Summary

MP Materials (NYSE: MP) is the leading U.S. rare earth producer, operating the Mountain Pass mine – America’s only scaled rare earth source. The company supplies critical rare earth elements (especially NdPr – neodymium-praseodymium) used in high-strength permanent magnets for electric vehicles (EVs), wind turbines, defense systems, and electronics. MP is rapidly expanding downstream capabilities (refining and magnet manufacturing) to create a fully domestic rare earth supply chain. This expansion is strategically timed as rare earth supply security becomes a priority: China currently mines ~60% of rare earths and produces ~90% of rare earth magnets, and recent Chinese export controls on rare earth alloys/magnets (mid-2025) have raised global supply chain concerns. In this context, MP Materials holds long-term strategic value, but investors must weigh elevated valuation metrics against execution risks and commodity price volatility. The stock has rallied sharply over the past year (up ~188% year-over-year) on optimism about U.S. policy support and MP’s progress (e.g. securing supply deals with a major EV automaker and the U.S. Department of Defense). At ~$35–36 per share, MP trades at a premium to current fundamentals – earnings are negative (TTM EPS –$0.64) and free cash flow is still in deficit as the company invests in growth. However, forward-looking investors are betting on a profit inflection in coming years as production scales and rare earth prices recover. Our deep-dive analysis provides a comprehensive outlook across multiple time horizons, incorporating peer benchmarks, macroeconomic drivers, and scenario-based valuation modeling (Bayesian and Monte Carlo). Bottom Line: MP Materials is a high-potential but high-volatility investment. We currently rate it a Hold, waiting for a more attractive margin of safety before accumulating. Long-term upside is substantial if MP’s vertical integration succeeds, but at the current price the stock appears to reflect an optimistic base case, offering limited near-term upside relative to risks (our estimated fair value is in the high-$20s per share). We’d turn bullish on significant dips into the outlined “Very Strong Buy” range or better (see Master Metrics & Buy Ranges below).

Master Metrics & Buy Range Guidance

The table below summarizes key valuation metrics and our Vulcan-mk5 model guidance on buy ranges for MP Materials. Despite MP’s strategic importance, its stock commands a rich valuation relative to current earnings – similar to peer Lynas Rare Earths’ high multiples (Lynas’ P/E ~170 and P/S 18) – reflecting depressed short-term profits across the rare earth sector. Our buy-range classifications are based on MP’s estimated intrinsic value ($30/share) and required margin of safety at various price levels:

| Metric/Category | MP Materials (Current) | Guidance (Buy Range Classification) |

|---|---|---|

| Stock Price | ~$35.40 (Recent close) | Hold – above fair value (overvalued) |

| Market Capitalization | ~$5.8–6.2 billion (USD) | (For reference – not a buy/sell trigger) |

| Enterprise Value (EV) | ~$6.3 billion (net of ~$0.75B cash) | (EV ≈ Market Cap + Debt – Cash) |

| P/E Ratio (TTM) | N/M (net loss; TTM EPS –$0.64) | (Not meaningful due to negative earnings) |

| Forward P/E | ~24–25× (2025–26 est., high uncertainty) | (Assumes sharp earnings rebound by 2026) |

| EV/EBITDA (TTM) | N/M (neg. Adj. EBITDA –$50M FY2024) | (MP had negative 2024 EBITDA amid low NdPr prices) |

| Price/Sales (TTM) | ~27× (TTM rev ~$216M) | (Very high – reflects future growth priced in) |

| Free Cash Flow Yield | Negative (MP investing heavily; FCF –$100M+ TTM) | (FCF likely to turn positive by ~2026+) |

| Estimated Fair Value | ~$28–$32 per share (DCF/Scenario-derived) | (Base-case intrinsic value; see below) |

| — Buy Range Guidance — | — Stock Price (USD) — | — Classification — |

| Ultra Value | < $15 | Ultra Value – Strongest buy (deep discount) |

| Very Strong Buy | $15 – $20 | Very Strong Buy – Compelling value |

| Strong Buy | $20 – $25 | Strong Buy – Significant upside |

| Buy | $25 – $30 | Buy – Undervalued (modest margin of safety) |

| Hold / Fair Value | ~$30 – $35 | Hold – Near fair value (neutral) |

| Sell / Overvalued | > $35 | Sell/Trim – Price exceeds value (overvalued) |

Table: Key metrics and valuation-based buy ratings for MP. Current price falls in the Hold/Overvalued zone, suggesting patience. We’d accumulate aggressively only if the stock drops below ~$25 (Strong Buy or better), which would imply a 30%+ discount to intrinsic value.

