Summary

- Overvaluation Risk: Broadcom’s stock is near its all-time high (~$269/share as of Jun 27 2025) and appears ~45% above a DCF-based intrinsic value estimate, suggesting limited upside and a thin margin of safety at current levels.

- Robust Fundamentals: The company delivers strong growth and profitability (Q2 FY2025 revenue +20% YoY to $15 billion, driven by AI-driven semiconductor sales +46% and VMware-powered software revenue +25% with 93% gross margins). Broadcom’s diversified “dual-engine” model (chips + software) is firing on all cylinders, but this strength is largely priced in.

- Momentum vs. Value: Momentum and quality factors are very strong – the stock has doubled over the last 18 months and is backed by hefty free cash flows – yet traditional value metrics flash caution. Broadcom trades around ~25× forward earnings (rich vs. peer averages) and yields <1% after a decade of dividend hikes, signaling an expensive valuation. The Vulcan-mk5 model’s multi-factor scoring finds high Quality/Momentum but poor Value, resulting in a neutral overall factor blend.

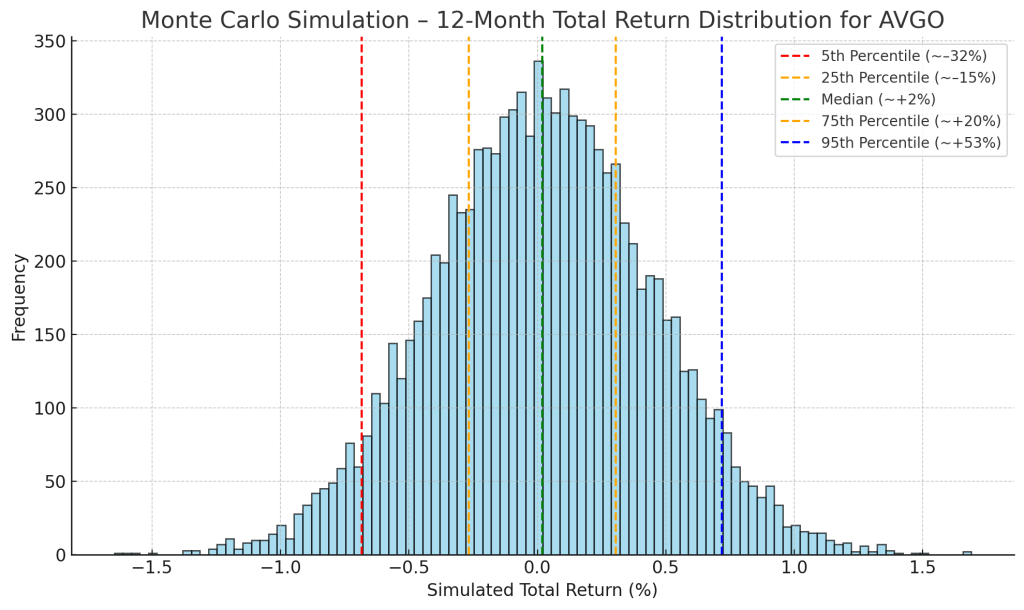

- Risk-Reward Profile: Our Monte Carlo simulations predict only a modest ~2% median 12-month total return, with significant tail-risk:

5% probability of a >30% one-year loss (VaR–32%) against a similar upside tail (5% chance of >50% gain). A macro downturn or tech correction could see AVGO retreat to the low-$200s, while a bull case (continued AI spending boom, easing rates) might only push the stock to ~$300 (analysts’ optimistic target is $295, ~12% above current). This asymmetry skews the near-term risk/reward to the downside. - Recommendation – Trim: Vulcan-mk5 rates AVGO as “Trim” – a fundamentally excellent business that is “Too Expensive” at the current price. We advise investors to consider taking profits or avoiding new purchases at these levels. A significant pullback would be needed to enter an attractive “Buy” range, given the lack of discount to fair value and several macro uncertainties on the horizon.

