The Hidden Backbone of AI: Memory, Networks, and Cloud Infrastructure

Everyone’s chasing Nvidia’s stock amid the AI frenzy – but behind every flashy AI model lies a lesser-known web of memory chips, networking gear, and cloud infrastructure that makes the magic possible. In fact, the current AI boom is lifting “legacy” tech sectors like memory, networking, and data centers as enterprises race to upgrade their infrastructure. The acceleration of AI deployment is fueling surging demand for high-bandwidth memory (HBM) chips, high-speed data center switches, and massive cloud capacity. As Sundar Pichai of Alphabet put it, “the risks of under investing [in AI] are dramatically higher than the risks of over investing” – meaning the big players will keep pouring billions into these foundational technologies. This creates an opportunity for thematic investors to tap into the AI boom via three under-the-radar stocks that are critical to AI’s growth, yet still appear undervalued relative to their potential. Below, we highlight our top pick in memory, networking, and cloud infrastructure – the often overlooked “picks and shovels” powering the next AI boom.

Micron Technology – The AI Memory Powerhouse

Micron Technology (MU) is one of the world’s leading memory chip makers, and it’s poised to be a big winner from AI’s insatiable demand for advanced memory. AI training and inference rely on huge amounts of fast memory (like HBM and DRAM), creating a surging market for suppliers. Micron’s latest earnings make this clear: its data center revenue more than doubled year-over-year last quarter to record levels, “driven by healthy demand for Micron’s high-bandwidth memory (HBM) chips” that are integrated into AI accelerators from Nvidia and AMD. In other words, Micron is already shipping HBM in high volume to at least four major customers for cutting-edge AI processors. And this is just the beginning – management notes that HBM is only ~6–7% of Micron’s DRAM bits today but is growing fast, with the overall HBM market projected to explode from $4 billion in 2023 to $130 billion by 2030. Micron is hustling to capture this growth: it’s ramping its next-gen HBM3E and sampling even faster HBM4 for 2026.

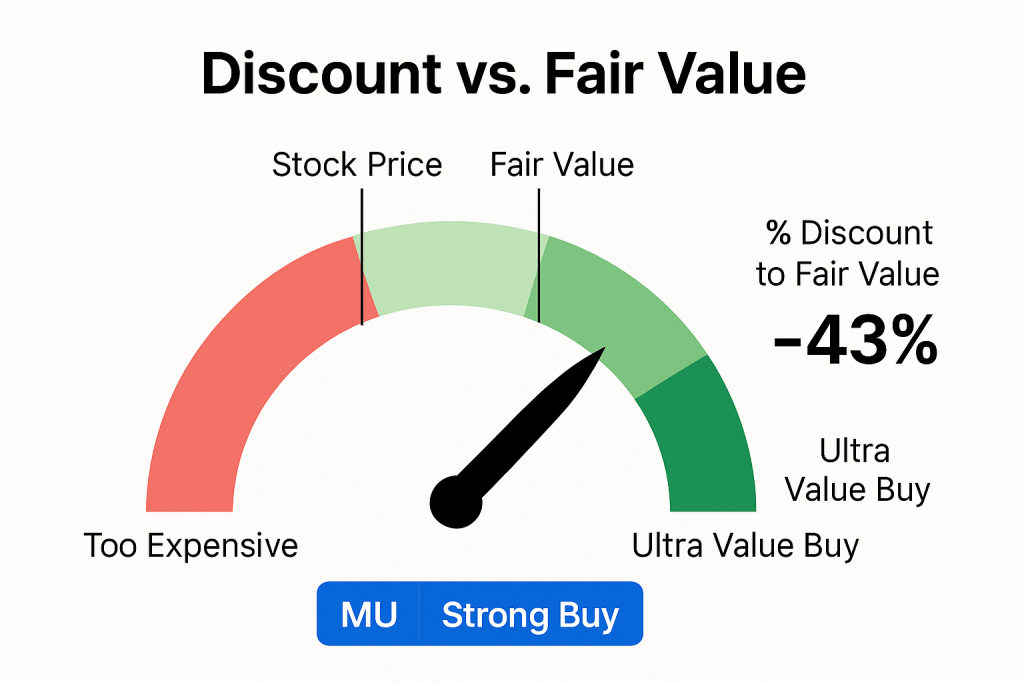

Importantly, Micron’s stock remains undervalued relative to its AI-fueled growth. The company swung back to strong profitability – fiscal Q3 2025 earnings tripled to $1.91/share as memory prices rebounded on AI demand. Yet Micron trades around 11× forward earnings, a steep discount to both the market and AI peers. UBS analysts recently raised their price target to $155 (from $120) on Micron, noting it delivered HBM sales and margins “a little better” than expected and has a robust balance sheet. With consensus expecting another +54% EPS jump next fiscal year, Micron’s forward P/E ~11 looks exceptionally low. For context, Nvidia trades near 38× forward earnings. This valuation gap gives Micron significant upside if the market rerates it as an AI beneficiary. In short, Micron is the memory powerhouse quietly fueling AI’s growth – and investors can still scoop it up at a reasonable price before the rest of the market catches on.

