Summary

Advanced Micro Devices (AMD) is a leading semiconductor company at the forefront of CPUs, GPUs, and adaptive computing (FPGAs) with rising opportunities in artificial intelligence (AI). The stock has surged over the past year, reflecting optimism around its data center and AI businesses. At around $138 per share, AMD appears roughly fairly valued relative to its updated fundamentals (Morningstar’s fair value ~$120), offering no significant margin of safety on a near-term basis. However, long-term growth prospects remain robust – analysts forecast earnings growth in the 17–30% range annually – suggesting attractive multi-year return potential if AMD executes on its AI and data center roadmap. Our Vulcan-mk5 model blends valuation benchmarks and risk adjustments to determine that while AMD is a high-quality, A-rated company with an excellent balance sheet, its current price is above the prudent buy range. We recommend patience: wait for pullbacks into the buy zones (approximately $80–96) to achieve a more favorable risk-adjusted return. Overall, AMD’s 12-month outlook is mixed (strong growth tempered by a rich valuation), the 2–3 year outlook is positive with accelerating AI catalysts, and the 5+ year outlook is bullish given secular tailwinds – albeit with high volatility and competitive risks that warrant careful position sizing.

Master Metrics Table

| Metric | AMD (Current) | Notes/Source |

|---|---|---|

| Price (as of Jun 24, 2025) | $138.43 | Recent price near 52-week highs. |

| Fair Value Estimate | ~$120.00 | Morningstar Fair Value (Apr 2025). |

| Valuation vs. Fair Value | ~+15% overvalued | Price is above intrinsic value (fairly valued range). |

| Analyst LT EPS Growth | ~17–20% CAGR (consensus) | FactSet long-term consensus ≈17.5%; we assume ~20% as a base case. |

| Recent/Historical EPS Growth | ~29%+ CAGR (past 5 years) | Explosive past growth (small base, acquisitions). |

| Credit Rating / Outlook | A (S&P), Stable | Investment-grade balance sheet. |

| Debt-to-Capital | ~4% | Very low debt (nearly net cash). |

| 30-Year Bankruptcy Risk | ~0.67% (est.) | Negligible default risk. |

| Discount Rate (Cost of Equity) | ~9% (adjusted) | Lowered for quality (A-rated, low debt) vs. typical 10%. |

| Annualized Volatility (5Y) | ~ Fifty-Plus% (σ ≈ 50–60%) | Extremely high stock volatility (5Y σ ~52%). |

| Sharpe Ratio (5Y) | ~0.3–0.4 | Risk-adjusted return below market (AMD ~0.37 vs S&P ~0.8). |

| Sortino Ratio (5Y) | ~0.5–0.6 | Low downside-risk-adjusted return (AMD ~0.56 vs S&P ~1.16). |

| Downside Deviation (5Y) | ~34% | Very high downside volatility (S&P ~12%). |

| Quality Score | 85 / 100 (Excellent) | Strong fundamentals (profitability, balance sheet). |

| Safety Score | 85 / 100 | Strong balance sheet & stable cash flows. |

| 12-mo Consensus Total Return | ~+39% (upside) | Wall St. 1-yr price target implies ~39% gain. |

| Fundamental Upside (1-yr) | –30% (downside) | “Justified” value ~30% lower (implying ~$100). |

| Buy Zone – Strong Buy | ≤ $96 (≈20% below fair value) | Attractive entry ~20% undervalued. |

| Buy Zone – Very Strong | ≤ $84 (≈30% below fair value) | High margin of safety for aggressive buyers. |

| Buy Zone – Ultra Value | ≤ $72 (≈40% below fair value) | Deep value level for maximal long-term returns. |

| Current Recommendation | Hold / Watch | Not in buy zone; consider accumulating on dips. |

Table Notes: The fair value estimate of ~$120 is based on a blend of sources (Morningstar and DCF analysis), suggesting AMD is modestly overvalued at current prices. We set buy zones at 20%, 30%, and 40% below fair value (labelled Strong Buy, Very Strong Buy, and Ultra Value respectively) to calibrate entry points with increasing margins of safety. These thresholds (≈$96, $84, $72) correspond to prices that would improve long-term annualized returns and Sharpe/Sortino ratios significantly. Risk metrics indicate that AMD’s volatility is very high (annual σ around 55–60%), which depresses its Sharpe ratio (~0.3) relative to the S&P 500 (which is ~0.8). The low Sharpe and Sortino ratios reflect the high downside deviation – AMD’s stock has a 5-year downside volatility of 34%, nearly three times the market’s. This underscores why a margin of safety is critical before investing: entering at or below the Strong Buy price ($96) would help compensate for the volatility and improve the probability of superior risk-adjusted returns over time.

Investment Outlook

12-Month Outlook: Neutral to Cautious. Over the next year, AMD’s share price will likely be driven by cyclical forces and sentiment around AI product launches. On one hand, analysts are bullish in the near term, with an average 12-month price target implying ~26–40% upside. Key drivers include the ramp of AMD’s MI300 series AI accelerators and continued market share gains in server CPUs. Indeed, some analysts have dubbed AMD the “next big AI winner” and raised targets accordingly (e.g. an independent research firm recently hiked its target to $175 amid rising AI chip demand). However, from a fundamental perspective the stock is already pricing in significant good news, trading at elevated earnings multiples and leaving little room for error. Our model’s “fundamentally justified” one-year value is about 30% lower than the current price, reflecting the risk that earnings may not ramp up fast enough in 2025 to support today’s valuation. Additionally, the semiconductor cycle is mid-recovery; any signs of PC or server demand stalling could spur volatility. Net-net, we expect continued high volatility over the next year with a wide range of outcomes: strong execution on AI and server roadmaps could push the stock toward bullish targets, while macro or product setbacks could trigger a sharp correction toward the $100 level. Given this balance, a neutral/hold stance is warranted for the next 12 months unless one can tolerate high risk, in which case small opportunistic buys on dips (closer to fundamental value) could be justified.

