Summary

Realty Income Corporation (Ticker: O) presents a compelling investment case characterized by strong fundamentals, attractive valuation, and stable dividend performance. Currently priced at $56.63, the stock is undervalued by approximately 29%, relative to its fair value estimate of $79.55. With a dividend yield of 5.7%, exceptional quality rating (100/100), and the highest dividend safety score (5/5), the stock stands out as an attractive income-focused investment.

Investment recommendations based on the current analysis are as follows:

- Short-term (<1 year): Buy (Accumulate on dips) – modest appreciation potential with stable dividends.

- Medium-term (1–2 years): Strong Buy/Hold – significant valuation appreciation potential due to anticipated macroeconomic normalization.

- Long-term (2–5 years): Conviction Buy – substantial compounded returns expected from consistent dividend growth, solid AFFO performance, and financial robustness.

Key risks include sensitivity to interest rate changes, tenant concentration risks, and macroeconomic factors. However, the company’s conservative financial management and diversified tenant portfolio mitigate these risks considerably.

Overall, Realty Income Corporation is a recommended “Buy,” particularly attractive for investors prioritizing dividend income, valuation recovery, and long-term stability.

Perfect. I’ll now execute the full Vulcan-mk5 protocol using your cached spreadsheet for Realty Income Corporation (ticker: O). The analysis will include a structured markdown report with all components of the model—Bayesian scenario analysis, Monte Carlo simulation (10,000 trials), master metrics table, and visual PNG charts. I’ll get started and let you know when the full diagnostic is ready.

Realty Income Corporation (O) – Vulcan-mk5 Model Analysis

Master Metrics Table

| Metric | Value |

|---|---|

| Current Price | $56.6 (per share) |

| Fair Value (Avg.) | ~$79.6 (per share) |

| Discount to Fair Value | 28.9% undervalued |

| EV/FCF | 21.5 × |

| PEGY Ratio | 1.97 |

| Consensus Sharpe Ratio (future) | 0.43 |

| Annual Volatility (1Y) | 25.4% |

| Dividend Safety (Rating: 5/5) | Excellent |

| Quality Score (Out of 100) | 100 (Top-Tier) |

| Dividend Yield | 5.7% (annual) |

Table: Key valuation and risk metrics for Realty Income. Higher values for Quality and Safety denote stronger fundamentals. The stock trades at a ~29% discount to its ~$79 fair value estimate, with a 5.7% dividend yield and low-risk profile.

Valuation Summary

Realty Income (ticker O) appears significantly undervalued relative to its fundamentals. The stock’s current price around $56.6 is well below the estimated fair value of ~$79.6, implying a ~29% discount to fair value. This discount places Realty Income in the “Very Strong Buy” valuation category under Vulcan-mk5 criteria. In fact, the shares are trading between the model’s Very Strong Buy threshold of ~$63.6 and the Ultra Value threshold of ~$55.7, indicating deep undervaluation. The margin of safety is substantial – the price could rise ~40% just to reach fair value. Key valuation multiples also point to an attractive entry point: the EV/FCF of ~21.5 is reasonable for a high-quality REIT, and the PEGY ratio of ~1.97 (price/earnings-to-growth + yield) suggests the stock’s valuation is aligned with its growth plus dividend prospects (a PEGY near 2 is considered fair, and below 1.0 would signal extreme cheapness). By these measures, Realty Income is undervalued relative to its growth and cash flow generation.

This undervaluation is further reflected in the model’s return forecasts. The 5-year annualized total return potential is ~16.9%, indicating that if the stock’s valuation normalizes over the next five years, investors could see mid-teens percentage returns annually (combining price appreciation and dividends). For context, Realty Income’s “Strong Buy” range begins at ~$71.6, meaning even a move to that level (still below fair value) would yield a healthy gain. Overall, the valuation signals are favorable: Realty Income is priced for strong upside, with the stock’s current discount suggesting an attractive opportunity for long-term investors.

