Visa Inc. (V) – Vulcan-mk5 Investment Analysis

Summary – Recommendation: Buy (Reasonable Long-Term Buy)

Visa Inc. is a high-quality, wide-moat payments leader that currently trades around fair value with a slight discount. Our Vulcan-mk5 model analysis indicates a Buy recommendation for long-term investors. Visa boasts exceptional financial quality (100/100 quality score) and stability, and its secular growth drivers (digital payments, e-commerce, travel spending) remain robust (Visa profit beats expectation on resilient consumer spending | Reuters) (Visa Earnings: Market Conditions Remain Favorable – Morningstar). While near-term upside may be modest given the stock’s recent rally to all-time highs (Visa – 17 Year Stock Price History | V | MacroTrends), Visa’s combination of steady double-digit growth, resilient cash flows, and strong risk-adjusted returns support a bullish long-term outlook. Investors can expect solid performance with relatively low volatility, though the stock’s rich valuation warrants watching for any macro or regulatory risks.

Key Master Metrics Summary

At ~$343 per share, Visa trades only slightly below our estimated fair value of ~$360 (about a 5% undervaluation). This aligns with analyst price targets (mean ~$377) implying ~10% upside (Visa, Inc.: Target Price Consensus and Analysts Recommendations | V). The dividend yield is modest at 0.7% (Visa Inc. (V) – Stock Analysis | PortfoliosLab), reflecting Visa’s focus on buybacks and growth over income. Visa’s valuation is elevated – about 33× free cash flow and a PEG ratio ~2.4 (Visa Inc. (V) Statistics & Valuation – Stock Analysis) – which is high, but arguably justified by its consistent growth and dominant market position. Despite the premium valuation, Visa’s volatility (~23% annual) is moderate (Visa Inc. (V) – Historical Volatility (Close-to-Close) (30-Day)) and its expected Sharpe ratio is a respectable ~0.6 (projected 5-year return ~10%/yr vs. volatility), signaling a favorable risk-adjusted return profile.

| Metric | Value |

|---|---|

| Current Price (Mar 2025) | ~$342.80 |

| Estimated Fair Value | ~$359.57 |

| Discount to Fair Value | ~4.9% (undervalued) |

| Dividend Yield | ~0.7% |

| PEGY Ratio | ~2.4 |

| EV/FCF | ~32.9× |

| Annual Volatility | ~23.6% |

| Sharpe Ratio (Expected) | ~0.58 |

(Source: Vulcan-mk5 model and data (Visa, Inc.: Target Price Consensus and Analysts Recommendations | V) (Visa Inc. (V) – Stock Analysis | PortfoliosLab) (Visa Inc. (V) Statistics & Valuation – Stock Analysis))

Short to Mid-Term Outlook (Now – Q1 2026)

In the next 4–6 quarters, Visa’s stock may see limited upside as it consolidates recent gains. The shares have surged to record highs (52-week high ~$366) on strong consumer spending trends (Visa profit beats expectation on resilient consumer spending | Reuters) (Visa – 17 Year Stock Price History | V | MacroTrends). This momentum means much of the good news may be priced in. Consensus 12-month forecasts even suggest a modest pullback (-~10% total return potential) from current levels, implying the stock is near fair value in the short run. Visa’s own fundamentals remain healthy – payment volumes are growing at high-single-digit rates and travel-related cross-border volumes are rising double-digits (Visa profit beats expectation on resilient consumer spending | Reuters) – but the valuation leaves little room for disappointment.

In the short term, macroeconomic conditions will be a key driver. Visa’s management expects consumer spending to stay “remarkably stable” into 2025 (Visa profit beats expectation on resilient consumer spending | Reuters), aided by a potential soft landing scenario for the economy. This bodes well for transaction volumes. However, any signs of a consumer slowdown or recession (e.g. from rising interest costs or geopolitical shocks) could temper Visa’s growth and hit the stock. Notably, Asia-Pacific spending has been softer due to China’s weaker economy (Visa profit beats expectation on resilient consumer spending | Reuters), so a rebound (or further weakness) there will impact results. On balance, through Q1 2026 we anticipate solid earnings growth (high single-digit to low teens) for Visa, but the stock’s valuation may compress slightly if interest rates stay high or market sentiment shifts. Overall, a hold or modest buy on dips approach seems prudent in the short run – Visa is not a screaming bargain at the moment, but any market pullbacks could present attractive entry points given its fundamental strength.

