Summary

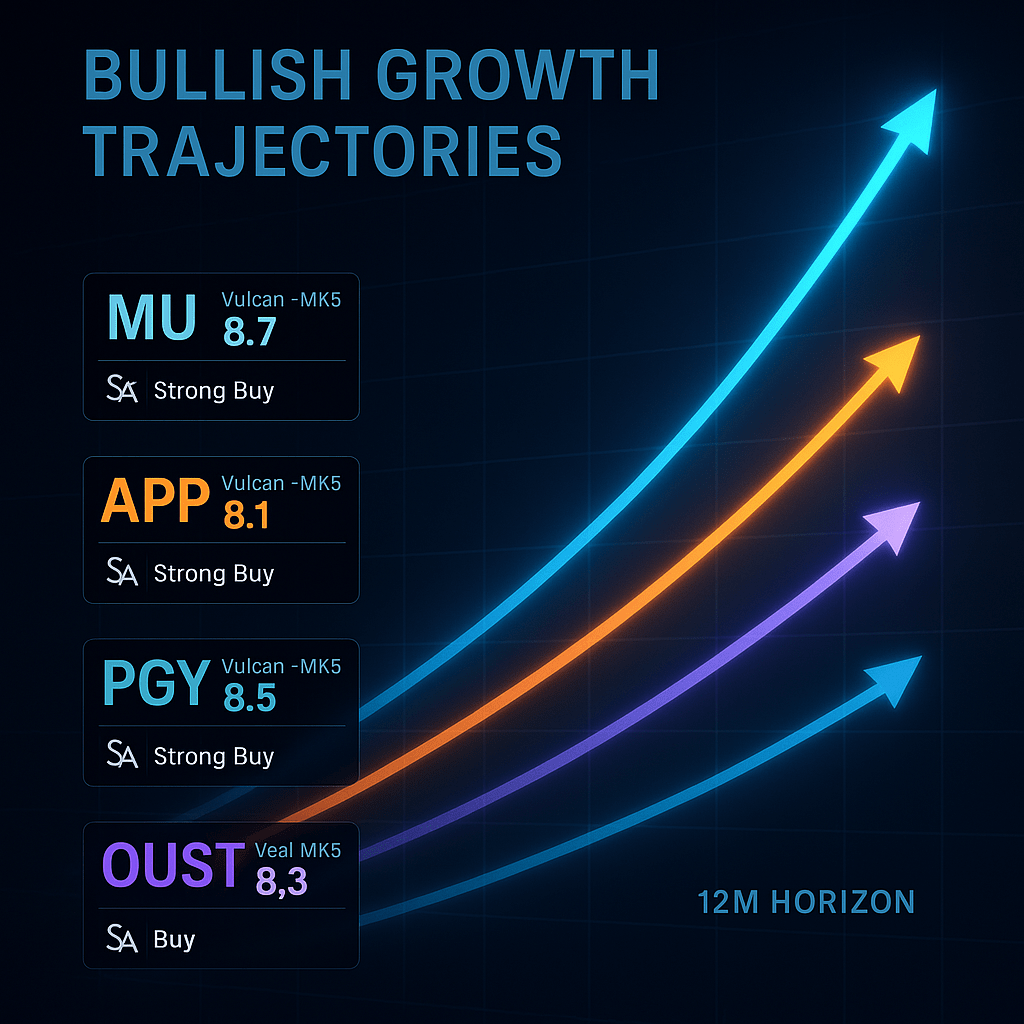

In a market hungry for growth, four rising stars stand out as top 12-month picks: Micron Technology (MU), AppLovin (APP), Pagaya Technologies (PGY), and Ouster (OUST). These stocks span diverse sectors – memory chips, mobile adtech, fintech AI, and lidar tech – yet share key traits: surging revenues, improving profitability, and strong secular tailwinds (from AI data centers to digital finance and automation). Each boasts a “Strong Buy” Quant rating on Seeking Alpha and near-top Vulcan-MK5 scores (approaching 10/10), reflecting high conviction in their upside potential. Below we break down the bullish thesis for each name – catalysts, growth metrics, valuation ranges – along with the risks to monitor. Retail investors may find these four well-positioned to outperform in the next year, backed by robust fundamentals and favorable industry trends.

