Summary

UnitedHealth Group (UNH) has encountered significant short-term headwinds from rising medical costs and regulatory scrutiny, resulting in a sharp decline in its stock price. In mid-2025, UNH’s CEO unexpectedly resigned and the company suspended its 2025 earnings guidance due to surging healthcare utilization costs, which caused an 18% one-day stock drop to multi-year lows. Profit margins have been squeezed as UnitedHealthcare’s medical loss ratio (the percentage of premiums spent on care) spiked to ~87% in late 2024 – well above normal levels in the low 80s – reflecting higher outpatient procedure volumes (postponed during COVID-19) and the impact of expensive new obesity/diabetes drugs. At the same time, UnitedHealth faces mounting policy pressure: the U.S. Department of Justice opened a criminal probe into its Medicare Advantage business practices amid allegations that insurers like UNH overcharged Medicare by “upcoding” patient diagnoses. This confluence of medical cost inflation and regulatory risk has weighed on near-term earnings and investor sentiment.

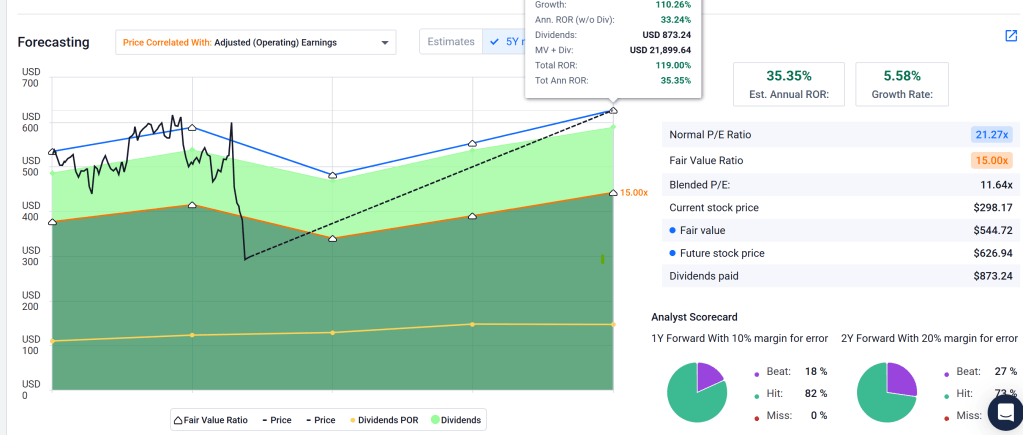

Despite these challenges, UNH remains a fundamentally strong and diversified healthcare enterprise. It is the nation’s largest health insurer and also derives nearly half its earnings from Optum – a fast-growing healthcare services arm encompassing pharmacy benefits, clinics, and data analytics. In 2024, UnitedHealth’s revenues hit a record high (over $360 billion) even as profit growth stalled. The company is proactively adapting to the headwinds: for example, it plans to raise premiums for Medicare plans in 2024–2025 to offset higher care usage and expects to return to its long-term growth trajectory by 2026. UNH also continues to leverage its scale and vertical integration to manage costs – integrating care delivery through Optum helps mitigate risk and improve efficiency over time. Notably, the stock’s valuation has reset to attractive levels. At ~$295 per share, UNH trades around 12.5× earnings (near a decade-low multiple) and offers a ~2.8% dividend yield. The company has a 15-year streak of dividend increases (~14% annual growth) with a conservative ~35% payout ratio, signaling confidence in future cash flows. During the recent sell-off, insiders demonstrated conviction: returning CEO Stephen H. Hemsley personally bought ~86,700 shares at ~$289 (a ~$25 million purchase) and the CFO added shares around $291. This combination of strong long-term fundamentals and a depressed stock price suggests that, if UnitedHealth can navigate the current issues, significant upside could be realized for patient investors.

