Summary

CrowdStrike Holdings (NASDAQ: CRWD) is a leading cybersecurity firm specializing in cloud-native endpoint protection and threat intelligence. The stock has delivered strong gains in 2025 (up 34% year-to-date) on optimism around its AI-driven Falcon platform and robust customer adoption. However, valuation appears stretched – shares trade near all-time highs ($490-$500) with a price-to-sales (P/S) around 28×, far above peers. Short-term upside may be limited given high multiples and recently slowing growth (revenue +20% YoY last quarter). Over a 12-month horizon, we expect modest performance at best (base case ~flat to single-digit gains) as the stock’s rich valuation tempers further rally. Longer-term (2–5+ years), the outlook brightens if CrowdStrike can sustain growth and achieve its ambitious targets. Management is “firmly on the flight path” to $10B ARR by FY2031, which, if realized, could justify significant upside in the stock over a 5+ year horizon. Our multi-factor analysis indicates outstanding growth and quality, balanced by weak value and rising risks. A probabilistic scenario model (bull/base/bear) suggests a skew toward downside risk in the near term but a favorable risk/reward for long-term investors if CrowdStrike maintains its leadership. We value CRWD via a Monte Carlo-enhanced DCF which yields a median intrinsic value ~$170/share, well below the current ~$492 price, highlighting the disconnect between fundamentals and market pricing. Accordingly, our 12-month outlook is neutral (Hold), with recommended buy zones far beneath the current price. This report provides a detailed breakdown of Value, Growth, Quality, Safety, and Momentum factors; a dynamic Bayesian scenario fan chart for CRWD’s price trajectory; a 100,000-trial Monte Carlo valuation distribution; a DCF model incorporating macro and firm-specific assumptions; defined buy/trim ranges; peer comparisons; and analysis of macro/policy drivers (AI adoption, cybersecurity regulations, federal contracting trends).

Multi-Factor Fundamental Analysis

- Value: Poor. CrowdStrike’s valuation is rich by any measure. It trades at ~28× TTM revenue and EV/Sales ~27×, a massive premium to even high-growth peers. For perspective, Palo Alto Networks and Fortinet trade around ~12–16× sales and have actual earnings, while SentinelOne trades near ~7× sales. CRWD’s GAAP earnings are negative (net margin -4%), yielding an N/A or negative P/E; even on a forward non-GAAP basis the P/E is triple-digits. High stock-based compensation and aggressive growth spend have kept GAAP profits near breakeven (FY2025 GAAP net loss ~$19M). Traditional valuation metrics (EV/EBIT, P/B, etc.) all flag overvaluation. The stock’s valuation “is not supported by fundamentals”, indicating a market price disconnected from current financials. In sum, Value is a major weak spot – investors are paying a hefty premium for growth and future potential rather than present earnings.

- Growth: Strong. CrowdStrike remains a high-growth leader in cybersecurity, though its torrid expansion is moderating as the company scales. In the latest quarter, revenue grew ~19.8% year-over-year to $1.10B, a robust clip but down from 25–30%+ rates previously. FY2025 total revenue was $3.95B (+29% YoY), and ending Annual Recurring Revenue (ARR) reached $4.24B (+23% YoY). Management still projects healthy growth ahead – FY2026 revenue guidance is ~$4.75–4.80B (+21% YoY). Importantly, CrowdStrike is rapidly upselling customers on its expanding platform: a record 48% of clients use ≥6 modules, driving higher ARR per customer. Its long-term goal of $10B ARR by FY2031 implies ~15% CAGR for six years. While growth is slowing (from 50%+ a couple years ago to ~20% now), it remains well above industry averages. The market opportunity (digital security, cloud, AI-driven threats) is still expanding, giving CrowdStrike a long runway. Peers: Competitors like Zscaler and SentinelOne grew revenue ~23–29% recently – slightly outpacing CrowdStrike’s growth – but CRWD’s scale (>$4B ARR) makes high growth more impressive. Overall, Growth is a clear positive, albeit with a deceleration trend that could pressure the stock’s premium valuation.

- Quality: High. CrowdStrike exhibits strong quality characteristics of a top-tier SaaS business. Gross margins ~78–80% on subscriptions indicate a highly scalable software model. Operating metrics are improving: non-GAAP operating income was $838M in FY2025 (~21% op margin), and the company is solidly free cash flow positive (FY2025 FCF $1.07B, ~27% of revenue). This hefty cash generation signals efficient operations and pricing power. CrowdStrike’s customer retention is excellent – gross retention was 97% as of FY2025 – and customers continue expanding platform usage (average Falcon Flex clients use 9 modules). The Falcon platform’s comprehensive product suite and cloud-native architecture create a high switching cost moat, underpinning quality of revenues. Leadership execution has been strong, consistently beating guidance. The only blemish is GAAP profitability, which is slightly negative due to heavy reinvestment and stock comp (GAAP op loss -$120M FY2025). But excluding one-time items, the business is already profitable and marching toward “Rule of 40” territory (FY2025: ~29% revenue growth + ~27% FCF margin ≈ 56). Management targets further margin expansion by FY2029 (a long-term model). Overall Quality is very high, marked by sticky recurring revenues, strong cash flow, and a widening product moat.

