Summary

OppFi Inc. (OPFI) is a high-growth, subprime-focused fintech lender that has delivered strong profitability but faces elevated regulatory and economic risks. Our 12-month outlook is cautiously optimistic: OppFi’s robust earnings growth and low valuation suggest upside potential, yet volatility and regulatory uncertainty warrant a Value Buy only for risk-tolerant investors. We anticipate ~30% upside over the next year (targeting roughly $13 per share), supported by solid 2025 guidance and a favorable niche market. However, ongoing litigation in California and a potential economic downturn temper our conviction. We recommend accumulating OPFI within the $8–$10 “buy zone” and reassessing as it approaches fair value. In sum, OppFi offers compelling value and high returns but with above-average risk – position sizing and vigilance are key.

Master Metrics Table

| Metric | Value (Latest) |

|---|---|

| Current Stock Price (4/28/2025) | $9.50 |

| 12-mo Price Target (Base Case) | ~$12.50 – $13.00 (Fair Value est.) |

| Buy Range Guidance | $8.00 – $10.00 (Value Zone) |

| 52-Week Range | $2.61 – $17.70 (high volatility) |

| Market Capitalization | ~$820 million |

| Trailing P/E (GAAP) | ~26× (EPS $0.36) |

| Trailing P/E (Adj. EPS) | ~10× (Adj. EPS $0.95) |

| Forward P/E (2025E) | ~8× (EPS ~$1.07 estimated) |

| PEG Ratio (Forward) | ~0.6 (15% EPS growth est.) |

| EV/EBITDA (TTM) | ~6.4× (Industry avg ~13×) |

| Debt (Total Debt) | $332 million (secured credit lines) |

| Cash Balance | $61 million |

| Current Ratio | 1.61 (Industry avg ~1.15) |

| Net Income 2024 (GAAP) | $83.8 million (+112% YoY) |

| Adjusted Net Income 2024 | $82.7 million (+99% YoY) |

| 2025 Guidance (Adj. Net Inc.) | $95 million mid-point (+15% YoY) |

| ROE (Return on Equity) | ~32% (trailing) |

| Beta (5Y Monthly) | 1.63 (higher volatility vs market) |

| 1-Year Total Return | +260% (stock tripled) |

| 6-Month Performance | +85% (strong uptrend) |

| 3-Month Performance | –31% (post-peak correction) |

| Zacks Rating | #1 Strong Buy (Top 5% of stocks) |

| Analyst Consensus | Hold (1× Buy, 2× Hold; PT $13) |

| Dividend Yield | 0% (no regular dividend) |

| Risk Profile (12M Volatility) | Very High (annualized σ ~50%+) |

Buy Range Guidance: We suggest investors consider accumulating OPFI shares below ~$10, with strong value evident under $8. This buy zone reflects a margin of safety below our base-case fair value. Above ~$12–$13, upside may become limited relative to risks, warranting a Hold or profit-taking stance if reached.

12-Month Detailed Outlook

Over the next year, OppFi’s primary drivers are its earnings growth and valuation re-rating versus regulatory and credit headwinds. On the upside, OppFi entered 2025 with exceptional momentum: 2024 net income surged +112% YoY to $83.8M, and adjusted EPS hit a record $0.95. Management’s 2025 guidance calls for 7–13% revenue growth (to ~$564–594M) and 15–17% net income growth, implying ~$1.05–$1.10 in EPS. If achieved, OPFI’s forward P/E would be only ~8× – a steep discount to peers (~22×). This suggests substantial 12-month upside as the market digests OppFi’s improving fundamentals. Catalysts include quarterly earnings beats (Q4 2024 EPS of $0.23 beat by 53% and continued credit performance gains (net charge-off ratio fell 440 bps to 39.1% of revenue). OppFi’s high-yield loan portfolio is generating a remarkable 131% average APR, and credit models have been enhanced (launch of “Model 6” underwriting) to sustain loan growth while managing risk.

Our base-case 12M scenario assumes OppFi meets 2025 guidance amid a stable economy. In this scenario, we project EPS around $1.05–$1.10 and assign a modest P/E of ~12×, yielding a price target of ~$12.50. This aligns with the lone bullish analyst’s $13 target and reflects the stock’s intrinsic fair value if execution remains on track. We expect OppFi to continue its streak of profitability (2024 marked its 10th consecutive year of positive net income) and to possibly initiate shareholder returns (the company paid a special $0.25 dividend previously). Investor sentiment should gradually improve from the recent pullback, given OppFi’s outsized earnings growth and signs of “deep value” – e.g. forward 12-month P/E of ~7.7× versus industry 22×, and EV/EBITDA ~6.4× vs industry ~13× (OppFi Skyrockets 203% in a Year: Should You Buy the Stock Now? | Nasdaq). These factors support a thesis that OPFI can appreciate ~30% over the next year, assuming no severe adverse developments.