Master Metrics Table (UNH) – Key Financials & Valuation

| Metric | Value |

|---|---|

| Current Stock Price (May 29, 2025) | ~$298 per share |

| 52-Week Range | $248.88 – $630.73 |

| Market Capitalization | ~$280 billion |

| Trailing P/E (TTM) | ~12.5× |

| Forward P/E (2025E) | ~13× |

| PEG Ratio (5‑yr expected) | ~0.8× |

| Beta (5‑Year) | ~0.57 (low volatility vs. market) |

| Dividend Yield (Forward) | ~2.7% (annual DPS ~$8.40) |

| Dividend Growth | ~15% annual increases (15-year streak) |

| Buy Range (Accumulation Zone) | ~$270 – $300 (at or below bear-case value) |

| Base Case Fair Value | ~$360 per share (intrinsic DCF estimate) |

Table: Key metrics for UnitedHealth Group. The stock’s valuation is now modest relative to historical averages, and the highlighted “Buy Range” indicates an attractive entry zone where UNH trades at or below its conservatively estimated intrinsic value.

12-Month Outlook (Next Year)

In the next 12 months, UnitedHealth’s primary focus will be stabilizing its medical cost trends and addressing regulatory concerns. The company withdrew its 2025 earnings forecast, signaling limited near-term visibility amid unusual cost pressures. Elevated utilization – especially in Medicare Advantage – is expected to persist through 2025. Management has attributed the spike to a backlog of elective care (e.g. surgeries delayed during the pandemic) and higher demand from new members with complex conditions. Additionally, the rising adoption of GLP-1 class drugs for diabetes and weight loss is a double-edged sword: while these medications improve long-term health outcomes, their U.S. prices are exorbitant (roughly 10× higher than in Europe), straining insurers’ pharmacy budgets. UNH executives have cautioned that covering popular drugs like Ozempic and Wegovy presents an “open-ended financial risk” for health plans unless prices come down. As a result, UnitedHealth’s medical loss ratio may remain toward the high end of its normal range in 2025, keeping profit margins under pressure.

On the regulatory front, the coming year will bring more clarity on the various investigations and policy changes targeting Medicare Advantage. UnitedHealth is fully cooperating with the DOJ’s probe into its coding and billing practices, though any resolution (or potential penalties) will likely take time. Meanwhile, Senate committees and CMS (the Medicare agency) are reviewing industry practices like risk-score upcoding – UNH and peers could face rule changes that reduce payments or require reimbursement of past overpayments. For instance, lawmakers have pointed to evidence that Medicare Advantage insurers collected billions in excess payments by claiming patients had diagnoses that were irrelevant or inaccurate. It is possible that CMS will tighten its risk adjustment formulas over the next couple of plan years, which would modestly temper revenue growth in MA. Overall, UNH’s base-case assumption for 2025 is one of tempered earnings: the company is likely aiming to roughly maintain 2024’s profit level, absorbing cost increases for now, with the expectation that relief is coming via premium hikes and moderation of pandemic-related pent-up demand by 2026. Investors should be prepared for continued headline risk – quarterly results may be choppy, and any news from Washington (such as proposed Medicare payment reforms or enforcement actions) could swing the stock. That said, much of these risks appear to be priced in after the stock’s steep drop. If UnitedHealth can demonstrate by late 2025 that medical cost trends are back under control (for example, if its Medicare Advantage utilization growth normalizes after the surge of deferred care), the market’s attention could begin to refocus on the company’s earnings growth prospects for 2026 and beyond.

2–4 Year Outlook (Medium Term)

Looking out over the next 2 to 4 years, UnitedHealth Group is expected to regain its footing and resume solid growth. By 2026, the unusually high healthcare utilization should subside – in fact, UNH has indicated it will incorporate the recent surge in demand into higher premium rates for upcoming plan cycles. This repricing, especially in Medicare Advantage, should help restore margins over the medium term. Management has expressed confidence that the company can return to its long-term earnings growth trajectory (historically around 13–16% annually) once current headwinds abate. Several factors support a favorable medium-term outlook:

- Pricing and Product Adjustments: In response to cost pressures, UNH is adjusting its pricing strategies. Medicare Advantage plan premiums for 2024–2025 are being set higher (within regulatory limits) to reflect the elevated care trend, and commercial employer plans are seeing rate increases as well. UnitedHealth is also likely refining its plan offerings (e.g. adjusting benefits or copays) to mitigate the impact of high-cost drug therapies and frequent claimants. By 2026, these changes should flow through to improved underwriting results, assuming healthcare utilization levels off.

