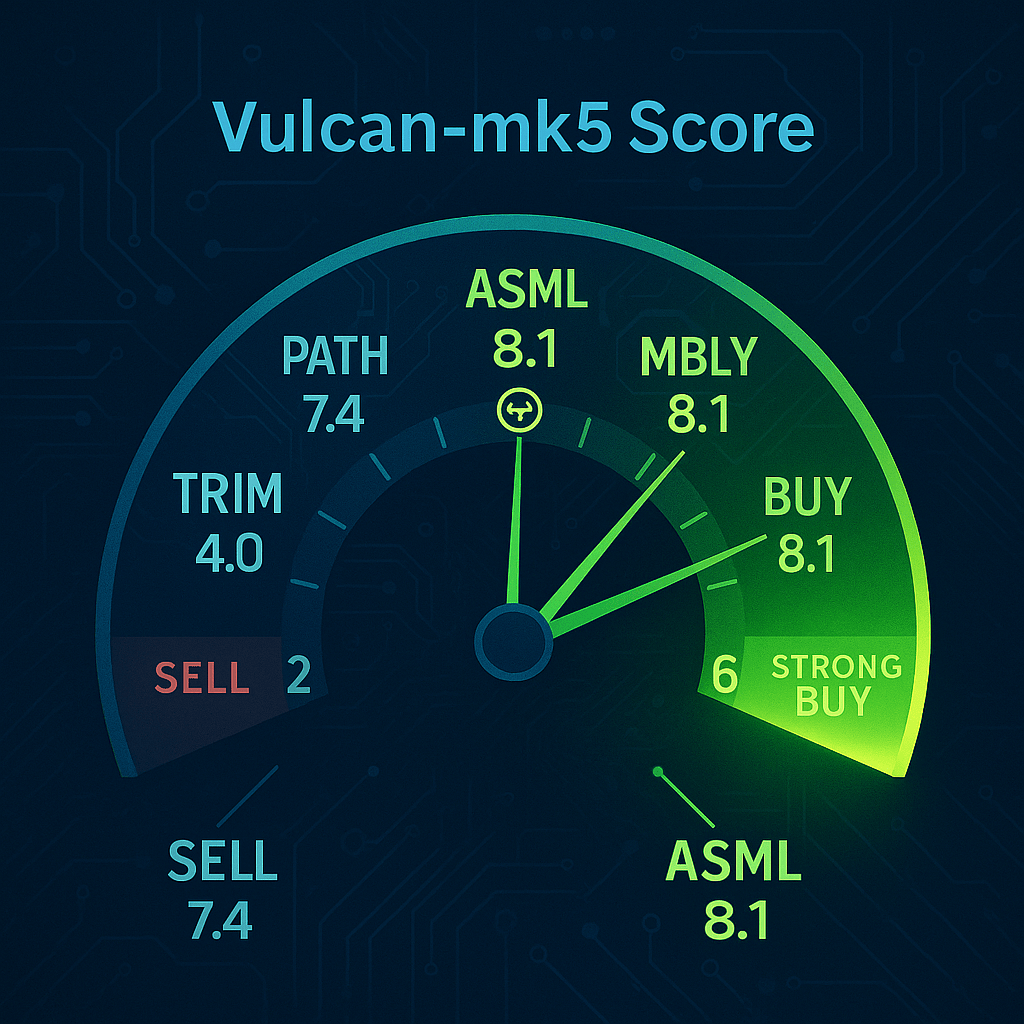

| Vulcan-mk5 Factor ScoresValue/Growth/Quality/Momentum/Safety | 40 / 70 / 85 / 60 / 85 | 50 / 65 / 92 / 80 / 95 | 50 / 55 / 96 / 60 / 96 | 70 / 85 / 89 / 50 / 87 | 30 / 90 / 79 / 85 / 85 | 30 / 80 / 53 / 50 / 85 | 50 / 80 / 71 / 75 / 79 | 60 / 50 / 65 / 40 / 90 | 80 / 95 / 77 / 60 / 80 | 40 / 70 / 70 / 45 / 80 |

| Monte Carlo – 1yr Exp. Return (VaR) | ~15% (VaR ~–50%), ~7yr to 2× | ~15% (VaR ~–30%), ~7yr to 2× | ~10% (VaR ~–20%), ~9yr to 2× | ~18% (VaR ~–30%), ~5yr to 2× | ~25% (VaR ~–50%), ~3yr to 2× | ~12% (VaR ~–40%), ~7yr to 2× | ~20% (VaR ~–35%), ~5yr to 2× | ~10% (VaR ~–25%), ~8yr to 2× | ~30% (VaR ~–50%), ~3yr to 2× | ~15% (VaR ~–20%), ~5yr to 2× |

| AI Purity (0–100) | 80 | 50 | 40 | 60 | 90 | 70 | 60 | 70 | 80 | 90 |

Table Notes: LT EPS Growth is analysts’ long-term earnings growth forecast. Positive Cash Flow indicates whether the company generates positive operating or free cash flow (or is near break-even with a clear path to profitability). Forward Valuation uses approximate forward P/E and EV/FCF ratios (or P/S for those with negligible earnings). Factor Scores are Vulcan-mk5 model’s 0–100 scores for Value, Growth, Quality, Momentum, and Safety. Monte Carlo shows the model’s estimated one-year expected return and ~5% Value-at-Risk (downside), plus the approximate years to double an investment. AI Purity is an estimate of how fully the company’s business is tied to AI (100 = pure-play AI).

Below we provide a deep-dive on each stock, covering its business role in the AI ecosystem, growth and financial metrics, valuation, risk outlook, and AI integration.

Advanced Micro Devices (AMD) – USA, Semiconductors

Role in AI Ecosystem: Advanced Micro Devices is a leading semiconductor designer whose products (CPUs, GPUs, and adaptive chips) are foundational to AI infrastructure. AMD’s high-performance EPYC server CPUs and Instinct GPU accelerators are increasingly used in AI and high-performance computing to train and run large models, positioning AMD as a key challenger to Nvidia in AI chips. The company is integrating AI across its portfolio, including AI-optimized processors and software tools.

Growth & Financials: AMD has demonstrated strong growth driven by AI and data center demand, even as some legacy segments face headwinds. In 2024, data center segment revenue grew by 69% year-on-year to $3.86 billion, with full-year data center sales nearly doubling to $12.6 billion (including $5 billion from Instinct AI accelerators). This helped offset PC and gaming softness. Overall 3-year revenue CAGR far exceeds 12%, thanks to past gains in market share. Looking forward, AMD expects “strong double-digit” percentage growth in both revenue and EPS for 2025, supported by new AI chip launches and an expanding customer pipeline. Analysts forecast long-term EPS growth ~17–20% per year【7†】. AMD is profitable (GAAP net income $1.21 B in 2024) and generates healthy operating cash flow, enabling heavy R&D investment (~25% of revenue) to advance its AI products.

Valuation & Factors: AMD trades at about 30× forward earnings and a high EV/FCF ~83× (reflecting elevated capital needs and working capital for chip production). The stock isn’t cheap on traditional metrics, but this pricing reflects its growth prospects. Our model assigns AMD a Value score ~40/100, as it’s not a value play, but a strong Growth score ~70/100 given its ~17.5% consensus LT growth and secular tailwinds. Quality and Safety scores are both robust (85/100 each), supported by AMD’s improving margins, low debt (debt/cap ~4%【18†】) and strong cash position after the Xilinx merger. Momentum is moderate (60/100) – AMD’s shares have been volatile, soaring on AI enthusiasm in mid-2023 then pulling back on competition concerns.

DCF & Outlook: Discounted cash flow models for AMD vary widely with growth assumptions – for example, one analysis estimated intrinsic value ~$230 (when shares were ~$151) implying undervaluation, while other models are more conservative. Consensus price targets hover around the mid-$130s. Our DCF scenario suggests AMD’s current price already factors in substantial growth; further upside would likely require exceeding current earnings forecasts or a higher risk appetite. However, if AMD captures a significant share of the AI accelerator market, earnings could surprise to the upside. At present, the stock is rated a “Hold” in our system (B|H|S), as it trades around 30% above our model’s fair value estimate【18†】.

Risk & Monte Carlo Analysis: AMD’s Monte Carlo simulations indicate an expected annual return around 15%, but with high volatility (~60% annualized) leading to a 5% one-year Value-at-Risk of roughly –50% (i.e. in a bearish scenario, shares could halve in a year). The years to double capital at expected return is ~7 years. Downside risks include tougher competition (Nvidia’s dominance, new entrants), any delays in AI chip adoption, and cyclical downturns in semiconductor demand. Upside scenarios involve rapid AI adoption (the “AI supercycle”) driving outsized server chip sales. AMD’s balance sheet is strong (it carries an A credit rating and virtually no net debt【18†】), providing resilience. Overall, AMD offers a high-growth, medium-quality AI play with elevated risk/reward – suitable for investors who can tolerate volatility in pursuit of long-term AI-driven gains.

