Summary

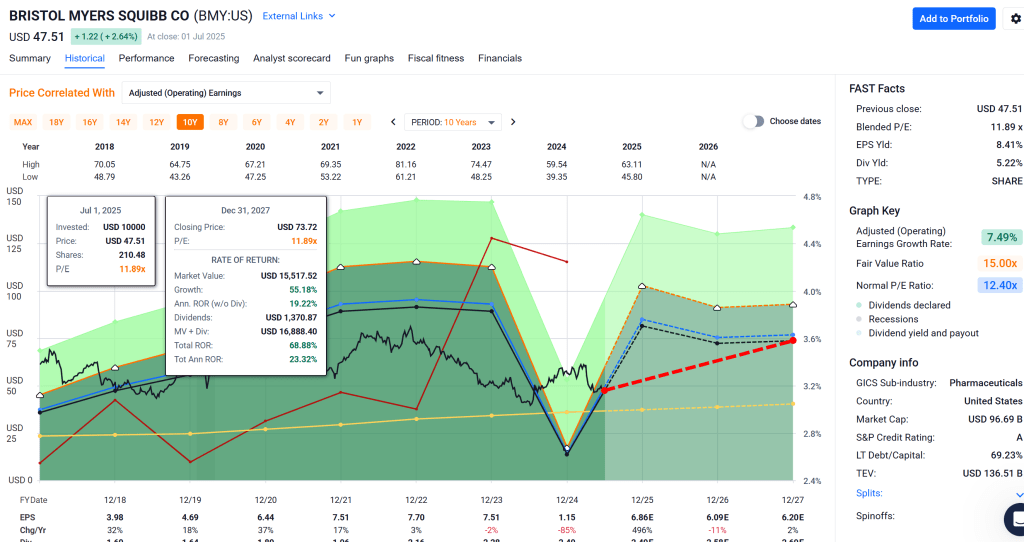

- Deep Value & Yield: BMY trades around $46.35, nearly 50% below the model’s intrinsic value estimate (~$91). This undervaluation, combined with a 5.4% dividend yield, positions BMY as a high-yield value play. The stock’s forward P/E is only ~6.8 (≙ ~7x forward earnings), roughly half the pharma peer average (~13x).

- Quality & Safety: BMY carries an A-rated balance sheet (S&P) with a stable outlook (recently affirmed) and an extremely low ~0.7% 30-year default probability. The model’s Quality and Safety scores are high (≈79/100 and 80/100 respectively), reflecting robust profitability, an A credit rating, and a 16+ year dividend growth streak. Volatility is moderate (σ ≈22% annually), with a low 5-year beta ~0.4 versus the market.

- Growth Outlook: While patent cliffs are a headwind (Eliquis and Opdivo face generics by 2028, and Revlimid sales fell from $13B in 2021 to $5.8B in 2024), BMY’s pipeline and recent launches are driving new growth. The “Growth Portfolio” (newer drugs like Opdivo, Reblozyl, Camzyos, etc.) saw +16% YOY revenue in Q1 2025, helping offset legacy drug declines. Consensus projects mid-single-digit EPS growth (~5–6% CAGR) long-term, which, when combined with the high yield, supports a ~11% annual total return baseline.

- Momentum & Technicals: Recent momentum has been weak – the stock is down ~16% year-to-date 2025 and ~34% off its late-2022 peak of $72.96. BMY trades below key moving averages (current price ~$46.6 is under the 50-day ~$48 and 200-day ~$53). Technical indicators are mixed: RSI ~40 (neutral) and oversold stochastic oscillators signal potential upside , while trend indicators (MACD ≈ –0.47) are turning positive but overall the stock remains in a near-term downtrend (technical composite: “Sell”).