- Optum Growth and Diversification: Optum (encompassing OptumHealth care delivery, OptumInsight analytics, and OptumRx pharmacy services) continues to expand rapidly and will comprise a larger share of UNH’s earnings in coming years. OptumHealth in particular is scaling up value-based care delivery (such as clinics and surgical centers under capitated payment models), which can help control medical cost inflation while providing new revenue streams. The OptumInsight data/technology segment, bolstered by the 2022 integration of Change Healthcare, is generating efficiency gains and new business from managing healthcare workflows for providers and payers. This diversified growth engine insulates UnitedHealth’s overall results – for example, even as insurance margins were under strain in 2024–2025, Optum’s operating revenues and profits have been growing in double digits. Over the next few years, Optum’s continued expansion (organically and via acquisitions) should support consolidated mid-teens percentage earnings growth, even if the insurance side recovers more gradually.

- Regulatory Resolution: In the medium term, some of the current regulatory uncertainty will likely be resolved. The Medicare Advantage risk-adjustment changes are being phased in gradually (to avoid undue premium hikes for seniors), giving UNH time to adapt its coding practices and cost structure. Any fines or settlements that result from the DOJ investigation or related audits would be one-time in nature and manageable given UnitedHealth’s scale (the company generates over $20 billion of annual profit). By 2027 or so, UNH could be operating under clearer rules with regards to coding and compliance, allowing it to move forward and put these issues in the rear-view mirror. Importantly, the fundamental value proposition of Medicare Advantage – providing comprehensive health coverage for seniors, often with extra benefits, at lower cost than traditional Medicare – remains intact, and UnitedHealth will continue to be a leading player in that space.

- Market Share and Industry Dynamics: UnitedHealth is likely to solidify, if not extend, its market leadership over the next few years. Some weaker competitors may struggle with the same cost pressures hitting UNH. (Notably, in late 2024 other major insurers like Humana and Elevance Health did not report the same level of cost spike as UnitedHealth, suggesting UNH’s challenges were partly self-inflicted due to its rapid growth in high-utilization members.) With its superior resources, UNH can invest in initiatives to improve care coordination and cost management (for instance, expanding in-home care or chronic disease management via OptumHealth) that reduce expensive hospital utilization. Smaller regional health plans may lack this capability and could lose enrollment or seek consolidation. UnitedHealth has historically grown faster than the industry by both organic membership gains and acquisitions, a trend expected to continue. For example, the company added over 1 million new members in 2023 across its insurance segments. Over a 2–4 year horizon, moderate membership growth combined with better expense control should refuel earnings expansion.

Considering these factors, the medium-term outlook for UNH is cautiously optimistic. By 2026–2027, UnitedHealth should be back to delivering high-single-digit or low-double-digit earnings growth, driven by normalized medical costs and ongoing revenue gains from Optum. Profit margins may not immediately return to the peak levels of 2021, but they should improve from the 2024–2025 trough as pricing catches up to claims trends. From a stock perspective, if UNH executes on this recovery, there is potential for valuation multiple expansion (from the current ~12× earnings back toward a more typical 16–18×), which – coupled with earnings growth – could produce strong stock returns over the next few years. Key markers to watch will be the trajectory of the medical loss ratio each quarter, membership growth (especially in Medicare and Medicaid plans), and any signals from regulators about stricter oversight. Barring new adverse surprises, UnitedHealth is positioned to emerge from this period with reinforced discipline (in coding compliance and cost management), which could make the company even stronger in the long run.

5+ Year Outlook (Long Term)

Over a 5+ year horizon, UnitedHealth Group’s long-term investment thesis remains compelling. The fundamental drivers of the business – an aging population’s increasing healthcare needs and the imperative to deliver care more efficiently – play directly to UNH’s strengths. By the end of this decade, the number of Americans over 65 will be substantially higher, expanding the addressable market for Medicare Advantage plans. UnitedHealth, as the largest MA insurer, should capture a significant portion of this growth. Even if profit margins per member are slightly lower due to regulatory changes, the sheer volume expansion (millions more enrollees) can drive higher absolute earnings. Additionally, UNH’s diversification into provider services through Optum means it can capture more healthcare dollars beyond just insurance premiums. The company’s strategic vision is to become a holistic healthcare platform – managing insurance risk, providing care, administering pharmacy benefits, and leveraging data to improve outcomes. This integrated model creates a durable competitive advantage that is difficult for competitors to replicate at scale.