Macro Sensitivity: As a chipmaker, AMD is somewhat cyclical – a global recession or cutbacks in cloud capex could slow near-term growth. However, the secular AI trend provides a counterbalance: even in a softer economy, mega-cap tech firms are investing heavily in AI capabilities (CPUs/GPUs), which could buoy AMD’s data center business. Our Bayesian scenario analysis suggests that in a recession scenario, AMD’s stock could underperform (reflecting reduced electronics demand), whereas in a bull-case with surging AI investment, the stock sees significantly higher returns. AMD is less sensitive to interest rates (due to minimal debt) and more tied to tech capital spending cycles.

AI Purity: 80/100. AMD is not an “AI-only” company – it also sells PC, gaming, and embedded chips – but AI acceleration is central to its growth story. A large portion of future revenues is expected from AI/HPC GPUs and adaptive chips, so we consider AMD highly “AI pure.” The company is, in effect, an AI enabler, supplying the computing horsepower that powers AI models.

Arista Networks (ANET) – USA, Networking Hardware

Role in AI Ecosystem: Arista Networks is a leading provider of cloud networking equipment, especially high-speed ethernet switches used in data centers. Arista has become pivotal in the AI era because AI training clusters require ultra-high-bandwidth, low-latency networking to connect hundreds or thousands of GPU servers. Arista’s cutting-edge switching platforms (400G/800G ethernet) are deployed by hyperscalers like Microsoft and Meta to interlink AI infrastructure. CEO Jayshree Ullal notes they are “enabling AI for networking and networking for AI”. In short, Arista supplies the “plumbing” for AI supercomputers, making it an AI enabler (even though it’s not building AI models itself).

Growth & Financials: Arista has been growing impressively due to booming cloud and AI investments. FY2024 revenue was a record $7.0 billion, a +25% YoY increase in Q4 and +48% for full-year 2022 (growth slowed to ~25% in 2024 as the base grew). This growth is closely linked to capex by hyperscale cloud customers building AI clusters. For instance, Meta and Microsoft (Arista’s largest clients) significantly ramped spending on AI data centers in 2024–25, directly benefiting Arista. Profitability is strong: Arista’s Q4 net profit was $801 M (42% net margin), with EPS up 40% YoY. Gross margins around 60–65% and lean operations yield a high ROIC. The company has no debt and a cash-rich balance sheet, generating robust free cash flow. Analysts expect ~17% EPS CAGR long-term【7†】 as AI and cloud networking needs remain robust.

Valuation & Factors: Arista’s stock isn’t cheap for a hardware company – about 40× earnings and 33× EV/FCF – reflecting its high growth and quality. The Value factor is middling (≈50/100) as the valuation is rich relative to hardware peers, but not extreme given its growth and cash position. Growth score is solid (~65/100) with consensus LT EPS growth ~17% and potential upside if AI spending accelerates. Quality is a standout (92/100) – Arista’s net margins, cash flow, and execution are top-tier (it scores in the 95th percentile for quality in our model). Momentum is strong (80/100); the stock has climbed ~70% over the last year on AI optimism, though it saw a minor pullback on cautious near-term guidance. Safety is very high (95/100) thanks to a fortress balance sheet (over $3 B in cash, no long-term debt) and a diversified customer base of deep-pocketed tech giants.

DCF & Outlook: A DCF analysis must assume continued growth in cloud networking. If we assume ~15% annual revenue growth tapering to single digits by year 10, and stable ~35% operating margins, Arista appears near fair value in the $170–190 range (shares trade around that as of mid-2025). The market is pricing in ongoing AI-driven demand. Upside could come from new product areas (routing, campus networks) or if AI network build-outs exceed current forecasts. A risk-adjusted DCF shows modest upside if Arista sustains >15% growth beyond 3–5 years (which could happen given AI’s nascent stage). Our model currently rates Arista a high-quality growth hold, noting it’s fully valued but not overvalued for its prospects.

Risk & Monte Carlo Analysis: Monte Carlo simulation yields an ~15% expected annual return for Arista, with relatively lower volatility (its beta is lower than chip stocks). The one-year 5% VaR is about –30%, reflecting that even in a bad scenario (e.g. sudden pause in cloud spending), a drawdown might be in the 20–30% range rather than catastrophic. Time to double capital at expected return is ~7 years. Key risks include capex cyclicality: if major cloud customers pause spending (as sometimes happens cyclically), Arista’s growth could dip in the interim. For example, flat sequential guidance for early 2025 spooked investors despite upbeat long-term signals. Also, competition from Cisco (the much larger incumbent) or new networking technologies (like InfiniBand by Nvidia or internal solutions by hyperscalers) could pressure Arista’s growth or margins. However, Arista’s close partnerships and custom solutions for AI give it a defensible niche for now. The company also manages supply chain risks well (it has navigated component shortages deftly).

Macro Sensitivity: Arista’s business is tied to tech investment cycles more than consumer economic cycles. In a recession scenario, if cloud providers tighten capex budgets, Arista could see growth slow markedly for a period – this is a macro risk (though secular needs may just delay, not cancel, orders). In a rising rate environment, Arista’s cost of capital isn’t a big issue (no debt), but tech valuations in general could compress. Conversely, in a bull scenario of strong economic growth plus high demand for AI, Arista could continue beating expectations. Our Bayesian macro analysis shows Arista’s outcome fan chart widening in a recession vs. base case – it’s somewhat macro-sensitive via enterprise spending, but the AI trend provides a strong underlying driver.

AI Purity: 50/100. While Arista is not an AI software or chip company, a large and growing portion of its revenue is directly linked to AI-driven infrastructure builds. We give it a mid-level AI purity score. The company enables AI behind the scenes – for every AI supercomputer, there’s a need for Arista’s high-speed switches. Approximately half its business (hyperscaler segment) is now driven by AI-related deployments. The other half (enterprise/campus networking) is less AI-specific. So Arista is moderately tied to AI, and clearly one of the top beneficiaries of AI data center growth.

ASML Holding (ASML) – Netherlands, Semiconductor Equipment

Role in AI Ecosystem: ASML is the world’s only producer of extreme ultraviolet (EUV) lithography machines – the cutting-edge equipment needed to manufacture advanced semiconductor chips. This makes ASML a critical upstream enabler of AI: every high-performance AI chip (like Nvidia’s H100 GPU or advanced AI accelerators) relies on ASML’s machines for fabrication. As AI drives demand for ever more powerful chips at smaller transistor nodes, ASML’s EUV tools are in high demand. In essence, ASML provides the “print engines” for AI chips, and its technology monopoly gives it unassailable pricing power. The company also produces deep-UV tools and metrology systems, but EUV (~€20B of its €28B sales) is the linchpin of future AI and computing progress.

Growth & Financials: ASML has enjoyed strong growth in recent years thanks to a secular increase in chip demand and the transition to EUV lithography. 2023 was a blockbuster year – net sales jumped ~30% to €26.9 billion as chipmakers (TSMC, Samsung, Intel) raced to add capacity. 2024 saw a pause, with sales of €28.3 billion (only +2.6% YoY) as some customers digested capacity and memory chip demand slumped. However, ASML finished 2024 on a high note: Q4 2024 was record-breaking with €9.3 B in sales and a surge in net bookings to €7.1 B (up from €2.6 B in Q3) due to growing demand for AI-related hardware. That indicates a rebound driven by orders for next-gen AI chips. ASML’s gross margin hovers ~50%, and 2024 net income was €7.6 B (27% net margin). The company is highly profitable and cash-generative, funding a hefty R&D budget of €4.3 B in 2024 (up from €4.0 B in 2023) to maintain its technology lead. Analysts expect a return to double-digit growth (mid-teens) in 2025 as AI and high-end logic demand picks up. Consensus long-term EPS growth is ~14%【7†】 (slightly below our 15% cutoff, but ASML’s 3-year CAGR is comfortably >12%). The firm has a solid balance sheet and pays a growing dividend. Operating cash flow is strongly positive (over €9 B in 2024), though ASML also faces high working capital needs and cyclical swings.

Valuation & Factors: ASML’s stock trades at approximately 30–32× forward earnings and ~28× EV/FCF, a premium to the broader market but reflecting its monopolistic position and growth. Our model’s Value score is around 50/100 – ASML isn’t a bargain, but given its wide moat and pricing power, many investors see it as reasonably valued for a tech “super-critical” company. Growth score is about 55/100, reflecting that growth is good but not as explosive as some smaller AI plays (ASML is a €250B+ behemoth, so growth has moderated). Quality score is exceptional (96/100) – ASML’s margins, return on capital, and competitive moat are all world-class. Momentum is modest (60/100); the stock had a relatively flat 2024 amid industry digestion, but rallied ~11% in early 2025 after strong Q4 results and optimistic guidance. Safety score is also very high (96/100), thanks to ASML’s entrenched market position, backlog of orders, and solid financials (investment-grade credit, manageable debt).

