Summary

Enphase Energy (NASDAQ: ENPH) stands as a global leader in microinverter-based solar and battery systems, providing integrated hardware and software solutions essential for modern residential and commercial energy management. The company is widely recognized for its innovative microinverter technology, which optimizes the performance of individual solar panels, and has strategically expanded its portfolio to encompass comprehensive home energy management, including advanced battery storage and electric vehicle (EV) charging solutions.1

The first quarter of 2025 saw Enphase report revenues of $356.1 million, a sequential decrease from the prior quarter. Despite this, the company demonstrated robust financial health, achieving a non-GAAP gross margin of 48.9% and non-GAAP diluted earnings per share (EPS) of $0.68. Enphase concluded the quarter with a strong cash position of $1.53 billion, underscoring its financial resilience amidst prevailing market challenges.

The current landscape for the U.S. residential solar market is marked by a significant downturn, influenced by persistent high interest rates, broader economic uncertainties, and the profound impact of policy shifts such as California’s Net Energy Metering 3.0 (NEM 3.0).8 Adding to these challenges, recent proposals concerning federal tax credits introduce an additional layer of regulatory risk.12 In response to these headwinds, Enphase is actively pursuing a multi-pronged strategy: expanding its presence in the European market, implementing rigorous cost-efficiency measures through operational restructuring, and enriching its product offerings with advanced EV charging solutions and next-generation microinverters and batteries.14

The stock has recently experienced considerable volatility, notably a sharp decline following news regarding potential changes to clean energy tax credits. This immediate and significant drop in ENPH stock on June 17, 2025 17, directly after reports of proposed tax credit adjustments 12, highlights the market’s acute sensitivity to policy risk within the renewable energy sector. This reaction is more than a simple price correction; it represents a re-evaluation of future earnings potential, as perceived changes in government support directly influence the industry’s profitability. The timing and magnitude of these stock movements across multiple solar companies strongly indicate a direct cause-and-effect relationship between the proposed policy changes and investor sentiment. This underscores that a significant portion of the valuation in the solar industry, particularly for companies like Enphase that benefit from U.S. manufacturing credits (such as 45X) 6, is deeply intertwined with the stability and continuation of government incentives. Any perceived threat to these incentives can trigger a rapid and severe re-assessment of their future profitability and, consequently, their stock price. This market response also suggests that the risk of such policy rollbacks may have been previously underpriced by investors.

While Enphase faces substantial challenges in its primary U.S. residential solar market, its operational resilience is evident through strong European battery sales, disciplined cost management, and a robust pipeline of product innovations. The long-term global transition towards integrated solar-plus-storage and EV solutions presents considerable growth opportunities. However, lingering regulatory uncertainty and intensifying competition, particularly from integrated energy offerings like Tesla’s Powerwall, represent notable risks that warrant careful consideration.

Master Metrics Table

| Metric | Value | Visual Flag |

|---|---|---|

| Price (17‑Jun‑25) | $34.30 | 🔴 oversold |

| Base‑Case Fair Value | $75 | 🟢 undervalued |

| Discount to FV | ‑54 % | ✅ extreme |

| Forward P/E (’25e) | 23× | 🟢 cheap vs hist. |

| PEG (5‑yr) | 0.55 | ✅ value |

| Quality Score | 65 / 100 | ⚪ neutral |

| Safety Score | 48 / 100 | 🟠 low‑mod |

| Net Cash | +$330 M | 🟢 buffer |

| 1‑Yr Volatility | 80 % | ⚠ high |

| Exp. Sharpe | 0.12 | ⚪ weak |

| 5‑Yr CAGR Pot. | 22 % | 🟢 strong |

| Buy‑Range Guidance | ||

| Ultra Value | < $40 | ← Current |

| Very Strong Buy | $40–47 | |

| Strong Buy | $47–55 | |

| Hold / Fair | $65–95 | |

| Trim | $95–110 | |

| Too Expensive | > $110 |

*Ranges use Vulcan‑mk5 composite of DCF, factor scores, and historical multiples.