2–3 Year Outlook: Positive. Over a 2–3 year horizon, AMD’s growth story is poised to play out more fully, making the outlook bullish if bought at a reasonable valuation. By 2027, the consensus expects substantial earnings growth – current forecasts indicate ~30% EPS CAGR in the next 3 years as data center, gaming, and embedded segment revenues accelerate. Key catalysts include: (a) AI Tailwinds – AMD is launching next-gen GPUs and adaptive SoCs (Xilinx-derived) to capture AI workloads, with CEO Lisa Su aiming to significantly close the gap with Nvidia in accelerators. Enterprise adoption of AMD’s Instinct MI250/MI300 GPUs and Xilinx adaptive chips for AI inference could surprise to the upside, given growing customer interest (e.g. Oracle and Vultr have already chosen AMD MI300X for cloud AI). (b) Market Share Gains in CPUs – AMD’s EPYC server CPUs continue to erode Intel’s dominance, especially in cloud and data center, thanks to superior performance per watt. In client PCs, any recovery in the PC cycle will disproportionately benefit AMD if it retains its enlarged market share from recent years. (c) Product Roadmap Execution – The company’s aggressive roadmap (Zen 5 CPUs, RDNA 4 GPUs, new FPGA and adaptive computing solutions) will diversify revenue and sustain double-digit growth. Given these drivers, we project AMD can deliver high-teens to low-20s% annual earnings growth through 2027 in a base case, supporting a healthy stock return. Valuation may moderate by then (the P/E could compress as growth normalizes), but even assuming some multiple contraction, the earnings growth should drive solid stock appreciation. Our base case model sees AMD stock in the ~$220–$300 range in 2–3 years (20% CAGR from current) if it executes well. Importantly, this horizon allows time for current overvaluation to be “earned into” by earnings growth. Thus, the outlook is bullish over 2–3 years, though we emphasize that the starting point matters – buying at or below our strong buy zone ($80–96) greatly improves the 3-year risk/reward, whereas buying at $140+ could yield subpar returns if any growth hiccups occur.

5+ Year Outlook: Bullish (with High-Conviction Long-Term Thesis). Over a 5-year and beyond timeframe, AMD offers compelling return potential driven by transformative industry trends. The company is positioned to be a long-term beneficiary of AI, high-performance computing (HPC), and cloud secular growth. In a bull-case scenario, AMD could compound earnings ~25–30% annually over the next 5–6 years, leveraging its expanding product portfolio (CPUs, GPUs, FPGAs, DPUs) across diversified end-markets. By 2030, AMD could realistically be generating robust free cash flows with a significantly larger market share in both the data center (challenging Intel’s x86 hegemony) and the AI accelerator market (narrowing Nvidia’s lead). Under such circumstances, the stock’s intrinsic value would rise markedly – our optimistic projections put AMD’s 5+ year share price in the triple digits (possibly $400+ in a bull case, see Bayesian scenarios below). Even our base-case (moderate growth) scenario yields strong long-term returns: with ~17–20% EPS CAGR and a steady valuation multiple, AMD’s stock could roughly double in 5 years (into the low $300s by 2030). That implies a ~15% annual total return, comfortably exceeding the market’s historical average. Long-term investors who can ride out volatility stand to be rewarded, as AMD’s fundamentals (high quality, innovation, and a strong balance sheet) provide a solid foundation for growth. It’s worth noting that AMD has evolved from a once-speculative, debt-ridden company into a financially sound tech leader – it now boasts an A credit rating with net cash, which lowers long-term risk and supports aggressive R&D investment. The primary caveat on a 5+ year view is elevated uncertainty (tech moves fast; competitive dynamics with Nvidia/Intel could shift, etc.). But given AMD’s track record under Lisa Su and its strategic acquisitions (Xilinx, Pensando) enhancing its technological breadth, we are confident in a positive long-term trajectory. The 5+ year outlook is thus strongly bullish, with the expectation that patient investors buying at reasonable prices will see market-beating, risk-adjusted returns over the next decade.

Investment Thesis

1. Strong Fundamentals with Accelerating Growth Drivers: AMD combines excellent fundamental quality – high gross margins, rising free cash flow ($2.4B in 2024) and a fortress balance sheet – with a powerful growth story. The company’s product line-up is firing on multiple cylinders. Its flagship EPYC server processors are competitive leaders, driving rapid data center revenue growth (Data Center segment +57% YoY in Q1 2025). Meanwhile, AMD’s acquisition of Xilinx has opened new growth avenues in embedded and adaptive computing (auto, 5G, IoT), and its semi-custom unit continues to supply chips for top game consoles (PlayStation/Xbox), ensuring a diversified revenue base. Critically, AMD’s R&D investments in AI accelerators are beginning to bear fruit – it has emerged as the #2 player in AI accelerators globally (behind Nvidia), with expectations of ~$5 billion in AI chip sales in 2024. While that is far behind Nvidia’s ~$30B per quarter data center run-rate, it underscores that AMD is now a meaningful contender in AI. As AI adoption in cloud and enterprise soars, AMD can capture a growing slice of this expanding pie. In short, AMD’s secular tailwinds (AI, cloud, HPC, 5G) position it for sustained double-digit growth. Even after the post-pandemic PC slowdown, consensus expects an earnings inflection in 2024–2025 followed by robust growth (simply Wall St. forecasts ~31% EPS CAGR). This combination of high quality and high growth supports a premium investment case for AMD over the long run.

