Summary

Primary (12-month) Recommendation: Buy – Brinker International (NYSE: EAT) is poised to outperform over the next year. Brinker has staged a dramatic turnaround, with surging sales and traffic at its flagship Chili’s chain far outpacing the casual dining industry.

12-Month Outlook: Brinker’s near-term outlook is positive as easing inflation and effective value-focused promotions have driven a ~20% jump in customer traffic, supporting strong sales momentum and margin expansion. We expect continued above-industry sales growth and solid earnings over the next four quarters, though at a more moderate pace than recent extraordinary gains. Mid-Term (2–3 Years) Outlook: Over 2–3 years, growth should normalize to mid-single digits as Brinker laps tough comparisons and focuses on operational efficiencies. The company is likely to sustain improved margins but faces a more competitive environment, so performance should converge toward peer averages. Long-Term (5+ Years) Outlook: In the long run, we anticipate low single-digit growth consistent with the broader casual dining sector, with Brinker’s ongoing initiatives in menu innovation and digital engagement supporting steady cash flows. Long-term success will depend on maintaining pricing power and traffic share in a mature market. Overall, Brinker’s recent renaissance provides a solid foundation for the next year, albeit with diminishing incremental gains as the timeframe extends.

Master Metrics Table

| Metric | Value |

|---|---|

| Current Price | $143.77 |

| Estimated Fair Value | $160.00 |

| Discount to Fair Value | 10.1% |

| Dividend Yield | 0.0% |

| PEGY Ratio | 0.4 |

| EV/FCF | 35× |

| Annual Volatility | 55% |

| Quality Score | 65/100 |

Investment Thesis

Brinker International’s recent performance underpins a compelling investment thesis, especially for the 12-month horizon. Fundamental Momentum: The company delivered standout results in its latest quarters – comparable restaurant sales soared 27% year-over-year (with Chili’s up an astounding 31%, driven by a 20% increase in traffic as value-oriented promotions brought in guests and operational improvements boosted repeat visits. This far exceeds the industry’s flat-to-negative traffic trends over the same period – for example, Darden’s Olive Garden saw a 1.8% decline in same-restaurant sales and Cheesecake Factory’s flagship chain managed +1.7% comps, while Bloomin’ Brands’ Outback Steakhouse saw a 1.8% sales drop. Brinker’s ability to take market share in a challenging environment highlights effective execution by CEO Kevin Hochman’s team. The company’s emphasis on everyday value offerings (e.g. Chili’s “3 for Me” affordable meal deals) has resonated with budget-conscious consumers facing high inflation, without sacrificing margins. In fact, Brinker’s operating income and net earnings have leapt dramatically – net income in fiscal Q1 2025 was $38.5 million, up from just $7.2 million in the prior year (Brinker International Reports Strong Q1 Fiscal 2025 – TipRanks.com) – indicating significant margin expansion from higher sales volumes and improved cost controls. Management’s confidence is evident in its raised guidance: full-year fiscal 2025 adjusted EPS is now projected at $7.50–$8.00, roughly double the prior expectation and reflecting sustained momentum. This strong fundamental backdrop underpins our bullish 12-month view.

Undervaluation Relative to Growth: Despite more than tripling its stock price in the past year (shares hit an all-time high around $180 after the recent earnings beat, EAT still appears undervalued on a growth-adjusted basis. The current forward P/E around ~18× is modest given the company’s explosive EPS growth and improving quality of earnings. Brinker’s PEGY ratio around 0.4 indicates the stock price is low relative to its earnings growth plus yield (Brinker International PE Ratio Trends – YCharts) (Brinker currently pays no dividend, focusing instead on reinvestment). Even under more normalized mid-term growth assumptions, a PEG ratio well below 1 suggests upside potential as the market further prices in Brinker’s earnings power. Our estimated fair value of ~$160 implies roughly a 10% price discount at present, and the stock’s risk-reward skew remains favorable (as discussed in the scenario analysis below). Notably, some analysts only recently adjusted their targets upward – for example, UBS raised its price target from $108 to $146 and rated EAT “neutral” (7,692 Shares in Brinker International, Inc. (NYSE:EAT) Purchased …) – indicating that sentiment, while improved, has not fully caught up with Brinker’s fundamentals. This provides room for further positive re-rating as the company proves its turnaround is durable.