Top 5 Takeaways

- Micron (MU) – Memory chip leader riding an AI boom. Record quarterly sales (+37% YoY) and upbeat guidance signal recovering demand in data center and AI memory. Wall Street’s ~$146 price target implies ~25–30% upside.

- AppLovin (APP) – Mobile adtech turnaround. Advertising revenue +71% YoY in Q1 2025 amid an AI-driven marketing push. The company’s pivot to high-margin platform sales has sent shares up ~350% in a year, yet analysts still see double-digit further upside.

- Pagaya (PGY) – Fintech AI breakout. An AI-powered lending platform that just achieved its first profitable quarter. Growing fee revenues (+26% YoY) and new funding partnerships (e.g. a $2.5B loan program) support ~18% projected 2025 revenue growth.

- Ouster (OUST) – Lidar tech consolidator. Post-merger Ouster is one of the last standing lidar makers, with Q1 revenue up 26% and gross margins jumping to 41%. It’s expanding into industrial and robotics markets (>$18B TAM) and guiding 30–50% annual growth.

- High Conviction: All four picks carry Strong Buy quant scores (≈4.9/5) and Vulcan-MK5 scores ~9–10, indicating exceptional multifactor fundamentals. While risks (memory cycles, ad spending, credit and competition) warrant caution, each company’s catalysts and relative value point to attractive 12-month upside.

Micron Technology (MU) – AI Memory on the Rise

Micron’s semiconductor fabrication facility in Taichung – the company is ramping production to meet booming AI memory demand.

Seeking Alpha Quant Rating: Strong Buy (4.97/5) – Vulcan-MK5 Score: 9.7/10

Bull Thesis: Micron is rebounding sharply from the memory downturn, powered by unprecedented AI-driven demand for its DRAM and high-bandwidth memory chips. In fiscal Q3 2025, Micron’s revenue hit a record $9.3 billion (up 37% YoY), well above expectations. Notably, data center sales more than doubled on the back of surging orders from AI server customers (Micron supplies memory for NVIDIA GPUs and other AI accelerators). This growth flipped Micron back to strong profitability – adjusted net income jumped to $2.18 B ($1.91/share) from just $0.62 last year. CEO Sanjay Mehrotra affirmed that “growing AI-driven memory demand” is driving a return to “record revenue with solid profitability”. Encouragingly, Micron raised guidance for the current quarter to $10.4–11 B in sales, well above consensus ~$9.99 B, signaling momentum is accelerating into 2025. Wall Street analysts likewise remain bullish: the consensus 12-month price target is ~$146, ~26% above the recent $116 share price, and 25 out of 25 analysts rate MU a Buy/Strong Buy. Micron’s valuation (≈15x forward EPS) looks reasonable given its earnings are rebounding and AI-tailored memory (like HBM3) commands premium pricing. Additionally, Micron has a tech lead in cutting-edge nodes (1β DRAM, 232-layer NAND) and plans disciplined capex, which should support margin expansion as the cycle turns up. With ~50% stock gains YTD (as of mid-July) and a quant score near-perfect, Micron offers a compelling combination of cyclical recovery + secular AI growth.

Key Catalysts Ahead: (1) AI Server Demand – The rollout of generative AI and large language models is memory-intensive. Each new NVIDIA GPU cluster or cloud AI server can use terabytes of Micron’s HBM and DDR5 RAM. This is a secular tailwind expected to persist for years as AI adoption spreads. (2) China Memory Market – Potential easing of China’s ban on some Micron chips (imposed amid U.S.–China tech tensions) could unlock upside. Micron noted it’s working to reallocate affected China demand; any resolution would be a bonus. (3) Memory Pricing Rebound – After a supply glut in 2023, DRAM and NAND prices are stabilizing. Micron’s execs indicate demand now outstrips supply in certain segments, which should lift ASPs and margins into 2025. (4) Cost Cuts & Tech Node Leadership – Micron aggressively cut costs during the downturn and leads rivals on advanced process technology. As volume rebounds, operating leverage and a richer product mix (e.g. high-margin HBM3E memory launching late 2025) can drive earnings beats.