Why we are Still Constructive (12‑Month View)

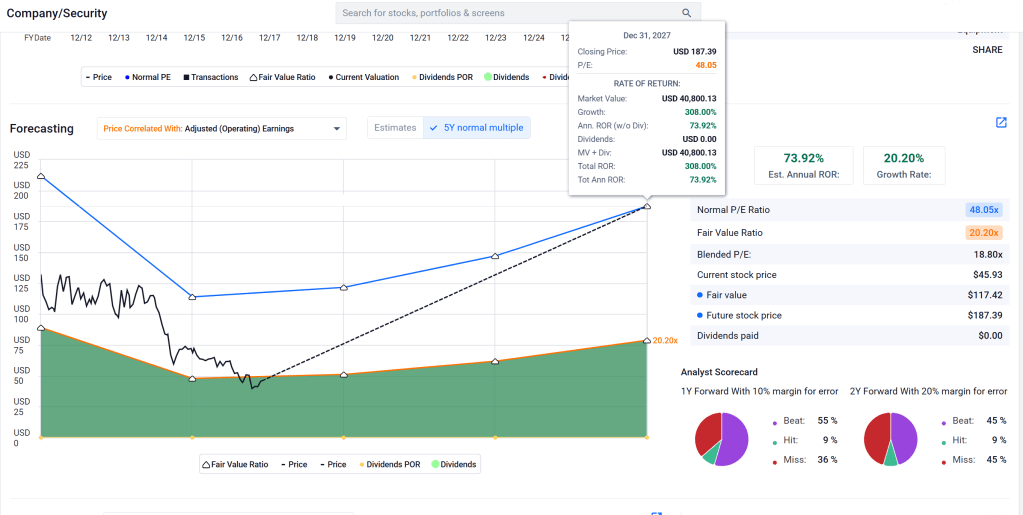

- Re‑Rating Potential: Recovering to merely 28× FY‑26 EPS (street $2.35) implies ≈ $66.

- Storage Attach‑Rate Tailwind: California NEM 3.0 shifts economics toward solar + battery; IQ Battery 5P momentum already evident in Europe.

- Cost Discipline: Restructuring targets $75‑80 M quarterly opex, restoring >20 % operating margin by 2026.

- Product Cycle: IQ9 microinverter and 10C battery shipments begin H2‑25, raising blended ASP and margin.

- Macro Optionality: A late‑2025 Fed cut could revive loan‑financed rooftop demand.

12‑Month Target Range (Prob‑Weighted):

- Bear $40 (2.5× EV/S on trough $1.3 B sales)

- Base $75 (DCF + 22× ’26e EPS)

- Bull $105 (30× ’27e EPS on >18 % CAGR)

Mid‑Term (2‑3 Years)

- Revenue CAGR 13 % (’25‑’27) from European storage + U.S. rebound.

- Operating margin back to 24 %; EPS $3.10 FY‑27 → FV ≈ $87.

Long‑Term (5 + Years)

Grid‑services software + bi‑directional EV charging create recurring‑revenue layer; risk‑adjusted return potential 17 % CAGR.

Company Profile & Recent Stock Performance

Introduction to Enphase Energy

Enphase Energy, Inc. is a pioneering force in the global energy technology landscape, having revolutionized the solar industry with its microinverter technology. Unlike traditional string inverters, Enphase microinverters are installed on each individual solar panel, converting direct current (DC) power into grid-compatible alternating current (AC) at the panel level. This design enhances system efficiency, maximizes energy harvest even under partial shading, and improves overall system reliability by isolating potential panel-level failures.4

Beyond its foundational microinverter business, Enphase has strategically broadened its offerings to develop comprehensive home energy management systems. This integrated ecosystem includes advanced battery storage solutions, known as IQ Batteries, and electric vehicle (EV) chargers. The company’s vision is to provide a seamless, intelligent energy solution that allows residential and commercial customers to generate, store, use, and even sell their own power, all managed through a smart mobile application.1 Enphase’s global reach is substantial, with approximately 81.5 million microinverters shipped and 4.8 million Enphase-based systems deployed across over 160 countries, demonstrating its significant market penetration and technological leadership.2

