British American Tobacco (BTI) – Investment Analysis Report

Summary

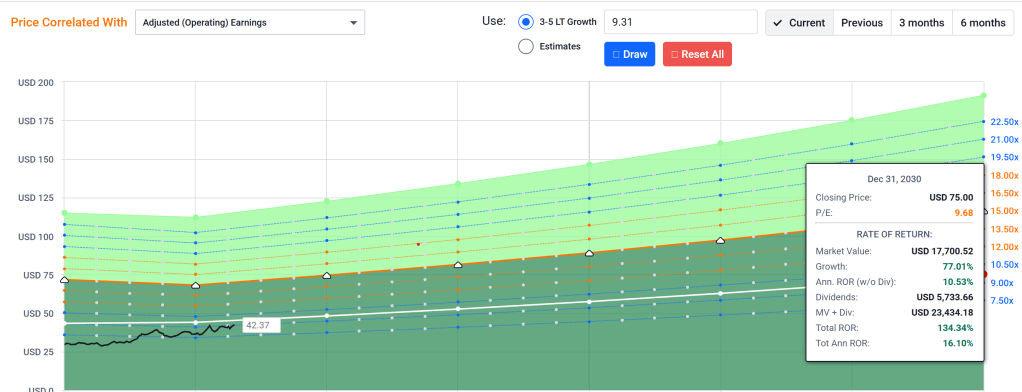

Recommendation (12-Month): Buy – British American Tobacco’s ADR (BTI) is attractively valued and offers a high yield, making it a compelling income investment for the next year. 12-Month Outlook: The stock is trading ~17% below fair value (≈$51 vs. ~$42 current) (British American Tobacco PLC ADR (BTI) – Morningstar), suggesting upside as valuation normalizes. We expect low-single-digit revenue growth and margin improvements to drive earnings recovery (with EPS potentially rebounding sharply post-2024). Combined with a 7% dividend yield, BTI could deliver high-teens total returns over the coming year. Mid-Term (2–3 Years): In the medium term, we anticipate moderate earnings growth (+5% CAGR) as new product categories (vaping, heated tobacco) gradually contribute more (BTI targets ~50% of revenue from non-combustibles by 2035 offsetting secular declines in cigarettes. The stock’s defensive nature and pricing power in a high-inflation environment should support steady cash flows. We see potential for mid-single-digit annual returns plus the hefty dividend, though regulatory headwinds (e.g. menthol restrictions) could temper gains. Long-Term (5+ Years): Over a 5+ year horizon, declining smoking volumes remain a challenge, but BTI’s pivot to reduced-risk nicotine products and its global footprint in emerging markets could sustain low revenue growth. We expect dividend reliability to remain a cornerstone, though long-run capital appreciation may taper as the tobacco industry matures. Overall, BTI is positioned as a durable income-generating investment with defensive characteristics to weather various macroeconomic regimes.

Master Metrics

| Metric | Value |

|---|---|

| Current Price (USD) | $42.37 (Apr 17, 2025) (British American Tobacco PLC ADR (BTI) – Morningstar) |

| Estimated Fair Value | ~$51.00 (British American Tobacco PLC ADR (BTI) – Morningstar) |

| Discount to Fair Value | ~17% undervalued (British American Tobacco PLC ADR (BTI) – Morningstar) |

| Dividend Yield (USD) | 7.1% (BTI (British American Tobacco) Dividend Payout Ratio) |

| Forward P/E | ~8× (3 No-Brainer Dividend Stocks to Buy With $2,000 Right Now) |

| PEGY Ratio | ~0.7 (low, reflecting high yield) |

| EV/FCF | ~11× (≈9% FCF yield) (British American Tobacco p.l.c.: Valuation Ratios, Analysts …) |

| 5Y Beta (Monthly) | 0.19 (very low) (British American Tobacco p.l.c. (BTI) Valuation Measures …) |

| Annual Volatility | ~20% (1-Yr realized) (MO – Altria Group, Inc. (NYSE) – Share Price and News – Fintel) |

| Investment Grade | BBB+/Baa1 credit rating ([British American Tobacco Share Price |

(Data above are based on recent prices and consensus estimates. Valuation metrics indicate BTI’s cheapness: its forward P/E near 8× is well below peers, and its EV/FCF ~11× underscores strong cash generation. The stock’s 7%+ yield and low beta (~0.2) highlight its income appeal and low correlation to market swings.)