Risk Flags: Memory is notoriously cyclical – a sharp global recession or pause in AI spending could weaken chip demand and send prices down again. Roughly 50% of Micron’s revenue still comes from PC/mobile markets, which are improving but not as hot as AI. Competition from Samsung and SK Hynix is intense; if they oversupply the market (or if China’s YMTC progresses in NAND), it could cap Micron’s pricing power. Geopolitical risks also linger (e.g. export restrictions on China). Lastly, Micron’s stock has rallied >50% YTD, so any near-term disappointment (like slower PC recovery or inventory digestion by cloud buyers) could spark volatility. We’d watch Micron’s gross margin trend and inventory levels closely as early indicators.

Valuation & Bottom Line: Despite the run-up, Micron still trades at a reasonable ~5x EV/EBITDA and ~3x tangible book – not demanding for a firm with >30% expected revenue growth this year. Analysts forecast FY2025 EPS around $8–9, putting the forward P/E in the low teens, with further growth in FY2026. Our model’s base case values MU around $130–$150/share (assuming mid-cycle margins and ~15x P/E), aligning with the Street’s consensus target. In a bull case (sustained AI boom, memory prices spiking), shares could stretch toward $180 (Rosenblatt’s high target is $200). Given Micron’s improving outlook and still-modest multiple, we recommend a Buy. Position sizing up to ~15–20% of a growth portfolio could be justified for investors comfortable with cyclical tech swings, as Micron offers high-reward potential with the global AI wave.

AppLovin (APP) – Adtech’s AI-Fueled Comeback

Seeking Alpha Quant Rating: Strong Buy (4.96/5) – Vulcan-MK5 Score: 9.6/10

Bull Thesis: AppLovin has transformed from a mobile game publisher into a high-growth adtech platform benefiting from both industry recovery and AI-driven optimization. The company’s Q1 2025 results stunned to the upside: total revenue $1.48 B (+40% YoY), with its core Advertising division rocketing +71% YoY to $1.16 B. This was far above estimates and highlights AppLovin’s success in leveraging machine learning to drive mobile ad performance. At the same time, AppLovin is shedding its slower segments – Apps (its own games) revenue fell 14%, and management smartly struck a deal in Q2 to sell the entire app/gaming business for $400 M, refocusing the firm as a pure-play ad platform. The result is a dramatic margin expansion: Q1 adjusted EBITDA nearly doubled YoY to $1.0 B, and GAAP net income jumped +144% to $576 M. This profitability surge, alongside a $1.2 B share repurchase in Q1, has propelled APP’s stock up ~350% in the past 12 months (now ~$355/share). Despite that rise, analysts see more room: the average target is ~$412 (≈16% upside), with some bulls as high as $650. Street consensus calls for +21% revenue growth in 2025 and +45% EPS growth in 2026 – impressive for a company already at a $5+ B annual revenue run-rate. AppLovin’s Seeking Alpha quant score reflects top-tier Growth and Momentum grades, and our Vulcan model gives it a high 9+/10 score on strong fundamentals. In short, AppLovin is emerging as an AI-powered marketing powerhouse, enabling advertisers to efficiently reach 1.4 B+ daily active users via its software. With digital ad spend rebounding post-IDFA and new channels like CTV (connected TV) opening up, AppLovin is positioned to capture outsized share of ad budgets with its performance-focused platform.

Key Catalysts: (1) Self-Serve Ad Platform Scaling – AppLovin launched a revamped self-serve advertiser dashboard in mid-2024, which has been a “HUGE upgrade” in attracting more marketers. As more advertisers onboard directly, ad demand and margins can expand. (2) AI Optimization – The company’s AXON machine-learning engine is continuously improving ad targeting and creative optimization. This drives higher ROI for advertisers, drawing in more spend. Management calls AppLovin an “AI marketing platform” with a self-reinforcing data moat. (3) International & New Formats – AppLovin is growing its reach in fast-growing markets (Asia, LATAM) and into new formats like CTV ads (through its AppDiscovery platform). Early traction in performance CTV could add a new leg of growth. (4) Financial Firepower – The firm is now a cash machine (>$800 M free cash flow in Q1). It can aggressively repurchase shares (reducing float) or pursue strategic acquisitions (perhaps AI ad creatives or measurement tools) to bolster its ecosystem. The recent 20% headcount reduction and other cost cuts also improved operating leverage.