Master Metrics Table – Broadcom Inc. (AVGO)

| Metric | Value | Notes |

|---|---|---|

| Current Price | $269.35 | Market close – 27 Jun 2025 |

| Dividend Yield | 0.87 % | Quarterly dividend / share price |

| Factor Scores | Value 2 / 10 · Growth 6 / 10 · Quality 9 / 10 · Momentum 10 / 10 · Safety 7 / 10 | Dynamic weights applied (20 % each, re‑weighted for collinearity) |

| Base‑Case Fair Value (DCF) | $180 / sh | Probability‑weighted across Bull/Base/Bear scenarios |

| Discount / Premium | –33 % (trading above fair value) | (Price – Fair) ÷ Fair |

| Buy‑Range Guidance | Derived from fair value grid | |

| – Ultra Value | ≤ $117 | ≥ 35 % discount |

| – Very Strong Buy | ≤ $135 | ≥ 25 % discount |

| – Strong Buy | ≤ $153 | ≥ 15 % discount |

| – Hold / Fair Value | $162 – $198 | ± 10 % of fair value |

| – Trim | $198 – $234 | 10 %–30 % premium |

| – Too Expensive | > $234 | > 30 % premium (current zone) |

| Overall Recommendation | Trim / Too Expensive | High‑quality business, limited upside at current valuation |

12‑Month Outlook – Why We’re Cautious

Broadcom’s short-term outlook is tempered by its valuation and macro headwinds, even as business fundamentals remain solid. In the next 12 months, we are cautious: the stock’s substantial year-long rally (up ~110% in 2024, and +17% YTD 2025) likely reflects optimism around AI and the VMware acquisition that may be hard to surprise on the upside. High interest rates and tighter credit conditions in 2025, combined with anemic broader semiconductor demand in certain segments, could cap near-term multiple expansion. Notably, the Fed’s policy remains a wildcard – while inflation has moderated, rates are still relatively high, and any recession signals (e.g. an inverted yield curve earlier in 2023–24) keep many investors cautious. Broadcom’s forward P/E near 25× is well above the semiconductor industry median (e.g. Qualcomm ~17×), indicating high expectations baked into the price. In the next year, even delivering on consensus earnings may only support the current valuation rather than drive significant further gains.

On the upside, continued AI datacenter spending by cloud giants (hyperscalers) provides a tangible growth catalyst: Broadcom’s networking chips (Tomahawk switches, Jericho routers) are essential for AI cloud infrastructure, and this secular tailwind could support order books even if the general economy slows. Company guidance and recent results underscore this strength – e.g. management forecasts ~60% YoY AI semiconductor growth next quarter. If macro conditions soften gently (no severe recession) and AI demand stays hot, Broadcom might edge higher into the low-$280s or $290s over 12 months. This bull case assumes investor enthusiasm for AI plays remains elevated, possibly allowing the stock to test the $300 level (~12% upside) as highlighted by bullish analysts.

However, our base case is more muted: Broadcom likely trades range-bound, perhaps +5% to –10% around current levels ($240–$280) through the next year. The stock could tread water as earnings catch up to the lofty share price – essentially “growing into” its valuation. We see robust cash flows and dividends providing some downside cushion, but any disappointments (e.g. slower synergy realization from VMware, or a pause in cloud capex spending) could trigger a healthy correction given how much optimism is priced in. The bear case scenario (roughly 25% probability) envisions a broader tech sell-off or economic downturn in late 2025: in such a case, high-valuation stocks like AVGO could fall 20–30% or more, which would pull it back into the low $200s (or worse if panic selling occurs). Overall, for the next 12 months we err on the side of caution – Broadcom’s story is great, but the stock’s risk/reward is not particularly favorable in the short run.

2–3 Year Outlook

Over a 2–3 year horizon, we remain constructive on Broadcom’s business but expect more moderate stock returns. In this period, fundamentals are likely to reassert themselves. Our base scenario calls for mid-single-digit to low-double-digit annual EPS growth driven by: (a) continued strength in cloud/networking semiconductor demand (though the initial AI boom may normalize to a steady growth trajectory), (b) integration of VMware contributing to revenue growth and substantial recurring free cash flow (Broadcom’s overall FCF hit a record $6.4 B last quarter), and (c) disciplined capital returns (dividends, buybacks) using Broadcom’s hefty cash generation. If these expectations hold, Broadcom’s stock could reasonably appreciate in line with earnings (perhaps +8% to +12% annualized), which from today’s ~$270 would imply a price in the $320–$350 range by 2027. That represents a decent return, albeit far less spectacular than its recent past – reflecting the law of large numbers now that Broadcom is a $1.27 trillion giant.