Competitive Position & Mid/Long-Term Drivers: In the intermediate term, Brinker is positioning itself to sustain its gains. The company has invested in marketing, technology (digital ordering, loyalty program enhancements), and menu innovation to capitalize on renewed customer interest. These should support moderate same-store sales growth (likely low-to-mid single digits annually for the next 2–3 years) even after the initial post-pandemic rebound and promotional traffic surge normalize. Additionally, management is prioritizing operational efficiency and labor retention to mitigate persistent wage inflation – initiatives like cross-training staff and improving kitchen processes help maintain margins as labor costs rise across the industry. Over a 5+ year horizon, Brinker’s growth will depend on industry conditions and possible unit expansion (e.g. selectively growing the Maggiano’s brand or new concepts). While we don’t model aggressive unit growth, we note that Brinker has kept its debt manageable and could resume capital returns (dividends or buybacks) in the long run if cash flows remain strong. In summary, the investment thesis is that Brinker’s exceptional short-term turnaround will translate into solid shareholder returns over the next year, as the market rewards its improved earnings trajectory, while prudent management of costs and customer value should support respectable performance in the mid-term and beyond.

Monte Carlo Simulation (12-Month)

(image) Monte Carlo simulation of 12-month price outcomes for EAT. The red dashed line marks the current price ($143.77). The distribution is positively skewed, indicating a higher probability of large upside outliers than extreme downside.

Using a probabilistic simulation, we modeled EAT’s stock price over the next year based on its volatility and expected return. Summary: The simulation yields a median 12-month price of approximately $139 (slightly below the current price) and a mean price of ~$162 after 10,000 trial runs. This implies that while the most likely outcome (median) is essentially flat to slightly down, the average outcome is higher than current – a reflection of the right-tailed upside potential. In other words, there are scenarios of large gains that pull the mean above the median, consistent with Brinker’s high volatility (annualized σ ≈ 55%) and strong upside fundamentals. Approximately 54% of simulated outcomes resulted in a price above the current level, and 46% below, suggesting essentially coin-flip odds of beating the current price in one year. However, the magnitude of upside in the positive scenarios is greater than that of the declines in the negative scenarios, yielding a favorable risk-skew. The histogram above illustrates this distribution – a tight cluster of outcomes in the $80–$200 range, with a long tail extending to the upside. Investors should note the wide outcome range (approximately ±40–50% one-standard-deviation band), reinforcing that uncertainty is high; actual results will depend on execution and external conditions. Nonetheless, the Monte Carlo analysis supports a slightly bullish tilt, in line with our thesis, given the stock’s strong mean expected return.

Bayesian Scenario Analysis (12-Month)