12-Month Outlook

Over the next year, MP’s investment thesis will be tested by operational milestones and market conditions. On the operational front, investors will watch for successful ramp-up of Stage II (full rare earth separation at Mountain Pass) and initial production from the new magnet alloy facility. The Q1 2025 report already showed encouraging progress – record quarterly NdPr output (563 tonnes, +36% QoQ) and first sales of magnet precursor (NdPr metal). These should translate to higher revenues (Q1 sales +25% YoY to $60.8M) going forward. However, profitability may remain under pressure in the near term. In Q1, MP still posted a net loss of $22.6M as higher costs from producing separated products and rising interest expense outweighed revenue gains. Management received another $50M customer prepayment, indicating strong demand, but also highlighting that cash flows are being bolstered by advance payments while operations scale. For the rest of 2025, consensus expects MP’s earnings to improve but stay modest, with full-year EPS likely around breakeven to slightly negative (analysts’ average 2025 EPS forecast implies forward P/E not meaningful or very high).

On the market side, a critical swing factor is the price of NdPr oxide, MP’s primary product. Rare earth magnet feedstock prices plunged in early 2024 (NdPr oxide fell ~17% in H1 2024) due to weak magnet demand and excess inventories, causing industry-wide profit “red ink”. By late 2024, prices partially recovered to ~$55–57/kg, and 2025 has seen further stabilization. Notably, neodymium prices in China have rebounded ~20% year-over-year as of mid-2025 on improving demand and supply curbs. If rare earth prices continue to firm (helped by China’s export restrictions and a potential H2 2025 global economic uptick), MP’s revenue and margins could surprise to the upside in the next 12 months. A stronger pricing environment combined with growing volumes might push MP toward profitability sooner. In a bull-case 12-month scenario, MP could trade higher (we estimate up to the high-$40s) on excitement over a profitable “strategic asset” with accelerating growth. This would likely require NdPr prices returning toward ~$80+ per kg (vs ~$60 now) and flawless execution of the magnet plant ramp-up.

Base-case: We expect a more tempered outcome. China’s economy remains a wildcard – Lynas (major peer) noted that magnet demand is tied to Chinese manufacturing (legacy auto, appliances), and a sustained pickup may be needed for a durable price rally. Moreover, rare earth markets face near-term headwinds: experts predict magnet demand growth of ~5% in 2025 (slower than prior ~9% forecasts), and inventory overhang from 2023 could persist into early 2026. In this base scenario, NdPr pricing stays range-bound (perhaps $50–$70/kg) and MP executes reasonably well but remains roughly breakeven on earnings through early 2026. The stock, after its huge run, could stall or pull back as the valuation catches up to fundamentals. We see MP trading in the high-$20s to low-$30s in a year under these conditions (in line with our ~$30 intrinsic value and the current analyst 1-year target of ~$27). That implies a modest decline from current levels.

Bear-case (12 mo): If rare earth markets weaken again – for example, if China unexpectedly lifts output quotas or a global EV slowdown occurs – NdPr prices could retrace, squeezing MP’s cash flow further. Additionally, any operational hiccup (delays in the Texas magnet factory, technical challenges in refining, etc.) would erode investor confidence. In a bearish scenario, MP’s stock could slide back toward the teens (we estimate low-$20s or even high-$10s in an extreme case), essentially pricing in continued losses and possibly requiring additional capital or curtailed growth plans. Notably, MP’s 52-week low was about $10, and while that reflected last year’s worst pessimism, it shows the downside if multiple contraction and negative sentiment coincide. Overall, for the next year our outlook is neutral-to-cautious: the risk/reward is not especially compelling at $35+, and the stock may trade sideways or lower as investors await proof of profitability. We would reassess our view on any significant dips or if fundamental news (e.g. a major policy support or a spike in magnet prices) changes the calculus.

2–3 Year Outlook (2026–2027)

Over a 2-3 year span, MP Materials’ investment narrative could shift favorably as its strategic initiatives bear fruit. By 2026, MP aims to be a fully integrated supplier: mining and separating light rare earth oxides at Mountain Pass, producing NdPr metal/alloy, and mass-producing finished NdFeB magnets at its Texas facility (in partnership with General Motors). Achieving this vertical integration should unlock more value per ton of rare earth and diversify MP’s revenue beyond raw concentrate sales (historically sold at a discount to China). We anticipate that by 2026 MP will be selling NdPr oxide and alloy directly to customers in the U.S. and allied countries, and possibly magnet components for EV motors – a business which commands higher margins. The company’s offtake agreements (with GM for EV motors, and with the U.S. government for defense needs) support this timeline. Successful execution here would turn MP into a specialty materials manufacturer rather than just a miner, likely resulting in improved earnings quality (more stable pricing via contracts) and a higher earnings multiple. By 2027, if things go to plan, MP could be generating substantial EBITDA and free cash flow, justifying a re-rating of the stock.