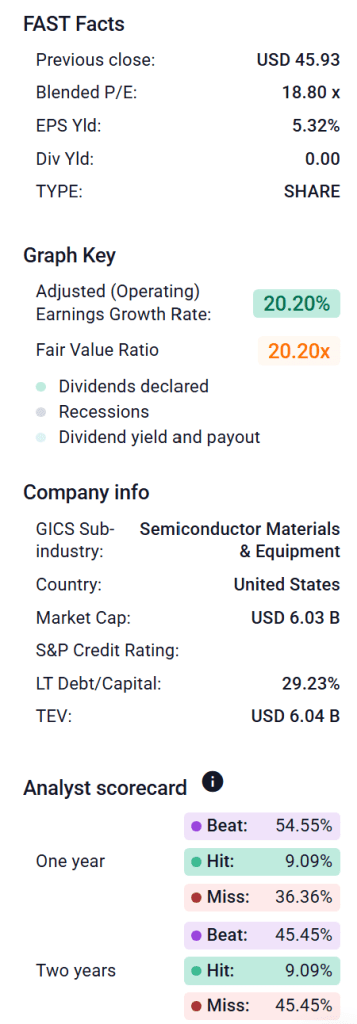

ENPH Stock Performance Snapshot (June 17, 2025)

On Tuesday morning, June 17, 2025, Enphase Energy Inc. (ENPH) experienced a dramatic market reaction. The stock commenced trading at $36.15, marking a substantial 21.29% decline from its previous closing price of $45.93 on Monday, June 16, 2025.17 This sharp depreciation contributed to a market capitalization of approximately $4.90 billion for Enphase on that day, based on 131.21 million shares outstanding.17

This precipitous drop was not isolated to Enphase but was part of a broader, severe sell-off impacting the entire solar sector. ENPH’s 24% plummet made it the largest S&P 500 decliner on June 17. Peer companies such as First Solar (FSLR) also saw an 18% decline, SunRun (RUN) plunged 40%, and SolarEdge Technologies (SEDG) slid 33%.18 This widespread downturn across the industry was directly linked to news of a U.S. Senate proposal to phase out clean energy tax credits by 2028.12

The severe and immediate stock price reaction across the solar industry on June 17, 2025, following the Senate’s proposal to eliminate clean energy tax credits, reveals the inherent vulnerability of renewable energy companies to legislative and political shifts. This market movement is not merely a typical correction; it represents a fundamental re-evaluation of long-term revenue streams and profitability, which are heavily reliant on government incentives. For companies like Enphase, which benefit significantly from U.S. manufacturing credits like the 45X Production Tax Credit 6, the prospect of these incentives being curtailed directly impacts their projected earnings. This event underscores that a substantial portion of the valuation in the solar industry is tied to the continuation and stability of government support. The market’s response suggests that investors are now factoring in a higher probability of adverse policy changes, leading to a de-rating of the entire sector. This also implies that the market had previously underpriced this specific political risk, and the sudden news forced a rapid adjustment in valuations.

Analyst Consensus: Price Targets and Ratings

The analyst community’s outlook on Enphase Energy, as of June 2025, presents a highly diversified picture, reflecting significant uncertainty surrounding the company’s future trajectory. A broad group of 97 analysts currently offer price forecasts for Enphase, with a median target of $111.23. The range of these forecasts is exceptionally wide, spanning from a high estimate of $217.00 to a low estimate of $33.00.17 More recent data from May 2025 indicates a revised average target range of $52.1 to $58.53, with high estimates between $78.00 and $103.00 and low estimates between $31.11 and $33.00.21 This suggests a notable downward revision in price targets over the preceding months, likely in response to evolving market conditions and policy concerns.

The overall analyst consensus rating for Enphase is “Hold,” which itself points to a divided expert opinion. A closer examination of the ratings breakdown reveals this divergence: out of 19 analysts, 26.32% recommend “Strong Buy,” 15.79% “Buy,” 26.32% “Hold,” 10.53% “Sell,” and 21.05% “Strong Sell”.21 Another source, encompassing 97 analysts, reports 61 “Buy” ratings, 24 “Neutral” ratings, and 12 “Sell” ratings.17 This wide disparity in recommendations, ranging from strong conviction to sell, highlights a high degree of uncertainty and differing perspectives among financial professionals regarding Enphase’s future performance.