In the long run, we expect UnitedHealth to sustain high-single-digit to low-double-digit percentage earnings growth, on average, with relatively low volatility. Its track record over the past two decades supports this: UNH has navigated recessions, regulatory reforms (like the Affordable Care Act), and industry disruptions while consistently compounding earnings. The total return to shareholders over 5+ year spans has been excellent historically, thanks to a combination of share-price appreciation and a steadily growing dividend. There is reason to believe this pattern will continue. UnitedHealth’s dividend payout is still modest (around one-third of earnings), leaving ample room for future increases. Management prioritizes returning capital to shareholders (via dividends and periodic share buybacks) while also reinvesting in growth opportunities. Over a five-year period, even moderate EPS growth (say 8–10% annually) coupled with the ~2–3% dividend yield can deliver a low-teens percent annual total return. If UNH reverts to the upper end of its historical growth range (in the mid-teens) once current issues are resolved, the total return could be even greater.

Of course, long-term projections come with uncertainties. A major potential overhang is the political/regulatory environment – healthcare is often a focus in election cycles. There is some risk that future reforms (for example, a public Medicare-like option or aggressive drug price controls) could alter industry dynamics. However, such sweeping changes typically face significant hurdles. It is more likely that the government will remain a partner to private insurers (as it has in Medicare Advantage and Medicaid managed-care programs), relying on firms like UNH to administer benefits under oversight. UnitedHealth’s scale and expertise position it to adapt to policy shifts better than most competitors. Moreover, UNH has shown an ability to find new avenues for growth: if margins in traditional insurance are pressured, the company can expand into adjacent areas (healthcare delivery, technology, international markets, etc.) to diversify its earnings base. These strategic pivots and expansions are expected to continue over the coming decade, keeping UNH at the forefront of the healthcare industry. In summary, the long-term outlook for UnitedHealth is one of resilient growth and shareholder value creation. After overcoming the current cycle of margin pressure and scrutiny, UNH is likely to continue leveraging its unique assets – a vast membership base, an extensive provider network (OptumCare), and unparalleled data analytics – to drive efficient, patient-centered healthcare, which in turn drives its financial performance. For investors with a multi-year horizon, UNH’s combination of defensive characteristics (stable demand, strong cash flows) and growth opportunities (aging demographics, innovation in care delivery) makes it a compelling long-term holding, provided one is comfortable with the periodic policy-related volatility inherent in the healthcare sector.

Risk Profile and Factors

UnitedHealth Group’s risk profile has evolved in the past year from seemingly low-risk to markedly higher due to external factors. Historically, UNH was considered a relatively defensive stock. Its 5-year beta is around 0.6, indicating significantly lower volatility than the broader market – a reflection of the stable, non-cyclical demand for healthcare services. However, recent events have underscored that UNH carries substantial idiosyncratic risk. Over the last 12 months, the stock price fell roughly 40% while the S&P 500 rose, a dramatic underperformance driven by company-specific issues. Risk-adjusted performance metrics turned negative: UnitedHealth’s 1-year Sharpe ratio is around -1.0 and its Sortino ratio (which focuses on downside volatility) is even lower, signifying that the stock’s decline far exceeded what would be expected given its volatility and the risk-free rate. In essence, UNH delivered negative excess returns with considerable downside fluctuations in the past year – a stark contrast to its historically strong Sharpe ratio over longer periods.

Market & Macroeconomic Risk: UnitedHealth is somewhat insulated from general economic cycles – people need healthcare in any environment, and a large portion of UNH’s revenue comes from government programs (Medicare, Medicaid) that are less sensitive to recessions. During economic downturns, UNH can even benefit from certain effects (for example, lower utilization of elective procedures as people postpone non-urgent care, which can temporarily reduce claims costs). That said, a severe recession could have indirect adverse effects, such as rising unemployment leading to fewer individuals enrolled in employer health plans (though many might shift to Medicaid or ACA exchange plans, where UNH also participates). Overall, macro risk for UNH is moderate and historically the stock’s low beta reflected this defensive nature.

