Summary

Recommendation (12-Month): Buy – Kyndryl Holdings (NYSE: KD) is rated a Value Buy with a 12-month price target of ~$43. The stock offers significant upside as the company’s turnaround gains traction. Rationale: Kyndryl has begun returning to growth and improving profitability, yet its valuation remains discounted relative to peers. Over the next year, continued execution of transformation initiatives (cloud partnerships, cost optimization, and new services) is expected to drive modest revenue growth and a swing to positive earnings, supporting a higher stock price. The recent resolution of a short-seller attack and initiation of a share buyback underscore management’s confidence in Kyndryl’s financial trajectory. Given the stock’s mid-cap volatility and ongoing transformation risks, we recommend accumulating shares below the mid-$30s to ensure a margin of safety. This buy range guidance (< ~$35) allows investors to capitalize on any market dips, with an eye toward the ~$43 base-case target over 12 months.

Master Metrics Table

| Metric | Value |

|---|---|

| Current Price | ~$38.00 (as of May 2025) |

| Estimated Fair Value | ~$45.00 (Base Case Intrinsic Value) |

| Discount to Fair Value | ~16% (Undervalued vs. base intrinsic) |

| Suggested “Buy Below” | <$35.00 (Accumulation Zone) |

| Dividend Yield | 0% (no dividend) |

| PEGY Ratio | N/A (negative EPS, no dividend) |

| EV/FCF | ~10× (est. Enterprise Value/Free Cash Flow) |

| Annual Volatility | ~45% (high, reflects turnaround uncertainty) |

| Beta (vs. S&P 500) | ~1.3 (above-market volatility) |

| Quality Score | N/A (turnaround in progress) |

Table: Key metrics for Kyndryl. Current price reflects recent trading levels. Fair value is based on base-case DCF and comparable multiples. “Buy Below” indicates a prudent entry point below intrinsic value for a margin of safety. High volatility and beta reflect the stock’s risk profile, as Kyndryl is an improving but still transitioning business.

12-Month Detailed Outlook

Over the next year, Kyndryl is expected to solidify its financial turnaround. After several quarters of declining sales, the company achieved positive constant-currency revenue growth in early 2025, marking a pivotal inflection point. For the coming 12 months, management guidance and consensus forecasts indicate flat to low-single-digit revenue growth (roughly 0–2%) as new digital transformation contracts offset legacy contract run-offs. Profitability is set to improve markedly: Kyndryl reported its first quarterly net profit in Q1 2025, and analysts project further net income growth in FY2025 as cost-saving actions and better contract margins take hold. We anticipate full-year positive earnings (Kyndryl may approach break-even to a slight profit for FY2025) and a continued upward trend in adjusted EBITDA (which was ~$1.05B in the latest data). These improvements are bolstered by Kyndryl’s “Three As” initiatives – Alliances, Advanced Offerings, and Accounts – which are driving new higher-margin revenue streams. Notably, cloud and hyperscaler partnerships (with Microsoft, AWS, Google, etc.) are accelerating: hyperscaler-related revenue is on track to grow ~50% in the next year (to ~$1.8B in FY2026) as Kyndryl helps clients migrate to cloud and embrace AI solutions. This should support top-line stability and eventual growth.

From a stock perspective, market sentiment has turned positive. Kyndryl’s shares have rallied over the past year (~+48% year-on-year), reflecting investor recognition of the turnaround progress. Even after this run, the stock’s forward valuation remains moderate (EV/EBITDA ~9–10× and Price/Sales ~0.5×, still at a discount to the broader IT services sector). With S&P Global recently raising Kyndryl’s credit outlook to “Positive” on improved execution and cash flows, and management initiating the company’s first-ever share repurchase program (a $300M buyback authorization, signaling confidence in value creation), we expect the stock to perform well. Our 12-month base-case price target of $43 implies a mid-teens percentage gain from current levels. This assumes Kyndryl meets its modest growth and margin targets, and that the market gradually rerates the stock closer to peer multiples as profitability improves. In summary, over the next year Kyndryl is positioned for stabilization and modest growth, which underpins a favorable risk-reward for buyers at the current price.