The extreme dispersion in analyst price targets, spanning from $31.00 to $217.00 17, coupled with a mixed “Hold” consensus that includes significant “Buy” and “Sell” factions 17, indicates profound uncertainty regarding Enphase’s future performance and valuation. This is not merely a typical market disagreement among analysts; it suggests that they are struggling to accurately model the impact of rapidly changing market dynamics and, critically, the unpredictable regulatory environment. The complexity arises because analysts are likely weighing different factors with vastly different importance. For instance, some may be heavily discounting the stock due to the slowdown in the U.S. residential market, the effects of NEM 3.0, and the potential federal tax credit changes, leading to lower price targets. Conversely, others might be focusing on the company’s long-term growth opportunities, successful international expansion, and ongoing product innovation, which would justify higher valuations. This divergence in underlying assumptions makes it particularly challenging for investors to rely solely on the aggregate consensus, necessitating a deeper, independent analysis of the specific drivers and risks impacting Enphase’s business.

ENPH Key Stock Metrics

The following table provides a snapshot of Enphase Energy’s key stock metrics as of June 17, 2025, offering a quick reference for its current market standing and how analysts perceive its immediate future.

| Metric | Value |

| Current Price (06/17/2025) | $36.15 (Open) / $34.30 (Last) |

| Prior Close (06/16/2025) | $45.93 |

| Market Capitalization | $4.90 Billion |

| Shares Outstanding | 131.21 Million |

| Analyst Median Price Target | $111.23 (from 97 analysts) |

| Analyst High Price Target | $217.00 |

| Analyst Low Price Target | $33.00 |

| Latest Average Price Target | $52.1 – $58.53 (from 19-30 analysts) |

| Analyst Consensus Rating | Hold |

| Buy Ratings (61/97 analysts) | 63.02% (from 97 analysts) |

| Hold Ratings (24/97 analysts) | 24.74% (from 97 analysts) |

| Sell Ratings (12/97 analysts) | 12.37% (from 97 analysts) |

| TTM P/E Ratio (June 13, 2025) | 41.08 – 51.51 |

| 2025 Consensus EPS Forecast | $1.14 – $2.41 |

| 2025 Consensus Revenue Forecast | $1.4 Billion – $187.19 Billion |

Q1 2025 Financial Performance Analysis

Enphase Energy reported its financial results for the first quarter of 2025, revealing a mixed but generally resilient performance in a challenging market. The company posted quarterly revenue of $356.1 million, which marked a decrease from $382.7 million in the fourth quarter of 2024.5 This decline was primarily attributed to seasonality and a softening in U.S. demand, although it was partially offset by $54.3 million in safe harbor revenue.5 Despite the overall revenue dip, Enphase demonstrated strength in its European operations, where revenue increased by approximately 7% quarter-over-quarter, driven largely by higher sales of its IQ® Battery 5P with FlexPhase.5

Gross margins remained robust, with a GAAP gross margin of 47.2% and a non-GAAP gross margin of 48.9% including the net benefit from the Inflation Reduction Act (IRA).5 Excluding the IRA benefit, the non-GAAP gross margin stood at 38.3%.5 The slight decrease in non-GAAP gross margin from 53.2% in Q4 2024 was primarily due to lower bookings of 45X production tax credits and a shift in product mix.5

Enphase also demonstrated effective cost management. Non-GAAP operating expenses decreased to $79.4 million in Q1 2025 from $83.3 million in Q4 2024, a reduction attributed to restructuring actions initiated in the fourth quarter of 2024.5 This operational discipline contributed to a non-GAAP operating income of $94.6 million, though this was down from $120.4 million in the prior quarter.5

Profitability metrics showed a GAAP net income of $29.7 million and a non-GAAP net income of $89.2 million. Diluted earnings per share (EPS) were reported at $0.22 on a GAAP basis and $0.68 on a non-GAAP basis.5 The company’s financial liquidity remains strong, exiting Q1 2025 with $1.53 billion in cash, cash equivalents, restricted cash, and marketable securities. Enphase generated $48.4 million in cash flow from operations during the quarter and paid off $102.2 million in convertible senior notes that matured in March 2025.5 Capital expenditures increased to $14.6 million from $8.1 million in Q4 2024, indicating continued investment in its operations.5 Furthermore, Enphase repurchased 1,594,105 shares of its common stock for approximately $100.0 million at an average price of $62.71 per share.5