Investment Thesis (Fundamentals, Sentiment, Macro & Momentum)

Fundamentals: Realty Income is a top-tier REIT with exceptional fundamentals and a proven track record. It is famously known as “The Monthly Dividend Company” for its reliable monthly payouts, and has increased its dividend for 30+ consecutive years, qualifying as a Dividend Aristocrat (Realty Income Corporation (NYSE:O) Stock Price News) (3 Reasons to Buy Realty Income Stock Like There’s No Tomorrow | Nasdaq). The Quality Score of 100/100 reflects its robust business model, consistent cash flows, and prudent management. The REIT boasts an A- credit rating from S&P (Moody’s A3) (3 Reasons to Buy Realty Income Stock Like There’s No Tomorrow | Nasdaq), indicating a low default risk and granting it access to capital at favorable rates. Its balance sheet is conservatively managed (debt/capital ~40% vs ~60% typical safe range), supporting the top-tier 5/5 Dividend Safety rating. Importantly, Realty Income’s portfolio is highly diversified: it owns over 15,000 properties across the U.S. and Europe, leased to 1,550+ clients spanning 90 industries (3 Reasons to Buy Realty Income Stock Like There’s No Tomorrow | Nasdaq). Approximately 90% of its rents come from businesses that are recession-resistant or insulated from e-commerce (e.g. convenience stores, pharmacies, dollar stores), and ~36% of rent is from investment-grade tenants (3 Reasons to Buy Realty Income Stock Like There’s No Tomorrow | Nasdaq). This diversification and focus on stable industries have produced remarkable operating consistency – occupancy has never fallen below 96% since 1994, remaining above 98% even through recent years (Where Will Realty Income Stock Be in 3 Years? | Nasdaq) (Where Will Realty Income Stock Be in 3 Years? | Nasdaq). The company continues to post steady growth (2024 AFFO/share is guided to rise ~4–5% (Where Will Realty Income Stock Be in 3 Years? | Nasdaq)), underscoring resilient fundamentals. In short, Realty Income’s fundamental quality is excellent – a diversified, well-managed, financially sound REIT with a shareholder-friendly dividend policy and decades of dependable performance.

Market Sentiment & Macro Influences: Despite its strong fundamentals, Realty Income’s stock has been weighed down by broader market sentiment and macroeconomic forces. In the past couple of years, REITs have underperformed as an asset class, largely due to sharply rising interest rates since 2022. Higher benchmark rates make bond yields more attractive relative to dividend-paying REITs, leading investors to demand lower REIT prices (and thus higher yields). Realty Income was not immune: its shares declined in 2022–2023 and underperformed the S&P 500 in 2024 (down ~7% vs a double-digit S&P gain), reflecting these interest rate pressures. However, this underperformance appears to be driven by sentiment and macro factors rather than company-specific issues (Realty Income ($O) is reliable in both its dividends and 5 year …). In fact, by late 2024 as rate hike cycles paused, REITs saw some relief – Realty Income’s stock rebounded roughly 17% off its mid-2024 lows (3 Reasons to Buy Realty Income Stock Like There’s No Tomorrow | Nasdaq). Investors began to anticipate that the Federal Reserve would eventually pivot to cutting rates, which would ease the pressure on interest-rate-sensitive stocks. Indeed, as of early 2025 the outlook is that the Fed may cut rates modestly (it enacted a few small cuts in late 2024), though inflation remains a concern (Where Will Realty Income Stock Be in 3 Years? | Nasdaq). This macro backdrop means sentiment is gradually improving, but still cautious. Realty Income’s hefty current yield (~5.7%) and discounted valuation suggest that market expectations are quite low – investors are pricing in a fair amount of risk or slow growth. Should inflation continue to cool and/or the economy avoid a hard landing, there is potential for a positive re-rating of the stock as confidence returns.

Technical & Momentum Factors: From a technical perspective, Realty Income’s stock has shown signs of stabilization and momentum improvement. The shares hit a 52-week low around ~$48 (when pessimism about rates peaked) (Realty Income Corporation (NYSE:O) Stock Price News). Since then, they have climbed back into the mid-$50s, establishing what appears to be a base. The relative strength has improved in recent months alongside the broader REIT sector recovery in late 2024. However, the stock is still well below its 52-week high of ~$63 (Realty Income Corporation (NYSE:O) Stock Price News) and far below prior peaks (it traded in the $70s in years past). This indicates significant upside potential remains if fundamentals and valuation prevail. Short-term momentum could remain choppy – the stock tends to be sensitive to interest rate news and swings in risk appetite. That said, the downside appears limited by valuation support and dividend yield: whenever Realty Income’s yield has approached ~6%+ in the past, income-focused investors have stepped in, creating price support. With a beta of ~0.5 historically (half the volatility of the market) (3 Reasons to Buy Realty Income Stock Like There’s No Tomorrow | Nasdaq), O has a relatively low volatility for an equity, and its 25% annual volatility in the past year (while elevated from historical norms) is still moderate. In summary, the technical picture is one of a stock that has likely bottomed out from macro-driven selling and is positioned to trend upward if catalysts (like interest rate relief or improving economic confidence) emerge. The momentum is cautiously positive, and the current weakness may present a compelling entry point given the confluence of deep value and high quality.