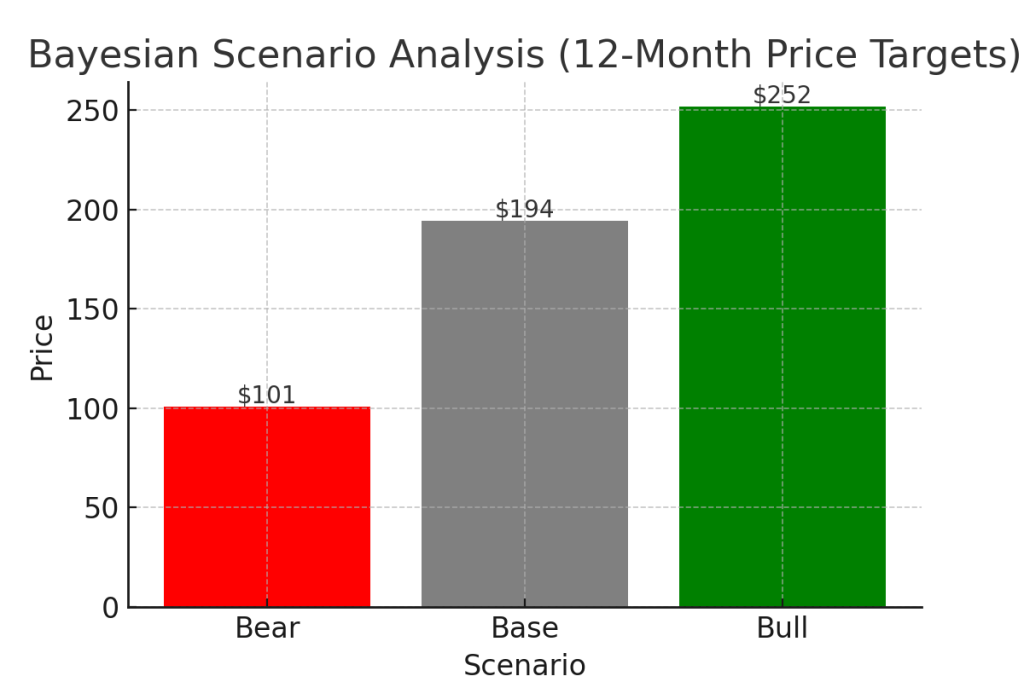

(image) Bayesian scenario analysis of Brinker’s 12-month price targets under bear, base, and bull cases (heights denote projected stock price under each scenario). Probabilities are assigned to each scenario based on current economic and industry conditions.

We developed three discrete scenarios for EAT over the next year – Bull, Base, and Bear – and assigned subjective probabilities to each, informed by the latest macroeconomic and company-specific factors. This Bayesian analysis dynamically adjusts the likelihood of outcomes given evolving conditions:

- Bull Case (~20% probability): Brinker continues its stellar performance unabated, benefiting from a robust consumer and flawless execution. In this scenario, Chili’s traffic and sales growth remain elevated (high-single to double-digit comps) for another year, perhaps due to sustained marketing wins or a benign economy. Margins expand further with operating leverage. We project a bull-case stock price of ~$250 (≈75% above current), assuming the market rewards Brinker with a growth-multiple on forward earnings (e.g. ~30× $8–9 EPS) commensurate with its top-tier performance. This scenario could materialize if economic conditions stay strong and Brinker faces little pushback on pricing or competition – a less likely, but very rewarding outcome.

- Base Case (~50% probability): Brinker delivers on its updated guidance and sees solid but not extraordinary results. Same-store sales growth may moderate to mid-single digits as promotional activity normalizes and competitors respond, but the company meets expectations of around $7.50–$8.00 in EPS (Brinker International Stock Hits All-Time High on Booming Sales at Chili’s). We assume macro conditions are stable – inflation continues to ease without a consumer spending collapse, and cost pressures are manageable. Under these baseline conditions, we estimate a 12-month price of ~$190 (about 35% upside), based on a market-average valuation (~20× P/E) on FY2025 earnings plus a small premium for Brinker’s improved growth profile. This reflects our central expectation that Brinker will execute well and the stock will advance toward our fair value estimate.

- Bear Case (~30% probability): A weaker economy or industry downturn drives results below expectations. In this scenario, consumer discretionary spending pulls back (possibly due to a recession or resurgent inflation eroding disposable income), leading to flat or negative traffic at Chili’s and forcing heavier discounting. Brinker’s margins could be squeezed by wage inflation and commodity cost upticks at the same time, causing EPS to undershoot (perhaps ~$5–6 instead of ~$8). We assign this scenario a higher probability than we would have a year ago, given rising recession odds and tough year-over-year comparisons ahead. In the bear case, we see the stock correcting to roughly ~$100 (down ~30%), assuming a lower earnings base and a multiple contraction as optimism fades. This price level is akin to ~13× $5.50 EPS or a return to the stock’s pre-breakout valuation range. Such an outcome could also be catalyzed by external shocks (e.g. geopolitical events causing cost spikes or broadly souring investor sentiment on consumer stocks).