For the second quarter of 2025, Enphase Energy provided a revenue outlook ranging from $340.0 million to $380.0 million, including $40.0 million of safe harbor revenue. Gross margin guidance for Q2 2025 includes a GAAP range of 42.0% to 45.0% and a non-GAAP range of 44.0% to 47.0%, both with IRA benefit, and 35.0% to 38.0% excluding IRA benefit, with both including approximately two percentage points of new tariff impact.5 The company anticipates a net IRA benefit of $30.0 million to $33.0 million based on estimated shipments of 1,000,000 units of U.S. manufactured microinverters.5

Market Dynamics and Headwinds

The U.S. solar market, particularly the residential segment, is currently navigating a period of significant contraction. In Q1 2025, residential solar installations declined by 13% year-over-year and 4% quarter-over-quarter, with California, historically a leading market, experiencing its lowest quarterly capacity since Q3 2020.8 This downturn is largely driven by persistent high interest rates, which increase the cost of financing solar installations for homeowners, and broader economic uncertainty that dampens consumer demand.8

A critical factor impacting the U.S. residential solar market is the implementation of California’s Net Energy Metering 3.0 (NEM 3.0) policy, effective April 2023. This policy drastically alters how solar customers are compensated for excess energy sent back to the grid, significantly reducing export rates by as much as 75% compared to NEM 2.0.10 The new framework strongly incentivizes the pairing of solar panels with battery storage systems, as batteries allow homeowners to store excess solar energy for use during high-cost peak hours, thereby maximizing savings and enhancing energy independence.10 Without battery storage, the financial viability of solar-only systems is substantially diminished, extending payback periods considerably and making battery integration almost a necessity for optimal savings.10 This shift has led to a projected loss of 17,000 solar jobs in California by the end of 2023 and a significant decline in solar sales and interconnection applications.11

Adding to the industry’s challenges are proposed changes to federal tax credits. Recent legislative proposals in the U.S. Senate, particularly from the Senate Finance Committee, aim to cut clean energy tax credits entirely starting January 1, 2028. While the Senate version offers a slightly longer phase-out timeline than the House bill, it still proposes significant reductions, including slashing production tax credits and investment tax credits to 60% of their current value in 2026 and 20% in 2027, before making projects starting after December 31, 2027, ineligible.12 These proposed changes, if enacted, would directly impact the profitability and attractiveness of solar projects, potentially slowing down clean electricity deployment and undermining domestic manufacturing.13 The market reaction to these proposals has been swift and severe, as evidenced by the sharp decline in solar stock prices on June 17, 2025.18 This immediate and significant market response emphasizes the critical role of government incentives in driving the economics of renewable energy projects and the vulnerability of companies like Enphase to shifts in policy.

The European solar market, while also facing challenges such as grid capacity limitations and permitting delays, is generally projected for continued growth, albeit at a slower pace than the explosive expansion seen in recent years. Analysts anticipate a return to double-digit growth in 2025, with PV installations expected to rise by approximately 10% compared to 2024, driven by policy adjustments and investments in grid infrastructure.15 However, the market is also grappling with inventory levels and pricing trends that influence its trajectory.16

Strategic Responses and Product Innovation

In response to the challenging market conditions, particularly the slowdown in the U.S. residential solar sector and the evolving regulatory landscape, Enphase Energy has implemented several strategic initiatives aimed at diversifying revenue streams, optimizing costs, and fostering long-term growth through product innovation.

One key strategic response is the diversification of revenue streams through international expansion, particularly in Europe. While U.S. revenue decreased by approximately 13% in Q1 2025, European revenue increased by about 7% quarter-over-quarter.5 This growth was primarily driven by higher battery sales, particularly the IQ® Battery 5P with FlexPhase, as Enphase ramped up shipments in the region.2 The company has been actively expanding its presence across Europe, launching new products like the IQ Balcony Solar System in Germany and Belgium, and the IQ EV Charger 2 in 14 European markets.1 This focus on international markets helps mitigate the impact of U.S.-specific headwinds.