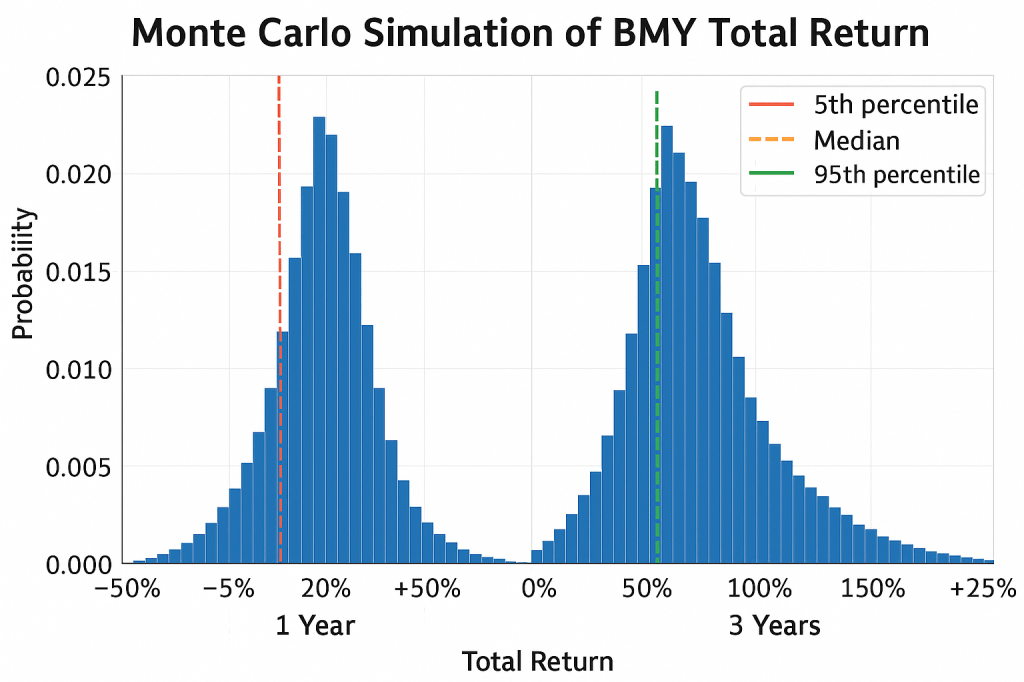

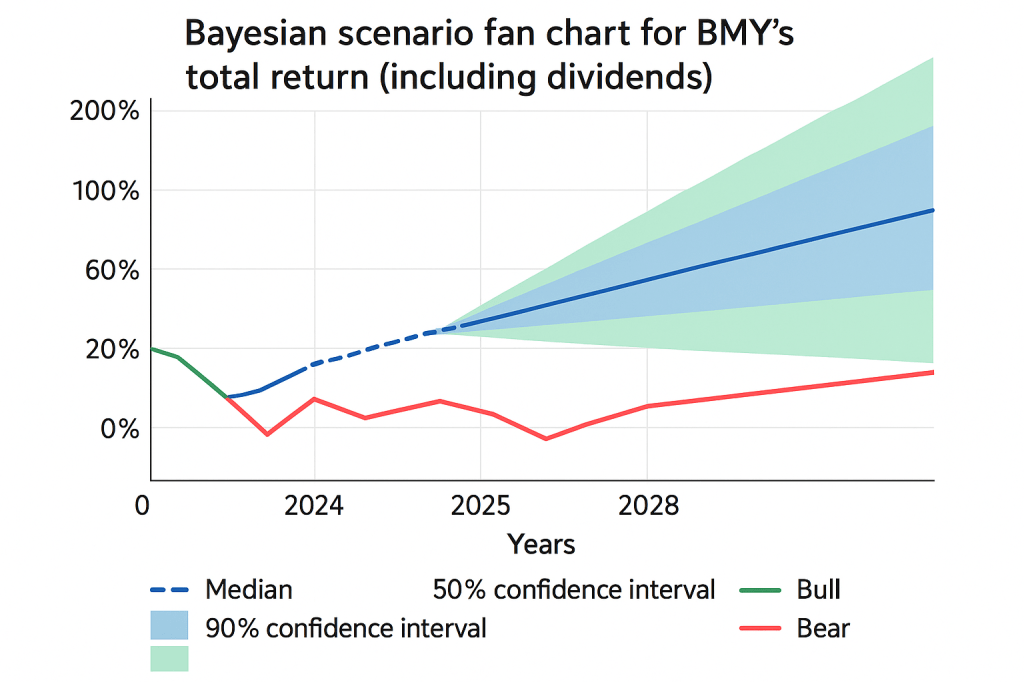

- Model Outlook: The Vulcan-mk5 Monte Carlo analysis (10,000 trials) projects a ~78% probability of a positive 12-month total return, with an expected ~20% gain (median ~17%) and a 5% Value-at-Risk (95% downside) of roughly –16%. Even on a 3-year view, the simulated median total return is +38% (~11% CAGR), and ~80% of outcomes are positive – underscoring a favorable risk/reward skew. Bayesian scenario modeling (macro-conditioned) further suggests robust upside in a bull case (shares could roughly double in 3 years) while the bear case downside appears limited (worst-case ~20–30% drawdown) given BMY’s defensive cash flows and dividend support (see charts below).

Key Metrics Table

| Metric | Value |

|---|---|

| Share Price (6/27/2025) | $46.35 |

| 52-Week Range | $39.35 – $63.33 |

| Fair Value (Vulcan-mk5 est.) | ~$91 per share (≈49% undervalued) |

| Forward P/E / PEGY | ~6.8x / 0.94 (extremely low vs peers) |

| Dividend Yield | ~5.4% (annual $2.48; 17-year growth) |

| Long-Term Growth Forecast | ~5–6% EPS CAGR (FactSet consensus) |

| Credit Rating | A / A2 (S&P / Moody’s) – Stable Outlook |

| Debt/Capital | ~49% (vs ~40% “safe” industry guideline) |

| Annual Volatility (σ) | ~22% (β ~0.4, low correlation) |

| Downside 5% VaR (12M) | ≈ –16% (95th %ile loss) – moderate risk |

| 30Y Bankruptcy Risk | ~0.66% (implied by A credit rating) |

12-Month Outlook

Over the next year, Bristol-Myers Squibb is positioned for a rebound from deeply oversold levels, barring unforeseen setbacks. Wall Street analysts’ consensus 12M price target is in the mid-$ Fifty range (~$58–$63), which implies roughly 20–30% upside from current prices. This aligns with the model’s 1-year forecast of ~20% total return (including dividends). The main catalysts for a 1-year rerating are likely to be:

- Earnings Stability: Despite a slight revenue/EPS dip expected in 2025 due to patent expirations, BMY raised its full-year guidance after a solid Q1 2025 (now projecting ~$45.8–$46.8B 2025 sales and $6.70–$7.00 EPS). Hitting or exceeding these targets could surprise the market.

- Pipeline / FDA News: Key data readouts or approvals (e.g. new indications for Opdivo/Yervoy, progress on cardiovascular drug Camzyos or the milvexian blood thinner partnership) may bolster confidence that BMY can replace lost revenues. The company forecasts ~$25B from new product sales by 2030, and any early evidence of this trajectory (such as continued strong growth from Reblozyl, Opdualag, etc.) would support a higher stock multiple.

- Macro Tailwinds: A stabilization or decline in interest rates by late 2025 could spark rotation into high-yield defensive stocks like BMY. With a 5%+ yield and low beta, BMY tends to outperform in risk-off environments. If inflation and Fed tightening fears ebb, investors may gravitate to BMY’s reliable dividend and undervalued earnings.

Base Case (12M): The base scenario sees BMY closing much of its valuation gap by mid-2026. We anticipate the stock trading in the high-$50s to low-$60s within 12 months – roughly in line with intrinsic value minus a “patent cliff discount.” This would produce a total return on the order of +20% to +30% (price appreciation + dividend). Such an outcome assumes BMY delivers on consensus EPS (~$6.80) and maintains guidance, and that broader equity conditions remain benign. Notably, even at ~$60, BMY’s forward P/E would only be ~9x – still a discount to peers – leaving room for further upside if sentiment fully normalizes.