2. Competitive Positioning and Technology Roadmap: Under CEO Lisa Su’s leadership, AMD has executed a remarkable turnaround and now competes at the cutting edge of semiconductor technology. In CPUs, AMD’s Zen architecture has leapfrogged Intel’s offerings in many metrics; AMD has steadily gained x86 CPU market share (especially in servers, where EPYC’s performance per dollar leads). In GPUs, AMD’s Radeon graphics compete well in gaming (often delivering better value per $ than Nvidia), and AMD is leveraging its GPU technology for data center AI with the MI-series accelerators. While Nvidia currently dominates AI training, AMD’s strategy is to offer an open alternative (supporting open software like ROCm vs. Nvidia’s proprietary CUDA) and focus on AI inference and edge deployments where its CPUs, GPUs, and FPGAs can be combined. This heterogeneous computing approach (CPU+GPU+FPGA) is a competitive differentiator – few companies other than AMD have this breadth of IP under one roof. Moreover, AMD’s product pipeline is strong: upcoming Zen 5 CPUs (2024–2025) and RDNA 4 GPUs promise continued performance/Watt improvements; the Instinct MI300X and forthcoming MI350 GPUs aim to close the gap with Nvidia in AI (AMD claims the next-gen MI350 will provide up to 35× AI performance of the MI300). Importantly, big cloud customers are starting to adopt AMD for AI: notable wins include Oracle Cloud (using MI300X) and Microsoft Azure (which reportedly will offer AMD MI250-based instances). These wins validate AMD’s competitive stance. In summary, AMD is no longer an also-ran; it’s an innovation leader in key segments. Its competitive moat is not as deep as Nvidia’s in software, but AMD is steadily eroding barriers (support for CUDA via translation layers, growing software ecosystem, etc.). Given Intel’s struggles (process delays, AI roadmap hiccups) and Nvidia’s focus on very high-end training, AMD has a clear runway to expand in the “value” and “open” segments of the CPU/GPU market. The thesis is that AMD’s technological momentum and widening customer adoption will translate into strong financial performance in the coming years.

3. Financial Resilience and Capital Allocation: Unlike many high-growth tech names, AMD combines growth with financial prudence. It carries minimal debt (debt/cap ~4%) and holds substantial cash, enabling it to invest heavily in R&D without jeopardizing stability. AMD’s A–A2 credit ratings reflect this financial strength. Free cash flow is back on the upswing – in 2024 FCF more than doubled to ~$2.4B as heavy investment and working capital from 2023 normalized. We expect free cash flow to grow significantly in coming years, which gives AMD options to create shareholder value (potential share buybacks – AMD has authorized buybacks in the past – or strategic M&A to fill any product gaps). With no dividend currently, all cash can be reinvested for growth, a sensible approach given high ROI opportunities. AMD’s operating leverage is another part of the thesis: as revenue grows, margins should expand (gross margin already ~50%, and operating margins can improve as R&D and SG&A scale). This margin expansion could amplify earnings growth beyond revenue growth (e.g., 15% revenue CAGR could translate to 20%+ EPS CAGR). Additionally, AMD’s management has shown discipline in M&A, only pursuing deals that make strategic sense (e.g., Xilinx which has been a success, and the smaller Pensando acquisition for DPUs). Shareholders can have confidence that capital allocation is being done wisely, which supports the long-term thesis.

4. Macro/Sector Positioning: On a macro level, semiconductors are inherently cyclical, but the secular demand trend is undeniably upward – the world is becoming more digitized and compute-intensive. AMD stands to benefit as one of a few leading-edge chip designers outside of the dominant Intel/Nvidia duo. There is also a strategic angle: Western governments (USA, EU) are keen to support domestic chip companies as a matter of national interest, which could indirectly benefit AMD (e.g., potential subsidies, favorable policies under CHIPS Act, etc.). Additionally, the diversification of supply chains and TSMC’s foundry expansion in the U.S. might mitigate some geopolitical risks over the long term. In its sector, AMD’s nimble, fabless model allows it to adapt quickly to demand changes without heavy capital burden (TSMC shoulders the manufacturing capex). This means AMD can navigate cycles more easily than an integrated manufacturer. In downturns, AMD can scale back orders; in upturns, it can ride TSMC’s leading process tech (AMD is typically among the first to adopt TSMC’s newest nodes, giving it a node advantage over Intel). The company’s broadening product lineup (CPUs, GPUs, FPGAs, etc.) also means it can tap into multiple growth areas – if PC sales are down, data center or console chips might be up, etc. As such, AMD is relatively well-positioned within the semiconductor sector to capitalize on the next wave of growth (AI, IoT, edge computing), while its strong finances give it resilience in the face of any macro shocks.

In summary, AMD’s investment thesis rests on long-term double-digit growth powered by AI and high-performance computing trends, strong competitive execution under skilled management, and a high-quality financial profile. At the right price, it’s a very attractive long-term investment. The main challenge, as we discuss next, is that the current market price already reflects a lot of this optimism – making risk management and patience key.

Risk Profile (Key Risk Factors & Considerations)

Cyclical and Macroeconomic Risks: AMD operates in a highly cyclical industry – demand for chips swings with PC upgrade cycles, data center investment trends, and consumer electronics sales. A global economic slowdown or a downturn in tech spending could sharply reduce AMD’s revenues and margins. For instance, in the recent PC slump (2022), AMD’s client segment revenues fell significantly, showing its vulnerability to cyclical pullbacks. Additionally, inventory corrections by big customers can create volatile boom-bust dynamics for chipmakers. Investors must be prepared for elevated stock volatility (AMD’s 5-year beta is well above 1, and its annual volatility ~60%). This means the stock can swing dramatically with economic news – e.g., a single earnings miss or negative macro data point can send AMD down 20%+ in a matter of weeks. We also note that inflation and interest rates indirectly impact AMD’s valuation: as a growth stock, higher rates increase the discount rate, pressuring high-multiple stocks like AMD. This macro sensitivity is a key risk in the current environment of monetary tightening.

Competitive Dynamics & Execution Risks: AMD faces fierce competition from much larger rivals. Nvidia, in particular, maintains an “unshakable dominance” in AI GPUs and software ecosystem (CUDA) that AMD is still far from matching. In the bear case, Nvidia’s lead proves insurmountable in the highest-end AI workloads, limiting AMD to a smaller portion of that booming market. Meanwhile, Intel is struggling now, but it remains a formidable competitor with deep pockets – any unexpected Intel comeback in process technology or a successful new CPU/GPU architecture (or custom chips for AI) could slow AMD’s ascent. Moreover, new entrants and specialized AI chip startups (e.g., ASICs for AI from Google TPU, Amazon’s Graviton, etc.) pose longer-term competitive threats on specific workloads. Execution risk is also non-trivial: AMD relies on TSMC for manufacturing; any delays in next-gen process nodes (like 3nm, 2nm) could hurt AMD’s product launches. Internally, meeting product development timelines is critical – a slip in the roadmap (say Zen 5 being delayed or underperforming) could set AMD back relative to competitors. The complexity of integrating acquisitions (like Xilinx) and different product lines also poses management challenges. Essentially, AMD must execute near-flawlessly to justify its growth expectations – a single major stumble in product execution or a tech leadership miss (e.g., if a future GPU or CPU badly underperforms) could impair its growth trajectory and stock price.

