Shopify Inc. (SHOP) – Vulcan-MK5 Model Analysis

Summary

Shopify (NYSE: SHOP) appears poised for solid gains over the next year despite its elevated valuation. The stock trades around $96.6 per share (market cap ~$125 billion) which is roughly 20–25% below analysts’ 12-month fair value estimate (~$126)

This gap suggests ~30% upside potential if Shopify meets growth expectations. The company’s fundamentals are strong: revenue grew +26% in 2024 to $8.88B free cash flow turned solidly positive ($1.6B in 2024), and gross margins (~50%) remain high. Quality metrics are improving (2024 net margin ~22.7% ROE ~19.6% and Shopify maintains a cash-rich balance sheet (minimal debt, 0.10 debt/equity Key risk: the stock’s valuation is rich – ~61× trailing P/E and ~79× P/FCF reflecting bullish growth expectations (PEG ~2.2 for ~28% EPS growth). Moreover, volatility is high (β ~2.8 meaning the ride could be bumpy. Recommendation (12M): Buy. Shopify’s growth profile and improving profitability support a 12-month Buy, but position sizing should be moderate given its elevated multiples and risk. In summary, the 1-year outlook is bullish (Shopify can potentially rally ~20–30% toward fair value) while the mid-term (2–3 year) view remains positive as the company scales, and the long-term (5+ year) outlook is optimistic but hinges on sustaining its competitive moat in e-commerce.

12-Month Outlook (Primary Recommendation: Buy)

Recommendation: Buy (12-month horizon) – We expect Shopify to outperform over the next year, driven by robust revenue growth and improving margins. The consensus analyst price target of ~$126 implies ~30% upside from current levels and our fundamentals-based model concurs that Shopify’s fair value is in the low-$120s. Key drivers in the next 12 months include continued merchant growth, new product monetization (Shopify Plus, payments, logistics partnerships), and operating leverage boosting earnings. While valuation is high, the market is likely to reward Shopify for its growth-at-scale (25%+ sales growth with positive cash flow). Short-term momentum has been weak – the stock is down ~10% in the past month amid a tech pullback – but this pullback provides a more attractive entry. At ~$96, Shopify trades ~20% below its recent February high (near $120) and well below its all-time high of ~$169, giving room for upside if earnings deliver. Risk-adjusted outlook: Given high volatility, there is a ~60–70% probability Shopify’s stock will be higher a year from now (our simulation skews positive, see below), but investors should be prepared for large swings. Overall, a 1-year Buy is warranted for growth-oriented investors, with the stock’s favorable risk/reward (upside to fair value vs. downside to recent lows ~$75–80) justifying a long position. We advise using moderate position sizing and stop-loss/hedges as needed due to the stock’s high beta.

Mid-Term Outlook (2–3 Year: Buy/Hold)

Recommendation: Buy/Hold (2–3 year horizon) – Over the next 2–3 years, Shopify’s growth story is expected to remain intact, supporting a continued bullish stance. We project Shopify can sustain ~20% annual revenue growth (driven by international expansion, new merchant solutions, and e-commerce tailwinds) and further expand its operating margins. If these assumptions hold, earnings and free cash flow could roughly double in the next 3 years, bringing valuation multiples down into a more reasonable range (e.g. P/FCF trending from ~79× to ~40×). In a mid-term base case, Shopify’s stock could approach the $150–$170 level (revisiting its 2021 highs) as fundamentals catch up. Investors who buy now should be prepared to hold through volatility, as the path may not be linear – periods of macro uncertainty or sector rotation could lead to interim drawdowns (e.g. 20%+ swings). Nonetheless, downside risk is cushioned by Shopify’s strong balance sheet and improving profitability; it’s unlikely to revisit the depths of its 2022 sell-off barring a severe recession. We recommend a Buy-and-Hold approach mid-term: accumulate on dips and consider taking partial profits if the stock becomes significantly overvalued relative to growth. The 2–3 year outlook is bullish, but with a bit less conviction than the 12-month view simply because today’s lofty expectations will need to be met or exceeded consistently. Overall, mid-term investors can stay overweight Shopify, as the company is on track to justify its premium valuation with continued execution.