In financial terms, the consensus (though sparse) expects MP’s EPS to turn positive by around 2026 and ramp up thereafter (one source projects a P/E of ~116 by 2027, implying still small earnings by then, but a positive trend). Our model projects that if NdPr prices normalize to perhaps $80/kg (still below prior peak) and MP achieves ~5,000+ tonnes of NdPr production annually (from ~1,300 tonnes in 2024), revenues could approach $500M by 2027. Add magnet sales on top (potentially another few hundred million in revenue at scale) and MP might clear ~$700M+ in annual sales. With operating leverage (much of the cost base is fixed from the huge upfront investments), EBITDA margins might climb above 30%. This scenario yields back-of-envelope EBITDA of $200M+, which – at a mid-teens EV/EBITDA for a growth tech/metals hybrid – could support an enterprise value of $3–4B. However, MP’s EV today is already ~$6.3B, implying the stock’s current pricing assumes significant growth ahead. In 2-3 years, a bull case outcome would be MP materially outperforming these projections (perhaps via even higher magnet demand or government subsidies improving margins). One upside wildcard: Department of Defense and OEM support – the U.S. has shown willingness to fund capacity (MP already received grants/tax credits) which could de-risk expansion and boost profits. If MP becomes the West’s go-to rare earth champion by 2027, market sentiment could propel the stock well past previous highs. We envision a potential share price in the $50s or higher under a strong bull case by 2027 (exceeding the 2022 all-time high ~$58), as investors reward both growth and strategic importance.

The base case for 2-3 years is more moderate: MP executes its plan with some hiccups (e.g. slight delays or cost overruns, which are not uncommon in complex processing projects). Rare earth prices likely remain cyclic – perhaps rising as EV penetration grows, but not soaring unless a severe supply crunch occurs. Competition outside China will also increase: Lynas is building a separation plant in Australia (to offset its Malaysia issues) and a heavy rare earth facility in the U.S., and Energy Fuels aims to produce several separated rare earth oxides by 2026. These efforts, along with potential new projects (Arafura’s Nolans, etc.), mean MP won’t have the non-China market to itself. Still, demand for magnets is expected to grow robustly through 2030, so multiple players can thrive if successful. In a base scenario, MP by 2027 is a profitable, growing company but not without competition and periodic pricing pressure. The stock could reasonably trade in the $30s or $40s (roughly where it is now, perhaps a bit higher if earnings justify it by then). That would actually represent a lower valuation multiple by 2027, as earnings “grow into” the current market cap. Thus, base-case 3-year returns might be modestly positive (collecting perhaps 5-10% annualized if bought at today’s price), which is okay but not spectacular given the execution and commodity risks along the way.

In a bear case over 2-3 years, one could imagine a scenario where: (1) Rare earth prices stay muted or fall (e.g. if EV motor tech shifts to lower rare earth content – note: Tesla has discussed eliminating rare earths in future motors, which could dampen NdPr demand growth long-term), (2) MP encounters technical or regulatory setbacks (perhaps the separation facility underperforms, or environmental opposition arises – though MP’s California operations benefit from prior permits, unforeseen issues can’t be ruled out), and/or (3) Macro/geopolitical events undercut the story (for instance, a China-U.S. trade détente leading China to flood the market with cheap rare earths to regain leverage, as it has done in the past). Under such conditions, MP’s lofty expansion might stall; the company could even need to conserve cash or raise equity if cash burn persists. The stock could languish or decline significantly. We’d project in a severe bear case MP shares returning to the teens (or lower if a recession hits and high-beta stocks sell off). Essentially, the stock’s downside could revisit levels 50%+ below today’s price if the bull thesis unravels. This underscores the risk profile: MP is a volatile, sentiment-driven equity that could swing drastically with changing narratives in this 2-3 year window.

5+ Year Outlook

Looking 5 or more years ahead, the discussion becomes more thematic. By 2030, the global push for electrification and supply chain resilience will likely have transformed the rare earth industry. If MP Materials executes successfully through 2025–2027, by 2030 it could evolve into a world-class rare earth magnet producer with an entrenched position in U.S. and European supply chains. In this optimistic long-term scenario, MP might not only be selling magnets to EV makers and defense contractors domestically, but potentially licensing technology or co-developing mining projects abroad (note: MP recently signed an MoU with Saudi Arabia’s Ma’aden to explore a rare earth supply chain in the Middle East, hinting at global ambitions). With a second act possibly in heavy rare earths (MP has indicated interest in separating heavies like dysprosium in the future, which could be enabled via partnerships or feedstock from allies), MP could broaden its product suite. Geopolitics will be a key driver: if U.S.-China tensions remain high, MP stands to benefit as a strategic asset – perhaps even seeing mandated demand (e.g. U.S. defense production requirements to source domestically). On the other hand, if by 2030 a significant portion of magnet manufacturing relocates outside China (with companies like MP, Lynas, and others meeting global demand), rare earths might become more of a normal commodity market with less extreme premiums, which could compress super-normal profits.

Our bull-case vision for 5+ years: MP becomes an essential supplier in an industry with structurally higher prices due to constrained Chinese exports and surging demand from EVs, wind, and advanced tech. Under such conditions, NdPr oxide prices could possibly revisit prior peaks (> $150/kg seen in 2011, or >$100/kg in 2022) during demand spikes. If MP is at full production (~6,000+ tonnes NdPr/year) and capturing value-added magnet margins, annual revenues could approach $1B, with strong free cash flows. The stock, in this scenario, could trade at a premium as a quasi-tech growth company in critical materials – we might foresee MP’s market cap hitting $10+ billion (roughly double today’s) or share prices in the $60s-$70s by early 2030s. This would require flawless execution and supportive market forces, but it’s not unfathomable given the irreplaceable role of NdFeB magnets (there are currently no equal alternatives for high-performance motors, barring a major breakthrough).