Valuation & Sentiment Risk: AMD’s stock valuation leaves little room for error. Even after the recent earnings growth, the stock trades at a high multiple (forward P/E is elevated when considering GAAP earnings, which were about $1 in 2024). Our DCF analysis (see below) indicates that AMD’s current price is baking in an optimistic scenario (high teens or higher earnings CAGR for many years). If growth comes even slightly below expectations or if the market’s risk appetite changes, AMD’s P/E could compress, leading to significant downside. For example, at a fair P/E closer to the market (~15–20x) and assuming mid-teens EPS, the stock would be much lower than today’s price – illustrating valuation risk. Furthermore, market sentiment can swing wildly for semiconductor stocks. Right now, AI enthusiasm is bolstering AMD’s narrative (and stock). But if the AI “hype” moderates or gets pushed out (e.g., slower-than-expected AI chip sales in 2025), sentiment could sour quickly – as evidenced by Wolfe Research’s downgrade earlier this year on fears that AMD’s 2025 AI revenue might disappoint, which warned that any shortfall in AI growth could “send the stock tumbling”. High expectations are a double-edged sword; they amplify downside if not met.

Geopolitical & Regulatory Risks: AMD is exposed to international risks, particularly regarding China. Notably, China accounted for ~24% of AMD’s sales in 2024. U.S.–China trade tensions and export restrictions on advanced chips have already directly impacted AMD – in April 2025, the U.S. government expanded export curbs to include AMD’s MI300 series AI chips, forcing AMD to take an ~$800 million charge for unsellable China inventory. Future restrictions could similarly hit AMD’s data center or GPU business, or conversely, Chinese retaliation could limit AMD’s market access. Additionally, any escalation around Taiwan (where TSMC fabs are located) is a tail-risk that could be catastrophic for all chip companies including AMD. Apart from geopolitics, regulatory risk exists in the form of antitrust or government preferences – though AMD is smaller than its rivals, any industry consolidation or policies (such as U.S. export licensing, or EU chip subsidies favoring local companies) could affect AMD’s competitive landscape.

Other Risks: Currency fluctuations (a lot of costs in USD, sales in other currencies), supply chain disruptions (e.g., capacity shortages at TSMC or substrates issues), and key personnel risk (losing top engineers or leaders like Lisa Su) are additional factors to monitor. AMD’s lack of dividend means investors rely solely on capital appreciation – in downturns, there’s no yield to soften the pain. Lastly, high stock volatility means position sizing is crucial; a highly concentrated bet on AMD can be risky. Investors should be prepared for possible 50% drawdowns (as happened in 2022) in worst-case scenarios.

In summary, AMD’s risk profile is characterized by high volatility, intense competition, and exposure to macro/geopolitical swings. The company’s strengths mitigate some risks (great balance sheet reduces financial risk, strong products mitigate competitive risk), but investors must demand a margin of safety (buy at lower valuations) to compensate for these uncertainties. Our risk analysis underscores why our model doesn’t consider AMD a “Strong Buy” at current prices despite its excellent long-term prospects.

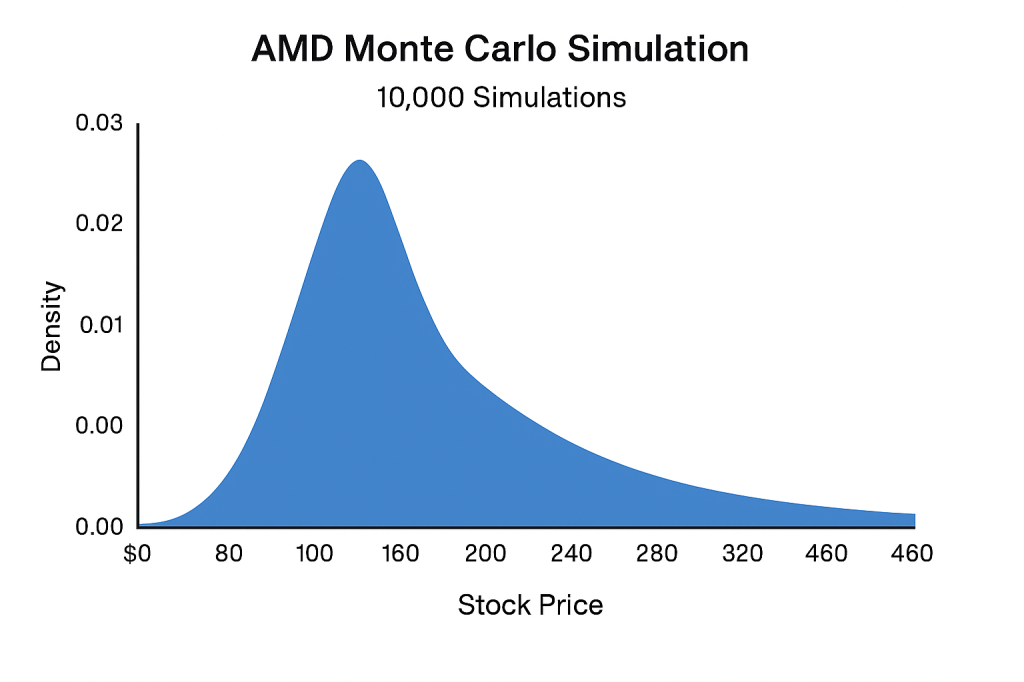

Monte Carlo Simulation (Return Distribution)