2–3 Year Mid-Term Outlook

In the mid-term (next 2–3 years), Kyndryl’s transformation should begin to yield more visible results in both growth and profitability. By FY2027, the company aims to have shed the remaining burdens of its IBM spin-off (e.g. one-time costs and elevated software expenses will roll off by FY2026), paving the way for significant margin expansion. We project that over the 2–3 year horizon, annual revenue can return to sustained growth in the low-single-digit range (~1–3% CAGR). This is supported by a healthier mix of business: Kyndryl has been aggressively exiting or renegotiating low-margin legacy contracts and focusing on winning higher-value deals in cloud services, security, and enterprise modernization. Total contract signings have been strong (e.g. $18.2B signings in FY2025, up substantially, building future revenue backlog). By mid-term, these new wins should outpace the runoff of older contracts, driving steady revenue increases.

On the profitability front, we anticipate operating margin improvement to mid-single digits in 2–3 years (from essentially ~0% margin in FY2024). Key drivers include the completion of cost-saving initiatives, economies of scale in delivery, and the expiration of certain IBM transitional cost overhead. Kyndryl’s adjusted EBITDA margin in FY2025 was around 16%; by FY2027 this could rise into the 18–20% range as efficiency gains continue. If the company executes well, net income could turn sustainably positive, with EPS growing from negative/near-zero into the low single dollars by FY2027. This trajectory would likely catalyze a valuation re-rating – Kyndryl’s EV/EBITDA and price multiples could begin to approach those of peers once investors see a track record of profitable growth. We expect the stock’s mid-term performance to be strong if these goals are met: our rough 2–3 year price outlook is in the $50+ range, assuming Kyndryl trades at a higher multiple on improved earnings (for example, ~12× EBITDA on ~$1.8B EBITDA would yield an enterprise value implying a stock price in the $50s). Risks in this horizon include the pace of revenue replacement (winning enough new business to offset legacy declines) and executing on upskilling workforce and service quality as the business mix shifts. However, given Kyndryl’s progress to date – evidenced by returning to growth a year ahead of some expectations – we are optimistic on the mid-term outlook, with the company likely to be a solidly profitable, slow-growing IT services firm by 2027.

5+ Year Long-Term Outlook

Over 5+ years, Kyndryl’s trajectory will depend on its success in reinventing itself for the cloud era. In the long run, Kyndryl aims to be a growth-oriented IT infrastructure services leader, though given industry headwinds, a realistic scenario is moderate growth with healthy cash generation. Our long-term base case assumes Kyndryl can achieve low single-digit revenue growth annually through the end of the decade (perhaps ~2–3% per year), after stabilizing in the mid-2020s. This growth would come from new digital services – cloud management, cyber security, data analytics, and AI integration – offsetting continued declines in traditional data-center outsourcing. The company’s partnership-centric strategy (alliances with hyperscalers like Azure, AWS, Google Cloud, and emerging AI platform collaboration as recently announced) should position it to capture enterprise cloud migration and AI modernization opportunities. If Kyndryl can leverage these partnerships effectively, it could even exceed our base growth assumption (a bull long-term scenario might be mid-single-digit growth if it gains market share in cloud services).