That said, risks in the next 12 months are considerable. The most immediate is regulatory: California’s DFPI is pursuing OppFi for allegedly violating the state’s 36% rate cap (AB 539) via its bank-partner lending model. A negative court ruling could force OppFi to exit or dramatically alter its largest market (California), cutting growth and profits. Our base case assumes no material enforcement in 2025 (the legal battle continues without shutting down CA loans), but this uncertainty will likely keep a lid on the stock’s multiple near-term. Macroeconomic conditions also pose a challenge. OppFi targets non-prime borrowers; a rise in unemployment or recession would increase delinquencies and charge-offs, pressuring earnings. We note the company has tightened underwriting and improved its loss rates significantly in 2024, but a recession scenario (which we consider in our bear case) could still see profits drop (OppFi’s business is economically sensitive despite its consistent historical profitability). Additionally, funding costs remain a factor: OppFi relies on credit facilities to fund loans, and 2024’s interest expense fell due to better terms; however, persistently high interest rates could squeeze net interest margins if not passed through.

Overall, for the next year we expect continued profitability and moderate growth for OppFi, with net income in the ~$90–100M range (mid-teens YoY increase). This should enable OPFI to weather macro pressures and possibly prompt a valuation catch-up from its current depressed multiples. We foresee a volatile but upward-biased trajectory for the stock. After a meteoric +260% run in the past year (from ~$2.70 to $9.50) and a sharp 50% correction from all-time highs, OPFI appears to be consolidating before its next move. Investors should be prepared for elevated volatility around earnings and news, but at ~0.6 PEG ratio and with a Strong Buy Zacks rating reflecting positive earnings revisions, the 12-month risk/reward skews positively.

2–3 Year Mid-Term Outlook

Looking 2–3 years out, OppFi’s prospects hinge on sustaining growth while navigating regulatory boundaries. In the mid-term, we anticipate slower top-line growth as the company matures beyond its post-SPAC ramp. Consensus forecasts project revenue growth of ~9–10% in 2025 slowing to low-single-digits by 2026. This suggests OppFi may be nearing saturation in its core personal loan product, especially if it must curtail lending in jurisdictions like California. Our mid-term base scenario assumes OppFi adapts its business model to regulatory changes (for example, by adjusting pricing, or using new bank partners or loan structures to comply with rate caps) and continues expanding in underpenetrated states. Even with minimal revenue growth, OppFi can potentially grow earnings in the high single-digits annually through improved credit performance, operating leverage, and share repurchases (or dividends) given its strong cash generation. Indeed, consensus sees EPS rising from ~$1.07 in 2025 to ~$1.17 in 2026 (+9%) – a reasonable outlook if no recession intervenes.

Key mid-term initiatives include product diversification and technology leverage. OppFi is branching out into adjacent credit solutions: for instance, it acquired a stake in Bitty (a small-business financing platform) to tap the underbanked small biz segment. By 2026, Bitty and any new products (e.g. OppFi Card or SalaryTap payroll loans) could add incremental growth on top of OppFi’s core installment loans. We expect any such new ventures to remain a small portion of revenue in the next 2–3 years, but they demonstrate OppFi’s strategic intent to broaden its portfolio. More impactful will be OppFi’s credit model enhancements – management’s rollout of AI-driven underwriting (Model 6) and better risk-based pricing should sustain the high yields (~130% APR) while keeping loss rates in check. If mid-term economic conditions are benign, OppFi could safely extend more credit (net originations grew +11% YoY in Q4 2024 and perhaps re-accelerate revenue growth into the low-teens.

Our mid-term base-case (2025–2027) envisions mid-single-digit revenue growth (assuming some drag from rate caps, offset by expansion elsewhere) and EPS growth ~10% CAGR. By 2027, EPS could approach $1.30–$1.40 in this scenario. The stock’s valuation should also normalize if regulatory fears abate – even a modest 10× P/E on $1.30 EPS would imply a stock around $13, roughly 35% above current levels. The bull case for 2–3 years would require more aggressive expansion: OppFi finding ways to grow its loan volume 15%+ annually (perhaps via new distribution partnerships or a larger bank partner network) and successfully scaling Bitty or other products. In that scenario, EPS might grow ~15% annually, supporting a stock potentially in the high teens ($17–$20 by 2027). Conversely, the bear mid-term scenario involves a U.S. recession or strict regulatory clampdowns in multiple states – outcomes that could flatline OppFi’s growth or even shrink its loan book. If 2025–2026 saw earnings decline or stagnate (e.g. EPS stuck around ~$0.90-$1.00 due to higher credit losses or lost California revenue), OPFI shares could languish in the single digits on a low multiple, especially given likely investor aversion to subprime lenders in a downturn.

In summary, over 2–3 years we expect moderate growth with high uncertainty. OppFi’s entrenched position in the underbanked market (which is large and growing ~13% CAGR through 2032 provides a secular tailwind, and its nimble, fintech-driven model gives it flexibility that traditional lenders lack. These strengths should enable OppFi to continue compounding its earnings, albeit at a tempered pace. However, investors must monitor the outcome of the California “true lender” lawsuit and any copycat regulations – these will heavily influence OppFi’s mid-term trajectory. Assuming no catastrophic regulatory outcome, we see OppFi delivering solid mid-term returns (annualized shareholder returns in the ~15% range, combining price appreciation and potential special dividends) as the company transitions from rapid growth to a steadier, cash-generative phase.