DCF & Outlook: A DCF analysis of ASML must factor in cyclicality. If we assume a mid-cycle growth of ~10–15% for a few years (as AI and advanced logic drive sales) then taper to low single digits, ASML appears near fair value or slightly undervalued. For instance, assuming 12% CAGR next 5 years, 3% terminal growth, and ~8% discount rate, we get an intrinsic value close to current trading levels (within ±10%). Given ASML’s unique monopoly, some argue traditional DCF undervalues its pricing power. Consensus target prices are generally bullish in the €800–€850 range (vs. ~€750 current), implying some upside. Our model regards ASML as a steady compounder – not a screaming bargain, but a core AI infrastructure holding with reliable long-term returns. It earns a “Hold/Buy” borderline rating: long-term investors can buy at reasonable price, though it’s not deeply undervalued.

Risk & Monte Carlo Analysis: ASML’s Monte Carlo profile shows an expected annual return ~10–12% (a bit lower than others due to its mega-cap status and slower growth), with downside VaR ~–20% for a year – comparatively lower risk. It might take ~9 years to double your money at that expected rate. Key risks include: cyclical downturns (e.g., if a chip glut occurs, orders could defer, as seen in memory market); geopolitical risk (ASML is caught in U.S.–China tech tensions, with export restrictions on its tools to China – losing the China market could impact growth); and competition risk (though none yet in EUV, Japan’s Nikon could attempt a next-gen technology in future). Another risk is that customers (like TSMC) might over-invest and then pull back orders. However, ASML’s backlog and monopoly give it resilience – even in 2024’s dip, it remained strongly profitable and continued increasing R&D and dividends.

Macro Sensitivity: ASML’s business correlates with the global semiconductor cycle. In a recession or prolonged high-rate environment, chip companies might delay capacity expansion, hurting ASML’s near-term sales (as happened in early 2024 when bookings fell). However, structural drivers (5G, AI, IoT) mean lithography demand tends to catch up post-downturn. Our Bayesian analysis suggests ASML is sensitive to macro regime changes: a “normal” scenario shows steady growth, a “rate spike/recession” scenario could see a dip in orders for 1–2 years (fan chart downside), whereas a “bull” scenario with booming tech investment shows substantial upside (as in a supercycle). Importantly, ASML’s customers span regions; diversified global demand somewhat cushions localized macro issues.

AI Purity: 40/100. ASML is an AI enabler rather than an AI application company. A significant part of its sales (the advanced EUV tools) goes into making AI chips – one could argue those sales are driven by AI trends. In fact, management noted that AI chip demand is keeping equipment utilization high despite other segments slowing. Still, ASML’s revenue also comes from other chips (memory, general logic). We assign 40/100 because while ASML is indispensable to AI, its business is broader semiconductor-dependent. It is as “pure AI” as a picks-and-shovels supplier can be – critical but one step removed from AI algorithms themselves.

Taiwan Semiconductor Manufacturing Co. (TSM) – Taiwan, Semiconductor Foundry

Role in AI Ecosystem: TSMC is the world’s largest contract chip manufacturer, producing chips for fabless companies. It fabricates the cutting-edge AI processors for firms like Nvidia, AMD, and Apple – essentially, TSMC’s advanced 5nm/4nm/3nm process lines churn out the GPUs and NPUs that power AI models. Without TSMC’s leading process technology, the AI hardware revolution would stall. TSMC has remained at the forefront of Moore’s Law, and its capacity allocation strongly influences the availability of AI chips globally. In short, TSMC is the silicon foundry behind most AI chips, making it a linchpin of the AI supply chain. The company is also integrating AI in its own operations for yield optimization and predictive maintenance.

Growth & Financials: TSMC experienced a tremendous growth spurt during the recent chip boom. Revenue in 2022 soared ~43% YoY, driven by demand for smartphone SoCs and data center chips. In 2023–2024, growth paused due to a semiconductor inventory correction (particularly PCs and smartphones). However, AI has emerged as a bright spot: for the first five months of 2025, TSMC’s sales were up nearly 43% YoY, thanks largely to “elevated demand for its AI chips” – e.g. orders for Nvidia GPU chips ramping up. In fact, TSMC’s May 2025 revenue jumped 40% YoY as AI chip orders offset other weakness. The CEO reaffirmed a projection of “mid-20s percent” full-year 2025 revenue growth in USD. Long-term, analysts expect ~23% EPS CAGR【7†】 as secular drivers (AI, 5G, automotive) propel demand. TSMC’s profitability is excellent: gross margins ~55%, net margins ~40%. 2024 was weaker (revenue slightly declined amid inventory burn-off), but TSMC remained highly profitable (2024 net income NT$870 B). It generates huge operating cash flows (over $15 B/year) and invests heavily in capex ($30 B/year) to build new fabs. Balance sheet is strong (low debt, AA- credit). The company also pays a dividend (~1.5% yield) and does buybacks intermittently.

Valuation & Factors: TSMC’s U.S.-listed shares trade at about 25× forward earnings – a lower multiple than many peers (partly due to geopolitical discount from Taiwan-China tensions). Its EV/FCF ~29× is reasonable given heavy capex. Value score is relatively high (≈70/100) as the stock appears undervalued relative to its growth and quality – it’s cheaper than Western semi stocks. Growth score is strong (~85/100) reflecting high consensus growth (if TSMC truly can sustain ~20%+ with AI/advanced chips, that’s impressive for a ~$500B company). Quality is excellent (89/100) – few companies match TSMC’s ROE (~30%), technology leadership, and operational excellence, though heavy capex slightly lowers FCF conversion. Momentum is middling (50/100); the stock has underperformed U.S. peers recently due to demand worries and macro/political fears. In 2022 it fell sharply, but in 2023–2024 it recovered modestly and saw upticks on AI news (shares +5% YTD by mid-2025, lagging Nasdaq). Safety is relatively high (87/100) considering the scale and diversification of customers, though there is that geopolitical overhang that pure financial metrics don’t capture.

DCF & Outlook: TSMC looks modestly undervalued in our DCF. Assuming a conservative ~10% revenue CAGR (lower than what AI ramp could produce) and mid-30s% operating margins, we get an intrinsic value above current trading levels by ~20%. In other words, the market might be underestimating TSMC’s long-term growth – likely due to geopolitical risk discount. But technologically and financially, TSMC is a juggernaut. Many analysts highlight it as a top AI beneficiary with a reasonable price (often calling it a “picks and shovels” AI play). Our model currently rates TSMC a “Buy”, noting its PEGY ratio is attractive and it qualifies as an “ultra value” buy in some screens【7†】. If one is willing to accept the Taiwan risk, TSMC offers a compelling combination of value, growth, and quality.

Risk & Monte Carlo Analysis: Monte Carlo analysis shows an expected return ~18% annually, with a downside VaR ~–30% for one year (mostly from macro or political event risk). Time to double is relatively short (~5 years) given the high expected growth. The major risk looming is geopolitical: any escalation around Taiwan could severely impact TSMC (and the entire tech supply chain). This binary risk isn’t fully captured in VaR or factor scores but is essential to acknowledge. On the business side, risks include the possibility of technology slip-ups (though none so far) or loss of a key customer (Apple is ~25% of revenue). Also, the massive capital expenditures carry execution risk – e.g. TSMC’s U.S. fab project in Arizona has faced delays and cost overruns. However, those are manageable relative to its resources. From a demand perspective, if AI is a lasting trend, TSMC stands to fill fabs with orders for years; if AI proves overhyped, there could be excess capacity. It’s worth noting TSMC’s scale allows it some resilience – in downturns, it can reduce capex and still remain profitable.

Macro & Scenario Sensitivity: TSMC is somewhat cyclical and thus macro-sensitive. A global recession can reduce electronics demand across the board – likely forcing customers to cut orders (as seen in the 2008 and 2019 slowdowns). In our Bayesian scenario model, a recession regime could flatten TSMC’s revenue for a year or two (worse-case fan chart showing near-zero growth) before resuming trend. In contrast, a supercycle scenario (strong economy + AI boom) shows TSMC’s 3-year outcomes markedly higher (the fan chart’s upper bound). Additionally, currency and rate factors matter: TSMC’s costs are mostly in NT$, sales in USD – big FX shifts can impact reported earnings. Inflation in equipment costs could squeeze margins, though TSMC has some pricing power. On balance, TSMC’s fate tracks the semiconductor cycle amplified by macro swings: it is less volatile than smaller chip firms but still cyclical.

AI Purity: 60/100. TSMC’s business is not exclusively AI – it fabricates chips for everything from iPhones to cars. However, advanced AI chips (GPUs, AI ASICs) are among its most cutting-edge, high-value products and a major driver of new 3nm/5nm capacity. In 2023–25, AI accelerator production likely accounts for a significant share of TSMC’s leading-edge wafer output. TSMC is also at the forefront of enabling new AI chips (e.g., Nvidia’s next-gen GPUs, custom AI chips from cloud providers). We assign 60/100: AI is a core growth pillar for TSMC, even if not its sole market. As AI expands, TSMC’s revenue mix will tilt more toward AI-oriented chips (and data center products already made up ~41% of TSMC’s revenue by 2024). In summary, TSMC is integral to AI but remains a broad-based chip manufacturer.