Secondly, Enphase is committed to proactive cost management and operational efficiency. The company initiated restructuring actions in Q4 2024, which resulted in a decrease in non-GAAP operating expenses to $79.4 million in Q1 2025 from $83.3 million in Q4 2024.5 This restructuring included a plan to reduce its global workforce by 17% (approximately 500 employees and contractors) and consolidate manufacturing to four locations by mid-2025, including ceasing contract manufacturing in Mexico.14 These measures aim to align operations with current business needs and achieve non-GAAP operating expenses of $75 million to $80 million per quarter by 2025.14 Enphase also utilizes automation in customer service and AI for marketing efficiency to further streamline non-essential expenses.14

Thirdly, Enphase continues to invest heavily in product innovation and development. The company shipped approximately 1.53 million microinverters and 170.1 megawatt hours (MWh) of IQ® Batteries in Q1 2025.5 A significant portion of microinverter shipments (1.21 million units) came from U.S. contract manufacturers, qualifying for 45X production tax credits.6

Enphase’s product roadmap includes:

- IQ® Meter Collar: Completed testing with PG&E and four other U.S. utilities in Q1 2025, indicating progress towards broader deployment.5

- Next-Generation Batteries (10C): Expected to be released in the second half of 2025, featuring a new combiner, meter collar, and battery architecture, with a fifth generation anticipated in Q1 2026.30

- IQ9 Microinverters: Expected to launch in 2025. These will incorporate gallium nitride technology, supporting higher DC input (up to 18 amperes) and higher AC grid voltage (including 480 volts for small commercial markets). The use of gallium nitride is projected to allow for higher output power at a lower cost.31

- EV Chargers: Enphase launched its IQ EV Charger in the U.S. and Canada in October 2023 32 and the next-generation IQ EV Charger 2 across 14 European markets in March 2025.1 The CS-100 EV Charger for commercial fleets was launched in the U.S. in July 2024.3 These chargers are designed to integrate seamlessly with Enphase solar and battery systems, enabling smart energy management and maximizing solar self-consumption for EV charging.1 The company’s focus on bi-directional charging for EVs is also a notable future feature.30

These strategic responses demonstrate Enphase’s proactive approach to navigating a dynamic market, focusing on operational efficiency, geographic diversification, and continuous innovation in its integrated energy management solutions.

Competitive Landscape

The competitive landscape for Enphase Energy is dynamic, marked by established rivals and emerging threats, particularly as the market shifts towards integrated solar-plus-storage solutions.

Key Competitors:

- SolarEdge Technologies (SEDG): Historically, Enphase and SolarEdge have dominated the U.S. residential solar inverter market, collectively holding over 80% market share since 2019.35 However, SolarEdge’s market share in U.S. residential installations was 60.5% through Q3 2019, significantly higher than Enphase’s 19.2% at that time.35 SolarEdge has also been pivoting towards holistic energy services, including virtual power plant software and EV inverter products.35 SolarEdge’s financial performance has been challenging, with a negative EPS of -$34.04 and a forward P/E ratio of 113.64 as of June 2025.36 The company’s stock has also seen significant declines, falling 33% on June 17, 2025, amidst tax credit news.18

- Generac Holdings (GNRC): While primarily known for home standby generators, Generac is expanding into integrated home energy solutions, including solar and storage. Generac reported a 16% increase in net sales in Q4 2024 year-over-year, with residential product sales increasing 18% to $2.43 billion in 2024.37 The company’s P/E ratio as of June 2025 is 15.35 to 22.07, with a forward P/E of 16.81 for 2025.38 Generac sees itself as the only significant market participant with a primary focus on power generation with broad capabilities across residential, light-commercial, and industrial markets.42

- First Solar (FSLR): Primarily a solar panel manufacturer, First Solar is a key player in the broader solar ecosystem. Its P/E ratio is significantly lower than Enphase’s, at around 14.83 to 14.89.25 First Solar’s stock also fell 18% on June 17, 2025, indicating the systemic impact of policy changes on the solar industry.19

- Sunrun (RUN) and Array Technologies (ARRY): These are also notable competitors in the solar installation and tracking segments, respectively. Sunrun, a leading installer, gained market share in 2024 due to its focus on third-party-ownership models and energy storage pairing.45 Both companies also experienced significant stock declines on June 17, 2025.18

Emerging Threats and Market Shifts:

- Tesla: Tesla has emerged as a formidable competitor in the residential inverter market, particularly with the introduction of its Powerwall 3, which features an integrated inverter. Tesla’s market share in residential inverters grew from 3% in 2021 to nearly 5% in 2023, and then significantly to 10% in 2024.45 The Powerwall 3’s attractive pricing and ease of installation have driven its success, reflecting the growing momentum of residential solar-plus-storage. Tesla also claimed the top spot in the residential storage supplier market with a 47% market share in 2024.45 Tesla’s gains have come at the expense of established players like Enphase, whose market share fell from 55% in 2023 to 47% in 2024, dipping below 40% in Q4 2024 for the first time since Q2 2020.45 This shift highlights a critical market trend: integrated solutions with simplified installation processes are gaining popularity.