A more conservative (base) long-term outcome is that MP in 5+ years is a solid, cash-generative mining & manufacturing firm, but operating in a competitive and cyclical industry. New rare earth sources (perhaps Canadian or African projects) could come online by then, easing supply tightness. Also, recycling of magnets might emerge as a small but growing source of material. If supply catches up to demand, rare earth prices in 2030 might be moderate (inflation-adjusted similar to today or lower). MP would still benefit from higher volume (more EVs = more magnets), but margins might normalize. We envision MP’s revenue growth leveling off by early 2030s once capacity is maxed, with the stock transitioning to a more typical mid-cap industrial profile. In this scenario, long-run returns from today’s price could be positive but not explosive – perhaps the stock grows into a steady compounder delivering high-single-digit annual returns (from a combination of moderate earnings growth and possibly initiating dividends or buybacks once capex falls). Essentially, MP could reward patient investors, but it might not be a multi-bagger from current levels unless one of the bullish super-cycles occurs.

Risks over 5+ years also deserve mention (discussed more in the Risk section below). One notable risk: technological change. If motor technology reduces reliance on rare earth magnets (for example, increased use of induction motors or new magnet chemistries without NdPr), long-term demand could undershoot current expectations. Auto OEMs are researching ways to lessen dependence on rare earths (due to cost and sourcing issues), and while completely eliminating NdFeB in high-performance motors is challenging, even partial thrifting (using less Nd or substituting some praseodymium) could impact market balance by 2030. MP’s fortunes are thus tied not just to overall EV adoption, but to the specific chemistry choices the industry makes. So far, trends still favor NdFeB magnets for performance, but this will remain an area to watch in the coming years.

In summary, 5+ years out, MP Materials could either be a cornerstone of a re-globalized rare earth supply chain – with commensurate financial rewards – or just one of several producers in a more balanced market. Given the heavy tail risks (both upside and downside), we model this horizon via scenarios with probabilities in our Bayesian analysis below. Long-term investors in MP should be prepared for a bumpy ride, but also understand that the option value of MP (in an extreme shortage or tech-driven boom scenario) is significant. That optionality is part of why MP trades at such a premium today despite current losses.

Technical Analysis (Price Trend & Key Levels)

From a technical perspective, MP’s stock has been in a strong uptrend since late 2022. The share price climbed from single-digits last year to a recent 52-week high of ~$39, dramatically outperforming the broader market over that period. This surge has pushed MP above key moving averages – it is well above the 200-day MA (which lies in the mid-$20s) and has often traded above the 50-day MA during this rally, confirming positive momentum. In mid-June 2025 the stock did pull back slightly from the ~$38–$39 peak, and short-term indicators like RSI cooled from overbought levels (14-day RSI ~68, down from 70+). This suggests the stock is working off some froth, possibly entering a consolidation phase. Notably, trading volume has been elevated on up-moves (a sign of accumulation) – average 3-month volume is ~9 million shares, and we saw spikes on news like earnings and policy developments. The Nasdaq Dorsey Wright technical rating for MP is currently “High” (indicating strong relative strength), reflecting its big gains and upward trend.

Looking at support levels, the first key support is around the $30 mark. This area coincides with a round-number support and roughly the top of the range in early 2023 (MP’s previous rally in late 2022 stalled in the high-$20s, so old resistance can become new support). The 50-day moving average is also rising toward the low-$30s, reinforcing this zone. If the stock were to dip further, $25 is the next notable support – it was a consolidation zone in spring 2025 and also corresponds to the upper bound of our “Strong Buy” valuation range. Below that, the low-$20s represent a major support band (the stock’s trading range for much of 2022 and 2023 when sentiment was weaker). Finally, the absolute floor in a severe selloff would be around $10–$12, which is the all-time low region (52-week low was $10.02 and all-time low ~$9.78 in mid-2020). While we do not expect a collapse to those levels barring a serious adverse event, it’s important to be aware of the full range.

On the resistance side, MP faces overhead supply near the recent peak. The $38–$40 zone is a formidable resistance – not only is ~$39 the 1-year high, but it’s also near the price at which early 2022’s rally failed (MP briefly traded around $40 before, on its way to the $58 peak, then fell sharply). A sustained break above $40 on strong volume would be a bullish signal, potentially opening the door toward $50, which is the next psychological and chart resistance (and aligns with our bull-case fundamental target for 12 months). It’s worth noting that $58 (the all-time closing high) remains the ultimate resistance; if MP ever approached that again, one would expect heavy profit-taking and volatility. In the near term, technical indicators suggest a neutral-to-positive bias – the trend is still up, but the stock may need to build a base (perhaps between $30 and $38) to gather strength for any further breakout. Momentum traders should watch the $40 level for a breakout (with possible run to mid-$40s), whereas risk-averse investors might look for pullbacks to support levels (like low-$30s or $25) as safer entry points consistent with fundamental value. Overall, MP’s chart reflects its high-beta nature: rapid swings and multi-bagger moves are part of its history, so prudent position sizing and stop-loss discipline are advisable for those trading this name.