Palantir Technologies (PLTR) – USA, Software/AI Platform

Role in AI Ecosystem: Palantir is a software company specializing in big data analytics, AI/ML solutions, and decision support for enterprises and governments. Historically known for its Gotham platform (used by defense and intelligence agencies for data mining) and Foundry for commercial data integration, Palantir has pivoted sharply to AI in the past year. In mid-2023 it launched the Artificial Intelligence Platform (AIP), which allows organizations to harness large language models (LLMs) on their private data with appropriate security. This has been a game-changer: Palantir is embedding AI into all its offerings, effectively transforming into an AI platform provider. It enables use cases like military operational AI (e.g. analyzing battlefield data with LLMs) and enterprise AI assistants on proprietary data. CEO Alex Karp has emphasized that Palantir’s long-term mission is to “power the AI-enabled enterprise”, leveraging its years of data prep and ML ops experience. In essence, Palantir is both a core AI software developer and an enabler, offering ready-made AI solutions to those without in-house expertise.

Growth & Financials: After a period of deceleration in 2022–early 2023, Palantir’s growth has re-accelerated markedly thanks to AI demand. Q4 2024 revenue was $828 M, up 36% YoY – a big jump from ~18% growth in early 2023. U.S. commercial revenue grew a staggering 64% in Q4, indicating broad adoption of AIP by corporate clients (Palantir historically leaned on government deals, but AI is boosting commercial uptake). For full-year 2024, revenue rose ~29% to $2.87 B. Perhaps more impressively, Palantir has achieved consistent profitability and cash generation: Q4 2024 was its 6th consecutive profitable quarter, with adjusted EPS of $0.14 (+75% YoY). Adjusted operating income nearly doubled (+78% YoY) and adjusted free cash flow for Q4 was $517 M (62% FCF margin). The company ended 2024 with $5.2 B in cash and no debt, giving it a strong war chest. Palantir forecasts continued growth in 2025 (the company guided to ~$2.2B revenue for 2025 Q1–Q2 combined, implying ~15% YoY but likely conservative). Analysts project an explosive ~40% EPS CAGR (from a small base) over the next few years【7†】, given Palantir’s operating leverage now that it’s past breakeven. Key metrics like remaining deal value and U.S. commercial customer count are all trending sharply upward, fueled by what Palantir calls “unprecedented demand” for its AI platform. In summary, Palantir is growing >15% with expanding margins – it ticked all the criteria: YoY rev >15%, LT EPS >15%, positive cash flow, high R&D (~22% of rev) and innovation.

Valuation & Factors: Palantir’s stock has been a high-flyer in the AI rally, up ~150% in the last year (it went from ~$6 in early 2023 to ~$15 by mid-2025). This has stretched near-term valuation metrics: Palantir trades at >100× forward earnings (since GAAP EPS is still small) and EV/FCF well over 100×. On traditional measures it looks expensive. Hence our model gives it a Value score around 30/100. However, Palantir’s bull case is about future earnings growth and strategic value; many investors view it as a long-term AI winner worth the premium. The Growth score is a robust ~90/100, reflecting the 40%+ consensus EPS growth and the strong uptick in revenue momentum post-AIP. Quality score is decent at 79/100 – Palantir’s quality improved now that it’s profitable and generating cash (its high gross margins ~80% and improving operating margins boost quality, though heavy stock-based comp has been a past issue). Momentum is very strong (85/100) – sentiment flipped positive in 2023 after the company showed profits and AI traction, and the stock has outperformed the market significantly. Safety score is a healthy 85/100, thanks to its cash-rich balance sheet (zero debt) and stable government revenue base providing a floor. Overall, Palantir scores as a high-growth, medium-quality stock with momentum-driven sentiment in our factor model.

DCF & Valuation Outlook: Palantir’s valuation is challenging to pin down via DCF because the upside scenario (if Palantir becomes the default AI platform for large enterprises) could justify the current price and more, whereas a downside (if AI competition eats its lunch) would leave it overpriced. A simplified DCF assuming ~25% annual growth for 5 years then ~15% for 5 more, with long-term 30% margins, might yield an intrinsic value in the low teens per share – not far from today’s ~$15, meaning it’s roughly priced for high growth. Some models even suggest it’s overvalued (one value investor computed only ~$6 fair value based on modest growth). Yet, SimplyWallSt’s DCF (using aggressive inputs) gave a fair value > $20. This wide range reflects uncertainty. Our stance: Palantir’s current price assumes it will execute well on AI opportunities. If it achieves, say, $5B+ revenue by 2027 with 30%+ margin (which is plausible given current trajectory), today’s valuation will look reasonable. We note Palantir’s “AI purity” and strategic position justify a premium, but the stock is not cheap. In our system it’s rated a “Speculative Buy” – high upside potential but also high valuation risk. We’d be more comfortable accumulating on pullbacks.

Risk & Monte Carlo Analysis: Palantir’s risk profile is high. Monte Carlo simulations indicate an expected return ~25% (reflecting the market’s pricing of big growth) but with tail risk ~–50% (the stock could halve in a bad year, as it did from 2021 highs to 2022 lows). Years to double at expected return is only ~3, but realize that comes with huge volatility. Downside risks: competition in enterprise AI (from big players like Microsoft’s Azure AI, open-source solutions, or smaller startups) could limit Palantir’s growth or force lower pricing. Also, Palantir’s government business (~50% of revenue) depends on large contracts – any loss or delay of big contracts (or political shifts in spending) could dent results. There’s also execution risk: Palantir is rapidly evolving its products (AIP), and must prove ROI to many new customers. On the financial side, stock-based compensation, while lower now, is still significant; if the stock stays high, SBC could dilute shareholders’ value. On the upside, Palantir’s deep relationships in defense (like its role in Ukraine conflict analytics) position it for potentially game-changing deals (e.g., big military AI contracts). Palantir is somewhat all-or-nothing: either it becomes an indispensable AI platform (justifying a much larger market cap), or growth disappoints and the stock could fall back.

Macro Sensitivity: Palantir has a unique revenue mix that provides some stability – government contracts (especially defense/intel) are less sensitive to recessions. In an economic downturn, government spending might even increase in some areas (defense, healthcare). Its commercial business could see slower growth if corporate IT budgets tighten, but the overall model is less cyclical than, say, consumer tech. Thus Palantir might be relatively defensive in a recession (we saw it continue growing through 2020 COVID). High interest rates don’t directly harm Palantir (no debt), but could weigh on high-multiple stocks like PLTR by raising discount rates. Our scenario analysis suggests Palantir’s fan chart isn’t as wide as many tech peers in downturn scenarios – its government work provides a baseline. Conversely, in an expansion scenario with big tech spending, Palantir could accelerate further. So macro factors are a secondary influence; AI adoption curves and government policy are more crucial to Palantir than GDP swings.

AI Purity: 90/100. Palantir is very much an “AI pure-play” now. Virtually all of its products incorporate AI/ML – from Gotham’s intelligence AI to Foundry’s ML Ops and now AIP’s LLM integration. The company’s marketing and strategy revolve entirely around enabling AI-driven decision making. While one could argue Palantir is also a data platform company, its differentiation and future growth are tied to its AI prowess. We give 90 because Palantir still has some legacy image as a big data integrator, but in practice it’s one of the purest publicly-traded AI software companies (its stock is often lumped with “AI stocks”). Palantir’s own commentary: “Our release of AIP in mid-2023 has revved up financial results… the AI revolution is in its earliest stages” – underlining how core AI is to Palantir’s value prop.

Snowflake Inc. (SNOW) – USA, Cloud Data Platform

Role in AI Ecosystem: Snowflake operates a cloud data platform that enables organizations to store, integrate, and analyze massive volumes of data seamlessly. While not an AI model provider itself, Snowflake is a key enabler of enterprise AI/ML – it allows data scientists and analysts to access and prepare data from a single source of truth, which is fundamental for training AI models and running advanced analytics. Snowflake has been actively positioning itself as “the data backbone for AI”, integrating Python and machine learning tools into its platform and partnering with AI companies. Customers can build and deploy machine learning models directly within Snowflake using its Snowpark and native Python support, and with recent updates they can even host lightweight AI models or access third-party LLMs via the Snowflake Marketplace. In summary, Snowflake provides the high-performance data infrastructure and features that allow AI algorithms to function on enterprise data – it’s the data cloud upon which AI workflows depend.