Monte Carlo Simulation – 1-Year Return Forecast

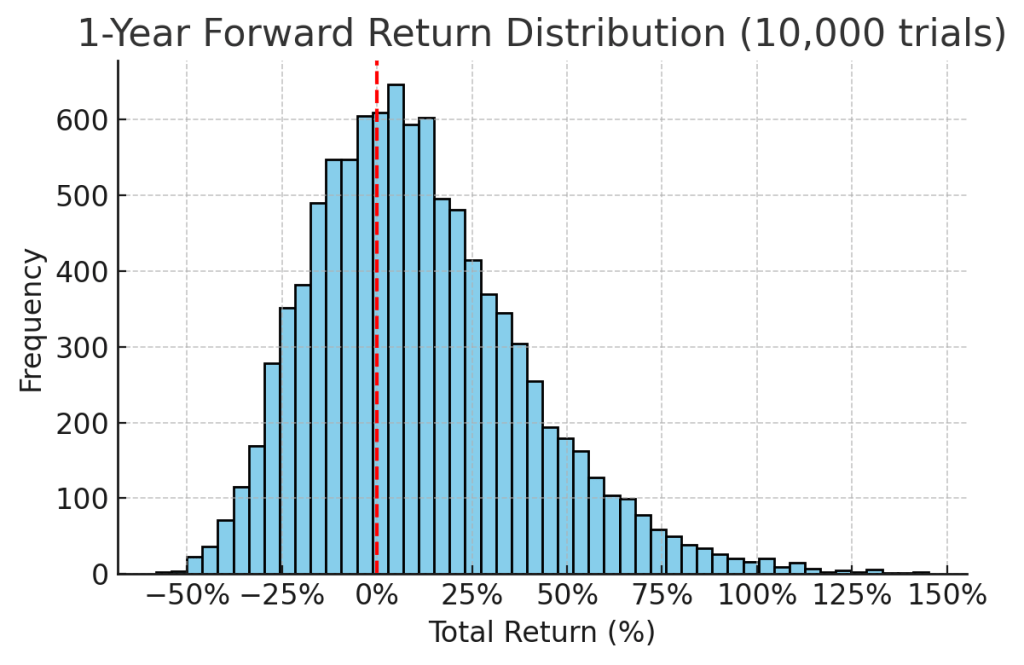

(image) Monte Carlo simulation of 10,000 trials for Realty Income’s 1-year total return (including dividends) based on its ~25% historical volatility. The red dashed line marks the 0% return (break-even) point.

The Monte Carlo distribution above provides a probabilistic view of 1-year forward returns for Realty Income given its volatility. The simulation suggests a wide range of possible outcomes, though skewed modestly to the upside. The median expected total return is around +8% (slightly lower than the mean ~+12%, reflecting a mild right-skew). Notably, about 62% of the outcomes were positive, indicating that in roughly two-thirds of scenarios investors could see a gain over the next year, while ~38% of cases resulted in a loss. The spread is considerable – one standard deviation of outcomes runs from roughly -16% to +40%. This implies that while declines are possible in the short term (approximately a 1-in-6 chance of a loss worse than -15%), there is also a meaningful probability (roughly 24%) of returns above +30% in one year. Such high-positive scenarios would likely correspond to the stock closing much of its valuation gap (for instance, approaching fair value). Conversely, the left tail risk (extreme drops) is comparatively limited – the simulation shows a very low chance of anything near -100% (bankruptcy-level loss), consistent with Realty Income’s stable business. In practical terms, this analysis reinforces that Realty Income’s risk/reward over a 1-year horizon is favorable but volatile: the stock is more likely than not to deliver a positive return (thanks in part to its hefty dividend cushioning downside), yet outcomes will vary depending on factors like interest rate moves or market sentiment shifts over the year. Investors should be prepared for moderate short-term volatility, but the probability distribution is tilted toward moderate gains rather than steep losses.