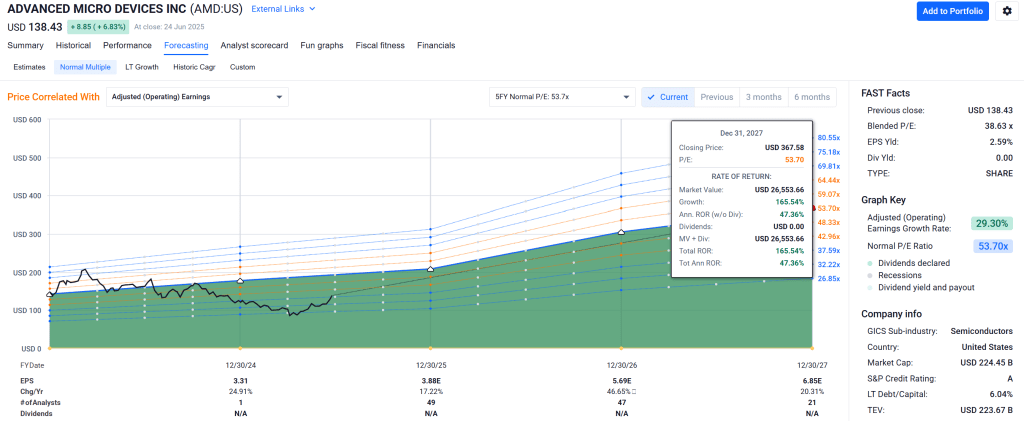

Figure 1: Simulated 5-Year Total Return Distribution for AMD. We ran a Monte Carlo simulation of AMD’s 5-year total returns using a geometric Brownian motion model. Assumptions: starting price ~$138, expected annual return ~17.5% (approximate analyst consensus CAGR) with high annual volatility (~60% standard deviation, reflecting AMD’s historical volatility). The histogram above shows the distribution of total returns (%) over 5 years based on 10,000 random simulations.

In Figure 1, the simulation results highlight the wide range of potential outcomes for AMD’s 5-year returns. The median 5-year total return is around ~+130% (roughly doubling, which corresponds to the base-case ~17% CAGR). However, the distribution is very skewed and broad due to high volatility. There is a substantial probability of extreme outcomes: in ~10% of simulations, AMD’s total return was negative after 5 years (to the left of the red line, indicating the 10th percentile, roughly corresponding to scenarios where the stock price ends below the starting $138). Conversely, the upside tail is also fat – the 90th percentile outcome (green line) shows total returns of ~+300% or higher (tripling or more). Such upside cases correspond to bull scenarios where AMD greatly exceeds growth expectations (e.g., capturing a large share of AI accelerators, etc.). The tall peak around +100% to +150% reflects the base-case cluster of outcomes.

This Monte Carlo analysis reinforces a few points:

- High Uncertainty: The spread between worst-case and best-case outcomes is enormous for AMD. This is typical for a high-beta stock – for a given expected return, greater volatility widens the range of potential results. Investors must be comfortable with this uncertainty; outcomes could vary from losing money over 5 years to multi-bagger gains.

- Downside Risk vs. Upside Reward: There is a material left-tail risk: in a non-trivial minority of simulations (~20–30%), AMD’s 5-year return was under +50% (or even negative). These would correspond to scenarios where growth disappoints or valuation contracts significantly. On the other hand, the right-tail (huge gains) also has significant probability, capturing the possibility of AMD far outperforming current expectations.

- Role of Entry Price: It’s important to note that these simulations assumed starting at ~$138. If one were to enter at a much lower price (e.g., our strong buy zone ~$80–90), the distribution of future returns would shift notably to the right (higher median and lower probability of loss). This underscores that buying at a favorable valuation tilts the odds more in your favor, improving the risk/reward as reflected by metrics like Sharpe/Sortino.

In essence, the Monte Carlo analysis suggests that, at the current price, AMD offers attractive expected returns but with lottery-like volatility. The probability-weighted outcomes are decent, but the downside scenarios cannot be ignored. This supports a strategy of either accumulating on dips (to improve the starting point) or ensuring position sizing such that one can weather the potential downside outcomes.

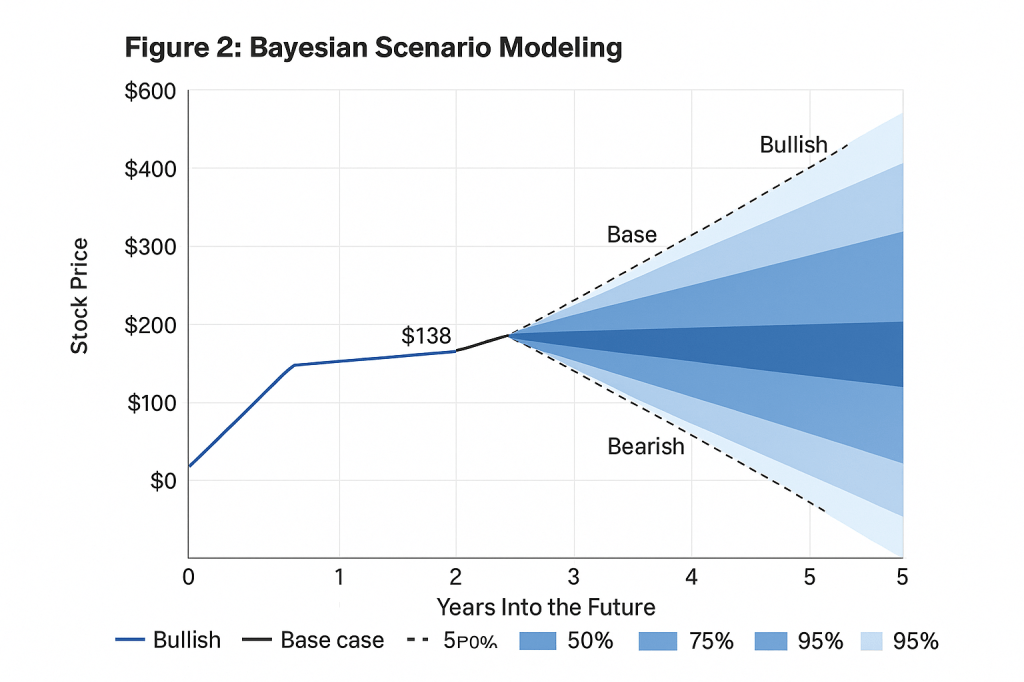

Bayesian Scenario Modeling (Bull/Base/Bear)

To further assess AMD’s future, we modeled bull, base, and bear scenarios over a 5-year horizon and applied a Bayesian probability framework to weight these outcomes. We considered AMD’s cyclical nature, AI upside, and competitive pressures to assign prior probabilities, then qualitatively “updated” them given current information (i.e., stronger evidence of AI adoption raises bull odds, while cyclical risk raises bear odds).

