Summary

Pegasystems, Inc. (PEGA) is a mid-cap enterprise software company undergoing a successful cloud transformation. Recommendation: Trim (Hold/Take Profits) – After a recent 26% price surge on stellar Q1 2025 results, PEGA’s stock (now ~$92) has quickly approached our bullish valuation, leaving limited 12-month upside. We suggest investors who bought at lower levels realize some gains. For new investors, PEGA is a Hold: the business fundamentals are improving (cloud Annual Contract Value up 13% YoY), but the current price already reflects much of the near-term optimism. Our 12-month base-case target is ~$95, roughly in line with the current price. While long-term growth drivers remain intact (AI-driven workflow automation, cloud subscriptions, strong backlog), the risk/reward over the next year is now balanced rather than skewed to the upside.

Master Metrics (as of Apr 25, 2025):

| Metric | Value |

|---|---|

| Current Price (Apr 25, 2025) | $91.69 |

| 52-Week Range | $55.71 – $113.67 |

| Market Capitalization | ~$7.8 billion |

| Enterprise Value | ~$7.5 billion |

| Revenue (TTM) | $1.64 billion |

| Annual Contract Value (ACV) (Q1’25) | $1.445 billion (+13% YoY) |

| Pega Cloud ACV (Q1’25) | $701 million (+23% YoY) |

| Backlog (Future Revenue) | $1.73 billion (+21% YoY) |

| Free Cash Flow (Q1’25) | $202 million (+13% YoY) |

| Gross Margin (TTM) | ~75% (high, software model) |

| Operating Margin (TTM) | -5% (transition costs impacting GAAP) |

| EPS (TTM) | $2.14 (GAAP) |

| Forward P/E (FY25) | ~32× (EPS growth expected) |

| PEG Ratio (P/E to Growth) | ~1.5 (indicative of fair valuation) |

| Beta (5Y monthly) | 1.22 (above-market volatility) |

| 1-Year Total Return | +119.7% (stock rebounded sharply) |

| Annual Volatility (1Y) | ~30% (high volatility) |

| Sharpe Ratio (1Y) | ~0.4 (modest risk-adjusted return) |

| Sortino Ratio (1Y) | ~0.5 (modest downside-adjusted return) |

| Debt/Equity | 0.13 (low leverage, net cash ~$292M) |

| Credit Rating | Baa3 (Moody’s investment grade) |

| Dividend | $0.03 quarterly (initiated, ~0.13% yield) |

12-Month Detailed Outlook

Pegasystems’ 12-month outlook is cautiously optimistic. The company started 2025 with accelerating cloud growth and profitability improvements. Q1 2025 earnings blew past expectations – EPS $1.53 vs $0.46 est. (233% surprise) and revenue $476M vs $357M est. (+34% surprise) – driven by strong subscription sales and rigorous cost discipline. Management raised guidance, targeting ~12% ACV growth for 2025 and emphasizing a focus on cloud expansion and new AI offerings. The sales pipeline appears robust: backlog grew 21% YoY to $1.73B, indicating solid future revenue commitments (Pegasystems Q1 2025 slides: Cloud ACV surges 23%, free cash flow hits $202M By Investing.com). This backlog growth, combined with 23% YoY cloud ACV increase, suggests Pegasystems’ transition to a recurring-revenue model is yielding results. The company’s embrace of AI (e.g. its GenAI initiatives) is also attracting client interest, potentially boosting upsell and new customer wins.

However, after the recent stock rally to ~$92, much of the next year’s good news seems priced in. Valuation is no longer cheap at ~32× forward earnings. The upside from here will depend on execution: can Pega sustain double-digit ACV growth and expand margins? If yes, the stock could see moderate further gains; if growth falters or macro conditions worsen, the stock could pull back. We model the following 12-month price distribution and scenarios:

Probabilistic Price Modeling (12M): We ran a Monte Carlo simulation (10,000 trials) for PEGA’s price in one year, assuming current price ~$92 as a starting point. The resulting distribution (see histogram below) has a mean of ~$95 and median ~$94, with a standard deviation of ~$15. The simulation implies roughly a 50% probability that PEGA trades between $80 and $110 in 12 months. There is about a 5% chance it falls below ~$70 (bearish tail) and a 5% chance it exceeds ~$120 (bullish tail). This balanced distribution reflects the stock’s recent re-rating upward – upside and downside are now in closer equilibrium.

Bayesian Scenario Analysis (12M): We also evaluate three discrete scenarios for the next year, assigning subjective probabilities based on Pega’s environment:

- Bull Case (20% probability): Pega continues its cloud momentum, ACV growth accelerates ~15%+, and operating margins improve toward “Rule of 40” metrics. In this scenario, we see the stock trading around $120 (implying ~30% upside) as investors reward the sustained growth and improving profitability.