Long-Term Outlook (Q2 2026 – 2029)

Looking 3–5 years out, Visa’s long-term trajectory appears strongly positive. The company enjoys powerful secular tailwinds: the ongoing shift from cash to digital payments, growth in e-commerce, and increasing travel & cross-border spending will all fuel Visa’s transaction volumes. Visa’s network scale and competitive moat (ubiquitous acceptance, trusted brand, and partnerships worldwide) position it to capture a large share of the $20+ trillion in payments still done via cash/checks globally (Visa Annual Report 2024). Analysts project Visa can sustain a low-teens annual EPS growth rate longer term (Visa profit beats expectation on resilient consumer spending | Reuters). Our model’s base case forecasts roughly ~13% earnings CAGR through 2029, which (with some multiple contraction) translates to high-single to low-double-digit annual stock returns (~10%/year). That implies the stock price could be in the mid-$500s by 2029 in a steady-state scenario (see Scenario Analysis below).

Critically, Visa’s business model generates high free cash flow and returns on capital, enabling continued dividend growth (11%+ 5yr DGR) and large share buybacks. This shareholder-friendly capital allocation should bolster long-term total returns. Visa has increased its dividend for 16 consecutive years (Visa Inc. (V) – Stock Analysis | PortfoliosLab), and while the yield is small, the compounding effect is meaningful over time. Barring major disruption, Visa’s earnings should roughly double over the next ~5–7 years, supported by global payment volume growth and expansion into new payment flows (like B2B, P2P, and fintech partnerships). Our long-term outlook thus sees compelling compounding potential with relatively low fundamental risk. Even if valuation multiples gradually normalize, Visa is poised to deliver solid risk-adjusted gains for patient investors through 2029.

Risk & Macroeconomic Considerations

Visa exhibits a favorable risk profile for a growth stock. Its beta tends to be below 1 (historically ~0.9), and annualized volatility around ~23–24% (Visa Inc. (V) – Historical Volatility (Close-to-Close) (30-Day)) is only modestly higher than the broader market. The stock’s risk-adjusted performance has been excellent: over the past year, Visa’s Sharpe ratio was ~1.30 versus ~0.52 for the S&P 500, and its Sortino ratio (downside-risk-adjusted) ~1.78 vs ~0.78 for the S&P (Visa Inc. (V) – Stock Analysis | PortfoliosLab). This indicates Visa has delivered superior returns per unit of risk and tends to hold up better during market drawdowns. Indeed, Visa’s downside capture has been relatively low – in market corrections, Visa often falls less than the overall market, reflecting its stable, transaction-driven revenue and strong margins. The company’s financial strength underpins this resilience: Visa carries an AA- credit rating and a conservative balance sheet (Debt/Capital ~35% vs ~40% “safe” guideline), with very low recession bankruptcy risk (~0.5% 30-yr default odds). This fortress-like safety (5/5 safety rating in our model) gives confidence that Visa can weather economic storms without jeopardy to its dividend or operations.

Macroeconomic exposure: Visa’s fortunes are tied to consumer spending and global economic activity. A broad economic downturn is the primary risk that could cause a significant drop in Visa’s stock. In a severe recession scenario, payment volumes could stagnate or decline (as seen briefly in early 2020), pressuring revenue. Our bear-case analysis (see below) assumes a period of sub-par growth (high single-digit % EPS growth) and a lower valuation multiple – which yields a roughly flat stock outcome over the next 5 years. On the upside, a robust global economy with sustained consumer spending (particularly travel and experiences spending) would be a boon for Visa. Recent trends are encouraging: consumers have largely maintained spending despite inflation and higher rates (Visa profit beats expectation on resilient consumer spending | Reuters) (Visa profit beats expectation on resilient consumer spending | Reuters). Cross-border travel spending has rebounded strongly post-pandemic (Visa profit beats expectation on resilient consumer spending | Reuters), which is high-margin business for Visa. This suggests Visa has macro tailwinds as long as the global economy avoids a deep recession.