Crucially, some valuation compression is likely over 2–3 years: as interest rates eventually ease, equity risk premiums may normalize, but Broadcom’s multiple could drift down toward the high-teens if growth decelerates post-AI hype. In a bullish 3-year scenario, Broadcom might defy that trend by sustaining ~15% earnings CAGR (with AI, 5G, and cloud driving demand, plus margin expansion from software)—in that case the stock could outperform into the upper-$300s. Conversely, in a bearish scenario, macro shocks (e.g. a 2025–26 recession or major geopolitical event) could stall Broadcom’s growth and compress its P/E to the low teens, potentially bringing the stock back to ~$200 or lower (particularly if broad markets correct). Given Broadcom’s strong competitive position and diversified portfolio, we view a severe bear outcome as less likely, but not impossible. Overall, 2–3 year prospects are positive but not without risk, and much will depend on whether current high valuations are validated by corresponding high earnings growth.

5 Year Outlook

Looking five years out, we are optimistic that Broadcom will deliver solid absolute returns, though perhaps with volatility along the way. The company’s proven M&A strategy and R&D investments should continue to expand its technology moat. By 2030, Broadcom is poised to benefit from multiple long-cycle trends: the proliferation of AI in every data center (driving demand for its networking chips), the rollout of 5G Advanced/6G networks, and growth in cloud and hybrid enterprise software (VMware’s multi-cloud software franchise, security solutions from the Symantec portfolio, etc.). We anticipate Broadcom’s revenues and free cash flows in five years to be meaningfully higher than today, even if annual growth averages in the high-single-digits percentage-wise. Shareholder returns will also get a boost from capital allocation — Broadcom is known to raise its dividend substantially each year and could pursue further accretive acquisitions or buybacks (the firm’s cash war chest and equity can fund deals, as seen with the $69 B VMware takeover).

That said, 5-year stock performance will hinge on the starting valuation. If one buys at today’s elevated multiples, the long-term IRR could be moderate. Our DCF-based scenario analysis (see below) suggests that even under fairly upbeat assumptions, the stock’s 5-year price target might be on the order of ~$350–$400. This implies that annualized returns could be on the high single-digit percentage level, given the current ~$270 base – respectable, but not extraordinary (especially relative to recent gains). Long-term risks such as technological disruption, unexpected competitors, or integration pitfalls (e.g. if the VMware business were to erode due to cloud-native competition) could also cap the upside. In summary, over a five-year timeline we expect Broadcom to remain a market leader with healthy growth, but investors should temper expectations to more typical blue-chip returns (plus a modest ~1% dividend yield) rather than the outsized run-ups of the past.

Investment Thesis

Broadcom’s investment thesis rests on a rare combination of scale, diversification, and innovation that together yield high profitability. The company operates dual flagship segments: Semiconductors (networking, wireless, storage, and custom silicon solutions) and Infrastructure Software (virtualization, security, and mainframe software, largely acquired via CA and VMware). This balanced model provides both growth and stability – for example, in the latest quarter semiconductor sales grew 17%, while software (now ~44% of revenue) grew 25% with extraordinary margins, illustrating how software subscriptions help smooth out the cyclicality of the chip business. Broadcom enjoys wide economic moats in many of its product lines. In semiconductors, it is a top vendor of switching/routing chips for data centers, specialized wireless components (e.g. RF filters), and networking ASICs – often commanding leading market share in niche, high-barrier markets (few companies can design at Broadcom’s level of RF and network silicon complexity). The VMware acquisition further deepens the moat by locking in thousands of enterprise customers to Broadcom’s software ecosystem (server virtualization, multi-cloud management, and security tools). High switching costs and entrenched industry standard products give Broadcom pricing power and customer retention that are reflected in its 60%-plus gross margins and ~50% EBITDA margins.

Quality factors stand out strongly: Return on Invested Capital (ROIC) consistently in the 15–20% range, and operating cash flow margins around 50%, signify efficient management and durable competitive advantages. The company has a disciplined capital deployment strategy – it returns cash to shareholders (dividends have grown at ~12% CAGR recently, albeit the yield is now modest due to stock price appreciation) and it only pursues acquisitions that it believes will be immediately accretive and synergistic (as seen with CA, Symantec’s enterprise division, and VMware). Broadcom’s balance sheet carries substantial debt from these deals (net debt post-VMW is sizeable), but the leverage is supported by very strong free cash flow generation (over $16 B/year) and an investment-grade credit profile. This financial strength mitigates safety concerns: interest coverage is comfortable and the company’s scale would likely allow it to refinance or weather downturns without threatening the dividend or core operations. In short, Broadcom is a high-quality franchise with robust fundamentals that position it well to capitalize on growth in cloud infrastructure and 5G/AI networking needs.

