Summary & Recommendation

Alexandria Real Estate Equities (ARE) is a leading life-sciences REIT that has recently faced headwinds from rising interest rates and softer tenant demand. The stock is trading around multi-year lows in the high-$60s, reflecting investor concerns over lowered 2025 earnings guidance and increased vacancy. Despite near-term challenges, Alexandria’s high-quality portfolio (focused on biotech lab campuses) and strong balance sheet position it for long-term gains. Recommendation: The stock appears undervalued at current levels with a favorable long-term risk/reward profile. Long-term investors can consider buying at current prices (accumulate below ~$80) to capitalize on a recovery, while using patience and risk controls given near-term volatility.

Master Metrics & Valuation

The table below highlights key metrics for ARE and provides valuation guidance based on our analysis:

| Metric | Value |

|---|---|

| Current Price (May 21, 2025) | $68.57 per share |

| 52-Week Range | $70.15 – $125.25 |

| Market Capitalization | ~$12.5 Billion |

| Dividend (Forward) | $5.28 per share (Yield ~7.7%) |

| 2025E FFO (Adj. Guidance) | ~$9.26 per share (midpoint) |

| Price/FFO (Current) | ~7.4× |

| Occupancy (Q1 2025) | ~91.7% |

| Net Debt/EBITDA | ~5.9× |

| Credit Rating | Baa1 (Moody’s) / BBB+ (S&P) |

| Base Case Fair Value | ~$100 per share |

| Bear Case Fair Value | ~$55 per share |

| Bull Case Fair Value | ~$130 per share |

| Buy Zone (Accumulation) | Below ~$80 |

| Hold Range | ~$80 – $120 |

| Sell Target | Above ~$120 |

Guidance: Based on our discounted cash flow and scenario analysis (detailed below), the base-case intrinsic value is around $100, implying ~45% upside from the current price. We view sub-$80 share prices as an attractive buy zone offering a margin of safety. The ~$80–$120 range is a reasonable hold, while approaching $120+ (near our bull-case valuation) would merit consideration of profit-taking or trimming positions.

Outlook

12-Month Outlook

Over the next year, Alexandria’s performance will largely depend on its leasing progress and the trajectory of interest rates. Management has tempered expectations for 2025, cutting full-year FFO guidance slightly after a tough first quarter. Near-term occupancy may remain under pressure – currently around 92% – as new lab space supply peaks in 2024 and tenants digest existing space. However, leasing activity is showing some resilience (over 1 million square feet signed in a recent quarter), suggesting that demand could stabilize. In the next 12 months, we expect AFFO (adjusted funds from operations) to be roughly flat to modestly lower versus last year, with a mid-point around $9.2 per share. Outlook: The stock could see modest recovery if Alexandria meets its guidance and macro conditions don’t worsen; a mid-double-digit percentage total return (from dividends and some price appreciation into the $80s–$90s) is feasible under base-case conditions.

2–3 Year Outlook

Over a 2–3 year horizon, Alexandria’s fundamentals should improve as headwinds abate. The life-sciences real estate sector is expected to gradually rebound – the company’s executive team notes that 2023 likely marked the bottom of demand, with a healthier funding and R&D environment emerging by 2024–2025. Additionally, new lab space supply is projected to taper off after 2024, easing competitive pressures on occupancy and rent growth. We anticipate Alexandria can restore occupancy to the mid-90s% range over the next couple of years and resume modest growth in FFO (2–4% annually). The dividend, which was recently increased, appears sustainable and likely to grow at a moderate pace (mid single-digit percentages) as cash flows recover. By 2027, adjusted FFO per share could approach or exceed pre-2024 levels (e.g. ~$10+), assuming successful lease-up of developments and stable cost of capital. Outlook: We expect the stock to re-rate higher over this period – potentially back to a more normal valuation of ~12× FFO – which would imply a stock price in the ~$110–120 range in 2–3 years (including dividends, a strong double-digit annualized total return).