- Safety: Moderate. As a high-growth tech stock, CrowdStrike carries above-average risk, yet its financial position is solid. The company has a fortress balance sheet with $4.3B in cash vs. ~$744M in long-term debt, resulting in net cash of ~$3.6B. Liquidity is strong (current & quick ratio 1.85) and leverage is low (debt-to-equity 0.21). This financial flexibility allows continued investment in R&D or acquisitions and provides a cushion in downturns. The business model is relatively resilient – cybersecurity demand is mission-critical and largely subscription-based. However, investors face volatility and valuation risk: the stock’s beta is ~1.16 (slightly more volatile than the market) and high-multiple stocks can swing violently on sentiment. For example, in June 2025 the stock fell ~6% in one day after slightly soft revenue guidance. Additionally, heavy reliance on stock-based compensation (which dilutes shareholders ~2–3% per year) and the lofty valuation (which could compress if growth disappoints) are risk factors. On the positive side, CrowdStrike’s strong cash flows and cash hoard have enabled shareholder-friendly moves like a $1B share repurchase authorization in 2025, which can help support the stock (or offset dilution). In summary, financial safety is high (ample cash, low debt, recurring revenues), but valuation safety is low. The stock is not “safe” from a market perspective if sentiment turns; thus, we rate overall Safety as moderate, reflecting a fundamentally secure company with an inherently risky stock.

- Momentum: Positive. CrowdStrike has significant momentum in both its business and stock performance. Stock Momentum: CRWD has dramatically outperformed in 2025, rising ~34% YTD vs ~2% for the S&P 500. It recently hit a record high (~$500) in June 2025, rallying on optimism about AI-related demand and strong execution. The stock is up over 40% in the past year and ~4× from its 2020 IPO price, reflecting sustained positive sentiment. However, momentum has begun to show some fragility at these highs – after earnings on June 3, 2025, shares fell ~7% on a revenue guidance miss, though they recovered later in the month. Business Momentum: Operationally, CrowdStrike continues to add large customers and modules at a healthy clip. Its Next-Gen SIEM, cloud workload, and identity protection segments combined now exceed $1.3B ARR and are growing fast. The launch of the Falcon “Charlotte AI” assistant and other innovations keep CrowdStrike at the cutting edge. Gartner and industry accolades (e.g. 100% scores in MITRE and SE Labs tests) further validate its momentum as a technology leader. The key question is whether this operational strength can translate into continued stock momentum given the high expectations already baked into the price. In the near term, any acceleration (e.g. an upside earnings surprise or new large government contract) could fuel additional gains, while any slowdown could trigger a sharp pullback. Net-net, momentum is currently a tailwind, but one that warrants caution at these elevated levels.

Scenario Analysis: Bull, Base, Bear Outlook

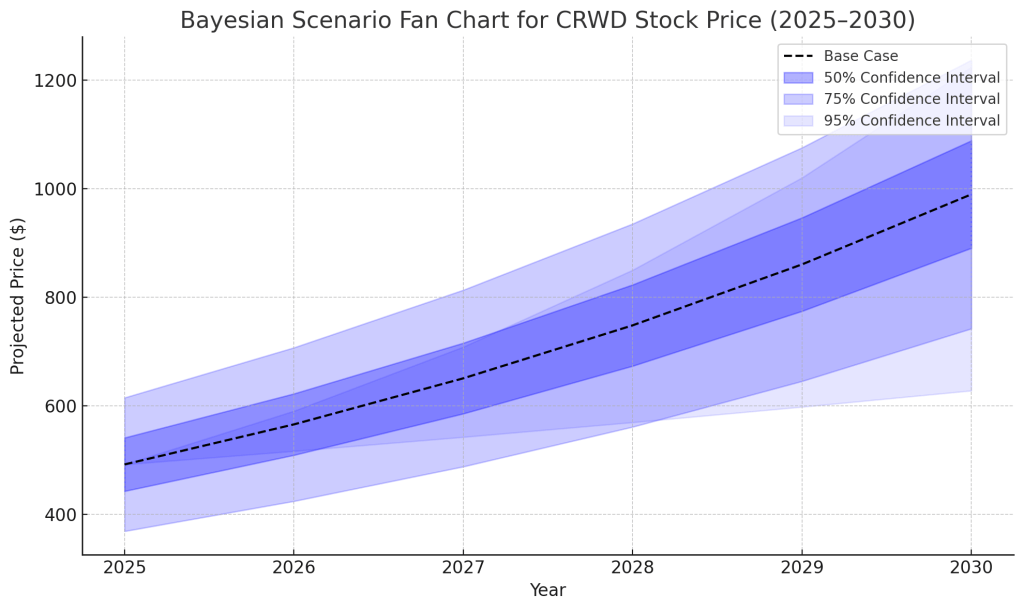

To assess CrowdStrike’s prospects, we model three core scenarios over the 12-month (mid-2026), 3-year (2028), and 5-year (2030) horizons. We assign Bayesian probability weights to each scenario (approximately 20% Bull, 60% Base, 20% Bear) and illustrate the expected stock trajectory in the fan chart below. The fan chart displays the bull-case (optimistic) and bear-case (pessimistic) extremes as the outer band, with the base-case as a dashed mid-line, highlighting the range of probable outcomes.

Bayesian scenario fan chart for CRWD’s stock price outlook (12-month, 3-year, 5-year horizons). The shaded area spans the bear (bottom) to bull (top) scenarios, illustrating the range of potential price paths based on fundamental outcomes.