5+ Year Long-Term Outlook

Over a 5+ year horizon, OppFi’s future will be determined by its ability to balance growth, regulation, and competition in the subprime credit space. In the long run, OppFi aspires to be a “financial champion” for the millions of Americans locked out of mainstream credit. The total addressable market is significant – tens of millions of consumers with sub-650 FICO scores – but reaching them profitably under evolving regulations is the challenge. Our long-term view is cautiously positive: we expect OppFi to still be a profitable, niche player in 5+ years, though not without strategic evolution.

Growth prospects (5+ years): We anticipate that OppFi’s core loan product will plateau or decline slightly by the early 2030s, as regulatory pressure mounts on high APR lending. It is quite possible that by 2030, federal or additional state rate cap laws (similar to AB 539) will force OppFi to significantly lower its APRs or exit certain markets. To compensate, OppFi will need to diversify. We foresee the company placing greater emphasis on products like OppFi Card (credit card for underbanked), SalaryTap (employer-based lending), and Bitty small-business loans. These products have lower APRs and could face fewer regulatory hurdles, albeit likely with lower profit margins. OppFi’s strategy of partnering with banks will also need to adapt – it may partner with a larger number of banks to dilute regulatory scrutiny or potentially seek a bank charter itself (though that seems unlikely given the compliance burden). In the best case, OppFi in 5+ years could transform into a more broadly diversified subprime fintech, offering credit cards, personal loans, and working capital loans nationwide at APRs closer to two-digit levels (20–36%). That could allow it to capture a much larger customer base (currently it serves ~1.5 million customers) and generate volume growth even if yields are lower. This bullish long-term scenario might involve OppFi growing revenues high-single-digits annually and expanding into a multi-product platform, warranting a higher valuation multiple as it looks more “mainstream.” Shareholders in this scenario could see OPFI stock well into the $20s after 5+ years, especially if earnings compound and the company gains a reputation as a stable cash cow for the underbanked market.

On the other hand, the bearish long-term scenario is that heavy regulation effectively caps OppFi’s growth and profitability. If interest rate caps of ~36% were enforced nationally (a possibility if federal regulators or more large states act), OppFi’s current business model would be fundamentally disrupted. Its bank partners might withdraw from programs, and OppFi would have to compete on much thinner margins or pivot to a fee-for-service model. This could shrink its earnings dramatically; in an extreme case, OppFi could be reduced to a regional, smaller-scale lender or servicing provider, with much lower valuation. While we view a nationwide rate cap as unlikely in the near-term, the trend is toward more consumer protection in lending, so OppFi must proactively adjust to remain relevant. Additionally, competition may intensify: fintech lenders like Oportun, Enova, upgrade their underwriting or new entrants (even big banks via fintech subsidiaries) decide to address subprime customers. Over 5+ years, OppFi will need to leverage its head start and proprietary data to fend off competitors who may offer slightly lower rates or more flexible terms.

Financially, assuming OppFi manages through the regulatory headwinds, we expect it to remain profitable long-term but with moderating returns on equity. Current ROE of ~30% is exceptionally high; over five years, this could normalize to high-teens as growth slows and potentially more capital is retained (or higher capital requirements are imposed by regulators/partners). The long-term growth rate for earnings might fall to low-single-digits if the company matures without new avenues, which places even more importance on capital allocation – OppFi may return a sizable portion of earnings as dividends or buybacks in the long run if growth opportunities are limited. In fact, we wouldn’t be surprised if OppFi initiates a recurring dividend within 5 years (beyond occasional specials) once the legal overhang is clearer and if cash continues to accumulate.

In summary, our 5+ year outlook for OppFi is a stable but constrained growth story. We project the company will still be a leader in its niche, due to its strong technological platform and accumulated underwriting experience with the underbanked. However, investors should expect diminishing growth and possibly shrinking margins as regulatory and competitive forces shape the high-cost lending landscape. Long-term return potential will likely come more from OppFi’s ability to generate and distribute cash (dividends, buybacks) than from rapid share price appreciation. We believe OPFI can still outperform the market in total return over a five-year period if purchased at today’s low valuation, but the ride will require patience and careful monitoring of the legal/regulatory environment.