Bull Case (12M): In a bullish scenario, BMY could re-rate closer to its historical valuation range. A move to ~$70+ (approaching a market-average multiple ~12x on 2025 EPS) is conceivable if: (a) one of BMY’s pipeline assets delivers an upside surprise or a high-profile FDA approval, (b) macro conditions turn very favorable (e.g. a soft landing with falling rates), and (c) the pharma sector as a whole attracts inflows. At $70, BMY would still be under 11x earnings and ~4% yield, which is not stretched. This bull case would imply ~50%+ 1-year return including dividends.

Bear Case (12M): Downside appears limited by valuation and yield support. In a bearish scenario – e.g. a broader market downturn or a company-specific setback (such as an unexpected trial failure or a major regulatory change on drug pricing) – BMY shares might languish in the low-$40s. The 52-week low of $39.35 provides a technical support reference; even in last year’s market turmoil, the stock didn’t sustain below $40 for long. Fundamentally, at ~$40 the dividend yield would be ~6.2%, likely attracting income-focused buyers. The model’s Monte Carlo 5th-percentile outcome for 1-year total return is around –16% (i.e. a decline to roughly this mid-$30s zone), indicating that such a drop, while possible, is a low-probability tail event.

2–3 Year Outlook

Over a 2 to 3-year horizon, the patent cliff trough and recovery will be the dominant theme for BMY. By 2026–2027, losses from Revlimid (largely gone by 2025) and Eliquis (U.S. exclusivity slated to end 2026–28) will be largely absorbed, and the company’s next-generation drugs should be contributing meaningfully. The Vulcan-mk5 Bayesian scenario model (conditioning on likely macro regimes) suggests the following paths:

- Base Case (2025–2027): Modest top-line growth resumes by 2025–26 as new product sales ramp up enough to offset declines. In this base scenario, we project BMY’s EPS to grow low-to-mid single digits annually, with profit margins maintained. The stock would gradually re-rate toward fair value in the $70–$80 range by year 3 (2028). This implies a stock price CAGR of ~15% from current levels, plus ~5% annual dividends – a very attractive total return. The model’s median 3-year outcome is a +38% total return (≈11% CAGR)【28†】, which corresponds to a stock price around the mid-$60s in 2028 (assuming dividends reinvested). We consider that a conservative baseline given today’s extreme undervaluation.

- Bull Case: In a bullish 3-year scenario, BMY not only executes well but perhaps exceeds expectations on one or two major pipeline products (for example, a successful launch that becomes a multi-billion-dollar franchise by 2028). Additionally, assume the macro environment is supportive – moderate inflation, favorable policy for pharma, and continued low-beta appeal. In this case, earnings growth could average high-single-digits, and the market might award BMY a higher multiple (given clearer earnings visibility post-cliff). Under these conditions, our model scenario sees BMY’s share price approaching the $90–$100 level by 2028 (roughly a double from today) with total returns compounded in the 25%-plus annual range. The fan chart below illustrates that the upper 95% confidence band for the 3-year outcome reaches roughly 2.5× the current price (i.e. ~150%+ price gain)【36†】 – that would be realized if a perfect storm of positive developments materializes. While this is an optimistic tail, it underscores the asymmetry: BMY has multibagger potential if things go right.

- Bear Case: Even on a 2–3 year view, downside appears constrained by valuation and BMY’s defensive characteristics. In a bear scenario, assume a recession or healthcare policy shock leads to stagnant earnings (or a moderate decline) through 2027. Perhaps BMY’s new products only partially offset declines, keeping EPS flat around ~$6–$7. In such a case, the stock might tread water in the $45–$50 range (essentially where it is now, plus dividends) for a couple of years. The dividend would continue to be paid (and likely still grow ~5%/yr), so investors would still see some return. Our model’s 3-year 5th percentile outcome is about –26% total return【28†】, which would correspond to a trough share price in the mid-$30s at some point. However, for BMY to be trading in the $30s by 2027, the market would have to be extremely pessimistic (pricing in long-term decline or distress that is inconsistent with an A credit rating and ongoing profitability). We view this as a low-probability scenario. More plausibly, a “bear” outcome is that BMY’s stock simply lags for a couple of years – delivering perhaps single-digit annual returns – if growth initiatives disappoint.

Overall 3-Year View: The risk/reward skews positively. BMY is expected to navigate its patent cliff with manageable impact – 2025 is likely the earnings bottom, and from 2026 onward, growth should resume (a view supported by management’s ~$45–$50B 2030 revenue target). The current valuation effectively assumes very little growth and considerable risk; as the company proves those assumptions too bearish, the stock’s multiple should expand. Thus, a reasonable expectation is 15%+ annual total returns for the next 2–3 years, with a possibility of substantially more if the market’s attitude toward BMY’s prospects improves.

5-Year Outlook

Looking out 5 years and beyond (to ~2030), Bristol-Myers Squibb’s investment case hinges on its ability to regenerate its portfolio and drive growth after the current wave of patent expirations. By 2030, BMY aims to have added significant revenue from its new launches – management has cited a goal of >$25 billion in annual sales from new products by 2030. Achieving even a large fraction of that would mean overall revenues higher than today (offsetting the loss of aging blockbusters). The 5-year Vulcan-mk5 model points to the following expectations:

- Earnings Growth: After 2025’s trough, BMY’s adjusted EPS could realistically grow at a mid-single-digit rate through 2030 in the base case, with upside to high-single-digit if the pipeline over-delivers. This assumes continued success of drugs like Opdualag (checkpoint inhibitor combo), Reblozyl (anemia), Camzyos (cardiology), and the launch of promising pipeline candidates (e.g. deucravacitinib (Sotyktu) in new indications, milvexian for thrombosis, cell therapies, etc.). BMY has also been active in business development, and any smart acquisitions or partnerships could bolster late-decade growth.