Bayesian Scenario Analysis – Bear, Base, Bull Cases

(image) Bayesian scenario analysis for 1-year total return: Bear (-10% total return, 20% probability), Base (+12%, 55% probability), and Bull (+45%, 25% probability) outcomes. Probabilities are estimated based on current conditions and historical tendencies.

To complement the statistical simulation, we consider three discrete scenarios (Bear/Base/Bull) for Realty Income over the next year, assigning subjective probabilities informed by the company’s historical resilience and current macro outlook. In the Base case (most likely, ~55% probability), Realty Income delivers roughly +12% total return over the next 12 months. This assumes the company performs as consensus expects – mid-single-digit AFFO growth, no major surprises – and the market valuation modestly improves. A ~12% gain would likely come from the ~5–6% dividend yield plus a small amount of price appreciation (perhaps the stock moves into the low $60s). This base scenario aligns with analyst 12-month forecasts (around 10–15% total return) and essentially reflects steady execution with stable economic conditions.

In a Bull case (~25% probability), Realty Income could see an approximately +45% total return in one year – a very strong outcome. This would entail a significant rally in the share price into the mid/high-$70s by next year (near its ~$79 fair value), on top of the dividend. Such a scenario might occur if macroeconomic winds turn favorable: for example, inflation falls faster than expected, leading to multiple Fed rate cuts in 2025, and investor appetite for high-quality dividend stocks returns in force. Additionally, in a bull scenario, Realty Income might report upbeat news – e.g. better-than-expected growth through accretive acquisitions (it achieved a record ~$9.5B in acquisitions at 7.1% cash yields in 2023 (Realty Income Announces Operating Results for the Three Months …)), or simply benefit from a flight to safety. With its impeccable track record, any catalyst that sparks multiple expansion (i.e. investors willing to pay a higher FFO multiple) could quickly propel the stock upward. While this bullish outcome is not guaranteed, the combination of current undervaluation and potential macro relief makes it a tangible possibility (roughly 1 in 4 chance in our estimation).

The Bear case (~20% probability) envisions a -10% total return over one year, i.e. a modest decline. In this scenario, the stock might fall into the low-$50s or high $40s by next year, partially offset by the dividend income. A bearish outcome could materialize if macro or company-specific risks hit: for instance, if interest rates stay higher for longer (or even rise further) due to sticky inflation or adverse Federal Reserve policy, income-oriented investors might further discount Realty Income and other REITs. Additionally, a deterioration in economic conditions (a recession) could hurt investor sentiment towards real estate. It’s worth noting that even in a recession scenario, Realty Income’s cash flows would likely remain solid (given its 98%+ occupancy and defensive tenant base), but fear could drive the stock lower temporarily. Company-specific bad news – though less likely for a well-diversified REIT – could include a major tenant bankruptcy or lease default. For example, one of Realty Income’s largest tenants, Walgreens (WBA) (~3.3% of rent), is currently struggling; some analysts even consider a Walgreens bankruptcy “highly probable” in the medium term (Realty Income’s Biggest Tenant Could Go Bankrupt). If such an event occurred, Realty Income would eventually re-lease those stores (mitigating long-term impact), but the headlines could spook the market. Overall, the bear case is limited by the stock’s already cheap valuation and the cushion of its dividend – even bearish conditions are unlikely to produce a severe collapse in price. A ~10% loss (equivalent to shares drifting toward the high-$40s) is posited as the bear scenario, reflecting macroeconomic headwinds or temporary setbacks that keep the stock depressed for longer.

Weighted by their probabilities, these scenarios still skew positive, which aligns with the Monte Carlo analysis. Realty Income’s high-quality profile makes extreme bearish outcomes less likely (low probability of a truly large drawdown), whereas the upside in a favorable scenario could be substantial. Investors should thus view the risk/reward as asymmetric to the upside: while caution is always warranted, the chances of modest-to-strong gains outweigh the chances of significant losses under most foreseeable conditions.