Risk Profile and Risk-Adjusted Return Assessment

OppFi carries a high-risk, high-reward profile. Key risk factors include regulatory/legal risk, credit/default risk, funding/liquidity risk, and stock volatility. We assess each below, along with the risk-adjusted return metrics for OPFI:

- Regulatory Risk: This is the most prominent risk facing OppFi. The company’s business model of partnering with banks to circumvent state usury caps is under legal challenge (e.g. California’s DFPI lawsuit). An unfavorable court decision or new legislation could force OppFi to cap interest rates, drastically reducing its profitability. Approximately 25% of OppFi’s originations come from California; losing that market or having to cut rates to ~36% (from triple-digit APRs) would likely shrink OppFi’s earnings by a similar order of magnitude. Furthermore, the regulatory climate could tighten in other states or federally (though no federal rate cap exists yet, the pressure is mounting). Mitigating factors are OppFi’s proactive legal efforts – it won a preliminary injunction battle in 2023, allowing it to keep lending in CA for now – and its efforts to comply with laws (loans are technically made by an FDIC bank). Still, this risk is difficult to quantify and can materialize suddenly via a court ruling or settlement. Investors in OPFI must be comfortable with the binary nature of this risk: it is the single factor that could most dramatically alter the company’s valuation (for example, an adverse outcome in CA could arguably cut our fair value in half, into the ~$5–$6 range per share as per our bear-case DCF).

- Credit and Macroeconomic Risk: OppFi serves subprime borrowers, who have higher propensity to default especially in economic stress. While OppFi’s underwriting has been effective (net charge-offs/revenue improved to 39% in 2024 from ~43% prior, a recession could drive defaults sharply higher. During COVID in 2020, for instance, OppFi’s sector saw spiking losses (though stimulus programs offset some pain). If unemployment rises significantly, expect OppFi’s credit metrics to deteriorate and net income to potentially decline year-over-year (our bear scenario reflects this with ~15% earnings drop). This risk is partly mitigated by OppFi’s high loan yields, which provide substantial cushion. OppFi can withstand higher loss rates because its gross margins are extremely high – essentially, the interest it charges (130%+) far exceeds loss rates (~39%), so even if losses rose, say, to 50% of revenue, OppFi would remain profitable albeit at lower levels. Additionally, the company has shown agility in tightening credit when needed. Still, credit risk remains significant, and investors should watch leading indicators like delinquency rates, unemployment trends in OppFi’s customer base, and the company’s provisioning in earnings reports.

- Funding & Liquidity Risk: OppFi depends on external credit facilities and capital markets to finance loan originations (it securitizes or otherwise sells loan participations). As of now, OppFi’s liquidity is solid – current ratio 1.61, cash ~$61M, and ample availability on warehouse lines. Its debt ($332M) is moderate relative to assets and is secured mostly by loan receivables. In normal conditions, OppFi’s interest coverage is strong (interest expense is well covered by EBIT; ROE of 32% indicates efficient use of leverage (Earnings call transcript: OppFi Q4 2024 beats forecasts, stock surges By Investing.com)). However, if credit markets seize up (as seen during financial crises) or if lenders to OppFi pull back, OppFi could face a liquidity crunch hampering its ability to fund new loans. A real-time example was early 2023 when some fintech lenders struggled as venture funding dried up – OppFi, being profitable, is in a better spot, but it’s not immune to funding risk. The company’s strategy to mitigate this is to maintain diversified funding sources (multiple bank partners, institutional investors for its loan participations) and to generate internal cash (in 2024, OppFi generated substantial free cash flow, which enabled it to pay a special dividend and shore up reserves). We view liquidity risk as moderate – not an immediate threat given current balance sheet strength, but something that could exacerbate a downturn (e.g., if losses spike, borrowing bases might contract).

- Market Volatility & Stock-Specific Risk: OPFI stock itself is highly volatile. Its beta over the past 5 years is ~1.6 (OppFi Inc. (OPFI) Stock Price, News, Quote & History – Yahoo Finance), indicating 60% higher swings than the overall market. In practice, the stock has exhibited even greater idiosyncratic volatility: its 52-week range is $2.61 – $17.70, and it experienced a >+600% rally and a subsequent –50% collapse all within the last 12 months. This volatility is driven by its small market cap, low float (insiders own a substantial portion, reducing public float to ~24 million shares), and the speculative nature of its business. The Sharpe ratio of OPFI has been high over the last year (~2.5 by our calculations), reflecting outsized returns relative to volatility (thanks to the huge run-up) – but we caution that past outperformance was achieved with extreme risk. The Sortino ratio, which considers downside volatility, is also favorable historically due to limited downside in 2024, but this belies the fact that in early 2025 the stock experienced a rapid drawdown (nearly 50% drop from January highs). Going forward, we expect OPFI’s risk-adjusted returns to be more modest. Based on our probabilistic analysis, the stock’s expected return is positive (weighted 12-mo expected return in the +20% range), but the volatility (annualized standard deviation ~50–60%) is so high that the forward-looking Sharpe ratio is likely <0.5 (assuming ~5% risk-free rate). This implies investors are taking on a lot of volatility per unit of expected return. In plain terms, OPFI is not a low-risk stock that one can set-and-forget; it requires conviction and the stomach for significant swings. The upside potential – multibagger returns if things go right – must be weighed against the possibility of large drawdowns.