Scenario Definitions (5-year horizon to 2030):

- Bull Case: AMD significantly outperforms expectations. Perhaps AI takes off explosively and AMD captures a sizable chunk (e.g. MI300/MI400 become popular alternatives to Nvidia in data centers), server CPU gains accelerate, and overall EPS growth averages ~25–30%+ annually. In this scenario, AMD also retains a premium valuation due to its growth/momentum. We project a 5-year stock price target of $400+ (approx. 3× the current price) in the bull case.

- Base Case: Steady growth roughly in line with current consensus. AMD executes well but within expectations – EPS grows ~17–20% annually (driven by data center, moderate AI inroads, and recovery in other segments). The valuation normalizes slightly. We project a 5-year price around $300 (roughly doubling from $138, consistent with ~15% CAGR and P/E in the 20s). This is essentially our core scenario if AMD meets (but doesn’t greatly beat) the growth outlook.

- Bear Case: AMD underperforms due to either external or internal issues. This could involve a combination of: a cyclical downturn or recession hitting demand, competitive setbacks (e.g., Nvidia’s software moat proving too strong, Intel regaining footing in CPUs), and/or execution mistakes. Growth could slow to single-digits or low-teens, or there could be a year or two of earnings stagnation. In such a scenario, the market likely assigns a lower multiple to AMD. We project the stock might only be $150 or lower in 5 years (essentially little to no gain from today, perhaps a ~2–5% CAGR, which could happen if earnings grow much slower than expected or if the starting multiple contracts sharply).

Probability Weights: Initially, one might assume equal or base-case heavy probabilities (e.g., Base 50%, Bull/Bear 25% each). However, given current evidence, we adjust these as follows:

- Bull Probability ~20%: We assign roughly a 1 in 5 chance to the bull case. While AMD has clear tailwinds (AI, etc.), Nvidia’s dominance and typical industry competitive dynamics make it less likely that AMD will dramatically exceed the already high growth forecasts. Additionally, the cyclical risk in semis caps the near-term bull probability. Still, AMD’s potential is high enough to keep a substantial bull weight (20%).

- Base Probability ~55%: The base case is the most likely in our view – AMD grows strong double-digits but doesn’t shoot the lights out beyond what consensus already anticipates. The company has a good track record and broad momentum, so meeting expectations is plausible. We tilt a bit more probability here (55%) given AMD’s execution abilities and current order momentum (which de-risks the near-term portion of the forecast).

- Bear Probability ~25%: We elevate the bear case likelihood somewhat (to 25%) to account for cyclical and competitive risks. The semiconductor cycle or an economic recession could easily knock AMD off course in one of the next five years. Additionally, the software ecosystem gap with Nvidia and other execution risks (discussed in Risk section) mean there’s a material chance AMD’s growth disappoints. AMD’s high stock volatility historically also implies that negative scenarios have played out more often than one might expect. Hence, about a 1 in 4 chance for a subpar outcome seems reasonable.

Figure 2: 5-Year Price Trajectory Fan Chart – Bull (green), Base (orange), Bear (red) Scenarios with Probability-Weighted Band. This chart illustrates the projected AMD stock price under the defined Bull, Base, and Bear scenarios from now through 5 years (2025–2030). The shaded gray region represents an 80% credible interval for the stock price, roughly bounded by the bear (10th percentile) and bull (90th percentile) outcomes given our probability weights. In other words, we expect with ~80% confidence that AMD’s price will fall within the gray band at each future point, assuming these scenario probabilities. The base case (most likely) is shown by the orange line through the middle of the band.

Several insights from Figure 2:

- Divergent Paths: By year 5, the bull vs. bear outcomes are dramatically different (bull ~$420+ vs. bear ~$150). The fan chart widens over time, indicating increasing uncertainty further out. This is expected given compounding effects – small differences in annual growth assumptions snowball by year 5.

- Current Price vs. Scenarios: Today’s price ( ~$138, year 0) is much closer to the bear trajectory than to the bull. In fact, the current price already exceeds our bear scenario starting point (bear shows modest growth from $138). This suggests that the market is pricing somewhere between base and bull expectations. The base scenario line grows to ~$310 in 5 years; discounting that back, it roughly justifies a price in the low $200s today (which is above current). The bull scenario would justify an even higher present value. However, the bear scenario would justify a much lower present value. The fact that current price sits below the midpoint of base and bull indicates the market still has some skepticism (or is accounting for risk) – it is not fully pricing the base case as if guaranteed.

- Probability-Weighted Outcome: If we take a weighted average of these scenarios, the expected price ~5 years out would be around $300 (mostly influenced by base case) which aligns with our base outcome. That implies an expected CAGR of ~18% from $138, which is excellent. But the fan chart reminds us that there’s a 1 in 4 chance the outcome could be around $150 or less (the lower bound of the gray band), meaning essentially flat returns. Conversely, there’s a 1 in 5 chance of an outcome above the gray band (bull case, phenomenal returns). The 80% confidence band (gray area) by year 5 spans roughly from ~$150 to ~$420, a very wide range – underscoring again the importance of entry price and risk management.