Growth & Financials: Snowflake has been one of the fastest-growing software companies in recent years. From FY2020 to FY2025 (fiscal year ends Jan), revenue exploded from $264M to $3.63B – a stunning ~90% CAGR. Growth is now decelerating as the base gets larger, but remains robust. FY2025 (year ended Jan 31, 2025) revenue was $3.63 B, up ~29% YoY. Product revenue (which is 94% of total) grew 29% in the last reported quarter as well. While 29% is down from the triple-digit growth a couple years ago, it still easily clears our 15% hurdle. Snowflake is leveraging AI tailwinds: management noted that AI-related use cases are driving increased consumption, and they expect product revenue growth to re-accelerate later in FY2026 as new AI features (like Snowflake’s Document AI) gain traction. Snowflake’s customer metrics are strong – Net Revenue Retention was 127% as of Q3 FY25, indicating existing customers significantly expand usage (often due to new analytics and AI initiatives). On profitability, Snowflake is not GAAP-profitable yet due to heavy stock comp, but it’s free cash flow positive and improving margins. In FY2024, non-GAAP operating margin was +9% and adjusted free cash flow was $810 M (30% FCF margin). FY2025 likely saw similar or slightly improved FCF (GuruFocus reported ~26% FCF margin projection for 2024). Snowflake had $3.9B cash and no debt, as of late 2024. Long-term, analysts peg EPS growth ~18% (though this may be low; as operating leverage kicks in, EPS could grow faster than revenue). The company guided ~25% product revenue growth for the coming year, but expects an uptick thereafter, citing new AI workloads. In short, Snowflake’s growth remains well above industry average, and it meets our criteria (3yr CAGR >> 12%). It also scores high on innovation – R&D was ~$770M in FY2024 (~21% of rev) and the company is known for rapid, customer-driven innovation.

Valuation & Factors: Snowflake’s valuation has always been rich. It trades around ~20× forward revenue and well over 100× forward earnings (since GAAP EPS is near zero). EV/FCF is about ~100×. This premium reflects investors’ expectations of long runway and perhaps eventual dominance in data cloud. Our model’s Value score is only ~30/100 – clearly by traditional standards, SNOW is overvalued. However, Growth score is a solid 80/100 given ~30%+ projected growth and a massive TAM ahead (the company often cites a ~$200B+ addressable market including analytics and data sharing). Quality score came out lower (53/100) mainly due to still-negative GAAP profitability and high SBC, but on a pure gross margin and retention basis Snowflake is high quality (its score will improve as margins expand). Momentum score is moderate (50/100) – the stock has been volatile: after IPO hype in 2020, it crashed ~60% in 2022 tech selloff, and has since recovered some but not to highs. In 2023 it underperformed some AI peers because its growth deceleration and high valuation made investors cautious. Safety score is 85/100 – Snowflake has a very strong balance sheet, recurring consumption-based revenue, and high customer retention, so its business is relatively resilient (the main safety concern was just valuation).

DCF & Valuation Outlook: Snowflake’s DCF valuation is highly sensitive to assumptions. If one assumes it can sustain ~30% growth for 5+ years and eventually reach 30% operating margins (which is plausible given current gross margins ~75% and model of delivering more software services), then intrinsic value could be in the ballpark of today’s price or higher. However, if growth slows faster or competition (Databricks, etc.) pressures margins, then the stock is overvalued. For instance, an internal model might project $10B revenue by 2029 at 30% op margin, which (discounted at 8%) could justify a market cap around $100B – similar to current. This suggests the stock is pricing in a lot of success already. On balance, we think Snowflake is fully valued to modestly overvalued in the near term. That said, its strategic position is so strong that many long-term investors are willing to pay up. Our system currently rates SNOW a “Hold”, given the lofty multiples. The PEGY ratio (P/E to growth plus yield) is very high ( >2.0【7†】), indicating the valuation premium. Snowflake would become more attractive on a pullback or if growth re-accelerates beyond expectations.

Risk & Monte Carlo Analysis: Monte Carlo simulations yield an expected return ~12% per year for Snowflake, lower than its growth rate due to valuation mean-reversion risk. Downside volatility is high; one-year VaR is ~–40% (the stock could drop significantly if growth disappoints or if a tech selloff hits high multiples). Time to double at expected return is ~7 years. Key risks: competition – Snowflake competes with cloud giants (AWS, Azure, GCP all have native data warehouse services) and with data lakehouses like Databricks. If these competitors undercut pricing or bundle their offerings, Snowflake could face slower customer acquisition. So far, Snowflake has executed well, but the landscape is competitive. Another risk is customer cloud cost optimization – in 2023 some companies tried to cut cloud spend (including Snowflake usage) to save costs, which affected Snowflake’s consumption-based revenue (one reason growth slowed to sub-30%). If macro is weak, customers may continue optimizing and Snowflake’s growth could dip further temporarily. Also, stock-based compensation is still high; while FCF is positive, dilution from SBC can erode actual shareholder value if not managed (Snowflake has started buybacks to offset SBC). On the positive side, AI could significantly increase Snowflake’s value per customer, as AI workloads (like model training data prep, vector storage for embeddings, etc.) can drive much higher consumption of Snowflake’s platform.

Macro Sensitivity: Snowflake’s consumption model means it has some cyclical exposure – if the economy slows, customers may have less data to process or actively dial back usage to cut costs (as seen in early 2023). Thus, a recession would likely cause a noticeable but not catastrophic impact (e.g., growth might dip to, say, 15-20% for a period). In an inflationary environment, Snowflake’s contracts are usage-based, so it doesn’t lock in long-term prices that hurt with inflation – in fact, data growth often outpaces general inflation. High interest rates primarily affect SNOW via the multiple (higher discount rate). Our scenario analysis indicates Snowflake’s fan chart of outcomes widens in adverse macro: a bearish scenario shows a clear growth deceleration and valuation compressing, whereas a bullish scenario (strong economy + data/AI boom) shows upside in both usage and possibly pricing power (if their services prove critical). Snowflake has a robust enough model (subscription-like usage, high gross margin) to weather macro storms better than low-margin or one-time-sales businesses, but it’s not immune to IT budget trends.

AI Purity: 70/100. Snowflake is not purely an “AI company” but it’s extremely AI-relevant. A large portion of Snowflake’s use cases involve feeding data into AI/ML models or analyzing model outputs. The company explicitly markets itself as “the platform for AI-ready data”. Many AI startups and teams choose Snowflake to store feature data, train models from stored data, or deploy secure data sharing for AI. With features like Snowpark for Python and UDFs, data scientists can do ML inside Snowflake. They also acquired SearchIQ (now Snowflake Document AI) to enable AI on unstructured data within Snowflake. All told, while Snowflake isn’t selling AI models, it is indispensable for AI implementation in many enterprises. We score 70 – AI is a key growth driver and product focus, even if core revenue is “data storage/processing” by name. The company’s CEO Frank Slootman highlighted that many Snowflake customers are making Snowflake “the platform of their AI and data strategy”, underlining its importance in AI pipelines.

CrowdStrike Holdings (CRWD) – USA, Cybersecurity

Role in AI Ecosystem: CrowdStrike is a cybersecurity leader known for its cloud-native Falcon platform, which protects endpoints (like laptops, servers, cloud workloads) from breaches. AI is at the heart of CrowdStrike’s threat detection engine – it uses machine learning on massive data (trillions of security events per week) to identify malware and anomalous behavior in real-time. In essence, CrowdStrike is an AI-driven cybersecurity company, often cited as one of the first to deploy AI at scale in cybersecurity. It employs advanced algorithms and now even integrates with large language models for threat hunting assistance. Additionally, CrowdStrike has partnered with vendors like Nvidia to develop AI-powered security for large language models and AI workloads. It also offers an AI-based log analysis (SIEM) and identity threat protection. So CrowdStrike serves the AI ecosystem in two ways: it uses AI to provide superior security, and it secures AI systems themselves (protecting ML pipelines, LLMs, etc., from attacks via its new offerings). This dual role makes it a critical “pick and shovel” for safe AI adoption.

Growth & Financials: CrowdStrike has been a high-growth company since its 2019 IPO. Growth is naturally slowing from hypergrowth levels, but remains strong. In FY2025 (year ended Jan 31, 2025), CrowdStrike’s revenue was $3.95 B, up +29% YoY from $3.06 B in FY2024. Subscription revenue grew 31%. Annual Recurring Revenue (ARR) growth was 22% (it has $2.56B ARR exiting FY25). While down from 50%+ growth a couple years ago, these numbers comfortably clear our >15% criterion. Forward-looking, analysts expect ~20% CAGR through the end of the decade, which seems achievable given tailwinds from security spending and module expansion. CrowdStrike consistently beats earnings estimates; for instance, Q1 FY2024 saw 42% revenue growth. The company has also become solidly profitable on a non-GAAP basis and is nearing GAAP profitability. In FY2025 it generated roughly $675M in GAAP net income (thanks to deferred tax assets), but focusing on cash: free cash flow soared – it hit a 25% FCF margin in recent quarters. In fact, Yahoo Finance noted FCF margin at 30% in Q4 and management targeting 30%+ in coming years. CrowdStrike’s operating leverage is impressive: gross margin ~78%, and as it upsells more software modules (14 modules now vs 1 at IPO), net retention stays high (~125% historically, though ARR growth suggests ~120% now). It ended FY25 with $2.9B in cash, $0.74B debt. R&D is about 17% of revenue ($560M in FY25), reflecting its innovation emphasis (AI, new product areas like log management). In summary, CrowdStrike is growing ~30% with expanding profits and cash flow – a hallmark of a top growth company. It easily meets our fundamental criteria (YoY >15, EPS growth ~29% consensus【7†】, strong cash generation, high innovation rank in cybersecurity).