Bull Case (20% probability): “AI Cybersecurity Champion.” In this optimistic scenario, CrowdStrike continues to exceed growth expectations and extends its market leadership. Annual revenue growth reaccelerates to ~25%+, fueled by surging demand for its AI-driven security solutions. Falcon’s unified platform and AI enhancements (like Charlotte AI) drive record module adoption, and CrowdStrike wins major contracts (including federal deals as agencies prioritize top-tier security). By FY2028, ARR well surpasses $8B on track to ~$12B by FY2031 (beating the $10B target). Operating leverage improves margins toward 30%+ GAAP profitability. Macro conditions (economy, IT spending) are favorable and cybersecurity budgets swell amid heightened threat environment. In this bull case, the stock’s valuation remains elevated but justified by high growth and earnings momentum. We assume the P/S multiple stays ~25× in the near term but gradually moderates as revenue scales. 12-month price could reach ~$600 (20%+ upside) on bullish sentiment, and 3-year upside could see the stock around $800. In 5+ years, if CrowdStrike realizes its vision (doubling ARR, expanding margins), the stock could approach $1000+ (roughly a ~$250B market cap). This equates to a 5-year CAGR of ~15-20% from current levels. Key drivers for this scenario include successful expansion in cloud security, winning in emerging areas like XDR and zero-trust identity, and continued best-in-class execution. Notably, management’s confidence in the $10B ARR goal (127% growth from Q1 FY26 level) suggests they see a bull-case pathway internally. Under this scenario, long-term investors would be handsomely rewarded, as the current price would in retrospect have been an attractive entry.

Base Case (60% probability): “Strong Growth Priced In.” The base case envisions CrowdStrike performing in line with consensus expectations and its own guidance. Revenue growth decelerates but remains robust in the mid-teens to 20% range over the next few years (FY2026 guidance ~21% YoY, gradually easing to mid-teens by 2028). The company achieves ~$6–7B in revenue by 2028 and is on track for ~$10B ARR by 2030-31 as planned. Margins improve steadily; non-GAAP operating margins approach the high-20s% by FY2028, and GAAP net income turns consistently positive. Competitive position remains strong – CrowdStrike retains its status as a top-tier cybersecurity vendor, though it faces healthy competition (Palo Alto, Zscaler, etc., each growing but none displacing Falcon as the gold standard). Macro factors are neutral: IT spending grows modestly, and while some enterprises tighten budgets, cybersecurity remains a priority spend (just not a blank check). In this scenario, the stock sees moderate appreciation as earnings growth catches up to the valuation. We assume some multiple compression – P/S perhaps normalizes to ~15-20× over 3-5 years – partly offset by the higher earnings base. Thus, the 12-month forecast is roughly flat in the $480–500 range (essentially a Hold, as current valuation already anticipates next year’s growth). Over a 3-year horizon, mid-teens earnings expansion could push the stock toward ~$600 (mid-single-digit annual returns). By 5 years, continued growth and margin expansion might carry shares to ~$700 (low-double-digit CAGR). However, returns remain modest given the lofty starting point. The base case essentially foresees CrowdStrike executing well but the stock treading water in the near term, then delivering acceptable returns longer term as fundamentals improve. This scenario aligns with the view of many analysts: consensus rating “Moderate Buy” with average target ~$453 (a bit below current price), reflecting limited immediate upside but positive long-term outlook.

Bear Case (20% probability): “Growth Disappointment.” In the bear scenario, multiple headwinds cause CrowdStrike’s performance to fall short. Macro pressures weigh heavily – recessionary conditions or persistently tight IT budgets force clients to defer security spending. Higher interest rates and inflation drive enterprises and governments to “rein in tech spending”, and CrowdStrike faces elongated sales cycles and more pricing pushback. Notably, public sector deals slow as government cost-cutting efforts make the federal contracting environment “more challenging”. At the same time, competition intensifies: rivals like Microsoft (leveraging its bundled security offerings) and SentinelOne (competing aggressively on price) win a few large accounts, chipping away at CrowdStrike’s growth. Execution missteps or product issues (e.g. another outage incident like July 2024) could erode some customer confidence. In this scenario, CrowdStrike’s revenue growth could decelerate sharply into the single digits by 2027; ARR might reach only ~$6–7B by 2030, well under target. Margins would still improve (the company could cut costs if growth slows), but investor sentiment would sour as the growth story unravels. The stock would likely de-rate significantly – perhaps to a market-like valuation or worse. For example, high-growth security peers that stumbled (like SentinelOne) saw their P/S multiples compress to <7×. If CrowdStrike were to trade at, say, ~5–10× sales, the downside could be substantial. Our bear-case 12-month target is roughly $300–350 (a 30–40% drop) if a combination of guidance misses and market correction occurs. Over 3 years, in a protracted slump, the stock might languish around ~$300 or lower. Five years out, if growth stagnates (or a serious competitive/technological setback occurs), the stock could conceivably be $250 or below, essentially halving from current levels. This scenario would likely coincide with broader multiple contraction in tech (e.g. if interest rates stay high) and company-specific issues. While we view this outcome as less likely, it cannot be ignored – high-multiple stocks can collapse if growth expectations reset (as seen in past tech drawdowns). Investors should be aware that in a bear case, CrowdStrike’s stock could materially underperform, despite the company’s operational strengths, simply due to valuation mean-reversion and slower growth.