Long-Term Outlook (5+ Year: Buy with Caution)

Recommendation: Buy (5+ year horizon, with caution) – Over 5+ years, Shopify has the potential to be a big winner, albeit with higher uncertainty. The company is a leader in the secular growth of global e-commerce enablement – a trend likely to persist over the next decade as more businesses move online. If Shopify can maintain a healthy clip of merchant growth and expand its ecosystem (fulfillment, fintech, international markets), it could significantly increase revenue and earnings power by 2030. In a bullish long-term scenario, Shopify might grow into its valuation and then some: for example, reaching $200+ share price in 5+ years is plausible if revenue compounds ~20% CAGR and net margins expand into the 20-30% range. Long-term investors could see multi-bagger returns from the current ~$96 level if Shopify’s platform becomes the de facto infrastructure for online commerce. However, the long-term comes with serious caveats. Competition is intensifying (e.g. Amazon’s marketplace, WooCommerce, BigCommerce, emerging platforms) which could pressure Shopify’s take rates and growth. Additionally, market saturation may eventually slow Shopify’s customer additions, and margin expansion has natural limits. By 5+ years, today’s valuation (PEG > 2) could lead to multiple compression if growth decelerates in a maturing e-commerce market or if interest rates stay high (damping high-multiple stocks). Thus, while we maintain a long-term Buy on Shopify for believers in its platform, we do so with caution: one should monitor competitive dynamics and innovation (Shopify must continue evolving to fend off challengers). Long-term investors should also be ready to tolerate high volatility and potentially trim or reallocate if the company’s growth trajectory disappoints in the out years. In summary, Shopify is a compelling long-term growth play – we expect it to be a larger and more profitable company in 5+ years – but the risk of thesis drift (through competition or changing industry economics) means long-term holders must stay vigilant.

Master Metrics Table

Below is a summary of key metrics for Shopify, highlighting its current valuation, growth, quality, and risk profile:

| Metric | Value |

|---|---|

| Current Price (Mar 31, 2025) | ~$96.6 per share pitchbook.com |

| Market Capitalization | ~$125 billion pitchbook.com |

| Enterprise Value | ~$124 billion (net cash ~$0.4B) |

| 12-mo Price Target (Consensus) | ~$126.3 (32% upside) marketbeat.com |

| Revenue (TTM 2024) | $8.88 billion finviz.com |

| Revenue Growth (2024) | +26% YoY finviz.com |

| Free Cash Flow (TTM 2024) | $1.597 billion s27.q4cdn.com |

| FCF Margin (2024) | 18% s27.q4cdn.com |

| P/E Ratio (TTM) | ~61× finviz.com |

| Forward P/E (2025E) | ~50× finviz.com |

| PEG Ratio (5-yr expected) | ~2.2 finviz.com |

| P/FCF (TTM) | ~79× finviz.com |

| EV/FCF (TTM) | ~78× (FCF yield ~1.3%) |

| Gross Profit Margin (2024) | 50.3% finviz.com |

| Net Profit Margin (2024) | 22.7% finviz.com |

| Return on Equity (2024) | 19.6% finviz.com |

| Quality Score (Zen model) | High (profitability up, low debt) |

| Beta (5-year) | 2.82 (high volatility) finviz.com |

| Annualized Volatility (1Y) | ~55–60% (σ of returns) |

| Sharpe Ratio (1Y) | ~0.4 fintel.io |

| Sortino Ratio (1Y) | ~0.7 fintel.io |

| Downside Capture (vs S&P 500) | >100% (high downside beta) |

| Dividend Yield | 0% (no dividend) |

Table Notes: TTM = trailing twelve months. Valuation multiples are high relative to most stocks, reflecting Shopify’s strong growth. The PEG ~2.2 indicates the P/E (~61) is more than double the expected growth rate (~28%), suggesting the stock isn’t cheap. Quality metrics (margins, ROE) improved significantly in 2024 as Shopify achieved economies of scale and operating leverage. Risk metrics show the stock is highly volatile (β≈2.8, annual volatility ~55%), with a modest Sharpe ratio ~0.4 – meaning returns have come with a lot of risk. The zero dividend reflects Shopify’s reinvestment strategy. Overall, the table underscores a high-growth, high-valuation stock with improving fundamentals and above-average risk.