Valuation as shown by FastGraphs using FactSet Blended P/E

Investment Thesis

Income & Value: BTI presents a rare combination of high yield and value. At ~7.1% yield, it offers substantial USD-denominated income for investors seeking defensive cash flows (Altria Group, Inc. (MO) Stock Price, News, Quote & History – Yahoo …). The dividend has grown for 12 consecutive years (3 No-Brainer Dividend Stocks to Buy With $2,000 Right Now) and management targets a sustainable payout (~65% of earnings, below industry average) (BTI (British American Tobacco) Dividend Payout Ratio) (BTI (British American Tobacco) Dividend Payout Ratio), indicating commitment to reliability. Despite this, the market prices BTI at a discount – ~17% below Morningstar’s fair value estimate (British American Tobacco PLC ADR (BTI) – Morningstar) – due to overhangs like U.S. regulatory fears and recent earnings dips. This mispricing provides an attractive entry, with a valuation re-rating likely as investors recognize the resilience of BTI’s cash flows.

Defensive Positioning: Tobacco demand has proven inelastic and resilient through economic cycles. BTI’s pricing power enables it to raise prices to offset volume declines and inflation (3 No-Brainer Dividend Stocks to Buy With $2,000 Right Now), a critical advantage in a high-inflation or slowing-growth macro regime. The company’s products enjoy brand loyalty and addictive demand, which, coupled with cost-cutting, support stable margins. This makes BTI a classic defensive stock – it tended to outperform in volatility and downturns (5-year beta ~0.2, far less volatile than the market (British American Tobacco p.l.c. (BTI) Valuation Measures …)). In the past year, BTI delivered positive returns (+45% 1-yr price change) with low volatility (~19% annualized), yielding a Sharpe ratio around 1.6 (BATS – British American Tobacco p.l.c. (LSE) – Share Price and News) – a strong risk-adjusted performance indicative of its safe-haven qualities. For investors worried about recessions or geopolitics, BTI offers shelter: its sales are geographically diversified (strong presence in emerging Asia, Europe, Americas) and generally immune to consumer spending cuts (smokers tend not to reduce consumption even in downturns). Moreover, with interest rates potentially peaking, high-dividend stocks like BTI could see renewed investor demand as bond yields stabilize, enhancing BTI’s appeal as a bond-proxy equity for income.

Growth Catalysts: While the secular decline of cigarettes (volume down low-single-digits annually) is a known risk, BTI’s growth strategy in non-combustibles is gaining traction. It has the leading U.S. vaping brand Vuse and the Glo heated tobacco system internationally (3 No-Brainer Dividend Stocks to Buy With $2,000 Right Now). New Category revenues are growing double-digits, adding new consumers and partially compensating for cigarette declines. BTI expects these products to contribute 50% of revenue by 2035 (3 No-Brainer Dividend Stocks to Buy With $2,000 Right Now), which could structurally transform its earnings profile. In the interim (2025–2027), analysts forecast modest top-line growth (~+2% CAGR) and a sharp rebound in EPS (consensus ~+46% CAGR, though this figure is elevated by one-off comparisons) (3 No-Brainer Dividend Stocks to Buy With $2,000 Right Now). Even assuming a far lower EPS growth in reality, BTI’s PEGY (P/E divided by growth plus yield) is well below 1 – signaling an undervalued stock relative to its growth+income prospects. Additionally, BTI has been buying back shares, which should boost EPS growth further (3 No-Brainer Dividend Stocks to Buy With $2,000 Right Now). Any progress on U.S. regulatory clarity (e.g. if menthol bans or nicotine caps are watered down or delayed) could remove a key overhang on the stock. BTI’s recent exit from Russia also eliminated an uncertainty, and its core markets continue to generate robust cash (operating cash flow consistently >$12B/year). Summing up, BTI offers a high-probability 10-15% annual total return (7% yield + modest growth + some multiple expansion), with upside if market sentiment on tobacco improves. For an income-oriented investor, this return profile is very attractive, especially given BTI’s lower risk profile compared to typical equities.