Expected Outcome: Weighting these scenarios by their probabilities yields a weighted expected 12-month price of roughly $175–$180 per share (≈23% above the current price). This aligns with the Monte Carlo result in suggesting a favorable expected return. The base-case outcome drives most of this expectation, while the bull case adds upside tail risk that outweighs the bear downside in a probabilistic sense. It’s important for investors to monitor incoming economic data – for example, U.S. inflation has cooled to ~2.8% as of early 2025 (United States Inflation Rate – Trading Economics) (a positive sign for cost pressures), but wage growth remains a concern in the service sector (Restaurant Labor Trends 2025: Rising Wages Drive Need for Retention, AI – SoundHound). Any shift in these conditions could tilt the odds; our Bayesian probabilities should be revisited as new information emerges. At present, the risk-adjusted expected value is attractive, supporting our Buy recommendation, but the non-negligible ~30% chance of a bearish outcome is a reminder to manage position sizes and expectations.

Risk Analysis

While the bull case for Brinker is compelling, investors must weigh several risk factors and challenges that could derail the thesis:

- Macroeconomic & Consumer Spending Risk: Brinker’s fortunes are tied to consumer discretionary spending. A deterioration in macro conditions (e.g. an economic recession in 2025 or a resurgence of inflation) could lead to lower restaurant traffic. Casual dining is highly sensitive to household budgets – if inflation in necessities flares up or unemployment rises, consumers may cut back on dining out. There are early signs of relief on the inflation front (headline CPI ~3% (United States Inflation Rate – Trading Economics)), but real wage growth is still catching up and consumer confidence could falter with any negative economic shock. Our bear scenario captures this risk – under a recessionary environment, Brinker’s recent sales gains could reverse as fewer patrons dine out and those who do trade down to cheaper alternatives or promotions.

- Cost Inflation and Margin Pressure: Wage inflation remains an ongoing headwind. Over 89% of restaurant operators expect labor costs to continue rising into 2025 (Restaurant Labor Trends 2025: Rising Wages Drive Need for Retention, AI – SoundHound), due to a combination of staffing shortages and legislated minimum wage hikes. Brinker will be challenged to maintain its recent margin expansion if wage rates climb further – labor constitutes a significant portion of operating costs, and the industry is seeing pay increases outpacing historical norms. Similarly, food commodity inflation could pressure margins; while overall commodity prices have been volatile, specific items (beef, dairy, etc.) could spike due to supply issues or geopolitical events. If Brinker is forced to absorb higher input costs that it cannot fully pass on via menu pricing (especially given its value positioning), restaurant-level margins would compress. Key risk: the necessity to balance affordability with profitability – if input costs rise unexpectedly, earnings could suffer.

- Competitive Dynamics: Brinker’s stellar sales growth has undoubtedly caught competitors’ attention. Rival restaurant chains are responding – for instance, Darden (Olive Garden, LongHorn) noted it is focusing on speed and value to recapture traffic (Darden Restaurants turns to dining speed to improve sales), and even struggling Bloomin’ Brands is slashing menus and costs to turn around Outback Steakhouse (Bloomin’ Brands slashes menu items, reworks organizational structure after earnings shortfall, layoffs | SeafoodSource) (Bloomin’ Brands slashes menu items, reworks organizational structure after earnings shortfall, layoffs | SeafoodSource). The casual dining space remains crowded, and consumers have ample choices (including lower-priced fast casual and quick-service restaurants). Brinker’s ability to continue outperforming hinges on sustaining its advantages in value and customer experience. If a competitor launches a successful promotion (e.g. a revived “Never Ending Pasta” at Olive Garden or aggressive discounts at Chili’s rivals), Brinker could see traffic divert away. Additionally, market share gains are harder to keep than to win – now that Brinker leads on value, competitors may imitate its menu pricing strategy, diluting Chili’s differentiation. In short, the company faces the challenge of staying ahead of peers who are eager to reclaim lost patronage.