Aside from the economy, regulatory and competitive factors present risks. Visa faces ongoing antitrust scrutiny over its dominant position and fees – the U.S. DOJ recently sued Visa alleging debit card market monopolization, and courts have challenged Visa/Mastercard’s interchange fee practices (Visa profit beats expectation on resilient consumer spending | Reuters). While Visa has called these claims meritless and has successfully navigated past regulatory challenges, adverse rulings or new fee regulations could impact its revenue or business model over time. Competition is also emerging at the margins: fintech alternatives, real-time payment networks, and regional payment schemes (especially in markets like Europe, India, and Brazil) aim to erode the card networks’ share. Thus far, Visa’s entrenched network effects and partnerships have preserved its dominance, but it will need to continuously innovate (e.g. in fintech integrations, mobile payments, crypto/blockchain capabilities, etc.) to fend off disintermediation. Overall, Visa’s wide moat and adaptiveness have kept competitive threats at bay (Visa Inc. Class A (V) Moat Analysis | EcoMoat) (Visa Inc. Class A (V) Moat Analysis | EcoMoat). We view regulatory/competition risks as manageable but worth monitoring.

In summary, Visa’s risk profile is attractive for a growth equity: it offers defensive characteristics (strong cash flows, global diversification, high margins) coupled with steady growth. Macroeconomic cycles will influence the ride, but Visa’s secular trends and prudent risk management should allow it to outperform over a full cycle on a risk-adjusted basis.

Investment Thesis – Key Factors

Valuation: Visa is not cheap, but it is reasonably valued relative to its quality and growth. The stock trades around 29× forward earnings and ~33× free cash flow (Visa Inc. (V) Statistics & Valuation – Stock Analysis), which is a premium to the market. Its PEGY ratio near 2.4 indicates the price is high relative to the earnings growth + dividend rate. However, Visa’s fair value is estimated around the mid-$300s per share in our model, close to the current price. This suggests the stock is fairly valued to slightly undervalued. Analysts also rate Visa a Buy with an average target in the $370s (Visa, Inc.: Target Price Consensus and Analysts Recommendations | V), corroborating that the stock isn’t excessively priced. In short, investors are paying up for a world-class business – the valuation leaves moderate but positive upside over time. As long as Visa delivers on consensus growth (~12–15% EPS growth), the current entry price can yield satisfactory returns. Downside risk from valuation appears limited; even a market pullback that contracts Visa’s P/E would likely be temporary given its earnings resilience. We view Visa’s valuation as justified by its dominant franchise and high ROI, though not a bargain – accumulation on dips is advisable.

Momentum: Visa’s stock has strong positive momentum. It rose ~26% in 2023 and another ~22% in 2024, significantly outperforming the S&P 500, and recently notched an all-time high of ~$362/share in early 2025 (Visa – 17 Year Stock Price History | V | MacroTrends). The stock is trading above key moving averages and in a long-term uptrend. This momentum reflects improving business performance post-pandemic and investor confidence in Visa’s durable growth. Technically, Visa has exhibited relative strength – for instance, it is ~35% above its 52-week low of $252 (Visa – 17 Year Stock Price History | V | MacroTrends). Such momentum can be self-sustaining in the absence of negative news, as investors are willing to “buy high” for consistent compounders like Visa. However, the recent pace of gains may moderate. The stock’s RSI and other momentum indicators have likely been in overbought territory after the multi-quarter rally. Indeed, as noted, Wall Street’s 1-year outlook is for essentially flat performance, implying the near-term momentum may flatten as the stock digests its run. We don’t foresee a major correction barring an external shock, but a period of range-bound trading (perhaps in the $320–$370 range) could occur as earnings catch up to the price. Overall, Visa’s momentum is a positive signal of market sentiment, but investors should be prepared for more normalized returns going forward rather than the 20%+ annual jumps of the past two years.

Macroeconomic Outlook: The macro backdrop for Visa appears generally favorable, with some caveats. Consumer spending – the lifeblood of Visa’s revenue – has been resilient. Despite inflation and higher interest rates, consumers (across income levels) continue to spend on travel and experiences, shifting from goods to services but not pulling back overall (Visa profit beats expectation on resilient consumer spending | Reuters) (‘Consumer spending has been remarkably stable,’ Visa CFO says – MarketWatch). This trend is underpinning mid-to-high single digit payment volume growth for Visa. Looking ahead, the baseline economic scenario is a soft landing or mild growth slowdown, rather than a severe recession. Visa’s CFO noted that “underlying drivers [of spending] have remained quite stable” and expects consumer resilience to extend into 2025 (Visa profit beats expectation on resilient consumer spending | Reuters). If this holds true, Visa should see steady growth in volumes and transactions. Additionally, the continued recovery in international travel (now near or above 2019 levels in many corridors) is a tailwind – cross-border volumes were up 13% in Visa’s latest quarter (Visa profit beats expectation on resilient consumer spending | Reuters) and should remain robust as Asia reopens more fully (Visa profit beats expectation on resilient consumer spending | Reuters). Geographic diversification helps: weakness in one region (e.g. China’s slower economy (Visa profit beats expectation on resilient consumer spending | Reuters)) can be offset by strength elsewhere (U.S., Europe, etc.).

