The second half of 2025 could separate the stock market’s winners from its laggards. Investors who position now in the right sectors may ride powerful tailwinds of AI, infrastructure spending, and resilient demand – while sidestepping segments squeezed by tariffs and inflation. Below we reveal 20 compelling stock ideas across the sectors poised to outperform (and importantly, none from the sectors we expect to struggle). Each pick comes with a bite-sized thesis. Buckle up – you’ll want to know which stocks could shine as 2025 enters the home stretch!

Why Sector Selection Matters in 2025

The macro backdrop of late 2025 is a mixed bag. High interest rates and trade policy shifts are creating clear winners and losers across sectors. According to Wells Fargo’s midyear outlook, areas like energy, utilities, financials, and communication services enjoy structural advantages (e.g. real assets or pricing power), positioning them to beat the market in 2025. Likewise, aerospace and defense companies stand to benefit from geopolitical uncertainties, making them smart hedges as global tensions simmer. In contrast, sectors tied to consumer spending are flashing warning signs: broad tariffs and inflation are expected to hit retailers, luxury goods makers, and automakers hard. Wells Fargo specifically warns that consumer discretionary industries (like leisure products and apparel) will be “unfavorable” over the next 18 months due to higher costs and squeezed consumers. Even consumer staples – though relatively shielded from tariffs – offer little upside beyond steady income, given their limited growth prospects.

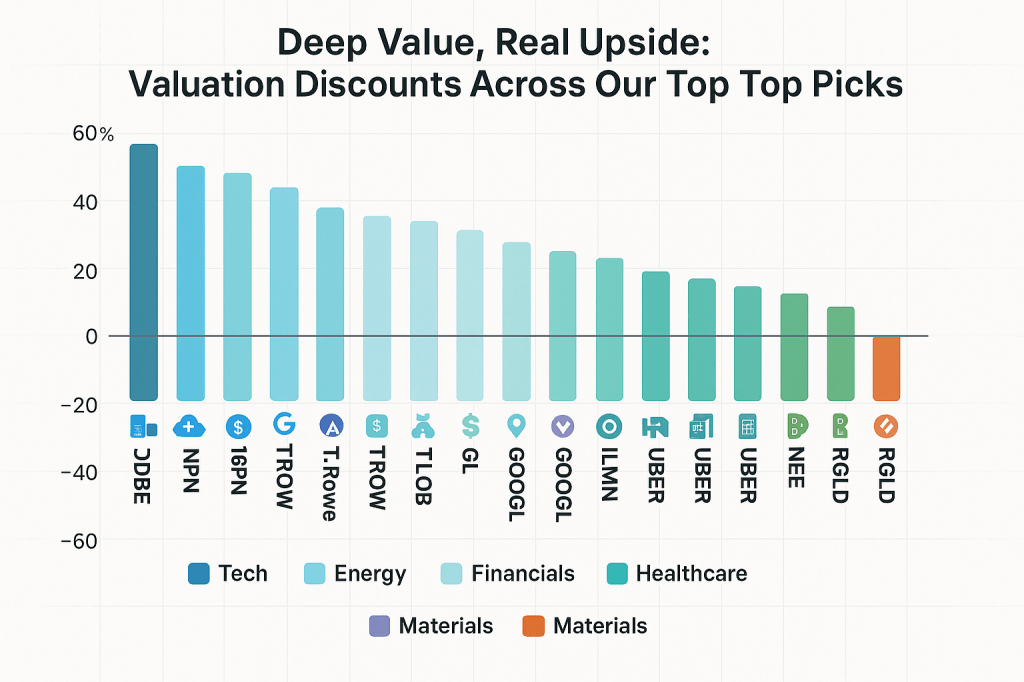

Our strategy: Focus on high-quality stocks in sectors with positive tailwinds through end-2025, and avoid those in sectors facing headwinds. We drew our stock universe from (500+ U.S. equities with up-to-date fundamentals) and filtered for strong buys in favored sectors. The 20 stocks below are diversified across finance, tech/communications, industrials (with defense), energy, utilities, healthcare, real estate and materials – zero picks from consumer discretionary or staples. Each is trading at a significant discount to fair value (according to consensus estimates) and boasts solid quality metrics, suggesting an attractive risk/reward profile for the remainder of 2025.

Before diving into the stock list, here’s a quick recap of key themes guiding these picks:

- Go Where the Growth (and Value) Is: Many of our picks play into the AI boom (benefiting tech, communications, and semiconductor-linked names) or into infrastructure/energy needs (utilities, midstream energy) identified by analysts. We emphasize companies with pricing power and robust balance sheets that can absorb tariff shocks.