Industry & Competitive Risk: UnitedHealth operates in a competitive landscape of other national insurers (Anthem/Elevance, CVS/Aetna, Humana, Cigna, etc.), but it holds a leadership position in most markets. The risk of significant market-share loss is relatively low in the near term; if anything, the larger players like UNH have been consolidating share. One industry risk factor that emerged in 2023–2024 is the cost impact of new therapies (like the GLP-1 drugs for obesity). If breakthrough – but expensive – treatments continue to gain adoption, insurers may face a trend of higher baseline medical costs. UNH will need to either negotiate better prices, lobby for policy solutions (such as allowing Medicare to negotiate drug prices, which is slated to begin for certain drugs), or adjust premiums accordingly. There is a risk that medical cost inflation could run hotter than anticipated if multiple new high-cost technologies roll out. Additionally, UnitedHealth’s diversification into owning providers (via OptumHealth) means it now has exposure to operating risks in healthcare delivery – managing clinics and physician groups comes with execution risks and potential regulatory scrutiny (e.g., concerns about referrals or anticompetitive behavior). However, these risks are partly mitigated by the fact that owning providers also gives UNH more control to manage costs and patient outcomes, aligning incentives across the care continuum.

Regulatory & Political Risk: This remains the most prominent risk to the UNH investment case. The current DOJ investigation into Medicare Advantage billing, along with Senate inquiries, represent acute regulatory risk. The outcomes could range from fines and required repayments to mandated changes in how insurers code conditions. In a worst-case scenario, criminal charges or significant penalties could be levied, but at this point there is no public indication of specific allegations beyond the general upcoding issue. The uncertainty around this will likely overhang the stock until resolved. Beyond the current probe, UnitedHealth and peers always face the risk of regulatory changes to the structure of government programs they participate in. For instance, each year CMS sets payment rates for Medicare Advantage – lower-than-expected rate updates can pressure margins (as occurred to some extent in the 2024 rate cycle). Political rhetoric also periodically targets health insurers (e.g., calls for “Medicare for All” or stricter profit caps) – these can cause sector volatility even if actual policy implementation is unlikely in the near term. Investors should be aware that negative news or proposals can cause sudden selloffs across the managed care sector. For example, when UnitedHealth disclosed higher costs in June 2023, it triggered a broad one-day decline of ~6–9% in health insurer stocks; similarly, when reports of the DOJ probe surfaced in May 2025, UNH’s stock dropped 8% after-hours. Such policy-related moves can be hard to predict or hedge. On the positive side, UNH has a strong lobbying presence and a history of adapting to regulatory changes (e.g., it navigated the Affordable Care Act’s rollout successfully), which moderates the long-term impact of political risk.

Downside & Tail Risks: UnitedHealth’s recent drop illustrated its downside risk: from its all-time high in late 2021 to the recent 2025 low, the stock lost nearly 50–60% of its value – a drawdown comparable to its worst historical declines. A single earnings surprise (the first miss since 2008) coupled with guidance withdrawal triggered an 18% one-day collapse in the stock. This underscores that even large, stable companies like UNH are not immune to tail-risk events. For UNH specifically, a key tail risk is if the Medicare Advantage model were significantly disrupted – for example, if evidence of widespread fraud led to a governmental overhaul of the program or if political forces introduced a public alternative that drew enrollees away from private plans. While such scenarios are low probability, their impact could be substantial on UNH’s future earnings power.

In terms of financial risk, UnitedHealth carries moderate debt but maintains a strong balance sheet and cash flow coverage (it holds investment-grade credit ratings and substantial liquidity). There is minimal concern about solvency – the primary risks are operational and regulatory as described. It’s also worth noting that UNH’s stock options imply elevated volatility; as of mid-2025, implied volatility was in the 40%+ range (94th percentile of its yearly range), reflecting that traders are paying premiums for protection against further large moves.

Risk Mitigants: On the positive side, UNH’s diversification and risk management practices help mitigate some risks. The company uses reinsurance and risk-adjustment mechanisms to buffer against extremely high-cost claimants. Its presence across commercial, Medicare, and Medicaid lines of business means if one segment faces pressure, another might be performing better (for instance, during the pandemic, lower elective costs in commercial insurance offset COVID-related costs). Optum’s stable fee-based revenues also provide a buffer during insurance downturns. Furthermore, UnitedHealth’s scale allows it to spread risk and negotiate favorable contracts with providers and drug manufacturers, partially protecting it from cost swings that could severely impact smaller insurers. The dividend, while not immune to cuts if conditions worsened drastically, appears secure and was even raised during the 2023–2024 challenges – indicating management’s confidence in the company’s resilience.