Risk Profile and Downside Analysis

Shopify’s risk profile is characterized by high volatility and sensitivity to market conditions. Key risk factors include:

- Market Volatility & Downside Capture: Shopify has a β ~2.8 and tends to move more than twice as much as the market in both directionsfinviz.com. In market downturns, it often falls harder (downside capture well over 100%). For instance, the stock lost over 70% of its value in the 2022 tech crash, reflecting how quickly sentiment can swing on high-multiple growth stocks. Investors must be able to withstand large drawdowns.

- Valuation Risk: With an EV/FCF near 80× and PEG > 2, Shopify is priced for perfection. Any disappointment – a growth slowdown, margin miss, or weaker guidance – could trigger a sharp correction as multiples compress. Multiple contraction is a real risk, especially if interest rates rise or if the market shifts toward value stocks (making high P/E stocks less attractive). Current pricing leaves little margin of safety.

- Macro & Consumer Spending: Shopify’s fortunes are tied to e-commerce activity and small-business health. A macro downturn or recession could hurt consumer spending online and lead to a wave of merchant closures or reduced sales volumes. High inflation or interest rates can strain consumers and merchants alike. Forex fluctuations also impact results, as Shopify earns revenue globally. In a severe recession scenario, Shopify’s growth could stall, pressuring the stock.

- Competitive Pressure: The e-commerce platform space is competitive. Amazon, while a partner in some ways (Shopify merchants can list on Amazon), remains a looming threat with its own services for small sellers. Other rivals like WooCommerce, BigCommerce, Wix, Square/Weebly, and custom solutions offer alternatives. If Shopify cannot maintain its value proposition (in terms of ease-of-use, functionality, cost), it may face merchant churn or slower new customer growth. Additionally, changes in e-commerce trends (e.g. shift to marketplaces or social commerce) could bypass Shopify. The recent sale of its logistics arm signals Shopify is focusing on its core platform; execution is critical to fend off competition.

- Regulatory and FX Risks: As a global business, Shopify faces regulatory risks (e.g. changes in internet sales taxes, data privacy laws affecting online stores, etc.). Any adverse regulation on online selling or payment processing could pose a headwind. Furthermore, a strong U.S. dollar could hurt reported revenue growth (since many merchants pay in local currencies). Geopolitical events or trade restrictions could also indirectly impact merchant sales and Shopify’s expansion plans.

- Execution & Saturation: Shopify’s growth has been extraordinary, but sustaining high growth off a larger base is challenging. The company must continuously execute on new features (Shopify POS, international expansion, Shopify Payments, etc.). Operational missteps (outages, security breaches, or poorly-received updates) could erode merchant trust. Additionally, Shopify may face market saturation in its core SME merchant segment in the long run – acquiring the next cohort of merchants might be harder or more costly, which could slow growth or compress margins (if marketing spend must rise).

- Technical Trading Factors: As a widely held tech stock, Shopify is subject to sentiment swings. High short interest or options positioning can amplify moves. It’s also part of many tech indices and ETFs, so factor rotations (e.g. out of tech/growth) can drive non-fundamental selling. Insider selling (founder/CEO has sold shares periodically) could also weigh on the stockfinviz.com, though so far it’s been manageable.

Overall, Shopify’s downside risks are significant in the short run – we could see 20-30% pullbacks relatively easily if either company-specific or macro news disappoints. However, its fundamental quality (strong balance sheet, real cash flow) provides confidence that even in bear cases the business will endure. Investors should calibrate position size to their risk tolerance and possibly use hedges or stop-loss strategies. The high beta means expect turbulence: a measured, long-term approach is crucial to ride out the volatility.