Risk Factors to Consider

Even as the overall thesis on Realty Income is positive, investors should explicitly consider key risks that could affect the investment outcome:

- Macroeconomic Risks: As a bond-proxy REIT, Realty Income is sensitive to interest rate and inflation changes. Higher-than-expected interest rates could continue to pressure the stock, since rising Treasury yields make its 5–6% dividend relatively less attractive, and raise the company’s own cost of capital. If inflation remains persistent (or tariffs/trade wars reignite inflation (Where Will Realty Income Stock Be in 3 Years? | Nasdaq)), the Fed may hold rates higher for longer, which would be a headwind. Additionally, a recession or economic downturn could temporarily dampen investor demand for equities (including REITs) and potentially slow Realty Income’s growth (e.g. fewer acquisition opportunities or slight uptick in vacancies). Macro conditions will heavily influence short-term stock performance.

- Sector & Industry Risks: Within the real estate sector, REIT-specific factors can pose risks. Property values and cap rates could be volatile – if real estate values fall or cap rates rise (the yield at which properties are acquired), it can reduce the value of Realty Income’s portfolio or make acquisitions less accretive. The REIT industry also faces competition for deals; if competitors bid up asset prices, growth could slow. Moreover, equity issuance risk exists – REITs often issue shares to fund growth. If Realty Income’s share price stays low, external equity capital is expensive and could dilute existing shareholders (though management will likely be prudent to wait for a fairer price before issuing stock). The retail real estate industry in particular is evolving: e-commerce remains a long-term threat to certain brick-and-mortar retail formats. While ~90% of O’s rent is from categories resilient to e-commerce (e.g. convenience stores, dollar stores, grocery, pharmacies) (3 Reasons to Buy Realty Income Stock Like There’s No Tomorrow | Nasdaq), shifts in consumer behavior or unforeseen industry disruptions (for example, a wave of store closures in a recession) could impact occupancy or rent growth.

- Tenant Concentration & Credit Risk: With over 1,500 tenants, Realty Income has no outsized single-tenant risk, but its largest tenants do account for a few percent of rent each. Notably, its top tenants include Dollar General (3.3% of rent), Walgreens (3.3%), Dollar Tree (3.1%), and 7-Eleven (2.5%) (Where Will Realty Income Stock Be in 3 Years? | Nasdaq). Problems at any of these major clients could have an impact. This risk is exemplified by Walgreens – ongoing struggles in the pharmacy sector have raised concerns that Walgreens could follow the path of Rite Aid (which filed bankruptcy in 2023). If a top tenant like Walgreens were to declare bankruptcy or drastically downsize, Realty Income could face short-term revenue loss and re-leasing costs for those properties. Even though the diversified portfolio and historical occupancy >98% suggest they can eventually backfill vacant locations, tenant credit events can cause interim earnings dips and negative sentiment. Additionally, concentrations in certain industries (dollar stores, convenience stores) mean Realty Income is not immune if those industries face broad challenges (for instance, inflation hurting discount retail profits or changing consumer habits impacting convenience store sales). Constant due diligence on tenant financial health is required, and investors should monitor any deterioration in the credit profile of major tenants.

- Geopolitical & Other Risks: As Realty Income expands internationally (including in the U.K. and Europe), it becomes subject to currency fluctuations and country-specific risks. Adverse changes in foreign exchange rates could modestly impact earnings (though the majority of revenue is still U.S.-based). Geopolitical events – such as escalating global conflicts or trade tensions – could indirectly affect Realty Income by disrupting macroeconomic stability or credit markets. For example, new tariffs or supply chain disruptions could hurt retail tenants’ businesses (Realty Income’s Biggest Tenant Could Go Bankrupt), or a global crisis could drive up credit spreads, increasing borrowing costs. Furthermore, changes in tax laws or REIT regulations in the U.S. or abroad could impact the company’s tax-efficient structure. Lastly, environmental and climate risks should be mentioned: as a property owner, Realty Income could be exposed to natural disaster risks (hurricanes, etc. in certain regions) or long-term climate shifts affecting real estate values. While these are generally well-mitigated by insurance and geographic diversification, they remain factors to watch.