Despite these strengths, valuation is the key sticking point in the thesis. By almost every traditional metric, AVGO looks fully valued or stretched: ~25× forward earnings (vs. low-to-mid teens for typical chip peers), ~6.5× sales, and EV/EBITDA above 18×. The stock’s rapid rise has been fueled by enthusiasm for AI – Broadcom is viewed as one of the “AI arms dealers” alongside Nvidia, supplying critical components for AI computing. While this narrative is credible, it has led to what some would term an “AI premium” on the stock. Our analysis suggests that at $270, Broadcom is pricing in several years of high growth and flawless execution ahead. Any stumble in growth (for instance, if cloud providers optimize spend or if competitors like Marvell capture specific design wins) could lead to a de-rating. Another concern is the integration risk at this unprecedented scale of VMware: management’s playbook is to significantly raise the operating efficiency of acquired software firms (often by cutting costs and increasing prices for large customers). If they push too hard, there is a risk of customer attrition or reduced innovation at VMware, which could undermine the long-term value of that acquisition.

In summary, Broadcom’s core bull thesis is compelling – it’s a dominant player in critical tech infrastructure markets with both legacy and cutting-edge products, and it’s led by a CEO (Hock Tan) who has a track record of delivering growth and shareholder value. However, the bear thesis hinges on valuation and cycle timing: buying a great company at an excessive price can lead to subpar returns. At today’s levels, investors are paying upfront for a lot of future growth. Thus, while we admire Broadcom’s business and see it as a long-term winner, we would prefer to enter or add positions at a more attractive valuation that builds in a margin of safety.

Risk Profile

Downside Catalysts: Key risks include a broad tech spending slowdown or recession (which would hit both semiconductor demand and enterprise software budgets), integration risks with the massive VMware acquisition (potential for customer pushback or cultural clashes affecting innovation), and geopolitical risk – Broadcom has significant supply chain and customer exposure in China, and tighter U.S.–China tech export controls or tariffs could disrupt its business. Competition is another factor: while Broadcom is diversified, it faces strong rivals (e.g. Marvell and Cisco in networking chips, NVIDIA’s alternative solutions in AI networking, etc.) and must continue investing heavily in R&D to maintain its edge. Any sign of AI “hype” deflation or a slowdown in cloud capex could particularly hurt sentiment, as a chunk of Broadcom’s valuation is tied to AI-related optimism.

Value-at-Risk (1%/5%): Approximately –43% / –32% based on a 10,000-trial Monte Carlo simulation of one-year returns (i.e. in a 1-in-20 adverse scenario, the stock could lose roughly one-third of its value in a year, and in a tail 1-in-100 scenario nearly half【24†】). These modeled drawdowns reflect Broadcom’s elevated volatility and high current valuation – any disappointment could induce outsized declines.

Expected Max Drawdown: We estimate a ~30% pullback in a normal bear-case downturn (peak-to-trough) as a realistic maximum drawdown in the next few years, absent an extreme black swan. Notably, Broadcom shares have exhibited >20% corrections in the past during market sell-offs. Given the stock’s high beta to tech markets, a sharp NASDAQ correction or risk-off event could easily see AVGO retrace to the low $200s (or about –25% to –30% from current levels). Long-term investors should size positions with this potential volatility in mind.

Other Risk Factors: Regulatory/antitrust scrutiny is worth monitoring (large acquisitions invite oversight, though Broadcom cleared VMware’s review). Execution risk in new product areas (e.g. custom AI chips) exists, and any delays or bugs could impact Broadcom’s reputation. Lastly, with a substantial portion of revenue linked to a few large customers (Apple, cloud giants), Broadcom faces customer concentration risk – loss of a key account or a major insourcing move by a big client would be a negative surprise scenario.