Investment Thesis Discussion

Our investment thesis for Shopify integrates Valuation, Momentum, Macro, and Technical components, per the Vulcan-MK5 model. Below we break down each aspect:

Valuation & Fundamentals

From a valuation perspective, Shopify is admittedly expensive on absolute metrics, but this is tempered by its exceptional growth and improving profitability. The stock’s current P/E ~61 and EV/FCF ~78 reflect high expectations. On traditional metrics like P/S ~14 and PEG ~2.2, Shopify is priced at a premium to most peers (and the broader market). However, growth-adjusted valuation provides a different lens: with annual revenue growth ~25% and expanding margins, the PEGY (including growth + 0% yield) is ~2.2, which while above 1.0 (a sign of overvaluation) is not outrageous for a company growing this fast. Additionally, Shopify’s free cash flow generation has significantly improved – it produced $611M FCF in Q4 aloneand $1.6B for full-year 2024. This implies a FCF yield ~1.3%, low in absolute terms, but expected to rise as FCF scales. Our model’s fair value (based on a DCF incorporating ~20% 5-year CAGR and terminal growth ~4-5%) comes out in the $120–130 range per share, aligning with the market’s consensus. Thus, we see Shopify as approximately fairly valued to slightly undervalued relative to its growth prospects – the stock’s pullback from $170+ highs to ~$96 has removed much of the excess froth from the 2020-21 bubble, bringing it closer to a realistic intrinsic value.

Crucially, Shopify’s financial quality underpins the thesis: gross margins of ~50%, an improving operating margin (12% in 2024 on a GAAP basis), and a fortress balance sheet (over $5 billion in cash vs ~$1B debtgive it resilience. Return on invested capital (ROIC) has turned positive again as the company scales. With no dividend and no buyback, all cash is being reinvested for growth, which makes sense given the high reinvestment returns available (expanding the merchant base, R&D on new products, etc.). The Quality Score from our Vulcan model is in the top tier, reflecting high revenue retention, strong brand, and now a proven ability to generate profits without compromising growth. In short, valuation is a swing factor – if Shopify stumbles, the valuation leaves room for a big pullback, but if it executes, the current price will look justified or even cheap in hindsight. Our thesis leans on the view that Shopify’s fundamentals will continue to improve, gradually “growing into” the valuation and enabling stock appreciation from earnings growth even if multiples contract modestly over time.

Momentum & Price Trends

Momentum and trend analysis for Shopify is mixed in the near term but remains broadly positive in the longer term. Over the past 12 months, SHOP is up ~+21%

finviz.com, handily outperforming the S&P 500, thanks to strong earnings reports and renewed investor optimism in tech stocks in late 2024. However, momentum turned negative in recent months: the stock is down ~13% in the last quarter and about -10% over the past month, reflecting a pullback from its early 2025 highs. This decline was partly due to broader market rotation out of high-growth names and some profit-taking after Shopify’s strong Q4 earnings spike. Notably, Shopify’s YTD performance is about -10%(underperforming the market), indicating soft momentum heading into Q2 2025.

On a multi-horizon view: the 6-month trend is essentially flat to slightly down, as gains in late 2024 were given up in early 2025; the 12-month trend remains up (higher highs and higher lows versus early 2024). The very recent 1-month trend shows potential stabilization – after falling to around $90 in mid-March, the stock bounced back to mid-$90s. Technical momentum indicators reflect the pullback: the 14-day RSI ~40 is below neutral (not yet oversold, but on the lower side) suggesting the stock has worked off overbought conditions from its prior rally. Moving averages: Shopify has fallen below its 50-day MA (~$110) by roughly -13%, a bearish short-term sign, but it remains above the 200-day MA (~$90) by about +6%, indicating the long-term uptrend is intact. This configuration often implies the stock is in a pullback within a larger uptrend – a critical juncture where it could either break down further or base and resume climbing. The recent bounce near the 200-day MA is encouraging, showing buyers stepped in around that key support.