- Defense and Stability: We include a tilt toward financials (banks and fintechs enjoying high rates), defense contractors (geopolitical hedges), and dividend-rich utilities/energy (real-asset businesses resilient to inflation). These are classic late-cycle or volatile-market outperformers.

- Avoid Overhyped and Vulnerable Areas: Notably absent are consumer-facing retail/apparel stocks (trade war casualties) and richly valued “story” stocks without fundamentals. Even within tech, we favor mega-cap and mid-cap tech with real earnings – as these have the scale to pass on tariff costs and maintain margins. Smaller speculative growth names are less represented unless they trade at deep value.

With that context, let’s explore the 20 stock picks positioned to thrive into year-end. (Each pick includes the company’s ticker, sector, and a brief thesis.)

Financials: Profiting from Rates and Cash Flows 💰

Interest rates remain elevated, creating a favorable backdrop for many financial firms. Banks and asset managers benefit from wider interest spreads and cheap valuations, while payment processors boast high margins and cash flow that shine in a strong economy. Our financial picks offer a mix of value and stability:

- MarketAxess (MKTX) – Electronic bond trading platform. MKTX dominates e-bond trading with a wide moat. The stock is down this year, now trading at less than 53% of its estimated fair value ( ~$216 vs ~$412 fair value ), making it an “Ultra Value” buy in our data. As bond yields stabilize, trading volumes should rebound, boosting MKTX’s revenue. With a high Quality Score of 93 and a modest dividend, it offers a rare combo of growth and value in fintech.

- T. Rowe Price (TROW) – Asset management firm. This blue-chip asset manager yields over 5% and has zero debt, yet its shares are ~37% below fair value. TROW’s earnings took a hit from 2022–24 bear markets, but markets recovering in 2025 plus cost-cutting bode well. It’s rated Ultra Value Buy with strong financial health. As investor confidence returns, T. Rowe’s AUM growth and renowned integrity should drive a solid rebound.

- Globe Life (GL) – Life insurance provider. GL is a steady Eddie insurer benefiting from higher interest rates (better investment income on its float). The stock is about 25% undervalued and carries a Strong Buy rating. While its ~1% dividend yield is modest, Globe Life consistently grows earnings ~6% annually and aggressively buys back shares. Predictable cash flows + rate tailwinds = a low-risk outperformer for late 2025.

Technology & Communications: Riding the AI & Digital Wave 📈

Tech and communication services have re-emerged as market leaders mid-2025 after a rocky start. Importantly, large-cap tech and digital communications firms have the pricing power and balance sheets to weather tariff turbulence. We favor companies tied to AI, software, and networks – themes driving secular growth:

- Adobe (ADBE) – Software & AI tools. ADBE is a juggernaut in digital media software and is integrating AI features (Firefly, etc.) across its products. Despite a big rally this year, it remains roughly 34% below fair value by estimates. With a Quality Score of 93, zero debt, and double-digit long-term growth forecast, Adobe is positioned to keep thriving as businesses invest in creative and marketing software. Pricing power (via subscriptions) and new AI offerings make it a standout.

- Salesforce (CRM) – Enterprise cloud software (CRM platform). Salesforce’s stock is still beaten down from 2022 highs, trading at less than 55% of fair value. The company is refocusing on profitability (recent margin improvements) while riding the AI CRM trend (integrating AI into customer relationship management). Analysts expect ~14% long-term earnings growth, and management’s cost discipline is boosting free cash flow. An Ultra Value Buy with clear catalysts (AI + cost cuts), CRM offers blue-chip tech exposure at a bargain.

- Global Payments (GPN) – Payment processing technology. GPN straddles tech and finance – exactly the kind of high-margin payments business Wells Fargo highlighted. Its shares plunged in recent years due to fintech competition worries, but those fears look overdone. Now ~68% undervalued, GPN has a strong moat in merchant acquiring and is growing ~10% a year. With digital payments volume expanding and a recent strategic refocus, Global Payments’ cash generation and cheap valuation make it a compelling play on the cashless economy.

- Alphabet (GOOGL) – Internet search, cloud & AI (Google). Alphabet is a cornerstone of communications services and AI. Despite its size, it’s rated Very Strong Buy and still about 25% below consensus fair value. Google’s search advertising business is resilient (even amid modest economic headwinds), and it’s a leader in AI with its DeepMind and Bard platforms. Crucially, Google’s scale gives it pricing power and the ability to pass on tariff costs if needed. With a fortress balance sheet and ongoing buybacks, GOOGL remains a reliable growth-at-reasonable-price pick for 2025.