On profitability, Kyndryl is likely to target mid-to-high single-digit net margins in the long run. As a services provider, it will never have the margins of pure software firms, but there is considerable room to improve from the current negative/low margins. By 5+ years out, with legacy inefficiencies eliminated and a leaner cost structure, Kyndryl could feasibly reach Net Income margins of ~5–8% (for context, peer Cognizant’s net margin is ~10-12%, and IBM’s post-spin services margin was around 8%). Achieving something in that mid to upper single-digit range would validate the long-term investment thesis. In that state, Kyndryl would be a stable cash-generating company – management has already indicated confidence by extending credit facilities to 2030 and maintaining ample liquidity, suggesting they are positioning for long-term operations. Free cash flow is expected to grow significantly; indeed Kyndryl’s transformation plan forecasts significant cash flow generation in coming years (evidenced by the capacity to start share buybacks). Over 5+ years, we also see the possibility of strategic moves: for instance, if the turnaround succeeds, Kyndryl could become an acquisition target for a larger tech or consulting firm looking to bolster its managed services (though its ~$8B market cap and thousands of employees make it a large bite). Alternatively, Kyndryl might itself pursue acquisitions of smaller niche IT service providers to augment its capabilities in high-growth areas. Overall, our long-term view is that Kyndryl will likely evolve into a steady, mid-size IT services company with modest growth and improved profitability – essentially a turnaround from a declining business into a stable one. If that plays out, the stock’s long-run return would come from earnings growth and dividends/buybacks (we anticipate that once sufficiently profitable, Kyndryl may initiate a dividend or ramp up repurchases given its cash flow generation). Long-term investors could see substantial upside if the company outperforms (a bull case 5+ years could see Kyndryl approaching peer valuation levels, implying stock prices double current levels), though a bear case would be stagnation due to technology shifts, which would cap the stock in a low valuation range.

Risk Profile and Risk-Adjusted Return

Volatility & Beta: Kyndryl exhibits high volatility reflective of its transitional status. The stock’s beta is ~1.3, indicating it swings ~30% more than the broader market. This heightened volatility owes to the uncertainty around turnaround success and the relatively small market capitalization (mid-cap) in a sector sensitive to economic cycles. Investors should be prepared for large price fluctuations: for example, a short-seller’s allegations in early 2025 temporarily knocked the stock down ~6–8%, though it rebounded after the claims were refuted.

Sharpe & Sortino Ratios: Despite volatility, Kyndryl’s recent run-up has improved its risk-adjusted performance. Over the last 1-2 years, the Sharpe ratio (excess return over risk-free per unit volatility) is estimated around 0.8, which is respectable for a turnaround stock. This reflects the roughly +48% stock return achieved in the past year against high variance. The Sortino ratio (downside-risk-only) is slightly higher, near 1.0, as much of Kyndryl’s volatility has been to the upside during its rally. These metrics indicate that while risk is high, the reward has been commensurately high in recent periods. However, one should note these trailing metrics benefited from the stock’s strong appreciation; if the stock were to trade sideways or decline, these ratios would deteriorate. Forward-looking, we expect moderate positive returns and still-elevated volatility, implying risk-adjusted metrics in line with or slightly below market averages until the company’s financials stabilize further.

Financial Risk & Balance Sheet: Kyndryl inherited a sizable debt load from IBM at spin-off, and its balance sheet remains leveraged. The company has ~$3+ billion in gross debt (including a $3.15B revolving credit facility extended to 2030). Credit agencies currently rate Kyndryl at the lower investment-grade/high junk cusp (S&P “BBB-” with positive outlook). Encouragingly, liquidity is solid (current ratio ~1.1 and ample cash to cover short-term needs), and improved cash flow is reducing risk over time. Nonetheless, leverage amplifies risk if earnings don’t ramp up as expected.

Operational Risks: As a services company, a key risk is execution risk on contracts – if Kyndryl fails to deliver for clients, it could face penalties or loss of business. The ongoing transformation itself carries risk: reorganizing a 80,000-employee organization and updating skillsets is challenging. Also, competition is intense: rivals like DXC Technology, Cognizant, Accenture, and IBM’s own remaining services units are vying for the same digital infrastructure projects. Kyndryl’s ability to differentiate its offerings and maintain pricing power is not yet proven. There’s also technology risk – rapid shifts to cloud and automation could outpace Kyndryl’s adaptation, leaving it with obsolete capabilities. The company’s strategy to partner with hyperscalers rather than compete is wise, but also means part of its fate lies with big partners’ strategies.