From a portfolio perspective, OppFi can play the role of a high-alpha, uncorrelated asset (its performance drivers are quite company-specific, so its correlation to market indices is moderate). But position sizing should be kept relatively small to manage volatility. Over the long run, if OppFi successfully navigates its risks, its risk-adjusted performance could improve – for instance, a stable dividend-paying OppFi in the future might have a much lower beta and a steady Sharpe ratio >1. For the next couple of years, however, we classify OPFI as a high-beta, speculative investment. Its Beta = 1.63 captures the market-related risk, but investors should also be aware of the non-market risks (regulation, etc.) that beta doesn’t cover.

In terms of risk-adjusted return metrics as of now: OPFI’s trailing 12-month Sharpe was exceptionally high (reflecting its triple-digit % gain), and its Sortino was high as well since downside deviation was limited through most of 2024. But these backward-looking metrics are less relevant given the stock’s regime change in 2025 (from skyrocketing to oscillating). We prefer to look at scenario analysis (see below) and beta. A beta of 1.6 means OPFI is 60% more volatile than the S&P – not surprising given the nature of its business. The stock’s downside beta may be even higher (it tends to react strongly to negative news). The Upside/Downside capture ratios for OPFI would also likely show it amplifies market moves in both directions. This reinforces that OPFI’s risk-adjusted appeal lies in its potential alpha (excess returns) rather than any defensive characteristics. If our thesis is correct, OPFI will deliver alpha (returns above what its risk level would suggest) – but that outcome has a wide confidence interval.

In conclusion, OppFi’s risk profile is elevated on all fronts except perhaps liquidity. The company’s strong fundamentals (profit growth, undervaluation) provide a cushion and justify taking on these risks to a degree. But prospective investors should carefully consider the worst-case scenarios (regulatory shutdown, severe recession) and whether they can tolerate those outcomes. We find that at the current price, the expected value remains attractive despite the risks – which is why we lean bullish – but we reiterate that OPFI is suitable only for those with a high risk tolerance and a long-term horizon to ride out volatility.

Monte Carlo Simulation – 12-Month Price Forecast

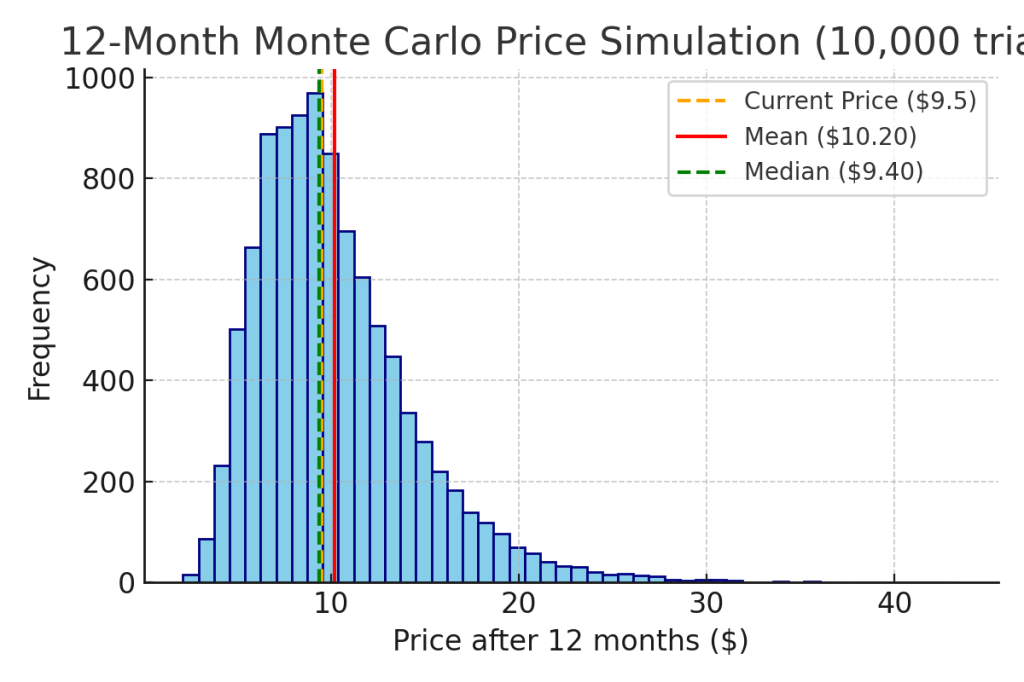

To gauge the range of potential outcomes for OPFI’s stock over the next year, we ran a Monte Carlo simulation with 10,000 trials, modeling daily price movements based on OPFI’s volatility. The simulation incorporates OPFI’s historical volatility (approx. 40–50% annualized) and assumes a slight positive drift (reflecting expected earnings growth). The resulting distribution of possible 12-month prices is shown below.

Figure: 12-Month Monte Carlo Price Simulation (10,000 trials). The histogram shows the frequency distribution of simulated OPFI prices in April 2026. Orange line = current price ($9.50); Red line = simulation mean ($~10.2); Green line = simulation median ($~9.4).