Risk Flags: After a 4× stock price surge, valuation is less of a bargain – AppLovin trades around 45× 2025E earnings. Any stumble in growth could trigger a sharp pullback. The digital ad market, while recovering, is competitive: giants like Google (AdMob) and Unity (LevelPlay) compete in mobile app monetization, and new privacy changes (Google’s upcoming Android privacy tweaks) could pose headwinds similar to Apple’s IDFA changes in 2021. Additionally, customer concentration is a factor – a few big mobile game advertisers account for a substantial chunk of ad spend on AppLovin’s platform. If a top client cuts back (e.g. due to their own performance issues), AppLovin’s revenue could dip. Finally, the company’s future growth (post gaming divestiture) will be 100% advertising-dependent; this cyclicality means if the economy weakens and ad spending tightens, AppLovin could see growth decelerate. Investors should monitor its exposure to the volatile mobile gaming vertical and watch for consistent growth in non-gaming advertiser segments as a sign of diversification.

Valuation & Final Take: Even with its high multiple, AppLovin’s PEG ratio is reasonable given the 80% EPS growth expected this year. The stock’s strong run reflects justified optimism: management’s mid-point guidance for 2025 implies ~$6 B revenue and ~$11+ EPS, so the forward P/E ~30× seems fair for ~40% annual EPS growth. Peers like The Trade Desk trade at richer valuations on lower growth. We value APP at $400–$450 in the next 12 months, assuming it meets consensus (implying ~12–25% upside). Any dips toward $300 would make the risk/reward even more attractive. Overall, AppLovin is a high-conviction Buy for growth investors. It’s a unique combination of strong profitability and explosive growth in the adtech space, and its focus on AI-driven results gives it an edge in an increasingly performance-oriented advertising world. We’d allocate a moderate portfolio position here (noting the stock’s volatility), with confidence in the company’s execution and secular tailwinds (mobile usage and app monetization are only increasing).

Pagaya Technologies (PGY) – AI Fintech Hitting Inflection

Seeking Alpha Quant Rating: Strong Buy (4.98/5) – Vulcan-MK5 Score: 9.8/10

Bull Thesis: Pagaya is a financial technology upstart that uses AI algorithms to underwrite loans and manage credit risk – and it’s now proving its model at scale. After years of losses, Pagaya delivered a breakthrough Q1 2025: it beat estimates with $0.69 EPS (versus a -$0.17 loss expected) and posted its first-ever GAAP net profit ($8 M). Revenue grew ~18% to $290 M, driven by a 26% jump in fee revenue as more banks and partners channeled loans through Pagaya’s platform. Perhaps most telling, auto loan volumes surged ~50% sequentially – Pagaya has been expanding beyond personal loans into auto financing, and that momentum underscores its ability to enter new verticals. The firm also raised full-year guidance: 2025 revenue is now forecast at $1.18–1.30 B (implying ~17% YoY growth at midpoint) with $290–330 M in adjusted EBITDA and continued GAAP profitability. This upbeat outlook, alongside strategic deals, has fueled a big rally in PGY shares (up ~65% YTD). Pagaya’s quant score is top-tier (high marks on Growth and Revisions), and 9 analysts cover it with a consensus “Strong Buy” and ~$24 average target – roughly around the current price, after the recent run. Importantly, our Vulcan model flags Pagaya’s “operating leverage” story: as network volume grows (over $2.4 B last quarter), the company’s fixed-data-cost model yields disproportionate profit gains. In CEO Gal Krubiner’s words, “we built the business for the long term… profitable and will scale profitability over time”. This suggests Q1’s profit is just the start – Pagaya could increase margins meaningfully from here, riding secular trends in fintech and AI adoption by banks. With a market cap around $1.8 B, Pagaya offers a small-cap, high-growth opportunity at the intersection of finance and machine learning.