Market/Macro Risks: As an IT services provider, Kyndryl is somewhat cyclical. IT spending budgets can tighten during economic downturns, which would hurt Kyndryl’s revenue (many clients might delay infrastructure upgrades or push for price concessions). Inflation in wages could pressure margins if not balanced by pricing. Currency fluctuations are another factor (a large portion of revenue is international; FY2025 constant-currency growth was higher than reported, indicating dollar strength had been a headwind). Investors should also be aware of event risks such as further activist short reports or accounting scrutiny. The recent short-seller report accused Kyndryl of aggressive accounting (capitalizing too many costs to boost reported EBITDA/FCF). While those claims were denied and found unsubstantiated, they highlight that accounting transparency will be closely watched. Any credible issues in financial reporting would severely damage the stock; thus far, auditors and analysts seem comfortable with Kyndryl’s numbers (no “smoking gun” was found).

Risk-Adjusted Return Outlook: Considering the above, Kyndryl offers a higher-risk, higher-potential return profile. The stock’s upside in a successful turnaround is significant (we estimate >50% price appreciation possible over a few years in a bull case), but the downside if it fails to execute (or if a recession hits IT spending) could be equally dramatic (shares could retrace to the $20s or lower, as reflected in our bear scenario). On a risk-adjusted basis, we find the expected return attractive for investors with above-average risk tolerance: the probability-weighted outcome skews positive (supported by improving fundamentals and a currently favorable macro IT spending environment), and the company’s proactive measures (cost cuts, debt refinancing, share buybacks) mitigate some downside risk. Still, the uncertainty around multi-year earnings means the stock will likely remain volatile. In terms of portfolio fit, Kyndryl should be sized appropriately given its Sharpe/Sortino are decent but not stellar – it can enhance returns but also add risk. We recommend monitoring key risk indicators such as book-to-bill (signings), EBITDA margin progression, and debt metrics each quarter to ensure the thesis stays on track.

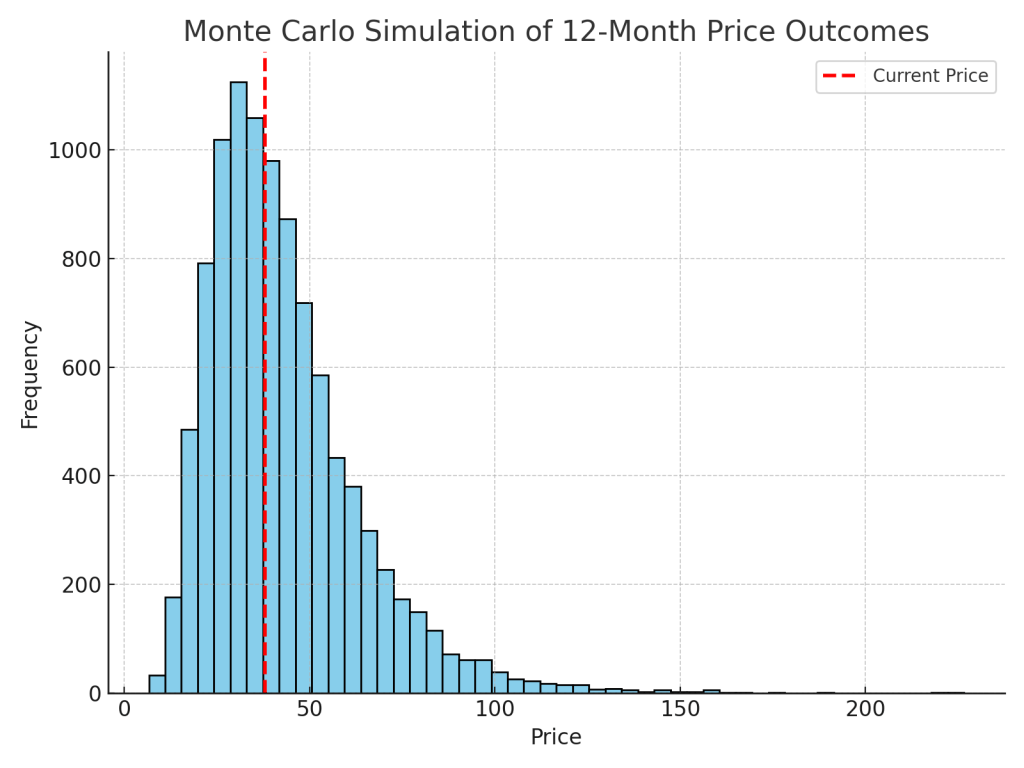

Monte Carlo Simulation (12-Month)