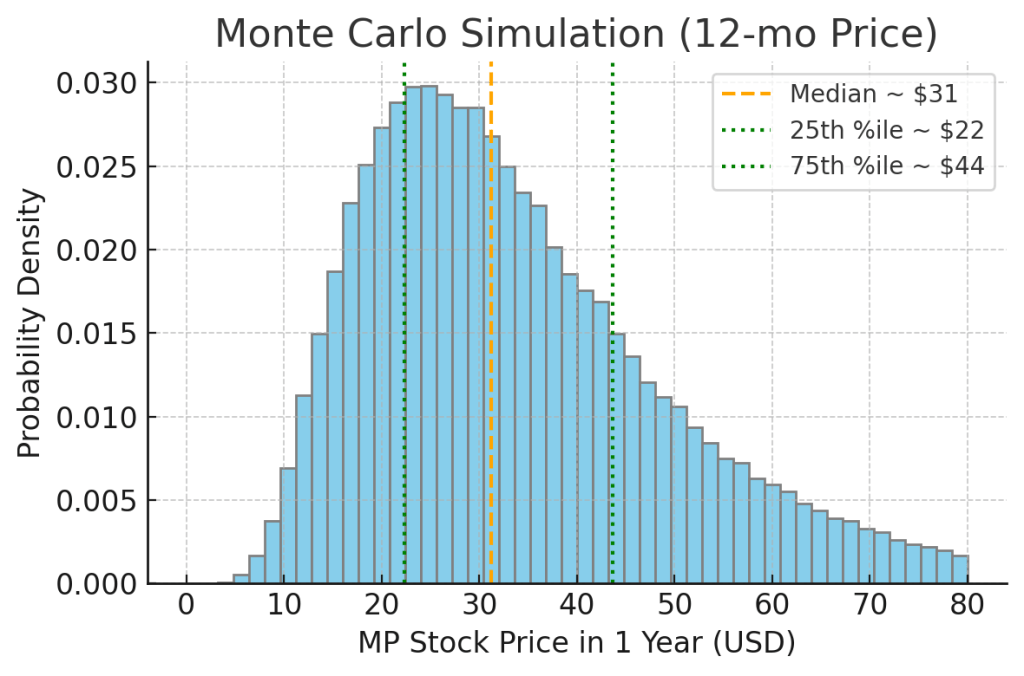

Technical chart: Monte Carlo simulation of 12-month MP stock price outcomes. The distribution (based on volatility ~50% annually) is skewed and wide, reflecting MP’s high volatility. There is roughly an equal chance of significant upside or downside – the median simulated price is ~$31 (orange line), while there’s ~25% probability of falling below ~$22 (left green line) and ~25% probability of exceeding ~$44 (right green line) within one year. (Note: This simulation assumes no net drift; actual outcomes will depend on fundamental news.)**

Monte Carlo Simulation (12-Month Price Forecast)

To quantify the range of possible 1-year outcomes for MP’s stock, we ran a Monte Carlo simulation using a geometric Brownian motion model. We input MP’s current price (~$35), an assumed annual volatility of ~50% (consistent with its historical fluctuations; e.g. 20-day realized vol ~65%), and assumed zero drift (i.e. the stock’s expected return equal to the risk-free rate, so no built-in upward bias). After 100,000 simulated trials (see chart above), the median 12-month price outcome was ~$31 – slightly below the current price, indicating a skew towards downside in the absence of positive drift. The mean outcome was ~$35 (by construction, since we set drift ~0, the mean stays around the initial price). More instructive are the probability bands: about 1-in-4 simulations (~25%) resulted in MP exceeding ~$44 a year from now, while an equal 25% of cases saw it below ~$22. The 10th–90th percentile range was approximately $14 to $70 – a tremendously broad span, underscoring the stock’s risk. In ~5% of scenarios, MP could be below ~$14 (this could correspond to, say, a severe recession or project failure scenario), whereas in the top 5% of outcomes MP was above ~$70 (representing perhaps a scenario of booming magnet prices or takeover speculation, etc.).

This stochastic analysis highlights that, given MP’s volatility, nearly any 12-month outcome is plausible – from losing half its value to doubling or more. The distribution is skewed right (long tail on the upside), which is typical for equity returns – there is theoretically unlimited upside but limited downside (can only go to zero). However, the fat left tail (e.g. noticeable probability of -50% or worse) reminds us that drawdowns in this stock can be severe. For instance, MP traded around $35–$40 in early 2022, then fell to ~$20 by mid-2022 and all the way to ~$10 by late-2022 amid sector turmoil – that kind of drop is not out of the question statistically. The simulation’s median of ~$31 aligns with our fundamental base-case (~high-$20s to $30) and suggests that at current pricing, expected return is roughly balanced with risk (slightly negative median return net of volatility). Only if one assumes a positive drift (i.e. that fundamentals will indeed improve) would the distribution’s center shift upward. For example, if we assumed a modest positive drift (say +5–10%), the median outcome would be closer to the current price or slightly above. That scenario would essentially embed the expectation of earnings growth or multiple expansion over the year.