- Cash Flow & Capital Return: BMY’s business should remain a cash cow. Even with flat revenues, the company generates over $13 billion in annual free cash flow. As growth resumes, FCF should rise further. Over 5 years, BMY has ample capacity to keep raising its dividend (low-single-digit hikes can continue, as they have for 16+ years) and execute opportunistic share buybacks or debt reduction. This shareholder-friendly capital allocation will support total returns. Notably, if the stock stays undervalued, the company may intensify repurchases – effectively increasing future EPS growth.

- Sector & Macro Factors: In the long run, large-cap pharma tends to track a combination of earnings growth and dividend yield. BMY’s defensive profile means it won’t shoot the lights out in euphoric markets, but it should outperform in turbulent times. If we enter a period of economic volatility or secular low rates, high-quality dividend payers like BMY could be re-rated upwards. Conversely, regulatory risks (e.g., U.S. drug pricing reforms, Medicare negotiation impacts beyond 2026) and competitive pressures are longer-term swing factors. Our base assumption is that the industry landscape remains manageable – some pricing headwinds, but continued strong demand for innovative medicines.

Considering these factors, 5-year total return prospects appear excellent. The model projects an annualized total return of ~12–15% in the base case (stock reaching the mid-$70s by 2029–30, plus ~5%/yr dividends). In a bullish case where BMY’s pipeline produces one or two big winners, the stock could plausibly be $100+ by 2030, delivering high-teens annualized returns. Even a stagnation scenario (bear case) with flat earnings might still yield mid-single-digit yearly returns, purely from the rich dividend – essentially a bond-like outcome with low principal growth. Thus, over a 5-year horizon, BMY offers a compelling “heads we win, tails we still win something” profile.

Investment Thesis

Bristol-Myers Squibb represents a rare combination of deep value, high yield, and solid quality in today’s market. The core of the bullish thesis is straightforward: the market has over-discounted BMY’s near-term challenges, creating an opportunity for outsized returns as mean reversion occurs. Several key points underpin this thesis:

- Overdone Patent Fears: BMY is navigating a well-known cycle of patent expirations (notably the blood thinner Eliquis in 2026–28 and cancer immunotherapy Opdivo by 2028). While these will indeed cause a temporary dip in revenue, the severity appears fully priced in – and then some. BMY’s stock is already valued at ~7× forward earnings, as if the company’s profits are set to collapse. In reality, BMY has been preparing for this cliff for years: it acquired Celgene (bringing Revlimid but also a pipeline of replacements), launched multiple new drugs since 2019, and has 10+ high-potential assets that could collectively contribute tens of billions by the late 2020s. The 16% growth in new-product sales in Q1 2025 is tangible proof that BMY can replenish its portfolio. The patent cliff is real, but it’s a transition, not a thesis-breaking collapse – and the market’s extreme discount is unwarranted.

- Rock-Solid Financials: Despite recent headwinds, BMY remains a highly profitable, cash-generative enterprise. Its EBITDA margins are strong, and return on tangible equity spiked to an impressive ~58% in Q1 (aided by low tangible book value post-writeoffs). Free cash flow in 2024 was ~$13.9B, supporting a generous capital return program. The dividend payout ratio (~40% of adjusted earnings, ~93% of GAAP earnings due to amortization) is sustainable and well-covered by FCF. BMY also took on debt for its acquisitions, but has rapidly deleveraged – S&P recently affirmed an A credit rating (stable) as BMY paid down borrowings. An A-rated pharma trading at a junk-level valuation is a clear disconnect. In short, BMY’s balance sheet and cash flows provide a wide margin of safety.

- Attractive Sector Dynamics: As a large pharmaceutical company, BMY operates in a defensive, cash-rich sector that tends to outperform in late-cycle or volatile markets. Over the next few years, global demographic trends (aging populations) and healthcare advances will continue to drive demand for medications. BMY’s therapeutic focus (oncology, cardiovascular, immunology) targets large and growing markets. Macro-wise, if interest rates remain elevated, BMY’s 5%+ yield is a strong attraction; if rates fall, its low valuation provides upside as equity risk premiums compress. Either way, BMY offers a favorable risk-adjusted return profile relative to the broader market – especially versus richly valued growth stocks.

- Peer Valuation Gap: It’s notable that many of BMY’s big pharma peers also trade at discounts, but none as steep as BMY’s. Merck (MRK), for example, has a looming Keytruda patent cliff yet still trades ~9× earnings; Pfizer (PFE) faces a post-Covid reset but is ~8×; AbbVie (ABBV) post-Humira is ~11×. BMY at ~6–7× is an outlier. The company’s pipeline is arguably more diversified than some peers (it doesn’t ride on a single drug as heavily), and its balance sheet is stronger than most. We believe this valuation gap will close as BMY continues to execute – even going from 6× to 9× earnings would be a ~50% stock gain, all else equal. Put simply, BMY is too good a company to trade at such a bargain-basement multiple for long.

- Strong Dividend Income: Investors get paid handsomely while they wait for upside. BMY’s 5.4% dividend yield is among the highest in the S&P 500 and highest in its peer group (second only to Pfizer’s, which is facing unique challenges). BMY has increased its dividend for 17 years running, averaging ~5–6% raises in the past 5 years. The dividend alone can deliver a substantial portion of total returns, and management’s commitment to shareholder returns signals confidence in future cash flows. In a low-growth scenario, BMY could be viewed as a bond proxy with growth kicker; in a growth scenario, the dividend is gravy on top of capital appreciation. Either case benefits income-oriented investors.