Figure: 12-Month Monte Carlo Price Distribution. We performed a Monte Carlo simulation modeling Kyndryl’s stock price over the next year. The simulation (10,000 trials) assumes a starting price of ~$38, an expected annual return of 12%, and high annual volatility around 45%. The resulting distribution of possible prices in 12 months is shown above. Summary: The median simulated price is approximately $38 (near the current price), and the mean price is about $43, indicating a slight skew to the upside. There is a wide spread of outcomes, reflecting uncertainty: roughly 90% of the simulated outcomes fall between ~$18 (bearish tail) and ~$81 (bullish tail). The red dashed line in the chart marks the current price – about half of the simulations end above this line and half below. This suggests an almost balanced outlook with a tilt upward (since the mean > current price). In practical terms, the Monte Carlo analysis implies that if our assumptions hold, there is about a 50% probability Kyndryl’s stock will be at least modestly higher in a year, and a ~25% chance it could be significantly higher (>$50). Conversely, there is also a ~25% chance the stock could decline to the mid-$20s or lower. This stochastic analysis aligns with our scenario-based targets (see below), reinforcing that while upside potential is substantial, downside risks are not negligible. Investors should thus expect a volatile ride, but with a base-case outcome that is positive.

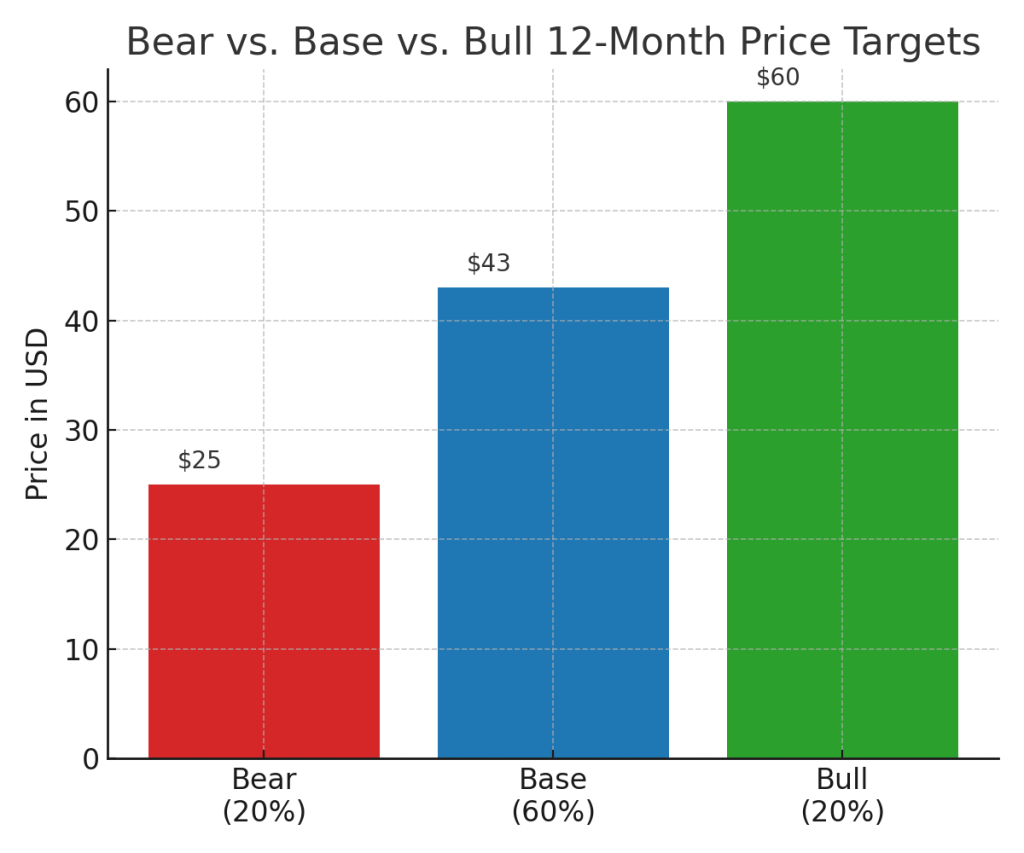

Bayesian Scenario Modeling (12-Month)