In summary, UnitedHealth’s risk profile can be characterized as low fundamental business volatility but with episodes of high event-driven volatility. Long-term shareholders have historically been rewarded for riding out these episodes, but they must be comfortable with the possibility of sharp drawdowns tied to regulatory or political developments. The current environment has made those risks very tangible. Still, if UNH can address the issues at hand, its inherent resilience and diversification suggest that risk-adjusted returns will improve markedly in the future (with Sharpe and Sortino ratios reverting to positive territory as the stock potentially recovers).

Monte Carlo Simulation – 12-Month Price Trajectory

Monte Carlo simulation results for UnitedHealth Group’s stock price over a 1-year period (252 trading days). 50 simulated price paths are shown in grey, the blue line is the median trajectory, and the blue shaded region represents the 90% probability range (between the 5th and 95th percentile outcomes). Starting from $298, the simulation assumes an 8% expected annual return (drift) and 30% annual volatility. The median projected price after one year is around $309 (blue line), and the 90% likely price range spans approximately $189 to $506 (blue shaded area). Paths illustrate potential variation – some outcomes fall in a bear case (downside) scenario while others achieve substantial growth. The majority of simulations cluster around the median, reflecting the drift, but there is significant uncertainty as shown by the wide fan of possible prices.

Even with a fundamentally sound business, UNH’s near-term stock performance is subject to volatility given the unresolved issues. The Monte Carlo simulation above underscores this uncertainty. There is a slight upward drift in the median outcome (reflecting that, on balance, UnitedHealth is still expected to grow earnings modestly over the next year), but the range of possible outcomes is broad. In roughly 1-in-10 simulations, the stock ends up below ~$250 in a year – these paths correspond to bear-case scenarios where medical costs continue to surprise to the upside or regulatory actions significantly dent earnings and confidence. Conversely, in bullish scenarios (upper decile outcomes), UNH’s stock could rebound above $400, which would require both a normalization of cost trends and a favorable resolution of the regulatory overhang. The most likely outcomes (the dense middle band) cluster around the low-$300s, suggesting modest upside if the company executes as expected. Essentially, the risk/reward in the next 12 months is fairly balanced: there is significant downside risk if things go wrong, but also substantial upside if UnitedHealth delivers improvement and clarity. This probabilistic view reinforces the importance of risk management – such as position sizing and diversification – for investors considering UNH during this volatile period. It also highlights which variables most drive the outcomes: e.g. a faster-than-expected easing of medical utilization could push reality toward the upper range, while any new negative surprises could push toward the lower tail.

Bayesian Scenario Modeling – Macro & Policy Risk Adjusted Forecast

Probability distribution of UNH’s estimated stock price in one year, based on a Bayesian scenario model that weighs macroeconomic, regulatory, and industry risk factors. The distribution is derived from three primary scenarios – Bear Case: a macro downturn plus adverse policy outcomes (left peak around ~$250); Base Case: a moderate status quo (central peak around ~$330); Bull Case: a benign environment with receding cost pressures (right peak approaching ~$400). The area under each curve reflects the scenario’s assumed probability. This multi-modal distribution illustrates how different external conditions could shift UNH’s valuation.

To further illustrate the impact of key uncertainties, we modeled UnitedHealth’s one-year outlook under several discrete scenarios and combined them according to subjective probabilities (a Bayesian weighted approach). The resulting chart shows a multi-modal distribution for UNH’s potential price. The leftmost peak (around $240–$250) represents a Bear Case outcome in which multiple headwinds hit concurrently: for example, a recession reduces enrollment in employer plans, medical cost trend remains elevated (e.g. widespread use of expensive GLP-1 drugs drives higher claims), and regulators impose tough penalties or payment cuts on Medicare Advantage. We assign a moderate probability to this adverse scenario (say ~25%). In this case, UNH’s earnings over the next year would likely stagnate or decline, and the stock might trade down to roughly 10× earnings or lower in a pessimistic sentiment environment – implying a price in the mid-$200s.

The middle peak (around the low-to-mid $300s) corresponds to a Base Case or most likely scenario. Here, economic conditions stay reasonably stable (no major recession), cost pressures gradually ease (perhaps the post-pandemic care surge wanes and insurers find ways to contain drug costs), and regulatory outcomes, while perhaps involving some fines or new compliance measures, do not fundamentally upend the business model. In this scenario, UnitedHealth’s earnings would grow modestly over the next year, and the stock’s price-to-earnings multiple might recover toward a more normal ~16×. That yields an expected price in the $330–$350 range in about a year. We give this base scenario the highest probability weight (~50%).