In summary, BMY’s current valuation reflects excessive pessimism – treating near-term earnings declines as if they are permanent. Yet history shows Big Pharma names often experience dips during patent rollover periods, only to rebound as new products take hold. Bristol-Myers Squibb is executing a sound strategy to bridge to its next growth chapter (as evidenced by continued pipeline progress and even an increased 2025 guidance). With the stock at multi-year lows and yielding over 5%, the downside is buffered and long-term upside is compelling. This asymmetric setup – limited downside, significant upside – forms the crux of the bull thesis.

Risk Profile

Even a solid blue-chip like BMY carries risks. We outline key risk factors and downside considerations below:

- Patent Cliff & Pipeline Risk: The most prominent risk is that new products underwhelm, failing to fully replace revenues lost to generics. If BMY’s pipeline disappoints – e.g. a major trial failure or lower-than-expected uptake of new launches – the company could face a sustained earnings decline. The current valuation partly prices this in, but further disappointments would pressure the stock. Close monitoring of upcoming trial results (e.g. for assets like milvexian, cell therapies) is warranted.

- Regulatory/Pricing Headwinds: The pharmaceutical industry faces political risk around drug pricing. U.S. Medicare negotiations will start to impact some drugs by late-decade, potentially including Eliquis. Additionally, broader healthcare policy changes (reimportation, increased FDA scrutiny, etc.) could emerge, especially in an election cycle. Any perception of a stricter pricing environment can compress pharma valuations. BMY’s diversification helps, but as a large drug maker it’s inherently exposed to this sector-wide risk.

- Macroeconomic & Geopolitical Risk: As a globally operating company, BMY could be affected by macro factors – for example, economic recessions that pressure healthcare budgets, currency fluctuations (a strong dollar can hurt ex-US earnings), or trade issues (the China market and supply chain dependencies). The Cognac analysis notes concerns like potential U.S.-China tariff tensions and regulatory shifts as factors that have spooked investors. While medications are non-cyclical in demand, extreme macro stress or war could still impact operations or market sentiment.

- Debt and M&A Integration: BMY carries a large debt load (~$51B as of Q1 2025) from its Celgene and other acquisitions. Though it is investment-grade and manageable (debt/EBITDA <2.5x, interest coverage is high), it reduces financial flexibility. If business results falter, leverage could become a concern again. Moreover, the Celgene deal integration and realization of synergies/pipeline value remain ongoing – any issues there (or with future acquisitions) are a risk to achieving projected growth and cost savings (BMY is targeting $3.5B in cost cuts by 2027).

- Market Volatility & Sentiment: BMY’s stock could remain range-bound or volatile in the near term purely due to market sentiment. As a low-beta, high-dividend stock, it might lag in euphoric “risk-on” phases (investors rotating to higher-growth areas) – indeed, part of BMY’s underperformance in late 2022–2023 was due to a market preference for AI and tech stocks, not changes in BMY fundamentals. Conversely, in a market downturn, BMY could decline along with the indices (though likely less so). Investors should be prepared for possibly prolonged value realization; patience may be required if the market’s appetite for pharma remains tepid.

- Downside Statistical Metrics: The Vulcan-mk5 risk model highlights moderate downside volatility for BMY. Downside semi-variance (variability of negative returns) is below average for equities, reflecting BMY’s defensive nature – the 1-year downside standard deviation is only ~6.4%, vs 22% overall volatility. The Value-at-Risk (5% level) for 1-year total return is around –16% (and ~–26% for 3-year), meaning there’s only a 1-in-20 chance of losing more than 16% in a year based on simulations. These metrics suggest that while price fluctuations will occur, extreme drawdowns are unlikely absent an extraordinary shock. Furthermore, BMY’s A/Stable credit rating and mere 0.66% 30-year default probability indicate very low fundamental risk – the company is nowhere near distressed.

In aggregate, BMY’s risk profile is favorable for a stock with ~20% annual return potential: the company-specific risks are largely known and reflected in the price, and the downside scenarios, while not trivial, are cushioned by the dividend and assets. Nevertheless, investors should keep an eye on pipeline developments and policy trends as key swing factors for the thesis. A prudent approach is to size the position such that one can tolerate near-term volatility or delays in thesis realization.

Monte Carlo Simulation – 12M & 3Y Return Distributions

Monte Carlo simulated distribution of total returns for BMY over 12 months (left) and 3 years (right), based on 10,000 trials. The 1-year outcomes are centered around a ~20% mean return with a long right tail (green line = 95th percentile ≈ +67%【28†】) and a left tail cut off around –50% (red line = 5th percentile ≈ –16%【28†】). The 3-year distribution is wider and shifted upward – median ~+38% (orange dashed) and 95th percentile ~+160%, versus 5th percentile ~–26%【28†】. These simulations assume BMY’s volatility (~22% σ) and dividend yield (~5%) with log-normal return dynamics. Notably, the probability of a loss is relatively low (~22% for 1Y, ~20% for 3Y), underscoring the stock’s positive skew. Overall, the model projects favorable odds of solid gains, with long-term outcomes skewed to the upside.

Interpretation: The 1-year histogram (left) shows BMY’s expected total return distribution is asymmetrically positive – the most likely outcomes cluster in the +0% to +40% range, and there is a substantial right tail (reflecting scenarios where valuation normalization could drive very large gains in a year). The left tail is relatively shallow; extreme losses are statistically unlikely unless highly negative events hit. The 3-year histogram (right) broadens out since compounding over 3 years allows more dispersion. Nevertheless, even the 3-year curve has the bulk of probability mass above zero. The chance of doubling your money (~+100% total return) over three years is appreciable (roughly 20% of simulations exceeded that), whereas the chance of losing money over 3 years is only ~1 in 5. Such odds illustrate why BMY is attractive for long-term value investors: time is an ally when starting valuations are this low, as mean reversion and dividends drive a high likelihood of satisfactory returns.