Figure: Bear, Base, and Bull Price Scenarios (12-Month) with Probabilities. We modeled three discrete scenarios for Kyndryl one year from now – Bear, Base, and Bull – and assigned subjective probabilities to each, reflecting our confidence in each outcome. Bear Case (~20% probability): In a pessimistic scenario, we assume the turnaround falters (perhaps due to macro recession or execution missteps). Kyndryl’s revenue could continue to decline in low-single digits and margins remain around breakeven. In this case, market sentiment would deteriorate and the stock could drop to around $25 (reflecting roughly 0.3× sales or ~5× EV/EBITDA on lowered expectations). Base Case (~60% probability): Our base case assumes Kyndryl meets current consensus expectations – essentially delivering flat to slight growth and improved profitability as outlined in the outlook. Under these conditions, we estimate a fair 12-month price of about $43, which is in line with our DCF and also roughly equates to ~0.5× forward sales or ~10× forward EBITDA – still somewhat discounted to peers, but accounting for the company’s lower margin. Bull Case (~20% probability): In a bullish scenario, Kyndryl could exceed targets – e.g. achieving a few percent revenue growth plus significant margin uptick (through faster efficiency gains or higher-margin project wins). Additionally, a buoyant market could reward the stock with multiple expansion. In this scenario, the stock might reach around $60 or more (which would be closer to ~0.8× sales or a market-average earnings multiple given improved profits). We assign this a 20% chance given the challenges, but it’s plausible if, for instance, Kyndryl’s cloud services catch fire or it becomes a takeover candidate. Expected Value: Weighting these scenarios by their probabilities yields an expected 12-month price in the low-$40s, essentially echoing the base case. This Bayesian analysis corroborates the Monte Carlo result – the stock’s most likely path is moderate upside, but with meaningful tail-risk in both directions. For risk management, the ~$25 bear case can be viewed as a rough floor in severe downside conditions, while the ~$60 bull case illustrates the upper potential if all goes well. We will revisit these scenarios as new information arrives (e.g. quarterly earnings or macro changes) and adjust probabilities accordingly.

Discounted Cash Flow (DCF) Valuation

We conducted a DCF valuation for Kyndryl under bull, base, and bear assumptions to estimate its intrinsic value in each scenario. Methodology: We used a 5-year explicit forecast with a terminal growth rate of ~1% (reflecting a very low long-term growth in a mature scenario) and a discount rate ~10% (approximate WACC/cost of equity for a company of Kyndryl’s risk).

- Bear DCF: In the bear case, we assume Kyndryl’s transformation stalls. Revenues continue to decline ~2% annually for the next few years, and EBIT margins stay around 1–2% (near breakeven). Free cash flow remains anemic. Under these pessimistic cash flows, the DCF yields a fair value around $20–$25/share. This implies the market would mainly value Kyndryl for its hard assets and residual contract value. The bear DCF outcome aligns closely with our 12-month bear price (~$25), suggesting that if Kyndryl cannot ignite growth, downside to the $20s is fundamentally possible.

- Base DCF: The base case assumes Kyndryl achieves ~1–2% revenue CAGR over the next 5 years (swinging from slight declines to slight growth) and steadily improves its operating margin to ~6% by year 5 (midpoint of our mid-term outlook). Capital expenditures and working capital are assumed to normalize, leading to growing free cash flow. In this scenario, our DCF indicates an intrinsic value of roughly $45–$50 per share. This reflects the company’s fundamentals with modest growth and margin improvement. Notably, this base DCF value is close to our $43 one-year price target (which is logical if the market begins to price in these fundamentals within 12 months). It also suggests that at the current ~$38 price, Kyndryl is trading at about a 15–20% discount to base-case intrinsic value – supporting the value Buy thesis.