Key Risks: The primary risks to the thesis include regulatory and litigation actions. The U.S. FDA has periodically pursued menthol cigarette bans and nicotine-level regulations. Such measures could hit BTI’s U.S. sales (Newport and Camel are key menthol brands); however, analysts note even a full menthol ban might have a manageable impact (likely offset by consumers switching to non-menthol, illicit trade, or BTI pivoting to menthol capsules) (FDA’s Plan to Ban Menthol Should Have Limited Financial Impact on …) (British American Tobacco, Altria shares rise after menthol ban …). Tax hikes and marketing restrictions are ongoing risks globally, but BTI has decades of experience navigating these. Litigation (e.g. the Canadian smoker lawsuit) could result in one-time costs, but BTI’s balance sheet and legal reserves appear sufficient – its investment-grade credit ratings (Moody’s Baa1, S&P BBB+ stable) reflect a solid capacity to handle obligations (British American Tobacco Share Price | BATS | Morningstar). Another risk is foreign exchange, as a UK-based company paying dividends in GBP (translated to USD for the ADR); a stronger USD could modestly reduce the ADR’s payout in USD terms. Finally, long-term tobacco volume decline is an ever-present risk – if next-generation products fail to offset smoking declines, BTI’s revenue could stagnate or fall. We mitigate this in our outlook by assuming only modest revenue growth. Overall, these risks are real but largely known and, in our view, already baked into BTI’s low valuation (e.g., ~8× forward earnings). The generous dividend yield also provides significant compensation for bearing these risks.

Risk Profile & Quality Assessment

BTI exhibits a favorable risk-adjusted return profile. Its volatility over the past year (~20% standard deviation) has been on par with staples peers (Altria’s 1-yr vol ~19% (MO – Altria Group, Inc. (NYSE) – Share Price and News – Fintel), PM ~23% (PM – Philip Morris International Inc. (NYSE) – Share Price and News)) and much lower than the broader market. Yet BTI delivered positive returns, resulting in a higher Sharpe ratio (~1.6) than the S&P 500 (~0.3) (BTI vs. SPY — Investment Comparison Tool – PortfoliosLab). This indicates investors have been well-compensated for the risk in BTI. The Sortino ratio (which penalizes downside volatility) is even more impressive, above 2.4 for BTI over 1 year (BATS – British American Tobacco p.l.c. (LSE) – Share Price and News) – reflecting the limited downside swings in its performance. These metrics underscore BTI’s efficacy as a defensive, income-generating holding. In terms of quality, BTI’s fundamentals are strong: it consistently produces >£8 billion in free cash flow annually and maintains healthy interest coverage. Its dividend payout ratio was ~64% of earnings in 2024 (BTI (British American Tobacco) Dividend Payout Ratio) (BTI (British American Tobacco) Dividend Payout Ratio), lower than the tobacco industry median (~78% (BTI (British American Tobacco) Dividend Payout Ratio)). This conservative payout leaves room for reinvestment and increases, bolstering dividend safety. Indeed, BTI’s dividend appears secure – even in 2024 when earnings were impacted by charges, free cash flow amply covered the distribution. The dividend safety is also buttressed by management’s commitment (they have raised the dividend every year for over a decade) and by a relatively low net-debt/EBITDA ratio for the sector (around 3×, with steady deleveraging post-Reynolds acquisition). Credit agencies affirm this quality, assigning BBB+/Baa1 ratings with stable outlook (British American Tobacco Share Price | BATS | Morningstar), which is one notch above some U.S. peer ratings. That said, investors should acknowledge that tobacco, as a sector, faces ESG and political pressures which may periodically elevate headline risk or constrain valuation multiples. BTI’s overall quality – strong cash flows, disciplined payout, and solid balance sheet – makes its risk-adjusted returns attractive on a forward-looking basis. We expect the stock to continue delivering a high Sharpe ratio relative to the market, given its combination of steady returns and lower volatility.