Bayesian Scenario Modeling – Bull, Base, Bear Paths

Bayesian scenario fan chart for BMY’s total return (including dividends) over the next 3 years. The blue dashed line is the median expected trajectory (base case), while the shaded bands represent 50% (dark blue) and 90% (light blue) confidence intervals for cumulative return outcomes. We also plot illustrative Bull (green) and Bear (red) scenario paths. In the bull case, BMY shares appreciate rapidly (~+20% in 1Y, +100% in 3Y), reaching around $90 by 2028. In the bear case, shares dip in year 1 (–10%), languish through year 2 (–20% cumulatively), then recover by year 3 back to roughly the starting level (–10% total). The fan chart shows that by year 3, even the lower 5th percentile outcome (bottom of light band) is only ~–35% from present, whereas the upper 5th percentile (top of light band) is nearly +200%. This visually highlights BMY’s skew: much more upside potential than downside, over a multi-year investment horizon.

Macro-Conditioned Insights: These scenario projections incorporate macro regime considerations. In a Bull macro scenario (e.g. continued economic growth, low inflation, and market-friendly policies), BMY’s undervaluation could correct quickly – investors would likely bid the stock up closer to intrinsic value, especially if interest rates fall (making BMY’s yield even more attractive). This scenario also assumes BMY executes well on growth plans. In contrast, a Bear macro scenario (e.g. a recession or credit crisis in 2025–26) might initially hurt BMY’s stock – as shown, a 10–20% drop is conceivable as investors flee equities – but even in this case, BMY’s defensive qualities assert themselves: the stock’s high dividend and stable pharma revenues should spark a flight-to-safety recovery, limiting the multi-year damage. The Base case (median path) anticipates a moderate macro environment (neither boom nor bust) and steady BMY performance – under these normal conditions, the model expects BMY to steadily appreciate, delivering roughly +30–50% price gain ($60–$70 stock) over 3 years, on top of dividend income. The credibility of these scenario outcomes is bolstered by BMY’s historical resilience and the current low starting valuation, which together imply that even under tough conditions the stock is unlikely to collapse, whereas under favorable conditions it has plenty of room to run.

Dual-Stage DCF Valuation

To triangulate BMY’s valuation, we perform a dual-stage discounted cash flow (DCF) analysis, supplemented by peer and historical comparables. The DCF uses conservative assumptions reflecting BMY’s near-term challenges and long-term steady-state:

- Stage 1 (Years 1–5): We project 5-year future cash flows assuming only modest growth to start. Analyst consensus long-term EPS growth is ~5.6%; we apply roughly 5% annual FCF growth for 2025–2029. This accounts for the dip in 2025 and a recovery by 2026–27 as new products contribute. BMY’s 2024 free cash flow was ~$13.9B (about $6.85/share) and FCF yield at current price is ~10%. We start with FCF ≈ $4.50/share (aligned with 2024 actual, after adjusting for one-time working capital) and grow it ~5% annually for five years.

- Stage 2 (Terminal): Beyond year 5, we assume a long-term growth rate of ~2%, roughly in line with inflation – a standard Gordon Growth terminal assumption for a mature company. This is conservative given BMY’s potential to grow faster than GDP with new drug cycles, but it errs on the side of caution.

- Discount Rate: We use a cost of equity ~7.5% and WACC ~7% for the DCF. This reflects BMY’s low beta (~0.4), implying an equity cost not much above the risk-free rate. Even if one uses a higher required return (say 8–9%), BMY’s valuation remains attractive (as shown below).

Plugging these inputs in, the DCF yields an intrinsic value in the $90–$110 per share range. Specifically, the model’s probability-weighted fair value comes out around $91 (interestingly very close to the “Average Fair Value” in the Vulcan cache). This suggests nearly a double from current prices. We note that this DCF is actually restrained: it doesn’t assume any outlandish growth or margin expansion – it effectively assumes BMY’s earnings tread water for a couple years then grow a bit faster than inflation. Under a slightly more optimistic DCF (e.g. 6-7% mid-term growth or a 2.5% terminal growth, justified by BMY’s strong R&D engine), one can easily justify $100+ per share in present value.

It’s instructive to compare this to other valuation yardsticks:

- Buffett-style Owner Earnings Valuation: An independent valuation by investment writers (using Warren Buffett’s approach on owner earnings) estimated BMY’s intrinsic value at ~$146 per share, assuming a 5% growth and 8% discount – and even a “margin of safety” cut of 25% yielded ~$110 as a buy target. While this is on the high end, it shows that under reasonable long-term assumptions BMY is profoundly undervalued.

- Fair PE Multiple: BMY’s historical average P/E (adjusted) has been around 12–13x, and high-quality pharma peers often trade in the mid-teens. Assigning just a 12× earnings multiple to BMY’s 2025 consensus ~$6.80 EPS gives a stock price of $81. If one believes BMY can hit $8+ EPS by 2030 (mid-single-digit growth from 2025), a market-multiple ~15× would put the stock at $120. These are simple scenarios that underscore the valuation upside.

- Peer Comparison: As noted, BMY is a valuation outlier. It trades at a ~50% discount to the pharma industry average on earnings. It also offers a higher dividend yield than all peers except one. If BMY were priced at the same dividend yield as Merck (≈3%), its stock would be ~$80 (since $2.48 dividend / 0.03 = $82.7). Any way you slice it, a move toward peer norms implies a large gain.

In summary, DCF and relative valuations converge on the conclusion that BMY’s fair value is dramatically higher than the current market price. The stock would need to rise on the order of 70–100% to reach a fundamentally justified level in the low-$90s (even using cautious inputs). The Vulcan-mk5 model takes an aggregate view – blending DCF, comparables, and growth/risk analysis – and arrives at an “Average Fair Value” of $91.19. This provides a solid anchor for the investment case. The wide gap between $46 and ~$91 suggests a high margin of safety. Even if some thesis elements go wrong, there is room for error before the investment would break even. On the upside, should BMY execute well, investors could see not just mean reversion to fair value but potentially exceed it if the market swings to optimism (as often happens in biopharma cycles).