In summary, the Monte Carlo analysis confirms MP as a high-risk, high-reward proposition. Traders might use this to calibrate option strategies or risk management – e.g. premiums on MP’s options are likely high (implied vol in this ballpark) and this distribution explains why. For long-term investors, the key takeaway is: be prepared for volatility. Short-term price swings may not reflect long-term value, so conviction is required to hold through the noise. Using Monte Carlo and probabilistic thinking also reinforces the wisdom of sizing one’s MP position according to risk tolerance – the position should be such that even a 50% drop wouldn’t be ruinous to one’s portfolio (unless one is specifically trading and stopping out). Conversely, it suggests that upside optionality is real – in a roaring bull scenario for MP, even our simulation shows material probability of large gains. Thus, MP can play a role in a portfolio as a speculative/high-growth allocation, but ideally purchased at a price that already embeds a margin of safety (to tilt the odds in your favor). As our scenario analysis next will show, the probability-weighted expected value of MP is sensitive to assumptions about these outcomes.

Bayesian scenario modeling: Projected MP stock price in four scenarios – Worst, Bear, Base, and Bull – along with our subjective probability for each scenario (values above bars). The base case (green bar) assumes moderate success and is assigned the highest probability (50%), yielding a price around $30 (near current intrinsic value). The bull case (blue bar, 20% probability) assumes strong outperformance, with a price target of ~$50 (20% chance). The bear (orange, 20% prob.) and worst (red, 10% prob.) cases yield ~$18 and ~$10 respectively. This distribution of outcomes results in an expected price around the high-$20s (close to base value), indicating limited upside relative to risk at the current price.

Bayesian Scenario Modeling (Bull vs. Bear Cases)

To complement the Monte Carlo analysis, we present a Bayesian scenario model that incorporates fundamental judgment on MP’s possible futures. We outline four scenarios – Bull, Base, Bear, and Worst-case – assign each a probability, and estimate the stock price outcome in each. This approach helps visualize the risk-reward balance and probability-weighted fair value. Our scenario definitions and assumptions are as follows:

- Bull Case (~20% probability): MP executes exceptionally well and external conditions are favorable. This scenario envisions rare earth magnet demand surging (EV and wind adoption at or above bullish forecasts), China’s export curbs creating supply shortages ex-China, and MP hitting all milestones (smooth ramp to full production, magnets qualified and selling out, possibly additional growth projects). NdPr pricing might rise significantly, boosting MP’s margins. In this bull case, we estimate a 12-month forward stock price target of ~$50. This assumes MP’s forward EV/EBITDA multiple remains high as growth stays strong, and investors start to price in 2027+ earnings power. A $50 share price equates to roughly 10x our 2027 EBITDA estimate or ~20x a hypothetical 2025 EBITDA if things ramp faster – rich, but justifiable for a strategic critical-minerals leader with a long growth runway. Notably, $50 is still below MP’s all-time high (~$58), reflecting some conservatism that even in a bull case the stock might not immediately retake peak without concrete earnings (that previous peak was fueled by rare earth hype in 2022).

- Base Case (~50% probability): This is our most likely scenario (hence the highest weight). MP makes steady progress but without major surprises. Magnet demand grows at a healthy but not explosive rate (mid-single-digit % annually near term). NdPr pricing remains moderate – perhaps volatile within $50–$80/kg but no sustained spike. MP successfully brings its separation and magnet facilities online by 2025-26, but initial volumes or yields might be just okay (learning curve in new production). The company becomes profitable by late 2025 or 2026, but earnings are modest. Essentially, MP’s story stays intact but doesn’t dramatically exceed expectations. In this scenario, we peg fair value around $30 per share, roughly aligning with our DCF and current intrinsic value estimates. That would imply the stock may not move much from current levels, or might oscillate around the low-$30s as earnings “catch up” to valuation. This base outcome also aligns with the average analyst target (~$27–$30). The expected return in this scenario is small (price roughly flat), which underscores why our current rating is Hold – the base case is largely priced in at ~$35.

- Bear Case (~20% probability): Here we consider a significantly weaker outcome. Perhaps rare earth prices stay depressed or fall further (e.g. if global economic growth disappoints or if new supply – including illegal or oversupply from China – hits the market). Or MP encounters execution issues (delays in refining ramp, cost overruns meaning profitability takes longer than anticipated, etc.). In this case, MP might continue operating at a loss or low profit into 2026, burning cash and eroding investor confidence. The market might de-rate the stock to a much lower multiple (treating it as a mining stock with uncertain prospects rather than a high-growth story). We estimate a bear-case price of ~$18, roughly half the current level. This figure is chosen because it’s in the vicinity of MP’s mid-2022 trading range and the lows of 2023 (the stock spent time around $17–$20 during those bearish periods). $18 would value MP at perhaps 3x 2024 sales or around book value ($6.34 per share book times 3 = ~$19), metrics more appropriate for a struggling commodity producer. A drop to this level, while painful, is not implausible if sentiment turns negative – it would likely require a combination of lower NdPr prices and disappointment in MP’s ramp.