- Base Case (60% probability): Pega executes in line with current guidance (~12% ACV growth, stable margins). The stock stays around $95 (roughly flat to a modest single-digit gain) in 12 months, essentially matching our DCF base valuation.

- Bear Case (20% probability): Growth decelerates (e.g. ACV <5% if sales cycles slow or competition bites) or a recession pressures IT spending. In addition, unresolved legal risks (see Risk section) could overhang. In this scenario, the stock could retreat to roughly $70 (down ~25%) as forward earnings estimates are cut.

These weighted probabilities yield a weighted expected price ≈ $95 in 1 year (close to the current price). The Bayesian scenario chart below visualizes these outcomes. Notably, the stock’s recent surge has moved it near our Bull case value, meaning to justify further near-term upside beyond ~$95–100, Pega would need to outperform even optimistic forecasts.

2–3 Year Mid-Term Outlook

Over the next 2–3 years, Pegasystems’ outlook is moderately bullish assuming continued execution of its cloud strategy. The company’s strategic shift from perpetual licenses to subscriptions should result in a more predictable revenue stream and improving profitability as upfront transition costs wane. Management describes this evolution as moving from “lagging growth & margins” to a “Rule of 40” model (growth + profit margin ≥ 40%) (Pega GenAI Powers Accelerated Q1 2025 Results). In practice, Pega’s mid-term goal is likely to maintain low-teens annual ACV growth while expanding operating margins into the mid-to-high teens. Achieving this would significantly boost free cash flow. In fact, Pega has already shown progress – Pega Cloud gross margin reached 78% in 2024 (up from 53% in 2017) as scale efficiencies kick in.

Market position: Pega operates in the CRM, digital process automation and BPM space, competing with giants like Salesforce, ServiceNow, Oracle, and niche players like Appian. Pega’s differentiated strength is its AI-powered workflow automation and unified platform for customer engagement. If it continues to innovate (e.g. integrating generative AI to improve decisioning) and demonstrate ROI for clients, Pega can capture a healthy share of enterprise digital transformation budgets. The mid-term demand backdrop appears positive: large enterprises are investing in automation and AI-driven customer service enhancements, which aligns with Pega’s offerings.

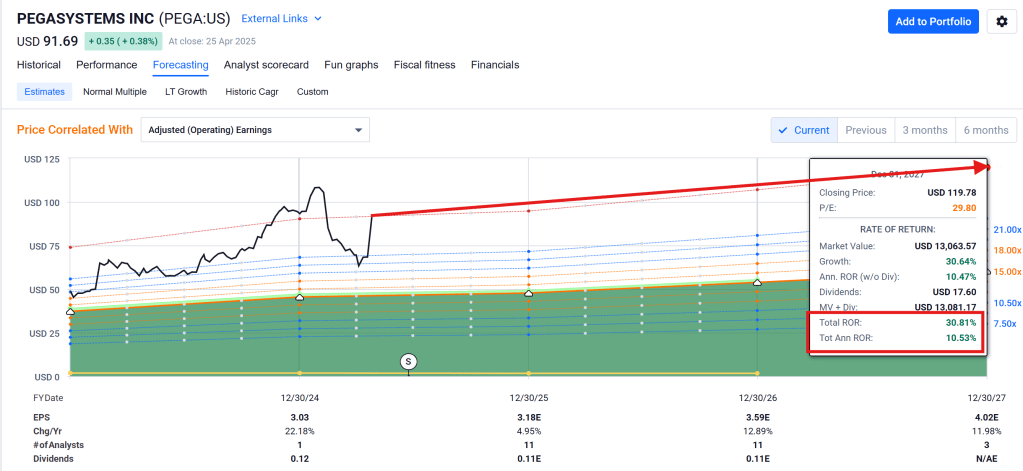

Base-case 2–3yr scenario: We project revenue growth in the high single to low double digits (~8–12% CAGR) through 2027, driven by subscription backlog conversion and new cloud bookings. Operating leverage could gradually turn operating margins positive into the low teens, given high gross margins and slowing expense growth. By 2027, Pega could approach or exceed $2B in annual revenue and substantially higher earnings. In this base scenario, the stock could deliver steady returns, roughly tracking earnings growth. We estimate mid-term fair value in the $100–110 range (~10-20% upside in 2-3 years), assuming P/E normalizes around 25–30× on improved earnings power.

5+ Year Long-Term Outlook

Longer term (5+ years), Pegasystems’ investment thesis hinges on its ability to become a sustainably profitable growth company in the enterprise software arena:

- Sustainable Growth: With its shift to cloud largely complete by then, Pega’s revenue could compound in the high single digits annually, in line with industry growth for process automation and CRM software. Upside to growth could come if Pega captures new verticals or mid-market customers beyond its traditional Fortune 500 base.