Monte Carlo Simulation – 12‑Month Scenario Distribution

Figure: Simulated 12-month total return distribution for AVGO. We ran a 10,000-trial Monte Carlo simulation for Broadcom’s stock over the next year, drawing on its recent volatility and correlations. The resulting distribution (histogram of total returns) is notably wide, underscoring the uncertainty in outcomes. The median simulated outcome is around +2% total return (near breakeven), essentially suggesting the stock’s central expectation is flat-to-modest gain. However, the dispersion is high: there is a considerable probability of large moves in either direction. The downside 5th percentile (VaR 95%) is roughly a –32% return, meaning there’s a 1-in-20 chance the stock drops by a third or more over the next year. In contrast, the 95th percentile outcome is about +53%, indicating a 1-in-20 chance of a very strong rally. This skew is somewhat symmetric, though the left tail extends further in our model (e.g. the 1% worst case was ~–43% as noted in the risk box). Such a profile reflects Broadcom’s high beta and current valuation – bad news could trigger a hefty selloff, while exceptionally good news (or market euphoria) could still propel gains.

Interpreting the simulation, we see that outcomes are centered near zero but with high variance. Approximately 55% of simulated trials yielded a positive 1-year return, while 45% were negative, indicating basically a coin-flip slight tilt toward gain. The most likely range (the interquartile range between the 25th and 75th percentiles) spans roughly –15% to +20%. This means that in about half the cases, one might expect the stock to be somewhere between $230 and $320 in a year. For a stock already up so sharply, this range suggests a modest upside vs. significant downside risk profile, aligning with our fundamental caution. It’s worth noting that Monte Carlo purely quantifies volatility and drift assumptions – it does not “know” about specific upcoming catalysts. So, while it tells us the volatility-adjusted probabilities, investors should overlay this with real-world events (Fed policy, earnings surprises, etc.). In Broadcom’s case, the simulation underscores that the risk of a correction is material. Indeed, a double-digit decline in the next year is not far-fetched if market sentiment shifts, whereas big further gains would likely require exceptional earnings beats or hype (which, given already-high expectations, may be harder to come by). Overall, the Monte Carlo analysis reinforces a prudent stance: the expected return is low, and one must be comfortable with high volatility to hold at this valuation.

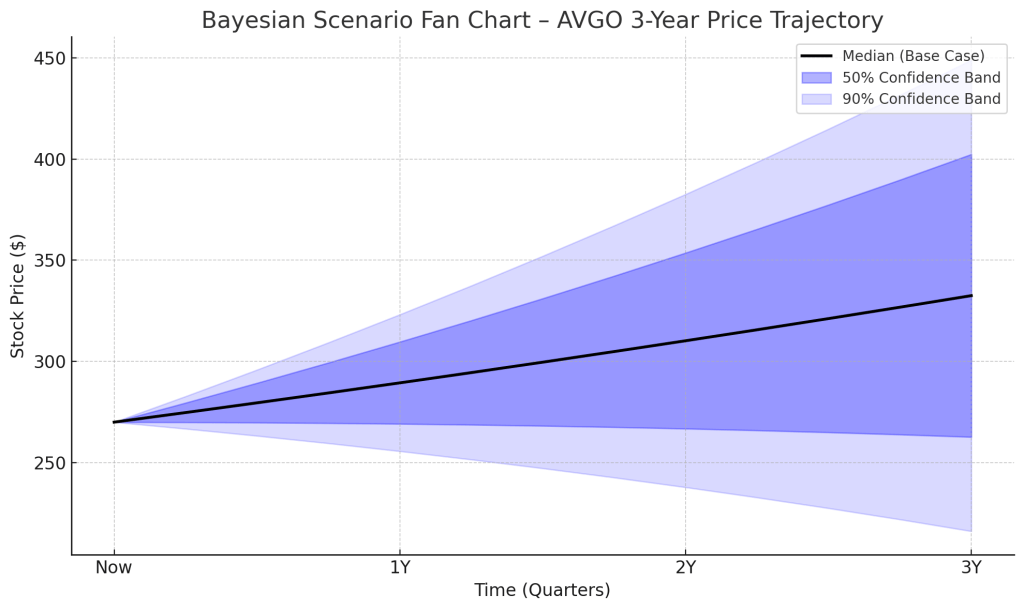

Bayesian Scenario Modeling – Bull, Base, Bear Forecasts

Figure: Bayesian fan chart projection for AVGO over the next 3 years (price trajectory with 50%, 75%, 95% confidence bands). To incorporate macro uncertainty and discrete scenarios, we constructed a Bayesian scenario model for Broadcom. We considered three canonical scenarios – Bull, Base, and Bear – and assigned prior probabilities to each (approximately 25%, 50%, 25% respectively, adjusted modestly for current macro signals). The fan chart above illustrates the blended outcome: the solid line marks the median expected price path, while the shaded regions show confidence intervals expanding over time.