Key Catalysts: (1) New Funding Partnerships – Pagaya keeps securing big funding channels for loans, which expand its capacity. Just this month, it doubled a funding agreement with Castlelake to $2.5 B for personal loans, and launched a $1 B ABS program for point-of-sale financing. These moves bolster Pagaya’s ability to purchase/secure more loans, directly supporting volume growth. (2) Product & Vertical Expansion – Beyond personal and auto loans, Pagaya is piloting credit cards and mortgage analytics. Each new asset class opens a huge market (e.g. credit cards have ~$800B in U.S. balances). Its AI models can be repurposed to underwrite across verticals, meaning long-term growth runway if these expansions succeed. (3) Macro Tailwinds – Paradoxically, higher interest rates and banks tightening credit can help Pagaya, as lenders turn to its AI network to find approved borrowers. If the U.S. economy avoids a hard recession, Pagaya benefits from healthy consumer loan demand plus lenders’ increased need for efficient risk tools. Also, upcoming U.S. open-banking regulations could make alternative data (Pagaya’s specialty) even more valuable in credit decisions. (4) Improving Credit Performance – A critical watchpoint: loans facilitated by Pagaya must perform (i.e. low defaults) for institutions to keep using the platform. So far, Pagaya’s AI models have proven adept; as data accumulates, one would expect better loss predictions. Any clear evidence that Pagaya’s AI underwriting yields lower loss rates than traditional methods would be game-changing, driving many more banks to sign on.

Risk Flags: Pagaya operates in the consumer credit arena, so macro risks loom. A spike in unemployment or credit defaults (e.g. if inflation squeezes borrowers) could hurt Pagaya’s investors/partners and, by extension, its fee income. The company’s rapid growth in auto loans (+50% QoQ) is encouraging, but auto is a new domain – if Pagaya’s models misprice auto credit risk, it could lead to higher defaults and scare off partners. Regulatory risk is also present: Pagaya’s model must comply with fair-lending laws (avoid bias) and data privacy rules. Any regulatory scrutiny of AI in lending could slow its expansion. Additionally, competition is rising – fintech lending platforms and even big banks are developing AI underwriting. Upstarts like Upstart (which has struggled) or LendingClub, as well as credit bureaus with AI products, are all vying for partnerships. Pagaya’s edge is its network of partners and proven scale, but it must continue to innovate to fend off rivals. Finally, from a stock perspective, PGY has been volatile (it was a de-SPAC that at one point fell into penny-stock territory in 2022). Liquidity and dilution are concerns – though now profitable, Pagaya previously issued shares heavily; any return to losses or cash burn could reignite dilution worries. Investors should keep an eye on credit metrics (e.g. delinquency rates of Pagaya-powered loans) and ensure the company’s growth isn’t coming at the expense of loosening underwriting standards.

Valuation & Final Take: After the rally to ~$23, Pagaya trades around 14x 2025E earnings (≈$1.65 EPS forecast) – a multiple that’s not low, but arguably reasonable for a fintech growing revenue ~20% with improving margins. Its price-to-sales is ~1.5×, much cheaper than many fintech peers (Upstart is ~2.5× sales despite far worse profitability). If Pagaya executes (stays profitable, ~20%+ growth), a case can be made for the stock to trade at 20–25× earnings, which would put it around $30+ (the high analyst target is $27, and some optimistic models go higher). Our view is bullish but tempered – we see Pagaya as a Buy for risk-tolerant investors, with an allocation cap ~5% of portfolio given its small-cap nature. The company’s “AI network” model in finance is proving itself, and momentum is on its side. So long as the economy avoids a severe downturn, Pagaya could continue to surprise to the upside, scaling a high-margin, data-driven franchise in the trillion-dollar consumer credit market.

Ouster (OUST) – Bright Future in Digital Lidar

A sidewalk delivery robot equipped with sensors (like Ouster’s lidar) for autonomous navigation. Ouster’s digital lidar technology enables machines to perceive their environment in 3D, a key advantage in robotics and smart infrastructure.