Key macro risks include a potential U.S. or global recession (which could be triggered by central banks over-tightening or external shocks). While not our base case for 2025, a recession would likely cause a dip in Visa’s revenue as transaction volumes fall – though notably, even during the 2020 COVID shock, Visa’s revenues rebounded quickly after an initial drop. Another macro factor is inflation/FX: higher inflation can actually boost nominal spending (thus Visa’s fees), but if it prompts more rate hikes, that could hurt economic growth. Currency fluctuations impact Visa’s reported results (a strong dollar can be a headwind to reported international revenue). On balance, the macro outlook supports Visa’s growth: secular trends (cashless payments) are more important in the long run than year-to-year GDP noise. As Morningstar analysts have observed, Visa enjoys “favorable long-term secular growth prospects, and a stable environment highlights the strength of the wide-moat company.” (Visa Earnings: Market Conditions Remain Favorable – Morningstar) We concur that barring a major economic crisis, Visa’s macro environment will remain constructive for its business through 2029.

Technical Factors: From a technical analysis perspective, Visa’s chart pattern is robust. The stock is trading near record highs and well above its 200-day moving average, indicating a sustained uptrend. There is clear support in the low-$300s (the stock’s breakout zone in late 2024), which should act as a floor absent drastic news. Volume trends have been healthy on up-moves, suggesting institutional accumulation. Visa is a mega-cap ($~700B) and a component of major indices, so it often moves with broader market sentiment as well. Its relative strength index (RSI) has occasionally hit overbought levels on rallies, followed by brief consolidations – a normal pattern for a steady climber. Traders may watch the $370-$380 area (prior high/analyst target zone) as a near-term resistance; a breakout above that on strong volume could signal another leg higher. Conversely, if the stock pulls back, the ~$300 level (around the 52-week low and a round-number support) would be a critical technical support to defend. Overall, technicals don’t flash any major red flags – the trend is your friend. However, given the extended multi-year climb, new investors might wait for minor pullbacks to avoid chasing at a high. In summary, Visa’s technical setup confirms the positive momentum and provides identifiable levels for risk management, complementing the fundamentally driven thesis.

Monte Carlo Simulation – Probabilistic 1-Year Forecast (2025–Q1 2026)

