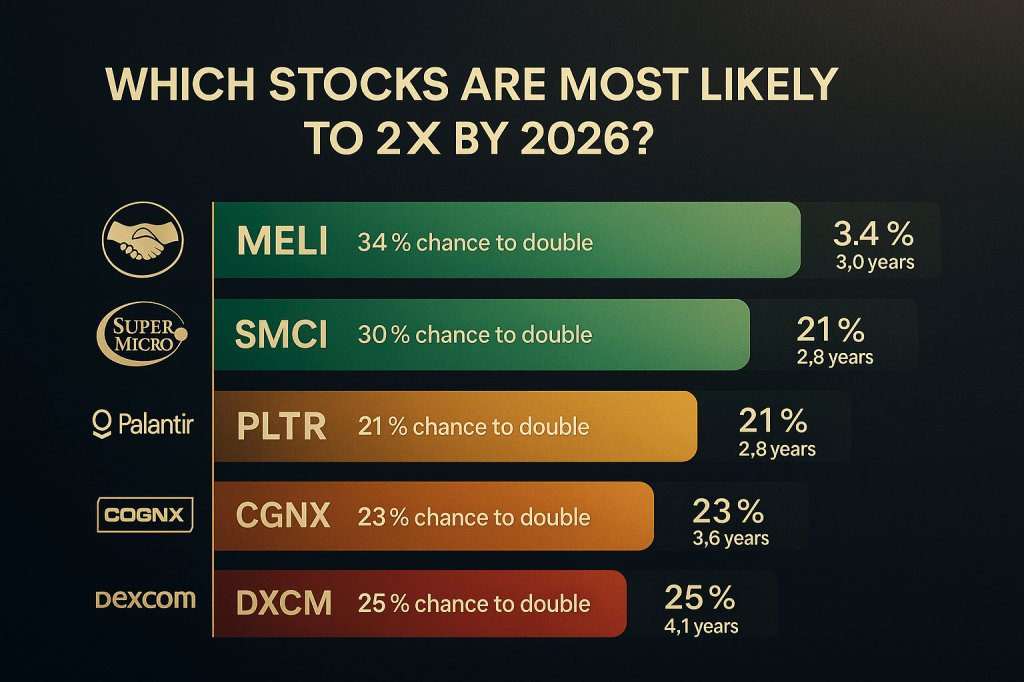

What if you could statistically model your way into finding the next stock that could 2× in 18–24 months? We did exactly that. Using the Vulcan-mk5 engine – a deep-learning, Monte Carlo-driven stock analysis model – we ran 10,000 simulation trials on over 500 global stocks to estimate their odds of doubling in value. The result: five “double bagger” candidates with upside odds too compelling to ignore. These stocks aren’t just hype; each has solid growth drivers or fundamental quality, but also carries some risk. Below we break down the five names most likely to deliver +100% returns by 2026, complete with simulation probabilities, “years to double” metrics, and the catalysts that could make it happen.

1. Palantir Technologies (PLTR) – AI Data Analytics Powerhouse

Monte Carlo simulation output for Palantir shows the distribution of 2-year price outcomes; the red dashed line marks the threshold for doubling. Palantir has emerged as a premier pure-play AI software company, and its stock’s meteoric rise reflects that narrative. The company turned profitable in 2023 and has strung together five consecutive GAAP-profitable quarters, making it eligible for S&P 500 inclusion – a potential catalyst that management believes could “spark” a further doubling of the stock. Palantir’s government and commercial revenues are both surging (U.S. commercial sales are guided to ~40% YoY growth in 2024), indicating real demand behind the AI hype. Our simulations underscore the high risk-reward in Palantir’s outlook: in ~21% of 10,000 trials, PLTR’s price at least doubled within two years (median scenario fell short due to volatility).

In fact, the expected time to 2× is ~2.8 years – the fastest of our top picks. Palantir’s extremely wide outcome spread (note the hefty left-tail in the chart) reflects its elevated volatility, but also the outsized upside if things go right. With continued AI traction and possible index inclusion on the horizon, Palantir remains a high-conviction “double or nothing” bet for 2025–2026.

2. MercadoLibre (MELI) – E-Commerce & Fintech Leader of LatAm

Simulation distribution for MercadoLibre’s 2-year return. The peak of the curve is below 2×, but the right tail (beyond the red line) is substantial, reflecting MELI’s ~45% chance to double by 2026. MercadoLibre is often called the “Amazon + PayPal of Latin America,” and its growth continues to justify that reputation. The company delivered 37.7% revenue growth over the last twelve months, with especially strong performance in its fintech arm (Mercado Pago) and e-commerce segments in Brazil and Argentina. Impressively, MELI maintains rich profitability (gross margins ~52%) and a solid balance sheet (more cash than debt) even as it aggressively expands. Analysts have taken note, with multiple firms raising price targets (UBS now sees $3,000/share within 12 months) – yet even that is only ~20% above recent prices, indicating significant further upside if current growth trends persist. According to our Monte Carlo analysis, MercadoLibre actually boasts the highest probability of doubling among the 500+ stocks screened: roughly 34% chance to 2× by late 2026. Its expected double time is ~3.0 years, thanks to an exceptional long-term growth forecast (~44% annually) and moderate volatility. In plain terms, MELI’s mix of consistent high growth and proven profitability makes it one of the most compelling big-cap “growth at a reasonable price” opportunities. If MercadoLibre continues capitalizing on favorable macro conditions (like Argentina’s e-commerce boom) and fintech adoption, it could realistically fulfill the simulations and double investors’ money within the next two years.