5+ Year Outlook

Longer-term (5+ years), Alexandria’s prospects remain solid given its unique position in a critical niche. The demand for high-quality life science lab space has secular growth drivers (biotechnology innovation, public health initiatives, etc.), and Alexandria is the market leader with irreplaceable campuses in Boston, San Francisco, San Diego, and other top clusters. Over five or more years, we project that Alexandria can generate mid-single-digit annual growth in FFO per share, driven by development projects coming online (its pipeline is largely pre-leased, indicating future revenue growth) and periodic rent escalations. The company’s balance sheet discipline – exemplified by long-dated fixed-rate debt and investment-grade ratings – should allow it to weather economic cycles and capitalize on growth opportunities (potential acquisitions or buildouts during industry upswings). Outlook: Looking out to the early 2030s, an upside scenario could see Alexandria meaningfully surpass its prior highs (>$150/share) if it achieves steady growth and if capitalization rates compress again in a lower-rate environment. Conversely, investors should be cognizant of risks from any structural shifts (e.g. remote/hybrid lab work or funding downturns), but such risks appear limited given the hands-on, infrastructure-heavy nature of lab research. Overall, the long-term outlook is favorable, with Alexandria likely to remain a core “pick-and-shovel” landlord for the life sciences industry, delivering reliable income and solid compounded returns.

Risk Profile & Risk-Adjusted Returns

Alexandria Real Estate Equities carries a moderate risk profile typical of equity REITs, with a mix of market volatility and company-specific factors to consider. The stock’s beta is around 1.3 when measured over a 5-year span (indicating slightly higher volatility than the broader market), though the 1-year beta has been lower (~0.8) due to the stock’s underperformance during a period when the general market was relatively strong. This suggests that Alexandria’s share price decline has been driven more by REIT sector and fundamental issues than by broad market movements. In other words, the stock didn’t closely track the S&P 500 recently – it fell while the market rose – which reduced its short-term correlation.

Volatility: Over the past year, ARE’s stock price has been quite volatile, with a peak-to-trough swing of roughly 45%. The annualized standard deviation of returns is high (estimated well above 30%), reflecting significant price fluctuations as investors reassessed the company’s prospects in a higher-rate environment. This is further evidenced by negative risk-adjusted return metrics: the trailing 1-year Sharpe ratio is deeply negative (around -1.3), and the Sortino ratio (which focuses on downside volatility) is even more negative (nearly -2.0). These negative ratios indicate that the stock’s decline over the last year produced a poor return relative to its risk – essentially, investors have not been compensated for the volatility, as the returns were negative. Over a longer 3-year period, Alexandria’s Sharpe ratio is still negative (the stock’s total return has lagged risk-free rates and the broader market), underscoring the recent underperformance.

Leverage & Financial Risk: Alexandria employs moderate leverage. Its net debt to EBITDA is about 5.9×, which is reasonable for an office/lab REIT and supported by the stability of its rental cash flows. The company’s balance sheet is a relative strength – Moody’s and S&P affirm investment-grade ratings (Baa1/BBB+), citing a well-laddered debt maturity schedule and mostly fixed-rate debt (over 99% fixed, with a weighted average maturity over 12 years). This means the impact of rising interest rates on Alexandria’s interest expense has been limited in the short term, and there are no major debt maturities until 2025. The debt-to-equity ratio stands around 0.7–0.8×, and interest coverage remains solid above 4×, indicating ample ability to service debt. These factors mitigate some financial risk, although continued high rates could make new financing or refinancing more expensive in a few years.

Tenant & Sector Risks: As a landlord primarily to life science and biotech tenants, Alexandria faces industry-specific risks. Biotech companies (especially smaller or early-stage firms) can be sensitive to funding cycles – the sector saw a slowdown in venture capital and IPO funding in 2022–2023, which indirectly affected demand for lab space. Indeed, Alexandria’s occupancy dipped into the low-90s%, and sublease availability increased in certain markets as some tenants downsized. The company’s top tenants, however, include large, established firms (e.g. Bristol-Myers Squibb, Moderna, Eli Lilly) which provide stability – no single tenant accounts for more than a few percent of annual rent. Nonetheless, investors should monitor the broader life sciences environment: if R&D budgets are cut or a wave of consolidations occurs, it could soften demand for space. Another risk is new supply: a surge of new lab development in 2024 has created a more competitive leasing landscape in the near term. Alexandria’s management noted that 2024 is likely the peak year for new deliveries of competing space; beyond that, construction is expected to slow, which should help the market equilibrium. Still, if oversupply persists or if speculative projects continue, rental rate growth could be muted. We factor these risks into our bear-case scenario.