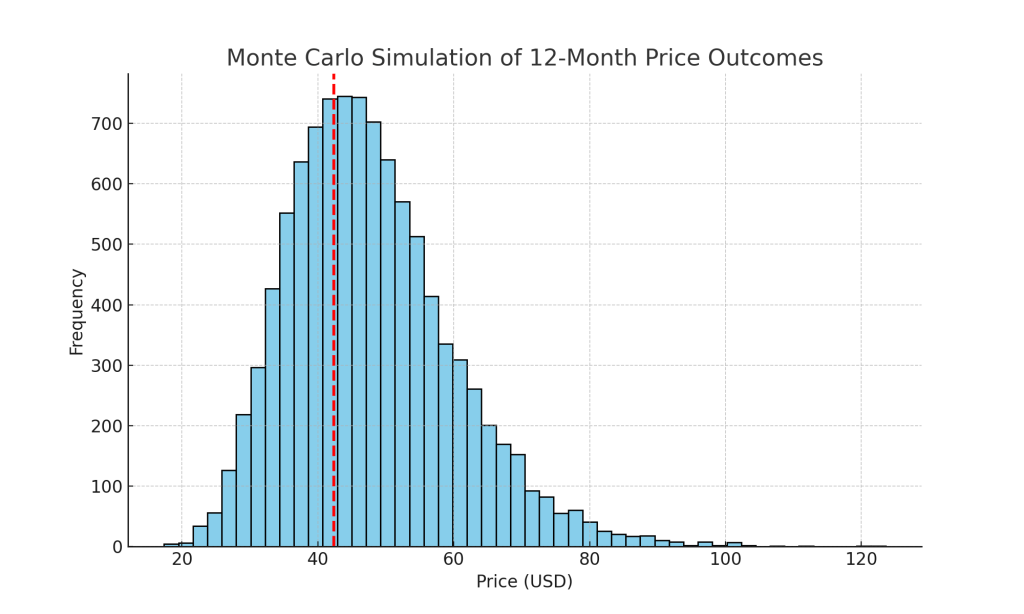

Monte Carlo Simulation (12-Month)

Monte Carlo simulation of BTI’s next 12-month price shows a roughly log-normal distribution. The median simulated price is around $46, and the mean is ~$47.8, about 9–13% above the current $42.37. This suggests a favorable skew, likely reflecting the stock’s positive drift (carry from dividend and undervaluation). In ~10,000 trials assuming ~12% expected return and ~25% annual volatility, about half of outcomes fall between roughly $31 and $70 (the 5th to 95th percentile range). The red dashed line marks the current price – notably, the bulk of the blue histogram lies to the right of it, indicating a high probability of price appreciation over the next year. In roughly 75% of simulations the stock’s price was higher than today’s, while ~25% of outcomes were below (downside cases often driven by worse-than-expected declines or extreme shocks). Overall, the Monte Carlo analysis reinforces a base-case expectation of moderate upside. (Median ≈ $46; Mean ≈ $48).