- Meta Platforms (META) – Social media & metaverse (Facebook/Instagram). Meta has rebounded strongly in 2023–2025 after its metaverse-induced slump, yet our data still shows it at ~20% discount to fair value. Advertising demand on Meta’s platforms is solid, and the company has dramatically cut costs. It boasts a Quality Score of 94 and long-term growth around 12%. Meta also introduced new AI features and the promising Threads app, adding to engagement. Given its renewed focus on efficiency and shareholder returns (big buybacks), Meta offers a high-quality play on digital ad growth at a reasonable price.

- Comcast (CMCSA) – Broadband, media and streaming. Comcast is an often-overlooked communications stock that checks many boxes: it’s the largest U.S. broadband provider, owns NBCUniversal, and pays a 3.7% dividend. Concerns about cord-cutting have left CMCSA trading at roughly half of its fair value, an Ultra Value level for such a high-quality company (Quality Score 87). Yet Comcast’s broadband internet business is a cash cow with pricing power, and its studios/theme parks are rebounding. It’s also investing in streaming (Peacock) for future growth. For defensive income and a potential upside as media sentiment improves, Comcast is a solid bet.

Industrials & Defense: Geopolitical Hedge and Reindustrialization 🛠️

Industrials are poised for a revival as manufacturing capex picks up and defense spending stays strong. Our picks here span defense contractors, a transportation disruptor, and a business services firm – each with unique catalysts:

- Lockheed Martin (LMT) – Defense contractor (aerospace & military). LMT is the world’s largest defense company (F-35 jets, missiles, etc.). Geopolitical tensions (Eastern Europe, Middle East) have heightened demand for advanced defense systems. While LMT’s stock isn’t deeply undervalued (about 8% below fair value), it’s a rock-solid quality (87/100) name yielding ~2.9%. Defense budgets are rising, and Lockheed has a record order backlog that should fuel ~14% earnings growth going forward. In a volatile world, LMT offers stability and modest upside – a classic “sleep-well” stock that still beats the market.

- Uber Technologies (UBER) – Ride-sharing & food delivery platform. Classified in our data as an industrial/transportation name, Uber is actually a tech-driven mobility leader. Importantly, it’s largely insulated from tariffs and global trade spats – its revenue comes from local services. Uber is finally profitable and is projected to grow earnings ~20%+ annually as it scales. Yet the stock, around $94, trades at just ~45% of fair value (huge discount). With its ride-share monopoly in many markets and improving unit economics (and no consumer goods exposure to inflation tariffs), Uber stands out as a high-growth, “new economy” industrial play. Any continued strength in travel and urban activity will further boost rides and deliveries.

- Robert Half International (RHI) – Staffing & recruitment services. RHI is a leading white-collar staffing firm (accounting, office professionals). Fears of a slowing job market have cut the stock in half – it’s ~45% undervalued now and yields 5.5%. While a severe recession would hurt placement volumes, a soft landing scenario (which many now expect) could surprise to the upside, with companies resuming hires in late 2025. Robert Half has minimal debt, strong margins, and benefits from any uptick in hiring or temp staffing demand. Trading at a bargain valuation and rated Ultra Value Buy, RHI is a cyclical rebound candidate that pays you generously to wait.

Energy & Utilities: Real Assets for Inflation Defense ⚡️

Energy and utility stocks offer tangible assets and cash flows that tend to hold up in inflationary or volatile conditions. Wells Fargo strategists favor midstream energy firms, electric utilities, and renewables – those owning “difficult-to-replicate assets” like pipelines and power grids. Our picks include a mix of oil/gas producers and power companies:

- Chevron (CVX) – Integrated oil & gas major. Chevron is a cornerstone energy holding with upstream (oil production) and downstream (refining) operations. It’s a Good Buy now, about 18% below fair value, and yields a hefty ~4.6%. Oil prices have been fairly strong in 2025, and any further spike (e.g. on geopolitical flare-ups) directly benefits Chevron’s profits. Meanwhile, CVX’s conservative balance sheet and steady dividend increases make it a safer pick than smaller drillers. High shareholder payouts + inflation-hedging assets (oil fields) position Chevron as a reliable performer if volatility returns.