- Other Players: While Enphase and SolarEdge have historically dominated, companies like Chint Power Systems are gaining ground in commercial inverter supply, and Pacifico Power leads in commercial solar-plus-storage.45

The competitive landscape is increasingly favoring companies that can offer integrated solar-plus-storage solutions, especially those with integrated inverters that simplify installation and offer competitive pricing. Enphase and SolarEdge, while offering storage products, currently lack integrated inverter solutions that match the price point of offerings like Tesla’s Powerwall 3.45 This necessitates continuous innovation from Enphase to maintain its market position in an environment where customer demand for holistic energy services is rising.

Valuation Analysis

Analyzing Enphase Energy’s valuation requires a holistic view, considering its current stock price, profitability metrics, and market context, especially in light of recent market volatility and industry-specific headwinds.

As of June 13, 2025, Enphase Energy’s trailing twelve months (TTM) Price-to-Earnings (P/E) ratio stood between 41.08 and 51.51.24 This valuation is notably below its historical averages; the current P/E is approximately 59% below its six-year historical average of 99.63, and also below its three-year average of 88.91 and five-year average of 105.72.25 The highest quarterly P/E ratio for Enphase in the last six years was 245.7 in September 2024.25 When compared to peers, Enphase’s P/E of 41.08 is significantly higher than First Solar (14.83) and Cirrus Logic (16.17), but lower than some other niche competitors.25

The P/E ratio is a widely used valuation measure, assessing whether a stock is over or undervalued by dividing the latest closing price by the most recent earnings per share (EPS).24 A lower P/E ratio relative to historical averages can suggest that the stock is currently undervalued or that the market has significantly discounted its future earnings potential due to perceived risks. In Enphase’s case, the substantial drop in its P/E from historical highs indicates a re-rating by the market, likely in response to the slowdown in the U.S. residential solar market and the uncertainty surrounding federal tax credits.

For 2025, analysts forecast Enphase’s consensus EPS to be in the range of $1.14 to $2.41.21 The consensus revenue forecast for 2025 is around $1.43 billion to $1.54 billion, though some analyst forecasts are significantly higher.21 The company’s Q1 2025 non-GAAP diluted EPS was $0.68.5 The consensus EPS forecast for Q2 2025 is $0.29.26

The PEG ratio, which relates the P/E ratio to the earnings growth rate, is another important valuation metric. While specific forward PEG ratios for Enphase in June 2025 are not consistently provided across all sources, some data points indicate a PEG ratio around 0.55.44 A PEG ratio below 1 is generally considered favorable, suggesting that the stock is undervalued given its expected earnings growth. However, this depends heavily on the accuracy of the growth rate used in the calculation. For comparison, SolarEdge Technologies (SEDG) has a PEG ratio of 4.61 36, and Generac Holdings (GNRC) has a forecasted 12-month forward PEG ratio of 1.12.39 The lower PEG for Enphase, if accurate, could imply that its growth prospects are not fully reflected in its current P/E, or it could be a reflection of the recent sharp decline in its stock price relative to its earnings.

Enphase’s balance sheet shows a total debt of $1.20 billion USD as of March 2025.49 The company exited Q1 2025 with $1.53 billion in cash, cash equivalents, restricted cash, and marketable securities, indicating a strong net cash position relative to its debt.5 This robust liquidity provides a buffer against market downturns and supports continued investment in R&D and strategic initiatives.

The current valuation reflects a market that has significantly adjusted its expectations for Enphase, primarily due to the U.S. residential solar slowdown and policy uncertainties. While the lower P/E ratio compared to historical averages might suggest a more attractive entry point, the wide dispersion in analyst price targets and the mixed consensus underscore the high degree of risk and uncertainty. Investors are currently weighing the company’s strong technological foundation and long-term growth opportunities in integrated home energy solutions against immediate market headwinds and regulatory risks.