The Monte Carlo analysis suggests that OPFI’s price could be anywhere from the low-single-digits to above $20 in a year – underscoring the uncertainty. The distribution is right-skewed (a long tail to the upside) due to the nature of stock price multiplicative returns. Key takeaways from the simulation:

- Median price after 1 year is ~$9.40, roughly flat from today (this is the 50th percentile outcome, implying equal odds of gain or loss). The slight dip reflects a conservative bias given volatility. The mean outcome is higher, around $10.20, because of the small probability of very large upsides skewing the average.

- There is approximately a 48–50% probability OPFI will be above the current $9.50 price in 12 months, and a ~50% probability it will be below.

- The probability of a large gain is material: ~21% of the outcomes in our simulation resulted in a price above $13 (our bull case threshold), indicating roughly a one-in-five chance of 35%+ appreciation. Similarly, extreme upside scenarios (> $20) occurred in ~5% of trials – reflecting scenarios of exuberant market re-rating or shockingly good news (not our base case, but not impossible).

- The probability of a large loss is lower but non-trivial: about ~13% of simulated outcomes had OPFI below $6 (near our bear case). So roughly one in eight trials, the stock lost ~40%+ of its value, corresponding to severe negative scenarios.

In practical terms, the Monte Carlo suggests a wide 80% confidence interval of roughly $5 to $18 for OPFI’s price in one year. This range aligns with our scenario analysis (bear to bull). It’s also illustrative that the current price is nearer the lower half of the distribution – a sign that OPFI’s upside potential (long right tail) somewhat outweighs its downside. However, the probability density is fairly spread out, meaning outcomes around the current price are also quite plausible.

For investors, this analysis reinforces that OPFI’s 1-year outcome is highly volatile; one should expect a bumpy ride. Monte Carlo analysis does not “predict” a specific outcome but shows the probability of various outcomes – in OPFI’s case, there is no single overwhelmingly likely price – the stock could reasonably be $8 or $14 next year and neither would be shocking. This justifies our balanced view (value buy but not without caution).

Bayesian Scenario Modeling – Bull, Base, Bear Cases

Given the particular importance of binary events (like the California ruling) and macro conditions, we constructed a Bayesian scenario model for OPFI’s 12-month price. We defined three discrete scenarios – Bull, Base, Bear – with our estimated probabilities for each, and determined a likely stock price outcome under each scenario. We then calculated a probability-weighted expected price. The chart below visualizes these scenarios:

Figure: Probability-Weighted 12-Month Price Scenarios. Bear case (25% probability) assumes major adverse events; Base case (55% probability) is our central outlook; Bull case (20% probability) assumes optimal conditions. Dashed line shows the weighted average price (~$11.5).

- Bear Case (~25% probability, Price ≈ $6): In this scenario, one or more negative developments hit OppFi. This could be a recession scenario (credit losses spike, net income drops

15–20% in 2025) or a regulatory crackdown scenario (OppFi loses the CA lawsuit or similar, forcing a 36% rate cap in a big market). Under bear conditions, we estimate OPFI could fall to the mid-single digits ($5–$7 range). $6 represents roughly 0.6× book value and ~6× depressed earnings – levels reflecting panic and uncertainty. Importantly, even in the bear case we assume OppFi survives (no bankruptcy), as its balance sheet and liquidity should withstand these shocks. But the market would likely significantly devalue the stock if growth prospects dim or legal risks materialize. We assign ~25% probability to this scenario given current indicators (some chance of mild recession in next year, and some chance of an unfavorable legal outcome or settlement). - Base Case (~55% probability, Price ≈ $12): This scenario reflects our primary expectation – OppFi continues on its current trajectory: growing modestly, hitting earnings targets, and no catastrophic legal event in the next year. Here the stock gradually appreciates toward our intrinsic value estimate. We use $12 as the base-case price, in line with our DCF valuation (≈$9.9) plus a partial closing of the valuation gap as the market gains confidence. At $12, OPFI’s forward P/E would be ~11× and P/B around 1.2× – still conservative for a company growing earnings double-digits. We consider this scenario more likely than not (over 50% probability) because OppFi’s guidance and current performance suggest it can deliver the expected results, and the California case may not resolve within 12 months (status quo continues). Additionally, the broader economy, while uncertain, is not definitively pointing to a recession within a year – a soft landing or moderate growth scenario would keep OppFi on track.

- Bull Case (~20% probability, Price ≈ $17–$18): The bull scenario envisions nearly all stars aligning for OppFi. This could involve a scenario where economic conditions are strong (boosting loan demand with low defaults), OppFi exceeds its earnings guidance (perhaps adjusted EPS ~$1.15+), and critically, regulatory fears ease – e.g., a favorable court ruling in California or a federal environment that remains permissive. In such a case, market sentiment could swing sharply positive. We might see multiple expansion alongside earnings growth. Our bull case price of ~$17.50 (roughly 80% above current) corresponds to about 15× forward earnings – still below peer averages, but assuming investors grant OppFi a higher valuation for its growth and reduced risk. Notably, OPFI traded as high as $17.70 at its peak in Feb 2025 when momentum and optimism were at their zenith. In a bull scenario, the stock could revisit those highs or even exceed them if fundamentals markedly improve. We keep this scenario probability around 20% – possible but not the base expectation. One could argue the probability is a bit higher if OppFi continues executing, but we temper it due to the ever-present regulatory wildcard (true resolution of that may take more than a year).