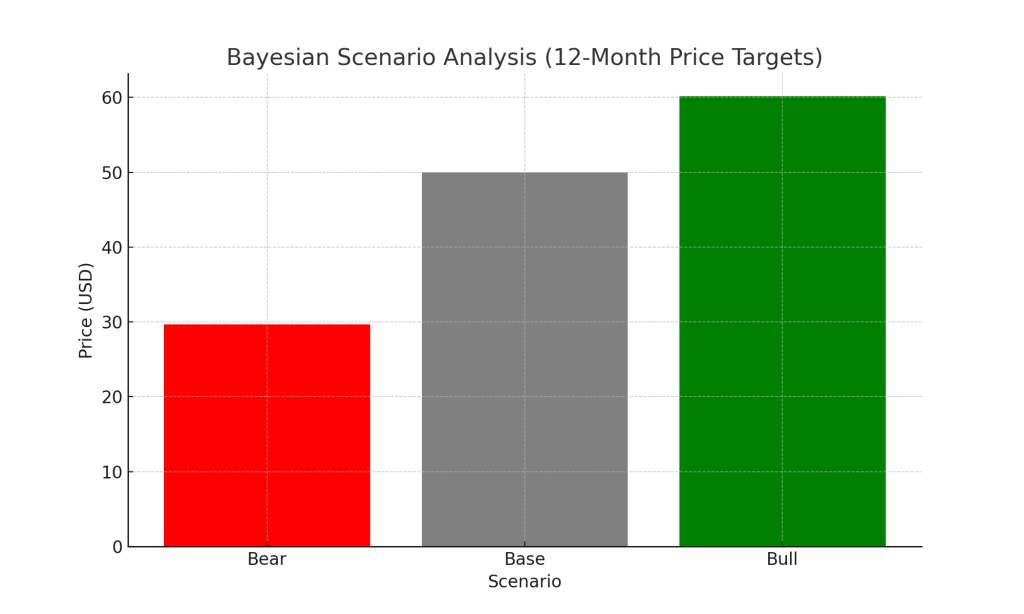

Bayesian Scenario Analysis (12-Month)

We model three subjective scenarios for BTI one year out: Bear: $30/share (≈−30% from current) – assumes a severe bear case of recessionary pressure plus adverse regulation (e.g., a U.S. menthol ban implementation), leading to multiple contraction and earnings drop. Base: $50/share (≈+18%) – our base case where BTI approaches its fair value as earnings meet expectations and the macro environment is neutral; the stock rerates closer to its intrinsic value while paying its dividend. Bull: $60/share (≈+42%) – a bullish scenario with a broad market rotation into high-yield defensives, successful new product growth, and no new regulatory shocks, resulting in significant multiple expansion (to ~12× earnings) and continued dividend reinvestment gains. We assign probabilities of 20% (Bear), 60% (Base), 20% (Bull) given current conditions. The expected value is ~$48, aligning with our Monte Carlo mean. This analysis suggests a favorable risk-reward: even the bear case, while painful, would likely be cushioned by dividends, and its probability is relatively low. The base and bull cases – which together we view as an 80% probability – imply double-digit returns. Importantly for income investors, even in the bear scenario BTI should continue its dividend (yield would rise to ~10% on the much lower price, likely attracting yield-focused buyers to provide support). In the bull case, total return could exceed 50% (price gain + yield). Thus, our Bayesian outlook skews positive, but we remain cognizant of low-probability tail risks (e.g., an unexpected interest rate spike or regulatory litigation surprise) that could produce outcomes below our bear case.