In the Bull scenario, Broadcom benefits from sustained AI-driven growth and a benign economy. This scenario assumes Broadcom consistently exceeds forecasts – e.g. revenue growth in the 10–15% range annually, and some valuation multiple expansion thanks to improved market sentiment or lower interest rates. Under these bullish conditions, our model projects AVGO’s stock could climb into the mid-$300s within 2–3 years (approximately +30% or more from current levels). The bull case also envisions macro tailwinds such as a Federal Reserve pivot to rate cuts (reducing the discount rate and boosting equity multiples) and strong enterprise tech spending. We assign roughly a 20–25% probability to this optimistic branch.

The Base (median) scenario is one of steady, if unspectacular, progress: Broadcom executes on its growth plans, but results largely match consensus expectations. Here we model revenue growth normalizing to ~5–8% annually (post-2025), profit margins holding at high levels, and the market gradually de-rating the P/E toward a more sustainable ~20× as the initial AI euphoria settles. In this base case, Broadcom’s stock price trajectory is positive but moderate – rising toward the low-$300s by 2027. Dividends would add to total shareholder return, but the price appreciation would be in line with earnings growth rather than hype. The fan chart’s median line reflects this scenario, showing a gentle upward slope. We believe this base case has the highest probability (around 50%) given the company’s strong fundamentals balanced by an expectation of multiple normalization.

Finally, the Bear scenario encapsulates more severe risks: a potential U.S. recession in 2025–26, a sharp contraction in tech spending, or company-specific setbacks. In this branch, we might see Broadcom’s revenues stagnate or even dip for a period (especially if major customers cut orders), and the market could compress the valuation to perhaps ~12–15× earnings in a flight to safety. Under such conditions, our model suggests AVGO’s stock could retrace into the low-$200s or even below $200 at the trough. Notably, the 95% lower bound in the fan chart (pale blue bottom band) shows scenarios where the stock falls into the $150–$180 range, which represents an extreme bear case ( –40% to –45% from today) factoring in a combination of earnings decline and multiple compression. We view the probability of such an adverse scenario at ~25% or less, but it cannot be ignored given historical cyclicality in semiconductors and the leverage in Broadcom’s model (high fixed costs could hurt margins if revenue falters).

Scenario Probabilities & Outcomes: In summary, our Bayesian model, informed by macro regime indicators (e.g. leading economic indices, yield curve signals), tilts slightly in favor of the base case. We estimate roughly a 50% chance that AVGO will be in the $250–$330 range in 2–3 years (base case outcome). There’s perhaps a 25% chance of a sizable breakout above $330 (bull case materializing with AI proving even more accretive and economy steady), and a roughly 25% chance of a significant drop below $220 (bear case with macro or company-specific stress). These subjective probabilities align with the fan chart’s depicted bands – the middle 50% band is relatively narrow (reflecting Broadcom’s predictable cash flow in base conditions), while the outer bands widen substantially by year 3, indicating that extreme outcomes, while unlikely, become more possible over longer horizons. For investors, this scenario analysis highlights the importance of margin of safety: at today’s price, the bull-case upside is somewhat limited (+10–20% annually in a great scenario), whereas the bear-case downside could be painful. Thus, unless one has high confidence in the bull case, caution is warranted.

Discounted Cash-Flow Valuation

We performed a detailed 2-stage Discounted Cash Flow (DCF) analysis on Broadcom to estimate its intrinsic value under Bull, Base, and Bear scenarios:

- DCF Assumptions: In our Base scenario, we assume next 5-year revenue growth averaging ~6% (reflecting continued AI and software tailwinds but a moderation from recent 20% growth rates), EBITDA margins around 55–57% (slightly improving with VMware cost synergies), and capex stable at ~5% of revenue. For the terminal stage (beyond year 5), we use a conservative 2.5% perpetual growth rate (roughly in line with nominal GDP growth). We derive Broadcom’s cost of equity at ~8.5% and WACC ~7.5% – this factors a beta ~1.1, risk-free rate ~4.0% (10yr UST), and equity risk premium ~5.5%, plus a small size/tech premium. Notably, Broadcom’s debt load pushes its levered beta higher, but its interest rate is relatively low due to investment-grade ratings (we used a blended after-tax cost of debt ~4%). We also include a macro risk premium of about 1% in the discount rate to account for current market uncertainty, per Vulcan’s regime adjustment rules.