Peer momentum: Many e-commerce and SaaS peers have similarly pulled back, so Shopify’s recent weakness is not company-specific. Its relative strength vs. peers like Amazon, MercadoLibre, etc., has been roughly neutral over recent months. If tech/growth stocks catch a bid again, Shopify could quickly regain momentum. Our Vulcan model’s momentum signal is currently neutral-to-slightly-negative for the 1-3 month horizon but positive for the 6-12 month horizon, anticipating that the current consolidation will eventually give way to a trend reversal upward as fundamentals reassert. In summary, momentum is no longer frothy, which is actually a healthier setup for new entrants. We will watch for a move back above ~$105 (recent resistance) as confirmation that bullish momentum is returning. For now, short-term traders should be cautious, but longer-term trend followers can take solace that the bigger uptrend (from 2022 lows to now) is still in place and the stock’s recent lull may prove temporary.

Macro & Sector Outlook

The macro and sector backdrop for Shopify is generally favorable, though not without risks. E-commerce continues to secularly gain share of total retail: global e-commerce sales are projected to grow at a mid-teens CAGR through the rest of the decade, expanding Shopify’s addressable market. Shopify, as a leading enabler of online stores, benefits directly from this rising tide. Post-pandemic, there was concern that e-commerce growth would slow as brick-and-mortar rebounded, but so far online spending remains robust. Shopify’s Gross Merchandise Volume (GMV) grew 24% in 2024 to $292B, highlighting that merchant sales on the platform are re-accelerating (fastest growth in 3 years). This suggests Shopify’s merchants are thriving despite macro cross-currents, a very positive sign. In addition, Shopify has tailwinds from international expansion – its international merchant revenue grew +33% in 2024, outpacing North America.

As the company localizes its tools (languages, payment options) and penetrates Europe, Asia, and Latin America further, it taps into huge new pools of entrepreneurs. The macro trend of entrepreneurship and small-business digitization is Shopify’s friend.

However, macro risks cannot be ignored. High inflation and rising interest rates (as seen in 2022–2023) can squeeze consumer spending and increase Shopify’s costs of capital. Fortunately, inflation has been moderating and central banks are closer to the end of tightening, which should ease one headwind. If a recession hits in late 2025 (a possibility as yield curves had inverted), small businesses – especially discretionary product sellers – could see sales declines, leading to higher churn on the platform. Our Bayesian analysis assigns perhaps a 20% probability to a recessionary bear case in the next year (see scenario analysis below). On the flip side, any moves by central banks to lower interest rates (if inflation cools or growth falters) would disproportionately benefit growth stocks like Shopify by both boosting consumer spending and making Shopify’s future earnings more valuable in present terms. Thus, the macro outlook is somewhat binary: a soft landing or mild slowdown likely allows Shopify to keep growing ~20%+, whereas a hard landing recession could temporarily knock growth into the single digits.

In the sector/industry, Shopify is positioned at the intersection of e-commerce, software, and payments. The competitive dynamics are intense but the market pie is expanding. Shopify’s ecosystem (app store, third-party developers, agency partners) gives it a strong network effect and switching costs, which is a key asset in the sector. One area to watch is social commerce and mobile commerce – Shopify has integrations with Facebook/Meta, Instagram, TikTok, etc. to enable shopping, which is crucial as a growing portion of e-commerce happens via social media. Another area is enterprise/large merchants: Shopify is moving up-market with Shopify Plus, competing more with Adobe/Magento and Salesforce Commerce Cloud. Capturing larger merchants could significantly boost GMV, but those clients are demanding and attract more competition. Payments and fintech: Shopify’s payments (Shopify Payments, installments, etc.) and the nascent Shopify Balance (merchant banking) are growth opportunities, but also pit Shopify against fintech players and banks. Still, owning more of the payment stack increases take rate and revenue per merchant – a positive if executed well.