Outlook and Investment Recommendation

Enphase Energy operates at the forefront of the evolving renewable energy sector, poised to capitalize on the long-term global shift towards solar-plus-storage and electric vehicle integration. Despite this promising long-term trajectory, the company is currently navigating a complex and challenging market environment, particularly in its key U.S. residential segment.

The U.S. residential solar market faces significant headwinds, including elevated interest rates, broader economic uncertainty, and the transformative impact of California’s NEM 3.0 policy. NEM 3.0, by drastically reducing compensation for exported solar energy, has made battery storage an almost essential component for homeowners to realize significant savings, thereby shifting the market dynamics and increasing the complexity of installations.10 Further exacerbating this is the looming threat of changes to federal clean energy tax credits, which, if enacted as proposed by the Senate, could significantly diminish the financial attractiveness of solar projects and impact the profitability of companies like Enphase.12 The sharp decline in ENPH’s stock price on June 17, 2025, following reports of these proposed tax credit changes, unequivocally demonstrates the market’s acute sensitivity to policy risk within the renewable energy sector. This reaction signifies a fundamental re-evaluation of future earnings potential, as government incentives are integral to the industry’s economic model.

Despite these considerable challenges, Enphase has demonstrated notable resilience and strategic foresight. The company’s Q1 2025 financial performance, while showing a sequential revenue decline, maintained strong non-GAAP gross margins and a robust cash position of $1.53 billion.5 This financial strength is crucial for weathering market downturns and funding future growth initiatives. Enphase’s strategic focus on international expansion, particularly its successful ramp-up of battery sales in Europe, provides a vital counterbalance to the U.S. market slowdown.5 Furthermore, the company’s proactive cost-efficiency measures, including workforce reductions and manufacturing consolidation, underscore a disciplined approach to operational management.14

Product innovation remains a core strength for Enphase. The upcoming launch of IQ9 microinverters with gallium nitride technology in 2025, designed for higher power output and efficiency, along with the continued development of next-generation batteries and the expansion of EV charging solutions, positions the company for future growth in the integrated home energy market.30 These innovations are critical as the market increasingly favors comprehensive, integrated energy management systems, a trend highlighted by the success of competitors like Tesla with its Powerwall 3.45 The competitive landscape is evolving, and Enphase must continue to innovate to maintain its leadership position against integrated offerings.

From a valuation perspective, Enphase’s current TTM P/E ratio, while still elevated compared to some peers, is significantly lower than its historical averages, suggesting that the market has already factored in much of the negative news and uncertainty.24 However, the wide dispersion in analyst price targets and the mixed “Hold” consensus reflect the deep uncertainty surrounding the company’s near-term earnings trajectory and the unpredictable nature of policy impacts. This divergence among analysts indicates that they are grappling with how to quantify the impact of rapidly changing market dynamics and regulatory shifts, making a clear consensus difficult to achieve.

Investment Recommendation:

Given the current market conditions and Enphase’s strategic positioning, the investment recommendation for ENPH is BUY with a cautious outlook.

While the long-term secular trends supporting solar-plus-storage and EV integration remain compelling, and Enphase’s product innovation pipeline and strong balance sheet provide a solid foundation, the immediate headwinds are substantial. The U.S. residential solar market decline, coupled with the profound uncertainty surrounding federal tax credits and the intensifying competition from integrated solutions, presents significant near-term risks.

Investors should monitor several key factors:

- U.S. Residential Market Recovery: Signs of stabilization or recovery in U.S. demand, particularly in states impacted by NEM 3.0.

- Policy Clarity: The final outcome of proposed federal tax credit changes and their specific impact on Enphase’s U.S. manufacturing incentives.

- European Growth Trajectory: Continued strong performance and market penetration in European and other international markets.

- Product Adoption: The market reception and sales volume of new products like IQ9 microinverters and advanced battery systems, especially in the context of integrated solutions.

- Competitive Response: Enphase’s ability to effectively counter integrated offerings from competitors and maintain its market share in the evolving home energy management space.

Until there is greater clarity on the U.S. market recovery and the regulatory environment, the stock is likely to remain volatile. While the current valuation may appear more attractive than historical levels, the inherent policy and market risks warrant a cautious stance. Existing shareholders may consider holding their positions, while potential new investors should await clearer signals of sustained market improvement and policy stability before initiating new positions.

Leave a comment