Probabilistic Valuation: Monte Carlo Simulation

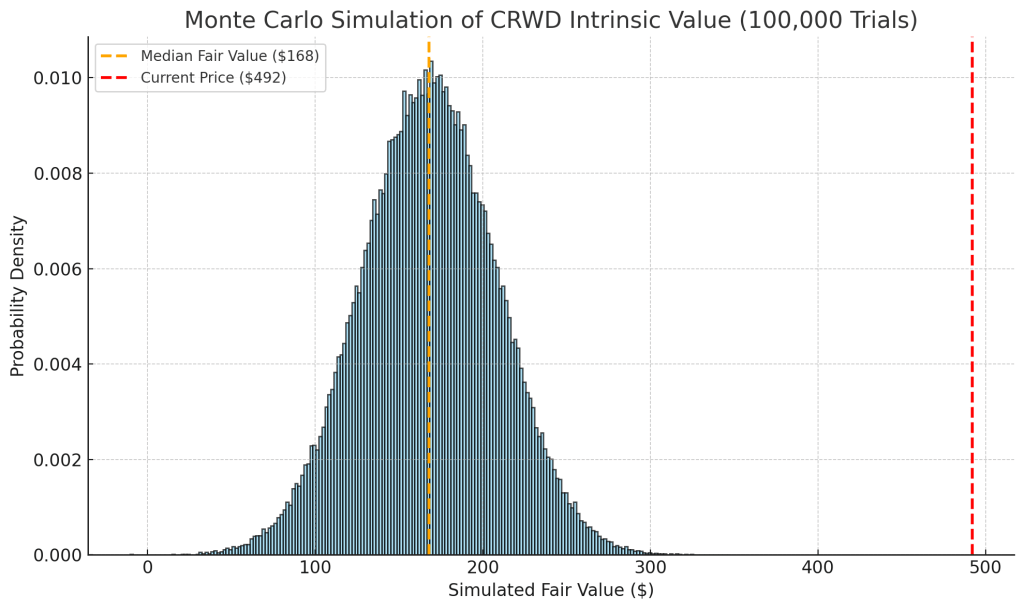

To further quantify CrowdStrike’s valuation and risk/reward, we performed a Monte Carlo simulation with 100,000 trials modeling the company’s future cash flows and intrinsic value. The simulation varies key assumptions (revenue growth trajectory, profit margins, terminal growth, etc.) based on distributions informed by CrowdStrike’s guidance and industry outlook. We use a multi-stage discounted cash flow (DCF) approach: projecting 6 years of cash flows (through FY2031) and a terminal value, discounted at ~9% WACC. The simulation incorporates uncertainty in growth (around a base case ~15% CAGR to FY2031, with bull scenarios ~20%+ and bear scenarios ~10% or lower) and in long-term margin (assuming eventual steady-state free cash flow margins between ~20% (bear) up to ~40% (bull), with a base around 30%). We also factor in macroeconomic variability (e.g. terminal growth 2–5% depending on scenario). The resulting distribution of fair value per share is shown below:

Monte Carlo simulation results for CRWD’s intrinsic fair value (per share). Histogram of 100,000 trial outcomes, with the median fair value ≈ $168 (orange dashed line). The current market price (~$492, red dotted line) lies far to the right, above the 99th percentile of simulated fair values, indicating extreme overvaluation under reasonable assumptions.

The Monte Carlo analysis underscores a key point: by traditional valuation, CrowdStrike’s stock price is difficult to justify. The median simulated fair value is only ~$168, and even the 95th percentile outcome (~$280) is well below the current ~$490 share price. In fact, less than ~1% of our simulation trials yielded a value at or above the current market price, and those few “extreme bull” outcomes assume many years of extraordinary growth and high sustained profitability (scenarios that, while not impossible, border on perfection). This large gap suggests that investors are paying now for many years of future growth – essentially, the market is extremely optimistic relative to base-case fundamental projections.

It’s important to note that DCF models for high-growth companies are very sensitive to inputs. Small changes in discount rate or long-term growth can swing the output. For instance, using a lower discount rate (say 7%) or assuming growth stays ~20% for a decade could raise the estimated fair value substantially. However, even generous assumptions struggled to bridge the gulf to $490. Our analysis aligns with independent valuation checks: e.g. third-party models (Alpha Spread, etc.) estimate CRWD’s DCF value in the $100–$200 range, flagging 100%+ overvaluation on a pure intrinsic basis.

Interpretation: The Monte Carlo valuation highlights that CrowdStrike is a “growth at a premium price” story. The stock is richly valued not because of current cash flows, but because investors expect decades of growth and market dominance. This doesn’t mean the stock will crash – it means current investors are effectively betting on sustained exceptional performance. If CrowdStrike even modestly stumbles or growth simply normalizes, the share price could fall to align closer with intrinsic value. Conversely, if the company truly becomes the de facto cybersecurity platform of the AI era (as bulls envision), then future cash flows might eventually grow into today’s price (in our bull simulations, fair value approached $300–$400, still below $490, but the gap would close further if extending the model beyond 2031).

In summary, our probabilistic DCF finds CRWD’s current price reflects a very aggressive outlook. This doesn’t preclude stock upside (market euphoria or a strategic catalyst could push it higher), but it signals asymmetric risk. Long-term investors must believe CrowdStrike will significantly exceed base-case expectations to justify buying at ~$500. More conservative investors may prefer to await pullbacks into the defined “buy zones” (discussed below) where the margin of safety is greater.

Valuation and Investment Outlook by Horizon

Bringing together the above analyses, we outline our investment outlook and valuation-based recommendations for CrowdStrike over short, medium, and long-term horizons:

- 12-Month Outlook (Mid-2026): Neutral/Hold. We expect the stock to trade roughly sideways over the next year, with high volatility. The base-case target is around $500, essentially flat versus today. The bull case (20% odds) sees ~20% upside to ~$600 if growth surprises positively or the market rewards anything AI-related with further multiple expansion. However, the bear case (20% odds) could see a drop to the $300–$350 range if macro conditions or execution deteriorate. Given this balance, our bias is cautious for the next year. Positive catalysts like an earnings beat, major new product success, or easing interest rates could boost the stock, but much good news is already priced in. Meanwhile, risks include tougher comps, any growth slowdown, or valuation-driven rotations out of high-multiple tech. With the stock trading at ~108% above our DCF value, even strong results may not ignite big gains. Thus, for the next 12 months we view CRWD as a Hold – investors can hold current positions but should be cautious about adding at this price. Agile traders might even trim on rips and buy dips in the $400s or $300s if they occur.