- EOG Resources (EOG) – Oil & natural gas exploration & production. EOG is often cited as one of the best-run shale producers, known for low-cost drilling. The stock remains ~30% undervalued, perhaps due to earlier oil price volatility. With oil stabilizing and EOG’s volumes growing, it’s set for strong cash flows. It yields ~3.3% and is committed to returning cash via dividends and buybacks. EOG also has substantial natural gas assets, which could surge if a cold winter or LNG demand jumps. Overall, EOG offers higher upside than the integrated majors, with a very strong quality rating (84) and efficient operations that can thrive even if energy prices modestly pull back.

- AES Corp (AES) – Global utility & renewables producer. AES combines regulated utility businesses with a growing renewables portfolio (wind, solar, battery storage) worldwide. Rising rates crushed many utilities, and AES is no exception – its shares trade at just 27% of fair value (a 73% discount!) and yield ~6.3%. Despite debt levels typical for a utility, AES’s dividend is rated quite safe (5/5 safety) and its 80+ score for quality reflects a solid track record. With AI and data centers driving power demand, electricity producers like AES should see stable growth. This is a higher-risk pick among utilities (due to global operations), but at this deep discount, AES’s risk-reward is very attractive for long-term defensive income and potential capital gains if utility valuations normalize.

- NextEra Energy (NEE) – Renewable energy-focused utility. NextEra is America’s largest utility by market cap, known for its Florida Power & Light subsidiary and expansive wind/solar generation fleet. After a rare stumble (its renewable energy unit hit some hurdles), NEE stock now sits ~25% under fair value with a 3.1% yield. Wells Fargo highlighted renewable energy companies and electric utilities as key defensive plays – and NEE is both in one. It has a Quality Score of 85 and a long runway of growth projects (offshore wind, green hydrogen, etc.). As interest rate pressures ease (the Fed may cut rates by late 2025), high-quality utilities like NextEra could see a strong rebound. NEE offers a way to play the clean energy mega-trend with a lower-risk, dividend-paying stock.

Healthcare: Resilient and Undervalued 📊

Healthcare was a neutral-rated sector in Wells Fargo’s outlook (not a standout, but with selective growth possible). We focus on two healthcare names that are significantly mispriced yet have solid long-term prospects:

- Illumina (ILMN) – Genomic sequencing leader. Illumina is the dominant provider of DNA sequencing machines, critical for biotech research and healthcare diagnostics. Its stock has been hammered (down ~70% from its peak) due to an ill-fated acquisition and regulatory issues. However, ILMN now trades at just ~32% of its fair value (an Ultra Value Buy) despite maintaining its leadership in a growth field. Genome sequencing demand is only increasing (precision medicine, cancer screening, etc.), and Illumina’s new CEO is refocusing on core execution. With zero debt and high gross margins, Illumina is a classic case of a great company priced as if it’s broken – any operational improvements or legal resolution could unlock huge upside. There’s risk here, but the long-term growth story (and possible takeout interest) makes ILMN compelling for 2025 and beyond.

- Bristol Myers Squibb (BMY) – Pharmaceuticals (oncology, cardiovascular). Big Pharma has been unloved in 2025, and Bristol is no exception – concerns about patent expirations have pushed BMY to about 50% below fair value. This is a dividend aristocrat yielding 5.3% with a strong pipeline of new drugs (in immunology and cancer) to replace its aging blockbusters. It’s rated Ultra Value Buy and carries a solid quality rating (79). While near-term growth is modest (~5–6%), Bristol’s cash flows are prodigious and management is using them for strategic acquisitions and buybacks. Healthcare demand is defensive by nature; even in a softer economy, people need their medications. For value and income in healthcare, Bristol Myers offers a wide margin of safety and a forthcoming pipeline that investors are under-appreciating.

Real Estate & Materials: Niche Opportunities 🏭🏢

Our final picks come from two sectors we classify as neutral but promising in specific niches – industrial real estate (a subset of real estate) and gold royalties (materials). Both picks are deeply undervalued and relatively insulated from the consumer softness:

- Rexford Industrial Realty (REXR) – Industrial warehouse REIT. Rexford specializes in warehouse and logistics properties in Southern California – a land-constrained, high-demand market for distribution centers. The e-commerce boom and reshoring trends keep demand high for industrial space. REXR is a high-quality REIT (86/100) that weathered the pandemic well, but its stock sank with rising interest rates. Now it trades at ~52% of fair value and yields 4.6%. With occupancy ~98% and strong rent growth on lease rollovers, Rexford should continue to post solid cash flow gains. As the market starts anticipating eventual Fed rate cuts, REITs like Rexford could rally. You get a growing stream of income and a play on the logistics economy at a bargain price here.