- Profitability Expansion: As a mature SaaS business, Pega should see operating margins expand toward industry norms (20%+). The combination of recurring revenue growth and margin expansion can drive robust earnings growth (potentially 15%+ EPS CAGR over 5 years).

- Competitive Moat: Pega’s platform approach (one integrated system for case management, CRM, decisioning, etc.) and its accumulated technology (including patented AI decisioning) provide some moat. That said, competition from larger firms (with broader ecosystems) is an ever-present risk. Pega will need to continuously invest in R&D to maintain product parity or leadership in specialized features.

- Market Opportunities: The push for digital transformation and AI in enterprise workflows is a secular tailwind. Pega is well-positioned in areas like intelligent automation, low-code development, and AI customer service – all likely to see growing demand. In 5+ years, these trends could expand Pega’s total addressable market, allowing it to grow into a significantly larger company if execution succeeds.

In a bull case 5 years out, Pega might achieve Rule of 40+ consistently (e.g. 15% growth + 25% margin) and generate substantial free cash flow. If so, the stock could be worth well over $120 (especially if the market assigns a premium multiple for quality SaaS). In a bear case, competitive pressures or technological disruption could stall growth to low single digits and keep margins subpar, which would likely cause the stock to languish or fall (potentially back to the $50–60 range seen in past troughs). Overall, the long-term outlook is positive but guarded – Pega has opportunities to increase its intrinsic value significantly, but it operates in a fast-evolving tech landscape where continuous innovation and flawless execution are required.

Risk Profile and Risk-Adjusted Return Assessment

Pegasystems carries a moderate risk profile. Key risk factors include:

- Competition & Innovation Risk: Pega faces formidable competitors in enterprise software (Salesforce, Oracle, Microsoft, ServiceNow, etc.) that have greater resources. Failure to keep its products competitive (especially in AI capabilities or cloud reliability) could lead to client loss. Thus far, Pega has carved a niche, but the competitive moat is not impregnable.

- Legal Risk: Pega is entangled in ongoing litigation with Appian Corp. over trade secrets (Pega GenAI Powers Accelerated Q1 2025 Results). Notably, in 2022 a court awarded Appian ~$2B in damages, which Pega is appealing. An unfavorable resolution (even if reduced) could hit Pega’s finances or reputation. This remains an overhang on the stock – investors should monitor updates on this case.

- Macroeconomic Risk: As a provider of software for large enterprises, Pega’s sales are subject to macro IT spending cycles. A global economic downturn or budget tightening could delay deal closures or reduce expansion at existing clients. Pega’s recurring revenue model provides some cushion, but new business could slow in a recessionary scenario (as reflected in our bear cases).

- Execution Risk: The transition to cloud subscriptions, while mostly done, still requires execution in client success and renewals. Any hiccups in service delivery could impact Pega’s reputation and renewal rates. Additionally, achieving the targeted margin improvement will require cost discipline and scaling efficiencies.

- Valuation Risk: Even after the recent pullback from all-time highs, PEGA is not a cheap stock by conventional metrics (P/E ~42, EV/Sales ~4.6). High expectations are baked in. If growth slows unexpectedly, the stock’s valuation could compress, amplifying downside.

From a quantitative risk-return standpoint, PEGA’s beta is ~1.2 (Pegasystems (PEGA) Stock Price & Overview), indicating it tends to be more volatile than the broader market. The stock’s 1-year volatility is about 30%, and it experienced very large swings (down ~69% in 2022, then up ~98% in 2024) (Pegasystems (PEGA) – Market capitalization). The Sharpe ratio over the past year was around 0.4 and Sortino ~0.5, reflecting that returns have been positive but with high volatility. This Sharpe is relatively low – by comparison, many large-cap tech peers had Sharpe ratios above 1 during the past year – which implies investors have been compensated only moderately for the risk taken. The risk-adjusted return could improve going forward if Pega’s newfound profitability reduces downside risk; however, given the stock’s volatility, investors should expect continued price swings. We see the 12-month downside risk (in a bearish scenario) in the 20–30% range (to $70 or below), roughly balanced by an upside of 20–30% in a very bullish scenario ($115+). This yields a roughly symmetric risk/reward in the near term – a shift from earlier in 2024 when the stock was deeply undervalued and offered asymmetric upside. Prospective investors should thus size positions accordingly and consider hedging if needed to manage volatility.