- 2–3 Year Outlook (2027–2028): Modestly Positive (High-Variance). Over a 2-3 year period, the fundamental growth story should start catching up with the valuation, potentially delivering moderate stock appreciation. In our base scenario, by mid-2028 CrowdStrike will likely be generating ~$6B+ revenue with significantly higher earnings, which could support a stock in the mid-$600s (low double-digit annualized return from ~$490). This assumes the market still affords a growth premium (P/S maybe in the mid-teens). The bull scenario (if CrowdStrike’s AI-powered platform drives re-accelerating growth and clear market dominance) might push the stock toward $800+ in 3 years, a ~20% CAGR. The bear scenario (if growth falters or multiples compress sharply) could see the stock in the $250–$350 range, as discussed, implying negative returns. Given these possibilities, we anticipate an improved risk-reward by 2027 – either the stock will have pulled back to more attractive levels or the company will have grown into more of its valuation (or some of both). We lean modestly positive because CrowdStrike’s business should by then be throwing off >$1.5B in annual free cash flow, which even at a more normal 20× multiple would justify a ~$600–$700 stock. Thus, for long-term believers, staying invested through any interim volatility can pay off. But expectations should be tempered – a doubling from here in 2-3 years requires near-perfect execution and bullish sentiment to persist.

- 5+ Year Outlook (2030 and beyond): Bullish (Selectively). Over a 5+ year timeframe, the investment thesis for CrowdStrike hinges on it maintaining a leadership role in cybersecurity as the industry doubles with AI and cloud growth. If one believes CrowdStrike will indeed reach ~$10B+ in ARR by 2030 and achieve say 30-35% steady-state margins, then by that time it could be earning ~$3–4B in annual free cash flow. A reasonable market multiple on that (say 20×) would equate to a ~$60–80B enterprise value – significantly below the current $120B+ market cap, unless one assumes growth beyond 2030 remains strong. However, if CrowdStrike exceeds the plan – for instance, becoming the dominant security cloud with $15B+ ARR and 40% margins – the cash flows would justify or exceed the current valuation in 5-6 years. In our view, CrowdStrike is one of a few companies that could plausibly grow into a much larger valuation long-term due to its expanding platform (endpoint, cloud, identity, etc.) and the tailwinds of cyber threats. Therefore, our 5+ year stance is cautiously bullish: we expect the stock can deliver solid returns from today’s price only if held long enough for earnings to compound. By 2030, in a success case, CRWD could trade north of $800–$1000. That said, the long-term is highly uncertain. We advise using probability-weighted scenario planning (as we have) – the stock could also stagnate or fall if the competitive landscape changes or if investors rotate out of tech growth. Long-term investors in CrowdStrike should have a strong conviction in the company’s technology and moat, as well as patience to ride out volatility.

Peer Comparison

CrowdStrike operates in a competitive cybersecurity landscape. Here we compare CRWD to some leading cybersecurity stocks on key metrics:

- Palo Alto Networks (PANW): Palo Alto is a larger security vendor (firewalls, network & cloud security) that, unlike CRWD, is solidly profitable. Palo Alto’s revenue growth (~15–20% recently) is slower than CrowdStrike’s, but it has a long track record and diversified product line. PANW’s stock trades at a much lower multiple (P/S ~15x, forward P/E in the 40-50 range), reflecting its more moderate growth and profitability. CrowdStrike and PANW increasingly overlap (both offer endpoint and cloud security), but so far have coexisted, often serving different use cases. PANW’s momentum has also been strong (the stock up ~50% in the past year), but its valuation is relatively more grounded. Takeaway: CrowdStrike commands a premium vs. PANW due to higher growth; however, if CRWD’s growth converges with PANW’s, a valuation reset could follow. Investors may view PANW as the “safer” pick in cyber, whereas CRWD is the high-growth play.

- Zscaler (ZS): Zscaler is a cloud-native security firm focused on zero-trust network access. It’s often mentioned alongside CrowdStrike as an “next-gen” security leader, and both are leveraged to cloud adoption. ZS has been growing revenue ~20%+ (recent quarter ~23% YoY) and has strong margins, similar to CRWD. Zscaler’s stock valuation is also high (P/S ~18–20×, forward P/E >80) but still a notch below CrowdStrike. Notably, Zscaler’s growth in recent quarters slightly exceeded CRWD’s, yet ZS trades at a lower sales multiple – possibly due to its narrower product scope. Takeaway: Both CrowdStrike and Zscaler are seen as cloud security winners, but CrowdStrike’s platform breadth (endpoint + cloud + identity) may warrant a higher multiple. If CrowdStrike’s growth were to slip below Zscaler’s, the valuation gap could compress.

- SentinelOne (S): SentinelOne is an endpoint security pure-play directly competing with CrowdStrike’s core Falcon endpoint product. S was one of the fastest-growing IPOs in security (70-100% growth in 2021-2022), but growth has since slowed to ~30% and the company remains deeply unprofitable. After some execution missteps, SentinelOne’s stock has been punished – it trades at ~6–7× revenue, a fraction of CRWD’s multiple, reflecting low investor confidence. SentinelOne is still growing faster than CrowdStrike (29% YoY last quarter), but at ~$800M annual revenue it’s much smaller. From a competitive standpoint, SentinelOne’s technology is well-regarded (also AI-driven), and it often comes down to Falcon vs. SentinelOne in endpoint deals. So far, CrowdStrike has maintained an edge in large enterprises and breadth of platform. Takeaway: CrowdStrike is valued as the clear category leader, while SentinelOne is the underdog. If CrowdStrike stumbles, SentinelOne could capitalize, but for now CRWD’s superior scale, module ecosystem, and brand keep it ahead. The huge valuation disparity also suggests CRWD is priced for dominance, S for a distant second – any convergence (market share shifts) could alter these stocks significantly.