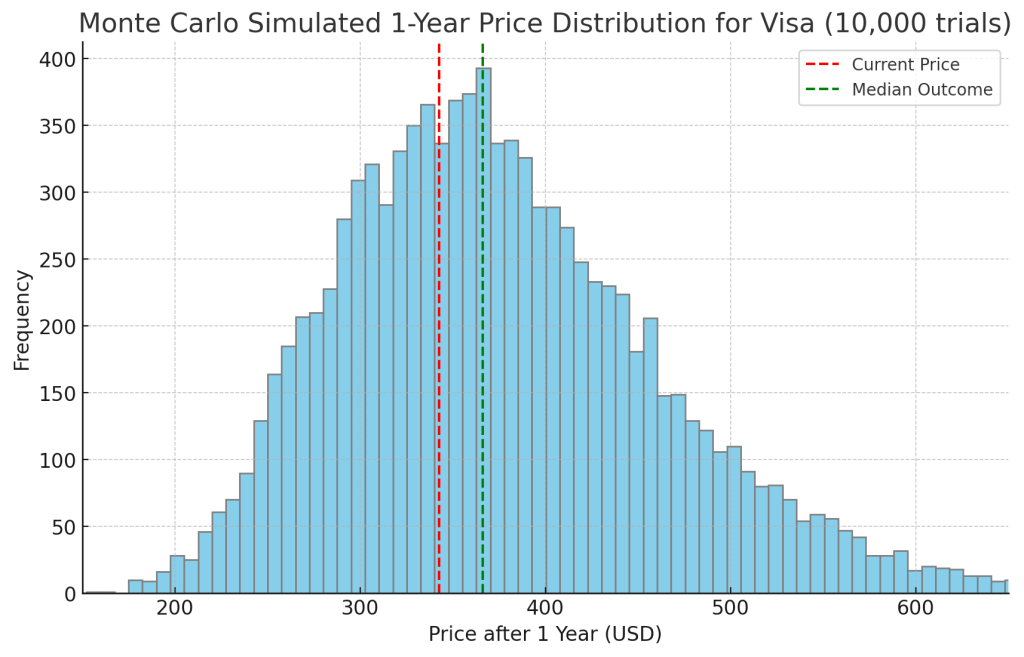

(image) Monte Carlo simulation of Visa’s 1-year price distribution (10,000 trials). This histogram shows the probability distribution of Visa’s stock price by Q1 2026, assuming ~10% expected annual return and 23% volatility. The green dashed line is the median simulated price ($366), slightly above the current ~$343 (red dashed line), reflecting Visa’s positive expected drift. There is roughly a 5% probability of the stock falling below ~$250 (≈27% drop) in one year, and a 5% chance of exceeding ~$540 (≈58% gain). Most outcomes cluster around the mid-$300s to mid-$400s, indicating a balanced risk/reward over the next year.

Our Monte Carlo analysis reinforces a moderate risk outlook for the next year. The median outcome of ~$366 is close to our base case and implies a modest single-digit price gain. The simulation suggests about a 70% probability that Visa’s stock will be between ~$280 and $460 in one year (within ~±1 standard deviation). Extreme outcomes are relatively unlikely but not impossible: there is a tail risk (~1% probability) of a <-$210 price (if a severe downside event occurs), and conversely a small chance of >$600 (if exceptionally positive surprises happen). Investors can take comfort that the odds of catastrophic loss are very low for Visa – in only 5% of simulations did the price drop more than ~25%. Meanwhile, the upside potential, while present, is also capped by Visa’s already-high valuation (only 5% of cases showed >~60% gain in a year). This aligns with our view that Visa offers a stable, lower-risk investment with decent, if not explosive, upside. The Monte Carlo distribution is roughly lognormal (skewed right), which is typical for equities – the longer right tail reflects that big positive surprises (e.g. new business breakthroughs, market re-ratings) can theoretically boost the stock significantly, whereas on the downside Visa’s strong floor on earnings and buybacks limit how far the stock could fall absent an outright crisis.

Bayesian Scenario Analysis – Bear vs. Base vs. Bull Cases (2029)

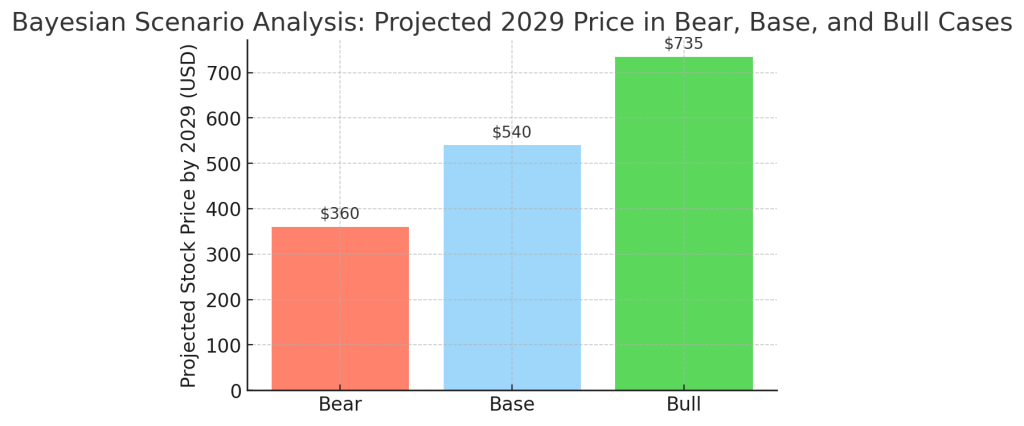

(image) Bayesian scenario analysis: projected 2029 year-end stock price for Visa under Bear, Base, and Bull scenarios. The bear case ($360) assumes slower growth and valuation compression, essentially keeping the stock flat over 5 years. The base case ($540) reflects consensus growth and stable multiples, implying 57% price appreciation. The bull case ($735) assumes faster growth and slight multiple expansion, roughly doubling the stock (+115%). Probabilities might be assigned ~20% Bear, 60% Base, 20% Bull in a Bayesian framework, yielding an expected outcome around the base-case ~$540.