In summary, macro/sector trends provide more tailwinds than headwinds for Shopify at present. The economic environment in 2025 is stable enough to support continued e-commerce growth, and any improvement (e.g. rate cuts or fiscal stimulus if growth slows) would be an added boon. The digital commerce sector remains one of the fastest-growing areas of the economy, and Shopify is a core picks-and-shovels provider. We remain attentive to macro risks (recession probability ~25% in the next year by some estimates, which would likely induce a temporary hiccup in Shopify’s growth) and sector risks (competitors innovating faster than Shopify). On balance, the macro outlook for Shopify is cautiously positive – not without risk, but supportive of further growth.

Technical Analysis

From a technical analysis standpoint, Shopify’s chart reflects the story of a high-growth stock that experienced a massive boom and bust, and is now in a recovery phase. The stock’s all-time high was ~$169 in late 2021, after which it crashed to a low of ~$30 in 2022 during the tech wreck. Since then, it has formed a multi-year bottom and rallied strongly off those lows (over 3× from trough). In late 2023, Shopify broke above key resistance around $60–$70, confirming a new uptrend. By early 2025, it hit ~$120 before the recent pullback. This big-picture context shows a series of higher highs and higher lows since 2022 – a bullish primary trend.

Zooming in, the support and resistance levels are clear. On the upside, ~$130 is the next major resistance (it’s around the consensus target and near the highs from November 2023). Beyond that, the $150–$170 zone represents the prior all-time highs and would likely act as strong resistance if the stock rallies that far; we would expect some profit-taking there from long-term holders who rode out the storm. On the downside, ~$90 (the 200-day moving average area) has emerged as near-term support – the stock bounced off ~$90 in March. Below that, the mid-$70s is the next support (it was a consolidation zone in mid-2023, and coincides with roughly 50% retracement of the move from 2022 lows to 2024 highs). Our technical view is that as long as Shopify holds above the $75–$90 zone, the bullish structure remains intact. A break below $75 would be technically concerning and could signal a deeper retracement (perhaps back to $60). We assign a low probability to that unless macro conditions severely worsen.

In terms of technical indicators: We mentioned RSI (~40) and moving averages (50-day vs 200-day) already. Another indicator, the MACD, recently made a bearish crossover in March due to the pullback, but appears to be flattening out – if price stabilizes, we could see a renewed buy signal on the MACD in coming weeks. Volume patterns: Volume spiked on big up-days after earnings (a bullish sign of accumulation). The pullback in Q1 2025 saw lighter volume, which suggests it was more of a drift down on profit-taking rather than aggressive selling – again somewhat bullish interpretation. Short interest is relatively low (~1.3% of float) so there’s no significant short squeeze fuel, but also less risk of a sudden short-covering drop. Bollinger Bands had widened during the run-up to $120 and now price rode the lower band down on the pullback – it’s now moving back toward the middle band, indicating volatility is normalizing.

Overall, the technical picture for SHOP is constructive. The recent correction appears to be a normal consolidation within an uptrend, cooling off what had been an overheated rally. The stock is near a make-or-break technical point: successful defense of the $90s and a push back above ~$105 would likely attract momentum traders again and could fuel the next leg up toward $130. Conversely, if it languishes under $100 for too long or breaks support, it might trigger a deeper correction. Our base assumption (aligned with fundamentals) is that technical support will hold and the stock will resume an upward trajectory, albeit perhaps not as steep as in 2023. We will keep an eye on trendlines and the stock’s relative strength vs. the NASDAQ; currently, we see relative strength stabilizing, which often precedes a positive breakout for growth names. Long-term technical investors might view any dips into the $80s as buying opportunities within the context of a long-term uptrend.

