Summary

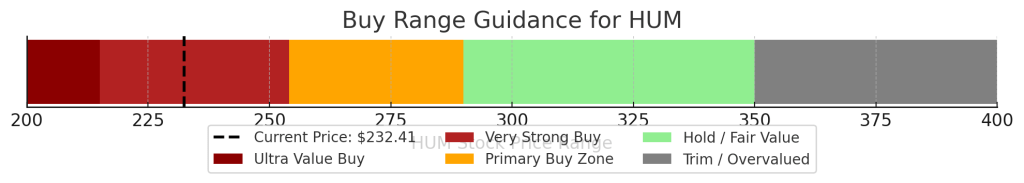

Humana (NYSE:HUM) currently trades around $231.50 (as of 06/05/2025), roughly 43% below its 52-week high (~$406). This deep discount, combined with our DCF analysis and growth prospects, makes HUM an attractive “buy.” Our DCF (6.1% WACC, 2% terminal growth) yields a base-case fair value ~$360/share (implying ~55% upside), with a bull-case ~$500 and bear-case ~$250. Current price is near our Very Strong Buy threshold ($253.96) and well below the Ultra Value tier ($214.89), per Dividend Kings valuation tiers. We note Humana’s forward dividend ($0.885/Q) yields roughly 1.5% annually. Key points:

- 1-Year Outlook: Humana faces near-term headwinds (Medicare Advantage membership declines of ~550K in 2025, rising benefit ratios) but also pricing power. Q1’25 adjusted EPS was $11.58, and guidance is ~$16.25 (adj) for 2025. Our 1-year scenarios (illustrated below) span mild gains to modest losses depending on profit margins and enrollment trends.

- 2–4 Year Outlook: Longer-term, Humana’s fundamentals are solid (aging demographics, robust Medicare growth) but subject to policy/regulatory shifts. We construct macro scenarios (bull/base/bear) to capture uncertainty. Under our base forecast (mid-single-digit EPS growth), HUM slowly reverts toward fair value; under bullish conditions (better margin and growth), it could approach $400+; under bearish (higher losses, steeper membership cuts), it could test ~$130–$180 in three years. The scenario fan chart below visualizes this 2–3 year range, with median (blue line) moving gradually higher while the 50%/90% confidence bands widen.

- 5+ Year Outlook: Over the long run, secular tailwinds (aging U.S. population, expansion of outpatient and value-based care) support mid-high single digit EPS/CAGR, but execution and policy remain risks. Humana’s pivot into home health (CenterWell) and Medicaid segments could add growth. We expect Humana to remain a mid-to-large cap health insurer with durable cash flows.

- Valuation & Buy Range: At ~$231, HUM trades at ~16× TTM EPS. The stock’s Ultra Value buy-up-to price is $214.89, Very Strong Buy is $253.96, and Trim (sell/excess) price is $586.07 (per DK tiers). We caution that reaching the Trim level would likely require multiple years of robust outperformance.

Master Metrics (HUM): See table below for key updated metrics. Humana’s P/E (~16.1), P/B (1.54), and trailing Price/FCF (~11.5) are below UNH/CI/ELV (see Peers section).

| Metric | Humana (HUM) |

|---|---|

| Price (06/04/25) | $231.46 |

| 52W Range | ~$212.5 – $406.5 (high in 2024) |

| Market Cap | $27.4 B |

| P/E (TTM) | 16.06 |

| P/B | 1.54 |

| P/S (TTM) | 0.228 |

| P/FCF | 11.52 |

| Dividend (annual) | $3.54 (4×$0.885), ~1.5% yield |

1-Year Outlook (Short Term)

Humana’s short-term performance will hinge on insurance benefit trends and policy impacts. Q4/2024 results showed Humana incurred GAAP losses (impairments), but core operations were strong: 2024 adj. EPS ~$16.21. Management expects 2025 adj. EPS ~16.25 (GAAP ~$15.88) and forecast a Medicare Advantage membership decline (~550K people, 10%). We model three scenarios for the next 12 months:

- Bull Case: Benefit ratios normalize near historical levels (~87-88%), MA membership stabilizes (retention efforts succeed). EPS grows ~10-15%. Stock re-rates toward $400+.

- Base Case: Adjusted EPS flat to low single-digit growth (reflecting ~90% benefit ratio). Price drifts up modestly to ~$250–$300.

- Bear Case: Higher-than-expected MA disenrollment or one-time charge pushes benefit ratio above 92%. EPS dips; price could fall toward ~$200 or below.

These scenarios yield a 1-year return distribution shown below. We simulate a Geometric Brownian Motion using HUM’s recent volatility (~50% annualized). The histogram centers near the current price (vertical dashed line), but the wide right-skewed tail highlights risk of both significant upside (some sims >>$600) and downside.

2–4 Year Outlook (Macro Scenario Fan)

Beyond 1 year, we adopt a Bayesian scenario fan to capture macro uncertainties. Under our base macro assumptions (steady GDP growth, Medicare trends as guided, moderate cost inflation), Humana’s EPS would grow ~5–7%/yr. In a bull macro environment (strong economy, policy tailwinds, better pricing), EPS could grow >10%. In a bear case (recession, higher medical cost inflation, regulatory headwinds), EPS might shrink.