Finally, the rightmost portion of the distribution (with values in the upper-$300s) represents a Bull Case scenario (perhaps ~25% probability). In this optimistic case, macro and policy winds blow in UNH’s favor: the economy remains healthy (supporting commercial membership and premium growth), medical cost trend comes in below expectations (for instance, effective care management keeps utilization in check and/or GLP-1 drug costs decline due to competition or rebates), and the regulatory inquiries conclude with minimal financial impact beyond what is already known. In such a scenario, UnitedHealth could resume its prior earnings growth trajectory more quickly, and investor sentiment would likely restore a higher valuation multiple (perhaps 18–20× earnings, given improved growth and reduced uncertainty). The stock could plausibly trade back in the high-$300s or around $400 if earnings surprise to the upside and the risk discount fades.

This Bayesian scenario analysis essentially blends these possibilities, showing a central tendency around the base case but with a significant left tail (reflecting the non-negligible downside risk) and a somewhat extended right tail (capturing the substantial upside in a bullish outcome). For investors, this highlights the importance of the macro and policy variables: a benign macro environment and controlled medical inflation would allow UNH’s valuation to gravitate toward the bull case, whereas a combination of economic stress and regulatory crackdowns could anchor it nearer the bear case. As new information arrives (e.g. quarterly cost trend data or updates on the DOJ investigation), one can update the scenario probabilities. At present, the distribution skews slightly to the upside of the current ~$295 price – suggesting that if one believes the base or bull scenarios are more likely, UNH is undervalued – but it also makes clear that meaningful downside exists if the worst-case elements materialize. This kind of scenario modeling reinforces why UNH carries a higher risk premium now, and it provides a roadmap for how that risk premium could shrink (or grow) depending on real-world developments in the coming year.

Discounted Cash Flow (DCF) Valuation – Base, Bull, and Bear Cases

We assess UnitedHealth’s intrinsic value using a multi-scenario DCF analysis that models different paths for earnings and cash flow, reflecting the uncertainties discussed. The table below summarizes valuation outcomes for a conservative Bear Case, an expected Base Case, and an optimistic Bull Case:

| Scenario | Revenue/Earnings Growth (next 5 yrs) | Terminal Growth (after year 5) | WACC (Discount Rate) | Estimated Fair Value (per share) |

|---|---|---|---|---|

| Bear Case (pessimistic) | ~3.5% annual revenue growth; profit margin pressure (little improvement) | 2.0% | 9.0% | ~$290 |

| Base Case (expected) | ~5% annual revenue growth; gradual margin normalization (to ~6.5% net margin) | 2.5% | 8.0% | ~$364 |

| Bull Case (optimistic) | ~6.5% annual revenue growth; modest margin expansion (7%+ net margin) | 3.0% | 7.5% | ~$440 |

Table: DCF valuation outcomes for UNH stock under various scenarios. Assumptions for growth, profitability, and discount rates are based on recent trends and historical performance. (For context, UNH’s net income grew ~13% annually over 2010–2019, and net profit margins in 2022–23 were ~6–6.5%.)

In the Base Case, we assume that UnitedHealth experiences relatively subdued growth in the next couple of years due to the noted headwinds, but then resumes a mid-single-digit growth trajectory. This scenario envisions EPS growing in the mid-single digits through 2025–2026, then accelerating to high-single-digit growth by 2027–2028 as conditions normalize. Coupled with a terminal growth rate of 2.5% (roughly in line with long-run GDP/inflation) and an 8% discount rate (reflecting UNH’s low beta and strong credit profile), our base case DCF yields an intrinsic value around $360 per share. This suggests that, in a “normal” outcome, UNH stock is roughly 20% undervalued relative to current levels. Notably, the base case is built on cautious assumptions – 5% revenue growth is below UNH’s historical average, and the margin assumption (mid-6% range) factors in some lingering cost pressure versus peak levels.