Arista Networks – Wiring the AI Supercomputers

Arista Networks (ANET) provides the high-performance networking gear that links together servers and AI accelerators in cloud data centers. Whenever you hear about an AI supercluster or massive model training run, behind the scenes there are racks of GPUs all connected by ultra-fast switches – and Arista is a top supplier of those network switches. The company is already thriving on the AI boom: Arista’s latest results smashed expectations, and it raised guidance on “higher demand for its cloud networking gear from a boom in AI applications and chips”. Management noted that the surge in AI workloads underscores the need for advanced networking infrastructure to support them. In practice, that means hyperscalers are spending heavily on Arista’s 100G/400G Ethernet switches to build out AI clusters. Analysts report that Arista serves 7 of the top 10 cloud players – including Microsoft Azure, Meta, and Amazon AWS – and those giants’ increased AI-driven capex bodes well for Arista. For example, Microsoft and Meta (Arista’s two largest customers) have dramatically ramped spending to expand AI data centers, which “benefit Arista as a key supplier”. Even legacy network vendors are feeling the AI tailwind – peer Juniper recently topped estimates thanks to cloud orders – but Arista, with its focus on cloud titans and cutting-edge speeds, is the purest play on this trend.

Despite robust growth, Arista’s stock hasn’t run up nearly as much as the hyped AI chip names, making it relatively attractive. The company has grown revenues at ~25% annually over the past decade, with strong profitability (gross margins ~60% and hefty free cash flow). Yet Arista’s forward valuation is around 32× earnings, only a modest premium to the broader tech sector. Analysts expect ~17% EPS growth next year (likely conservative given AI momentum) – a PEG ratio roughly around 2, reasonable for a dominant franchise with 50%+ ROIC. By comparison, Nvidia at ~38× forward P/E for ~50% growth is far more “priced for perfection”. Arista’s more measured valuation reflects that it’s somewhat under the radar; many investors still think of it as a niche network vendor. In reality, Arista has become the go-to choice for cloud providers building AI infrastructure – even Meta chose Arista’s switches for its latest AI clusters. With a fortress balance sheet (over $3 billion net cash) and continued innovation in 400G/800G switching, Arista is well positioned to ride the AI wave for years. This underappreciated “AI plumbing” stock offers a compelling mix of secular growth and quality, without the extreme valuation risk of the marquee AI names.

Digital Realty Trust – Real Estate for the AI Era

Massive cloud data centers, like the one above, form the physical backbone of AI – and Digital Realty provides much of that space and power. Digital Realty Trust (DLR) is a leading data center REIT that leases out the server warehouses and interconnection hubs underpinning the cloud. Simply put, every time an AI model is trained or deployed, it’s running in a data center – and companies like Digital Realty make sure there is enough server space, electricity, and cooling to handle those demanding workloads. After a sluggish 2022–2023 (amid rising interest rates and overcapacity fears), data center demand is roaring back thanks to AI. Hyperscale cloud giants and even new AI startups are racing to secure rack space for AI supercomputers, driving a record leasing surge in the industry. Digital Realty’s management noted that investments by hyperscale customers in AI models are “driving demand for data services” and boosting new bookings. In fact, Digital Realty signed an all-time high ~$1 billion in bookings last year amid the AI and digital transformation push. In Q1 2025, the company saw “robust demand across key product segments” with leasing pipelines near record levels. This strength led DLR to raise its earnings outlook, as it now expects 2025 core FFO of $7.05–7.15/share (slightly up from prior guidance). In short, after a rough patch, Digital Realty is bouncing back with the help of AI – CEO Andy Power said Q1 saw an acceleration in FFO growth thanks to strong AI-driven leasing.