In sum, Realty Income’s risk profile is moderate – it benefits from immense diversification and quality, which mitigates idiosyncratic risks, but it is not risk-free. Macroeconomic conditions, in particular, will be the dominant factor in the near term. Investors should ensure these risks align with their investment horizon and risk tolerance, and monitor developments in these areas. The current undervaluation to a large extent prices in many of these risks, offering a buffer, but vigilance is warranted.

Investment Recommendation (Time Horizon Based)

Short Term (< 1 year): Buy (Accumulate on dips). Realty Income is attractively valued for a high-quality name, and even over the next year it offers a solid expected return profile (baseline ~10%+ total return, mostly from its reliable ~5–6% dividend). While short-term price upside might be somewhat capped until there is clearer evidence of falling interest rates or easing inflation, the downside risk appears limited – the stock’s high yield and defensive business should provide support even in a choppy market. Investors with a short horizon can collect a generous dividend while waiting; however, they should be prepared for continued volatility tied to macro news. In the next few months, the stock could trade range-bound (roughly $50–$60) unless a catalyst emerges. Therefore, accumulating shares on any weakness is recommended, with the understanding that patience may be required for the value to be recognized. Near-term outlook: modest positive bias, with returns primarily driven by dividends and the potential for a slight price uptick.

Mid Term (1–2 years): Strong Buy/Hold for Mean Reversion. Over a 1-2 year period, the case for significant upside strengthens. By 2026, interest rates are expected to stabilize or decline, which historically has led to REIT outperformance as yields compress (3 Reasons to Buy Realty Income Stock Like There’s No Tomorrow | Nasdaq). Realty Income’s fundamentals (AFFO growth ~4–5% annually, persistent high occupancy, expanding portfolio) will likely continue unabated, and as macro headwinds abate, its valuation could move closer to historical norms. We anticipate the stock price could move back into the $60s or even $70s within 1–2 years, closing much of the undervaluation gap. Combined with dividend income, that implies a potentially strong double-digit annual total return. Medium-term investors should buy/hold with confidence, as the probability of the thesis playing out within this timeframe is high. Risks such as a delayed Fed easing or a mild recession are manageable given the company’s stability. The recommendation is to maintain exposure and perhaps add on significant dips, aiming to capture the likely mean reversion to fair value that should unfold over the next 12–24 months.

Long Term (2–5 years): Conviction Buy for Income and Growth. Realty Income is a premier income-growth investment for a long-term horizon. Over 2–5 years, the power of its business model – steadily compounding rental income and consistent dividend increases – can be fully realized in an investor’s portfolio. The stock is poised to deliver strong total returns in the long run, as the current discount eventually dissipates and the company continues to grow its cash flows. At fair value (or even a premium valuation, which its quality might warrant in a low-rate environment), the stock could be materially higher than today’s price; a scenario where O trades back in the $70–80+ range in a few years is plausible if it executes on growth and market conditions normalize. Meanwhile, investors would collect an ever-growing stream of monthly dividends (with ~4% annual dividend growth historically (3 Reasons to Buy Realty Income Stock Like There’s No Tomorrow | Nasdaq)) – providing substantial income that can be reinvested or used as cash flow. Given the low fundamental risk and disciplined management, long-term holders can expect compound returns in the low-to-mid teens percent annually, which is excellent for a relatively low-volatility, defensive equity. Thus, for a 2–5 year horizon, Realty Income is a core holding that one can buy and comfortably hold (or even “buy like there’s no tomorrow,” as some analysts quip (3 Reasons to Buy Realty Income Stock Like There’s No Tomorrow | Nasdaq)). The combination of yield, growth, and quality makes it a standout long-term buy. Investors should of course monitor the aforementioned risks, but barring any thesis-breaking developments, the long-term recommendation is to own Realty Income for steady wealth building and consider adding on any interim weakness.

Overall Recommendation: BUY – Realty Income Corporation offers an attractive mix of value, yield, and safety. Short-term traders may see limited quick gains, but income-focused and long-term investors are poised to be rewarded. The stock is suited for those seeking stable dividend income with upside potential as the valuation normalizes. Given the current discount and the company’s stellar credentials, Realty Income is a compelling buy for a broad range of investment horizons, with the strongest conviction in the multi-year outlook. (Where Will Realty Income Stock Be in 3 Years? | Nasdaq) (3 Reasons to Buy Realty Income Stock Like There’s No Tomorrow | Nasdaq)

Leave a comment