Market & Macro Risks: Broader market conditions, particularly interest rates, have a large impact on REITs like Alexandria. The sharp rise in the 10-year Treasury yield (from ~1.5% in 2021 to ~3.9%–4.0%+ by 2023) led to a significant selloff in REITs – the FTSE Nareit All Equity REITs Index fell about 25% in 2022, and REITs broadly lagged the S&P 500 over the past two years. High interest rates increase REITs’ cost of capital and also make their dividend yields less relatively attractive, necessitating lower share prices (higher yields) for equilibrium. With ARE’s yield now around 7.5%, the market has essentially adjusted for a higher-rate world. If inflation remains sticky and the Federal Reserve keeps rates “higher for longer,” REIT valuations could stay suppressed. Conversely, any signals of rate cuts or easing monetary policy would likely act as a catalyst for REIT stock appreciation. We also note general economic risk: in a recession scenario, even though Alexandria’s properties are mission-critical facilities (labs are not easily closed or abandoned), some tenants might delay expansions or even default in worst cases, affecting occupancy and rent collections. Overall, Alexandria’s risk profile can be characterized as medium – it has higher volatility and sector sensitivity than a typical blue-chip stock, but it also has quality assets and prudent financial management that temper the risk of any catastrophic downside.

Monte Carlo Simulation (12-Month Forecast)

Monte Carlo simulation of ARE’s 1-year price forecast. The histogram shows the distribution of simulated outcomes for the stock price in one year, based on historical volatility. The red, orange, and green dashed lines mark the 5th percentile ($~43$), median ($~70$), and 95th percentile ($~115$) prices, respectively.

To assess the range of possible short-term outcomes, we conducted a Monte Carlo simulation projecting ARE’s stock price over the next year. This simulation assumes a random walk (geometric Brownian motion) for the share price, using parameters roughly calibrated to Alexandria’s recent historical volatility (around 30% annualized) and a modest expected drift (we assumed ~5% annual expected return drift, roughly in line with the dividend yield plus slight growth). We ran 100,000 simulated price paths for 252 trading days (one year). The resulting distribution of prices is shown above. Key insights: The median simulated 12-month price is around $70 – essentially in line with the current price, reflecting the assumption of modest drift. However, the distribution is wide: there is a ~5% chance the stock could fall below ~$43 in one year (a severe downside case), and a symmetric ~5% probability it could exceed ~$115** (a strong upside surprise). The middle 90% of outcomes roughly spans from the mid-$40s to the mid-$110s. The mean expected price in this simulation is in the low-$70s, slightly above the current price (owing to the small assumed upward drift). This analysis highlights the high volatility around Alexandria’s near-term prospects – outcomes are quite dispersed. While the stock has substantial upside potential if things go well (e.g., favorable news could push it back toward $100+), there is also considerable downside risk if conditions deteriorate further. Investors should be prepared for this volatility; position sizing and time horizon are important considerations when dealing with such a wide range of potential outcomes.

It’s worth noting that this Monte Carlo model is purely statistical and does not account for specific fundamental developments. In practice, actual outcomes will be driven by events such as earnings surprises, changes in interest rates, or major tenant news. The simulation does, however, provide a sense of risk – the one-year value at risk (5th percentile) in this model suggests that in a downside case there is a scenario where roughly one-third of the value could be lost, whereas upside of a similar magnitude is also possible. This symmetry is roughly in line with our scenario analysis below, though our fundamental scenarios assign different probabilities than the purely random model.