Yet despite these improving fundamentals, DLR’s stock is still well below its peak and appears undervalued. The shares trade around 15–16× forward FFO (funds from operations), which is a discount to the stock’s historical multiples (20×+ during the cloud boom) and to peer Equinix. At ~$110–120 per share, DLR yields roughly 2.76 in dividends, offering investors a solid income stream while they wait for further upside. That payout is well-covered (~70% FFO payout ratio) and has grown consistently – a sign of management’s confidence in cash flow growth. It’s worth noting that higher interest rates have been a headwind (as with all REITs), but Digital Realty has managed to recycle capital and partner on projects to fund growth. And importantly, the secular demand from AI and cloud is offsetting some rate pressure – occupancy and pricing power are improving as tenants urgently expand capacity. As one example of the priority: Alphabet (Google) said it remains committed to spending $75 billion this year on data centers, noting “the risk of under-investing is dramatically greater than the risk of over-investing” in AI. This suggests the major customers will continue to invest through economic cycles to avoid falling behind in AI – a very favorable backdrop for landlords like DLR. Overall, Digital Realty offers a unique picks-and-shovels play on AI with a combination of hard assets, improving growth (thanks to AI demand), and a value price tag.

Undervalued vs. the AI Hype: Peer Comparison Mini-Table

To put things in perspective, here’s a quick snapshot of our three picks versus Nvidia on key metrics:

| Company | Forward Valuation | Est. Next-Year Growth | Dividend Yield |

|---|---|---|---|

| Nvidia (for ref.) | ~38× P/E | +50% EPS (est.) | 0% |

| Micron (MU) | ~11× P/E | +54% EPS | ~0.7% |

| Arista Networks | ~32× P/E | +17% EPS | 0% |

| Digital Realty (DLR) | ~16× P/FFO | +5% FFO (est.) | ~2.76 |

Nvidia’s stock valuation clearly reflects its rockstar status – around 38 times forward earnings. Our picks, however, trade at much lower multiples despite strong growth outlooks. Micron at ~11× and Arista at ~32× forward earnings each have PEG ratios comfortably below 1.5, indicating their growth is not fully priced in. And Digital Realty’s ~16× cash flow multiple (FFO is REITs’ cash earnings) coupled with a ~4% yield suggests a market expectation of slow growth – just as AI is reaccelerating its business. This disconnect between perception and reality is exactly what we seek in “overlooked” opportunities. In essence, investors can pay a fraction of the valuation for these critical AI enablers compared to the headline-grabbing AI chip makers. That sets the stage for potential outsized returns if/when the market rerates these names upward.