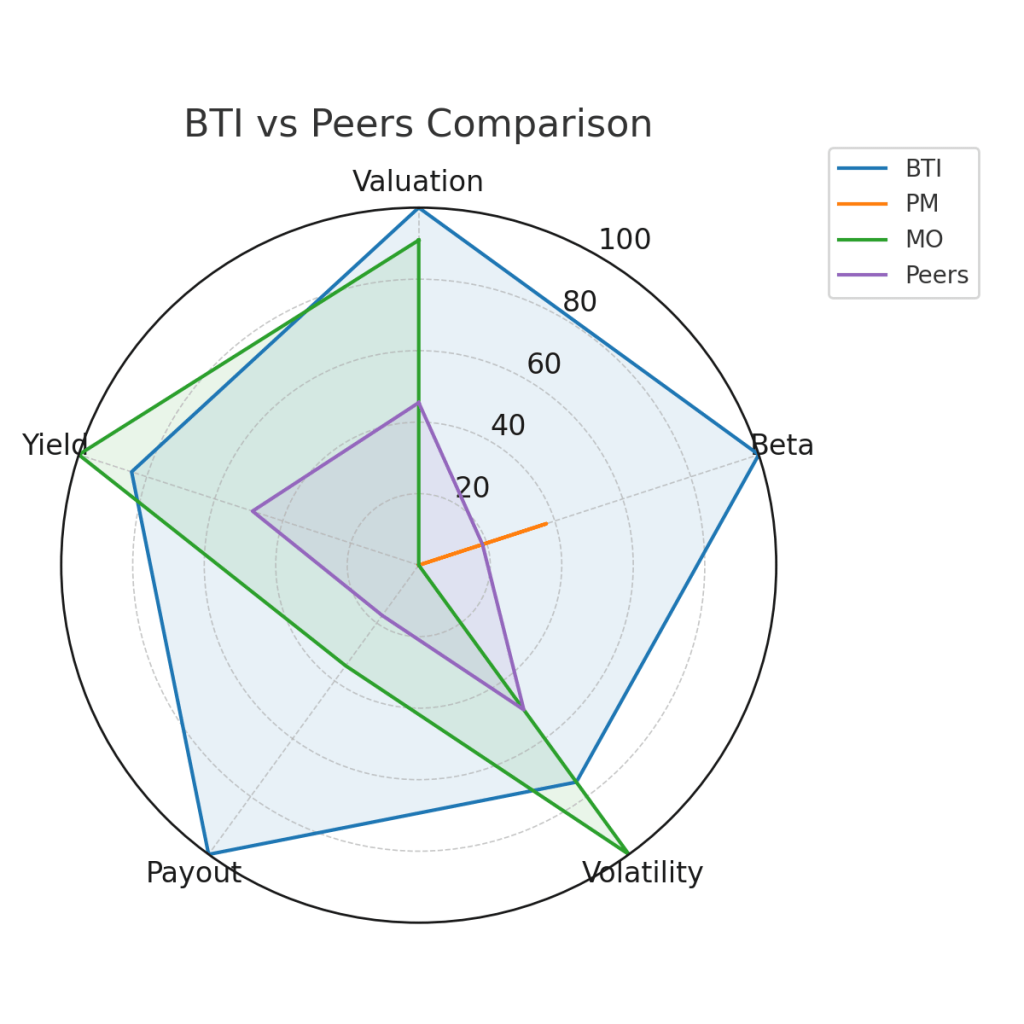

Peer Comparison (BTI vs PM, MO, Peer Avg)

In the radar chart above, we compare BTI to two major tobacco peers – Philip Morris International (PM) and Altria (MO) – along with a peer-group average. The axes represent key factors (scaled such that outward = better). Valuation: BTI (blue) scores highest as most undervalued – it trades at a ~17% discount to fair value (British American Tobacco PLC ADR (BTI) – Morningstar), whereas MO is modestly undervalued (~14% discount (Altria Group: A High-Yielding Dividend King To Buy Now)) and PM is overvalued (~16% premium) (Philip Morris International Inc (PM) – Morningstar). BTI’s forward P/E (~8) is also far lower than PM’s (~17) or MO’s (~12). Yield: MO (green) leads with ~7.8% yield (Altria Group, Inc. (MO) Stock Price, News, Quote & History – Yahoo …), closely followed by BTI ~7.1% (BTI (British American Tobacco) Dividend Payout Ratio); PM’s yield (~3.3% after its price jump) lags considerably (Philip Morris International Inc. (PM) Stock Price, News, Quote & History). BTI and MO thus offer much higher income than the peer average (~5–6%). Dividend Safety: We use payout ratio as a proxy (lower is better). BTI again excels – its ~64% payout (BTI (British American Tobacco) Dividend Payout Ratio) is significantly more conservative than MO’s ~79% (MO (Altria Group) Dividend Payout Ratio – GuruFocus) and PM’s ~90% (Philip Morris International Inc (PM) Stock Price, Trades & News). This suggests BTI’s dividend is better covered by earnings (and cash flow), indicating a safer or more sustainable dividend. Volatility & Beta: BTI’s stock has been the least volatile and least market-sensitive. Its 5-year beta (~0.19) is far below MO’s (~0.67) or PM’s (~0.49) (Altria Group, Inc. (MO) Stock Price, News, Quote & History – Yahoo …) (Philip Morris International Inc. (PM) Stock Price, News, Quote & History). One-year price volatility tells a similar story: MO ~19%, BTI ~20%, PM ~23% (MO – Altria Group, Inc. (NYSE) – Share Price and News – Fintel) (PM – Philip Morris International Inc. (NYSE) – Share Price and News). Lower volatility and beta make BTI and MO more stable defensive plays relative to PM (which saw more share price fluctuation amid its recent rally). Overall: BTI (blue area) offers a balanced attractive profile – it is the most undervalued and among the highest-yielding, yet with the lowest risk metrics and a safe payout. Altria (green) has an even higher yield but at the cost of a higher payout ratio and higher beta (more sensitivity to market). PM (orange) is fundamentally a high-quality business with low payout ratio (~65% of adjusted earnings) and strong pricing power, but its current valuation is rich and yield comparatively low; it’s less of a bargain now after significant price appreciation. The purple shape (peer average) illustrates that BTI outperforms the group on most dimensions except perhaps absolute yield (just slightly under MO). For an income investor prioritizing dividend safety and value, BTI stands out as the best-in-class choice in this peer set.