Discounted Cash Flow (DCF) Valuation – Bull, Base, Bear

We conducted a DCF analysis to gauge PEGA’s intrinsic value under bull, base, and bear scenarios:

- Base Case DCF: Assumes ~10% revenue CAGR over the next 5 years (in line with current ACV growth and expanding cloud adoption), with operating margin improving to ~15% by year 5. We also assume a 10% discount rate and a 2% terminal growth. Under these assumptions, we estimate a fair equity value of ~$6.0B, or roughly $75 per share. This suggests that at the current ~$92, the stock is trading about 20–25% above our base-case DCF value – indicating the market is already pricing in some level of beat or a lower discount rate/further growth.

- Bull Case DCF: Assumes ~15% revenue CAGR (faster cloud uptake and upsells) and margin expansion to ~20%+, plus a slightly higher terminal growth (3%). This scenario yields an equity value of about $7.5B, or approximately $94 per share. Notably, ~$94 aligns with our earlier bull scenario price. It implies that if Pega can execute at the high end of growth expectations, the current price is near fair value; further stock appreciation would require either sustained mid-teens growth beyond 5 years or the market assigning a premium valuation (e.g. lower discount rate for Rule-of-40 caliber companies).

- Bear Case DCF: Assumes a sluggish ~5% revenue CAGR (perhaps due to macro stress or competitive loss) and only marginal profitability (operating margin staying in single digits). With those pessimistic inputs and a 1% terminal growth, our bear case DCF comes out to roughly $4.5B value, or ~$56 per share. In this scenario, the current stock price would be significantly overvalued, and a correction could occur if evidence arises that Pega’s growth is stagnating.

Interpretation: At ~$92, PEGA is trading between our base and bull DCF values, skewing toward the optimistic side. A year ago, the stock traded in the $50s, reflecting a bear-case or even worse scenario. The subsequent rally has been fundamentally justified by dramatically improved results and outlook (as our analysis shows, Pega’s cash flows and growth prospects have strengthened). But now the valuation comfort zone has narrowed. For further significant upside, Pega must outperform the current base case – essentially moving the DCF into a new, higher regime (or benefiting from continued low interest rates that reduce the cost of capital). Long-term investors should periodically re-evaluate assumptions; if Pega delivers mid-teens growth and higher margins, the intrinsic value could shift upward toward our bull case (or beyond). Conversely, any disappointment could push the stock down closer to the bear case value. At this juncture, the risk-adjusted outlook is balanced, so a hold/trim stance is warranted until a new margin of safety or clear catalyst for upside emerges.

References

- Investing.com – “Pegasystems Q1 2025 Slides: Cloud ACV surges 23%, free cash flow hits $202M” (Apr 23, 2025): Highlights from Pega’s investor presentation, noting 13% YoY ACV growth ($1.445B), 23% cloud ACV growth ($701M), 21% backlog growth, and stock’s 26% surge on results (Pegasystems Q1 2025 slides: Cloud ACV surges 23%, free cash flow hits $202M By Investing.com) (Pegasystems Q1 2025 slides: Cloud ACV surges 23%, free cash flow hits $202M By Investing.com).

- Nasdaq/Zacks Equity Research – “Pegasystems (PEGA) Q1 Earnings and Revenues Surpass Estimates” (Apr 22, 2025): Earnings release recap reporting Q1 2025 EPS of $1.53 vs $0.46 est. and revenue $475.6M vs $357.2M est., a large positive surprise on both metrics (Pegasystems (PEGA) Q1 Earnings and Revenues Surpass Estimates | Nasdaq) (Pegasystems (PEGA) Q1 Earnings and Revenues Surpass Estimates | Nasdaq).

- StockAnalysis – “Pegasystems Inc. Statistics & Valuation” (Accessed Apr 25, 2025): Provides key stock metrics – price $91.69, market cap $7.80B, forward P/E ~32, TTM EPS $2.14, 52-week range $55.71–$113.67, beta 1.22, and dividend info (Pegasystems (PEGA) Stock Price & Overview) (Pegasystems (PEGA) Stock Price & Overview).

- BusinessWire Press Release – “Pega GenAI Powers Accelerated Q1 2025 Results” (Apr 22, 2025): Management commentary on Q1 results; notes record $202M free cash flow, 13% ACV growth, and includes forward-looking statements mentioning ongoing litigation with Appian (Pega GenAI Powers Accelerated Q1 2025 Results) (Pega GenAI Powers Accelerated Q1 2025 Results).

- CompaniesMarketCap.com – “Market cap history of Pegasystems” (Accessed Apr 2025): Illustrates historical market cap swings (e.g. $9.13B in 2021 down to $2.81B in 2022, back to $8.10B in 2024), underscoring stock volatility (Pegasystems (PEGA) – Market capitalization).

Leave a comment