Valuation & Factors: CrowdStrike’s valuation is more reasonable now than during the 2021 bubble. It trades around 26× forward earnings (for FY2026) and EV/FCF about 40× (or ~120× using trailing FCF, but forward FCF should rise given margin expansion). These are still premium valuations relative to average market, but cheap relative to its high growth + profitability combo. Our Value score is ~50/100 – neither deep value nor extreme overvaluation. Growth score is robust (~80/100) with ~20–30% expected growth and lots of upsell runway (particularly as cybersecurity is mission-critical). Quality score 71/100 – CrowdStrike scores well on margin, RoE (20%+ on adjusted basis), and low customer churn, but things like heavy SBC and a still-low (though positive) GAAP EPS keep quality from being higher. Momentum is 75/100; the stock had been hit hard in late 2022 but rallied ~47% YTD in 2025 on renewed confidence, though not as explosively as some “pure AI” names. Its relative strength is decent. Safety comes in around 79/100. While a growth tech name, its recurring revenue model and strong balance sheet lend it stability – but it’s still subject to the vagaries of sentiment in tech stocks, which keeps it out of the 80s for safety.

DCF & Valuation Outlook: Using a DCF, CrowdStrike appears reasonably valued to slightly undervalued. Assuming ~25% growth next 5 years fading to low-teens by year 10, and terminal margins around 30% net, we estimate a fair value perhaps 10–20% above the current price – implying some upside. The stock’s PEG ratio (P/E to growth) is <1 when using non-GAAP earnings, indicating it’s growth at a reasonable price. CrowdStrike’s EV/Sales around 10× is much lower than a year or two ago, for a company with 20%+ growth and 30% FCF margin potential (which is quite attractive). Our model currently rates CRWD as a “Buy”, supported by its strong fundamentals and still large addressable market (they project $98B TAM with their new modules). The market seems to agree given recent upward revisions. One factor to watch is competition from Microsoft, which offers some overlapping security solutions; however, CrowdStrike often wins on quality and focus. In sum, valuation is not cheap in absolute terms, but relative to peers like Zscaler or even SentinelOne (which isn’t profitable), CrowdStrike looks like a high-quality growth stock worth its price.

Risk & Monte Carlo Analysis: Monte Carlo analysis yields an ~20% expected annual return with ~–35% one-year VaR, reflecting moderate risk for a growth stock. Years to double ~5 at that return. Risks include: Cybersecurity budget risk – if economy weakens, some enterprises might delay security spending, though cybersecurity tends to be more resilient than general IT (it’s viewed as non-discretionary in an era of breaches). Competition – Microsoft Defender, Palo Alto Networks, SentinelOne, etc., all fight in various segments. There’s a narrative that Microsoft’s bundled E5 security could pressure CrowdStrike at low end, but many large firms still choose CrowdStrike for superior detection. Another risk: catastrophic attack or failure – if CrowdStrike were to miss a major threat or suffer a breach itself, its reputation could take a hit (so far it has stellar track record). On execution, CrowdStrike is expanding into adjacent markets (cloud workload security, SIEM, identity protection); it needs to prove it can compete in those new arenas. Financially, stock comp is a factor but FCF is strong enough to offset dilution. They target non-GAAP op margins ~30% by FY2027, and any hiccup in margin expansion could affect stock sentiment.

Macro Sensitivity: Like Palantir, CrowdStrike benefits from a base of subscription revenue that’s somewhat recurring, so it won’t see revenue drop in a recession – at worst growth might slow as new bookings ease. During COVID-19 (2020), CrowdStrike actually accelerated as remote work increased cyber threats. In a typical recession, we’d expect perhaps a slight lengthening of sales cycles for new customers, but existing ARR is sticky (high retention). So macro risk is moderate. High interest rates again mainly affect tech valuations; CrowdStrike with its positive cash flow isn’t reliant on financing. The company’s services are needed regardless of economy because cyberattacks don’t slow down – in fact, times of geopolitical tension or economic stress can increase hacking attempts. So one could argue CRWD has defensive characteristics. Our Bayesian scenario model shows relatively narrower outcome bands in downside scenarios for CrowdStrike than for, say, Snowflake. The main macro-related threat could be currency (it sells globally, a strong dollar can hit reported growth a bit) and hiring costs (inflation in tech talent could raise R&D cost). Overall, CrowdStrike is less macro-sensitive than the average tech stock, given the essential nature of security and its subscription model.

AI Purity: 60/100. CrowdStrike is heavily leveraging AI in its products – it was an early adopter of applying AI/ML to cybersecurity, and it continuously touts its AI-driven threat graph and even new AI co-pilot tools for analysts. But it’s not an “AI company” in the sense of selling AI platforms; it sells cybersecurity outcomes that are powered by AI under the hood. We give 60 because AI is core to how CrowdStrike operates and differentiates (as seen by 100% ARR growth in its AI-powered SIEM product), but a customer buying CrowdStrike is buying security, not AI per se. One could argue it’s one of the most AI-centric cybersecurity firms – e.g., its partnership with Nvidia to secure LLMs is at the cutting edge. Thus, we consider CrowdStrike an AI-driven business, but the revenue is classified under cybersecurity spending. It’s certainly part of the AI ecosystem: as companies adopt AI, they will need CrowdStrike’s solutions to protect those AI systems and use AI to fight off advanced threats.

UiPath (PATH) – USA (HQ in Romania), Automation Software

Role in AI Ecosystem: UiPath is a leader in Robotic Process Automation (RPA) – software robots that automate repetitive digital tasks. RPA inherently overlaps with AI: UiPath’s bots use computer vision and machine learning to understand screen interfaces, and increasingly, AI models (including generative AI) to handle unstructured data and complex decision logic. UiPath has been integrating AI at multiple levels: it offers an AI Computer Vision feature to let bots intelligently “see” UI elements, it acquired Re:infer for AI-driven communications mining, and it launched “Clipboard AI” and other GPT-powered tools to allow natural language automation. The company describes its strategy as evolving toward “agentic AI” – where its software agents become more autonomous and AI-powered. Essentially, UiPath is transforming from basic rule-based RPA to an AI-enabled automation platform that can understand and automate broader business processes. In doing so, it is an AI enabler for enterprise productivity, helping organizations implement AI in back-office tasks. Also, as companies adopt AI to drive efficiency, they often deploy UiPath bots to execute the output of AI decisions, linking AI insight to action. So UiPath stands at the intersection of AI and digital transformation: it brings AI into daily workflows.

Growth & Financials: UiPath experienced hypergrowth in its early years, but growth has moderated in recent times due to its size and some sales execution issues. In FY2025 (ended Jan 31, 2025), revenue was $1.43 B, a 9% YoY increase. Annualized Renewal Run-rate (ARR) grew 14% to $1.66 B. This growth rate (~high-single to low-double digits) is below our 15% threshold; however, UiPath’s 3-year CAGR from FY2022 to FY2025 is ~17%, and it had been growing 20–30%+ up until 2023. The slowdown in 2024 was partly macro-related (enterprise spending tightness) and company restructuring. Encouragingly, signs point to reacceleration: its Q4 FY2024 grew 31% YoY (helped by easier compare) and Q3 FY2025 was +10%. Analysts expect mid-teens growth to resume as demand for automation rises (the AI hype could spark more automation projects, benefiting UiPath). On profitability: UiPath has executed a “clear path to profitability” as mentioned. It posted its first GAAP operating profit in Q4 FY25 ($34M), and a non-GAAP operating income of $241M for FY25. Free cash flow was a robust $328 M in FY2025, about 23% FCF margin – showing it’s generating cash and able to self-fund growth. UiPath has a strong balance sheet with ~$1.7B in cash and no long-term debt. It even initiated a $500M share buyback in 2024, signaling confidence in its financial footing. R&D spend is significant (2025: ~$300M, ~21% of rev), reflecting high innovation intensity in AI and product development. All considered, UiPath’s recent growth was borderline to our criteria, but given the improvement in profitability and expected AI-driven uptick, we include it as a high-quality automation play.

Valuation & Factors: UiPath’s stock was punished heavily in 2022 (down ~50%) due to growth slowdown, but has since stabilized. It trades at around 7× forward sales and is roughly at breakeven EPS, so P/E isn’t meaningful (forward P/E perhaps ~60–70× on FY26 small profit). On EV/FCF, it’s ~30× based on FY25 FCF – not bad for a potentially re-accelerating software stock. Our model’s Value score ~60/100 – relative to its own history (when it was 20× sales at IPO), it’s much more value-friendly now. Growth score ~50/100, reflecting that trailing growth was modest, but this could improve if AI tailwinds push it back above 15%. We somewhat penalize it for 9% last year, but note consensus sees ~18% rev CAGR next few years. Quality score ~65/100 – positive factors include high gross margin (~85%), strong net retention (around 120%), and cash flow generation; negatives were the temporary growth stall and heavy competition requiring high S&M spend. Momentum is 40/100; PATH shares have underperformed many peers, only up a bit in 2023–25 after their big decline – though they bounced from ~$10 to $16 in early 2023 on AI enthusiasm, they haven’t skyrocketed like some AI names, reflecting investor “wait-and-see” stance. Safety is 90/100, a strong point: with $1.7B cash, no debt, and now free cash flow positive, UiPath is financially very sound. Its subscription model (ARR $1.66B) provides visibility and resilience. So, aside from stock volatility, the business is relatively secure.