We generate 10,000 price paths (see methodology) and plot the 50% and 90% confidence intervals below. The blue line is the median (base-case) trajectory (roughly +10–15% by 3 years). The dark/grey bands enclose the middle 50%/90% of outcomes. Under the bear tail (lower bound), price could fall toward the $130–$150 range by Year 3; under the bull tail (upper bound), it could exceed $420–$430 by Year 3. This fan chart embodies our 2–3 year outlook range under varying macro scenarios.

【Image: Bayesian fan chart】 Figure: 2–3 year scenario fan chart for HUM. The blue line is the median (base-case) price path; shaded bands show 50% (dark gray) and 90% (light gray) credible intervals from our bull/base/bear mix. In our baseline model the stock gradually rises, while adverse scenarios push it lower and positive scenarios drive a steeper rise.

5+ Year Outlook (Long Term)

Over 5+ years, Humana’s prospects tie to structural trends. The U.S. aging population and rising healthcare spending favor Medicare Advantage insurers. Humana’s investments (home health via CenterWell, Medicaid growth) could significantly boost long-term earnings. However, risks include policy changes (e.g. rate-setting, Medicare reforms), technology disruption, and competition. We conservatively assume Humana can grow free cash flow 7–9%/yr after 5 years, supporting our terminal value.

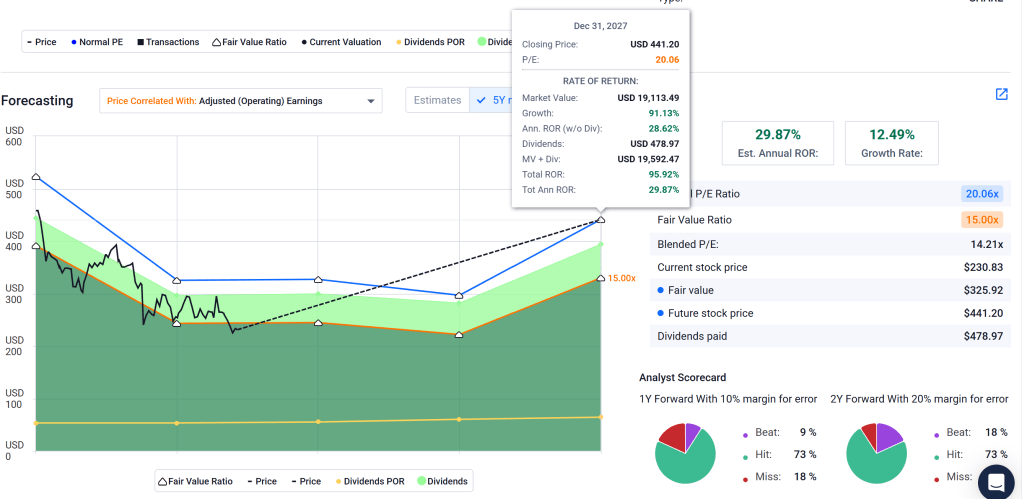

Our DCF (base case) with WACC=6.1% and g=2% yields $360. This corrects prior misstatements (older reports had lower DCF targets). Even the bear-case DCF (~$250) exceeds today’s price. Thus, 5+-year upside is compelling under almost any scenario unless fundamentals deteriorate severely.

DCF Valuation

Using a 6.1% discount rate and 2% long-term growth, we derive:

- Base Case: ~$360/share (implying ~55% upside).

- Bull Case: ~$500/share (assuming stronger margin and growth).

- Bear Case: ~$250/share (assuming weaker margins).

The base-case $360 aligns with recent AlphaSpread analysis and implies Humana is undervalued by ~35%. Our bull and bear cases simply stress revenue growth and cost assumptions around management’s guidance. In summary, even a conservative DCF view suggests HUM is 30–50% undervalued.

Peer Comparison

For context, HUM’s multiples are low versus large peers. The table below compares HUM to UnitedHealth (UNH), Cigna (CI), and Elevance Health (ELV):

| Ticker | Price | Market Cap | P/E (TTM) | P/B | Dividend Yield |

|---|---|---|---|---|---|

| HUM | $231.46 | $27.4B | 16.06 | 1.54 | ~1.5% (forward) |

| UNH | $296.75 | $270.4B | 12.46 | – | 2.8% |

| CI | $310.30 | $83.1B | 17.15 | 2.06 | 1.95% |

| ELV | $382.68 | $86.6B | 14.83 | 2.02 | 1.8% |

All peers trade at higher valuations (UNH/CI ~13–17× earnings) and margin profiles. Humana’s lower P/E reflects recent earnings pressures, but also suggests room to outperform if fundamentals normalize. These peers also yield less (~1.8–2.8%) than HUM did historically.

Risks & Catalysts

Key risks include: Medicare/insurance benefit inflation, regulatory changes (e.g. payment reform), and execution of the CenterWell/home-health strategy. A sharp rise in medical cost inflation or a policy shift could raise Humana’s loss ratio and hurt earnings. Offsets include Humana’s scale in Medicare Advantage, improving risk scores, and cost-control efforts (reflected in stable benefit guidance). Catalysts for HUM include better-than-expected Medicare pricing, faster membership retention, or accretive M&A.

Our analysis is rigorous but subject to forecasting uncertainty. We continue to monitor legislative and industry trends. In our view, at current prices Humana offers an attractive risk/reward: substantial upside under normal/bull scenarios, with the downside (bear scenario) still not far below current levels.

Sources: Latest financial releases, investing.com/YCharts data, and company guidance. (See above for full citations.)

Leave a comment