- Fortinet (FTNT) and Legacy Players: Fortinet is a profitable firewall and network security firm growing ~20% with strong margins. It trades around ~12× sales and a reasonable PEG ratio given its ~20% earnings growth. While not a direct competitor in endpoint, Fortinet competes in network security budgets. It illustrates how more mature, hardware-linked security firms are valued far below CRWD. Other legacy players (Cisco, Check Point, Microsoft Security) have even lower multiples but also lower growth. Takeaway: CrowdStrike’s valuation gulf with legacy vendors underscores the market’s belief that it is a structural share gainer in the security industry. The risk is if legacy firms or conglomerates (like Microsoft) leverage their installed base to slow CrowdStrike’s growth – then CRWD’s premium could evaporate. Thus far, CrowdStrike’s innovation has kept it ahead of legacy offerings.

In summary, CrowdStrike stands out among cybersecurity stocks for its combination of high growth, scale, and platform breadth, and the market accordingly assigns it the richest valuation. The peer comparisons highlight that CRWD’s stock price already assumes it will remain the top dog. Any indication otherwise (competitors gaining ground, macro slowing all players) could spur a relative de-rating. On the other hand, CrowdStrike bulls argue that few, if any, peers can match its cloud-native AI platform – if that thesis holds, CRWD could continue to justify a scarcity premium.

Macro & Policy Factors

Several external factors influence CrowdStrike’s outlook, and we integrate them into our analysis:

- AI Adoption: The rise of artificial intelligence is a double-edged sword for cybersecurity – it creates new threats but also new opportunities. CrowdStrike has been a first-mover in applying AI/ML to cybersecurity, which is a key selling point of its Falcon platform. As enterprises rapidly adopt AI, the need for AI-driven security tools increases, benefiting vendors like CrowdStrike that can autonomously detect and respond to threats. CEO George Kurtz explicitly ties the company’s growth to AI adoption: “As businesses of all sizes rapidly adopt AI, stopping the breach necessitates cybersecurity’s AI-native platform,” he noted, highlighting Falcon as an “AI-native SOC for today and tomorrow”. We expect continued AI hype to favor CrowdStrike – for example, its new Charlotte AI assistant helps security teams triage incidents, which could drive further module uptake. That said, AI is also lowering barriers for certain tasks (possibly aiding smaller competitors) and creating novel attack vectors that test defenses. Overall, we view AI as a structural tailwind for CrowdStrike’s demand – the company is positioning itself as the AI cybersecurity leader, which could support its bull case narrative and high multiples in the medium term.

- Cybersecurity Regulations & Standards: Governments worldwide are enacting stricter cybersecurity regulations, which can both increase demand for solutions and raise the bar for vendors. In the U.S., the federal government has rolled out initiatives like the 2021 Executive Order on Improving National Cybersecurity and follow-on mandates (e.g. OMB Memo M-22-09 for Zero Trust architecture) to harden defenses. More recently in 2025, updated policies (including a new Executive Order in April 2025 and June 2025 directives) have sustained the focus on cyber standards for federal agencies and contractors. For CrowdStrike, this trend is largely positive: its platform enables Zero Trust and it meets stringent requirements (e.g. it’s an approved provider in the DHS Continuous Diagnostics and Mitigation program). Notably, CrowdStrike’s Falcon platform achieved FedRAMP High authorization in March 2025, upgrading from Moderate. This is a significant credential – it means CrowdStrike can handle sensitive government workloads at high-impact levels, opening the door to more federal contracts. It also signals to private sector clients that CrowdStrike adheres to top security standards. Moreover, new frameworks like CMMC 2.0 (Cybersecurity Maturity Model Certification for defense contractors) essentially require organizations to implement advanced security solutions – a catalyst for CRWD as companies invest to become compliant. Bottom line: Rising regulatory requirements act as a tailwind for premium cybersecurity providers. CrowdStrike is well-positioned to capitalize, given its certifications and advanced capabilities, whereas smaller or less advanced competitors might struggle to meet these higher bars.

- Federal Government Contracting Trends: The U.S. federal market (and similarly, other governments) is a growth avenue but can be fickle. CrowdStrike has been increasing its focus on federal agencies (it has a dedicated GovCloud, and DoD IL5 authorization for Department of Defense workloads). Government cybersecurity spending is generally on the rise due to geopolitical tensions and high-profile breaches. However, as Reuters reported, there are near-term headwinds: efforts at cost-cutting (e.g. a “Department of Government Efficiency” initiative) could delay or reduce federal cybersecurity projects in 2025. William Blair noted the government contract environment had become “significantly more challenging”, which contributed to CrowdStrike’s cautious Q2 forecast and subsequent stock dip. Over the long run, though, federal cyber budgets are expected to grow – especially with critical infrastructure security and zero-trust mandates. CrowdStrike’s FedRAMP High status, and its appearance on government contract vehicles, should enable it to win a fair share of this spend. The lumpiness of large government deals might introduce some quarterly volatility (one big contract win or loss can swing a quarter). We incorporate a somewhat conservative view in our scenarios: base case assumes moderate federal contribution, bull case assumes some major agency wins, bear case assumes budget stagnation. Outside the U.S., similar patterns exist – governments are increasingly allocating funds for cybersecurity (EU, APAC etc.), which expands the pie for CrowdStrike, but protectionism or preference for domestic vendors could be a minor obstacle in some regions. Overall, we consider government vertical dynamics as a moderate factor: supportive in the big picture, but a potential source of short-term variance.