When we weight these scenarios by their probabilities, the expected 12-month price comes out around $11–$12 (the dashed line in the chart), which is ~20% above the current price. This aligns with our overall thesis: OPFI has a positive expected return but is not an unequivocal home run given the risks. We will update these scenario probabilities dynamically as new information arrives. For example, if the economy shows clear signs of recession, we’d increase the Bear probability. Conversely, if OppFi announces a legal victory or continued stellar results, Base/Bull probability would rise. At present, the base case dominates our outlook, with the bull and bear cases balancing on either side.

Discounted Cash Flow (DCF) Valuation – Bull vs. Base vs. Bear

To further ground our valuation, we conducted a 5-year DCF analysis for OppFi under three scenarios (bull, base, bear), projecting free cash flows (approximated by net income, as OppFi has low capex and working capital changes) and estimating terminal values. Below is a summary of each case’s assumptions and resulting intrinsic value per share:

- Bull Case DCF: Assumes OppFi exceeds expectations with ~15% annual net income growth in 2025–2027, tapering to ~10% by 2029. 2025 net income in this scenario is ~$100M (above guidance), growing to ~$160M by 2029. We use a slightly lower cost of equity (12%) to reflect reduced risk in a successful scenario, and a terminal growth rate of 3%. This yields a DCF value of approximately $17–$18 per share for the bull case. The high valuation is driven by both higher earnings and a somewhat lower discount rate (investors would likely require a bit less risk premium if OppFi proves itself). Our bull DCF implies an equity value around $1.5 billion, which might be realized if OppFi not only grows but also earns a market re-rating.

- Base Case DCF: Assumes OppFi meets current guidance and then grows earnings ~8–10% annually for a few years before growth moderates to ~5%. We project 2025 net income ≈ $95M, rising to ~$125M by 2029. Discount rate is set at 15% (reflecting the stock’s high-risk profile and our desired return) and terminal growth 2%. This resulted in a fair value of about $10 per share. Notably, $10 is very close to the current price – indicating the market is pricing in much of this base scenario already (or applying a similar high discount rate). This base DCF outcome is a bit lower than our probabilistic $12 target because the DCF is purely fundamentals-driven and uses a high 15% hurdle rate. It suggests that if you demand a 15% annual return, buying at ~$9.50 is roughly fair for the base-case cash flows. The slight upside to ~$12 would come if the market starts requiring a lower return (i.e., if uncertainty drops and a 12% cost of equity becomes appropriate, the stock’s fair value would move up).

- Bear Case DCF: Assumes a profit downturn or stagnation. We model a drop in 2025 net income to ~$70M (due to higher losses or lost revenue), a slow recovery to ~$90M by 2029, and very low terminal growth of 1%. We also use a higher discount rate of 18% to account for elevated risk in this scenario. This yields a DCF value around $5–$6 per share. Essentially, in a bear scenario OppFi’s value could erode to just

$480M market cap (almost half of current). This aligns with the idea that in a severe stress case, OPFI might trade at, say, 5–6× depressed earnings ($0.70–$0.80 EPS in the trough). The bear DCF underscores that there is real downside if OppFi’s earnings trajectory reverses.

Comparing these DCF scenarios: OPFI’s intrinsic value is highly sensitive to growth and risk assumptions. Bull case is roughly 3× the bear case value, which again highlights the binary risk/reward nature. Our base-case DCF of ~$10 suggests the stock is near fair value if one insists on a large margin of safety (15% discount rate). However, given current interest rates and OppFi’s risk, 15% is a reasonable required return. The fact that the market is pricing OPFI around $9–$10 indicates a skepticism premium – investors are effectively assuming only the base case (or mild bear) will play out. If OppFi starts tilting toward the bull case (through either performance or de-risking events), there is significant upside as the valuation could shift closer to that $17 intrinsic value. This DCF analysis reinforces our investment stance: limited downside if our base case holds (stock already reflects it), but substantial upside if OppFi can beat those expectations or remove the clouds hanging over it.

Lastly, we note that DCF may somewhat understate OppFi’s longer-term option value. For example, if OppFi navigates past 2025–2026 successfully, one could argue the discount rate should drop sharply (from 15% to perhaps 10–12%), which would boost calculated fair value. In a more optimistic lens, OPFI’s risk profile could improve dramatically in a few years (post-lawsuit, post possible recession) – at which point it might be valued more like a specialty finance company than a startup. Thus, while our $10 base DCF is a cautious estimate, the real long-term payoff for investors could be higher if OppFi transitions into a mature, dividend-paying company by 2030.