- Worst-Case (~10% probability): We attach a smaller probability to an extreme downside scenario. This could involve a severe global recession or financial crisis (which would crush commodity prices and high-beta stocks), or a major company-specific setback (for example, a technical failure requiring expensive redesign, or a geopolitical event that unexpectedly helps China regain leverage, such as a trade deal that ends tariffs on Chinese magnets). In such a scenario, MP’s stock could conceivably re-test all-time lows (~$10). We use $10 as the worst-case price, which is also the 52-week low. At

$10, MP’s market cap ($1.6B) would basically equal its net cash + asset liquidation value, implying the market sees little viable future for the growth story. While we view this as unlikely given the company’s importance and government support (which would probably step in before MP ever failed outright), it’s a tail risk to keep in mind.

Assigning the probabilities above (20% Bull, 50% Base, 20% Bear, 10% Worst), we can compute an expected value: approximately $0.2*$50 + $0.5*$30 + $0.2*$18 + $0.1*$10 = ~$30. This aligns neatly with our intrinsic value estimate and suggests that at the current mid-$30s stock price, MP is trading above the probability-weighted fair value (i.e. the market is implying a higher chance of bull outcomes or a more optimistic base). In other words, upside and downside appear evenly balanced to slightly negative from here. The scenario chart above visualizes this – the weighted average (dotted line in the middle of the bars) is around the base-case level.

For an investor, this scenario analysis provides a roadmap: if you have a strong view that the Bull case probability should be higher (e.g. you believe EV demand or government actions will be far more favorable than consensus), then you might justify paying the current premium or even higher. Conversely, if you fear the Bear case is more likely than we’ve allotted, you’d demand a much lower entry price to compensate. Our current weighting (which we believe is balanced but slightly conservative) leads us to refrain from an outright Buy at $35+, instead favoring to wait for a margin of safety. Ideally, buying when the stock falls into the “Strong Buy” or better range (see table) – say in the low-$20s – would mean the expected value far exceeds the price (i.e. a positively skewed bet). In Bayesian terms, new information will continually update these scenario probabilities. Key updates to watch in coming quarters: MP’s actual progress on magnet output (if they demonstrate full-rate production with good margins, the bull probability rises), any further China policy changes (if China restricts exports even more, the bull case strengthens for MP by boosting non-China prices; conversely, if China floods the market, bear odds go up), and demand signals from automakers (large long-term offtake contracts or JVs would reduce uncertainty). We will adjust our scenario weights as these developments unfold.

Risk Profile (Key Risks & Considerations)

- Commodity Price Volatility: MP’s fortunes are highly leveraged to rare earth prices, especially NdPr. These commodity prices can swing wildly – e.g. NdPr oxide plunged ~50%+ from 2022 highs to late-2024 lows, then partially rebounded. Such volatility directly impacts MP’s revenue and profit. A sustained price downturn (due to oversupply, weak demand, or China using low prices strategically) is a core risk to MP’s cash flows.

- Execution & Operational Risk: MP is undertaking complex projects (chemical separation plant, metal refining, magnet production) that are new for the company. Delays, cost overruns, or technical issues could occur. For instance, achieving high-purity separation at scale is non-trivial (China spent decades mastering it). If MP’s facilities underperform or ramp up slower than expected, financial targets will be missed. The company’s single-site concentration (Mountain Pass) also means any mine or plant outage (due to accidents, maintenance, etc.) could significantly disrupt production.

- Regulatory/Policy Risk: While MP currently enjoys U.S. government support (grants, DoD contracts), it also operates under regulatory scrutiny. Environmental regulations in California are stringent – any mishandling of mine waste or hazardous chemicals could lead to shutdowns or fines (Mountain Pass was previously closed in part due to environmental issues decades ago). Policy risk cuts both ways: positive support (credits, tariffs on Chinese magnets, etc.) helps MP, but a change in political priorities or budget allocation could remove expected tailwinds. Additionally, MP’s planned expansion in Texas depends on maintaining good relations with local/state authorities and community support.

- Geopolitical Risk: U.S.-China tensions heavily influence MP. If tensions escalate (e.g. in a Taiwan scenario), China could retaliate by cutting off rare earth exports or dumping product to hurt Western producers. In 2025, China imposed new export license requirements on certain rare earths and has a history of using rare earths as a bargaining chip. Such actions could either benefit MP (by raising non-Chinese prices) or hurt it (if supply to MP’s downstream partners is choked or if China floods the market before MP is ready). Geopolitical events are unpredictable and could drastically alter MP’s outlook.