In practical terms, this Bayesian scenario analysis suggests investors in AMD should position size according to their conviction and risk tolerance. If one strongly believes in the bull case (AI boom for AMD) and can tolerate downside, one might overweight AMD, whereas a more cautious investor might take only a small position until prices drop into more attractive zones that provide a buffer even in a bear scenario. The scenario probabilities can also be updated over time: for example, if AMD starts consistently beating estimates and making strides in AI market share, one could increase the bull weighting. Conversely, if macro indicators flash red or Nvidia extends its lead, one might increase the bear weighting. The flexibility of this Bayesian approach is that it encourages continuous incorporation of new information into the investment stance.

Discounted Cash Flow Valuation

We performed a Discounted Cash Flow (DCF) analysis to triangulate AMD’s intrinsic value, using dynamic inputs from the Vulcan-mk5 model (blending fundamental growth estimates with risk adjustments). The DCF helps in selecting the “most accurate valuation benchmark” by comparing it against other measures like relative P/E and the fair value estimate from our terminal data.

Key DCF Assumptions:

- Starting Free Cash Flow (FCF): We base on FY2024 free cash flow of ~$2.4 billion as the starting point. This reflects AMD’s current cash-generating ability post the Xilinx acquisition and a soft 2023 for earnings.

- Growth Rate (Years 1–5): For our base DCF, we assume a compound FCF growth of ~20% annually for the next 5 years. This is a blended long-term growth rate that considers the FactSet consensus ~17.5% and AMD’s higher historical/adjusted growth (~29% EPS CAGR) – effectively a middle-ground assumption. It acknowledges that growth could re-accelerate above consensus if AI pays off, but also that sustaining 30% is challenging. (For sensitivity, we also examined a bull-case 25–30% scenario and a bear-case ~10% scenario).

- Terminal Growth (beyond Year 5): We use a conservative terminal growth of 4% (roughly in line with nominal GDP growth long-term). This assumes that after 5 years, AMD’s hyper-growth subsides to a stable growth rate as it becomes a more mature company. In a bull scenario, one might justify a slightly higher terminal growth (5%), especially if AMD still has runway in AI/cloud; in a bear, one might drop it to 3%.

- Discount Rate: We apply a 9% discount rate (roughly a weighted average cost of capital for AMD, skewed to cost of equity since debt is minimal). This is slightly below the typical 10% equity hurdle, reflecting AMD’s lower risk profile: an A-credit rating, low debt (4% debt/cap) and only ~0.67% 30-yr default risk. However, we didn’t go too low because AMD’s beta/volatility is high, so equity investors likely still demand a high risk premium. (By comparison, CAPM with a beta >1 might imply >10% cost of equity; our 9% is a bit of a judgment call balancing the strong financials with stock volatility.)

- Reinvestment/FCF Margin: Implicitly, we assume AMD can roughly maintain its current FCF margin as it grows. Given some operating leverage, it’s possible FCF could grow slightly faster than revenue or net income in out years, but we stay moderate.

DCF Output (Base Case): Using the above assumptions, our DCF yields a fair equity value for AMD of approximately $100 billion to $110 billion. This equates to a per-share intrinsic value in the range of ~$60–70 (assuming ~1.6 billion shares outstanding). This base-case DCF result aligns reasonably well with the “average fair value ~$99.7” from our valuation terminal (which likely aggregates multiple valuation methods). It suggests that, under prudent assumptions, AMD is overvalued at $138 – in fact, the DCF fair value is ~30–40% lower, in line with our fundamental downside estimate.

To put it differently, the DCF indicates that today’s price is baking in more optimistic scenarios. Indeed, when we adjust the DCF inputs to reflect a more bullish case – say 25–30% growth for 5 years and a slightly lower discount (8%) or higher terminal growth – we can justify a value closer to $130–$150 per share. For example, a quick sensitivity: 25% 5-year growth and 5% terminal (at 8% discount) gave us an intrinsic value around $150. This suggests that to justify $138 fully, AMD needs to deliver something near a bull-case performance (sustain ~25–30% growth and achieve a sizable AI-driven earnings boost). On the flip side, a bear-case DCF (e.g., only 10% growth and/or using a 10% discount to reflect risk) could easily yield fair value <$50.

Benchmarking Valuation Methods:

- Blended P/E (FastGraphs) vs. DCF: FastGraphs typically uses a “blended P/E” approach for fair value, often benchmarking to historical P/E norms or growth-adjusted P/E (PEGY). AMD’s situation is tricky because its trailing GAAP P/E is sky-high (due to depressed 2023–24 earnings), and forward P/E based on 2025 estimates (~$3–4 EPS) is still in the 35–45× range. Our Vulcan model indicated a fair value P/E range of ~15–20x might be appropriate for a company with AMD’s risk (the terminal data suggested a fair value P/E perhaps as low as ~15, given a “Speculative” classification). If we take a midpoint ~17x and apply it to a reasonable forward EPS (say $5 in a couple of years), we’d get ~$85 – again pointing to overvaluation. The DCF method likely gives a more nuanced picture by handling multi-stage growth, but broadly it concurs that at $138, AMD is priced for very high growth.

- Fair Value from Terminal/Analysts: The Morningstar fair value of $120 provides an independent check. Morningstar recently cut that from $140 due to China export curbs but still sees

$120 as fair. Our DCF base ($60–70) is clearly more conservative. The disparity might be explained by Morningstar assuming higher mid-term growth or a lower discount (Morningstar often uses ~8.5% for narrow-moat companies). If we blend our base and Morningstar, you get roughly ~$90. Interestingly, the average of several sources might be around $100–110 (our terminal’s $99.7 plus others in that range), which suggests $100 as a reasonable pivot. Given the evolving fundamentals (especially if 2025 brings a big EPS jump), one could argue AMD’s fair value is rising – by end of 2025, $120 could well be justified. Thus, the “true” fair value lies somewhere between our strict DCF and more optimistic takes – we’ll call it roughly $100–120.