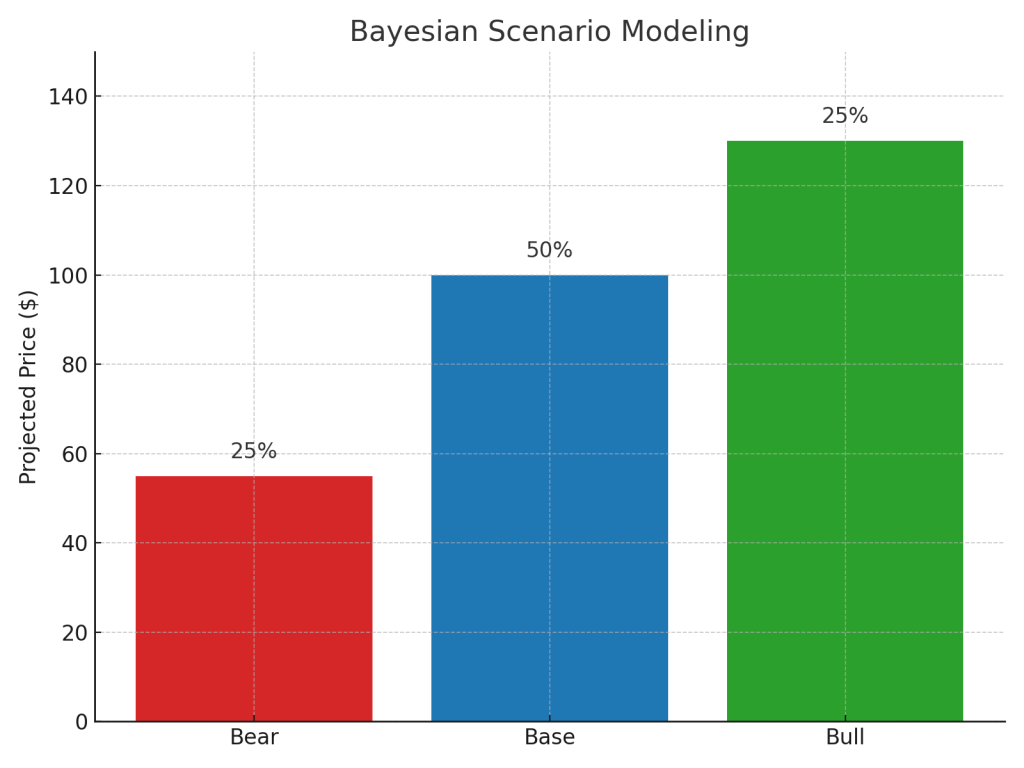

Bayesian Scenario Modeling (Bear, Base, Bull)

Bayesian scenario analysis for ARE’s 12-month price targets. Each bar represents the projected share price in one year under a given scenario, and the percentage above each bar is the assumed probability of that scenario. (Bear Case: $55, Base Case: $100, Bull Case: $130).

In addition to the purely statistical Monte Carlo approach, we modeled three discrete scenarios for Alexandria’s stock over the next 12 months – Bear, Base, and Bull – and assigned subjective probabilities to each. This “Bayesian” scenario analysis incorporates our fundamental outlook and judgments about the likelihood of various outcomes:

- Bear Case ($~55$ share price, 25% probability): In the bear scenario, macroeconomic and sector conditions worsen. Perhaps interest rates stay elevated or even rise further, putting additional pressure on REIT valuations, and the life science real estate market continues to soften. Under this scenario, Alexandria might experience a further dip in occupancy (falling below 90%) as some tenants vacate or downsize. Rental rate growth could stagnate or turn negative in key markets due to oversupply and weak demand. We also assume adjusted FFO stagnates or declines (possibly into the high-$8 per share range) and investors demand a high dividend yield to compensate for risk (e.g. 9%–10% AFFO yield). This combination would drive the stock lower to around the mid-$50s. At ~$55, the stock would be trading at roughly a 10% implied cap rate and ~6× FFO – levels that imply significant pessimism about the future. This price is near our estimate of tangible book value per share (given the value of Alexandria’s assets and liabilities), suggesting the market would be pricing in a scenario of prolonged distress. Though this outcome is not our base expectation, we assign it roughly a one-in-four chance given uncertainties in the economy (e.g. the risk of recession or a credit crunch affecting tenants).

- Base Case ($~100$ share price, 50% probability): The base scenario reflects our central expectation that Alexandria navigates the current challenges and shows modest improvement. In this outcome, the broader economy avoids a deep recession and interest rates begin to stabilize (or gently decline) by 2024–2025, which helps support REIT investor sentiment. Leasing activity gradually improves – Alexandria manages to lease up most of its development pipeline and vacant space such that occupancy returns to ~94–95% within a year or so. Rent spreads on lease renewals remain positive (though not as high as pre-2022 levels) and cash rents overall inch upward. We assume the company hits its adjusted FFO guidance for 2025 (around $9.2–$9.3 per share) and perhaps grows slightly into 2026. Under these conditions, we expect the market would reward Alexandria with a partial valuation re-rating: a FFO multiple in the ~11× range or an AFFO yield around 7–8% (still higher than its historical norm, but lower than at the trough). That yields a 12-month target price around $100, which also aligns with the consensus analyst price target range. At $100, the stock would still be below its net asset value (our rough NAV estimate is in the $120+ range), implying room for further upside in subsequent years if fundamentals continue to improve. We assign the base case a 50% probability, as it represents the expected scenario given current information.