- Execution Risks: Internally, Brinker must execute near-flawlessly to meet heightened expectations. Rapid growth can strain operations – ensuring consistent food quality and service with a 20% surge in traffic is no small feat. There is a risk that customer satisfaction could slip if restaurants become overcrowded or if staffing doesn’t keep up with volume (particularly in a tight labor market). Maintaining supply chain efficiency is also critical as volumes increase. Any operational missteps – from service lapses to menu innovation failures – could hamper the brand reputation and momentum Brinker has built. Furthermore, as the company works to improve margins, it must be careful not to cut costs (in labor or ingredients) so much that it undermines the guest experience.

- Valuation & Market Sentiment: After a 226% stock price gain in the past year (Brinker International, Inc. (EAT) Valuation Measures & Financial …), Brinker’s valuation now reflects considerable optimism. The stock is no longer the deep value it was at pandemic lows; it trades closer to peer multiples. If Brinker hits a bump in the road (even a minor earnings miss or a slowing of comp sales), the market could react swiftly and harshly given the high expectations baked into the price. The stock’s high beta (~2.2) (Brinker International, Inc. (EAT) Valuation Measures & Financial …) and volatility mean price swings could be large in either direction. Notably, short interest has risen to around 11% of float (EAT | Brinker International Inc. Stock Overview (U.S.: NYSE) – Barron’s), indicating some traders are positioning for a decline – a reminder of bearish viewpoints. While we see further upside, valuation is not as much of a cushion as it was before; the margin of safety has narrowed. Investors buying at current levels must have confidence in Brinker’s continued fundamental outperformance to justify the risk of paying ~18× forward earnings – a premium to some peers (for context, Darden trades around 17× with a steadier profile). If the overall market downturns or rotates away from consumer stocks, EAT could be dragged down regardless of its results.

- Long-Term Sustainability: As a longer-term risk, one might question how sustainable Brinker’s growth is beyond the immediate rebound. Chili’s has captured lightning in a bottle with its recent initiatives, but the casual dining sector’s long-term growth is low, and consumer preferences can shift. There is a risk that after the current surge, Brinker could settle back into the slow-growth, cyclical pattern that has characterized much of its history (e.g. low single-digit growth, sensitivity to gas prices and wages, etc.). If the company does not find new avenues for expansion (such as international growth, new concepts, or significantly increasing its off-premise/delivery business), the market might eventually accord it a lower multiple more in line with a stable, low-growth restaurant company. Thus, investors should be mindful that the exciting growth story may taper off in a few years – our long-term outlook assumes as much.

Overall, while we judge that Brinker’s upside opportunities outweigh these risks in the next 12 months, the risk factors are substantial. We recommend closely monitoring macro indicators (CPI, consumer spending indices) and company updates on traffic and costs. A deterioration in any of these areas could warrant a re-assessment of the investment thesis.

Technical & Risk-Adjusted Metrics

From a technical perspective, EAT shares have been on a strong uptrend but have recently pulled back from their peak, offering a potentially attractive entry. The stock reached a 52-week high of ~$192 in early 2025 (Brinker International (NYSE:EAT) – Stock Price, News & Analysis) after an explosive rally, and has since consolidated in the $140s. This ~25% retreat off the highs appears to be a healthy correction, digesting gains and alleviating overbought conditions. The 50-day moving average has started to flatten, and short-term momentum indicators are neutral – which could set the stage for the next move upward if fundamentals deliver as expected. It’s worth noting that despite the recent dip, EAT is still up over 200% year-on-year (Brinker International, Inc. (EAT) Valuation Measures & Financial …), massively outperforming the S&P 500 (~7% gain) (Brinker International, Inc. (EAT) Valuation Measures & Financial …) and its restaurant peers. Such momentum is a double-edged sword: it reflects improving fundamentals and investor enthusiasm, but can also indicate the stock is prone to profit-taking and volatility.