3. Super Micro Computer (SMCI) – Undervalued Picks-and-Shovels AI Play

Simulation outcomes for Super Micro Computer (SMCI) over 2 years. The distribution is skewed right, with a sizable tail above the double line, reflecting ~30% odds of a 2× gain. Supermicro is a lesser-known name riding one of tech’s biggest waves: AI hardware infrastructure. This server and storage maker saw demand explode as companies raced to deploy AI models – at one point in 2024, sales were growing over 50% year-on-year. For the fiscal year 2025, Supermicro expects revenue around $22 billion, and astonishingly projects revenue could reach $40 billion in FY2026 if AI investment stays hot. Such growth, if achieved, would be transformative. Yet due to past hiccups (accounting/audit issues that shook investors), SMCI’s stock got crushed in 2024 and trades ~65% below its peak, at just ~14 times earnings. This combination of rising earnings and falling stock price means the stock is cheap relative to its growth. Our simulations give Supermicro roughly a 30% chance to double by 2026, with a median outcome of ~+53% in two years. In fact, its “expected years to double” is ~3.3, not far behind the top two picks. The fundamentals support the bullish case: even cautious analysts agree the company is back on track, and AI spending remains high. Supermicro’s volatility is significant, but with its low valuation and continued AI tailwinds (e.g. new data-center products using Nvidia’s latest chips), this stock has clear 2× potential. For risk-tolerant investors who believe in the ongoing AI hardware cycle, SMCI could deliver outsized gains.

4. Cognex Corporation (CGNX) – Vision Systems Poised for a Rebound

Two-year return simulations for Cognex (CGNX). The bell curve centers below the 2× line, but there is a noticeable right-side extension beyond the red line, indicating roughly a 23% doubling chance by 2026. Cognex is the global leader in machine vision – its advanced cameras and AI software help automate quality control in factories and warehouses. The stock has been beaten down recently (trading ~34% below its 52-week high) due to soft industrial spending and macro headwinds. However, this temporary slowdown belies Cognex’s long-term strengths. The company has zero debt and a history of high margins, and it stands to benefit as manufacturers invest in automation (a trend that’s likely to re-accelerate with any economic upturn). Wall Street still sees upside: the consensus analyst view is Buy, and the most optimistic price target ($53) is ~53% above the current price. Our Monte Carlo model indicates Cognex has about a 23–24% probability of doubling by late 2026, with an expected ~3.6 years to double. Those odds, while lower than the first three names, are still well above average in our 500-stock universe. Why? Because Cognex’s valuation has become attractive – it’s an “ultra value” pick in our scoring, with shares roughly 40% below fair value by discounted cash flow metrics. In other words, the market is pricing in a lot of pessimism. Should global manufacturing capex pick up even modestly, Cognex’s earnings could snap back to double-digit growth, and the stock would likely rerate upward. Bottom line: as a quality, niche industry leader, Cognex offers a compelling combination of value and growth potential – making a double feasible if it can ride the next automation wave.

5. DexCom (DXCM) – Diabetes Tech Leader with New Markets

DexCom’s 2-year Monte Carlo return distribution. The bulk of outcomes are below the 2× line, but a meaningful upper segment crosses it (~25% of trials), consistent with DexCom’s high-growth outlook. Rounding out our list is DexCom, the dominant player in continuous glucose monitoring (CGM) devices. DexCom’s wearable sensors are already the standard for Type-1 diabetics, and now the company is aggressively expanding into the much larger Type-2 diabetes population. In fact, as of early 2025, two of the largest U.S. pharmacy benefit managers opened coverage of DexCom’s CGM to over 5 million non-insulin-using Type-2 patients – a huge new addressable market. Fueled by new product launches (the G7 sensor and upcoming G8 platform with advanced analytics) and broader insurance reimbursement, DexCom projects ~19% compound annual growth for the next five years. Recent numbers back this up: the company grew its user base to 2.8 million (up 25% in 2024) and continues to post double-digit revenue increases. Despite these strengths, DXCM shares slid ~20% YTD amid market rotation, leaving a reasonable valuation for a high-growth medtech. Our simulations estimate 24–31% probability that DexCom’s stock will double by 2026, with a median outcome around +35% and an expected time to double of ~4.1 years. As a profitable market leader innovating in a growing field, DexCom offers a balanced “growth stock” double-up chance: not as explosive as a tech startup, but supported by tangible earnings and expansion into untapped markets. If the company executes on its Type-2 expansion and upcoming product improvements, the payoff could be significant for investors – potentially validating the one-in-four simulation odds of a double.

Conclusion: While nothing is guaranteed in the stock market, these five names currently boast the strongest statistical odds of doubling by 2026 according to our 10,000-trial Monte Carlo analysis. Each combines a compelling growth story or value gap with a dose of volatility that makes a 100% gain possible. Investors should remember that high-upside stocks often carry higher risk – the simulation distributions make it clear that outcomes can vary widely (note how even these top candidates have plenty of sub-par scenarios in the charts). However, for those willing to embrace calculated risk, “Vulcan-mk5” has identified these five as the most promising double-bagger contenders. With robust business catalysts ranging from AI booms to new market opportunities, any of these stocks could realistically turn a $1 into $2 by 2026 – and that’s a proposition worth a second look.

Sources: The Vulcan-mk5 simulation engine (10,000 trials per stock) and data from FactSet/Yahoo Finance were used to identify and analyze the above stocks. Key company-specific insights were referenced from recent analyst reports and news: InvestorPlace/TradingView (Palantir), Investing.com (MercadoLibre), Nasdaq/Motley Fool (Supermicro), Yahoo Finance/Analyst forecasts (Cognex), and Nasdaq/Zacks (DexCom). These sources provide additional context on growth drivers, valuations, and risks for each of the highlighted companies.

Leave a comment