- Competition & Substitute Technologies: MP is not guaranteed a monopoly on non-Chinese rare earth supply. Competitors like Lynas (Australia) are expanding, and junior projects worldwide (USA Rare Earth, Pensana, Arafura, etc.) are attempting to come online by late-decade. Increased non-China supply could cap price upside. Moreover, alternative technologies could reduce rare earth demand: e.g. motor designs that use less or no rare earth magnets (Tesla is researching a rare-earth-free EV motor). If such tech becomes viable and adopted widely by 2030, it would significantly erode the long-term demand growth for MP’s products. Likewise, improvements in recycling of rare earth magnets could reintroduce material into the market, dampening fresh mining demand.

- Financial & Market Risks: MP is still in investment mode – it has spent heavily on capex and even on share buybacks. While it has a strong balance sheet now (over $0.75B in cash and manageable debt, after extending maturities to 2030), continued losses or cost inflation could strain finances. If additional funding is needed (for expansion or a downturn), MP might dilute shareholders or issue debt. Market sentiment for high-growth/no-earnings companies can swing: MP could be vulnerable to broad market sell-offs, rising interest rates (which make future profits less valuable), or sector rotation away from speculative stocks. Its beta ~2.2 indicates higher volatility than the market.

- Concentration Risk: MP’s business is essentially tied to one mine (Mountain Pass) and one set of commodities. Any unforeseen issue with the ore body (e.g. reserve overestimation, grade decline) or legal title, etc., would be catastrophic. While current reports show ample reserves, single-asset miners inherently carry concentration risk. Investors in MP are making a relatively concentrated bet on rare earths and one company’s ability to deliver – this is not a diversified play.

Overall, MP Materials carries a high risk profile, suitable for investors who understand and can tolerate these multifaceted risks. The company operates at the intersection of commodities and technology – facing both mining-company risks and those typical of a growth manufacturing firm. We believe these risks are mitigated somewhat by MP’s strategic importance (which likely ensures government support in dire scenarios) and by the secular demand trend (EV and clean tech growth). Nevertheless, position sizing and ongoing risk monitoring are crucial. We will watch indicators like NdPr price trends, project updates, competitor progress, and geopolitical developments closely as they directly feed into MP’s risk/reward at any given time.

Final Recommendation

MP Materials (MP) – Current Rating: HOLD. The stock’s recent surge and premium valuation leave little room for error in the short term. At $35+, MP trades above our base-case fair value ($30) and even above some optimistic DCF scenarios, implying the market is already pricing in a successful growth trajectory. While we remain long-term bullish on MP’s strategic prospects (the company is foundational to western efforts to secure critical minerals), we cannot ignore the near-term valuation stretch and execution risks. The risk-adjusted return over the next 12-24 months skews neutral to slightly negative at the current price. Therefore, we advise investors to hold existing positions – continue to own MP if you believe in the long game, but avoid adding new capital at this level.

For those looking to initiate or increase exposure, patience is warranted. We would turn more aggressive buyers on a meaningful pullback into the mid/high-$20s or below, which would provide a comfortable margin of safety. Our “Very Strong Buy” threshold is ~$20 (or lower), correlating to a scenario where the market overly discounts MP due to transient issues. In that range, the upside potential (toward our bull case) would far outweigh downside. Could MP reach those lower prices again? It’s possible – volatility is high, and as our analysis shows, swings of 30-40% have happened before and could happen again with shifting sentiment. Investors should be ready to act if such opportunities arise, assuming the fundamental thesis (long-term demand for rare earths and MP’s competitive position) remains intact.

In summary, MP Materials is a company to keep on your radar. It offers a unique pure-play on a critical resource and has significant growth optionality. However, investing at the right price is key to strong returns. At the moment, the stock appears fully valued relative to its medium-term earnings outlook – essentially a “show-me” story where the price anticipates success. We are content to watch from the sidelines for now, acknowledging the positive momentum but not chasing it. We will reassess our stance with each earnings report and development: clear signs of accelerating cash flow or a rare earth price breakout could justify raising our fair value (and rating), whereas any stumbling could reinforce our caution. For long-term holders, we recommend staying the course if you bought at lower levels, but consider trimming partial positions on further strength (above ~$40) to lock in gains and manage risk. New investors should wait for a better entry – in the volatile world of rare earths, opportunities tend to come around. In the meantime, keep an eye on those NdPr prices and MP’s quarterly progress – they will be the bellwethers of whether MP’s promise is turning into performance.

Final Verdict: A strategically vital company with a bright future, but a stock that has run ahead of itself. Hold for now; accumulate on dips into value range.

References

- Reuters – What to know about China’s rare earth export controls (June 2025)

- Fastmarkets – Rare Earths 2025 Outlook (Dec 2024)

- StockTitan (MP Materials Q4’24 and Q1’25 highlights)

- Investing.com – MP stock statistics (Jun 2025)

- YCharts – Lynas Rare Earths valuation metrics (Jun 2025)

- Yahoo Finance – Analyst target for MP (2025)

- MP Materials 10-Q (Q1 2025) – Balance sheet and shares data

- CompaniesMarketCap – Energy Fuels market cap (Jun 2025)

- Nasdaq Dorsey Wright Technical Rating (2025)

- Investing.com – MP key financials and ratios

Leave a comment