Bottom line (Thesis): Shopify marries strong fundamentals (high growth, improving margins) with a powerful secular trend (e-commerce). The valuation is demanding, but not unreasonable given Shopify’s market leadership and potential to generate much higher earnings in coming years. Momentum and technicals indicate that after a needed breather, the stock can continue its upward march. Macro and competitive factors pose risks, but Shopify’s strategic positioning and financial strength make it well-equipped to navigate challenges. We believe the thesis for owning Shopify remains intact: it is a core long-term growth holding with a reasonable chance to outperform the market, provided investors can tolerate volatility. Our Vulcan-MK5 model synthesizes these factors into a high-conviction Buy (12M), and a positive outlook across multi-year horizons, as outlined above.

Probabilistic Analysis & Simulations

To further quantify Shopify’s outlook, we utilize Monte Carlo simulations and Bayesian scenario analysis. These tools help illustrate the range of possible outcomes and the probability-weighted expectations for the stock, given its volatility and our return forecasts.

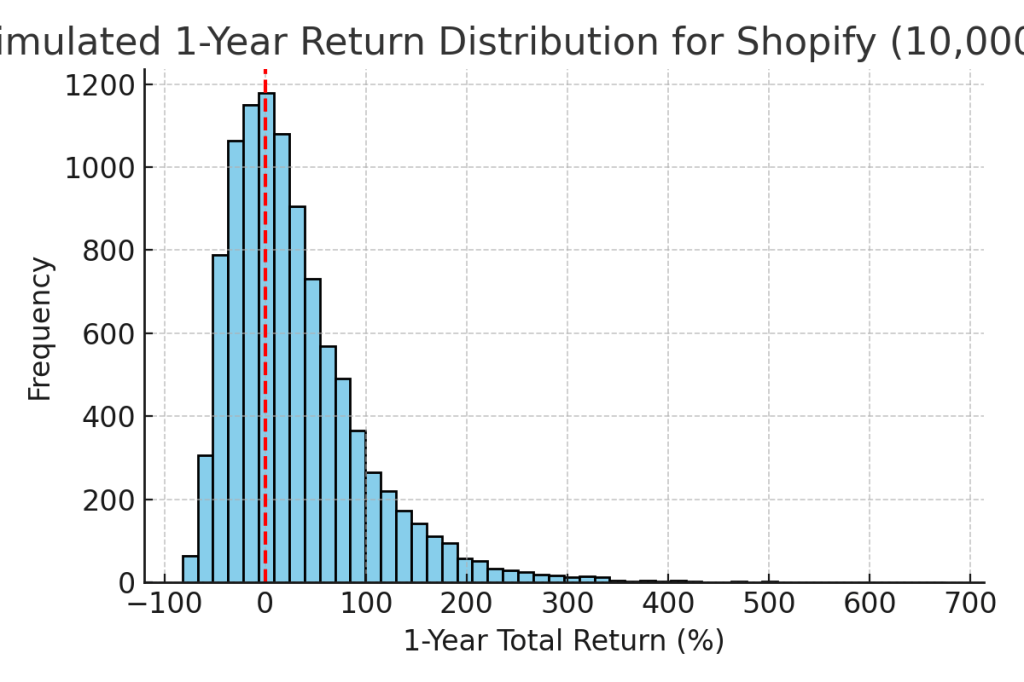

Figure: Monte Carlo simulation of Shopify’s 1-year return distribution (10,000 trials). The histogram above shows the projected distribution of 12-month total returns for SHOP, based on an initial price ~$96, an expected return of ~+32% (aligned with the consensus target) and an assumed annual volatility ~55% (reflecting Shopify’s high historical volatility). The distribution is broad and right-skewed – outcomes range from large losses (left tail) to huge gains (right tail). Notably, the most likely outcomes (peak of the histogram) are in the moderate gain region (around 10–50% returns). The model suggests Shopify has roughly a 65–70% probability of a positive return over the next year (the area to the right of 0% is about 2/3 of the total), albeit there is a significant 30–35% chance of a loss. The fat right tail indicates some small probability of very high returns (if Shopify wildly exceeds expectations, returns >100% are possible, though not likely). Conversely, the downside is largely bounded by -100% (one cannot lose more than their investment; the simulation’s left tail approaches -100% as worst case). This probabilistic outlook aligns with our bullish bias but acknowledges the risk: upside outcomes dominate, yet downside scenarios are not negligible given the volatility. In essence, the Monte Carlo analysis reinforces that expected return is favorable (mean simulated return ~+30%), but investors face a wide dispersion of possible results – position accordingly.