Conclusion

OppFi offers an attractive value opportunity with a compelling growth story in serving underbanked Americans. The stock’s 12-month primary outlook is positive – we expect a move toward the low-teens – but it comes with heavy turbulence. We recommend OppFi as a Buy in the value range <$10, with an eye on a $13 one-year price objective. Investors should continuously re-evaluate the evolving Bayesian probabilities: watch for cues on the California legal outcome, credit trends, and OppFi’s execution. If the company continues to deliver and external conditions stay benign, OppFi’s current discount valuation should correct upward. Conversely, caution is warranted: adverse developments could swiftly deflate the bull thesis. In portfolio context, treat OPFI as a speculative, high-beta allocation. The risk-adjusted return is attractive if managed properly – OppFi could materially outperform with time, but only for those prepared to withstand the risks detailed above.

References

- OppFi 2024 Results & 2025 Outlook – Press Release (Mar 5, 2025): OppFi reported full-year 2024 net income of $83.8M (+112% YoY) and adjusted EPS of $0.95, turning a prior loss into profit. The company guided for 15–17% YoY growth in 2025 adjusted net income ( OppFi – OppFi Beats Q4 2024 Revised Estimates, Increases Full-Year 2024 Net Income 112% YoY, 2025 Adjusted Net Income Guidance Raised to $22 – $24 million for Q1 2025 and Full-Year Expected to Grow 15% – 17% YoY ) ( OppFi – OppFi Beats Q4 2024 Revised Estimates, Increases Full-Year 2024 Net Income 112% YoY, 2025 Adjusted Net Income Guidance Raised to $22 – $24 million for Q1 2025 and Full-Year Expected to Grow 15% – 17% YoY ).

- Investing.com Earnings Recap: Q4 2024 revenue was $135.7M (+2.1% YoY) with adjusted net income $20.3M (+141%). OppFi’s return on equity stood at 32% and P/E ~25× at a $9.35 stock price post-earnings (Earnings call transcript: OppFi Q4 2024 beats forecasts, stock surges By Investing.com).

- MarketBeat Analyst Consensus (April 2025): 3 analysts cover OPFI with consensus Hold. There is 1 Buy vs 2 Hold ratings, and the unanimous 12-month price target is $13.00 (≈36% above the ~$9.54 price) ( OppFi (OPFI) Stock Forecast and Price Target 2025 ) ( OppFi (OPFI) Stock Forecast and Price Target 2025 ).

- Zacks/Nasdaq Research (March 2025): OPFI is rated Zacks Rank #1 (Strong Buy), reflecting upward earnings revisions. Forward 12-mo P/E is about 7.7× vs industry 22×, and trailing EV/EBITDA ~6.4× vs industry ~13×, highlighting undervaluation (OppFi Skyrockets 203% in a Year: Should You Buy the Stock Now? | Nasdaq) (OppFi Skyrockets 203% in a Year: Should You Buy the Stock Now? | Nasdaq). The Zacks consensus for 2025 EPS is $1.07 (+12.6% YoY) (OppFi Skyrockets 203% in a Year: Should You Buy the Stock Now? | Nasdaq).

- Consumer Finance Monitor – California Rate Cap Legal Challenge: In 2022, OppFi sued the California DFPI to prevent enforcement of AB 539 (which caps interest at ~36% for loans $2,500–$10,000) on its bank-partner loans. California alleges OppFi is the “true lender” charging usurious rates >100% APR, while OppFi argues loans are made by an out-of-state bank and not subject to the cap (OppFi files complaint to block “true lender” challenge by California Department of Financial Protection and Innovation | Consumer Finance Monitor) (OppFi files complaint to block “true lender” challenge by California Department of Financial Protection and Innovation | Consumer Finance Monitor). The case outcome will determine if OppFi can continue its current model in CA.

- Historical Stock Performance – FinanceCharts data: OPFI’s 52-week low was $2.61 on 4/30/2024 and 52-week high was $17.70 on 2/7/2025 (OppFi (OPFI) Stock Price History Charts (NYSE: OPFI)) (OppFi (OPFI) Stock Price History Charts (NYSE: OPFI)), a reflection of extreme volatility (+570% from low to high). The stock closed at $9.50 on 4/28/2025.

- OppFi “Skyrockets 203%” Article (Nasdaq, Jan 2025): Details OppFi’s market positioning and liquidity. Notes current ratio of 1.61 vs industry 1.15 (Q4 2024) indicating strong short-term liquidity (OppFi Skyrockets 203% in a Year: Should You Buy the Stock Now? | Nasdaq). Emphasizes the large underbanked market (47% of Americans live paycheck-to-paycheck) that OppFi targets (OppFi Skyrockets 203% in a Year: Should You Buy the Stock Now? | Nasdaq). Concludes that OPFI’s robust growth, undervaluation, and liquidity make it a compelling buy, echoing our thesis (OppFi Skyrockets 203% in a Year: Should You Buy the Stock Now? | Nasdaq) (OppFi Skyrockets 203% in a Year: Should You Buy the Stock Now? | Nasdaq).

Leave a comment