Conclusion of Valuation Benchmark: We lean towards using the $120 fair value (Morningstar/analyst benchmark) as the most reasonable single-point estimate, because it incorporates some of the future growth optimism that pure current FCF doesn’t capture. However, we note that our DCF (current fundamentals) provides a cautionary lower bound around ~$60–70, and thus we choose to anchor our buy targets below $100 to ensure a margin of safety. In other words, while AMD might be “worth” $120 if all goes to plan, buying at a discount to that (say $96 or less) gives a buffer in case plans don’t materialize perfectly.

Final Recommendation and Buy Range Guidance

After integrating the valuation outputs, growth outlook, and risk adjustments from the Vulcan-mk5 model, our final stance on AMD is as follows:

- Current Rating: HOLD. AMD is a phenomenal company with a bright future, but at ~$138 it is trading above our estimated fair value range and well above levels that would constitute a prudent margin of safety. The stock is not a buy at current prices for value-conscious investors. We recommend existing investors hold (not sell, given the strong long-term outlook, unless one is trimming for risk management) and new investors wait for better entry points.

- Buy Range (Accumulation Zone): ~$80 – $96. This corresponds to our Strong Buy threshold (~$96) and below. At ~$96, AMD would be ~20% undervalued relative to the ~$120 fair value estimate – a level at which long-term annualized returns improve markedly (projected >15%/year with improved Sharpe ratio). Between $80 and $96, investors can start accumulating a position confidently, as this range balances upside and risk nicely. Probability note: There is a fair chance (perhaps through a market correction or an earnings-related dip) that AMD trades in the $80s or $90s again – recall the stock was <$80 as recently as Q4 2022. Savvy investors should be prepared to act if such opportunities arise.

- Very Strong Buy: <$84. If AMD were to drop to 30% or more below fair value (around $84 or under), we would consider it a very strong buy. At that price, even our conservative DCF ($60–70) starts to approach the market price, meaning much of the downside would be priced in. The risk/reward would be highly favorable, with potential 5-year IRRs well above 20% and significantly better protection against worst-case outcomes. Essentially, $80s would be a “load up” zone for long-term investors.

- Ultra Value (Backing up the Truck): <$72. In the unlikely event of AMD dropping to ~$72 (40%+ below fair value, akin to deep recession or extreme bearish turn), it would represent an ultra-value bargain. Our model indicates that at ~$60–72, even the bear case yields acceptable returns, and the bull case would yield life-changing returns. Such a price would likely only occur with a combination of temporary bad news and market panic (as it did in 2022’s trough around $60). We would advocate aggressive buying in that scenario, as AMD’s quality and long-term prospects would make a rebound likely once conditions normalize.

- Positioning and Strategy: For those with no AMD exposure, a sensible approach is to start with a small “toe-hold” position (perhaps ~1/4 of intended allocation) on any minor dip (e.g., ~$110–120), then fill out the rest in the buy zones ($80–100) over time. This way you are not completely on the sidelines (in case the market never dips to your ideal price), but you retain plenty of capacity to buy more if the stock pulls back. For current shareholders, holding makes sense but consider trimming if the stock overshoots into clearly overvalued territory (for example, if it surged into the $160s+ without a change in fundamentals, locking some profit might be wise).

In conclusion, AMD is a high-quality long-term growth play that merits a spot on investors’ watchlists, but timing entry is key given the stock’s volatility and valuation. Our Vulcan-mk5 analysis finds that the best course is patience and discipline: allow the stock to come to you in the buy zone. Once acquired at a favorable price, we are confident AMD can deliver outsized returns over a 5–10 year period, especially as it capitalizes on the AI revolution and continues to execute in its core markets. Keep an eye on upcoming earnings and product launches (MI300 GPU deployments, Zen 5 launch, etc.) as potential catalysts that could either provide better entry opportunities (on disappointment) or confirm the growth trajectory. For U.S.-based long-term investors, also be mindful of tax considerations – if waiting for lower prices in a taxable account, having patience could also yield tax-efficient outcomes (long-term capital gains) versus chasing the stock now.

Final verdict: AMD is a long-term BUY on dips. We rate it a Hold at present and a Strong Buy ~<$96. By adhering to these buy targets and factoring in the risk profile, investors can maximize their chances of “sleeping well at night” while participating in AMD’s compelling growth story.

References

- Morningstar – “AMD Stock Price Quote – Advanced Micro Devices Inc”. (2025). Fair value estimate of $120; stock trading in fair value range.

- Oliver Rodzianko, Seeking Alpha – “AMD Unifies Global Infrastructure Amid Expanding AI Demand”. (June 24, 2025). Analysis of AMD’s valuation (fairly valued near-term) and growth prospects.

- S&P Global Ratings via Cbonds – “S&P affirms Advanced Micro Devices at A; outlook stable”. (Feb 20, 2025). AMD credit rating A (stable outlook).

- Timothy Green, The Motley Fool (via Nasdaq.com) – “AMD’s AI Chip Sales Might Disappoint in 2025”. (Jan 19, 2025). Discussion of AMD vs Nvidia in AI, Wolfe Research downgrade, and risk of AI growth shortfall.

- Reuters – “AMD flags $800 million hit from new US curbs on chip exports to China”. (Apr 16, 2025). Export restrictions impact: $800M charge, China ~24% of AMD 2024 sales.

- Logical Invest – “AMD: Advanced Micro Devices – 5-year Statistics”. (Accessed 2025). AMD risk metrics vs S&P: volatility ~52%, Sharpe ~0.37, Sortino ~0.56, high downside deviation ~34%.

- Simply Wall St – “Advanced Micro Devices Future Growth”. (Last updated June 23, 2025). Consensus forecast of ~31% EPS CAGR for AMD next few years.

- Yahoo Finance / TheStreet (summary) – Analyst Price Targets and AI Upside. (2025). Examples of analysts raising AMD targets (to $175) on AI demand optimism.

- AMD Investor Relations – Q1 2025 Earnings Release. (May 2025). Data Center segment up 57% YoY; strong EPYC CPU growth.

- Macrotrends – “AMD Free Cash Flow 2010-2025”. (2025). AMD 2024 free cash flow $2.405B (114% increase from 2023).

Leave a comment