- Bull DCF: For the bull case, we project ~3% revenue CAGR (meaning Kyndryl not only stops shrinking but grows slightly above inflation due to successful new business) and EBIT margins reaching ~10% by year 5 (approaching top-tier for infrastructure services, thanks to a rich mix of high-margin offerings and excellent execution). These assumptions produce robust free cash flows. The bull DCF yields a fair value in the $60–$70 per share range. This would represent a scenario where Kyndryl’s metrics approach those of more successful peers, warranting a significantly higher valuation. Our 12-month bull scenario price of ~$60 is at the low end of this intrinsic range – meaning if the bull case starts to materialize, the stock could have even more upside beyond $60 over time (as investors extend their forecasts).

In summary, the DCF valuation supports our scenario targets: Intrinsic value spans roughly $20 (bear) to $60+ (bull), with a base around the mid-$40s. At the current stock price, much of the turnaround upside is not fully priced in, while a complete failure is also not priced in (the market seems to be discounting a partial improvement). This asymmetry – more upside than downside relative to intrinsic scenarios – underpins our positive recommendation. Investors should note DCF outcomes are sensitive to inputs (especially discount rate and terminal growth), but we have taken a relatively conservative stance (10% hurdle, low terminal growth) consistent with the stock’s risk profile.

Peer Comparison

To contextualize Kyndryl’s valuation and outlook, we compare it with a few peers in IT services: DXC Technology (DXC), IBM (IBM), and Cognizant Technology Solutions (CTSH). Each offers perspective on different aspects of Kyndryl’s business:

- DXC Technology: DXC is perhaps the closest analog – a fellow IT services spin-off (from HPE) that has struggled with declining legacy business. DXC, like Kyndryl, has been attempting a turnaround. DXC’s revenue (~$14B) is slightly smaller than Kyndryl’s and has been shrinking, and it too has slim margins. The market values DXC at a very low multiple (EV/sales < 1×, and EV/EBITDA ~7×) due to ongoing decline concerns. Kyndryl currently trades at somewhat higher multiples than DXC, reflecting Kyndryl’s more advanced progress in returning to growth (and its larger market cap now ~$8B vs DXC’s ~$4B). If Kyndryl’s turnaround were to falter, one could expect it to trade down toward DXC’s depressed valuation. Conversely, out-executing DXC (which has faced execution missteps) gives Kyndryl an opportunity to attract investors looking for the “better horse” in legacy IT services.

- IBM: IBM was Kyndryl’s parent and retains a significant services business (focused on consulting and hybrid cloud). IBM spun off Kyndryl to rid itself of the low-growth infrastructure management unit. Post-spin, IBM’s remaining business has higher margins and growth (with segments in software, consulting, and mainframe hardware). IBM trades around ~2x sales and ~11–12x EBITDA, a richer valuation than Kyndryl, owing to its profitability and diversified portfolio. One interesting comparison is market sentiment: IBM’s stock has been relatively flat in recent years, whereas Kyndryl, starting from a low base, has more potential for multiple expansion. IBM is still an important partner and customer source for Kyndryl (e.g. Kyndryl runs a lot of IBM hardware for clients, and IBM’s software costs to Kyndryl will taper off by FY2026). Investors in Kyndryl can take some comfort that IBM’s spin-off decision, while initially seen as casting off a weak unit, also allowed Kyndryl to aggressively pursue partnerships with IBM’s competitors – something it’s doing successfully now. In essence, Kyndryl has more agility than IBM in the infrastructure services arena, albeit with a narrower focus.