- Royal Gold (RGLD) – Gold royalty company. Royal Gold isn’t a miner itself – it finances mines in exchange for royalty streams on production. This asset-light model yields very high margins and lower risk than owning mines. RGLD shares are about 48% undervalued and pay a 1% dividend. Gold prices have held up reasonably well around $1,900/oz; if inflation stays elevated or economic fears return, gold could climb (providing optionality for RGLD). But even at flat gold prices, Royal Gold’s existing royalty portfolio (over 180 properties) delivers steady cash, and new projects coming online will drive growth. It’s rated Very Strong Buy in our system. Royal Gold offers a low-risk way to get gold exposure – a useful diversifier should market volatility spike – while also being a fundamentally undervalued stock on its own merits.

Table: 20 Stocks Positioned to Outperform in H2 2025 (with sector and key thesis)

| No. | Company (Ticker) | Sector | Thesis Summary |

|---|---|---|---|

| 1. | MarketAxess (MKTX) | Finance | Electronic bond trading leader, ~47% undervalued, poised to benefit from bond market stabilization and higher rates. |

| 2. | T. Rowe Price (TROW) | Finance | Asset manager with 5% yield, strong balance sheet; deep value play on market recovery and AUM growth. |

| 3. | Globe Life (GL) | Finance | Life insurer gaining from higher interest income; steady 6% earnings growth, undervalued and financially solid. |

| 4. | Adobe (ADBE) | Technology | Software giant integrating AI; high-margin subscription model with pricing power, ~34% below fair value. |

| 5. | Salesforce (CRM) | Technology | Cloud CRM leader refocusing on profit; 45% undervalued with double-digit growth and AI tailwinds. |

| 6. | Global Payments (GPN) | Tech/FinTech | Payments processor with robust cash flows; ~68% undervalued, fits Wells Fargo’s favored high-margin finance theme. |

| 7. | Alphabet (GOOGL) | Communications | Google’s core ads and cloud are resilient; large-cap AI leader with pricing power, trading ~25% under fair value. |

| 8. | Meta Platforms (META) | Communications | Social media titan with renewed efficiency; still ~20% undervalued, strong ad business plus upside from new apps. |

| 9. | Comcast (CMCSA) | Communications | Broadband & media conglomerate at ~50% discount; stable internet revenues, 3.7% yield, and potential media recovery. |

| 10. | Lockheed Martin (LMT) | Industrial/Defense | Top defense contractor benefiting from geopolitical spending; not deeply undervalued but high-quality income and stability. |

| 11. | Uber Technologies (UBER) | Industrial (Transport) | Rideshare/delivery leader finally profitable; ~55% undervalued, strong growth and insulated from tariffs. |

| 12. | Robert Half (RHI) | Industrial | Staffing firm with 5.5% yield, ~45% undervalued; a cyclical rebound play if hiring picks up into 2025. |

| 13. | Chevron (CVX) | Energy | Oil & gas major (4.6% yield) trading ~18% below fair value; inflation hedge with integrated operations and shareholder-friendly policies. |

| 14. | EOG Resources (EOG) | Energy | High-quality shale producer about 30% undervalued; efficient operations and strong returns even at moderate oil prices. |

| 15. | AES Corp (AES) | Utilities | Global utility/renewables at ~73% discount; 6.3% yield, real asset exposure and upside as renewable projects come online. |

| 16. | NextEra Energy (NEE) | Utilities | Leading renewable-focused utility ~25% undervalued; growth in clean energy plus defensive characteristics, set to rebound if rates ease. |

| 17. | Illumina (ILMN) | Healthcare | Genomics leader ~68% undervalued; temporary setbacks priced in, long-term demand for DNA sequencing supports recovery. |

| 18. | Bristol Myers Squibb (BMY) | Healthcare | Big Pharma with 5.3% yield at ~50% discount; pipeline and acquisitions to offset patent cliffs, offering value and income. |

| 19. | Rexford Industrial (REXR) | Real Estate | Warehouse REIT ~52% undervalued; high occupancy and rent growth, well-positioned for e-commerce and eventual rate relief. |

| 20. | Royal Gold (RGLD) | Materials | Gold royalty company ~48% undervalued; low-risk exposure to gold prices, strong margins and growth from new mining projects. |

Leave a comment