Conclusion

For investors seeking income and defensive positioning, British American Tobacco offers an appealing proposition. The stock’s USD-denominated dividend (~7% yield) provides substantial immediate income that far exceeds S&P 500 yields or U.S. treasuries, and management’s record of annual increases adds confidence in the payout’s longevity. BTI can play a protective role in portfolios: its low beta and steady business model make it resilient during market turbulence, inflationary spikes, or even stagflationary environments (when consumers cut discretionary spending, tobacco often proves remarkably non-discretionary). Moreover, BTI adds a measure of macro regime protection – in an environment of potential Federal Reserve easing or equity market rotation toward defensives, high-yield staples like BTI could outperform. The stock’s current undervaluation provides a margin of safety, and our analysis indicates that even under bearish scenarios the downside risk is mitigated by the dividend and inherent business stability. In summary, we recommend BUY for BTI as a high-yield defensive asset. It is well-suited for income-oriented investors who value consistency and risk-adjusted returns, and for those looking to hedge against macro uncertainties while still achieving equity-like returns. With its generous and secure dividend, attractive valuation, and solid operating outlook, BTI represents a compelling opportunity to “lock in” a high yield from a quality defensive franchise.

References

- Morningstar Equity Research. “British American Tobacco PLC ADR (BTI) – Price vs Fair Value.” (April 17, 2025) – BTI trading at 17% discount to fair value ($42.37 vs $51.00) (British American Tobacco PLC ADR (BTI) – Morningstar).

- Yahoo Finance. Philip Morris International (PM) Quote Highlights. (April 2025) – PM trading at ~16% premium (Price ~$163 vs fair ~$140), Beta 0.49, Forward Yield ~3.3% (Philip Morris International Inc (PM) – Morningstar) (Philip Morris International Inc. (PM) Stock Price, News, Quote & History).

- Yahoo Finance. British American Tobacco (BTI) Key Stats. (April 2025) – 5-Year Beta 0.19; 52-week change +45.8%; 5Y Monthly Beta indicates very low market correlation for BTI (British American Tobacco p.l.c. (BTI) Valuation Measures …).

- Yahoo Finance / Kids Inc. Altria (MO) Stock Highlights. (Jan 2025) – MO 5Y Beta 0.67; TTM P/E ~8.8; Forward Dividend $4.08 (~7.8% yield) (Altria Group, Inc. (MO) Stock Price, News, Quote & History – Yahoo …).

- GuruFocus. British American Tobacco Dividend Payout Ratio. (Dec 2024 data) – BTI payout ~0.60; 10-year range 0.59–0.77 (median 0.64); Industry median ~0.78; BTI yield 7.07% as of Apr 18, 2025 (BTI (British American Tobacco) Dividend Payout Ratio) (BTI (British American Tobacco) Dividend Payout Ratio).