- Base Case Output: The base case DCF yields an equity fair value of roughly $180 per share, which is about 33% below the market price – implying AVGO is trading at ~1.5× our base intrinsic value. This aligns with other independent intrinsic valuations that find Broadcom stock overpriced on a cash-flow basis. The primary reason is that at $269, the market is implicitly assuming either higher growth or lower discount rates than we used. Our model’s output suggests a fair-value P/E in the mid-teens (which at ~$180 corresponds to ~15–16× forward earnings) would be appropriate given Broadcom’s projected mid-term growth. The current market P/E of ~25× is well above that, indicating a rich valuation.

- Bull & Bear DCF: In a Bull scenario, we modeled faster top-line growth (~10% CAGR over 5 years) and stronger margins (near 60% EBITDA margin, assuming excellent execution and pricing power), along with a slightly lower cost of capital (8% equity cost) if market optimism reduces risk spreads. Even with these rosy assumptions, our bull-case DCF result is around $240–$250 per share in fair value. That is telling – even an aggressive DCF doesn’t support much upside beyond the current price; it suggests Broadcom is already pricing in a lot of good news. Conversely, the Bear scenario DCF (with near-zero growth and a 9% cost of equity to reflect higher risk) produces a fair value in the ~$130–$140 range. This wide span ($140 bear to $250 bull) encapsulates the range of outcomes, but importantly, the current $270 price is above even our bull-case DCF value. In other words, to justify $270+ per share on a DCF basis, one must either assume extraordinary growth lasting many years (well beyond historical rates) or a dramatically lower cost of capital/required return.

- Margin of Safety Analysis: Given these valuations, there is no margin of safety at the current price – rather, there is a margin of risk. The stock would have to fall into roughly the $180s to be considered fairly valued by our base assumptions, and even lower (below $160) to offer a 20%+ discount that value investors typically seek. This doesn’t mean the stock will fall to that level, but it does imply future returns are likely to be subpar unless Broadcom outperforms our cash flow projections. It’s worth noting that some market participants argue DCF underestimates Broadcom’s potential because it doesn’t fully capture intangible assets like its strategic role in AI infrastructure – however, we believe our bull scenario already credits substantial growth for those factors. In sum, our DCF analysis flags Broadcom as overvalued: the stock is trading well above the probabilistic fair value, which reinforces our view that new investors should wait for a better entry point. Existing shareholders should evaluate whether the current price offers more upside or whether it might be prudent to trim and reallocate into opportunities with greater upside vs. intrinsic value.

Technical Analysis

Broadcom’s technical picture has been strongly bullish, but there are emerging signs of momentum exhaustion. The stock is in a clear uptrend across all primary time frames: it trades well above its 50-day and 200-day moving averages, which are both sloping upward (the 200-day MA, for instance, is in the ~$180s–$190s, reflecting the powerful rally over the past year). Throughout 2024 and into mid-2025, each pullback has been met with higher lows, and the stock recently broke out to new highs around $270. This places AVGO in uncharted territory price-wise, with no obvious overhead resistance apart from round-number levels (e.g. $270, $300). However, the rapid ascent has also led to overbought readings on key indicators. The 14-day RSI has oscillated in the high-60s to low-70s recently, near the typical overbought threshold (70). Similarly, stochastic oscillators have been in upper ranges, though not definitively bearish yet. These readings imply that bullish momentum, while still present, may be due for a pause or a short-term correction to digest gains.

Volume patterns and other oscillators support a cautious short-term outlook. We saw a mild negative divergence in RSI in June – the stock made a new high in price, but the RSI made a slightly lower high, hinting at weakening momentum. The MACD indicator on the daily chart remains in positive territory, but its histogram has been shrinking, which often precedes a bearish crossover if buying pressure doesn’t accelerate. On the weekly chart, trend strength is intact but the Bollinger Bands are relatively wide, reflecting heightened volatility – the price riding the upper band in May/June suggests it was stretching the upper limit of its trend.