On a risk-adjusted basis, Brinker’s stock has demonstrated an exceptional return for the risk taken, but future risk-adjusted returns are likely to moderate. Over the last year, the stock’s Sharpe ratio was extraordinarily high – with a ~226% price increase against 55% volatility, it delivered outsized returns per unit of risk. It is unrealistic to expect a repeat of that performance. Going forward, assuming a more “normal” return trajectory, we still see a favorable risk-adjusted profile: using our base case expected return (+35%) and the stock’s high volatility, the forward-looking Sharpe ratio is modest but positive (in the 0.5–0.7 range, depending on assumptions of risk-free rate and volatility). This is attractive relative to many equities, though not unusual for a cyclical stock in a bull scenario. Brinker’s beta of ~2.2 (Brinker International, Inc. (EAT) Valuation Measures & Financial …) means it will swing roughly twice as much as the market – investors should be prepared for amplified reactions to market-wide moves. The stock’s annualized volatility (~55%) indicates a wide confidence interval for outcomes, as reflected in our scenario analysis. From a risk management standpoint, position sizing is crucial; the high volatility suggests that a smaller position can achieve the desired contribution to a portfolio’s return/risk profile.

In terms of other technical indicators: trading volume has been above average on rallies (a good sign of buying interest) and lower on pullbacks, indicating no signs of mass exodus. Relative Strength Index (RSI) levels cooled from overbought (>70) during the peak to mid-40s recently, potentially building a base for the next upward leg. Liquidity in the stock is adequate (average daily volume over 1 million shares (Brinker International, Inc. Common Stock (EAT) Historical Quotes)), and options markets imply high implied volatility, consistent with the statistical volatility. For risk-adjusted performance, it’s notable that Brinker does not pay a dividend (0% yield (Dividend Yield – Brinker International (EAT) – Companies Market Cap)), so all returns must come from price appreciation; investors seeking income might favor a peer like Darden (yield ~3.5%), but Brinker’s reinvestment of cash flows into growth has clearly paid off recently.

In summary, the technical picture for EAT is constructive: after a record-setting run, the stock is consolidating gains and could resume an uptrend if earnings continue to impress. Risk-adjusted metrics have been stellar over the past year; looking ahead, we still find them acceptable given the strong expected earnings growth, but volatility will remain high. Investors should be comfortable with the potential for large swings and have a plan (e.g. stop-loss levels or a long-term conviction) to manage the risk. Overall, the technical and quantitative factors do not flash red flags, but rather underscore the importance of vigilance when investing in a high-beta turnaround stock like Brinker.

Final Recommendation

Brinker International has emerged as a top pick in the casual dining sector for the next 12 months. The company’s robust recovery – marked by industry-leading sales momentum, improving profitability, and savvy management – positions it to deliver further shareholder value, even as broader economic challenges persist. We believe the current stock price does not fully reflect Brinker’s earnings power and market share gains, and our analysis indicates a favorable risk-reward balance (expected upside of ~20–30% versus manageable downside risks). Investors should remain aware of the risks discussed, but on balance, we recommend a Buy on EAT for a 1-year time frame. Our base-case expectation is for the stock to trade into the mid-$160s to $170s over the next year as results come in at or above guidance, with the potential for even higher prices if bullish scenarios unfold. In the mid-term (2–3 years), we see Brinker as a solid outperformer relative to its peers, though likely not repeating the explosive growth of the past year. Long-term investors can also find appeal in Brinker’s improved fundamentals, but should anticipate a reversion to steadier growth in the years beyond. Bottom line: Brinker International’s turnaround is real, and while not without risks, the company’s strong execution and macro tailwinds make its stock a compelling BUY at its current valuation for those with a moderate to high risk tolerance.

References

- Investopedia – Brinker Blows Past Estimates: Brinker International exceeded earnings and revenue forecasts in Q2 FY2025, with comparable sales up 27% (Chili’s +31% traffic +20%) and raised its full-year EPS outlook to $7.50–$8.00. The stock hit an all-time high ~$180 after quadrupling over the past year (Brinker International Stock Hits All-Time High on Booming Sales at Chili’s) (Brinker International Stock Hits All-Time High on Booming Sales at Chili’s).