- Bull Case ($~130$ share price, 25% probability): The bull scenario envisions a swift and strong recovery for Alexandria’s operating and market environment. This could occur if interest rates fall meaningfully (for example, if inflation rapidly cools and the Fed begins cutting rates in 2024, bringing the 10-year yield back down towards ~2–3%). Lower rates would likely rejuvenate REIT valuations broadly. Additionally, in this scenario the life sciences sector experiences a robust rebound – perhaps a wave of biotech funding returns, leading to expansion and new leases, and minimal tenant defaults. Alexandria could then lease essentially all available space (pushing occupancy to 96–97%) and achieve higher rent growth (mid-single-digit or more) as demand outpaces the diminished new supply. We might see FFO growth re-accelerate to ~5%+ annually. In such a goldilocks scenario, investor sentiment could swing positive, and the stock’s valuation might revert to a premium level – say, 14×–15× FFO (still below its peak multiples but reflecting renewed confidence). That would equate to a share price in the $120–$140 range (we choose $130 as a representative point). This bull case also factors in the possibility of Alexandria attracting strategic interest or unlocking additional value (for instance, via joint ventures or asset sales at favorable prices, which signal higher private market valuations for its assets). We view this outcome as less likely than the base (hence ~25% probability), but it’s plausible if macro conditions improve faster than anticipated.

Under this scenario framework, our expected 12-month price (probability-weighted) comes out around the mid-$90s, which is generally consistent with the idea that the stock is undervalued today (in the high-$60s) and has a favorable risk-adjusted expected return. Importantly, the scenario analysis shows that while upside to $100+ is reasonably likely if things go right, there is also a not-insignificant risk of further downside into the $50s if things go wrong. Investors should consider their own risk tolerance: if one is confident in Alexandria’s long-term prospects and can withstand potential short-term drawdowns, the current price offers an attractive entry. On the other hand, those with a shorter horizon or lower risk appetite might wait for clearer signs of stabilization (even if that means paying a higher price later once the uptrend is confirmed).

Discounted Cash Flow Valuation

We performed a Discounted Cash Flow (DCF) analysis for Alexandria under each of the three scenarios to estimate intrinsic value. This valuation is based on projecting the company’s cash flows (proxied by AFFO/FFO) over a multi-year period and then discounting them to present value using an appropriate cost of equity. Key assumptions include: (a) near-term growth rates in FFO, (b) long-term terminal growth, and (c) the discount rate (investors’ required return). Below is a summary of our DCF approach and findings:

- Bear Scenario DCF: We assume that in the bear case Alexandria’s FFO per share declines slightly over the next couple of years (due to higher vacancy and zero rent growth) and then only stabilizes at a lower level. For example, FFO might go from about $9.2 this year down to ~$8.5–$9.0 over the next year or two and then remain flat. We also use a higher discount rate (around 10–11% cost of equity) reflecting the risk and high yield required by investors in this pessimistic scenario. We assume minimal long-term growth (terminal growth rate ~1%). Under these conditions, our DCF yields an intrinsic value in the mid-$50s per share, in line with the bear-case price target. This suggests that if the market believed Alexandria’s future cash flows would stagnate at current levels (or decline) with little growth and high discount rates, then a ~$55 stock price would be justified. Essentially, the bear DCF implies the company would be valued almost like a bond substitute with a high yield, reflecting low expectations for future growth.

- Base Scenario DCF: For the base case, we project moderate growth: FFO expands by ~3% annually for the next few years (as occupancy improves and rent increases modestly) and stabilizes thereafter with a terminal growth of ~2%. We use a discount rate around 8.5–9.0%, roughly consistent with Alexandria’s cost of equity (this assumes a ~4% risk-free rate and a modest equity risk premium given the stock’s beta near 1). With these inputs, the DCF indicates an intrinsic value in the $95–$105 per share range. This aligns with our earlier fair value estimate of ~$100. In this scenario, the present value of projected cash flows (and a terminal value based on perpetuity growth) comfortably exceeds the current market price, underscoring that the stock is undervalued if one believes in even modest growth. For instance, the dividend alone (currently ~$5.28 annually) provides a solid yield, and if FFO grows, the DCF captures the additional value creation beyond the dividend. The base DCF essentially assumes Alexandria continues as a stable, slowly growing REIT – given its track record and portfolio quality, this is a reasonable expectation, and thus the $100 intrinsic value seems well-founded.