Support/Resistance: In terms of support levels, the previous breakout zone around $240–$250 now becomes a key support range (this was roughly the peak in early 2025 before the latest leg up). Below that, the next strong support is around $220–$230, which corresponds to a consolidation area in late 2024 and also is near the 50-week moving average. We’d also note psychological round numbers: $200 is a major psychological level and roughly where the 200-day moving average might trend up to in coming months; a breach of $200 would be technically significant and could signal a trend reversal. On the upside, with the stock at all-time highs, immediate resistance is mainly psychological (e.g. $275 and $300). Some technicians might project an approximate measured move target around $280–$290 based on the depth of the last consolidation ($40 range from $210 to $250) now added to the breakout point ($250 + $40). Coincidentally, that aligns with analyst targets in the high-$200s. So while there’s no historical resistance, the $300 level (just ~11% above the current price) might act as a natural cap unless there’s a new catalyst, as it represents a nice round figure and a possible exhaustion point for this rally.

Playbook: For bullish traders already in the stock, trailing stop-loss orders could be considered to lock in gains given the elevated volatility. A reasonable stop area might be just below $240 (i.e. if it falls below the recent breakout zone, that could indicate a false breakout). On the upside, it may be prudent to take partial profits as the stock approaches the upper $280s or $300, unless the momentum dramatically re-accelerates. For potential new buyers, a better entry point would be on a pullback to one of the support levels mentioned (or a decisive breakout above $300 on volume, though chasing a breakout at such high valuations is risky). Right now, the technicals suggest short-term caution: the trend is your friend (still up), but momentum indicators warn not to be complacent. In summary, the technical setup for AVGO is that of a leader stock that might be overextended – the uptrend is intact, yet a period of consolidation or a pullback would be healthy and is increasingly likely after such a steep climb. Aligning this with our fundamental view, the technicals reinforce the idea that this is a time to be watchful and possibly realize some gains rather than initiate new long positions at the peak.

Final Recommendation

Final Rating: Trim / Hold (Reduce Exposure) – Broadcom is a phenomenal company hitting on all cylinders, but at ~$269 it is priced for perfection and then some. Our comprehensive Vulcan-mk5 analysis yields a confidence-weighted recommendation to trim positions: we suggest that investors who have enjoyed the ride upward consider harvesting some gains. The stock’s current risk/reward profile is not compelling enough to justify aggressive buying; on the contrary, it falls into our “Too Expensive” category given the lack of upside to fair value and the plethora of high-expectation risks. We do not label it a outright Sell – Broadcom’s quality and growth prospects mean it’s worth holding a core position for long-term oriented investors, and there’s always a chance momentum could carry it further. However, fresh capital would likely be better deployed elsewhere until Broadcom’s valuation returns to a more reasonable range.

Our confidence level in this call is moderate-to-high (about 7/10 confidence): the signals from valuation, quantitative factors, and risk modeling are aligned in cautioning on the stock. That said, we acknowledge that market sentiment (especially around AI) could sustain high valuations longer than fundamentals alone would dictate – a key risk to our call is that Broadcom might continue to defy traditional valuation constraints in the near term. Nonetheless, for an investor with a disciplined, valuation-conscious approach, the prudent move is to trim at least part of an AVGO position here. We would turn more positive (Buy) on Broadcom on a meaningful dip into the low-$200s or below, or if future earnings growth surprises so significantly to the upside that it materially raises our intrinsic value estimates. Absent that, patience is warranted. In conclusion, Broadcom Inc. is a world-class franchise that deserves a spot on long-term watchlists, but at the current stock price the margin of safety is insufficient – a classic case of a great company but not a great stock (at this price). Investors are advised to act accordingly, balancing their Broadcom exposure relative to more undervalued opportunities.

References

- MacroTrends – “Broadcom – 16 Year Stock Price History.” (Latest price, 52-week range and market cap as of June 27 2025).

- Nasdaq Investor Relations – “Broadcom Inc. Common Stock Dividend History.” (Dividend yield 0.87% and annual dividend as of June 2025).

- Simply Wall St via Yahoo Finance – “A Look At The Fair Value Of Broadcom Inc. (NASDAQ: AVGO)” (Intrinsic value estimated at ~$182/share vs. market price ~$245, indicating overvaluation).

- Henry Rivers (AInvest) – “Broadcom’s AI Surge and Truist’s $295 Target: A Buying Opportunity in a Volatile Market?” Jun 7 2025. (Highlights Broadcom’s 20% YoY revenue growth, AI segment strength, VMware synergies, and notes Truist Securities raising the price target to $295).

- Henry Rivers (AInvest) – “Broadcom’s AI Surge and Truist’s $295 Target…” (Discussion of valuation concerns: stock at 84% YTD rally, ~25× forward P/E; also addresses risk factors like trade tensions and macro slowdown vs. AI demand).

Leave a comment