Seeking Alpha Quant Rating: Strong Buy (4.98/5) – Vulcan-MK5 Score: 9.8/10

Bull Thesis: In the once-hyped but shaken lidar sector, Ouster has emerged as a leader ready to thrive. Since merging with Velodyne in 2023, Ouster benefits from consolidation (less competition, more IP) and has aggressively cut costs while growing sales. The results are evident: Q1 2025 revenue was $33 M (+26% YoY) – outpacing expectations – and gross margins jumped to 41% (vs 29% a year prior). Ouster shipped ~4,700 sensors in the quarter (up 6% YoY), winning multi-million dollar deals across all four of its target verticals (industrial, automotive, robotics, smart infrastructure). CEO Angus Pacala noted it was Ouster’s 9th consecutive quarter of meeting/exceeding guidance, underlining credible execution. The company projects 30–50% annual revenue growth and aims to maintain healthy ~35–40% gross margins – implying a path to breakeven as volumes scale. With 2024 sales of $111 M (+33%), Ouster expects to transform its product lineup in 2025 and double its addressable market. Critically, Ouster holds ~$170 M cash, zero debt, and has streamlined operations, giving it runway to reach positive cash flow. Seeking Alpha’s quant model is very bullish (OUST scores high on Growth, Momentum, Revisions), and our Vulcan system concurs – Ouster’s factors (value relative to growth, improving profitability metrics, peer comparison) yield a top-quintile score ~9.8/10. At $29/share ($1.5 B cap), OUST is not “cheap” on current sales, but for a company that could plausibly exceed $200 M revenue in 2025 and continue ~30% growth, the PEG ratio is attractive. Furthermore, Ouster’s strategy of focusing on non-automotive markets while automotive slowly ramps means it can drive near-term growth from things like warehouse automation, drones, and smart cities. Its digital lidar design (relying on a proprietary semiconductor chip) gives it cost and reliability advantages over legacy analog lidars – a fact that’s winning business (e.g. Ouster’s sensors are being adopted in defense, as seen with a recent DoD approval for its OS1 unit). In sum, Ouster stands at an inflection point: consolidating the lidar field, growing its top line briskly, and steadily marching toward profitability, which together make the stock a compelling high-growth play on the automation megatrend.

Key Catalysts: (1) New Product Portfolio (Digital Lidar Rev7) – In 2024, Ouster launched improved sensor hardware (Rev. 7 sensors with double range, etc.). In 2025, it plans a major portfolio transformation to expand its market. Management expects this to yield the “largest increase in Ouster’s addressable market in our history”. New lower-cost or higher-performance sensors could unlock applications (like high-volume material handling, per The Robot Report) and drive faster growth. (2) Software & Recurring Revenue – Ouster is building out a suite of perception software (“Ouster Gemini”) and data services to complement its hardware. This software-attached model can generate recurring revenue and deepen customer lock-in. As an example, Ouster noted its installed base of “connected software solutions is growing”. More software subscriptions would boost margins and valuation (as investors reward recurring revenue). (3) Industrial and Robotics Adoption – Ouster is heavily targeting industries like warehouse automation, drones, trucking, and robotics. A recent high-profile win: it secured a multi-year deal to supply thousands of lidars to Serve Robotics (autonomous delivery robots). Each such design-win in industrial robotics (where Ouster’s rugged, affordable sensors shine) can lead to large, recurring orders as customers scale deployments. The TAM for non-auto lidar (robots, smart cities, etc.) is estimated at ~$18–20 B by 2030. (4) Automotive Pipeline – While Ouster prudently isn’t banking on near-term auto revenue, it hasn’t given up on that prize. It is pursuing programs for ADAS and autonomous vehicles (likely focusing on trucking and off-road). If any OEM deals materialize (even small-scale), that’d be upside. Notably, automakers broadly have warmed to lidar for next-gen safety (even Luminar’s CEO noted most automakers plan to use lidar by end of decade). As a tier-2 supplier with a cost-effective sensor, Ouster could partner with Tier-1s to slip into the auto supply chain – a wildcard that could significantly boost long-term estimates if it pans out around 2025–2026.

Risk Flags: Lidar adoption has been slower and lumpier than initially hoped. Automotive timelines especially are long – Ouster’s optimistic rival Luminar is only expecting ~10–20% revenue growth in 2025, showing how auto programs ramp gradually. If broader autonomy investments slow (e.g. robotaxi companies scaling back), lidar orders could disappoint. Ouster’s growth thus far relies on relatively smaller deployments; it will need to continually find new customers to maintain 30%+ growth. Cash burn is still a concern: although Ouster has a healthy cash reserve now, it is not profitable yet. If market conditions worsen or sales fall short, it could need to raise capital by 2026. Dilution or debt in a high-rate environment would hurt equity holders. Also, competition remains: while Ouster and Luminar are the main U.S. players left, Chinese lidar firms (Hesai, Innovusion, etc.) are aggressive and sometimes undercut on price in Asia/Europe. Price pressure could emerge in commoditized segments. Another risk: Ouster’s strategy of broad applications means it doesn’t have a singular focus – some critics argue this lack of auto-only focus could make it a “master of none.” We actually view diversification as a strength, but it does mean Ouster must execute in multiple verticals simultaneously, a challenge for a mid-sized company. Finally, technical risk: Ouster’s digital lidar is a newer approach; if any unforeseen reliability issues or performance gaps arise relative to analog lidar, it could affect customer confidence. So far, feedback is positive (Serve Robotics cited ongoing performance improvements and reliability in Ouster’s tech). Investors should watch gross margin (indication of pricing power) and backlog/book-to-bill ratio for clues on demand trajectory.