- Bull Scenario DCF: In the optimistic case, we model a higher growth trajectory: perhaps 5–6% annual FFO growth for five years (driven by high occupancy and strong rent increases) and a terminal growth rate of ~3%. We also assume the cost of equity falls to ~7.5–8% (which could happen if interest rates decline and/or Alexandria’s perceived risk drops). These bullish inputs produce an intrinsic value on the order of $130+ per share. This result dovetails with our bull-case target. It reflects a scenario where Alexandria’s cash flows compound faster and investors are willing to pay a premium for those growing dividends in a lower-rate environment. Under such conditions, the stock’s yield would compress (the price rises relative to dividends/FFO), rewarding shareholders with significant capital appreciation. The bull DCF outcome shows the potential upside if Alexandria can recapture a higher valuation multiple akin to past cycles when high-quality REITs traded at 20× FFO or more (for context, $130 would be roughly 14× 2025e FFO, still below prior peaks, so it’s not an absurd reach if the climate improves).

Overall DCF Conclusion: Across scenarios, our DCF analysis supports the view that Alexandria is undervalued in the current market. Even with conservative assumptions (bear case), the stock is around fair value in the mid-$50s, suggesting limited extreme downside unless fundamentals truly unravel. In our base and bull cases, the DCF indicates substantial upside (40%+ to base value, nearly 90% in bull case). This asymmetric risk/reward skews positively for long-term investors. We have incorporated macroeconomic risk adjustments in our discount rates – e.g., using a higher discount rate in the bear case to simulate tighter financial conditions. Additionally, our terminal value calculations consider the possibility that cap rates (the inverse of valuation multiples) remain elevated in a high-rate world. Even so, the intrinsic values are comfortably above the current market price in the neutral-to-positive scenarios. This gives confidence in our Buy rating: the market appears overly pessimistic in pricing ARE at present. However, patience may be required for the valuation gap to close; it likely hinges on either interest rates easing or Alexandria delivering a few quarters of solid results to rebuild confidence.

Macroeconomic & REIT Sector Outlook

The broader backdrop for REITs and Alexandria in particular is a mixed bag of challenges and opportunities. Interest rates have been the dominant factor in recent years. After an era of ultra-low rates that fueled high REIT valuations, the rapid tightening by the Federal Reserve (to combat inflation) has re-priced income-producing assets across the board. With the 10-year U.S. Treasury yield hovering around multi-year highs, income-focused investors have alternatives (like bonds) that offer 4–5% yields with less risk, pressuring REIT dividend yields upward (and prices downward). This environment explains much of Alexandria’s stock decline from ~$180 (early 2022) to ~$70 today – the dividend yield went from ~2.5% to ~7.5% to stay competitive. Looking ahead, the interest rate outlook is crucial: if inflation continues to cool and the economy slows, the Fed could pause or cut rates in late 2024, which would likely spark a REIT recovery. On the other hand, if inflation proves sticky and rates stay higher for longer (or even rise further), REITs may languish or fall more. Our base case assumes rates have peaked, and we’ll see stabilization and slight declines in yields over the next year or two, which should provide a tailwind for REIT valuations.

In the commercial real estate sector, there is considerable differentiation. Office REITs, for example, are facing severe secular headwinds from remote work, but Alexandria’s lab spaces are a different animal – labs generally require physical presence and specialized infrastructure, meaning the “work from home” trend is less applicable. That said, life science real estate is not immune to cyclical swings. After a boom in 2020–2021 (with record biotech funding and expansion), the sector hit a rough patch in 2022–2023 as funding tightened. Vacancy rates in key life science hubs ticked up and sublease space flooded the market as startups pulled back. Current state: According to industry reports, the overall lab space vacancy in major markets has increased into the low-to-mid teens percent (from previously under 10%). Alexandria itself reported a vacancy uptick, and it proactively slowed some developments to match supply with demand. However, there are signs of stabilization. The company and industry observers have noted that demand appears to be gradually recovering in 2024 – leasing volumes are improving and there’s optimism that the second half of 2023 marked the trough. Additionally, new construction is decelerating: many planned projects have been delayed or canceled given higher financing costs and market uncertainty. Forecast: By 2025–2026, we anticipate a healthier equilibrium where demand for lab space picks up (driven by scientific R&D needs, which are likely to grow long-term, supported by government and private investment in healthcare and technology) while supply growth moderates. This would benefit landlords like Alexandria through higher occupancy and more pricing power on rents.