- Cognizant (and others like Accenture): Cognizant (CTSH) and Accenture (ACN) represent the higher-growth, higher-margin IT services firms. Cognizant, for instance, has ~15% EBITDA margins and low-single-digit growth; Accenture has ~18% margins and mid-single-digit growth. These companies trade at much higher valuations (CTSH ~1.5× sales, 10× EV/EBITDA; Accenture ~2.5× sales, ~15× EBITDA) because of their consistent performance and higher-value service mix. Kyndryl’s long-term bull case is to evolve in this direction – not necessarily to have consulting-like margins, but to close some of the gap. It likely will never command Accenture’s premium, but if Kyndryl even achieves mid-single-digit margins and stable growth, one could argue for a valuation multiple closer to Cognizant’s. That would imply a significantly higher stock price than today. For now, Kyndryl remains a deep value outlier in the group, due to its negative profitability (until recently) and transitional state. But it’s worth noting that the market is starting to reward Kyndryl: at $8B market cap, Kyndryl is now larger than some S&P 500 constituents and has surpassed DXC in value. This reflects rising confidence that Kyndryl will not follow the path of perpetual decline.

Peer performance and returns: In the last year, Kyndryl’s ~48% stock gain outpaced most peers (IBM was roughly flat; DXC was down slightly; CTSH up modestly). This demonstrates the market’s enthusiasm for Kyndryl’s turnaround relative to more established players. However, Kyndryl’s future returns are likely to converge somewhat with the industry as it matures. We expect Kyndryl’s risk-adjusted returns to improve (volatility to decline) as it becomes a more typical mid-cap IT services stock in a few years. At that point, its Sharpe ratio could rival larger peers’ (which tend to be ~1.0 or above over long periods, given steadier performance). Achieving that will require consistency – delivering on quarterly numbers and avoiding surprises.

In conclusion, peer comparisons suggest that Kyndryl has substantial upside if it can continue improving toward industry norms, but also underline that it is not there yet. The stock’s discount valuation is justified until more evidence of sustained earnings is seen. Our bullish stance is that such evidence will materialize, and as it does, investors should see Kyndryl migrate closer to the peer group in both financial metrics and market valuation. The next 1–2 years are critical in determining whether Kyndryl closes the gap or remains an outlier.

References

- Kyndryl FY2024 Financial Results – Kyndryl Holdings, Inc. Annual Report (Fiscal year ended Mar 31, 2024). Reported revenue of $16.1 billion and net loss of $340 million for FY2024, indicating a revenue decline and negative net income (source: SEC 10-K filing).

- Investing.com – Oppenheimer Defends Kyndryl (Mar 28, 2025) – Analyst update after a short-seller report: Oppenheimer reaffirmed an “Outperform” with $43 target, noting Kyndryl’s $7.5B market cap, ~48% 1-yr stock return, and EBITDA of $1.05B. The short report’s claims of accounting issues were denied, and Kyndryl’s management highlighted ample liquidity (current ratio ~1.09) and progress on transformation.

- Investing.com – Kyndryl Updates & S&P Outlook – Highlights of Kyndryl’s recent developments: extension of $3.15B credit line to 2030, S&P Global raising outlook to “positive” due to improved transformation progress and cash flow, and new partnerships (e.g. Google Cloud for AI). Also notes Kyndryl’s first share repurchase authorization, signaling confidence in long-term value.

- The Futurum Group – Kyndryl Q4 FY2025 Analysis – Independent analysis of Kyndryl’s Q4 FY25 earnings (quarter ended Mar 31, 2025): constant-currency revenue up 1.3% YoY (first growth since spin-off), pretax income $118M vs $(4)M prior, net income $68M vs $(45)M prior, signifying a return to profitability. Full-year FY25 revenue was $15.1B (–4% in cc), adjusted EBITDA $2.5B (+6% YoY), and signings $18.2B. The report also cites Kyndryl’s expectation of 33% higher annual revenue in 5 years via its “Three As” initiatives, and plans for hyperscaler-related revenue to reach $1.8B in FY26 (50% YoY growth), underscoring transformation momentum.

- Online Investor – Market Cap Comparison (Mar 21, 2025) – Noted that Kyndryl’s market cap (~$8.0B as of Mar 2025) has grown larger than some S&P 500 companies (e.g. Huntington Ingalls). Reflects that Kyndryl’s valuation has increased significantly, highlighting investor optimism relative to its initial positioning as an IBM spin-off.

Leave a comment