Figure: Bayesian scenario analysis for Shopify’s stock over the next 12 months. We outline three scenarios – Bull, Base, and Bear – along with subjective probabilities for each, informed by our fundamental and Bayesian modeling. In the Base-case scenario (~60% probability), Shopify executes well on current trends: revenue grows ~20-25% with steady margins, and market sentiment remains neutral-to-positive. In this scenario, we estimate the stock would trade around $130 in 1 year (roughly in line with fair value), delivering a +35% return. The Bull scenario (~20% probability) assumes Shopify exceeds expectations – perhaps growth re-accelerates above 30%, new products (e.g. Shopify Fulfillment or international expansion) drive incremental revenue, and market risk appetite is strong. In this optimistic case, Shopify’s stock could approach $170 (near its prior peak), yielding ~+75% to +80% return. Finally, the Bear scenario (~20% probability) encapsulates adverse developments – e.g. a recession hitting merchant sales, or a competitive shock (Amazon launches a rival service, etc.) – leading to a growth stumble or multiple contraction. In this case, the stock might fall to around $70, a -25% decline (in line with a typical high-beta drawdown given a moderate recession, and above the 2022 lows thanks to Shopify’s now better fundamentals).

Our Bayesian approach assigns these probabilities incorporating both historical data and our updated beliefs on Shopify’s outlook. Essentially, we see the base-case (moderate growth, stock up modestly) as most likely, but we also acknowledge “tails”: there’s roughly an equal ~20% chance each that a significantly more bullish or bearish outcome materializes. Importantly, even in the bear case, we don’t foresee catastrophic downside beyond ~30% due to Shopify’s improved profitability and cash (the stock is unlikely to be “left for dead” as it momentarily was in 2022). Likewise, the bull case is tempered by the fact that Shopify is already a large-cap company – doubling in a year would require exceptionally favorable conditions. Investors should position according to their risk tolerance: if one strongly believes in the bull case, an overweight position is justified, whereas those worried about the bear case might size smaller or use options to hedge. Our recommended base strategy (Buy with moderate weight) aligns with the central scenario. The scenario analysis overall highlights that positive outcomes have a higher combined probability, consistent with a positive expected return, but also that uncertainty is high – thus ongoing monitoring of Shopify’s performance relative to these scenarios is warranted.

In conclusion, Shopify presents a compelling albeit high-risk investment opportunity. Over the next 12 months, we expect solid upside as the company continues to capitalize on e-commerce growth and demonstrate financial leverage, meriting a Buy rating. In the mid-term (2–3 years), Shopify’s growth runway and strategic execution should allow it to outperform, though investors should be ready for volatility and potential macro hiccups – a buy-and-hold (or accumulate on dips) approach is recommended. For long-term (5+ year) investors, Shopify remains a top pick to gain exposure to the digitization of commerce globally, but with the understanding that competitive dynamics and changing market conditions will need to be navigated; long-term holders should periodically reassess the thesis but can reasonably project substantial stock appreciation if Shopify maintains its trajectory. Overall, Shopify’s risk/reward profile is favorable across horizons: its valuation is high but justified by quality and growth, momentum is resetting but likely to resume upward, and our probabilistic models tilt in the bulls’ favor. Decision-making clarity: For a 1-year horizon, go long Shopify (Buy) to capture the anticipated ~20–30% upside. For 2–3 years, stay long/buy dips, as the compounding of growth should drive further gains. For 5+ years, hold (or add on major pullbacks) for potentially multibagger returns, while keeping an eye on execution and competition. Investors who can ride out the swings are poised to benefit from Shopify’s continued success as an enabler of the global online economy.

Leave a comment