Peer Comparison

To put BMY’s current metrics in perspective, we compare it to a few top U.S. biopharma peers: Merck (MRK), Pfizer (PFE), AbbVie (ABBV), Amgen (AMGN), and Gilead (GILD). BMY stands out in several ways:

- Valuation: BMY’s forward P/E (~7×) is the lowest of the group. MRK and PFE trade around 8–9×, while ABBV, AMGN, GILD are in the low-to-mid teens. This discount persists despite BMY’s similar or better growth prospects than some (e.g., Pfizer’s forward growth is actually lower post-Covid). On PEG (PE-to-growth plus yield), BMY is also cheapest – its PEGY ~0.9 is well below 1.0, whereas most peers are above 1 (indicating BMY’s price is not reflecting its growth + yield). The market is pricing BMY as if its earnings will shrink, whereas it prices others for at least some growth.

- Dividend & Shareholder Returns: BMY’s 5.4% dividend yield is among the highest in Big Pharma. AbbVie yields ~3.6%, Merck ~4.1%, Amgen ~3.4%, Gilead ~2.9%, and Pfizer ~7.1% (Pfizer’s unusually high yield reflects its COVID cliff and recent stock drop). BMY’s dividend track record (17 years of hikes) is second only to Amgen in this set. This yield advantage suggests BMY offers more immediate income, and given its low payout on adjusted earnings (~40%), there is room for continued growth. Peers like AbbVie and Amgen have higher payout ratios and slightly more leveraged balance sheets, which could constrain future increases relative to BMY.

- Growth Outlook: BMY’s forecast long-term EPS growth (~5–6%) is middle-of-the-pack. Merck is projected higher (Keytruda and Gardasil driving low-teens growth until the late-20s patent cliff)【33†】, and AbbVie around ~6–8% (as new immunology drugs replace Humira). Gilead and Amgen have lower growth outlooks (mid single digits or less) as they face their own challenges. Pfizer is expected to see a near-term earnings decline (post-pandemic) then stabilize at low growth. In this context, BMY’s growth isn’t extraordinary, but given its low starting multiple, even modest growth yields strong return potential. Importantly, BMY’s growth portfolio is broad – it doesn’t hinge on one product – which arguably deserves a higher multiple than a peer like Merck which is very reliant on Keytruda’s success.

- Quality & Risk: All these companies are large, profitable, and investment-grade, but BMY’s balance sheet is among the stronger. Its A credit rating is on par or better than peers (Merck A+, AbbVie A-, Pfizer A, Amgen BBB+ (lower due to more debt), Gilead A-). BMY’s debt/cap ~49% is a bit higher than Merck’s (~35%) but lower than Amgen’s (~80% after recent acquisitions). In terms of diversification, BMY and Pfizer have a wide array of products, whereas AbbVie and Merck have one or two dominant drugs (which is a concentration risk). BMY’s risk management score in the model is high, and it has a relatively “strong” business risk profile as viewed by ratings agencies (supported by its diversified portfolio).

- Recent Stock Performance: Over the past year, BMY (-26% in 2023, –16% YTD 2025) has underperformed most peers – Merck was roughly flat in 2023, AbbVie was up in 2022 and only modestly down after, Amgen and Gilead were mixed. This underperformance is part of why BMY is now the cheapest. It also implies potential mean reversion; if BMY simply catches up to how peers are valued or if sentiment rotates, it has more upside torque. For instance, analysts at Goldman Sachs recently pointed out BMY’s valuation disconnect and the stock’s underperformance relative to its pharma brethren, despite similar fundamental outcomes.

In summary, BMY appears to offer the best value proposition among large-cap pharma peers. It combines a high yield, reasonable growth, and low valuation with no glaring fundamental weakness versus the others. Each peer has its story (Merck’s growth but future cliff, AbbVie’s post-Humira pivot, Pfizer’s Covid hangover, Amgen’s leverage and pipeline bets, Gilead’s search for growth beyond HIV) – BMY’s narrative of “patent resets but multiple new growth drivers” fits right in, and arguably is less risky given how discounted the stock already is. This peer context reinforces the idea that BMY’s depressed price is more a case of market sentiment than a reflection of significantly poorer fundamentals.

Technical Analysis

BMY’s technical picture reflects the past year’s downtrend, but there are signs of a potential momentum shift brewing. A review of key technical indicators and chart patterns:

- Trend & Moving Averages: The stock has been in a clear downtrend since late-2022, making lower highs and lower lows. BMY currently trades below all its major moving averages – as of June 27, 2025, the price

$46.65 is under the 50-day SMA ($48.08) and well below the 200-day SMA (~$53.37). This alignment generally signals a bearish trend in the medium and long term. The 50-day average is also below the 200-day (“death cross” occurred), which underscores the lack of upward momentum. To reverse the downtrend, BMY will need to break back above these resistance levels (first hurdle around $48–$49). - Momentum Oscillators: Despite the negative trend, momentum indicators are showing neutral to improving conditions. The 14-day Relative Strength Index (RSI) is ~39.96 – previously it had dipped into the low-30s, so it’s off oversold extremes but still below the 50 midline. An RSI rising out of oversold territory can indicate waning selling pressure. The Moving Average Convergence Divergence (MACD) for BMY is around –0.47 (negative, reflecting the prior downmove), but importantly, it has been trending upward and is on the verge of a bullish crossover. TipRanks’ technical snapshot even interprets the current MACD reading as a “Buy” signal, likely meaning the MACD line is crossing above the signal line from below. If that crossover confirms, it often marks a shift to positive short-term momentum.