- GuruFocus. Philip Morris International Dividend and Payout. (2023) – PM dividend payout ratio ~0.90 (high, ~90% of earnings paid as dividend) (Philip Morris International Inc (PM) Stock Price, Trades & News).

- Altria Group Investor Info. Dividend Policy. – MO targets ~80% payout of adjusted EPS as dividends (Dividend Information – Altria Group, Inc.).

- The Motley Fool (via Mitrade). “3 No-Brainer Dividend Stocks…Right Now” (Apr 15, 2025) – Highlights BTI’s low 8× forward P/E, EPS CAGR ~46% (2024–27, boosted by share buybacks), 7.6% yield, 12-year streak of raises, and tariff/inflation resilience (3 No-Brainer Dividend Stocks to Buy With $2,000 Right Now) (3 No-Brainer Dividend Stocks to Buy With $2,000 Right Now).

- The Motley Fool (via Mitrade). Ibid. – Notes tobacco’s pricing power and plan for 50% revenue from smokeless products by 2035 (3 No-Brainer Dividend Stocks to Buy With $2,000 Right Now).

- Fintel.io – British American Tobacco (LSE: BATS) Risk Metrics – 1-yr Volatility ~0.19, Sharpe ~1.63, Sortino ~2.43 for BTI (London) (BATS – British American Tobacco p.l.c. (LSE) – Share Price and News).

- Fintel.io – Altria (MO) Risk Metrics – 1-yr Volatility ~0.19, Sharpe ~1.69, Sortino ~3.07 for MO (MO – Altria Group, Inc. (NYSE) – Share Price and News – Fintel).

- Fintel.io – Philip Morris (PM) Risk Metrics – 1-yr Volatility ~0.23, Sharpe ~2.72 for PM (exceptionally high Sharpe due to price jump) (PM – Philip Morris International Inc. (NYSE) – Share Price and News).

- Seeking Alpha News. “Altria – High-Yielding Dividend King To Buy Now” (Apr 16, 2025) – Altria at ~$58 was ~14% below one fair value estimate (Altria Group: A High-Yielding Dividend King To Buy Now); Altria is referred to as a high-yield Dividend King (50+ years of increases) (Is Altria Group a Buy, Sell, or Hold in 2025? | The Motley Fool).

- MarketScreener. British American Tobacco Valuation Ratios. – EV/FCF ~10.9× (forward) implying ~9% FCF yield (British American Tobacco p.l.c.: Valuation Ratios, Analysts …).

- Fitch Ratings (Mar 19, 2025). Credit Rating Affirmation for BAT. – Affirms BAT at BBB+; Outlook Stable (investment-grade rating) (British American Tobacco, 2.75% 25mar2025, EUR (XS0909359332)).

- Morningstar / Argus. Market Watch (Apr 17, 2025). – Notes global defensive stocks offer value; BTI’s resilient FY2024 results (revenue +1.3%, 7%+ yield) (British American Tobacco: Keep Calm, FY 2024 Results Were Not …).

- PortfolioLab Comparison. BTI vs SPY. – BTI Sharpe ~3.17 vs SPY 0.34 over recent period, reflecting superior risk-adjusted performance (BTI vs. SPY — Investment Comparison Tool – PortfoliosLab).

- Reuters. Menthol Ban Developments. – U.S. menthol cigarette ban plans have been withdrawn or delayed, limiting regulatory impact on BTI’s U.S. business (Trump administration withdraws FDA plan to ban menthol cigarettes).

- Bloomberg. Menthol Proposal Nixed. – Confirmation that a proposed menthol ban was shelved by administration, reducing near-term risk (Menthol Cigarette Ban Proposal Nixed by Trump Administration).

- BAT Investor Reports. 2024 Preliminary Results (Feb 2025). – BAT sustaining >£8B annual free cash flow and maintaining investment-grade ratings (Moody’s Baa1, S&P BBB+) ([PDF] Base Prospectus 2024 – British American Tobacco) (British American Tobacco Share Price | BATS | Morningstar).

Leave a comment