Economic Growth and Tenant Health: Another macro factor is the trajectory of the economy and healthcare sector. A strong economy with robust R&D spending (from pharma and biotech firms flush with cash) would obviously bolster Alexandria’s tenant base. Conversely, a recession – especially one that constrains government research budgets or private biotech funding – is a risk. Currently, large pharmaceutical companies are performing well (many have strong cash flows and are investing in new research facilities, often partnering with Alexandria for space), which provides a buffer. Moreover, Alexandria’s focus on top-tier life science clusters means it operates in markets with deep talent pools and institutional support (e.g., Boston’s research hospitals, Silicon Valley’s tech-bio convergence, etc.). These markets tend to be resilient over the long run. We do acknowledge the risk that if borrowing costs remain high, highly leveraged or early-stage biotech tenants could face cash crunches. Alexandria’s management has indicated they are closely monitoring tenant credit and in some cases have backfilled spaces from weaker tenants with stronger ones (often with minimal downtime). Macro-wise, the U.S. government’s stance on biomedical funding (NIH budgets, etc.) and any major healthcare reforms could also indirectly influence the sector’s growth.

REIT Sector Sentiment: As of mid-2025, sentiment toward REITs is cautious. Many REITs are trading at large discounts to their net asset values (NAVs), and institutional investors have reduced exposure, fearing interest rate and property market risks. However, history shows that these cycles can turn into opportunities – when rates eventually plateau or decline, and when there is clarity on property fundamentals, REITs often rally strongly from trough valuations. For instance, after the Great Financial Crisis and again after the 2013 “taper tantrum,” REIT indexes rebounded as the rate environment improved. We see a similar potential setup for late 2024 or 2025: if inflation is tamed and the Fed even hints at cuts, income investors may pile back into high-yield names like Alexandria, locking in yields before prices climb. Additionally, any positive news specific to Alexandria – such as better-than-expected earnings, asset sales at good prices (which would validate its NAV), or share buybacks (management might consider buying back stock if it stays significantly undervalued) – could act as catalysts.

In summary, the macro and sector outlook for Alexandria Real Estate Equities is gradually improving but still uncertain. High interest rates and a recent soft patch in life science real estate have been a drag, but many negative factors appear priced in. The company’s underlying portfolio is leveraged to a sector with strong long-term tailwinds (biotech and pharma innovation), and as the broader economy and financial conditions normalize, Alexandria is poised to regain lost ground. Investors should keep an eye on Fed policy updates, biotech funding trends (e.g., are venture capital and IPOs picking up?), and Alexandria’s quarterly leasing metrics as key indicators for the stock’s next moves. Given the current information, we remain cautiously optimistic that conditions will turn in Alexandria’s favor within the next 12–24 months, supporting our positive investment thesis.

References

- Reuters. “Alexandria Real Estate reduces annual FFO forecast on lower leasing demand.” April 28, 2025.

- StocksToTrade News. “Alexandria Real Estate’s Tough Quarter: What Now?” May 21, 2025 (Tim Bohen).

- Yahoo Finance. Profile for Alexandria Real Estate Equities (ARE). (Accessed May 21, 2025). Beta (5Y Monthly) and dividend data.

- Fintel.io. ARE Volatility and Risk Metrics. (Accessed May 21, 2025). 1-Year Beta, Sharpe and Sortino ratios.

- Nareit. “REITs Underperformed Broader Markets in 2022.” Market Commentary, Jan 10, 2023. (Discussion of REIT index returns and interest rates).

- Wolf, M. – Wolf Media. “Life Sciences: Alexandria sees ‘solid indicators’ of a rebound.” April 26, 2024. (Q1 2024 performance and management commentary on supply/demand).

- StockTitan. Alexandria Real Estate Equities – Latest Stock FAQ. (Accessed May 21, 2025). Current price, market cap, and share statistics.

- TipRanks. “Alexandria Equities (ARE) Stock Forecast & Price Target.” (Accessed May 2025). Consensus analyst 12-mo price target ~$102, with high and low estimates.

Leave a comment