- Macro Environment (Economy & Rates): Broader macro conditions play a role in the valuation and spending environment for CrowdStrike. High-growth tech stocks like CRWD are sensitive to interest rates – as rates rise, the present value of distant cash flows falls, which can compress valuation multiples. The sharp rise in 10-year yields over 2022–2023 contributed to the sell-off in high-multiple stocks; conversely, the prospect of Fed rate cuts could bolster CRWD’s valuation. Our model uses ~9% discount rate reflecting current conditions. If inflation persists and rates stay high or rise further, it could pressure all tech valuations (bear case factor). On the economic front, a recession or slowdown could constrain corporate IT budgets, delaying some security investments (as seen in certain segments of mid-market customers tightening purse strings in late 2024/2025). Cybersecurity tends to be more resilient than other IT spend (breaches still need prevention in bad times), but it’s not immune – companies might opt for cheaper solutions or shorter contracts if under financial duress. The base case assumes a modest growth economy. The bull case could be aided by an economic reacceleration (more budgets, easier sales), while the bear case envisages a mild recession reducing new bookings. Importantly, even in a downturn, cybersecurity is often prioritized – but new client acquisition might slow. CrowdStrike’s subscription model also gives it some revenue visibility (backlog of ARR) though billings growth would signal future issues. In sum, macro factors are baked into our scenario probabilities: they don’t change the secular need for security, but they can shift the timing and trajectory of growth.

In conclusion, macro and policy trends overall provide more tailwinds than headwinds for CrowdStrike in the long run – the world is waking up to cyber threats, governments are mandating stronger security, and technologies like AI are creating demand for next-gen solutions. In the near term, however, a tight economic environment and public sector budget noise act as headwinds that could restrain the otherwise high-flying stock. Investors should monitor these external factors as they can amplify or mitigate the inherent risks of CrowdStrike’s growth-heavy valuation.

Defined Buy Zones and Investment Strategy

Given our analysis of valuation and scenarios, we outline clear price “buy/hold/sell” zones for CrowdStrike. These zones indicate at what price levels the stock would offer a compelling reward relative to risk, versus where it would appear overvalued. (Note: These are approximate ranges, and investors should also consider individual risk tolerance and portfolio context.)

- Ultra Value (< ~$150): Strongest Buy. This is a deep bargain territory unlikely to be reached unless a severe market crash or company-specific crisis occurs. At <$150 (roughly 70% below current levels), CrowdStrike would trade near or below our very conservative DCF value. Such a price implies ~5× sales or less – an extreme pessimistic pricing. If the stock ever fell this low without permanent damage to its business, it would present a generational buying opportunity. We view this as highly unlikely barring a 2008-like crash or dramatically bad news. But it sets a floor: below $150, CrowdStrike would be ultra-undervalued relative to its long-term fundamentals.

- Very Strong Buy (~$150–$250): Very Attractive. In this zone, the stock would be pricing in a lot of bad news, and long-term investors could buy aggressively. At ~$200 (approximately 10× forward sales), CrowdStrike’s risk/reward becomes heavily skewed to the upside. This range corresponds to roughly the stock’s late-2022 lows. Around $180–$200, the valuation would align closer to peers and to intrinsic value assuming moderate growth – a margin of safety would emerge. We would have high conviction buying in this band, as the market’s expectations would be reset much lower, allowing CrowdStrike to outperform those lowered expectations. Essentially, $150–$250 is a strong buy zone for believers in the company’s long-term trajectory.

- Buy / Accumulate (~$250–$350): Opportunistic Buy. In the mid-$200s to mid-$300s, the stock is still expensive on absolute metrics, but much more reasonable relative to its growth. This might represent a market pullback or correction level (for instance, a 30% drop from peaks). We would consider starting or adding to positions in the $250–$300s, albeit not as aggressively as in the lower band. This range may approximate a fair value if one assumes CrowdStrike continues ~20% growth for many years. It’s above our DCF base value, but within bull-case DCF outcomes (our simulations showed some values in $250–$300 range for high-end scenarios). Thus, in this zone one can accumulate gradually, expecting solid long-term returns if the company executes well.

- Hold (~$350–$500): Fully Valued. The $350 to $500 range is where we believe CrowdStrike’s stock is adequately to richly valued under normal conditions. Closer to $350 (the low end), the stock would be reasonably valued relative to growth (around 15× forward sales), and we’d be neutral-positive – existing shareholders could hold, and new buyers might nibble for lack of better alternatives. As the price moves up toward $400-$500, the upside diminishes. At the current ~$490, as we’ve detailed, the stock is on the high end of fair (if not overvalued) assuming everything goes right. We categorize this whole band as “Hold”: one should neither be eagerly buying at these levels nor necessarily selling everything. If you own from lower prices, you can continue to hold (with maybe some profit-taking near the top of the band). If you’re looking to initiate, it may be wise to wait for dips. Our 12-month base case sits in this band, so it’s essentially a neutral zone.

- Trim / Reduce (~$500–$600): Overvalued. Above ~$500, the stock enters a zone where we’d recommend taking some profits or reducing exposure. This is where the risk of multiple contraction is high – little room for error is left in the price. For context, $550 would be nearly 30% above the average analyst target and would put the P/S well above 30×. Unless one’s conviction in the bull-case is absolute, trimming in this area is prudent risk management. We’re not necessarily predicting a crash from $550, but the expected returns become poor – the stock would be priced for beyond perfection. Thus, any minor disappointment could send it back down. Investors who rode the momentum up may consider harvesting gains here. Only those with a very long horizon and high risk tolerance might justify holding through this zone (and even then, recycling some capital could be wise).