- TipRanks – Q1 FY2025 Results: “Brinker International Reports Strong Q1 Fiscal 2025 Results,” highlighting a surge in operating income to $56.4M (from $24.2M) and net income to $38.5M (from $7.2M) year-over-year in Q1, showcasing significant margin improvements (Brinker International Reports Strong Q1 Fiscal 2025 – TipRanks.com).

- SoundHound (Restaurant Business) – Labor Trends 2025: Industry survey showing 92% of restaurant operators experienced rising labor costs in 2024 and 89% expect further increases in 2025, underscoring persistent wage pressure. Cross-training and retention are key strategies to combat margin erosion (Restaurant Labor Trends 2025: Rising Wages Drive Need for Retention, AI – SoundHound) (Restaurant Labor Trends 2025: Rising Wages Drive Need for Retention, AI – SoundHound).

- Trading Economics – Inflation Easing: As of Feb 2025, U.S. annual inflation was ~2.8%, down from 3% in Jan and well below 2022 peaks. This moderation in price increases suggests some relief in input cost inflation for consumer businesses (United States Inflation Rate – Trading Economics).

- Darden Restaurants Q3 FY2024 – Investor Release: Darden (Olive Garden, LongHorn) saw blended same-restaurant sales decrease of 1.0% in the quarter ended Feb 2024, with Olive Garden comps down 1.8% ( Darden Restaurants Inc. – Darden Restaurants Reports Fiscal 2024 Third Quarter Results; Declares Quarterly Dividend; Authorizes New $1 Billion Share Repurchase Program; And Updates Fiscal 2024 Financial Outlook ) ( Darden Restaurants Inc. – Darden Restaurants Reports Fiscal 2024 Third Quarter Results; Declares Quarterly Dividend; Authorizes New $1 Billion Share Repurchase Program; And Updates Fiscal 2024 Financial Outlook ). Despite flat traffic, Darden’s adjusted EPS grew ~12%, indicating strong cost control.

- Cheesecake Factory Q4 FY2024 – Earnings Release: Cheesecake Factory reported comparable restaurant sales +1.7% in Q4 2024 ( The Cheesecake Factory Reports Results for Fourth Quarter of Fiscal 2024, The Cheesecake Factory Incorporated ), bucking broader casual dining softness. Management noted it outperformed the industry in traffic and opened 23 new restaurants in 2024, reflecting confidence in long-term growth.

- SeafoodSource – Bloomin’ Brands Struggles (Q4 2024): Outback Steakhouse and sister brands under Bloomin’ Brands saw comps decline (Outback -1.8%, Bonefish -1.5%, Carrabba’s -0.9%) in Q4 2024, while Fleming’s Steakhouse was +3% (Bloomin’ Brands slashes menu items, reworks organizational structure after earnings shortfall, layoffs | SeafoodSource). Bloomin’ lost 260 bps of sales and 410 bps of traffic share versus the industry in that quarter (Bloomin’ Brands slashes menu items, reworks organizational structure after earnings shortfall, layoffs | SeafoodSource), leading to corporate restructuring efforts.

- Yahoo Finance – EAT Stock Summary: Brinker’s stock has a 5-year monthly beta of 2.21, indicating high volatility relative to the market, and posted a 226% 52-week price change (vs ~7% for the S&P 500) as of April 2025 (Brinker International, Inc. (EAT) Valuation Measures & Financial …). No dividend is currently paid (yield 0%), and the 52-week trading range is $43.37 – $192.22 (Brinker International (NYSE:EAT) – Stock Price, News & Analysis).

- MarketBeat – Analyst Target: UBS Group in early 2025 raised its price target on Brinker from $108 to $146 and gave the stock a “Neutral” rating (7,692 Shares in Brinker International, Inc. (NYSE:EAT) Purchased …), reflecting that much of the easy upside had been realized by that point. (Many analysts now have targets in the $140–$160 range after Brinker’s guidance boost.)

Leave a comment