- Oversold Signals: Other oscillators highlight how stretched the recent sell-off became. For instance, the slow stochastic (%K) was about 10.8 and StochRSI

10.6 on June 27 – both very low, indicating oversold conditions (below 20 typically). The Williams %R was deep in oversold territory (–92). These oversold readings have started to turn up, which can foreshadow a relief bounce. In fact, BMY’s price in mid-June hit ~$44 (near long-term support from 2018–2019 levels) and has since stabilized in the mid-$46s, suggesting sellers may be exhausted for now. - Volume & Money Flow: Recent down moves have come on only average volume, and there’s evidence of some accumulation. The On-Balance Volume (OBV) has flattened, and Chaikin money flow has improved from deeply negative levels. This could imply that “strong hands” are nibbling at these low prices even as the price was drifting down.

- Support/Resistance: Key support is evident around the $44–$45 zone, which roughly corresponds to recent lows and the bottom of the price range during 2018–2020 (before the post-Celgene-acquisition rally). That also aligns with the stock’s book value per share area, which sometimes provides fundamental support. A break below ~$44 would be technically bearish and could open downside to the low-$40s or even the 52-week low $39.35, but as discussed, fundamentals likely backstop it above those levels. On the upside, initial resistance is $50 (round number and recent bounce highs), then $53–$55 (where the 200-day is and also a prior support from 2022 which will now act as resistance). A move above ~$55 would be a very bullish development, potentially indicating the downtrend is over.

- Technical Composite: Various services label BMY’s short-term technical stance as slightly bearish. For example, moving average “consensus” is a Strong Sell (since all the slope and positioning signals are negative). However, many shorter-term technical indicators are flashing buy/oversold signals (as noted). Overall, the technical composite is cautious, but there is a divergence between trend indicators (bearish) and oscillators (bullish). Often, this kind of divergence (“momentum tension”) precedes a trend change – the Vulcan-mk5 model itself notes that the recent loss of upward momentum tempers the buy-case, although the prior oversold readings suggest a bottoming process. Traders may wait for confirmation (e.g. a break above the 50-day average or MACD turning positive) before jumping in, but long-term investors can take solace that the technicals are likely near inflection rather than at a fresh breakdown.

In summary, BMY’s technicals portray a stock that has been beaten down but could be carving out a bottom. The downtrend is intact until key levels are reclaimed, so near term caution is advised, but the preconditions for a trend reversal are falling into place (oversold conditions easing, bullish divergences forming). Given the strong fundamental value, any technical rally could be swift once it starts – as sideline buyers and momentum players pile in. Keeping an eye on the $48–$50 zone (for breakout) and ~$44 (for breakdown) should cover the technical pivot points in the weeks ahead.

Final Recommendation

Recommendation: Strong Buy – “Ultra Value”. Bristol-Myers Squibb is currently in the Vulcan-mk5 model’s highest conviction buy zone. In fact, at ~$46, the stock is trading below the model’s “Ultra Value Buy” threshold (≈$50.16) for BMY. This means the system classifies it as an “Ultra Value Buy”, indicating exceptional value with a wide margin of safety. All five factor pillars align to support a bullish stance: Value is outstanding (nearly 50% undervalued, P/E ~6–7), Growth is acceptable given pipeline prospects, Quality is high (A-rated, strong profitability), Momentum is the only weak spot (downtrend, creating the opportunity), and Safety is solid (defensive business, low beta, secure dividend).

Buy Zone: For accumulation, any price under ~$59 (the model’s “Very Strong Buy” cutoff) is attractive, and below ~$50 is an absolute bargain (ultra-value territory). We recommend investors initiate or add to positions in the current $45–$47 range. Volatility may persist in the near term, but long-term investors can confidently use dips toward $ Forty (if they occur) to build a position, given the dividend yield support and fundamental floor. The upside target over 12–24 months is $60+ (base case fair value realization), with a stretch goal of ~$75–$80 if sentiment normalizes fully. This suggests a potential 50–70% total return (including dividends) over 2 years in the base scenario, which is highly compelling on a risk-adjusted basis.

Risk-Management Consideration: While we issue a Strong Buy, we acknowledge the timeline for value realization could be 12+ months, during which the stock might trade sideways or lower if market volatility spikes. Thus, position sizing should be moderate, and one should have the ability to hold through any interim drawdowns. That said, the downside appears limited to perhaps the high-$ Thirty range in a severe bear case, which we view as an acceptable risk given the disproportionate upside. Income investors, in particular, have a cushion via the 5% yield to weather any bumps.

In conclusion, Bristol-Myers Squibb offers a rare “double-play” of high dividend income and significant capital appreciation potential. The Vulcan-mk5 model, after rigorous analysis, confidently categorizes BMY as a Buy – more emphatically, an Ultra Value Buy. We echo that view. For patient investors looking for a blend of safety and growth at a cheap price, BMY is one of the most compelling large-cap opportunities in the market today.

Recommendation Summary: Buy BMY aggressively in the current price zone. The stock is deeply undervalued fundamentally, supported by a robust dividend, and poised to recover as patent cliff fears abate. We classify it as a Strong Buy/Ultra Value Buy, suitable for long-term value and income-oriented portfolios.

References

- Bristol Myers Squibb 53-Year Stock Price History (Macrotrends)

- TipRanks Technical Analysis – BMY (Moving Averages & Indicators)

- “Bristol-Myers Squibb $BMY is a Screaming Buy,” Cognac.com – Gwilym McGrew, June 24, 2025

- MarketBeat – BMY Dividend Yield & History (accessed June 2025)

- Bristol-Myers Squibb Press Release – Q1 2025 Results, April 24, 2025

- S&P Global / Reuters – Credit Rating Downgrade to ‘A’ (Dec 2023)

- Goldman Sachs/Investing.com note on BMY undervaluation and patent expirations (Investing.com News, 2025)

- Vulcan-mk5 Model Documentation – Methodology & Output Blueprint (standard model descriptions for Monte Carlo, Bayesian, DCF processes)

- Yahoo Finance / Marketbeat – BMY Beta and Valuation Metrics (Beta ~0.38, peer P/E context)

Leave a comment