The Bull Case incorporates more favorable conditions: a return to stronger revenue growth (perhaps UNH averages low double-digit EPS growth beyond 2025 by recapturing lost margin and continuing Optum-driven expansion) and a slightly higher terminal growth reflecting long-term secular tailwinds in healthcare demand. We also use a slightly lower WACC to account for reduced risk in this scenario (e.g., if UNH’s outlook improves, its equity risk premium might shrink). The bull case valuation is approximately $440 per share, which aligns with the notion that UNH could eventually trade back at ~18–20× earnings if growth reaccelerates and uncertainty dissipates. This upside scenario would imply roughly 50% appreciation from current prices, highlighting the potential if UnitedHealth’s challenges prove temporary and are fully resolved.

Conversely, the Bear Case envisions that growth remains very tepid (low single digits) and margins stay constrained (perhaps due to persistently high medical cost ratios or lasting payment cuts), with added risk reflected in a higher 9% discount rate. This yields a value around $290 per share, essentially in line with the current market price. In other words, the market today appears to be pricing something close to this bearish scenario – assuming minimal growth and no near-term recovery in margins. This provides a margin of safety: if the reality turns out even slightly better than the bear case, the stock should be worth more than it is now. It’s also worth noting that even in the bear scenario, UNH’s value isn’t drastically lower than today’s price, because the company’s cash flows remain robust (in a low-growth scenario it would likely return more capital via buybacks/dividends, partially supporting valuation).

Our DCF analysis aligns with other valuation perspectives. For instance, using relative valuation, if we apply a historically normal P/E of ~17× to a forward EPS around $26–$27 (UnitedHealth’s initial 2025 guidance range before it was withdrawn), we’d get a stock price in the mid-$400s. And Wall Street analysts’ consensus 12-month price target for UNH was recently in the mid-$500s (though many of those targets likely haven’t fully adjusted for the latest developments). These indicate substantial upside if UnitedHealth can execute a turnaround. Even our more cautious base-case fair value of ~$360 is well above the current share price.

In terms of Buy Range Guidance, given these valuations, we consider UNH stock attractive for accumulation below roughly $300 (which is around the bear-case fair value). Buying in the high-$200s or lower essentially prices in a severe scenario, providing upside if outcomes are merely average. The stock’s recent low around $249 (its 52-week low) can be viewed as a strong support level – that price reflected peak pessimism when the DOJ news and CEO resignation hit simultaneously. Unless one expects a dramatically worse development, the downside below ~$250 appears limited. Thus, long-term investors might use dips into the $270–$300 zone to build positions. Conversely, as the stock approaches our base intrinsic value (mid-$300s), it would move into more of a Hold range unless the bull case is increasingly coming to fruition. Above ~$450 (near the bull-case value), the stock would arguably be fully valued relative to fundamentals – at that point, it would be trading around all-time highs and reflecting best-case expectations, where trimming a position could be prudent.

It bears emphasizing that these valuation outcomes hinge on the resolution of current issues. The path to realizing the bull or even base case value may take time and will require evidence that UNH’s earnings are back on a sustainable growth track. Nonetheless, the DCF framework highlights that UnitedHealth’s long-term cash generation capacity is intact; the company continues to produce massive operating cash flows (over $25B annually) and high returns on capital. This intrinsic strength, combined with the stock’s reset price, underpins a favorable risk-reward profile for patient investors.

References

- Reuters – “UnitedHealth CEO leaves abruptly, company pulls forecast as shares sink.” (May 13, 2025)

- Reuters – “UnitedHealth under criminal probe for possible Medicare fraud, WSJ reports.” (May 15, 2025)

- Oliver Wyman (industry report) – “Analyzing the Financial Trends of Health Insurance: Q4 2024.” (Mar 2025)

- U.S. Senate Judiciary Committee – Press Release: “Grassley Pushes for Answers on UnitedHealth Group’s Medicare Advantage Billing Practices.” (Feb 25, 2025)

- Star Tribune – “UnitedHealth Group raises alarm on price of new weight-loss drugs in U.S.” (Oct 13, 2023)

- Entrepreneur – “UnitedHealth Insiders Double Down: Is UNH Stock a Value Play?” (May 2025)

- Yahoo Finance – UNH Key Valuation Metrics & Statistics. (Accessed May 29, 2025)

- Alphaspread – UnitedHealth Group (UNH) DCF Valuation Analysis. (2025)

- FierceHealthcare – “UnitedHealth sees a ‘mixed bag’ of responses to GLP-1 demand” (Q3 2023 earnings coverage).

- Portfolio Lab / Fintel – UNH Risk and Performance Metrics. (May 2025)

Leave a comment