Durable Growth and Upside Across Scenarios

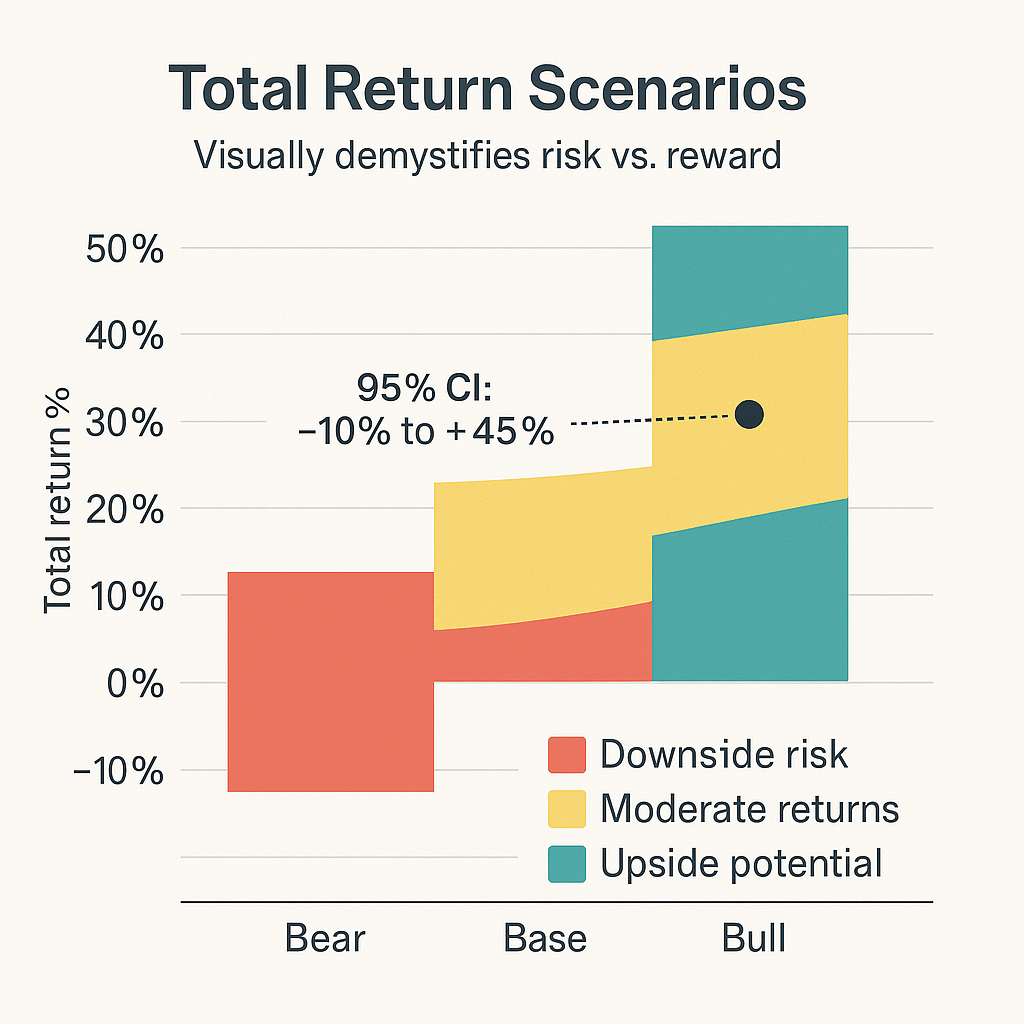

Illustrative fan chart of Arista’s annual revenue under bearish (15% CAGR), base (20%), and bullish (25%) growth scenarios. Even in a slower macro case, AI demand could sustain robust double-digit growth (gray band), underscoring the secular tailwind.

One reason we’re confident in the long-term potential of these picks is that their growth drivers are secular and resilient across macroeconomic swings. The development of AI is now a strategic arms race – cloud giants, chipmakers, and enterprises must keep investing in AI capabilities, recession or not, to stay competitive. This means companies supplying the “AI infrastructure” enjoy a degree of insulation from typical cyclical downturns. For instance, in the networking segment, even a bearish scenario might see Arista growing ~15% annually (if enterprise IT spending slowed); a base case around 20% is plausible given current backlogs, with upside to 25%+ if AI adoption accelerates. The fan chart above illustrates that in all scenarios Arista’s revenue trajectory stays strongly upward. Similarly, memory makers like Micron are benefiting from a structural shift – AI memory content per server is exploding – which could offset the usual PC/phone demand cycles. And Digital Realty’s leasing pipeline is so robust (with multi-year hyperscale commitments) that its cash flows should rise steadily through various economic conditions (perhaps mid-single-digit growth in a soft economy, vs. high-single-digit if trends stay hot).

Crucially, these stocks also offer a margin of safety on valuation, as demonstrated by our DCF analysis. Our DCF tornado sensitivity for Digital Realty, for example, shows that even under more conservative assumptions – higher discount rates or lower growth – the estimated fair value (bars) remains above the current market price (center line). In other words, you don’t need heroic assumptions to justify upside in these names. Digital Realty’s base-case DCF (assuming ~8% discount rate and 3% terminal growth) came out around $180/share – well above the recent ~$120 stock price – and even with a harsher scenario (9% discount or slower growth), the valuation stayed near ~$150 (still a ~25% premium to market) . Micron’s scenario is similar: with EPS expected to hit ~$12 in 2026, even a moderate 15× P/E would put the stock over $180 (versus ~$70–80 today). These analyses suggest that the downside risk is limited (supported by real cash flows and assets), while the upside could be significant if the companies execute on the AI opportunity.

In summary, everyone may be chasing Nvidia, but the smarter play could be these “picks and shovels” supporting the AI gold rush. Memory, networking, and cloud infrastructure may not grab headlines, but they are mission-critical to enabling every AI breakthrough – and our three picks are leaders in each category. With secular growth tailwinds at their backs and valuations that still leave room for expansion, Micron, Arista Networks, and Digital Realty Trust offer a compelling way to invest in the next leg of the AI boom without paying a fortune. The thematic case here is underpinned by tangible evidence of surging demand – from Micron’s HBM chips flying off the shelves, to Arista’s order book swelling with AI network deals, to Digital Realty’s data halls filling up with AI gear. By combining under-the-radar discovery with fundamental upside, this trio gives investors exposure to AI’s durable growth path in a potentially more defensive, value-savvy manner. In the end, the AI revolution will enrich not only the obvious chip champions, but also the infrastructure providers that quietly keep the whole ecosystem running – and that’s exactly where these three companies excel.

Leave a comment