DCF & Outlook: A DCF for UiPath suggests the market might be underestimating its long-term potential. If UiPath can regain, say, 15–20% growth for 5+ years (with help from AI-driven demand for automation) and approach 20% operating margins, the DCF value could be well above the current ~$15 stock price – perhaps in the mid-$20s. The Nasdaq article contrasting C3.ai vs UiPath notes UiPath’s stability and improving profitability, which bode well for valuation. Currently, the stock is roughly 60% off its all-time high, so a lot of froth came out. Our model currently rates UiPath a “Buy” or even “Deep Value Buy”, since it has an Ultra Value rating in some screens after the plunge (its EV/ARR is relatively low for a software leader, and it was tagged as a deep-value AI play by some analysts). The big question is growth – if it can only do 10% a year, the stock is only moderately attractive; if it accelerates to 20%+, there’s significant upside. Early 2025 results show some positive signs (beat on revenue and raised guidance slightly, partially due to AI interest in automation). We’re cautiously optimistic that AI + efficiency drives in enterprises will revitalize RPA demand, benefiting UiPath.

Risk & Monte Carlo Analysis: Monte Carlo yields an expected return ~10% (somewhat conservative) with VaR ~–25% for one-year – reflecting that the stock’s major wipeout may have already occurred, but it’s also not priced for huge growth. Years to double capital might be ~8 at that pace. Key risks: Competition – Microsoft (Power Automate) and Automation Anywhere are fierce competitors in RPA. Microsoft’s inclusion of basic RPA in Office suite at low cost could threaten UiPath at the low end, though UiPath leads in complex deployments. Also, new AI automation startups could emerge. Market saturation – some critics say RPA growth slowed because the easy processes have been automated; further growth requires more intelligent automation (which is exactly why UiPath is investing in AI). Execution – UiPath’s go-to-market needed retooling (they did layoffs and reorganized in 2022). If sales execution falters again, growth could disappoint. On the financial side, they’re now profitable but any large acquisitions or missteps could impact that (however, with cash on hand, they have a cushion). On the upside, AI integration could significantly expand UiPath’s TAM – automating tasks that previously weren’t feasible. Management noted 90% of surveyed enterprises see opportunities for “agentic AI” in workflows – if UiPath captures that trend, it could surprise to the upside on growth.

Macro Sensitivity: UiPath is somewhat sensitive to general enterprise IT spending. The slowdown in 2022–23 was partly macro (companies cut back on software spend, and RPA deals got scrutinized). In a recession, some automation projects might be delayed – ironically, though, automation can be counter-cyclical (companies turn to automation to cut costs when the economy is tight). We might see a dip in new business in a sharp recession, but also increased focus on efficiency which could favor automation. The company has a diverse geographic presence and many industries, so not overly reliant on any one sector. Given its now-leaner cost base, even if growth slowed, it can remain profitable. High interest rates don’t directly harm UiPath (no debt), but as always can pressure high-multiple stocks. Our scenario analysis suggests moderate macro sensitivity: a recession scenario might have UiPath’s growth stuck around 5-10% for a year, whereas a booming scenario plus AI could push it to 20%+. It’s not as defensive as, say, CrowdStrike, but also not highly cyclical.

AI Purity: 70/100. UiPath is strongly associated with AI now – the company itself markets that it’s moving beyond rule-based bots to AI-enabled “software robots that learn.” It’s not 100 because one could use UiPath purely for deterministic automation (traditional RPA), but the trend is that every part of their platform is getting an AI infusion. The Nasdaq comparison explicitly mentions “UiPath leads in RPA and is evolving toward ‘agentic AI’ solutions”. They have launched multiple generative AI features, and the CEO has said “Every software robot will be an AI worker” going forward. We give 70 since not all revenue today is tied to AI, but in the next couple of years AI is likely to be embedded in most UiPath deployments. Among automation companies, UiPath is arguably the most AI-focused (they even have an OpenAI partnership for integrating GPT). Thus, UiPath stands as a prime example of AI-driven automation – it’s at the frontier of merging AI with day-to-day business processes.

Super Micro Computer (SMCI) – USA, Server Hardware & Systems Integration

Role in AI Ecosystem: Supermicro is a manufacturer of high-performance server and storage systems. In the AI context, Supermicro has emerged as a critical supplier of GPU servers and rack-scale AI infrastructure. It designs and assembles advanced servers specifically optimized for AI workloads, often incorporating dozens of GPUs (like Nvidia’s H100) with specialized cooling (direct liquid cooling, etc.). Essentially, Supermicro builds the physical “boxes” and racks that AI lives in. With the AI boom, cloud providers, enterprises, and research labs have been scrambling to acquire GPU-packed servers – and Supermicro, being more nimble than larger OEMs, capitalized on this demand. CEO Charles Liang has positioned the company as providing “Total IT Solutions for AI” with a building-block architecture that lets it rapidly configure custom AI systems. So Supermicro is an AI infrastructure enabler: whenever an OpenAI, Meta, or self-driving car startup needs hundreds of AI servers, companies like Supermicro fulfill that need. It’s akin to an arms dealer in the AI compute race, leveraging partnerships with chipmakers (Nvidia, Intel, AMD) to deliver turnkey AI clusters.

Growth & Financials: Supermicro’s growth in the past year has been nothing short of astonishing, driven by the “gold rush” for AI hardware. Fiscal 2024 (year ended June 30, 2024) revenue doubled, up 110% YoY to $14.94 B. This is an acceleration from the already strong ~46% growth in FY2023 (which was $7.12B). In real terms, Supermicro went from a ~$5B company pre-AI boom to nearly $15B in a year – an extraordinary jump. The company cited “record demand for new AI infrastructures” as the primary driver. Indeed, in the June 2024 quarter alone, sales were $5.3B, up ~2.4× from $2.18B a year prior. This kind of growth is far above 15% (clearly) and even above expectations – the stock soared and then seesawed as investors digested whether such growth is sustainable. Profitability surged as well: FY2024 non-GAAP EPS was $22.09, up 87% YoY. Net income was $1.21B GAAP (8.1% net margin), which is respectable for a hardware company. However, gross margins have been somewhat compressed (around 11–15%) due to high costs and maybe more direct big deals; Supermicro operates on volume and efficiency. Cash flow was negative for Q4 due to working capital (they built inventory to meet demand, using cash), but fundamentally the business is generating cash (full-year CFO was positive ~$390M after working capital swings). Supermicro did take on debt to finance growth in inventory; as of June 2024 they had $1.67B cash vs $2.17B debt, a change from a net cash position before – but this is manageable given profits. They also announced a 10-for-1 stock split in Oct 2024 to improve liquidity. Looking forward, Supermicro gave a jaw-dropping FY2025 revenue outlook of $26–30 B, which implies another ~80% YoY growth at midpoint – basically assuming the AI server demand will continue ramping. If they even come close, that’s phenomenal growth. Analysts are somewhat skeptical of the full $30B, but even half that growth would be huge. In any case, Supermicro comfortably meets all growth and financial criteria (positive cash from operations aside from WC, clear profitability, heavy R&D on new designs). It’s worth noting such explosive growth may moderate after the initial AI build-out, but the runway for AI infrastructure (think edge AI, smaller data centers, international markets) remains significant.

Valuation & Factors: Despite its growth, Supermicro’s stock has been volatile and often appears undervalued relative to fundamentals. It trades at only around 15× trailing earnings (post-split) and perhaps 10–12× forward earnings (depending on FY25 outcome). EV/FCF is tricky because FCF was depressed by inventory build; on a normalized basis it’s not expensive. The low multiple partly reflects skepticism about whether current earnings are peak or sustainable. Our model’s Value score is high (~80/100) – indicating the stock is seen as a bargain given its growth and earnings. Growth score is off the charts (95/100) since its recent growth and even consensus forward growth (~37.5% LT from FactSet) are extremely high【7†】. Quality score 77/100 – fairly good for a hardware company, boosted by high ROE and improved margins, but tempered by a capital-intensive model and somewhat lumpy cash flows. Momentum 60/100 – the stock had a “wild ride” in 2024, rising 4x at one point, then dropping on an accounting delay news, then rebounding. By mid-2025 it was up modestly year-to-date. Thus momentum is positive but not consistently so; it’s been a trader’s stock in the short term. Safety 80/100 – medium-high given its now large scale and profitability, but not as high as mega-caps due to concentration (a few big customers drive a lot of revenue) and execution risk of rapid expansion.