To gauge Visa’s long-term potential, we consider three scenarios for the 2025–2029 period:

- Bear Case (Low Growth/Pessimistic): Assume global economic growth underperforms, with periodic recessions or payment industry disruptions. Visa’s EPS grows ~8% annually (well below historical ~13% rate). Competition or regulation squeezes margins slightly. By 2029, earnings are ~$14/share and the market assigns a lower P/E of ~25× (due to slower growth outlook). This yields a stock price of roughly $360 in 2029 – essentially flat vs. today (plus minimal dividends). Including dividends, this scenario might generate a low single-digit annual total return (~1–3%/yr). This is the downside scenario where Visa disappoints but still grows modestly; it suggests capital preservation but little gain. Importantly, even in our bear case, we do not see a severe loss for long-term holders – a testament to Visa’s resilience (a truly catastrophic scenario would require an implosion of the business model, which is very unlikely short of extreme regulatory action or technological disruption).

- Base Case (Consensus/Most Likely): Assume Visa executes in line with current expectations. EPS grows ~13% annually (factoring secular growth and some operating leverage). By 2029, earnings reach ~$18–19/share. The valuation multiple normalizes to around 30× (close to today’s, reflecting continued confidence in Visa’s moat and growth). This results in a 2029 stock price around $540. At the current ~$343, that implies about +57% price increase, which with dividends (~0.7% yield) would produce a total return around 10% per year – squarely in line with our model’s 5-year annualized return projection (10.0%). This base case assumes no major shocks: steady global expansion, Visa maintaining its market share, and expenses managed. It is essentially a continuation of Visa’s status quo trajectory. The outcome – mid-$500s stock – would roughly double an investor’s money this decade (including dividends), underscoring why Visa is an appealing long-term holding.

- Bull Case (High Growth/Optimistic): Assume Visa exceeds expectations. Perhaps digital payment adoption accelerates even faster (e.g. emerging markets leapfrog to cards/digital, fintech partnerships unlock new revenue streams), and global GDP growth is robust. Visa’s EPS could grow ~18% annually – faster than historical, but conceivable with new revenue lines (like B2B, crypto, open banking) and operating leverage. In this scenario, by 2029 EPS might be ~$22+/share. If investors also reward Visa with a slight P/E expansion (say ~33×) due to its superior growth and competitive position, the stock could reach about $730–$750. We use ~$735 as the bull-case target. This would be a home-run scenario – roughly doubling the stock (+115% price gain, ~15–16% CAGR, or ~17%/yr including dividends). It assumes everything goes mostly right for Visa (and the market), and the company perhaps finds new growth avenues that are not fully appreciated today (such as significant traction in new payment flows or successfully capturing more cash displacement than expected). While this scenario has a lower probability (~20%), it highlights Visa’s upside leverage if growth surprises to the upside.

Assigning subjective probabilities (Bear ~20%, Base ~60%, Bull ~20%), we can estimate a probability-weighted 5-year price of around $540–$550, very close to the base-case. This indicates the base-case is our central expectation. The distribution of outcomes skews positive – even the bear case isn’t dramatically below the current price, whereas the bull case is significantly higher. This asymmetric payoff (limited downside, solid upside) is attractive for long-term investors. It’s also worth noting that Visa’s management and track record make the base-to-bull scenarios more plausible; the company has a history of meeting or beating growth expectations over the past decade. Meanwhile, the bear case largely represents external factors outside Visa’s control (macro slowdown or regulatory constraints).

Bottom Line: Visa Inc. offers a compelling long-term investment proposition with strong fundamentals and manageable risks. Our Vulcan-mk5 model analysis yields a Buy rating – Visa is a high-quality compounder trading at a fair price. Short-term returns might be moderate given the stock’s recent strength and valuation, but the risk-adjusted outlook remains positive. Visa’s wide moat, secular growth tailwinds, and consistent execution support annual returns in the high-single to low-double digits over the next 5+ years, which is attractive for a blue-chip equity. Investors should remain mindful of macro and regulatory developments, but Visa’s core business is rock-solid. In a diversified portfolio, Visa can serve as a cornerstone growth holding with defensive characteristics, an uncommon and valuable combination.

Leave a comment