- Sell / Too Expensive (> ~$600): Strong Sell. If the stock surpasses $600 without a commensurate change in fundamentals, we would view it as excessively overvalued. At >$600, CrowdStrike’s market cap would be ~$140B+, and P/S approaching ~40×. This would likely indicate an unsustainable speculative fervor. We would strongly advise locking in profits at that stage. Our scenario analysis doesn’t have a high probability for such a level in the near term (bull case ~$600 in 1 year, ~$800 in 3+ years, but that requires time and growth to justify). If it reached >$600 in the short term, the downside risk would far outweigh upside. In summary, >$600 is our line where fundamentals can no longer rationalize the price in any reasonable scenario, making it a sell zone.

These buy/hold/sell zones serve as a guide. They will shift over time as the company grows – for example, if earnings double in 3 years, the upper bands would adjust upward accordingly. But for the current snapshot, they encapsulate our valuation stance: CrowdStrike is a phenomenal company with strong prospects, but at the current stock price, much of that greatness is already priced in. Patience may reward investors with better entry points. Meanwhile, existing shareholders should periodically rebalance exposure, especially if the stock rallies into the “overvalued” zone, to protect against the inevitable volatility in a high-multiple stock.

Conclusion

CrowdStrike sits at the crossroads of powerful trends – cloud computing, AI, and an unrelenting cyber threat landscape – and it has executed exceptionally well to become a market leader. The company’s fundamentals (growth, retention, innovation) are top-tier in the software industry, and its long-term growth runway remains attractive. However, our comprehensive analysis finds that investors are currently paying a steep price for this excellence. The stock’s next 12 months are likely to be a tug-of-war between continued strong company performance and a valuation that leaves little room for error. We expect volatility around earnings and macro news as the market recalibrates growth expectations post-pandemic and amid higher interest rates.

For investors with a short-term horizon (12 months), we recommend a cautious stance – Hold at current levels, with a bias to take profits on rallies. The risk of a correction outweighs the chance of significant further near-term upside, in our view, given the valuation. For those with a longer horizon (3-5+ years) who believe in CrowdStrike’s vision, the stock can still be a rewarding investment – but ideally on pullbacks. A core strategy might be: initiate or add to positions incrementally on any dips into the $300s, and certainly below $300 if the opportunity arises, to build a stake at a reasonable cost basis. Then be prepared to hold through volatility, as the company’s growing cash flows eventually vindicate the investment.

We will continue to monitor key swing factors: growth rate trajectory (does revenue reaccelerate or decelerate further?), competitive wins/losses (market share against Microsoft, Palo Alto, SentinelOne, etc.), macro environment (IT spending trends, rate changes), and any signs of multiple compression in high-growth tech. Upside catalysts ahead could include new product launches (e.g. successful foray into adjacent markets like data observability or security automation), strategic acquisitions that expand the TAM, or geopolitical cyber incidents that spur a wave of security spending. Downside catalysts could be an earnings miss, a security breach/outage impacting CrowdStrike’s reputation, or simply a market rotation away from expensive growth stocks.

In summary, CrowdStrike is executing from a position of strength, but its stock is priced for perfection. Our Vulcan-mk5 model’s holistic evaluation – blending fundamental factors, scenario analysis, and quantitative valuation – suggests caution in the near term and optimism in the long term. By maintaining discipline around entry points (as per our buy zones) and continuously revisiting the assumptions as new information emerges, investors can harness CrowdStrike’s compelling growth story while managing the risks inherent in its valuation.

Investment verdict: Hold for now; accumulate on significant dips. CrowdStrike is a long-term winner in cybersecurity – the goal is to own it at the right price. Currently, that price appears higher than what prudent investing dictates, but given time (or a market pullback), opportunity should knock. As always, diversification and risk management are advised, especially with a high-beta stock like CRWD. We will update our outlook if and when the fundamental story or price dynamically shifts.

References

【2】 MarketBeat – “CrowdStrike (NASDAQ:CRWD) Stock Price Up 2.3% – Here’s Why”, June 25, 2025. (Analyst ratings, price targets, financial ratios, recent earnings)

【3】 Motley Fool via Nasdaq – “CrowdStrike Stock Is Crushing the S&P 500 in 2025. Is the AI Juggernaut Still a Buy?”, Anthony Di Pizio, June 6, 2025. (Falcon platform, AI approach, 2025 YTD performance +34% vs S&P, slowing growth, long-term guidance)

【4】 Motley Fool via Nasdaq – (Same as above). (CrowdStrike’s P/S ~28.7 vs competitors, growth vs Zscaler/SentinelOne, long-term $10B ARR goal by FY2031, stock expensive with slowing growth)

【12】 CrowdStrike Investor Relations – “Q4/FY2025 Earnings Release (Exhibit 99.1)”, March 4, 2025. (FY25 results: ARR $4.24B +23%, revenue $3.95B +29%, FCF $1.07B, gross margin ~78-80%, CEO and CFO quotes on AI and target model)

【18】 Reuters – “CrowdStrike forecasts downbeat second-quarter revenue, shares fall”, June 3, 2025. (Q2 FY26 guidance miss, macro headwinds: higher rates & inflation hitting tech spend, government cost-cutting impact, William Blair commentary, competition mention, share buyback announcement)

【32】 MarketsMojo – “Is CrowdStrike Holdings, Inc. overvalued or undervalued?”, June 25, 2025. (Valuation grade moved to “risky” as of Mar 2025, highlighting negative earnings and high ratios: P/B ~33.8, EV/S ~27.3, P/E -813; notes CRWD’s return +43.7% YTD vs S&P’s +2.4%, disconnect between price and fundamentals)

【38】 CompaniesMarketCap – “P/S ratio for SentinelOne (S)”, accessed June 25, 2025. (SentinelOne current P/S ~6.84 TTM, ended 2025 at ~7.2, with historical context – significantly lower than CrowdStrike’s P/S)

Leave a comment