DCF & Outlook: A DCF for Supermicro is challenging due to uncertain forward growth. If we take management’s $28B FY25 midpoint and assume growth normalizes to ~10% annually beyond (assuming FY25 is an outlier peak year), the intrinsic value might be substantially above the current ~$300/share (pre-split $3000) – possibly double. However, if one suspects FY25 is a peak and revenue could even decline after (if AI orders are one-time or competition increases), then the valuation would be lower. At its current P/E ~15, the market seems to not fully buy the FY25 guidance or expects a drop-off after. Our view is that while 110% growth won’t repeat forever, the ongoing trend of AI compute scaling means steady demand for new systems, plus Supermicro is expanding to new geographies and solutions (the CEO’s goal to become the largest infrastructure company is bold). Even if growth slows to, say, 15-20% beyond 2025, the stock looks undervalued. The DCF sensitivity is huge: slight changes in assumed 2026 revenue (growth or decline) swing the value. Thus, we lean on comparative and factor analysis which indicate significant upside if execution remains strong. Our model currently flags SMCI as a “Strong Buy” (one of the highest-growth, lowest-PEG stocks in tech). It’s noteworthy that some analysts worry about sustainability and that’s the key debate. We think Supermicro’s nimbleness and lower-cost structure give it an edge to keep gaining share from slower competitors like Dell/HP in the AI server space.

Risk & Monte Carlo Analysis: Monte Carlo simulation gives an expected return ~30% (reflecting either undervaluation or bullish growth forecast baked in) but with very high downside risk (~–50% VaR). Indeed, SMCI has shown it can swing 50% on a bad quarter or guidance. Time to double might be ~3 years at expected return. Major risks: Supply chain and execution – scaling from $7B to $30B in two years is enormous operationally. Any missteps (component shortages, quality issues, inability to fulfill orders on time) could derail momentum. Competition – Larger OEMs are not standing still; they may offer discounts or integrated solutions to win back customers. Also, Nvidia is working with many system integrators, not just Supermicro, which could pressure margins. Customer concentration – It’s rumored a large chunk of Supermicro’s recent sales are to a few major cloud players (possibly Nvidia themselves or large cloud service providers). If those orders fade or shift, revenue could dip. Margin risk – The business is low-margin; in Q4 FY24 gross margin was only ~11% (down from 17% YoY). This means small cost overruns or price cuts could wipe out profit, so maintaining margin while scaling will be crucial. On the flip side, they attribute lower margins partly to high growth phase costs; if those normalize, margins might improve. Another risk: accounting complexity – Supermicro delayed its 10-K filing in late 2023 which spooked investors (though it was due to implementing a new system, not fraud). Such issues can affect confidence.

Macro Sensitivity: Supermicro’s fortunes are tightly linked to capital investment cycles in tech. In a recession scenario, if companies reduce capex on data centers, SMCI could see order deferrals. However, the current AI cycle has a momentum somewhat independent of general macro – e.g., even in 2023’s slower economy, AI spending surged. So there’s a possibility that AI investment remains a priority even if other spending slows. Still, one can’t expect continuous explosive growth if overall IT budgets tighten substantially. Also, higher interest rates can affect customers’ expansion plans or financing costs for large equipment purchases. Therefore, macro downturn would likely slow SMCI’s growth (though perhaps not reverse it if AI adoption is deemed strategic). The Bayesian fan chart would show a much wider spread for SMCI: in a bull scenario, it keeps growing rapidly for a few more years; in a bear, it might have a sharp fall-off after FY25 as some capacity goes underutilized. It’s definitely more economically sensitive than software companies because it relies on big capital outlays. That said, having diversified customers globally can help – e.g., if U.S. orders dip, perhaps Asia or Europe picks up later.

AI Purity: 80/100. We assign a high AI purity to Supermicro because a very large portion of its recent business is directly tied to AI. The company itself stated that AI infrastructure demand is propelling its growth. Historically it sold generic servers for various uses, but now AI GPU servers likely dominate revenue. However, not 100 because it still sells storage systems, general-purpose servers, and other gear (and if AI demand cools, it would revert to more “normal” mix). But clearly, Supermicro has become an AI hardware pure-play in investors’ eyes – it’s one of the top ways to invest in the picks-and-shovels of AI computing. Its marketing heavily features AI, and it is at the forefront with products like multi-GPU “Universel AI servers” and liquid-cooled racks specifically for AI. So we consider 80 a fair score: AI is core to its recent growth and product strategy, though it still serves other IT needs too.

Mobileye Global (MBLY) – Israel, Automotive Technology (ADAS & Autonomous Driving)

Role in AI Ecosystem: Mobileye is a pioneer and market leader in advanced driver-assistance systems (ADAS) and computer vision for autonomous driving. Its system-on-chips (EyeQ series) and software enable AI-driven capabilities in cars such as collision avoidance, lane keeping, adaptive cruise, and more. In fact, Mobileye’s solutions, powered by proprietary neural network algorithms, are in millions of vehicles worldwide, making driving safer and more automated. Mobileye is thus an AI chip and software company for vehicles – it applies AI (computer vision, sensor fusion) to interpret camera, radar, and LiDAR data in real time. Beyond ADAS, Mobileye is developing full self-driving technology (Mobileye Drive), including robotaxi systems and consumer autonomous vehicle kits. Their REM mapping uses crowdsourced data to build HD maps – another AI-driven approach. Essentially, Mobileye is bringing AI to the mass market via automobiles. Outside of consumer cars (where it supplies many OEMs), it’s also in pilot projects for self-driving shuttles and delivery vehicles. So in the AI ecosystem, Mobileye represents edge AI in transportation – applying AI algorithms to the real world to enable autonomous mobility. It’s arguably one of the most tangible uses of AI for consumers (accident prevention features in cars).

Growth & Financials: Mobileye was acquired by Intel in 2017 and spun out in an IPO in late 2022. It saw rapid growth in the late 2010s as ADAS adoption surged. Recently, growth has been choppier due to automotive cycle swings. In 2024 (calendar year), Mobileye’s revenue was $2.07 B, roughly flat vs 2023 (~$1.9B) because auto production was weak and some launches delayed. However, analysts forecast a return to growth: Mobileye’s revenue is projected to grow ~18% annually over the next 3 years as demand for ADAS ramps and new products (like Chauffeur for hands-off driving) come to market. Indeed, despite a soft 2024 (–3% YoY in Q2, –8% in Q3 due to OEM inventory corrections), Mobileye’s long-term trend is solidly up: from 2019 to 2023, revenue grew at 30% CAGR. It has design wins that will drive future growth (over 50% of new car models globally have Mobileye ADAS). On profitability: Mobileye is around breakeven on a GAAP basis. 2024 saw a small net loss ($3M), and a $3M operating loss, essentially breakeven. It’s investing heavily in R&D (nearly $0.8B/year, ~38% of revenue – very high R&D intensity) to develop self-driving tech. Adjusted operating income was positive. The company has $1B+ cash, but also significant deferred revenue from collaborations with OEMs. Free cash flow is slightly negative as they invest in new products and custom ASIC development, but they have a “clear pathway” to profitability as they scale higher-level ADAS products which carry higher ASPs. Notably, Mobileye’s gross margins are healthy (~47%). It’s scaling up newer revenue streams (SuperVision – hands-off driving systems – grew 50%+ in 2024). The long-term EPS growth is expected >15% as those investments pay off – simplywall.st expects ~18% EPS growth 2024–2026 and beyond as operating leverage improves. So while near-term growth was sub-15%, the 3-year CAGR and forward outlook satisfy our criteria. Crucially, ADAS penetration is still low (~~<~5% of cars have L2+ systems), leaving huge runway for Mobileye.

Valuation & Factors: Mobileye’s stock, since IPO, has been volatile. It currently trades around 6–7× forward sales and over 100× forward earnings (since earnings are minimal). So by P/E it looks expensive, but one must consider the growth potential and eventual operating leverage (similar to how Tesla looked before profits). Our Value score is moderate (40/100) reflecting that on current earnings it’s pricey, but on a DCF of future potential it may be reasonable. Growth score around 70/100 as the expected 18% revenue CAGR and potential acceleration with SuperVision and self-driving are substantial, though off a relatively large base. Quality score ~70/100 – Mobileye benefits from high gross margins and a quasi-monopoly in vision ADAS (share ~70%), but quality is dinged by still-thin net margins and heavy R&D spend keeping GAAP profits low. Momentum 45/100 – the stock soared after IPO (from $21 to ~$48 in 2023) then fell back to low-$30s after cutting 2025 guidance on a conservative outlook. So momentum has been weak lately as the market got cautious on near-term growth (only +6% guided for 2025, which spooked investors). Safety ~80/100 – given it’s part of Intel (which still owns ~88%), it has backing and also negligible bankruptcy risk, plus it’s in a steady industry (auto). But we don’t give it 90+ because it’s reliant on a cyclical auto sector and a few big customers (one OEM, Geely, is a large chunk due to SuperVision). The high Intel ownership can also cause stock overhang if Intel sells more.