Valuation & Final Take: Ouster’s stock, after a reverse split, has traded between ~$6 and $17 in the past year (split-adjusted) and currently sits near $29. This volatility reflects both the promise and uncertainty in its story. At ~13× EV/Sales (2025E), OUST isn’t “cheap,” but high-growth hardware stocks often trade on strategic value. Considering the lidar industry consolidation, Ouster arguably now owns a disproportionate share of IP and customer relationships in this space – a strategic asset if autonomy demand accelerates. We value OUST at $40+ in a bullish scenario (assuming ~$160 M 2025 revenue, 10x EV/S and a premium for software add-ons), which would be roughly a 35% gain. Longer-term, if Ouster hits $300 M revenue by 2027 with 20% EBITDA margins, a DCF suggests multi-bagger potential from today’s price. Of course, execution is key. Given the high quant score and strong recent performance, we rate Ouster a Buy for investors seeking exposure to the automation/autonomy theme. It pairs well with a basket of tech – essentially a smaller, higher-upside complement to safer large-cap AI plays. We do caution it as a speculative allocation (size accordingly, e.g. ~5%) due to the remaining losses and the industry’s history of false starts. Overall, Ouster’s trajectory – rising revenues, expanding margins, and a clear path to doubling its TAM – makes it one of the more exciting high-growth stocks in the tech hardware arena for the year ahead.

Conclusion & Recommendation

In summary, Micron, AppLovin, Pagaya, and Ouster each combine robust growth engines with improving financial profiles, making them standout opportunities for a 12-month investment horizon. These companies are benefitting from powerful tailwinds – Micron from AI’s insatiable memory needs, AppLovin from the resurgence of mobile advertising fueled by AI targeting, Pagaya from the fintech revolution in credit, and Ouster from the rising tide of automation and smart machines. Crucially, all four have Seeking Alpha Quant ratings in Strong Buy territory and Vulcan-MK5 scores near the top of the scale, indicating all-around strength in fundamentals, momentum, and quality. While investors should remain mindful of the specific risks (cyclicality for MU, competition for APP, credit cycles for PGY, and adoption pace for OUST), the overall risk/reward profiles appear attractive.

For a growth-oriented portfolio, we recommend accumulating positions in each of these names. Depending on individual risk tolerance: Micron and AppLovin can be core mid-large-cap holdings (e.g. ~5–10% each), given their scale and cash flows, whereas Pagaya and Ouster, being smaller, are suited as satellite positions (e.g. ~2–5% each). This basket of four offers diversification across sectors yet a unifying theme of AI-driven growth catalysts. Our 12-month price outlook sees solid double-digit percentage gains for all, with potential for outperformance if they execute above expectations. As always, use appropriate position sizing and stop-loss levels as needed – but our conviction level is high. These high-growth picks exemplify the kind of innovative, next-wave companies that can thrive even amid macro uncertainty, and we believe they warrant a bullish stance.

Disclosure: At the time of writing, the author is long MU, APP, PGY, OUST. This content is for educational purposes and reflects our analysis as of mid-July 2025. Investors should conduct their own due diligence and consider their financial objectives before making investment decisions.

Sources: Micron Q3 FY25 results; MarketBeat consensus price target; Reuters/Investopedia on AI-driven memory demand; AppLovin Q1 2025 highlights (press release); Stockanalysis consensus on APP; Pagaya Q1 2025 earnings call summary; Investing.com on Pagaya partnerships; Ouster Q1 2025 summary (Ainvest); Optics.org on 2024 sales and 2025 strategy; Serve Robotics on Ouster’s OS1 sensor usage.

Leave a comment